UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant |

x |

| Filed by a Party other than the Registrant |

¨ |

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

ALTC ACQUISITION CORP.

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant) Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 26, 2023

ALTC ACQUISITION CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-40583 |

86-2292473 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

640 Fifth Avenue, 12th Floor

New York, NY 10019

(Address of principal executive offices, including

zip code)

(212) 380-7500

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

¨ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Shares of Class A common stock, par value $0.0001 per share |

|

ALCC |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

As previously disclosed, AltC Acquisition Corp., a Delaware corporation

(“AltC”) has instructed the trustee with respect to AltC’s trust account (the “Trust Account”),

to hold all funds in the Trust Account in cash (which may include demand deposit accounts) until the earlier of consummation of a business

combination or liquidation of AltC. The funds in the Trust Account are currently held in an interest bearing demand deposit account. The

interest rate on such deposit account is currently approximately 5.20% per annum, but such deposit account carries a variable rate, and

AltC cannot assure investors that such rate will not decrease or increase significantly.

Additional Information and Where to Find It

On September 14, 2023, AltC filed a

definitive proxy statement (the “Proxy Statement”) with the U.S. Securities and Exchange Commission (the “SEC”)

in connection with its solicitation of proxies for a special meeting of AltC’s shareholders (the “Special Meeting”),

which further describes the proposal to amend AltC’s amended and restated certificate of incorporation, in the form set forth in

Annex A to the Proxy Statement, to extend the date by which AltC must consummate a merger, capital stock exchange, asset acquisition,

stock purchase, reorganization or similar business combination with one or more businesses, which we refer to as a “business combination”

from October 12, 2023 to July 12, 2024.

Shareholders may obtain a copy of the

Proxy Statement, as well as other documents filed by AltC with the SEC, without charge, at the SEC’s website located at www.sec.gov

or by directing a written request to AltC Acquisition Corp., 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Forward-Looking Statements

This Current Report includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are

not statements of historical matters. We have based these forward-looking statements on our current expectations and projections about

future events. These forward-looking statements include, but are not limited to, statements regarding: AltC’s ability to complete

a business combination; the anticipated benefits of a business combination; the volatility of the market price and liquidity of the shares

of AltC’s Class A common stock, par value $0.0001, per share and other securities of AltC; changes to interest rates of the

deposit account where Trust Account funds are held; the use of funds not held in the Trust Account or available to AltC from interest

income on the Trust Account balance; and the competitive environment in which AltC will operate following a business combination.

These statements are based on various assumptions,

whether or not identified in this Current Report, and on the current expectations of AltC’s management and are not predictions of

actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and

must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual

events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances

are beyond the control of AltC. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions

about AltC that may cause AltC’s actual results, levels of activity, performance or achievements to be materially different from

any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Such risks

and uncertainties include, but are not limited to, those factors discussed in AltC’s Quarterly Reports filed by AltC with the SEC

on Form 10-Q and the Annual Reports filed by AltC with the SEC on Form 10-K, in each case, under the heading “Risk Factors,”

and other documents filed, or to be filed, with the SEC by AltC. If any of these risks or uncertainties materialize or AltC’s assumptions

prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Accordingly, undue

reliance should not be placed upon the forward-looking statements. An investment in AltC is not an investment in any of our founders’

or sponsors’ past investments or companies or any funds affiliated with any of the foregoing. The historical results of these investments

are not indicative of future performance of AltC, which may differ materially from the performance of the founders or sponsors past investments,

companies or affiliated funds.

No Offer or Solicitation

This Current Report does not constitute

an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be

any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. This Current Report is not, and under no circumstances is to be construed as, a prospectus,

an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions

therefrom. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY

AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

AltC and certain of its directors,

executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation

of AltC’s shareholders in connection with the Special Meeting. Information regarding such persons who may, under SEC rules, be deemed

participants in the solicitation of AltC’s shareholders in connection with the Special Meeting is set forth in the Proxy Statement

You can find more information about AltC’s directors and executive officers in AltC’s final prospectus filed with the SEC

on July 7, 2021 and in the Annual Reports filed by AltC with the SEC on Form 10-K. Additional information regarding the participants in

the proxy solicitation and a description of their direct and indirect interests is included in the Proxy Statement. Shareholders, potential

investors and other interested persons should read the Proxy Statement and any amendments thereto carefully before making any voting or

investment decisions. You may obtain free copies of these documents from the sources indicated above.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 26, 2023

| |

ALTC ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Jay Taragin |

| |

Name: |

Jay Taragin |

| |

Title: |

Chief Financial Officer |

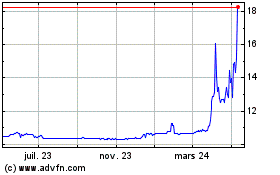

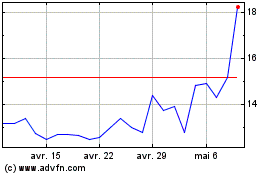

AltC Acquisition (NYSE:ALCC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

AltC Acquisition (NYSE:ALCC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024