false00000061760000006176us-gaap:CommonStockMember2024-07-102024-07-100000006176us-gaap:WarrantMember2024-07-102024-07-1000000061762024-07-102024-07-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 10, 2024 |

AMPCO-PITTSBURGH CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Pennsylvania |

1-898 |

25-1117717 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

726 Bell Avenue Suite 301 |

|

Carnegie, Pennsylvania |

|

15106 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 412 456-4400 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $1 par value |

|

AP |

|

New York Stock Exchange |

Series A Warrants to purchase shares of Common Stock |

|

AP WS |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 10, 2024, Ampco-Pittsburgh Corporation issued a press release announcing preliminary results on its second quarter 2024 earnings and current liquidity position. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference into this Item 2.02.

The information and exhibit contained in this Item 2.02 is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

AMPCO-PITTSBURGH CORPORATION |

|

|

|

|

Date: |

July 10, 2024 |

By: |

/s/ Michael G. McAuley |

|

|

|

Michael G. McAuley

Senior Vice President, Chief Financial Officer

and Treasurer |

EXHIBIT 99.1

Contact:

Michael G. McAuley

Senior Vice President, Chief Financial Officer and Treasurer

(412) 429-2472

mmcauley@ampcopgh.com

FOR IMMEDIATE RELEASE

CARNEGIE, PA

July 10, 2024

Ampco-Pittsburgh Corporation Provides Preliminary Results on its Second Quarter 2024 Earnings and Current Liquidity Position

•Expects strong sequential earnings improvement in Q2 2024 compared to Q1 2024

Carnegie, PA, July 10, 2024 – Ampco-Pittsburgh Corporation (NYSE: AP) (the “Corporation”) announced today preliminary estimates of net sales, income from operations and net income for the fiscal quarter ended June 30, 2024, and an update on its current liquidity position:

•Net sales for the quarter ended June 30, 2024, is expected to be in the range of $107 million to $112 million. This compares to net sales of $107.2 million in the quarter ended June 30, 2023, and $110.0 million in the quarter ended March 31, 2024.

•Income from operations for the quarter ended June 30, 2024, is expected to be in the range of $3.8 million to $4.8 million. This compares to income from operations of $3.3 million in the quarter ended June 30, 2023 (which included a $1.9 million foreign energy credit), and $0.1 million in the quarter ended March 31, 2024.

•Net income for the quarter ended June 30, 2024, is expected in the range of $1.1 to $2.1 million, or $0.05 to $0.10 per diluted share. This compares to a net income of $0.4 million, or $0.02 per diluted share for the quarter ended June 30, 2023 (which included a benefit of $1.9 million, or $0.10 per diluted share, for the foreign energy credit), and a net loss of $(2.7) million, or $(0.14) per diluted share for the quarter ended March 31, 2024.

•As of July 9, 2024, the Corporation’s liquidity position improved modestly compared to March 31, 2024, and included cash on hand of approximately $8.6 million and availability on its revolving credit facility of $27.2 million.

Remarking on this outlook, Brett McBrayer, Ampco-Pittsburgh’s Chief Executive Officer, said, “As we expected, Q2 2024 earnings should improve sequentially versus Q1 2024 with the impact of the Q1 foundry fire in our Sweden plant largely behind us, along with sequential improvement in Air & Liquid Processing segment margins. We experienced a full-quarter benefit of the new machinery in our U.S. forged operation in Q2. Although we are still experiencing excess capacity in our European cast roll business relative to

demand, this is consistent with our experience the last few quarters. We are committed to delivering returns on the recent investments we have made for improved results. At this point, outside of typical operating variations, we believe there are no new significant headwinds which would have a material adverse effect on our businesses.”

This is not a comprehensive statement of the Corporation’s financial results and is subject to change. The Corporation has provided ranges, rather than specific amounts, for the preliminary estimates of the unaudited financial data described below primarily because the Corporation’s financial closing procedures for the quarter ended June 30, 2024, are not yet complete and, as a result, the Corporation’s final results upon completion of its closing procedures may vary from the preliminary estimates. These estimates should not be viewed as a substitute for the Corporation’s quarterly and year-to-date financial statements prepared in accordance with generally accepted accounting principles in the United States. The Corporation expects to file its Quarterly Report on Form 10-Q for the second quarter (its “Quarterly Report”) on approximately August 12, 2024. Except as otherwise required by applicable law, the Corporation undertakes no responsibility to update this outlook prior to the release of its Quarterly Report.

About Ampco-Pittsburgh Corporation

Ampco-Pittsburgh Corporation manufactures and sells highly engineered, high-performance specialty metal products and customized equipment utilized by industry throughout the world. Through its operating subsidiary, Union Electric Steel Corporation, it is a leading producer of forged and cast rolls for the global steel and aluminum industries. It also manufactures open-die forged products that are sold principally to customers in the steel distribution market, oil and gas industry, and the aluminum and plastic extrusion industries. The Corporation is also a producer of air and liquid processing equipment, primarily custom-engineered finned tube heat exchange coils, large custom air handling systems and centrifugal pumps. It operates manufacturing facilities in the United States, England, Sweden, and Slovenia and participates in three operating joint ventures located in China. It has sales offices in North America, Asia, Europe, and the Middle East. The Corporation’s corporate headquarters is located in Carnegie, Pennsylvania.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 (the “Act”) provides a safe harbor for forward-looking statements made by us or on behalf of the Corporation. This press release may include, but is not limited to, statements about operating and financial performance, statements related to the preliminary financial estimates and projections related to Q2 2024 and liquidity estimates for July 9, 2024, trends and events that the Corporation may expect or anticipate will occur in the future, statements about sales and production levels, restructurings, the impact from pandemics and geopolitical conflicts, profitability and anticipated expenses, inflation, the global supply chain, future proceeds from the exercise of outstanding warrants, and cash outflows. All statements in this document other than statements of historical fact are statements that are, or could be, deemed “forward-looking statements” within the meaning of the Act and words such as “may,” “will,” “intend,” “believe,” “expect,” “anticipate,” “estimate,” “project,” “target,” “goal,” “forecast” and other terms of similar meaning that indicate future events and trends are also generally intended to identify forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made, are not guarantees of future performance or expectations, and involve risks and uncertainties. For the Corporation, these risks and uncertainties include, but are not limited to: economic downturns, cyclical demand for our products and insufficient demand for our products; excess global capacity in the steel industry; limitations in availability of capital to fund our strategic plan; inability to maintain adequate liquidity to meet our operating cash flow requirements, repay maturing debt and meet other financial obligations; fluctuations in the value of the U.S. dollar relative to other currencies; increases in commodity prices or insufficient hedging against increases in commodity

prices, reductions in electricity and natural gas supply or shortages of key production materials for us or our customers; inability to obtain necessary capital or financing on satisfactory terms to acquire capital expenditures that may be necessary to support our growth strategy;inoperability of certain equipment on which we rely; inability to execute our capital expenditure plan; liability of our subsidiaries for claims alleging personal injury from exposure to asbestos-containing components historically used in certain products of our subsidiaries; changes in the existing regulatory environment; inability to successfully restructure our operations and/or invest in operations that will yield the best long-term value to our shareholders; consequences of pandemics and geopolitical conflicts; work stoppage or another industrial action on the part of any of our unions; inability to satisfy the continued listing requirements of the New York Stock Exchange or the NYSE American Exchange; potential attacks on information technology infrastructure and other cyber-based business disruptions; failure to maintain an effective system of internal control; and those discussed more fully elsewhere in Item 1A, Risk Factors, in Part I of the Corporation’s latest Annual Report on Form 10-K and Part II of the latest Quarterly Report on Form 10-Q. The Corporation cannot guarantee any future results, levels of activity, performance or achievements. In addition, there may be events in the future that it is not able to predict accurately or control which may cause actual results to differ materially from expectations expressed or implied by forward-looking statements. Except as required by applicable law, the Corporation assumes no obligation, and disclaims any obligation, to update forward-looking statements whether as a result of new information, events or otherwise.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

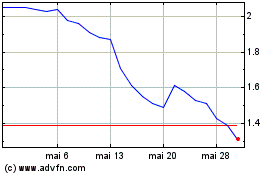

Ampco Pittsburgh (NYSE:AP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Ampco Pittsburgh (NYSE:AP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024