0001487712false00014877122023-11-062023-11-060001487712us-gaap:CommonClassAMember2023-11-062023-11-060001487712us-gaap:SeriesAPreferredStockMember2023-11-062023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 | | |

| November 6, 2023 |

Date of Report (Date of earliest event reported) |

AIR LEASE CORPORATION

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware | 001-35121 | 27-1840403 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 2000 Avenue of the Stars, | Suite 1000N | | |

| Los Angeles, | California | | 90067 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 553-0555 | | |

Not Applicable (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | AL | New York Stock Exchange |

| 6.150% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series A | AL PRA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure

On November 6, 2023, the Company held a conference call to discuss its financial results for the three and nine months ended September 30, 2023. A copy of the conference call transcript is furnished herewith and attached hereto as Exhibit 99.1.

The information in this Item 7.01 and the related information in Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit 104 The cover page from this Current Report on 8-K formatted in Inline XBRL

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| AIR LEASE CORPORATION | |

| | | | |

| Date: November 7, 2023 | /s/ Gregory B. Willis | |

| Gregory B. Willis | |

| Executive Vice President and Chief Financial Officer

| |

| | |

11 - 06 - 2023 |

|

Air Lease |

|

Third Quarter 2023 Earnings |

|

|

TOTAL PAGES: 14

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

CORPORATE SPEAKERS:

Jason Arnold

Air Lease Corp; Head of Investor Relations

John Plueger

Air Lease Corp; Chief Executive Officer and President

Steven Udvar-Hazy

Air Lease Corp; Executive Chairman

Gregory Willis

Air Lease Corp; Executive Vice President & Chief Financial Officer

PARTICIPANTS:

Catherine O'Brien

Goldman Sachs; Analyst

Hillary Cacanando

Deutsche Bank; Analyst

Helane Becker

TD Cowen; Analyst

Vincent Caintic

Stephens; Managing Director and Equity Research Analyst

James Kirby

JPMorgan; Analyst

Stephen Trent

Citi; Analyst

PRESENTATION:

Operator^ Good afternoon. (Operator Instructions) At this time, I would like to welcome everyone to the Air Lease Corporation third quarter 2023 Earnings Conference Call. (Operator Instructions) I will now turn the call over to Mr. Jason Arnold, Head of Investor Relations. Mr. Arnold, you may begin your conference.

Jason Arnold^ Thank you, [Rob]. And good morning, everyone. Welcome to Air Lease Corporation's third quarter 2023 earnings call. This is Jason Arnold. I'm joined by Steve Hazy, our Executive Chairman; John Plueger, our Chief Executive Officer and President; and Greg Willis, our Executive Vice President and Chief Financial Officer.

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

Earlier this morning we published our third quarter 2023 results. A copy of our earnings release is available on the Investors section of our website at www.airleasecorp.com. This conference call is being webcast and recorded today Monday November 6, 2023.

The webcast will be available for replay on our website. (Operator Instructions) Before we begin, please note that certain statements in this conference call, including certain answers to your questions are forward-looking statements within the meaning of the Private Securities Litigation Reform Act.

This includes without limitation statements regarding the state of the airline industry; the impact of rising interest rates and inflation; the impact of sanctions imposed on Russia; the impact of the Israel-Hamas conflict; the impact of aircraft and engine delivery delays [and] manufacturing defects; our aircraft sales pipeline and our future operations and performance; revenues, operating expenses, stock-based compensation expense and other income and expense items.

These statements and any projections as to our future performance represent management's estimates for future results and speak only as of today November 6, 2023. These estimates involve risks and uncertainties that could cause actual results to differ materially from expectations.

Please refer to our filings with the SEC for a more detailed description of risk factors that may affect our results. Air Lease Corporation assumes no obligation to update any forward-looking statements or information in light of new information or future events.

In addition, we may discuss certain financial measures such as adjusted net income before income taxes, adjusted diluted earnings per share before income taxes and adjusted pretax return on equity, which are non-GAAP measures.

A description of our reasons for utilizing these non-GAAP measures as well as our definition of them and the reconciliation to corresponding GAAP measures can be found in our earnings release and in the 10-Q that we issued today.

This release can be found both in the Investors and Press section of our website at www.airleasecorp.com. As a reminder, unauthorized recording of this conference call is not permitted. I would now like to turn the call over to our Chief Executive Officer and President, John Plueger. John?

John Plueger^ Well thanks, Jason. Good morning, everyone. Thank you for joining us on our call today. I'm happy to report that during the third quarter, ALC generated quarterly revenues of $659 million, up approximately 18% relative to the same quarter last year. We also earned $1.10 earnings per share, up 22% from last year's third quarter.

Strong continued expansion of our fleet and higher sales activity as compared to the prior year were the primary drivers of upside to our results. During the third quarter, we

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

purchased eight new aircraft from our order book adding approximately $450 million in flight equipment to our balance sheet, while we sold eight aircraft totaling approximately $350 million in sales proceeds. The utilization rate on our fleet remains very strong at 99.9% during the third quarter.

At present, we are 100% placed on our forward orders through 2025 and we placed 67% of our entire order book. Airline customer demand for new and fuel-efficient commercial aircraft remains exceptionally strong and is only being exacerbated by OEM challenges, including RTX's announcement in September on the impact due to the Pratt & Whitney geared turbofan engines, which I do want to comment on for a moment here.

As mentioned last quarter, Pratt & Whitney 1100G engines that power a significant number of the GTF powered A320neos and 321neos have been found to have a powder metal coating flaw. RTX now believes that a greater number of these engines will need to be removed and inspected on an accelerated basis, which ultimately will lead to a significant number of A320neo and 321neo aircraft on the ground over the next several years.

So what does this all mean for Air Lease? Well as highlighted last quarter, more aircraft on the ground for longer will create significant operational challenges for airlines, will further congest MRO facilities and boost demand for alternative aircraft and spare engines. We also believe that the circumstance will likely make for additional Airbus narrow-body delivery delays if new production engines and as new production engines are redirected to support aircraft in the fleet versus new aircraft production. So clearly, a challenging circumstance for the industry and our airline customers. As a reminder, while we do try to ensure that our customers receive help from Pratt, our leases are triple net, and lease payments remain the obligation of our lessees, whether the aircraft is flying or not. On the other side of the coin, I think it's important to note that further reductions to the availability of commercial aircraft certainly creates even more scarcity value for ALC's fleet and our order book delivery positions. This, in turn, is already driving a further strengthening of lease rates and aircraft values and significantly bolstering lease extensions at higher rates.

ALC's $23 billion forward order book of aircraft extends out from the present through 2029 inclusive of OEM delivery delay expectations, leaving us in a position of significant strength in the current environment for our remaining unplaced aircraft. We're being very thoughtful about placing these remaining positions in order to maximize lease rates and, therefore, returns on these valuable new aircraft delivery positions.

Secondary market demand continues to be very strong, and our sales activity continued at a healthy pace in the third quarter. We're pleased by the gain on sale margins we are realizing on these aircraft. ALC's pipeline of aircraft for sale stands at a solid $1.8 billion as of today and that includes around $700 million of aircraft classified as held for sale and another $1.1 billion subject to letters of intent. We now anticipate approximately $500 million of aircraft sales to close in the fourth quarter, which means that we expect to hit the midpoint of our full year sales target range in 2023 at $1.5 billion. We'll update you on our expectations for 2024 sales at our next earnings call in February.

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

So, while the rate of increases in lease rates still lags interest rates, our aircraft values are benefiting from supply-demand dynamics. It's important to emphasize that lease rates should not be looked at in isolation. The earnings cycle on every aircraft is not complete until it's sold, and our aircraft sales are benefiting from the rise in aircraft values. So the view must be taken of the total picture to include aircraft valuations and sales.

Moving on to deliveries. We guided new aircraft deliveries to be approximately $700 million to $800 million for the third quarter, and actual deliveries came in lighter at about $450 million given continued OEM delays. In the big picture, there is no change to our outlook for aircraft delivery delays to persist for years to come, which we've discussed many times before on our calls in the past. As for expectations for fourth quarter deliveries, at present we anticipate approximately $900 million to $1.1 billion of aircraft deliveries, representing a total of about $4.3 billion to $4.5 billion of deliveries for the full year of 2023. While delays are clearly disappointing to us as large customers of Boeing and Airbus, as well as disappointing to our airline partners who are basing fleet planning decisions on timely deliveries, I would note that the scale of deliveries we've received has still contributed to a healthy fleet expansion over the past year.

I'd like to conclude with a few final comments on the current operating environment:

First, as to the current conflict in the Middle East, ALC has two aircraft on lease in Israel, two Boeing 787s leased to EL AL. As you may know, the government of Israel has stepped in to provide the insurance on those aircraft. Most of the non-Israel-based airlines have discontinued flying to Israel. We continue to monitor this region very closely with all of our airline lessees.

Second, globally, air traffic demand continues to expand at a brisk pace with volumes of 25% to 30% relative to the prior year and expanding at an even faster pace in many key markets. Steve will comment further on demand in his section, but we see no major signs of macroeconomic crosswinds impacting aircraft demand from the airline industry. We remain watchful, but we feel that some travel softening and discounting of airfares in the fourth quarter and in next year's first quarter as announced by a few U.S. and European LCCs may reflect a return to more normal seasonal fluctuation. In contrast to some of the softening of demand comments, over the past several business days both Southwest Airlines in the U.S.A. and Lufthansa in Germany report strong demand for this holiday season and the fourth quarter.

Third, our fleet continues to benefit from high airline demand and market supply constraints. We've always viewed our fleet as having significantly more value than what's on our balance sheet, but we see this is especially true in the current operating environment as can be seen in the gains we're recognizing on aircraft sales.

Finally, with over $23 billion of high-demand Airbus and Boeing aircraft in our forward order book, we have a long runway of growth ahead on our $26 billion fleet. Our order book aircraft were purchased with attractive volume discounts and in many cases, will launch customer pricing at times the market demand for commercial aircraft was far less robust

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

than it is at present. Airlines have limited access to the newest technology and lowest emissions aircraft over the next four to five years other than from ourselves and a limited number of lessors with forward orders over this period.

So, we remain very positive in our outlook in our business and positioning for the future. I'd like to turn the call over now to Steve Hazy, who will provide some additional industry and ALC commentary. Steve?

Steven Udvar-Hazy^ Thank you very much, John. The fundamentals of our business remain strong, and the value of our forward order book focused strategy has only increased over time. The earliest delivery slots for new narrow-bodies are now extending into the 2030s, and widebodies are also quickly being snapped up as well as international traffic volumes have rebounded sharply over the past year or so giving Air Lease a tremendous advantage relative to others in the industry. Aircraft lease rates and values are strengthening and momentum appears likely to continue given aircraft shortages. As a product of these positive trends and reflection of our earnings performance over the past year. Last Friday our Board of Directors approved an increase to our quarterly dividend distribution of 5% to $0.21 per share per quarter.

As John touched upon a moment ago, airline traffic volumes remain very robust. IATA traffic figures leased in October continue to show continued strong expansion with total volumes rising 28% year-over-year. Domestic traffic is up 25% with domestic China and India volumes also rising at double-digit percentage rates while other major regions expand at strong single-digit percentage rates or higher. International volumes, meanwhile are also strong, rising approximately 30% year-over-year and in some individual markets, they're experiencing exceptional growth. The Asia Pacific region, for example, international traffic has nearly doubled relative to the prior year. That market continues to see significant international traffic recovery although there's certainly room for more improvement in the major Asia to Europe and Asia to North America markets, while North America, Europe and Central America, Caribbean to Europe routes continue to remain the strongest major segments of the international market. The Middle East, Latin America and Africa, major international markets, are also witnessing high rates of traffic growth. We see continued expansion of international traffic in Asia and globally is further supporting wide-body aircraft demand in the coming years.

Passenger load factors, meanwhile, are very strong, approaching in many cases for exceeding historical highs witnessed four or five years ago, currently at 85% in the latest month of October as reported IATA and with the expectation of around 81% for the full year 2023. Given limited commercial aircraft availability, we believe that it is likely that load factors only continue to rise from here, benefiting airline yields, though with the cost of creating potential headaches and challenges for airline network operations and planning. This is particularly a risk for airlines operating older fleets with reduced dispatch reliability illustrating yet another reason why young aircraft are advantageous in the current environment.

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

The industry has been on a largely one-way robust recovery path since pandemic restrictions were eased in the past two years. Those restrictions obscure normal airline industry seasonality trends. Airlines though experience very clear seasonal demand with stronger volumes in the summer holiday months and weaker traffic in the winter months. So, we're not surprised to see some level of seasonal normalization especially in the Northern Hemisphere. Conversations with many of our airline customers also reflect these trends, especially in the markets that have seen the greatest rebound in traffic over the last three or four years. So we see recent market and media concerns as overlooking normal business trends and continue to view long-term drivers of global traffic growth remaining in place. Additionally, as a reminder, our fleet is very geographically diverse with 117 airline customers in 63 different countries at the end of the third quarter. So most of our airline customers are not observing a slowdown in traffic levels at the present time.

Circling back to Air Lease's third quarter results, as John mentioned, we delivered eight new aircraft during the period, consisting of seven narrow-body new aircraft and one new wide-body aircraft. We delivered two A220-300 aircraft. One was delivered to ITA Airways, the national carrier of Italy, and one of the 31 aircraft we signed for lease with ITA that will deliver through 2025. The other A220 was delivered to Bulgaria Air, the flag carrier of that country, which is based in the city of Sofia. We continue to see broadening of the operator base globally of the A220 given its attractive operating economics and fuel burn savings. We also delivered two new A321neos this past quarter, both to Volaris in Mexico, and Volaris is the largest domestic airline by passenger volume in Mexico. In September, the FAA returned Mexico to category one status which should benefit Volaris and its competitors in international expansion efforts to and from Mexico. ALC's narrow-body order book focus is concentrated very heavily on the A321neo, which offers superior combination of capacity, range and fuel efficiency. We also had three 737 MAX deliveries during the quarter, two of which went to Corendon Airlines Group as part of a placement of nine aircraft to that airline. Corendon has three operating airline units in the Netherlands, Malta and Turkey. The other 737 new aircraft was delivered to Norwegian, Scandinavia's second largest airline. All three of the 737 aircraft are delivering significantly improved operational efficiency to these airline customers. Our single wide-body delivery in the third quarter was a new A330-900neo which was also delivered to ITA Airways as part of the same large lease transaction I mentioned a moment ago, offering the airline, improved technology efficiency and customer experience on its intercontinental route network.

In closing, we continue to see the operating environment as being highly advantageous to us at this time. Our young fleet of high-demand commercial aircraft not only stands to benefit from the shortages that we foresee persisting for several years ahead. ALC’s order book strategy continues to provide us the newest and most efficient aircraft at attractive prices with delivery positions well ahead of those available at present from the manufacturers and commanding high lease rates.

I now turn the call over to our CFO, Greg Willis, for his comments on our financial performance.

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

Gregory Willis^ Thank you, Steve. Good morning, everyone. During the third quarter of 2023, Air Lease generated revenues of $659 million. This was comprised of approximately $604 million of rental revenues and $55 million from aircraft sales, trading and other activities. The increase in total revenues was primarily driven by the growth of our fleet along with increased sales activity. As John highlighted earlier, we sold roughly $350 million in aircraft during the third quarter and recognized $44 million in gains from the sale of eight aircraft and one finance lease transaction. We are pleased by our healthy gain on sales this quarter and with the size of our $1.8 billion sales pipeline.

As our fleet was booked organically, we have no purchase accounting adjustments nor have we taken any impairments that would magnify our gain on sale margin. Our gain on sale margin will vary from quarter-to-quarter based on the aircraft sold and market conditions. So clearly, strong gain margins imply significant embedded value not reflected in the carrying value of the fleet on our balance sheet today.

Moving on to expenses. Interest expense increased primarily due to the uptake in our composite cost of funds from 3.07% to 3.67% at the end of the third quarter, prevailing interest rates are serving to increase our interest expense, though we do continue to benefit from 85% of our debt being at fixed rates. Depreciation expense continues to track the size of our fleet, while SG&A rose as our business activities and leasing expenses have increased over the course of the past year.

Our cash flows from operations year-to-date rose 34% relative to the prior year benefiting from our continued strong airline customer cash collection efforts.

Moving on to financing our largely fixed rate balance sheet and strong investment-grade credit ratings continue to help offset the impact from elevated borrowing costs. We remain steadfast in maintaining our strong investment-grade balance sheet, utilizing unsecured debt as our main source of financing, maintaining a high ratio of fixed rate funding and utilizing conservative amount of leverage, maintaining our target debt-to-equity ratio of 2.5x.

Our debt-to-equity ratio at the end of the third quarter was 2.68x on a GAAP basis, which is net of cash on the balance sheet is approximately 2.61x, declining relative to the prior quarter given aircraft sales and lower deliveries. Our leverage remains modestly above our target following our Russia fleet write-off last year. We continue to expect leverage to trend towards our long-term target as we sell aircraft and given the current OEM delivery delays.

Our balance sheet remains solid, supported by our strong liquidity position of $6.6 billion and our unencumbered asset base of $28 billion as of the end of the third quarter. We plan to remain opportunistic on the financing front, leveraging our large liquidity base, which provides us with the flexibility to access the financing markets as to raise attractively priced debt capital.

In conclusion, the combination of our continued fleet growth constrained commercial aircraft supply, improving lease yields and attractive aircraft sales market trends continue to bolster

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

our business outlook, which we also expect to benefit our profit margins and ROE over time.

With that, I'll turn the call back over to Jason for the question-and-answer session of the call.

Jason Arnold^ Thanks, Greg. This concludes the management team's commentary and remarks or the question-and-answer session. (Operator Instructions) Rob, can you please open the line for Q&A?

Operator^ (Operator Instructions) And your first question comes from the line of Catherine O'Brien from -- my apologies, from Hillary -- my apologies again Catherine O'Brien just jump back into the queue.

Catherine O’Brien^ I'm sorry about that. I couldn't remember if I had raised my hand yet, so I appreciate that. I had a couple on the sales pipeline. A little bit of a multiparter. I hope you'll allow it.

You spoke to GTF already driving increases in lease rates and aircraft values. Should we expect to see the impact of that on the fourth quarter sales margin? Or is that more something we'll see over the course of the next year or so? Then I guess who are the buyers on the other side of these contracts, financial buyers, airlines?

Then last of the multipart one. You've expressed some frustration with the length of time it's been taking to close sales recently. You already gave us guidance on the fourth quarter.

But how should we big picture think about the timing of that $1.8 billion total held for sale under LOI? Is that something that could close over the next six months? Or will that take longer? I appreciate all the time.

John Plueger^ Yes. Well look, thanks for the question. First of all, this is progressive over the course of, I would say the next probably eight to 12 months. We will continue to add sales prospects going forward.

In terms of the shortages and the values with respect to the Pratt & Whitney power plants, this is just a general phenomenon that is increasing is one element of a generally increasing demand environment and therefore, generally increasing asset-buying environment.

So we're realizing the benefits of these on an ongoing basis in the first quarter, second, fourth quarter of this year, we anticipate and progressively through next year. It's -- I would say it's on a very regular straight line, scaling basis.

Gregory Willis^ And I guess Catie, your question about the buyers we're selling mainly to other leasing companies.

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

In terms of the cadence of sales, we're looking to do as best possible at a nice steady stream of aircraft sales quarter-to-quarter to have a nice steady impact to the financials.

Catherine O’Brien^ Got it. Totally makes sense. If you allow me a follow-up here. You didn't have any aircraft with Aeroflot for the events in Ukraine. There have been a couple of articles out there knowing that some private airlines may also be approaching insurance settlements with the lessors.

Any comments there? Or should we keep in mind why Aeroflot might be a special case, a state-owned airline? I appreciate all the color.

Steven Udvar-Hazy^ Yes. We're working the problem. We're in dialogue with our customers in Russia, which were all private airlines. We're working with the insurance companies. We're working with the U.S. and Russian authorities under their guidelines and staying within the sanction regulations, and that's all I can say at this time.

Operator^ Your next question comes from the line of Hillary Cacanando from Deutsche Bank.

Hillary Cacanando^ So with $1.8 billion in your sales pipeline and attractive stock valuation, I was wondering how you were thinking about share buybacks and is that something you will consider in the near to medium term?

John Plueger^ Sure. Look, capital allocation, including share buybacks is always a really big consideration for us. Keep in mind, that we are still trying to lower our debt equity ratio to the target of 2.5:1. That's important for our investment-grade ratings and that we have always said is sacrosanct.

So given all those elements, we are prioritizing reducing our debt equity ratio down to our guidance level first.

Hillary Cacanando^ Okay. Got it. Then you've spoken about the extension rates being very high in the current environment. I just wanted to kind of understand the economics. Is it more profitable to extend the current lease to the previous owner?

Or would it be more profitable to market it to a new party just given the high demand for aircraft right now?

John Plueger^ Yes. I mean I think the case is both. Most of the time, most of our airlines want to keep their aircraft. So as the lease term is expiring, especially in this demand environment, they're protecting their lift. They're worried about their own delivery delays.

So we are seeing a strong rate of lease extensions at higher rates. And at the same time, the few aircraft we have available, we are enjoying placement at, I would say meaningfully significantly higher lease rates.

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

Hillary Cacanando^ So you can -- so you say it's the same thing pretty much. Is that what you're saying? Whether you extended or you market it? Could you get like similar rate?

John Plueger^ Well I would say most of the time, it's usually easier to extend the lease with the current operator. In some cases -- in a number of cases, we keep lease extension options. But for the most part, those options are determined at the time of extension.

And so, most of the airlines are looking to protect their equipment and for airlines that have no more extension options or the leases are just expiring with nothing further, which is probably the majority of the case. We enter into dialogue, and we extend those leases at much more reflective of the current market, higher lease rates.

Hillary Cacanando^ Okay. Got it. I guess you don't have to spend like marketing these -- marketing expense and stuff like that stuff?

John Plueger^ Right. That's part of the beauty and the ease of extending with the current customer. There's no change in configuration, there's nothing.

Operator^ Your next question comes from the line of Helane Becker from TD Cowen.

Helane Becker^ I have exactly two questions. The first question is what's your expectation for deliveries midway through the quarter? I know you said what you're contracted to get, but how many of -- how much of that do you think will actually be delivered?

Steven Udvar-Hazy^ It's really hard to tell because both manufacturers are working hard to cram in as many deliveries as they can in November and December. To get close to what they targeted and pronounced to Wall Street.

Our feeling at the moment, Helane, is that neither of the two big players will reach the target deliveries that they forecast. And for two reasons.

One, you're well aware of the 737 MAX issues where they have to rework a certain part of the structure and then the FAA has to sign off on each aircraft. Then 787s are just perennially delayed in Charleston.

Then on the Airbus side, the situation with engine suppliers, mainly Pratt & Whitney is not enabling Airbus to meet their fourth quarter targets. Of course a lot of engines are being diverted as spare engines to keep airlines flying. So we're a little bit more cautious than others on fourth quarter deliveries.

John Plueger^ Helane, that's why we've done our best in my remarks, I guided that we are expecting a range of maybe $900 million to about $1.1 billion of aircraft for the fourth quarter, and that would yield about for the entire year, $4.3 billion to $4.5 billion. But for the reasons Steve indicated, this could be off.

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

Steven Udvar-Hazy^ And let me just point out something to all of you who are listening in. Whether we get an aircraft in, say early December or middle of January has almost no financial impact on the company because on a 12-year lease, we're still going to get the same cash flows particularly in 2024, '25 and onwards.

So missing a delivery at the end of the year has minimal impact on Air Lease. Missing a delivery in the first half of the year has a much greater impact because it reduces the number of rental months for the remainder of the year.

So while it's upsetting to us, I don't believe that some aircraft that will slide into early January of '24 will really affect our financial performance.

Helane Becker^ That's really helpful. Then my other question is, I don't think you have any freighters and that all of a sudden among leasing companies became very popular for whatever reason. I'm wondering how you think about that, how you think about the freighter market?

John Plueger^ Well clearly, the cargo markets have softened a little bit as was to be expected with the large return to capacity of the passenger airliners post Covid and the strong recovery we've seen.

So this is sort of a normal fluctuation that we see. Having said that, we only have one freighter aircraft in our fleet today.

Steven Udvar-Hazy^ A partial freighter..

John Plueger^ A partial freighter conversion.

Steven Udvar-Hazy^ It still doesn't have the cargo door.

John Plueger^ So for us, we really – it doesn't really have much of an impact on us today.

Operator^ Your next question comes from the line of Jamie Baker from JPMorgan.

James Kirby^ This is James on for Jamie. Just starting off, in the U.S., there's been pressure in the ultra low cost carrier business model. Just wanted to hear your thoughts if you're also seeing that and if that would impact your decision to do business with an airline, that is an ultra low-cost carrier?

John Plueger^ No. I tried to cover that in my opening remarks, James. The bottom line is, no, we don't have any concerns from the airlines of the world [around?] softening aircraft demand. I gave you a contrast between a few LCCs in Europe and the U.S. over the past month or two, reporting some softening. And yet in the last several days, Southwest and Lufthansa reported very strong bookings/earnings. So if nothing else, our gut tells us that this is just a return to normal seasonal demand.

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

Steven Udvar-Hazy^ And we don't make aircraft placement decisions for 2026, 2027 on results for a few weeks or a month of an airline because while they may report some softness in some reservations, maybe they'll have a record Thanksgiving and then everything changes I think the media tends to be very trigger happy, and we try to get more of the long-term trends of each airline customer.

Operator^ Your next question comes from the line of Vincent Caintic from Stephens.

Vincent Caintic^ I have two of them, so I'll just ask them both. The first one on the dynamic between aircraft deliveries and aircraft sales.

So it's nice to see the large aircraft sale pipeline of that $1.8 billion. So that's at the high end of the year 2023 guidance of the $1 billion to $2 billion. I think historically, the pipeline of sales have been tied with purchases.

So you had strong sales activity and strong delivery activity. So I'm just curious if maybe we're talking about these delivery delays, but maybe the outlook is better or how you're thinking about that dynamic between the two.

Then just a second question, if you can update us on how you're thinking about lease rates versus your cost of funds. I know the cost of funds have been going up but so have the lease rates. And maybe you can just talk about that?

John Plueger^ Yes. Thanks, Vincent. I'll take the first one. Look, I think you have to realize going back during the Covid pandemic, we significantly slowed down aircraft sales. In fact, we virtually stopped them.

So, we've now returned to a more normalized pace, and we've been dealing with delivery delays now for a number of years.

So in the big picture, given those delays, those have kind of normalized out. And as Steve mentioned in an answer to an earlier question, if we have a delay of delivery at the fourth quarter into the first quarter, it doesn't really impact us.

We have now returned based upon robust aircraft values to a normalcy of aircraft sales. So our goal is to consider delivering and to continue delivering a fairly normal pace quarter-to-quarter according to aircraft sales. So I would just say in the grand scheme of things, those two things have sort of evened out.

Gregory Willis^ Then second question was with regards to the lease rates catching up with interest rates and quarter-to-quarter, there's been all kinds of publications out there about what the market is seeing in terms of lease rate increases, some forms have been reporting that lease rates have gone up north of 20%, and we're continuing to see our lease rates go up.

| | |

Air Lease Corporation |

Q3 2023 Earnings Conference Call |

So as we continue to deliver our order book, there should be upward pressure on our lease margins. Again that's being balanced with the aircraft that are being sold.

Operator^ Your next question comes from the line of Stephen Trent from Citi.

Stephen Trent^ I was curious in terms of your product suite, if you -- to what extent you would consider leaning more heavily or exploring, doing more engine leasing versus the bread and butter aircraft leasing?

Gregory Willis^ I think right now, our core business is to focus on commercial passenger traffic leasing. I don't see us going too far into the engine leasing space or helicopters or other forms of transportation leasing. I think our expertise is in passenger jet aircraft.

John Plueger^ And the reality today is spare engines are really scarce to come by. So building a platform in the middle of some turmoil in the aircraft engine world globally is not something that's on the table right now.

Stephen Trent^ Really appreciate it. I'm guessing apropos with that answer that an acquisition on that side of the fence is also something you're not really contemplating at the moment?

Steven Udvar-Hazy^ Well the other thing is if we bought 100 engines today the financial impact on Air Lease would be minimal. That would be like two wide-body aircraft.

So going heavily into engine acquisitions would not meaningfully move the needle in terms of revenues, ROEs, margins. And as Greg said, we would have to add staff and experts in that segment of the business. So, we've looked at this.

We do have some selected engines that we are going to be leasing to airlines. But it's not a real strong focal point of our business. There's others that have the expertise and the infrastructure and facilities to deal with engine leasing.

Operator^ And we have reached the end of our question-and-answer session. Mr. Arnold, I turn the call back over to you.

Jason Arnold^ Thanks very much, Rob. Thank you, all for participating in our third quarter earnings call. We look forward to speaking with you again when we report the fourth quarter results. Operator, please disconnect line.

Operator^ This concludes today's conference call. You may now disconnect.

v3.23.3

Cover Page Cover Page

|

Nov. 06, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2023

|

| Entity Registrant Name |

AIR LEASE CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35121

|

| Entity Tax Identification Number |

27-1840403

|

| Entity Address, Address Line One |

2000 Avenue of the Stars,

|

| Entity Address, Address Line Two |

Suite 1000N

|

| Entity Address, City or Town |

Los Angeles,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90067

|

| City Area Code |

310

|

| Local Phone Number |

553-0555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001487712

|

| Amendment Flag |

false

|

| Class A Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock

|

| Trading Symbol |

AL

|

| Security Exchange Name |

NYSE

|

| 6.150% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

6.150% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series A

|

| Trading Symbol |

AL PRA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

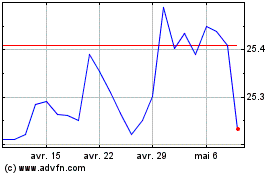

Air Lease (NYSE:AL-A)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Air Lease (NYSE:AL-A)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024