Aramark Announces Successful Closing of Debt Refinancing

18 Février 2025 - 3:00PM

Business Wire

Fully Repaid 2025 U.S. Senior Notes

Actions Extend Maturities and Further Enhance

Financial Flexibility

Aramark (NYSE: ARMK), a global leader in food and facilities

management, announced today that the Company successfully closed on

a debt refinancing, raising approximately $1,395 million as an

add-on to its existing Term Loan B, with a maturity date in 2030.

The refinancing was significantly oversubscribed, which led to

upsizing the Term Loan B. The proceeds were used to fully repay

$552 million of 2025 U.S. Senior Notes, as well as to refinance

$839 million of 2027 Term Loan B. These transactions are 1) net

leverage neutral, 2) at comparable interest rates, and 3) further

extend maturities.

“We are extremely pleased with the favorable outcome of our debt

refinancing and the strong market demand for the transaction,” said

Jim Tarangelo, Aramark’s Chief Financial Officer. “The Company will

continue to proactively pursue opportunities to further enhance our

capital structure given our financial flexibility with a focus on

shareholder value creation.”

About Aramark Aramark (NYSE: ARMK) proudly serves the

world’s leading educational institutions, Fortune 500 companies,

world champion sports teams, prominent healthcare providers, iconic

destinations and cultural attractions, and numerous municipalities

in 16 countries around the world with food and facilities

management. Because of our hospitality culture, our employees

strive to do great things for each other, our partners, our

communities, and the planet. Learn more at www.aramark.com and

connect with us on LinkedIn, Facebook, X, and Instagram.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218786733/en/

Inquiries Felise Glantz Kissell (215) 409-7287

Kissell-Felise@aramark.com

Gene Cleary (215) 409-7945 Cleary-Gene@aramark.com

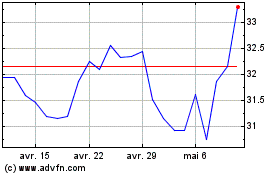

Aramark (NYSE:ARMK)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Aramark (NYSE:ARMK)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025