Alcoa Corporation Announces Closing of Debt Offering

17 Mars 2025 - 9:26PM

Business Wire

Alcoa Corporation (NYSE:AA; ASX: AAI) (“Alcoa”) announced today

that Alumina Pty Ltd (ABN 85 004 820 419) (the “Issuer”), a

wholly-owned subsidiary of Alcoa, closed its offering of

$500,000,000 aggregate principal amount of 6.125% senior notes due

2030 and $500,000,000 aggregate principal amount of 6.375% senior

notes due 2032 (the “notes”). The notes are guaranteed on a senior

unsecured basis by Alcoa and certain of its subsidiaries.

The Issuer intends to deploy the funds within the Alcoa group,

including funding contributions to Alcoa Nederland Holding B.V.

(“ANHBV”), a wholly-owned subsidiary of Alcoa and the issuer of the

outstanding $750 million aggregate principal amount of 5.500% Notes

due 2027 (the “Existing 2027 Notes”) and $500 million aggregate

principal amount of 6.125% Notes due 2028 (the “Existing 2028

Notes”). These contributions will be funded through a series of

intercompany transactions, including the repayment of intercompany

indebtedness and the issuance of intercompany dividends. ANHBV

intends to use such funds, along with cash on hand, to fund the

purchase price pursuant to the cash tender offers (the “Tender

Offers”) announced on March 3, 2025 for any and all of the Existing

2027 Notes and up to $250 million of the Existing 2028 Notes to the

extent tendered and accepted by ANHBV for purchase in the Tender

Offers and to pay related transaction fees, including applicable

premiums and expenses. If there are any net proceeds remaining from

this offering, including if the Tender Offers are not consummated,

Alcoa intends to use such funds for general corporate purposes,

which may include the redemption by ANHBV of the Existing 2027

Notes and Existing 2028 Notes.

The notes and related guarantees were sold in a private

placement to qualified institutional buyers in accordance with Rule

144A under the Securities Act of 1933, as amended (the “Securities

Act”), and to certain non-United States persons in offshore

transactions in accordance with Regulation S under the Securities

Act. The notes and related guarantees offering have not been and

will not be registered under the Securities Act or the securities

laws of any other jurisdiction and may not be offered or sold in

the United States or to, or for the benefit of, U.S. persons absent

registration under, or an applicable exemption from, the

registration requirements of the Securities Act.

This press release does not constitute an offer to buy or sell

or a solicitation of an offer to buy or sell the notes and related

guarantees, the Existing 2027 Notes, the Existing 2028 Notes or any

other security and there will be no offer, solicitation, purchase

or sale in any state or jurisdiction in which, or to any persons to

whom, such an offer, solicitation, purchase or sale would be

unlawful. Any offers of the notes and related guarantees were made

only by means of a private offering memorandum. The Tender Offers

are being made only by means of the relevant offer to purchase and

notice of guaranteed delivery, as applicable.

About Alcoa

Alcoa is a global industry leader in bauxite, alumina and

aluminum products with a vision to reinvent the aluminum industry

for a sustainable future. Our purpose is to turn raw potential into

real progress, underpinned by Alcoa Values that encompass

integrity, operating excellence, care for people and courageous

leadership. Since developing the process that made aluminum an

affordable and vital part of modern life, our talented Alcoans have

developed breakthrough innovations and best practices that have led

to improved safety, sustainability, efficiency, and stronger

communities wherever we operate.

Forward-Looking Statements

This press release contains statements that relate to future

events and expectations, including those relating to the intended

use of the net proceeds from the issuance of the notes and the

Tender Offers, and as such constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements include those containing such

words as “aims,” “ambition,” “anticipates,” “believes,” “could,”

“develop,” “endeavors,” “estimates,” “expects,” “forecasts,”

“goal,” “intends,” “may,” “outlook,” “potential,” “plans,”

“projects,” “reach,” “seeks,” “sees,” “should,” “strive,”

“targets,” “will,” “working,” “would,” or other words of similar

meaning. All statements by Alcoa that reflect expectations,

assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements. Forward-looking

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties, and changes in

circumstances that are difficult to predict. Although Alcoa

believes that the expectations reflected in any forward-looking

statements are based on reasonable assumptions, it can give no

assurance that these expectations will be attained and it is

possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of

risks and uncertainties. Additional information concerning factors

that could cause actual results to differ materially from those

projected in the forward-looking statements is contained in Alcoa’s

filings with the Securities and Exchange Commission. Alcoa

disclaims any obligation to update publicly any forward-looking

statements, whether in response to new information, future events

or otherwise, except as required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250317165644/en/

Investor Contact Yolande Doctor 412-992-5450

Yolande.B.Doctor@alcoa.com

Media Contact Courtney Boone 412-527-9792

Courtney.Boone@alcoa.com

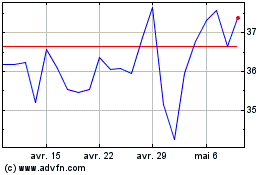

Alcoa (NYSE:AA)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

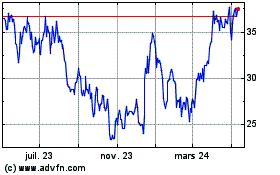

Alcoa (NYSE:AA)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025