- $0.16 per share increase, or 23.2%, in recorded third

quarter 2023 consolidated diluted EPS (“2023 third quarter

results”) compared to third quarter of 2022

- or $0.12 per share increase, or 16.4%, as adjusted, to

remove a favorable variance of $0.04 per share resulting from the

receipt of a final decision in the cost of capital proceeding in

June 2023.

- American States Water Company filed a water utility general

rate case in August 2023 for new rates in the years 2025 - 2027

- Filing outlines a core business infrastructure investment

plan of $611.4 million over the rate cycle.

American States Water Company (NYSE:AWR) today reported basic

and fully diluted earnings per share of $0.85 for the quarter ended

September 30, 2023, as compared to basic and fully diluted earnings

per share of $0.69 for the quarter ended September 30, 2022, an

increase of $0.16 per share, or 23.2%, which includes a favorable

variance of $0.04 per share resulting from the impact of accounting

estimates recorded in the third quarter of 2022 for revenues

subject to refund related to the pending cost of capital proceeding

at that time, which were subsequently reversed during the second

quarter of 2023 upon receipt of a final decision adopted by the

California Public Utilities Commission (“CPUC”) in June 2023, as

discussed immediately below.

On June 29, 2023, a final decision was adopted by the CPUC in

the cost of capital proceeding at AWR's regulated water utility

segment, Golden State Water Company (“GSWC”) that, among other

things, adopted a lower cost of debt of 5.1% as compared to 6.6%

previously authorized. During 2022, GSWC had recorded estimated

revenues subject to refund to reflect the lower cost of debt. Based

on the final decision, all adjustments to rates are to be

prospective and not retroactive. GSWC filed an advice letter that

implemented the new cost of capital effective July 31, 2023. As a

result, management updated the accounting estimates recorded during

2022 that resulted in the reversal during the second quarter of

2023 of all the revenues subject to refund that had been recorded

during 2022, of which $1.9 million, or $0.04 per share, was

recorded during the three months ended September 30, 2022.

Excluding the impact from the final cost of capital proceeding for

the three months ended September 30, 2022, adjusted consolidated

diluted earnings were $0.73 per share, compared to adjusted and

recorded consolidated diluted earnings of $0.85 per share for the

three months ended September 30, 2023, an adjusted increase of

$0.12 per share for 2023, or 16.4%, largely due to new 2023 water

rates approved by the CPUC.

Third Quarter 2023 Results

The table below sets forth a comparison of the third quarter

2023 diluted earnings per share contribution recorded by business

segment and for the parent company with amounts recorded during the

same period in 2022.

Diluted Earnings per

Share

Three Months Ended

9/30/2023

9/30/2022

CHANGE

Water

$

0.72

$

0.54

$

0.18

Electric

0.04

0.04

—

Contracted services

0.12

0.12

—

AWR (parent)

(0.02

)

(0.01

)

(0.01

)

Consolidated fully diluted earnings per

share, as recorded (GAAP)

0.85

0.69

0.16

Adjustment to GAAP

measure:

Impact of revenues subject to refund

recorded in 2022*

—

0.04

(0.04

)

Consolidated diluted earnings per share,

as adjusted (Non-GAAP)*

$

0.85

$

0.73

$

0.12

Water diluted earnings per share, as

adjusted (Non-GAAP)*

$

0.72

$

0.58

$

0.14

Note: Certain amounts in the

table above may not foot or crossfoot due to rounding.

*

The adjustment to recorded

diluted earnings per share relates to the water segment. The water

segment’s adjusted earnings for 2022 exclude the impact of

accounting estimates made in 2022 for revenues subject to refund

related to the pending cost of capital proceeding at that time, and

as shown separately in the table above. The lower revenues recorded

during the three months ended September 30, 2022 totaled $1.9

million, or $0.04 per share, based on the estimate of revenues

subject to refund that were subsequently reversed in June 2023 upon

receiving the final decision in the cost of capital proceeding

making all adjustments to rates prospective and not

retroactive.

Water Segment:

For the three months ended September 30, 2023, recorded diluted

earnings from the water utility segment were $0.72 per share, as

compared to $0.54 per share for the same period in 2022, an

increase of $0.18 per share, which includes a favorable variance of

$0.04 per share from the impact of accounting estimates made in the

third quarter of 2022 for revenues subject to refund related to the

pending cost of capital proceeding at that time, which were

subsequently reversed during the second quarter of 2023, as

previously discussed and as shown separately in the table above.

Excluding this item, adjusted diluted earnings at the water segment

for the third quarter of 2022 were $0.58 per share, as compared to

adjusted and recorded earnings of $0.72 per share for the third

quarter of 2023, an adjusted increase at the water segment of $0.14

per share, or a 24.1% increase due largely to the following

items:

- An increase in water operating revenues of approximately $13.5

million was largely as a result of the second-year rate increases

related to the three months ended September 30, 2023, partially

offset by the prospective change in the new cost of capital

effective July 31, 2023 that lowered GSWC's authorized return on

rate base. The return on rate base was revised to reflect the new

authorized cost of debt, which decreased from 6.6% to 5.1%, offset

by a higher return on equity which increased from 8.9% to 9.36%. In

June 2023, GSWC filed for the implementation of new 2023 rates upon

receiving the final decisions on the general rate case and cost of

capital proceedings both of which became effective July 31, 2023.

The increase in water revenues during the third quarter of 2023

represents the difference from the 2021 adopted rates recorded

during the three-month period ended September 30, 2022 and the 2023

second-year increases recorded during the same period ended in

2023.

- An increase in water supply costs of $3.6 million, which

consist of purchased water, purchased power for pumping,

groundwater production assessments and changes in the water supply

cost balancing accounts. Adopted supply costs for the third quarter

of 2023 were based on 2023 authorized amounts approved in the final

CPUC decision in the water general rate case application. Actual

water supply costs are tracked and passed through to customers on a

dollar-for-dollar basis by way of the CPUC-approved water supply

cost balancing accounts. The increase in water supply costs results

in a corresponding increase in water operating revenues and has no

net impact on the water segment’s profitability.

- An overall increase in operating expenses of $1.1 million

(excluding supply costs) due primarily to increases in (i) overall

labor costs and other employee-related benefits, (ii) other

operation-related expenses resulting primarily from higher water

treatment and chemical costs, (iii) maintenance expense, (iv)

administrative and general expenses resulting largely from higher

outside-services costs, and (v) depreciation and amortization

expenses resulting from additions to utility plant and the higher

composite depreciation rates based on a revised depreciation study

approved in the final decision on the water general rate case.

- An increase in interest expense (net of interest income) of

$1.2 million resulting primarily from an overall increase in

interest rates, as well as an overall increase in total borrowing

levels to support, among other things, the capital expenditure

programs at GSWC, partially offset by higher interest income earned

on regulatory assets bearing interest at the current 90-day

commercial-paper rate, which increased compared to 2022’s rates, as

well as an increase in the level of regulatory assets recorded that

resulted, in large part, from the final decision on the water

general rate case that had been delayed.

- An overall increase in other expenses (net of other income) of

$1.2 million due primarily to an increase in the non-service cost

components related to GSWC’s benefit plans resulting from changes

in actuarial assumptions including expected returns on plan assets.

However, as a result of GSWC’s two-way pension balancing accounts

authorized by the CPUC, changes in total net periodic benefits

costs related to the pension plan have no material impact to

earnings.

- Changes in certain flowed-through income taxes and permanent

items included in GSWC’s income tax expense for the three months

ended September 30, 2023 as compared to the same period in 2022

that favorably impacted the water segment’s earnings. As a

regulated utility, GSWC treats certain temporary differences as

being flowed-through in computing its income tax expense consistent

with the income tax method used in its CPUC-jurisdiction rate

making. Changes in the magnitude of flowed-through items either

increase or decrease tax expense, thereby affecting diluted

earnings per share.

Electric Segment:

Diluted earnings from the electric utility segment for the three

months ended September 30, 2023 were flat compared to the same

period in 2022, largely resulting from not having new rates in 2023

while awaiting the processing of the pending electric general rate

case that will set new rates for 2023 – 2026, while also

experiencing continued increases in overall operating expenses and

interest costs that were mostly offset by favorable changes in

certain flowed-through income taxes. When a decision is issued in

the electric general rate case, new rates are expected to be

retroactive to January 1, 2023 and cumulative adjustments will be

recorded at that time.

Contracted Services Segment:

Diluted earnings from the contracted services segment for the

three months ended September 30, 2023 were consistent when compared

to the same period in 2022. The contracted services segment is

expected to contribute $0.45 to $0.49 per share for the full 2023

year.

AWR (Parent):

For the third quarter of 2023, the diluted loss from AWR

(parent) increased by $0.01 per share compared to the same period

in 2022 due primarily to an increase in interest expense resulting

from higher short-term interest rates and higher borrowings under

AWR’s revolving credit facility, as well as changes in state

unitary taxes.

Year-To-Date (“YTD”) 2023 Results

- $1.21 per share increase in recorded YTD 2023 consolidated

diluted EPS compared to YTD 2022, or $0.43 per share increase as

adjusted

- YTD 2023 recorded results reflect the impact of retroactive

rates of $0.38 per share related to the full year of 2022 because

of receiving a final decision in the water utility general rate

case.

- YTD 2023 recorded results also reflect a net favorable

variance of $0.23 per share resulting from the reversal of revenues

subject to refund that had been previously recorded in 2022 of

$0.13 per share following the receipt of a final decision in the

cost of capital proceeding in June 2023, of which $0.10 per share

had been recorded during the same period in 2022.

- YTD 2023 recorded results also reflect a net favorable

variance of $0.17 per share from gains on investments held to fund

a retirement plan compared to losses during the same period in

2022.

The table below sets forth a comparison of diluted earnings per

share contribution by business segment and for the parent company

as recorded during the nine months ended September 30, 2023 and

2022.

Diluted Earnings per

Share

Nine Months Ended

9/30/2023

9/30/2022

CHANGE

Water

$

2.36

$

1.17

$

1.19

Electric

0.14

0.16

(0.02

)

Contracted services

0.38

0.29

0.09

AWR (parent)

(0.06

)

(0.01

)

(0.05

)

Consolidated fully diluted earnings per

share, as recorded (GAAP)

2.82

1.61

1.21

Adjustments to GAAP

measure:

Impact of retroactive rates related to the

full year of 2022 from the final decision in the water general rate

case (approximately $0.30 per share relates to the first nine

months of 2022)*

(0.38

)

—

(0.38

)

Impact related to the final cost of

capital decision*

(0.13

)

0.10

(0.23

)

Consolidated diluted earnings per share,

as adjusted (Non-GAAP)*

$

2.31

$

1.71

$

0.60

Water diluted earnings per share, as

adjusted (Non-GAAP)*

$

1.85

$

1.27

$

0.58

*

All adjustments to recorded

diluted earnings per share relate to the water segment. The water

segment’s adjusted earnings for 2023 exclude the impact of

retroactive rates related to the full year of 2022 resulting from

the final CPUC decision in the general rate case, and for 2023 and

2022 they exclude the impact of estimates and changes in estimates

resulting from revenues subject to refund related to the cost of

capital proceeding, both shown separately in the table above.

As noted in the table above, fully diluted recorded earnings for

the nine months ended September 30, 2023 were $2.82 per share as

compared to $1.61 per share recorded for the same period in 2022, a

$1.21 per share increase. Included in the results for the nine

months ended September 30, 2023 were: (i) the impact of retroactive

new water rates related to the full 2022 year of $0.38 per share

(shown separately in the table above) as a result of receiving a

final decision in the water general rate case as discussed below,

(ii) a net favorable variance of $0.23 per share (shown separately

in the table above) from the impact of the final cost of capital

decision that resulted in the reversal during the nine months ended

September 30, 2023 of revenues subject to refund due to a change in

estimate from what had been recorded during 2022, and (iii) a net

favorable variance of $0.17 per share from gains totaling $2.1

million, or $0.04 per share, recorded during the nine months ended

September 30, 2023 on investments held to fund one of the company's

retirement plans, as compared to losses of $6.4 million, or $0.13

per share, recorded for the same period in 2022, both due to

financial market conditions. Excluding these three items, adjusted

consolidated diluted earnings for the nine months ended September

30, 2023 were $2.27 per share as compared to adjusted diluted

earnings of $1.84 per share for the same period in 2022, an

adjusted increase of $0.43 per share, or a 23.4% increase, largely

due to new 2023 water rates approved in GSWC's final decision in

its general rate case proceeding.

On June 29, 2023, the CPUC adopted a final decision in GSWC's

general rate case application that determines new water rates for

the years 2022–2024 retroactive to January 1, 2022. Among other

things, the final decision (i) adopted the full settlement

agreement between GSWC and the Public Advocates Office at the CPUC

that resolved all issues related to the 2022 annual revenue

requirement, and (ii) allowed for additional increases in adopted

revenues for 2023 and 2024 subject to an earnings test and

inflationary index values at the time of filing for implementation

of the new rates.

Because of receiving a final decision in GSWC's general rate

case, second-year rate increases for 2023 have been reflected in

the three and nine months ended September 30, 2023. Through the

nine months ended September 30, 2023, this included increases in

revenues of $36.8 million, or $0.72 per share, compared to the

adopted 2021 rates, and increases in supply costs of $8.0 million,

or $0.16 per share, which combined is an increase of $0.56 per

share for the nine months ended September 30, 2023. GSWC filed for

the implementation of new 2023 rate increases that became effective

on July 31, 2023. In October 2023, GSWC also filed with the CPUC to

recover all retroactive rate amounts accumulated in memorandum

accounts for the full 2022 year and for 2023 through July 30, 2023.

Surcharges were implemented to recover these cumulative retroactive

rate differences over 36 months. As of September 30, 2023, there is

an aggregate cumulative balance of $55.1 million in CPUC-approved

general rate case memorandum accounts that have been recognized as

regulatory assets with a corresponding increase in unbilled water

revenues.

For more details on the YTD results, please refer to the

company’s Form 10-Q filed with the Securities and Exchange

Commission.

Regulatory Matters

On June 29, 2023, a final decision was adopted by the CPUC in

the cost of capital proceeding that, among other things, adopted a

new return on equity of 8.85% for GSWC as compared to 8.9%

previously authorized, and allowed for the continuation of the

Water Cost of Capital Mechanism (“WCCM”) through December 31, 2024.

The WCCM adjusts the return on equity and rate of return on rate

base between the three-year cost of capital proceedings only if

there is a positive or negative change of more than 100 basis

points in the average of the Moody’s Aa utility bond rate as

measured over the period from October 1 through September 30. If

there is a positive or negative change of more than 100 basis

points, the return on equity is adjusted by one half of the

difference. For the period from October 1, 2021 through September

30, 2022, the Moody’s Aa utility bond rate increased by 102.8 basis

points from the benchmark, which triggered the WCCM adjustment,

which increased GSWC's adopted return on equity to 9.36% effective

July 31, 2023. Additionally, for the period from October 1, 2022

through September 30, 2023, the Moody's Aa utility bond rate

increased by 139.7 basis points from the benchmark, which again

triggered another WCCM adjustment. On October 12, 2023, GSWC filed

an advice letter to establish the WCCM for 2024, which has been

approved by the CPUC and will increase GSWC’s 9.36% adopted return

on equity to 10.06% effective January 1, 2024.

Dividends

On October 30, 2023, AWR’s Board of Directors approved a fourth

quarter dividend of $0.43 per share on AWR’s Common Shares.

Dividends on the Common Shares will be paid on December 1, 2023 to

shareholders of record at the close of business on November 15,

2023. AWR has paid common dividends every year since 1931, and has

increased the dividends received by shareholders each calendar year

for 69 consecutive years, which places it in an exclusive group of

companies on the New York Stock Exchange that have achieved that

result. The company’s quarterly dividend rate has grown at a

compound annual growth rate (“CAGR”) of 9.4% over the last five

years. AWR's current policy is to achieve a CAGR in the dividend of

more than 7% over the long-term.

Non-GAAP Financial Measures

This press release includes a discussion on AWR’s operations in

terms of diluted earnings per share by business segment, which is

each business segment’s earnings divided by the company’s weighted

average number of diluted common shares. The gains and losses

generated on the investments held to fund one of the company’s

retirement plans during the nine months ended September 30, 2023

and 2022 have been excluded when communicating the results to help

facilitate comparisons of AWR’s performance from period to period.

In addition, both the impact of retroactive rates related to the

full year 2022 recorded during the nine months ended September 30,

2023 resulting from the final decision on the water general rate

case, and the impact from the estimates of revenues subject to

refund recorded in 2022 and changes to estimates recorded in 2023

following the receipt of a final cost of capital decision in June

of 2023 have been excluded when communicating AWR’s consolidated

and water segment results for the three months ended September 30,

2022 and the nine months ended September 30, 2023 and 2022 to help

facilitate comparisons of the company’s performance from period to

period. All of these measures are derived from consolidated

financial information but are not presented in our financial

statements that are prepared in accordance with Generally Accepted

Accounting Principles (“GAAP”) in the United States. These items

constitute "non-GAAP financial measures" under Securities and

Exchange Commission rules, which supplement our GAAP disclosures

but should not be considered as an alternative to the respective

GAAP measures. Furthermore, the non-GAAP financial measures may not

be comparable to similarly titled non-GAAP financial measures of

other registrants.

The company uses earnings per share by business segment as an

important measure in evaluating its operating results and believes

this measure is a useful internal benchmark in evaluating the

performance of its operating segments. The company reviews this

measurement regularly and compares it to historical periods and to

the operating budget. The company has provided the computations and

reconciliations of diluted earnings per share from the measure of

operating income by business segment to AWR’s consolidated fully

diluted earnings per share in this press release.

Forward-Looking Statements

Certain matters discussed in this press release with regard to

the company’s expectations may be forward-looking statements that

involve risks and uncertainties. The assumptions and risk factors

that could cause actual results to differ materially include those

described in the company’s most recent Form 10-Q and Form 10-K

filed with the Securities and Exchange Commission.

Conference Call

Robert Sprowls, president and chief executive officer, and Eva

Tang, senior vice president and chief financial officer, will host

a conference call to discuss these results at 2:00 p.m. Eastern

Time (11:00 a.m. Pacific Time) on Tuesday, November 7. There will

be a question and answer session as part of the call. Interested

parties can listen to the live conference call and view

accompanying slides on the internet at www.aswater.com. The call

will be archived on the website and available for replay beginning

November 7, 2023 at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time)

through November 14, 2023.

About American States Water Company

American States Water Company is the parent of Golden State

Water Company, Bear Valley Electric Service, Inc. and American

States Utility Services, Inc., serving over one million people in

nine states. Through its water utility subsidiary, Golden State

Water Company, the company provides water service to approximately

264,000 customer connections located within more than 80

communities in Northern, Coastal and Southern California. Through

its electric utility subsidiary, Bear Valley Electric Service,

Inc., the company distributes electricity to approximately 24,700

customer connections in the City of Big Bear Lake and surrounding

areas in San Bernardino County, California. Through its contracted

services subsidiary, American States Utility Services, Inc., the

company provides operations, maintenance and construction

management services for water distribution, wastewater collection,

and treatment facilities located on twelve military bases

throughout the country under 50-year privatization contracts with

the U.S. government.

The company has achieved an 8.1% compound annual growth rate in

its calendar year dividend payments from 2013 – 2023.

American States Water

Company

Consolidated

Comparative Condensed Balance

Sheets (Unaudited)

(in thousands)

September 30, 2023

December 31, 2022

Assets

Net Property, Plant and Equipment

$

1,850,471

$

1,753,766

Goodwill

1,116

1,116

Other Property and Investments

37,767

36,907

Current Assets

191,685

151,294

Other Assets

124,190

91,291

Total Assets

$

2,205,229

$

2,034,374

Capitalization and Liabilities

Capitalization

$

1,346,796

$

1,156,096

Current Liabilities

195,007

396,522

Other Credits

663,426

481,756

Total Capitalization and

Liabilities

$

2,205,229

$

2,034,374

Condensed Statements of Income

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in thousands,

except per share amounts)

2023

2022

2023

2022

Operating Revenues

Water

$

116,231

$

100,799

$

345,851

$

265,561

Electric

8,956

8,919

30,688

29,028

Contracted services

26,509

25,266

93,980

71,572

Total operating revenues

151,696

134,984

470,519

366,161

Operating Expenses

Water purchased

23,216

20,304

55,590

58,115

Power purchased for pumping

4,291

3,878

9,514

9,182

Groundwater production assessment

5,990

5,650

15,188

14,726

Power purchased for resale

2,383

2,673

9,838

9,186

Supply cost balancing accounts

723

640

15,126

(6,160

)

Other operation

10,429

9,696

30,261

28,028

Administrative and general

20,982

21,594

66,032

65,030

Depreciation and amortization

10,184

10,117

31,645

30,402

Maintenance

4,097

3,408

11,026

10,120

Property and other taxes

6,034

5,942

17,884

17,247

ASUS construction

11,616

10,742

46,554

31,263

Total operating expenses

99,945

94,644

308,658

267,139

Operating income

51,751

40,340

161,861

99,022

Other Income and Expenses

Interest expense

(11,691

)

(7,331

)

(31,900

)

(19,246

)

Interest income

2,125

667

5,792

1,387

Other, net

(1,073

)

338

2,243

(2,370

)

Total other income and (expenses),

net

(10,639

)

(6,326

)

(23,865

)

(20,229

)

Income Before Income Tax

Expense

41,112

34,014

137,996

78,793

Income tax expense

9,547

8,360

33,503

19,026

Net Income

$

31,565

$

25,654

$

104,493

$

59,767

Weighted average shares outstanding

36,977

36,958

36,974

36,953

Basic earnings per Common Share

$

0.85

$

0.69

$

2.82

$

1.61

Weighted average diluted shares

37,071

37,042

37,064

37,034

Fully diluted earnings per Common

Share

$

0.85

$

0.69

$

2.82

$

1.61

Dividends paid per Common Share

$

0.4300

$

0.3975

$

1.2250

$

1.1275

Computation and Reconciliation of Non-GAAP Financial Measure

(Unaudited)

Below are the computation and reconciliation of diluted earnings

per share from the measure of operating income by business segment

to AWR’s consolidated fully diluted earnings per share for the

three and nine months ended September 30, 2023 and 2022.

Water

Electric

Contracted Services

AWR (Parent)

Consolidated (GAAP)

In 000's except per

share amounts

Q3 2023

Q3 2022

Q3 2023

Q3 2022

Q3 2023

Q3 2022

Q3 2023

Q3 2022

Q3 2023

Q3 2022

Operating income (loss)

$

43,243

$

32,451

$

2,049

$

2,337

$

6,204

$

5,553

$

255

$

(1

)

$

51,751

$

40,340

Other (income) and expenses, net

7,820

5,695

754

243

428

(65

)

1,637

453

10,639

6,326

Income tax expense (benefit)

8,830

6,831

(154

)

478

1,430

1,347

(559

)

(296

)

9,547

8,360

Net income (loss)

$

26,593

$

19,925

$

1,449

$

1,616

$

4,346

$

4,271

$

(823

)

$

(158

)

$

31,565

$

25,654

Weighted Average Number of Diluted

Shares

37,071

37,042

37,071

37,042

37,071

37,042

37,071

37,042

37,071

37,042

Diluted earnings (loss) per share

$

0.72

$

0.54

$

0.04

$

0.04

$

0.12

$

0.12

$

(0.02

)

$

(0.01

)

$

0.85

$

0.69

Note: Certain amounts in the table above

may not foot or crossfoot due to rounding.

Water

Electric

Contracted Services

AWR (Parent)

Consolidated (GAAP)

In 000's except per

share amounts

YTD 2023

YTD 2022

YTD 2023

YTD 2022

YTD 2023

YTD 2022

YTD 2023

YTD 2022

YTD 2023

YTD 2022

Operating income (loss)

$

134,006

$

77,161

$

7,783

$

7,973

$

19,854

$

13,894

$

218

$

(6

)

$

161,861

$

99,022

Other (income) and expenses, net

16,743

19,158

1,959

431

1,042

(374

)

4,121

1,014

23,865

20,229

Income tax expense (benefit)

29,674

14,623

794

1,645

4,621

3,399

(1,586

)

(641

)

33,503

19,026

Net income (loss)

$

87,589

$

43,380

$

5,030

$

5,897

$

14,191

$

10,869

$

(2,317

)

$

(379

)

$

104,493

$

59,767

Weighted Average Number of Diluted

Shares

37,064

37,034

37,064

37,034

37,064

37,034

37,064

37,034

37,064

37,034

Diluted earnings (loss) per share

$

2.36

$

1.17

$

0.14

$

0.16

$

0.38

$

0.29

$

(0.06

)

$

(0.01

)

$

2.82

$

1.61

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231103658542/en/

Eva G. Tang Senior Vice President-Finance, Chief Financial

Officer, Corporate Secretary and Treasurer Telephone: (909)

394-3600, ext. 707

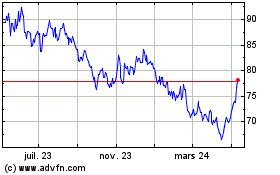

American States Water (NYSE:AWR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

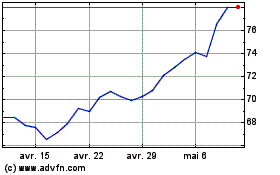

American States Water (NYSE:AWR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024