- Strong sequential earnings improvement delivered at top end

of previous guidance range.

- Q2 2024 operating income up 53% over prior-year period led

by Forged and Cast Engineered Products segment

improvement.

- Air and Liquid Processing segment sales up 19% for both Q2

and YTD compared to prior-year periods.

In the Teleconference Access section, website link should read:

https://dpregister.com/sreg/10191257/fd2870d5f2 (instead of

https://dpregister.com/sreg/10188757/fc6d48eec8.)

The updated release reads:

AMPCO-PITTSBURGH

CORPORATION (NYSE: AP) ANNOUNCES SECOND QUARTER 2024

RESULTS

- Strong sequential earnings improvement delivered at top end

of previous guidance range.

- Q2 2024 operating income up 53% over prior-year period led

by Forged and Cast Engineered Products segment

improvement.

- Air and Liquid Processing segment sales up 19% for both Q2

and YTD compared to prior-year periods.

Ampco-Pittsburgh Corporation (NYSE: AP) reported net sales of

$111.0 million and $221.2 million for the three and six months

ended June 30, 2024, respectively, compared to $107.2 million and

$212.0 million for the three and six months ended June 30, 2023,

respectively. The increase is attributable to sales growth in the

Air and Liquid Processing segment.

The Corporation reported income from operations for the three

and six months ended June 30, 2024, of $5.0 million and $5.1

million, respectively, compared to $3.3 million and $5.3 million

for the three and six months ended June 30, 2023, respectively. The

three and six months ended June 30, 2023, include a benefit from a

$1.9 million foreign energy credit. The underlying improvement is

primarily due to higher net roll pricing in the Forged and Cast

Engineered Products segment.

Commenting on the quarter, Ampco-Pittsburgh’s CEO, Brett

McBrayer, said, “Our final Q2 results came in at the high end of

our previous guidance range, reflecting the strong sequential

improvement we expected in both segments. With the first full

quarter of all the new machinery running in our U.S. forged plants

and a sequential rebound in Air and Liquid Processing segment

margins during the quarter, our Q2 results reflect our current

potential in a steady production environment with no unusual items

coming into play. We are still experiencing losses in our European

cast roll business due to excess capacity and the market for forged

engineered products remains weak, but total backlog has improved

sequentially due to higher order intake during the quarter.”

Interest expense for the three and six months ended June 30,

2024, increased in comparison to the same periods of the prior year

primarily due to the higher equipment financing debt balance,

higher average revolving credit facility borrowings and higher

average interest rates. Other income – net improved for the three

and six months ended June 30, 2024, compared to the same periods of

the prior year, primarily due to higher losses on foreign exchange

in the prior year periods.

Net income (loss) for the current year periods equaled $2.0

million, or $0.10 per diluted share, and $(0.7) million, or $(0.04)

per share, for the three and six months ended June 20, 2024,

respectively. This compares to net income of $0.4 million, or $0.02

per diluted share, and $1.1 million, or $0.06 per diluted share,

for the three and six months ended June 30, 2023, respectively. The

foreign energy credit improved earnings per share by $0.10 for the

three and six months ended June 30, 2023.

Segment Results

Forged and Cast Engineered

Products

Sales for the Forged and Cast Engineered Products segment for

the three and six months ended June 30, 2024, declined slightly

from the same periods of the prior year primarily due to a lower

volume of shipments, offset by improved pricing and favorable

changes in product mix.

Operating results for the three and six months ended June 30,

2024, improved when compared to the same periods of the prior year

primarily due to improved pricing and fluctuations in manufacturing

costs, net of lower variable-index surcharges. The three and six

months ended June 30, 2023, include a $1.9 million benefit for a

foreign energy credit.

Air and Liquid Processing

Sales for the Air and Liquid Processing segment for both the

three and six months ended June 30, 2024, improved 19% compared to

the same periods of the prior year due primarily to an increase in

shipments of air handling systems as a result of expansion of its

sales distribution network and the additional manufacturing

facility opened in the third quarter of 2023.

Operating results for the three months ended June 30, 2024,

improved slightly compared to the prior year period but declined

for the six months ended June 30, 2024. The benefit from the higher

sales volume was minimized by an unfavorable product mix of heat

exchangers, caused by the timing of shipments for several large

orders, and centrifugal pumps, due to shipping older lower margin

orders. In addition, higher commissions and employee-related costs

associated with the expansion of the segment’s sales distribution

network and higher lease costs associated with the additional

manufacturing facility negatively impacted operating income when

compared to the prior year periods.

Teleconference Access

Ampco-Pittsburgh Corporation will hold a conference call on

Tuesday August 13, 2014, at 10:30 a.m. Eastern Time (ET) to discuss

its financial results for the second quarter ended June 30, 2024.

The Corporation encourages participants to pre-register at any

time, including up to and after the call start time via this link:

https://dpregister.com/sreg/10191257/fd2870d5f2. Those without

internet access or unable to pre-register should dial in at least

five minutes before the start time using:

- Participant Dial-in (Toll Free): 1-844-308-3408

- Participant International Dial-in: 1-412-317-5408

For those unable to listen to the live broadcast, a replay will

be available one hour after the event concludes on the

Corporation’s website under the Investors menu at

www.ampcopgh.com.

About Ampco-Pittsburgh Corporation

Ampco-Pittsburgh Corporation manufactures and sells highly

engineered, high-performance specialty metal products and

customized equipment utilized by industry throughout the world.

Through its operating subsidiary, Union Electric Steel Corporation,

it is a leading producer of forged and cast rolls for the global

steel and aluminum industries. It also manufactures open-die forged

products that are sold principally to customers in the steel

distribution market, oil and gas industry, and the aluminum and

plastic extrusion industries. The Corporation is also a producer of

air and liquid processing equipment, primarily custom-engineered

finned tube heat exchange coils, large custom air handling systems

and centrifugal pumps. It operates manufacturing facilities in the

United States, England, Sweden, and Slovenia and participates in

three operating joint ventures located in China. It has sales

offices in North America, Asia, Europe, and the Middle East.

Corporate headquarters is located in Carnegie, Pennsylvania.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 (the “Act”)

provides a safe harbor for forward-looking statements made by us or

on behalf of the Corporation. This press release may include, but

is not limited to, statements about operating performance, trends

and events that the Corporation may expect or anticipate will occur

in the future, statements about sales and production levels,

restructurings, the impact from pandemics and geopolitical

conflicts, profitability and anticipated expenses, inflation, the

global supply chain, future proceeds from the exercise of

outstanding warrants, and cash outflows. All statements in this

document other than statements of historical fact are statements

that are, or could be, deemed “forward-looking statements” within

the meaning of the Act and words such as “may,” “will,” “intend,”

“believe,” “expect,” “anticipate,” “estimate,” “project,” “target,”

“goal,” “forecast” and other terms of similar meaning that indicate

future events and trends are also generally intended to identify

forward-looking statements. Forward-looking statements speak only

as of the date on which such statements are made, are not

guarantees of future performance or expectations, and involve risks

and uncertainties. For the Corporation, these risks and

uncertainties include, but are not limited to: economic downturns,

cyclical demand for our products and insufficient demand for our

products; excess global capacity in the steel industry; limitations

in availability of capital to fund our strategic plan; inability to

maintain adequate liquidity to meet our operating cash flow

requirements, repay maturing debt and meet other financial

obligations; fluctuations in the value of the U.S. dollar relative

to other currencies; increases in commodity prices or insufficient

hedging against increases in commodity prices, reductions in

electricity and natural gas supply or shortages of key production

materials for us or our customers; inability to obtain necessary

capital or financing on satisfactory terms to acquire capital

expenditures that may be necessary to support our growth strategy;

inoperability of certain equipment on which we rely; inability to

execute our capital expenditure plan; liability of our subsidiaries

for claims alleging personal injury from exposure to

asbestos-containing components historically used in certain

products of our subsidiaries; changes in the existing regulatory

environment; inability to successfully restructure our operations

and/or invest in operations that will yield the best long-term

value to our shareholders; consequences of pandemics and

geopolitical conflicts; work stoppage or another industrial action

on the part of any of our unions; inability to satisfy the

continued listing requirements of the New York Stock Exchange or

the NYSE American Exchange; potential attacks on information

technology infrastructure and other cyber-based business

disruptions; failure to maintain an effective system of internal

control; and those discussed more fully elsewhere in Item 1A, Risk

Factors, in Part I of the Corporation’s latest Annual Report on

Form 10-K and Part II of the latest Quarterly Report on Form 10-Q.

The Corporation cannot guarantee any future results, levels of

activity, performance or achievements. In addition, there may be

events in the future that it is not able to predict accurately or

control which may cause actual results to differ materially from

expectations expressed or implied by forward-looking statements.

Except as required by applicable law, the Corporation assumes no

obligation, and disclaims any obligation, to update forward-looking

statements whether as a result of new information, events or

otherwise.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL SUMMARY

(in thousands, except per

share amounts)

Three

Months Ended June 30,

Six Months

Ended June 30,

2024

2023

2024

2023

Total net sales

$

110,988

$

107,211

$

221,203

$

212,014

Cost of products sold (excl. depreciation

and amortization)

87,684

85,471

180,174

171,843

Selling and administrative

13,550

14,093

26,523

26,280

Depreciation and amortization

4,698

4,354

9,368

8,728

Loss (gain) on disposal of assets

13

5

13

(118

)

Total operating costs and expenses

105,945

103,923

216,078

206,733

Income from operations

5,043

3,288

5,125

5,281

Other expense - net:

Investment-related income

8

7

27

16

Interest expense

(3,017

)

(2,245

)

(5,774

)

(4,316

)

Other income – net

1,381

98

2,285

1,465

Total other expense – net

(1,628

)

(2,140

)

(3,462

)

(2,835

)

Income before income taxes

3,415

1,148

1,663

2,446

Income tax provision

(863

)

(152

)

(1,317

)

(465

)

Net income

2,552

996

346

1,981

Less: Net income attributable to

noncontrolling interest

540

573

1,051

882

Net income (loss) attributable to

Ampco-Pittsburgh

$

2,012

$

423

$

(705

)

$

1,099

Net income (loss) per share attributable

to

Ampco-Pittsburgh common shareholders:

Basic

$

0.10

$

0.02

$

(0.04

)

$

0.06

Diluted

$

0.10

$

0.02

$

(0.04

)

$

0.06

Weighted-average number of common

shares

outstanding: Basic

19,859

19,541

19,794

19,504

Diluted

19,875

19,590

19,794

19,587

AMPCO-PITTSBURGH

CORPORATION

SEGMENT INFORMATION

(in thousands)

Three

Months Ended June 30,

Six Months

Ended June 30,

2024

2023

2024

2023

Net Sales:

Forged and Cast Engineered Products

$

75,713

$

77,581

$

152,902

$

154,379

Air and Liquid Processing

35,275

29,630

68,301

57,635

Consolidated

$

110,988

$

107,211

$

221,203

$

212,014

Income from Operations:

Forged and Cast Engineered Products

$

5,361

$

3,904

$

6,937

$

6,128

Air and Liquid Processing

3,174

2,977

5,156

5,930

Corporate costs

(3,492

)

(3,593

)

(6,968

)

(6,777

)

Consolidated

$

5,043

$

3,288

$

5,125

$

5,281

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240812995167/en/

Michael G. McAuley Senior Vice President, Chief Financial

Officer and Treasurer (412) 429-2472 mmcauley@ampcopgh.com

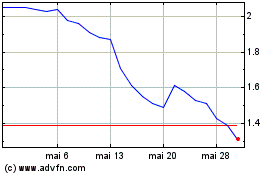

Ampco Pittsburgh (NYSE:AP)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ampco Pittsburgh (NYSE:AP)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025