American States Water Company Announces a Settlement Agreement in its Water Utility General Rate Case

18 Juillet 2024 - 3:00PM

Business Wire

American States Water Company (NYSE:AWR) announced that on July

12, 2024, its regulated water utility subsidiary, Golden State

Water Company (GSWC) and the Public Advocates Office (Cal

Advocates) at the California Public Utilities Commission (CPUC)

filed a joint motion to adopt a settlement agreement between GSWC

and Cal Advocates in connection with the water utility general rate

case. GSWC had filed a general rate case application in August 2023

for all of its water regions and the general office to determine

new rates for the years 2025 - 2027. The CPUC is scheduled to issue

a decision in the water general rate case by the end of 2024 with

the new rates expected to become effective January 1, 2025.

The proposed settlement agreement, if approved by the CPUC,

resolves most of the issues related to the calculation of the 2025

annual revenue requirement in the general rate case application

leaving only two unresolved issues discussed later. Among other

things, the settlement authorizes GSWC to invest approximately

$573.1 million in capital infrastructure over the three-year

capital cycle in order to continue to provide safe and reliable

water utility service to its customers. The $573.1 million of

infrastructure investment, as settled, includes $17.7 million of

advice letter capital investments to be filed for revenue recovery

during the second and third year attrition increases when those

projects are completed. In addition, the settlement agreement

approves $58.2 million of advice letter capital investments already

under construction beginning in 2023 also to be filed for revenue

recovery during the second and third year attrition increases when

those projects are completed. For all of the advice letter

projects, GSWC will be allowed to accrue interest during

construction at the adopted cost of debt and recover the full rate

of return and all applicable components of the revenue requirement

after the assets are placed in service up until the assets are

placed in customer rates.

Excluding revenues for all of the advice letter capital projects

discussed above, under the terms of the settlement agreement (i)

GSWC’s adopted operating revenues less water supply costs (RLWSC)

for 2025 are projected to increase by approximately $23 million as

compared to the 2024 adopted RLWSC, and (ii) there are potential

additional revenue increases of approximately $20 million for each

of the years 2026 and 2027 based on inflation factors used at the

time of the application filing in August 2023. The increases in

2026 and 2027 are subject to the results of an earnings test and

changes to the forecasted inflationary index values. Actual

increases for 2026 and 2027 will be determined when the CPUC

approves the filings to implement the new rate increases, using

inflationary index values applicable at that time.

The two remaining unresolved 2025 revenue requirement issues

relate to the sales forecast and supply mix. In addition, four

items related to GSWC’s request for certain regulatory mechanisms

will be litigated and they include (i) a sales and revenue

decoupling mechanism, (ii) a sales reconciliation mechanism, (iii)

a supply mix adjustment mechanism, and (iv) a request to modify the

existing per- and polyfluoroalkyl substances (“PFAS”) memorandum

account to track carrying costs on capital investments needed to

comply with the new PFAS maximum contaminant levels (monitoring and

reporting required effective 2027) established by the Environmental

Protection Agency. With regards to all of these unresolved issues,

GSWC and Cal Advocates will file briefs with the CPUC by the end of

July 2024. When the administrative law judge in the proceeding

issues a proposed decision, it will address the unresolved issues

along with the settlement agreement filed by GSWC and Cal

Advocates.

Credit Ratings

AWR currently maintains a credit rating of A Stable with

Standard and Poor’s Global Ratings (“S&P”), while GSWC

maintains an A+ Stable rating with S&P and an A2 Stable rating

with Moody’s Investors Service. Each of these ratings have been

affirmed during 2024. These are some of the highest credit ratings

in the U.S. investor-owned water utility industry.

Forward-Looking Statements

Certain matters discussed in this press release with regard to

the company’s expectations may be forward-looking statements that

involve risks and uncertainties. The assumptions and risk factors

that could cause actual results to differ materially include those

described in the company’s most recent Form 10-Q and Form 10-K

filed with the Securities and Exchange Commission.

About American States Water Company

American States Water Company is the parent of Golden State

Water Company, Bear Valley Electric Service, Inc. and American

States Utility Services, Inc., serving over one million people in

ten states. Through its water utility subsidiary, Golden State

Water Company, the company provides water service to approximately

264,200 customer connections located within more than 80

communities in Northern, Coastal and Southern California. Through

its electric utility subsidiary, Bear Valley Electric Service,

Inc., the company distributes electricity to approximately 24,800

customer connections in the City of Big Bear Lake and surrounding

areas in San Bernardino County, California. Through its contracted

services subsidiary, American States Utility Services, Inc., the

company provides operations, maintenance and construction

management services for water distribution, wastewater collection,

and treatment facilities located on 12 military bases throughout

the country under 50-year privatization contracts with the U.S.

government and one military base under a 15-year contract.

American States Water Company has paid dividends to shareholders

every year since 1931, increasing the dividends received by

shareholders each calendar year for 69 consecutive years, which

places it in an exclusive group of companies on the New York Stock

Exchange that have achieved that result. The company’s quarterly

dividend rate has grown at a compound annual growth rate (“CAGR”)

of 9.4% over the last five years since the third quarter of 2018

and has achieved an 8.1% CAGR in calendar dividend payments over

the last ten years. The company’s current policy is to achieve a

CAGR in the dividend of more than 7% over the long-term.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717349150/en/

Eva G. Tang Senior Vice President-Finance, Chief Financial

Officer, Corporate Secretary and Treasurer (909) 394-3600, ext.

707

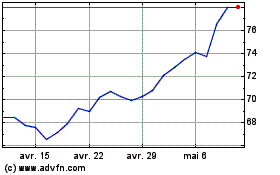

American States Water (NYSE:AWR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

American States Water (NYSE:AWR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024