216 Airport DriveRochesterNew HampshireFALSE0000819793NYSE00008197932023-08-212023-08-210000819793ain:ClassACommonStockMember2023-08-212023-08-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report: August 21, 2023

(Date of earliest event reported)

| | | | | | | | |

| ALBANY INTERNATIONAL CORP. | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | |

| Delaware | 1-10026 | 14-0462060 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S Employer Identification No.) |

| | | | | |

216 Airport Drive Rochester, New Hampshire | 03867 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 603-330-5850

| | |

None |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, $0.001 par value per share | | AIN | | The New York Stock Exchange (NYSE) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter).

☐ Emerging growth company

¨ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

Item 5.02. Departure of Certain Officers; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Chief Executive Officer Succession

On August 21, 2023, Albany International Corp. (the “Company”) announced that A. William Higgins, its President and Chief Executive Officer, will retire as an officer of the Company on September 1, 2023. Mr. Higgins will remain a member of the Board of Directors (the “Board”). In connection with his retirement, (i) all of Mr. Higgins’ unvested restricted stock units will automatically vest and become payable upon his termination of employment and (ii) his performance-based incentive awards will remain outstanding and have the opportunity to vest, without proration, based on the extent to which performance goals are achieved for the open performance periods.

The Board has appointed Gunnar Kleveland to succeed Mr. Higgins as President and Chief Executive Officer of the Company effective September 1, 2023, and elected Mr. Kleveland to serve as a member of the Board effective that same date. Prior to joining Albany International Corp., Mr. Kleveland, age 54, served in leadership positions in the business segments of Textron Inc. Most recently, he served as the President and Chief Executive Officer of Textron Specialized Vehicles Inc. Previously, Mr. Kleveland was the President of TRU Simulation + Trading Inc. Mr. Kleveland also held the position of Executive Vice President of Integrated Operations for Bell Textron Inc. Prior to joining Textron in 2004, Mr. Kleveland was a fighter pilot in the Royal Norwegian Air Force (RNoAF) and finished his 15-year career in the air force as the Chief of Flight Safety. Mr. Kleveland holds a degree from the RNoAF Academy, a Bachelor of Science in Aeronautics from Embry Riddle Aeronautical University and a Master of Business Administration from Midwestern State University.

On August 21, 2023, the Company entered into an employment agreement with Mr. Kleveland, in connection with his appointment as its President and Chief Executive Officer (the “Kleveland Employment Agreement”). The Kleveland Employment Agreement provides for (i) an annual base salary of $900,000; (ii) an Annual Performance Period (“APP”) award for 2023 in the form of a target cash bonus equal to 100% of his base salary; (iii) a Multi-year Performance Period (“MPP”) award for 2023 in the form of share-settled performance stock units for service performed in 2023, 2024 and 2025 to be determined and paid in 2026 with a grant date value equal to 100% of his 2023 base salary; (iv) a share-settled restricted stock unit (“RSU”) award for a number of shares equal to 100% of his base salary at the time of grant, vesting on March 1 of each of 2024, 2025 and 2026 (each of which are prorated for the actual period employed during the applicable vesting period and subject to his continued employment with the Company through each vesting date); (v) a one-time sign-on award in the form of share-settled RSUs for a number of shares equal to $1.9 million that will vest in three equal installments on March 1, 2024, 2025 and 2026 (subject to his continued employment with the Company through each vesting date); and (vi) eligibility to participate in subsequent year APP and MPP programs.

The Kleveland Employment Agreement also provides that in the event the Company terminates Mr. Kleveland’s employment without “cause” or Mr. Kleveland resigns for “good cause” (as such terms are defined in the Kleveland Employment Agreement) – each a “Qualifying Termination – Mr. Kleveland shall be entitled to severance equal to his gross monthly salary in effect at termination, less applicable withholdings and deductions, for a period of 24-months.

The foregoing description of the Kleveland Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of each of the Kleveland Employment Agreement , a copy of which is attached hereto as Exhibit 10.3 and incorporated herein by reference.

Retention Bonus Award

On August 18, 2023, the Compensation Committee of the Board granted a special retention incentive in the form of a Special Incentive Award Agreement to the Company’s President – Albany Engineered Composites, Mr. Gregory Harwell.

Pursuant to the Special Incentive Award Agreement, Mr. Harwell will have the opportunity to earn a Performance Share award with a grant date fair value of $1,500,000, subject to his continued employment through December 31, 2024, and the achievement of certain performance objectives by December 31, 2025.

In the event that Mr. Harwell’s employment is involuntarily terminated by the Company without “cause” (as defined in the Special Incentive Award Agreement) prior to achievement of the performance objectives, the special incentive award shall nevertheless be earned and become payable.

The foregoing description of the Special Incentive Award Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Special Incentive Award Agreement, a copy of which is attached hereto as Exhibit 10.4 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is being furnished herewith:

| | | | | | | | | | | | | | |

| 10.3 | Kleveland Employment Agreement |

| 10.4 | Special Incentive Award Agreement |

| 99.1 | Press release dated August 21, 2023 |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ALBANY INTERNATIONAL CORP. | |

| | | |

| By: | /s/ Robert D. Starr | |

| | | |

| Name: | Robert D. Starr | |

| Title: | Executive Vice President and Chief Financial Officer |

| | (Principal Financial Officer) |

Date: August 21, 2023

EXHIBIT INDEX

| | | | | | | | | | | | | | |

Exhibit No. | Description | | | |

| 10.3 | |

| 10.4 | |

| 99.1 | |

| 104 | Inline XBRL cover page. | | | |

Exhibit 10.3

EMPLOYMENT AGREEMENT

This Agreement is entered into as of September 1, 2023 (the “Effective Date”) by and between Albany International Corp. (the "Company") and Gunnar Kleveland ("Executive").

1. Duties and Scope of Employment.

(a) Positions and Duties. Commencing on the Effective Date, Executive will serve as President and Chief Executive Officer of the Company, reporting to the Company's Board of Directors (the "Board"). The period during which Executive is employed by the Company under this Agreement is referred to herein as the "Employment Term." During the Employment Term, Executive will render such business and professional services in the performance of his duties, consistent with Executive's position within the Company, as may be assigned to him by the Board. Executive shall be based at the Company's headquarters in Rochester, New Hampshire, or such other place, as may be reasonably requested by the Company.

Executive shall be nominated for election to the Board such that his nomination shall be voted on by the shareholders of the Company at the first annual shareholder’s meeting following the Effective Date.

(b) Obligations. During the Employment Term, Executive will devote Executive's full business efforts to the Company and will use good faith efforts to discharge Executive's obligations under this Agreement to the best of Executive's ability. For the first three years of the Employment Term, Executive agrees not to serve as a director for any for-profit entity or organization or actively engage in any employment, occupation, or consulting activity, and thereafter only to do so with the mutual consent of the Board; provided, however, that Executive may at any time, without the approval of the Board, (i) serve in any capacity with any civic, educational, or charitable organization and (ii) manage his personal investments; in each case, provided such services do not interfere with Executive's obligations to the Company.

2. Term of Agreement; At-Will Employment. Executive and the Company agree that Executive's employment with the Company constitutes "at-will" employment. Executive and the Company acknowledge that, subject to the provisions of Sections 5 and 6 of this Agreement, Executive's employment relationship with the Company may be terminated at any time, upon written notice to the other party, with or without good cause, at the option either of the Company or Executive.

3. Compensation.

(a) Base Salary. Commencing on the Effective Date, the Company will pay Executive an annual salary of $900,000 as compensation for his services (such annual salary, as is then effective, to be referred to herein as "Base Salary"). The Base Salary will be paid periodically in accordance with the Company's normal payroll practices and be subject to standard and customary withholdings. Executive's salary will be subject to review by the Compensation Committee of the Board, or any successor thereto (the "Committee"), at least annually, and adjustments will be made in the discretion of the Committee.

(b) Annual Bonus. Executive will be granted an Annual Performance Period (“APP”) award for service performed in 2023 under the Company's 2023 Incentive Plan, to be determined and paid in cash during early 2024. Under this award, Executive will be entitled to receive between 0% and 200% of his target award, based on performance goal attainment during 2023. Executive’s 2023 APP target award amount will be equal to100% of his actual 2023 Base Salary, pro-rated for the portion of the year during which he is actually employed. (For example, as the Effective Date is September 1, 2023, the target amount would be $900,000 x 4/12, or $300,000). The Compensation Committee of the Company's Board of Directors has determined that the 2023 APP award goal for senior management, including Executive, will determined based upon (1) achievement of a specified level of Company Adjusted EBITDA, (2) achievement of a specified Total Recordable Incident Rate, (3) the avoidance of significant deficiencies or material weaknesses in the Company’s financial controls and (4) the lack of medium or high findings, or the timely remediation of any such findings identified in the Company’s internal audit reports, all according to differing weighting, as more fully described in the award agreements. The Committee retains the right to exercise its discretion, after the end of 2023, as in prior years, to determine to what extent the APP awards Executive and the other executive officers have been earned and reserves the right to take individual performance factors into account, and to employ subjective and objective criteria. (The other terms of this award shall be as specified in the 2023 Annual Performance Award Agreement). Executive will be eligible in 2024 and thereafter to participate in the 2024 APP award or any other annual executive bonus program, as the same may be adopted, amended, modified or terminated by the Company, in accordance with its terms. Target bonuses in future periods will be at the discretion of the Compensation Committee.

(c) Long Term Incentive – Performance Shares. Executive will be granted a Multi-year Performance Period (“MPP”) award for service performed in 2023, 2024 and 2025 under the Company's 2023 Incentive Plan, to be determined and paid in equity during early 2026. Under this award, Executive will be granted performance shares and be entitled to receive between 0% and 200% of his target award, based on performance goal attainment during the three-year performance period. Executive’s 2023 MPP target award will be a share amount with a grant date value equal to 100% of his 2023 Base Salary, pro-rated for the portion of the performance period during which he is actually employed. The Compensation Committee of the Company's Board of Directors has determined that the 2023 MPP award goal for senior management, including Executive, will be a specified level of Company Aggregate Adjusted EBITDA (as defined in the award agreements). The Committee retains the right to exercise its discretion, after the end of 2025, as in prior years, to determine to what extent the MPP awards Executive and the other executive officers have been earned and reserves the right to take individual performance factors into account, and to employ subjective and objective criteria. (The other terms of this award shall be as specified in the 2023 Multi-year Performance Award Agreement). Executive will be eligible in 2024 and thereafter to participate in the 2024 MPP award or any other long term executive bonus program, as the same may be adopted, amended, modified or terminated by the Company, in accordance with its terms. Target bonuses in future periods will be at the discretion of the Compensation Committee.

(d) Long Term Incentive - Restricted Stock. Executive will receive, as of the Effective Date, a grant of restricted stock units under the Company's 2023 Incentive Plan having a grant date value equal to 100% of his 2023 Base Salary, pro-rated for the portion of the three-year performance period during which he is actually employed. The grant shall vest and be paid out in shares ratably on March 1, 2024, 2025 and 2026. Executive will be eligible in 2024 and thereafter to participate in the 2024 restricted stock award or any other long term executive bonus program, as the same may be adopted, amended, modified or terminated by the Company, in accordance with its terms. Target bonuses in future periods will be at the discretion of the Compensation Committee.

(e) Executive will receive, as of the Effective Date, a one-time, sign-on grant of restricted stock units under the Company's 2023 Incentive Plan having a grant date value equal to $1.9 million. The grant shall vest and be paid out in shares ratably on March 1, 2024, 2025 and 2026, provided he is still employed with the Company as of those dates.

(f) Executive acknowledges that he has been advised that the share ownership guidelines adopted by the Company for its CEO requires that he is expected to own and hold shares of the Company's Common Stock equal in value to five times his then current base salary and that while there is no deadline by which this target must be attained, that at any time that the value of his holdings is less than this target, he will be expected to retain, in addition to all shares already owned, (1) all shares acquired upon the exercise of any stock options, and (2) all shares received upon a distribution of shares pursuant to the terms of any Restricted Stock Unit or Performance Award (in each case, net of shares used, if any, to satisfy the exercise price, taxes, or commissions).

(g) Relocation. Executive shall relocate to Rochester, New Hampshire area no later than September 1, 2024. Executive shall be reimbursed for temporary housing expenses and shall be entitled to such other relocation benefits as provided for pursuant to the Company's Executive Relocation Policy, (i.e., Level 3) a copy of which has been provided to the Executive. Provided such expenses are incurred in compliance with the Company’s travel and expense policy, the Company will pay or reimburse Executive for all flight expenses incurred prior to September 1, 2024 for travel from any Company work location to Augusta, GA, travel from Augusta, GA to any Company work location, and travel from any Company work location to any other Company work location through Augusta, GA. The Company will provide tax assistance (gross-up) to Executive on all such expenses for travel to, from, or through Augusta, GA that are personal to Executive or will appear as income on Executive's Form W-2.

4. Employee Benefits and Policies. Executive will be entitled to 3 weeks of vacation with pay during the remainder of 2023, and thereafter will be entitled to four weeks of vacation per calendar year, unless the Company's then-current vacation policy applicable to executive officers provides for a greater period. In addition, Executive will be eligible to participate in all of the Company's employee benefit plans, policies, and arrangements that are applicable to other executive officers of the Company (including, without limitation, 401(k), health care, vision, dental, life insurance and disability), subject to eligibility and otherwise on such terms and as such plans, policies, and arrangements may exist from time to time.

5. Termination of Employment. In the event Executive's employment with the Company terminates for any reason, Executive will be entitled to any (a) all unpaid Base Salary accrued to the effective date of termination, (b) unpaid but earned short-term or long-term cash bonuses, all unpaid but vested performance stock awards, all unpaid but vested portions of restricted stock units grants, subject to the terms of the applicable bonus plan, agreement or arrangement, (c) all benefits or compensation required to be provided after termination pursuant to, and in accordance with the terms of, any employee benefit plans, policies or arrangements applicable to Executive, (d) all unreimbursed business expenses incurred prior to termination and required to be reimbursed to Executive pursuant to the Company's policy, and (e) all rights to indemnification to which Executive may be entitled under the Company's Articles of Incorporation, Bylaws, or separate indemnification agreement, as applicable. In addition, if the termination is a “Qualifying Termination” (as defined in Section 6), Executive will be entitled to the amounts and benefits specified in Section 6.

6. Severance. If Executive's employment is terminated pursuant to a Qualifying Termination, Executive will receive an amount equal to twice the Base Salary plus twice the APP award target or other annual cash incentive target of Executive at the time of termination, payable in 24 substantially equal monthly installments (the “Severance Amount”). Executive's right to receive the Severance Amount is contingent upon Executive's continuing compliance with the provisions of Sections 8, 9 and 10 of this Agreement and subject to the Executive having executed and delivered to the Company an effective release of any and all claims in such form as is reasonably acceptable to the Company. Executive will not be required to mitigate the amount of payments under this Section 6, nor will any earnings that Executive may receive from any other source reduce any the Severance Amount. For purposes of this Agreement,

(a) “Qualifying Termination” shall mean (i) an involuntary termination of Executive’s employment by the Company without Cause, or (ii) a termination of Executive’s employment by Executive for Good Cause.

(b) “involuntary termination of Executive’s employment by the Company without Cause" shall not include termination as the result of death or Disability.

(c) "Cause" shall be deemed to exist upon any of the following, determined by a majority of the members of the Board in its sole discretion: (i) the indictment of Executive for, or the entry of a plea of guilty or nolo contendere by Executive to, a felony charge or any crime involving moral turpitude; (ii) Unlawful conduct on the part of Executive that may reasonably be considered to reflect negatively on the Company or compromise the effective performance of Executive’s duties as determined by the Board in its sole discretion; (iii) Executive’s willful misconduct in connection with his duties or willful failure to use reasonable effort to perform substantially his responsibilities in the best interest of the Company (including, without limitation, breach by the Executive of this Agreement), except in cases involving Executive’s mental or physical incapacity or disability; (iv) Executive’s willful violation of the Company’s Business Ethics Policy, Code of Ethics or any other Company policy that may reasonably be considered to reflect negatively on the Company or compromise the effective performance of Executive’s duties as determined by the Board in its sole discretion; (v) fraud, material dishonesty, or gross misconduct in connection with the Company perpetrated by Executive; (vi) Executive undertaking a position or any activity in or in furtherance of competition with Company during the Employment Term; (vii) Executive having caused substantial harm to the Company with intent to do so or as a result of gross negligence in the performance of his duties; or (viii) Executive having wrongfully and substantially enriched himself at the expense of the Company.

(d) "Disability" shall be deemed to exist if (i) by reason of mental or physical illness the Executive has not performed his or her duties for a period of six consecutive months; and (ii) the Executive does not return to the performance of his duties within thirty days after written notice is given by Company that the Executive has been determined by the Board of Directors to be "Disabled" under the Company's long term disability policy.

(e) “Good Cause” shall mean a termination of Executive’s employment by Executive, as a consequence of , and following: (i) a material adverse change in Executive’s authority and responsibilities without Executive’s consent, (ii) a material reduction in Executive’s compensation, not proportionally and similarly affecting other senior executives, without Executive’s consent, (iii) the failure of the Company or any successor to fully honor the terms of any contractual agreements with Executive, or (iv) a Change in Control; provided, that, in the case (i), (ii) or (iii) , Executive shall have delivered written notice to the Company of his intention to terminate his employment for Good Cause within 90 days of the event or

events constituting Good Cause, which notice specifies in reasonable detail the circumstances claimed to give rise to the Executive’s right to terminate employment for Good Cause, and the Company shall not have cured such circumstances within 30 days following receipt of such notice.

(f) ) "Change in Control" shall be deemed to have occurred if (i) there is a change of ownership of the Company as a result of one person, or more than one person acting as a group, acquiring ownership of stock of the Company that, together with stock held by such person or group, constitutes more than 50% of the total fair market value or total voting power of the stock of the Company, provided, however, that the acquisition of additional stock by a person or group who already owns 50% of the total fair market value or total voting power of the stock of the Company shall not be considered a Change in Control; (ii) notwithstanding that the Company has not undergone a change in ownership as described in subsection (i) above, there is a change in the effective control of the Company as a result of either (a) one person, or more than one person, acting as a group, acquiring (or having acquired during the 12 month period ending on the date of the most recent acquisition) ownership of stock of the Company possessing 30% or more of the total voting power of the stock of the Common, or (b) a majority of the members of the Board is replaced during any 12 month period by directors whose appointment or election is not endorsed by a majority of the members of the Board before the date of appointment or election, provided, however, that in either case the acquisition of additional control by a person or group who already is considered to effectively control the Company shall not be considered to a Change in Control; (iii) there is a change in ownership of a substantial portion of the Company's assets as a result of one person, or more than one person acting as a group, acquiring (or having acquired during the 12 month period ending on the date of the most recent acquisition) assets from the Company (A) constituting substantially all the assets of either of the Company’s two business units, or (B) that have a total gross fair market value equal to or more than 40% of the total gross fair market value of all the assets of the Company immediately before such acquisition or acquisitions; or (iv) the sale, spinoff, or other disposition of either of the Company’s two business units, provided, however, that there is no Change in Control if the transfer of assets is to the shareholders of the Company or an entity controlled by the shareholders of the Company.

7. Internal Revenue Code Section 280G. In the event that the benefits provided for in this Agreement, when aggregated with any other payments or benefits or to be received by Executive (the “Aggregate Benefits”), would (i) constitute “parachute payments” within the meaning of Section 280G of the Internal Revenue Code (the “Code”), and (ii) would be subject to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then Executive’s Aggregate Benefits will be either: (a) delivered in full, or (b) delivered as to such lesser extent as would result in no portion of such Aggregate Benefits being subject to the Excise Tax, whichever of the foregoing amounts, taking into account the applicable federal, state and local income taxes and the Excise Tax, results in the receipt by Executive on an after-tax basis of the greatest amount of Aggregate Benefits, notwithstanding that all or some portion of such Aggregate Benefits may be taxable under Section 4999 of the Code. Unless the Company and Executive otherwise agree in writing, any determination required under this paragraph will be made in writing by an independent certified public accounting firm engaged by the Company (the “Accounting Firm”) whose determination will be conclusive and binding upon Executive and the Company for all purposes. For purposes of making the calculations required by this paragraph, the Accounting Firm may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations concerning the application of Sections 280G and 4999 of the Code. The Company and Executive will furnish to the Accounting Firm such information and documents as the Accounting Firm may reasonably request in order to make a determination under this paragraph. To the extent any reduction in Aggregate Benefits is required by this paragraph, the Company and Executive shall cooperate so that the reduction results in Executive retaining the maximum amount of the Aggregate Benefits.

8. Confidential Information. Executive agrees that all aspects of the Company's business, products, prospects, plans and strategies that have not been publicly disclosed, including, but not limited to, the identities, needs and preferences of its customers, internal business operations and pricing information, manufacturing know-how, technical attributes of products, annual or strategic business plans or analyses, and any and all other trade secrets (collectively, "Confidential Information"), are confidential and secret, shall be maintained in confidence and not disclosed to any third party, and shall remain the exclusive property of the Company. Any Confidential Information may be used or disclosed by the Executive solely to discharge his obligations hereunder, and shall not be used or disclosed for any other purpose, including, without limitation, for any purpose whatsoever following termination of Executive's employment. All Confidential Information in tangible form that is provided to the Executive shall be returned by the Executive to the Company within 30 days of any termination of employment, together with a statement certifying: (1) that Executive has returned all Confidential Information in his possession, (2) that Executive has at all times maintained the confidential nature of the Confidential Information, and (3) that Executive confirms his continuing obligations of confidentiality under this Agreement following such termination.

9. Non-disparagement. During the Employment Term, and thereafter, Executive will not knowingly disparage, criticize or otherwise make any derogatory statements regarding the Company, its shareholders, directors or its officers. The foregoing restriction will not apply to any truthful statements made in response to a valid subpoena or other compulsory legal process.

10. Restrictive Covenants. Executive acknowledges and recognizes the highly competitive nature of the Company’s business. Accordingly, Executive agrees as follows:

A.That for a period of twenty-four (24) months following the termination of his employment with the Company for any reason, whether on his own behalf or on behalf of or in conjunction with any person, firm, partnership, joint venture, association, corporation or other business, organization, entity or enterprise whatsoever (“Person”), Executive shall not directly or indirectly:

(i) operate a Competitive Business;

(ii) enter into the employ of, or render any services to, any Person in respect of any Competitive Business;

(iii)acquire a financial interest in, or otherwise become actively involved with, any Competitive Business, directly or indirectly, as an individual, partner, shareholder, officer, director, principal, agent, trustee or consultant; provided, however, that in no event shall ownership of less than 2% of the outstanding capital stock of any corporation, in and of itself, be deemed a violation of this Release if such capital stock is listed on a national securities exchange or regularly traded in an over-the-counter market; or

(iv)interfere with, or attempt to interfere with, any business relationships between Albany or any of its subsidiaries or affiliates and their customers, clients, suppliers or investors; and

B.That for a period of twenty-four (24) months following the termination of his employment with the Company for any reason, whether on the Executive’s own behalf or on behalf of or in conjunction with any person, firm, partnership, joint venture, association, corporation or other business, organization, entity or enterprise whatsoever, Executive shall not directly or indirectly:

(i) solicit or encourage any employee of the Company or any of its subsidiaries or affiliates to leave the employment of the Company or any of its subsidiaries or affiliates; or

(ii) hire any such employee who was employed by the Company or any of its subsidiaries or affiliates as of the date of such termination or, if later, within the six-months before the date the person was hired by Executive.

Executive understands that the Company will have the right to seek injunctive relief in the event that Executive violates this paragraph 10 because the harm caused by such violation will be irreparable and difficult to calculate in terms of monetary damages.

For the purposes of this paragraph 10, a Competitive Business is any person or entity that manufactures or sells (a) papermachine clothing or belts used in the manufacture or paper, nonwovens or fiber cement, or (b) advanced composite materials, structures or components for use in defense, aerospace or automotive applications.

11. Blue Pencil Doctrine. It is expressly understood and agreed by Executive that although Executive considers the restrictions in this Agreement to be reasonable, if a final determination is made by a court of competent jurisdiction or an arbitrator that the time or territory or any other restriction contained in the Agreement is an unenforceable restriction against Executive, the provisions of this Agreement shall not be rendered void but shall be deemed amended to apply as to such maximum time and territory and to such maximum extent as such court or arbitrator may determine or indicate to be enforceable.

12. Board Membership. Upon the termination of Executive's employment for any reason, Executive will be deemed to have resigned from any seat on the Board (and from any seats on the boards, and from any offices, of subsidiaries) held at such time, voluntarily, without any further required action by the Executive, as of the end of the Employment Term. Executive, at the Board's request, will execute any documents necessary to reflect his resignation.

13. Assignment. This Agreement will be binding upon and inure to the benefit of (a) the heirs, executors, and legal representatives of Executive upon Executive's death, and (b) any successor of the Company. Any such successor of the Company will be deemed substituted for the Company under the terms of this Agreement for all purposes. For this purpose, "successor" means any person, firm, corporation, or other business entity which at any time, whether by purchase, merger, or otherwise, directly or indirectly acquires all or substantially all of the assets or business of the Company. None of the rights of Executive to receive any form of compensation payable pursuant to this Agreement may be assigned or transferred except by will or the laws of descent and distribution. Any other attempted assignment, transfer, conveyance, or other disposition of

Executive's right to compensation or other benefits will be null and void.

14. Notices. All notices, requests, demands, and other communications called for hereunder will be in writing and will be deemed given (a) on the date of delivery if delivered personally, (b) one (1) day after being sent overnight by a well-established commercial overnight service, or (c) four (4) days after being mailed by registered or certified mail, return receipt requested, prepaid

and addressed to the parties or their successors at the following addresses, or at such other addresses as the parties may later designate in writing:

If to the Company:

Attn: Chairman of the Board

Albany International Corp.

218 Airport Drive

Rochester, NH 03867

If to the Executive:

at the last residential address known by the Company. In addition, the Company shall make a reasonable effort to fax or e-mail such notice to Executive at his most recent personal fax number or e-mail address, with a copy to Executive's lawyer by the same method, to the extent known to the Company.

15. Severability. If any provision hereof becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable, or void, this Agreement will continue in full force and effect without said provision.

16. Arbitration. The Parties agree that any and all disputes arising out of the terms of this Agreement, Executive's employment by the Company, Executive's service as an officer or director of the Company, or Executive's compensation and benefits, their interpretation, and any of the matters herein released, will be subject to binding arbitration in New York, New York under the American Arbitration Association's National Rules for the Resolution of Employment Disputes. The Parties agree that the prevailing party in any arbitration will be entitled to injunctive relief in any court of competent jurisdiction to enforce the arbitration award. The Parties hereto agree to waive their right to have any dispute between them resolved in a court of law by a judge or jury. This paragraph will not prevent either party from seeking injunctive relief (or any other provisional remedy) from any court having jurisdiction over the Parties and the subject matter of their dispute relating to Executive's obligations under this Agreement.

17. Integration. This Agreement, together with the Exhibit, represents the entire agreement and understanding between the parties as to the subject matter herein and supersedes all prior or contemporaneous agreements whether written or oral. No waiver, alteration, or modification of any of the provisions of this Agreement will be binding unless in a writing that is signed by duly authorized representatives of the parties hereto, provided that any benefits or compensation provided to Executive pursuant to the terms of any plan, program, policy, or arrangement may be amended or terminated by the Company at any time, in accordance with the terms of such plan, program, policy or arrangement. In entering into this Agreement, no party has relied on or made any representation, warranty, inducement, promise or understanding that is not in this Agreement.

Executive acknowledges that Executive is not subject to any contract, obligation or understanding (whether written or not) that would in any way restrict the performance of Executive's duties as set forth in this Agreement.

18. Waiver of Breach. The waiver of a breach of any term or provision of this Agreement, which must be in writing, will not operate as or be construed to be a waiver of any other previous or subsequent breach of this Agreement.

19. Survival. The Company's and Executive's obligations under Section 6 and, to the extent provided in Section 6, the Executive's obligations under Sections 9 and 10, will survive the termination of this Agreement.

20. Headings. All captions and Section headings used in this Agreement are for convenient reference only and do not form a part of this Agreement.

21. Tax Withholding. All payments made pursuant to this Agreement will be subject to withholding of applicable taxes.

22. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York without regard to any provisions thereof relating to conflict of laws.

23. Certain Acknowledgment. Executive acknowledges that he has had the opportunity to obtain legal advice with respect to this Agreement, has had sufficient time to read, and has carefully read and fully understands all the provisions of this Agreement, and is knowingly and voluntarily entering into this Agreement. Executive represents that he has no other employment or other agreement, arrangements or undertakings that might restrict or impair his performance of this Agreement or to serve as an employee of the Company. Executive will not in connection with his employment by the Company, use or disclose any confidential, trade secret, or other proprietary information of any previous employer or other Person that Executive is not lawfully entitled to disclose.

24. Counterparts. This Agreement may be executed in counterparts, and each counterpart will have the same force and effect as an original and will constitute an effective, binding agreement on the part of each of the undersigned.

25. Certain Disclosures to Governmental Agencies and Others. Notwithstanding anything herein or in any other agreement with or policy (including without limitation any code of conduct or employee manual) of the Company, nothing herein or therein is intended to or shall: (i) prohibit Executive from making reports of possible violations of federal law or regulation (even if Executive participated in such violations) to, and cooperating with, any governmental agency or entity in accordance with the provisions of and rules promulgated under Section 21F of the Securities Exchange Act of 1934 or Section 806 of the Sarbanes-Oxley Act of 2002 or of any other whistleblower protection provisions of state or federal law or regulation; (ii) require notification to or prior approval by the Company of any such reporting or cooperation; or (iii) result in a waiver or other limitation of Executive’s rights and remedies as a whistleblower, including to a monetary award. Notwithstanding the foregoing, Executive is not authorized (and the above should not be read as permitting Executive) to disclose communications with counsel that were made for the purpose of receiving legal advice or that contain legal advice or that are protected by the attorney work product or similar privilege. Furthermore, Executive will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made (1) in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney, in each case, solely for the purpose of reporting or investigating a suspected violation of law or (2) in a complaint or other document filed in a lawsuit or proceeding, if such filings are made under seal.

IN WITNESS WHEREOF, each of the parties has executed this Agreement, in the case of the Company by a duly authorized officer, as of the day and year written below.

COMPANY:

ALBANY INTERNATIONAL CORP.

By:____________________________________ Date:

Name

Title

EXECUTIVE

_______________________________________ Date:

Gunnar Kleveland

Exhibit 10.4

SPECIAL INCENTIVE AWARD AGREEMENT

This SPECIAL INCENTIVE AWARD AGREEMENT (the “Agreement”) is dated as of the 18th day of August 2023, between Albany International Corp., a Delaware corporation (the “Company”), and Gregory Harwell (the “Participant”).

WHEREAS, the Company has adopted and maintains the Albany International Corp. 2023 Incentive Plan (the “Plan”);

WHEREAS, Section 6 of the Plan provides for the grant of incentive awards to Participants in the Plan, which awards may or may not be equity-based or equity-related awards; and

WHEREAS, Participant has been, and is currently, employed by Albany in a key senior management position, to wit: President - Albany Engineered Composites; and

WHEREAS, Participant is employed by Albany on an at-will basis; and

WHEREAS, Albany wishes for Employee to continue his employment with Albany in order to effectuate the strategic plan for the Albany Engineered Composites business segment and to assist with the anticipated transition to a new Chief Executive Officer (“CEO”); and

WHEREAS, Albany therefore seeks to incentivize Employee to continue his voluntary employment with Albany, at least until December 31, 2024; and

WHEREAS, as an incentive to encourage the Participant to remain in the employ of the Company by affording the Participant a greater interest in the success of the Company, the Company desires to grant the Participant the opportunity to earn shares of the Company’s Class A Common Stock (“Common Stock”), as provided herein;

NOW THEREFORE, in consideration of the agreements and obligations hereinafter set forth, the parties hereto agree as follows:

1.Definitions; References.

As used herein, the following terms shall have the meanings indicated below. Capitalized terms used but not defined herein shall have the meanings assigned to them in the Plan.

(i)“Beneficiary” shall mean the person(s) designated by the Participant in a written instrument delivered pursuant to the Plan to receive a payment due under the Plan upon the Participant’s death, signed by the Participant and delivered to the Company prior to the Participant’s death or, if no such written instrument is on file, the Participant’s estate.

(ii)“Cause” shall be deemed to exist if a majority of the members of the Board of Directors determine that the Participant has (i) caused substantial harm to the Company with intent to do so or as a result of gross negligence in the performance of his or her duties; (ii) not

made a good faith effort to carry out his or her duties; (iii) wrongfully and substantially enriched himself or herself at the expense of the Company; or (iv) been convicted of a felony.

(iii)“Determination Date” shall mean the date on which the Compensation Committee of the Company’s Board of Directors (the “Committee”) shall have determined, in its sole discretion, that the hereinafter defined Milestone Objectives have been achieved, which date shall not be any sooner than December 31, 2024, nor later than December 31, 2025.

(iv)“Distribution Date” shall be the first Business Day of the second month following the Determination Date.

(v)“Milestone Objectives” shall be as specified in Section 3.

(vi)“Share Bonus” with respect to the Service Period, shall mean the number of

shares of Common Stock specified in Section 2.

2.Establishment of the Share Bonus Amount. Pursuant to, and subject to, the terms and conditions set forth herein and, in the Plan, the Company hereby establishes the Participant’s target Share Bonus amount at 16,584 shares of the Company’s Common Stock. The Share Bonus shall be earned and paid based on the criteria and in in the manner set forth in Sections 3 and 4 hereof.

3. “Establishment of the Milestone Objectives”. Pursuant to, and subject to, the terms and conditions set forth herein and, in the Plan, the Company hereby establishes the Milestone Objectives as set forth in Exhibit “A” to evaluate the Participant’s performance. The Milestone Objectives shall represent the subjective basis for determining whether the Participant has satisfactorily performed his duties in implementing and executing the strategic business decisions to be adopted by the Company, so as to warrant the payment of the Share Bonus.

4.Determination of Achievement of the Milestone Objectives. Beginning in February 2024 the Committee shall, at least quarterly, confer and determine, in its sole discretion, whether the Milestone Objectives have been achieved to its satisfaction according to the criteria outlined in Exhibit “A”. In the event the Milestone Objectives are not achieved by December 31, 2025, no bonus shall be earned, and the Participant shall not be entitled to any other payment under this Agreement or have any other rights with respect to the Share Bonus. Participant shall report quarterly to the Committee on the progress of achieving the Milestone Objectives beginning in December 2023.

5. Time and Method of Payment of Bonus.

a.The Share Bonus shall be distributed in shares of Common Stock, less applicable taxes and withholdings, which may be satisfied with shares of Common Stock, and shall be distributed on the Distribution Date.

b.In the event that a payment is called for hereunder to the Participant at a time when the Participant is deceased, such payment shall be made to the Participant’s Beneficiary.

6.Effect of Termination of Employment.

a.In the event the Participant’s employment with the Company terminates prior to the achievement of the Milestone Objectives for any reason other than an involuntary termination without Cause, no bonus shall be earned, and the Participant shall not be entitled to

any other payment under this Agreement or have any other rights with respect to the Share Bonus.

b.In the event the Company terminates the Participant’s employment without Cause at any time prior to the achievement of the Milestone Objectives, the Share Bonus Amount shall nevertheless be earned and paid to the Participant in accordance with the otherwise applicable provisions of this Agreement; provided however, that any unpaid Share Bonus shall be forfeited in its entirety should Participant engage in any business or activity, either on his own or as an employee, which is deemed to be in competition with the Company.

7.Clawback. In the event of the Company’s material restatement of its financial results the Participant shall repay the entire Share Bonus, or forfeit such if not already paid, whether vested or unvested, to the extent the restatement is caused or substantially caused by the fraud or intentional misconduct of the Participant.

8. Modification and Waiver. Except as provided in the Plan with respect to determinations of the Committee and subject to the Company’s Board of Directors’ right to amend the Plan, neither this Agreement nor any provision hereof can be changed, modified, amended, discharged, terminated or waived orally or by any course of dealing or purported course of dealing, but only by an agreement in writing signed by the Participant and the Company. No such agreement shall extend to or affect any provision of this Agreement not expressly changed, modified, amended, discharged, terminated or waived or impair any right consequent on such a provision. The waiver of or failure to enforce any breach of this Agreement shall not be deemed to be a waiver or acquiescence in any other breach thereof.

9.Notices. All notices and other communications hereunder shall be in writing, shall be deemed to have been given if delivered in person or by first-class registered or certified mail, return receipt requested, and shall be deemed to have been given when personally delivered or five (5) days after mailing to the following address (or to such other address as either party may have furnished to the others in writing in accordance herewith, except that notices of change of address shall only be effective upon receipt):If to the Company:

Albany International Corp.

216 Airport Drive

Rochester, New Hampshire 03867

Fax: (518) 445-2270

Attention: General Counsel

If to the Participant, to the most recent address of the Participant that the Company has in its records.

10.Participant Acknowledgement. The Participant hereby acknowledges receipt of a copy of the Plan.

11.Incorporation of the Plan. All terms and provisions of the Plan are incorporated herein and made part hereof as if stated herein. If any provision hereof and of the Plan shall be in conflict, the terms of the Plan shall govern. All capitalized terms used herein and not defined herein shall have the meanings assigned to them in the Plan.

12.Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed to be an original, but each of which together shall constitute one and the same document.

13.Governing Law; Choice of Forum. This Agreement shall be governed by and interpreted in accordance with New York law, without regard to its conflicts of law principles, and the parties hereby submit to the jurisdiction of the courts and tribunals of New York.

14.Binding Effect. This Agreement shall be binding upon, inure to the benefit of, and be enforceable by the heirs, personal representatives and successors of the parties hereto. Nothing expressed or referred to in this Agreement is intended or shall be construed to give any person other than the parties to this Agreement, or their respective heirs, personal representatives or successors, any legal or equitable rights, remedy or claim under or in respect of this Agreement or any provision contained herein.

15.Severability. If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Agreement shall remain in full force and effect and shall in no way be affected, impaired or invalidated.

16.Miscellaneous. The headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Company and the Participant have duly executed this Award Agreement as of the Award Date specified above.

ALBANY INTERNATIONAL CORP.

By: _________________________________

Name:

Title:

Participant

_________________________________

Gregory Harwell

EXHIBIT A

MILESTONE OBJECTIVES

Objective 1 - Succession Plan – President, Albany Engineered Composites

Performance Goals and Criteria: Participant shall identify and develop a “ready-now” successor either internally or begin an external search to hire, onboard and develop an external candidate such that that there is a candidate ready, able and capable to assume the position of President, Albany Engineered Composites, regardless of whether such position is open or needs to be filled at that time. The determination of whether a candidate is “ready-now” shall be made by the Chief Executive Officer, in consultation with the Chief Human Resources Officer, according to the Company’s established talent management and succession planning processes, taking into consideration the input from a retained outside organizational consulting firm.

Objective 2 – Albany Engineered Composites Strategic Plan

Performance Goals and Criteria: Participant shall prepare, review, revise and lead the implementation of an updated strategic plan for the Albany Engineered Composites business segment with the goal of driving earnings improvements through new business awards and coordinated interaction with other business functions. The achievement of this Milestone Objective shall require the Board of Directors’ approval of the proffered strategic plan and meaningful progress in the achievement of the goal.

Exhibit 99.1

Albany International Appoints Gunnar Kleveland as President and Chief Executive Officer

Accomplished Industrial and Aerospace Executive Brings Nearly 20 Years

of Operational and Leadership Experience

ROCHESTER, N.H.--(BUSINESS WIRE)—August 21 , 2023--– Albany International Corp. (“Albany” or the “Company”) (NYSE: AIN) today announced that its Board of Directors has appointed Gunnar Kleveland to succeed Bill Higgins as President and CEO, effective September 1. Mr. Kleveland will also join the Company’s Board at that time. Mr. Higgins, who previously announced his intention to retire as CEO, will remain a member of Albany’s Board.

Mr. Kleveland is a seasoned executive with nearly two decades of industrial and aerospace leadership experience at Textron Inc. Most recently, he served as President and CEO of Textron Specialized Vehicles Inc., which designs and manufactures a range of vehicles and equipment for commercial and consumer applications. During his tenure, Mr. Kleveland was instrumental in developing and executing a strategy that leveraged the business’ expertise in electric drivetrains and lithium-ion battery technology across its brands and product lines. As a result, Textron was able to reduce its vehicles’ carbon footprints and increase energy efficiency, outperforming its peers and meeting the evolving needs of its customers. Prior to that, Mr. Kleveland served as President of Textron’s TRU Simulation + Training Inc. He also held various leadership roles in strategic sourcing, supply chain and logistics at Bell Helicopter, including as Executive Vice President of Integrated Operations. Prior to these roles, he was a fighter pilot in the Royal Norwegian Air Force (RNoAF) and finished his 15-year career in the air force as the Chief of Flight Safety.

Mr. Kleveland (age 54) holds a degree from the RNoAF Academy, a Bachelor of Science in Aeronautics from Embry Riddle Aeronautical University and a Master of Business Administration from Midwestern State University.

“Gunnar’s appointment is the culmination of a comprehensive search process that the Board and Bill have worked on together over the last several months,” said Erkie Kailbourne, Chairman of the Albany Board of Directors. “We are pleased to have identified such an accomplished and experienced executive and are confident that he is the right person to lead Albany. Gunnar’s strategic vision, focus on commercial execution and innovation and proven ability to build strong and collaborative teams have translated to tangible results. We look forward to leveraging his expertise to further build on our momentum and deliver value for all of our stakeholders.”

Mr. Kailbourne added, “On behalf of the Board, I would like to thank Bill for his service to Albany. We are grateful for his many contributions and will continue to benefit from his insights and experience as a member of our Board.”

“Albany is an industry leader with a strong reputation for innovation and technological expertise,” said Mr. Kleveland. “I am thrilled to be joining the company and, on the heels of its pending acquisition of Heimbach Group, to lead the next chapter of Albany’s evolution. I look forward to working closely with Bill to ensure a smooth transition, and to partnering with the entire Board and leadership team as we work to advance Albany’s track record of operational excellence and remain the partner of choice for a growing customer base.”

Mr. Higgins said, “It has been a privilege to lead Albany and this talented team and to see all that we have accomplished. Albany stands today as the trusted supplier and premier partner of choice to vital global industries, and I am confident that this team will continue delivering unrivaled, mission-critical solutions to our customers under Gunnar’s leadership.”

About Albany International Corp.

Albany International is a leading developer and manufacturer of engineered components, using advanced materials processing and automation capabilities, with two core businesses. Machine Clothing is the world’s leading producer of custom-designed, consumable belts essential for the manufacture of all grades of paper products. Albany Engineered Composites is a growing designer and manufacturer of advanced materials-based engineered components for demanding aerospace applications, supporting both commercial and military platforms. Albany International is headquartered in Rochester, New Hampshire, operates 23 facilities in 11 countries, employs more than 4,200 people worldwide, and is listed on the New York Stock Exchange (Symbol AIN). Additional information about the Company and its products and services can be found at www.albint.com

Forward-Looking Statements

Readers are cautioned that certain statements made by Albany International herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements include any statement that does not directly relate to any historical or current fact. Forward-looking statements may project, indicate or imply future results, events, performance or achievements, and such statements may contain the words “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “will be,” “will continue,” “will likely result,” and similar expressions. In addition, any statement concerning future performance, ongoing strategies or prospects, and possible actions taken by Albany International are also forward-looking statements. Forward-looking statements are based on current expectations and projections about future events and are inherently subject to a variety of risks and uncertainties, many of which are beyond Albany International’s control, that could cause actual results to differ materially from those anticipated or projected. Developments in any of the risks or uncertainties facing Albany International, including those described in risk factors included in annual and quarterly reports and other filings with the Securities and Exchange Commission (“SEC”) made by Albany International, could cause results to differ materially from results that have been or may be anticipated or projected. Given these risks and uncertainties, readers should not place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made and Albany International expressly disclaims any obligation or undertaking to update these statements to reflect any change in expectations or beliefs or any change in events, conditions or circumstances on which any forward-looking statement is based.

Contacts

John Hobbs

603-330-5897

john.hobbs@albint.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ain_ClassACommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

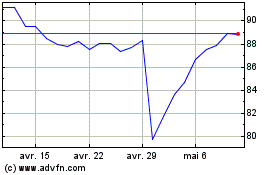

Albany (NYSE:AIN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Albany (NYSE:AIN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024