0001655050false00016550502024-05-062024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 06, 2024 |

BAIN CAPITAL SPECIALTY FINANCE, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

814-01175 |

81-2878769 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

200 Clarendon Street 37th Floor |

|

Boston, Massachusetts |

|

02116 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 516-2000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

BCSF |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 6, 2024, Bain Capital Specialty Finance, Inc. (the “Company”) issued a press release announcing its financial results for the first quarter ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished herewith, is being furnished and shall not be deemed “filed” for any purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such Section. The information in this Current Report on Form 8-K shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On May 6, 2024, the Company issued a press release announcing the declaration of a second fiscal quarter 2024 dividend of $0.42 per share and an additional dividend of $0.03 per share that was previously announced on February 27, 2024. The second fiscal quarter 2024 dividend of $0.42 per share and the additional dividend of $0.03 per share are for stockholders of record as of June 28, 2024 and payable on July 29, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

99.1 Press Release, dated May 6, 2024.

104 Cover page interactive data file (formatted as Inline XBRL)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

BAIN CAPITAL SPECIALTY FINANCE, INC. |

|

|

|

|

Date: |

May 6, 2024 |

By: |

/s/ Jessica Yeager |

|

|

|

Name: Jessica Yeager

Title: Secretary |

Exhibit 99.1

Bain Capital Specialty Finance, Inc. Announces March 31, 2024 Financial Results and Declares Second Quarter 2024 Dividend of $0.42 per Share

BOSTON – May 6, 2024 – Bain Capital Specialty Finance, Inc. (NYSE: BCSF, the “Company”, “our” or “we”) today announced financial results for the first quarter ended March 31, 2024, and that its Board of Directors (the “Board”) has declared a dividend of $0.42 per share for the second quarter of 2024 and an additional dividend of $0.03 per share that was previously announced on February 27, 2024.

“Our first quarter results reflected a strong start to the year driven by high net investment income, improving credit quality across our diversified senior secured portfolio and another consecutive quarter of NAV growth for our shareholders,” said Michael Ewald, Chief Executive Officer of BCSF. “We also had an active quarter of new originations, and we believe BCSF remains well-positioned to capitalize on opportunities in the current environment as we continue to execute our longstanding strategy of investing in senior secured loans to middle market companies.”

QUARTERLY HIGHLIGHTS

•Net investment income (NII) per share was $0.53, equating to an annualized NII yield on book value of 12.0%(1);

•Net income per share was $0.55, equating to an annualized return on book value of 12.5%(1);

•Net asset value per share as of March 31, 2024 was $17.70, as compared to $17.60 as of December 31, 2023;

•Gross and net investment fundings were $403.1 million and $107.1 million, respectively; ending net debt-to-equity was 1.09x, as compared to 1.02x as of December 31, 2023(2);

•Investments on non-accrual declined quarter-over-quarter to 1.7% and 1.0% of the total investment portfolio at amortized cost and fair value, respectively, as of March 31, 2024;

•Subsequent to quarter-end, the Company’s Board of Directors declared a dividend of $0.42 per share for the second quarter of 2024 payable to stockholders of record as of June 28, 2024. The Board of Directors previously announced an additional dividend of $0.03 per share payable to stockholders of record as of June 28, 2024(3); and

•In March 2024, Fitch Ratings affirmed the Company’s investment grade rating of BBB- and stable outlook.

SELECTED FINANCIAL HIGHLIGHTS

|

|

|

|

($ in millions, unless otherwise noted) |

Q1 2024 |

Q4 2023 |

Net investment income per share |

$0.53 |

$0.54 |

Net investment income |

$34.0 |

$34.9 |

Earnings per share |

$0.55 |

$0.48 |

Dividends per share declared and payable |

$0.45 |

$0.42 |

|

|

|

($ in millions, unless otherwise noted) |

As of March 31, 2024 |

As of December 31, 2023 |

Total fair value of investments |

$2,406.0 |

$2,298.3 |

Total assets |

$2,580.1 |

$2,472.3 |

Total net assets |

$1,142.5 |

$1,136.5 |

Net asset value per share |

$17.70 |

$17.60 |

PORTFOLIO AND INVESTMENT ACTIVITY

For the three months ended March 31, 2024, the Company invested $403.1 million in 83 portfolio companies, including $238.4 million in seven new companies, $127.3 million in 60 existing companies, $34.4 million in 15 companies to be contributed to SLP and $3.0 million in SLP. The Company had $296.0 million of principal repayments and sales in the quarter, resulting in net investment fundings of $107.1 million.

Investment Activity for the Quarter Ended March 31, 2024:

|

|

|

($ in millions) |

Q1 2024 |

Q4 2023 |

Investment Fundings |

$403.1 |

$206.4 |

Sales and Repayments |

$296.0 |

$308.2 |

Net Investment Activity |

$107.1 |

$(101.8) |

As of March 31, 2024, the Company’s investment portfolio had a fair value of $2,406.0 million, comprised of investments in 153 portfolio companies operating across 32 different industries.

Investment Portfolio at Fair Value as of March 31, 2024:

|

|

|

Investment Type |

$ in Millions |

% of Total |

First Lien Senior Secured Loans |

$1,612.8 |

67.0% |

Second Lien Senior Secured Loans |

59.8 |

2.5 |

Subordinated Debt |

46.6 |

1.9 |

Preferred Equity |

107.2 |

4.5 |

Equity Interests |

207.2 |

8.6 |

Warrants |

0.7 |

0.0 |

Investment Vehicles |

371.7 |

15.5 |

Subordinated Note in ISLP |

190.7 |

7.9 |

Equity Interest in ISLP |

66.1 |

2.7 |

Subordinated Note in SLP |

119.0 |

5.0 |

Preferred and Equity Interest in SLP |

(4.1) |

(0.1) |

Total |

$2,406.0 |

100.0% |

As of March 31, 2024, the weighted average yield on the investment portfolio at amortized cost and fair value were 12.9% and 13.0%, respectively, as compared to 13.0% and 13.1%, respectively, as of December 31, 2023(4). 94.3% of the Company’s debt investments at fair value were in floating rate securities.

As of March 31, 2024, three portfolio companies were on non-accrual status, representing 1.7% and 1.0% of the total investment portfolio at amortized cost and fair value, respectively.

As of March 31, 2024, ISLP’s investment portfolio had an aggregate fair value of $731.2 million, comprised of investments in 38 portfolio companies operating across 16 different industries. The investment portfolio on a fair value basis was comprised of 93.8% first lien senior secured loans, 2.8% second lien senior secured loans and 3.4% equity interests. 100% of ISLP’s debt investments at fair value were in floating rate securities.

As of March 31, 2024, SLP’s investment portfolio had an aggregate fair value of $811.4 million, comprised of investments in 57 portfolio companies operating across 21 different industries. The investment portfolio on a fair value basis was comprised of 98.1% first lien senior secured loans and 1.9% second lien senior secured loans. 99.9% of SLP’s debt investments at fair value were in floating rate securities.

RESULTS OF OPERATIONS

For the three months ended March 31, 2024 and December 31, 2023, total investment income was $74.5 million and $74.9 million, respectively. The decrease in investment income was primarily due to a decrease in interest and dividend income, partially offset by an increase in other income.

Total expenses (before taxes) for the three months ended March 31, 2024 and December 31, 2023 were $39.5 million and $39.0 million, respectively.

Net investment income for the three months ended March 31, 2024 and December 31, 2023 was $34.0 million or $0.53 per share and $34.9 million or $0.54 per share, respectively.

During the three months ended March 31, 2024, the Company had net realized and unrealized gains of $1.1 million.

Net increase in net assets resulting from operations for the three months ended March 31, 2024 was $35.1 million, or $0.55 per share.

CAPITAL AND LIQUIDITY

As of March 31, 2024, the Company had total principal debt outstanding of $1,364.5 million, including $412.0 million outstanding in the Company’s Sumitomo Credit Facility, $352.5 million outstanding of the debt issued through BCC Middle Market CLO 2019-1 LLC, $300.0 million outstanding in the Company’s senior unsecured notes due March 2026 and $300.0 million outstanding in the Company’s senior unsecured notes due October 2026.

For the three months ended March 31, 2024, the weighted average interest rate on debt outstanding was 5.2%, as compared to 5.3% for the three months ended December 31, 2023.

As of March 31, 2024, the Company had cash and cash equivalents (including foreign cash) of $48.9 million, restricted cash and cash equivalents of $73.6 million, $(6.4) million of unsettled trades, net of receivables and payables of investments, and $242.3 million of capacity under its Sumitomo Credit Facility. As of March 31, 2024, the Company had $315.4 million of undrawn investment commitments.

As of March 31, 2024, the Company’s debt-to-equity and net debt-to-equity ratios were 1.19x and 1.09x, respectively, as compared to 1.11x and 1.02x, respectively, as of December 31, 2023(2).

Endnotes

(1)Net investment income yields and net income returns are calculated on average net assets, or book value, for the respective periods shown.

(2)Net debt-to-equity represents principal debt outstanding less cash and cash equivalents and unsettled trades, net of receivables and payables of investments.

(3)The second quarter dividend is payable on July 29, 2024 to stockholders of record as of June 28, 2024.

(4)The weighted average yield is computed as (a) the annual stated interest rate or yield earned on the relevant accruing debt and other income producing securities plus amortization of fees and discounts on the performing debt and other income producing investments, divided by (b) the total relevant investments at amortized cost or fair value. The weighted average yield does not represent the total return to our stockholders.

CONFERENCE CALL INFORMATION

A conference call to discuss the Company’s financial results will be held live at 8:00 a.m. Eastern Time on May 7, 2024. Please visit BCSF’s webcast link located on the Events & Presentations page of the Investor Resources section of BCSF’s website at http://www.baincapitalspecialtyfinance.com for a slide presentation that complements the Earnings Conference Call.

Participants are also invited to access the conference call by dialing one of the following numbers:

•Domestic: 1-800-717-1738

•International: 1-646-307-1865

All participants will need to reference “Bain Capital Specialty Finance - First Quarter Ended March 31, 2024 Earnings Conference Call” once connected with the operator. All participants are asked to dial in 10-15 minutes prior to the call.

Replay Information:

An archived replay will be available approximately three hours after the conference call concludes through May 14, 2024 via a webcast link located on the Investor Resources section of BCSF’s website, and via the dial-in numbers listed below:

•Domestic: 1-844-512-2921

•International: 1-412-317-6671

Bain Capital Specialty Finance, Inc.

Consolidated Statements of Assets and Liabilities

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

As of |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

(Unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

Investments at fair value: |

|

|

|

|

|

|

|

|

|

Non-controlled/non-affiliate investments (amortized cost of $1,825,313 and $1,615,061, respectively) |

|

$ |

|

1,814,170 |

|

|

$ |

|

1,593,360 |

Non-controlled/affiliate investment (amortized cost of $33,707 and $132,650, respectively) |

|

|

|

35,670 |

|

|

|

|

147,971 |

Controlled affiliate investment (amortized cost of $554,244 and $554,123, respectively) |

|

|

|

556,112 |

|

|

|

|

557,012 |

Cash and cash equivalents |

|

|

|

46,708 |

|

|

|

|

42,995 |

Foreign cash (cost of $2,851 and $6,865, respectively) |

|

|

|

2,234 |

|

|

|

|

6,405 |

Restricted cash and cash equivalents |

|

|

|

73,553 |

|

|

|

|

63,084 |

Collateral on forward currency exchange contracts |

|

|

|

8,053 |

|

|

|

|

7,613 |

Deferred financing costs |

|

|

|

2,568 |

|

|

|

|

2,802 |

Interest receivable on investments |

|

|

|

30,080 |

|

|

|

|

37,169 |

Receivable for sales and paydowns of investments |

|

|

|

2,383 |

|

|

|

|

4,310 |

Prepaid Insurance |

|

|

|

754 |

|

|

|

|

210 |

Unrealized appreciation on forward currency exchange contracts |

|

|

|

918 |

|

|

|

|

— |

Dividend receivable |

|

|

|

6,910 |

|

|

|

|

9,417 |

Total Assets |

|

$ |

|

2,580,113 |

|

|

$ |

|

2,472,348 |

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

Debt (net of unamortized debt issuance costs of $6,911 and $7,567, respectively) |

|

$ |

|

1,357,589 |

|

|

$ |

|

1,255,933 |

Interest payable |

|

|

|

12,887 |

|

|

|

|

13,283 |

Payable for investments purchased |

|

|

|

8,830 |

|

|

|

|

11,453 |

Unrealized depreciation on forward currency exchange contracts |

|

|

|

1,937 |

|

|

|

|

2,260 |

Base management fee payable |

|

|

|

8,818 |

|

|

|

|

8,929 |

Incentive fee payable |

|

|

|

9,232 |

|

|

|

|

7,327 |

Accounts payable and accrued expenses |

|

|

|

9,259 |

|

|

|

|

9,581 |

Distributions payable |

|

|

|

29,053 |

|

|

|

|

27,116 |

Total Liabilities |

|

|

|

1,437,605 |

|

|

|

|

1,335,882 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies (See Note 10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets |

|

|

|

|

|

|

|

|

|

Common stock, par value $0.001 per share, 100,000,000,000 and 100,000,000,000 shares authorized, 64,562,265 and 64,562,265 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively |

|

|

|

65 |

|

|

|

|

65 |

Paid in capital in excess of par value |

|

|

|

1,165,191 |

|

|

|

|

1,168,384 |

Total distributable loss |

|

|

|

(22,748) |

|

|

|

|

(31,983) |

Total Net Assets |

|

|

|

1,142,508 |

|

|

|

|

1,136,466 |

Total Liabilities and Total Net Assets |

|

$ |

|

2,580,113 |

|

|

$ |

|

2,472,348 |

|

|

|

|

|

|

|

|

|

|

Net asset value per share |

|

$ |

|

17.70 |

|

|

$ |

|

17.60 |

See Notes to Consolidated Financial Statements

Bain Capital Specialty Finance, Inc.

Consolidated Statements of Operations

(in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31 |

|

|

For the Three Months Ended March 31 |

|

|

2024 |

|

|

2023 |

Income |

|

|

|

|

|

|

|

|

|

Investment income from non-controlled/non-affiliate investments: |

|

|

|

|

|

|

|

|

|

Interest from investments |

|

$ |

|

43,849 |

|

|

$ |

|

48,069 |

Dividend income |

|

|

|

— |

|

|

|

|

1 |

PIK income |

|

|

|

5,067 |

|

|

|

|

3,840 |

Other income |

|

|

|

5,255 |

|

|

|

|

5,248 |

Total investment income from non-controlled/non-affiliate investments |

|

|

|

54,171 |

|

|

|

|

57,158 |

|

|

|

|

|

|

|

|

|

|

Investment income from non-controlled/affiliate investments: |

|

|

|

|

|

|

|

|

|

Interest from investments |

|

|

|

2,581 |

|

|

|

|

2,438 |

Dividend income |

|

|

|

821 |

|

|

|

|

1,375 |

PIK income |

|

|

|

315 |

|

|

|

|

394 |

Total investment income from non-controlled/affiliate investments |

|

|

|

3,717 |

|

|

|

|

4,207 |

|

|

|

|

|

|

|

|

|

|

Investment income from controlled affiliate investments: |

|

|

|

|

|

|

|

|

|

Interest from investments |

|

|

|

9,165 |

|

|

|

|

6,355 |

Dividend income |

|

|

|

7,446 |

|

|

|

|

7,017 |

Total investment income from controlled affiliate investments |

|

|

|

16,611 |

|

|

|

|

13,372 |

Total investment income |

|

|

|

74,499 |

|

|

|

|

74,737 |

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

Interest and debt financing expenses |

|

|

|

18,056 |

|

|

|

|

19,550 |

Base management fee |

|

|

|

8,818 |

|

|

|

|

8,910 |

Incentive fee |

|

|

|

9,232 |

|

|

|

|

11,110 |

Professional fees |

|

|

|

801 |

|

|

|

|

581 |

Directors fees |

|

|

|

174 |

|

|

|

|

174 |

Other general and administrative expenses |

|

|

|

2,443 |

|

|

|

|

1,659 |

Total expenses, net of fee waivers |

|

|

|

39,524 |

|

|

|

|

41,984 |

Net investment income before taxes |

|

|

|

34,975 |

|

|

|

|

32,753 |

Income tax expense, including excise tax |

|

|

|

1,025 |

|

|

|

|

595 |

Net investment income |

|

|

|

33,950 |

|

|

|

|

32,158 |

|

|

|

|

|

|

|

|

|

|

Net realized and unrealized gains (losses) |

|

|

|

|

|

|

|

|

|

Net realized loss on non-controlled/non-affiliate investments |

|

|

|

(2,536) |

|

|

|

|

(10,651) |

Net realized loss on non-controlled/affiliate investments |

|

|

|

4,719 |

|

|

|

|

— |

Net realized gain (loss) on foreign currency transactions |

|

|

|

23 |

|

|

|

|

(4,213) |

Net realized gain (loss) on forward currency exchange contracts |

|

|

|

1,727 |

|

|

|

|

(2,385) |

Net change in unrealized appreciation on foreign currency translation |

|

|

|

(208) |

|

|

|

|

3,767 |

Net change in unrealized appreciation on forward currency exchange contracts |

|

|

|

1,241 |

|

|

|

|

161 |

Net change in unrealized appreciation on non-controlled/non-affiliate investments |

|

|

|

10,558 |

|

|

|

|

1,388 |

Net change in unrealized appreciation on non-controlled/affiliate investments |

|

|

|

(13,358) |

|

|

|

|

3,459 |

Net change in unrealized appreciation on controlled affiliate investments |

|

|

|

(1,021) |

|

|

|

|

5,601 |

Total net losses |

|

|

|

1,145 |

|

|

|

|

(2,873) |

Net increase in net assets resulting from operations |

|

$ |

|

35,095 |

|

|

$ |

|

29,285 |

|

|

|

|

|

|

|

|

|

|

Basic and diluted net investment income per common share |

|

$ |

|

0.53 |

|

|

$ |

|

0.50 |

Basic and diluted increase in net assets resulting from operations per common share |

|

$ |

|

0.55 |

|

|

$ |

|

0.45 |

Basic and diluted weighted average common shares outstanding |

|

|

|

64,562,265 |

|

|

|

|

64,562,265 |

About Bain Capital Specialty Finance, Inc.

Bain Capital Specialty Finance, Inc. is an externally managed specialty finance company focused on lending to middle market companies. BCSF is managed by BCSF Advisors, LP, an SEC-registered investment adviser and a subsidiary of Bain Capital Credit, LP. Since commencing investment operations on October 13, 2016, and through March 31, 2024, BCSF has invested approximately $7.4 billion in aggregate principal amount of debt and equity investments prior to any subsequent exits or repayments. BCSF’s investment objective is to generate current income and, to a lesser extent, capital appreciation through direct originations of secured debt, including first lien, first lien/last out, unitranche and second lien debt, investments in strategic joint ventures, equity investments and, to a lesser extent, corporate bonds. BCSF has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended.

Forward-Looking Statements

This letter may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this letter may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in filings with the U.S. Securities and Exchange Commission. The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this letter.

Investor Contact:

Katherine Schneider

Tel. (212) 803-9613

investors@baincapitalbdc.com

Media Contact:

Charlyn Lusk

Tel. (646) 502-3549

clusk@stantonprm.com

v3.24.1.u1

Document And Entity Information

|

May 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 06, 2024

|

| Entity Registrant Name |

BAIN CAPITAL SPECIALTY FINANCE, INC.

|

| Entity Central Index Key |

0001655050

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

814-01175

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

81-2878769

|

| Entity Address, Address Line One |

200 Clarendon Street

|

| Entity Address, Address Line Two |

37th Floor

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02116

|

| City Area Code |

(617)

|

| Local Phone Number |

516-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

BCSF

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

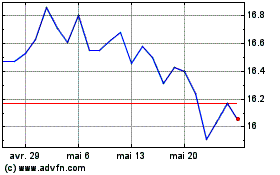

Bain Capital Specialty F... (NYSE:BCSF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Bain Capital Specialty F... (NYSE:BCSF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024