false

0000915912

0000915912

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13

OR 15(d)

OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 23, 2024

AVALONBAY

COMMUNITIES, INC.

(Exact name of registrant as specified

in its charter)

|

Maryland

(State or other jurisdiction of

incorporation

or

organization) |

1-12672

(Commission

File Number) |

77-0404318

(I.R.S. Employer

Identification No.) |

4040 Wilson Blvd., Suite 1000

Arlington, Virginia 22203

(Address of principal executive offices)(Zip

code)

(703)

329-6300

(Registrant’s telephone number,

including area code)

(Former name, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.01 per share |

|

AVB |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

On February 23, 2024, AvalonBay Communities, Inc.

(the “Company”) filed with the Securities and Exchange Commission (the “SEC”) a shelf registration statement on

Form S-3, which became automatically effective upon filing and which replaced the Company’s previous shelf registration statement

on Form S-3 (File No. 333- 253532) filed with the SEC on February 25, 2021. In connection with the filing of the new shelf

registration statement, the Company also filed with the SEC a new prospectus supplement (the “Prospectus Supplement”), dated

February 23, 2024, with respect to the Company’s existing continuous equity program (“CEP”), pursuant to which

the Company may issue and sell shares of its common stock having an aggregate sales price of up to $1,000,000,000 (the “Shares”)

from time to time through the Sales Agents and the Forward Sellers (each as defined below).

As previously reported, in connection with

the CEP the Company has entered into separate sales agency financing agreements, dated January 17, 2023, with each of J.P. Morgan

Securities LLC, Barclays Capital Inc., BNP Paribas Securities Corp., BofA Securities, Inc., BTIG, LLC, Deutsche Bank Securities Inc.,

Goldman Sachs & Co. LLC, Jefferies LLC, Mizuho Securities USA LLC, Morgan Stanley & Co. LLC, RBC Capital Markets, LLC,

Scotia Capital (USA) Inc., TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC (the “Sales Agents”),

in their capacity as sales agents for the Company and/or as Forward Sellers, and, as applicable, the relevant Forward Purchasers (each

as defined below). Concurrently with the entry into the sales agency financing agreements, the Company also previously entered into separate

master forward sale agreements between the Company and each of JPMorgan Chase Bank, N.A., Bank of America, N.A., Barclays Bank PLC., BNP

Paribas, Deutsche Bank AG, London Branch, Goldman Sachs & Co. LLC, Jefferies LLC, Mizuho Markets Americas LLC, Morgan Stanley &

Co. LLC, Royal Bank of Canada, The Bank of Nova Scotia, The Toronto-Dominion Bank, Truist Bank and Wells Fargo Bank, National Association

(or their respective affiliates) (collectively, the “Prior Forward Purchasers”).

On February 23, 2024, the Company amended

its sales agency financing agreement with BTIG, LLC to reflect the addition of Nomura Securities International, Inc. (acting through

BTIG, LLC as agent) as a Forward Seller and Nomura Global Financial Products, Inc. as a Forward Purchaser thereunder, and entered

into a master forward sale agreement, dated February 23, 2024, with Nomura Global Financial Products, Inc. (together with the

Prior Forward Purchasers, the “Forward Purchasers”).

The sales agency financing agreements provide

that, in addition to the issuance and sale of the Shares by the Company through the Sales Agents, the Company may enter into separate

forward sale agreements pursuant to the master forward sale confirmations. In connection with any particular forward sale agreement pursuant

to the relevant master forward sale confirmation, the relevant Forward Purchaser will, at the Company’s request, attempt to borrow

from third parties and, through the relevant Forward Seller, sell Shares to hedge such Forward Purchaser’s exposure underlying the

particular forward sale agreement pursuant to the relevant master forward sale confirmation (the Sales Agents, when acting as agents for

Forward Purchasers, are referred to in this Current Report as the “Forward Sellers,” except that with respect to Nomura Global

Financial Products, Inc., the relevant Forward Seller is Nomura Securities International, Inc. (acting through BTIG, LLC as

agent)).

As of the date of the Prospectus Supplement,

the Company has sold Shares having an aggregate offering price of approximately $294,039,000 under the CEP. Accordingly, Shares having

an aggregate offering price of up to approximately $705,961,000 remain available for offer and sale under the CEP.

The foregoing description of the sales agency

financing agreements and the master forward sale confirmations does not purport to be complete and is qualified in its entirety by reference

to the terms and conditions of the forms of sales agency financing agreement and master forward sale confirmation which are incorporated

by reference herein as Exhibits 1.1 and 1.2, respectively. This Current Report shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such state.

In connection with the filing of the Prospectus

Supplement, the Company is filing as Exhibit 5.1 hereto the opinion of its counsel, Goodwin Procter LLP, which opinion is incorporated

herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) (filed herewith) |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AVALONBAY COMMUNITIES, INC. |

| |

|

|

| Dated: February 23, 2024 |

By: |

/s/

Kevin P. O’Shea |

| |

|

Kevin P. O’Shea |

| |

|

Chief Financial Officer |

Exhibit 5.1

|

|

Goodwin Procter llp

620 Eighth Avenue

New York, NY 10018

goodwinlaw.com

+1 212 813-8800 |

February 23, 2024

AvalonBay Communities, Inc.

4040 Wilson Blvd., Suite 1000

Arlington, Virginia 22203

Re: Securities

Registered under Registration Statement on Form S-3

We have acted as counsel to you in connection with

your filing of a Registration Statement on Form S-3 (File No. 333-277313) (as amended or supplemented, the “Registration

Statement”) filed on February 23, 2024 with the Securities and Exchange Commission (the “Commission”) pursuant

to the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration of the offering by AvalonBay

Communities, Inc., a Maryland corporation (the “Company”) of any combination of securities of the types specified therein.

The Registration Statement became effective automatically upon filing with the Commission on February 23, 2024. Reference is made

to our opinion letter dated February 23, 2024 and included as Exhibit 5.1 to the Registration Statement. We are delivering this

supplemental opinion letter in connection with the prospectus supplement (the “Prospectus Supplement”) filed on February 23,

2024 by the Company with the Commission pursuant to Rule 424 under the Securities Act. The Prospectus Supplement relates to the offering

by the Company of up to $705,960,888 in shares (the “Shares”) of the Company’s common stock, par value $0.01 per share

(“Common Stock”) covered by the Registration Statement. The Shares are being offered and sold pursuant to, (i) those

certain Amended and Restated Sales Agency Financing Agreements, dated as of January 17, 2023 (as each may be amended from time to

time, the “Sales Agency Financing Agreements”), by and among the Company and each of J.P. Morgan Securities LLC, Barclays

Capital Inc., BNP Paribas Securities Corp., BofA Securities, Inc., BTIG, LLC, Deutsche Bank Securities Inc., Goldman Sachs &

Co. LLC, Jefferies LLC, Mizuho Securities USA, Morgan Stanley & Co. LLC, RBC Capital Markets, LLC, Scotia Capital (USA) Inc.,

TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC, each as a sales agent, J.P. Morgan Securities LLC,

Barclays Capital Inc., BNP Paribas Securities Corp., BofA Securities, Inc., Deutsche Bank Securities Inc., Goldman Sachs &

Co. LLC, Jefferies LLC, Mizuho Securities USA, Nomura Securities International, Inc., RBC Capital Markets, LLC, Scotia Capital (USA)

Inc., TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC, each as a forward seller, and each of JPMorgan

Chase Bank, N.A., Barclays Bank PLC, BNP Paribas, Bank of America, N.A., Nomura Global Financial Products, Inc., Deutsche Bank AG,

London Branch, Goldman Sachs & Co. LLC, Jefferies LLC, Mizuho Markets Americas LLC, Morgan Stanley & Co. LLC, Royal

Bank of Canada, The Bank of Nova Scotia, The Toronto-Dominion Bank, Truist Bank and Wells Fargo Bank, National Association, as forward

sellers, and (ii) those certain Master Confirmations, dated as of January 17, 2023 or February 23, 2024 (the “Master

Confirmations”), by and between the Company and each of JPMorgan Chase Bank, N.A., Barclays Bank PLC, BNP Paribas, Bank of America,

N.A., Nomura Global Financial Products, Inc., Deutsche Bank AG, London Branch, Goldman Sachs & Co. LLC, Jefferies LLC, Mizuho

Markets Americas LLC, Morgan Stanley & Co. LLC, Royal Bank of Canada, The Bank of Nova Scotia, The Toronto-Dominion Bank, Truist

Bank and Wells Fargo Bank, National Association.

AvalonBay Communities, Inc.

February 23, 2024

Page 2

We have reviewed such documents and made such examination

of law as we have deemed appropriate to give the opinion set forth below. We have relied, without independent verification, on certificates

of public officials and, as to matters of fact material to the opinion set forth below, on certificates of officers of the Company.

For purposes of the opinion set forth below, we

have assumed that the Shares are issued for a price per share equal to or greater than the minimum price authorized by the Company’s

board of directors or an authorized committee thereof prior to the date hereof (the “Minimum Price”) and that no event occurs

that causes the number of authorized shares of Common Stock available for issuance by the Company to be less than the number of then unissued

Shares that may be issued for the Minimum Price.

The opinion set forth below is limited to the Maryland

General Corporation Law.

Based on the foregoing, we are of the opinion that

the Shares have been duly authorized and, when issued, delivered and paid for in accordance with the Sales Agency Financing Agreements

and the Master Confirmations and in exchange for a price per share equal to or greater than the Minimum Price, will be validly issued,

fully paid and nonassessable.

This opinion letter and the opinions it contains

shall be interpreted in accordance with the Core Opinion Principles as published in 74 Business Lawyer 815 (Summer 2019).

This opinion is being furnished to you for submission

to the Commission as an exhibit to the Company’s Current Report on Form 8-K relating to the Shares (the “Current Report”),

which is incorporated by reference in the Registration Statement. We hereby consent to the filing of this supplemental opinion letter

as an exhibit to the Current Report and its incorporation by reference and the reference to our firm in that report. In giving our consent,

we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and

regulations thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ GOODWIN PROCTER LLP |

| |

|

| |

GOODWIN PROCTER LLP |

| |

|

v3.24.0.1

Cover

|

Feb. 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 23, 2024

|

| Entity File Number |

1-12672

|

| Entity Registrant Name |

AVALONBAY

COMMUNITIES, INC.

|

| Entity Central Index Key |

0000915912

|

| Entity Tax Identification Number |

77-0404318

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

4040 Wilson Blvd., Suite 1000

|

| Entity Address, City or Town |

Arlington

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22203

|

| City Area Code |

703

|

| Local Phone Number |

329-6300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

AVB

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

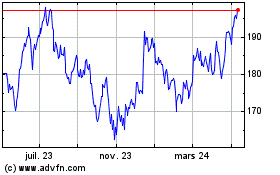

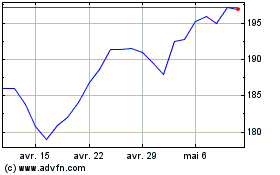

Avalonbay Communities (NYSE:AVB)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Avalonbay Communities (NYSE:AVB)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024