|

Main Post Office, P.O. Box 751 |

www.asyousow.org |

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

Notice of Exempt Solicitation Pursuant to Rule 14a-103

Name of the Registrant: Berkshire Hathaway Inc (BRK)

Name of persons relying on exemption: As You Sow

Address of persons relying on exemption: Main Post Office, P.O. Box 751, Berkeley, CA 94704

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated

under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

Berkshire

Hathaway Inc (BRK)

Vote Yes: Item #4 – Paris Aligned Goals

Annual

Meeting: April 30, 2022

CONTACT: Danielle

Fugere| dfugere@asyousow.org

THE RESOLUTION

Resolved: Shareholders

request that Berkshire issue a report, at reasonable cost and omitting proprietary information, addressing if and how it intends to measure,

disclose, and reduce the GHG emissions associated with its underwriting, insuring, and investment activities, in alignment with the Paris

Agreement’s 1.5°C goal, requiring net zero emissions.

Supporting Statement:

Shareholders recommend the report disclose at board discretion:

| · | Whether Berkshire will begin measuring and disclosing the emissions associated with the full range of its operations and by when,

and |

| · | Whether Berkshire will set a Paris aligned, net zero target, and on what timeline. |

SUMMARY

As reported in the most recent IPCC report,

climate emissions and climate related risk continues to grow.1 A warming climate poses a major risk to the stability of the

U.S. financial system.2 2021 was the second-most costly year on record for the world’s insurers according to Munich Re,

with insured losses totaling approximately $120 billion from natural catastrophe. The U.S., ravaged by tornadoes, Hurricane Ida, and freezes

in Texas, accounted for an unusually large portion of those losses.3

_____________________________

1 https://www.iea.org/news/global-co2-emissions-rebounded-to-their-highest-level-in-history-in-2021

2 https://www.cftc.gov/sites/default/files/2020-09/9-9-20%20Report%20of%20the%20Subcommittee%20on%20Climate-Related%20Market%20Risk%20-%20Managing%20Climate

%20Risk%20in%20the%20U.S.%20Financial%20System%20for%20posting.pdf

p.1

3 https://money.usnews.com/investing/news/articles/2022-01-10/natural-disasters-cost-insurers-120-billion-in-2021-munich-re-says

|

Main Post Office, P.O. Box 751 |

www.asyousow.org |

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

The insurance industry faces climate-related

liabilities on two fronts: investment risk on the asset side of the balance sheet and underwriting risk, particularly in the property

and casualty line, on the liability side.4 Yet, U.S. insurers, including Berkshire Hathaway, remain highly exposed to carbon

emissions-intensive industries like oil, gas, coal, and utilities. In 2019, the U.S. insurance industry invested $582 billion in fossil

fuel related activities, an increase from $519 billion in 2018.5 Emissions facilitated by underwriting and investing in high

carbon activities and companies adds to the global inventory of emissions. Berkshire Hathaway is a leading insurer and investor in fossil

fuels, and thus has responsibility for a significant swath of Scope 3 financed and insured emissions that it has not disclosed, nor set

targets to reduce.

Investors seek further transparency from Berkshire Hathaway on its

climate strategy related to its underwriting and investment activities. Without measuring and disclosing its financed emissions, investors

cannot fully understand the climate exposure their company faces, especially in relation to other companies. Additionally, the lack of

plan from Berkshire on reducing such emissions indicates to investors that Berkshire may not be fully acknowledging the risks associated

with climate change and its contribution to that risk.

Berkshire Hathaway currently lacks targets

and a clear plan to reduce the GHG emissions associated with its underwriting and investment activities and to align the full scope of

its business activities with the Paris Agreement’s 1.5 degree Celsius goal. We urge a “Yes” vote on this proposal.

RATIONALE FOR A YES VOTE

| 1) | Berkshire Hathaway’s underwriting and investment in carbon-intensive activities increases risk to Berkshire, the global climate,

and investor portfolios. |

| 2) | Berkshire Hathaway does not provide shareholders with sufficient analysis and disclosure of whether and how it will measure, disclose,

and reduce the significant GHG emissions associated with its underwriting and investment activities to be aligned with the Paris Agreement’s

1.5 degree goal. |

| 3) | Berkshire Hathaway compares poorly to peers in addressing the climate impact of its insuring activities. |

DISCUSSION

| 1) | Berkshire Hathaway’s underwriting and investment in carbon-intensive activities increases risk to Berkshire, to the global

climate, and to investor portfolios. |

Berkshire Hathaway’s insurance operations

make up over 26% of its business and are its largest value segment.6 Its insurance business faces risk from the escalating

effects of climate change. In 2021’s third quarter, Berkshire’s combined insurance units posted a $784 million pre-tax underwriting

loss largely attributable to $1.7 billion in catastrophe claims, including claims from Hurricane Ida and flooding in Europe.7

This follows a larger global trend: insured losses from natural disasters reached $42 billion in the first six months of 2021, a ten year

high.8

_____________________________

4 https://www.spglobal.com/esg/insights/climate-risks-for-insurers-why-the-industry-needs-to-act-now-to-address-climate-risk-on-both-sides-of-the-balance-sheet

5 https://www.spglobal.com/esg/insights/climate-risks-for-insurers-why-the-industry-needs-to-act-now-to-address-climate-risk-on-both-sides-of-the-balance-sheet

6 https://www.spglobal.com/esg/insights/completing-data-gaps-in-environmental-performance-disclosure

7 https://www.insurancejournal.com/news/national/2021/11/08/641046.htm

8 https://www.weforum.org/agenda/2021/07/natural-disasters-cost-economic-insurance-2021-extreme-weather-floods-polar-vortex/

|

Main Post Office, P.O. Box 751 |

www.asyousow.org |

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

Berkshire’s underwriting and investment

decisions contribute to this impact by enabling carbon intensive projects and companies. Berkshire is one of the largest underwriters

of fossil fuels. According to an Insure Our Future report on insurer’s exposure to the oil and gas sector, Berkshire provides some

of the largest coverage to the oil and gas industry, surpassing peers such as Chubb and Liberty Mutual.9 Additionally, Berkshire’s

bondholding in coal is around $472 million and its shareholding in coal amounts to $5.1 billion, once again, far surpassing its American

peers.10

McKinsey & Company advises insurers to consider the environmental

impact of their investments, just as banks and asset managers are doing, and develop a plan to shift significant portions of their portfolios

to help facilitate a sustainable, decarbonized economy.11 In addition to long-term climate risk reduction benefits, such a

shift can help insurers align with increasingly likely regulatory policies and incentives.12

In the United States, more pressure is being placed on insurers to

account for their climate intensive activities. In September 2020, a group of 60 businesses wrote to U.S. insurance companies asking them

to drop investments in fossil fuels to avoid worsening impacts of global climate change.13 In March 2021, U.S. Senators wrote

to top insurance companies, including Berkshire, asking if their fossil fuel underwriting and investment policies are consistent with

its broader commitments to sustainability.14 States are also taking action. For instance, Connecticut passed a law requiring

the state insurance regulator to include emission reduction targets into its review of insurers and the potential risks they face, highlighting

the increased attention government is focusing on the insurance industry’s climate responsibility.15

Investors as well are increasingly concerned about the insurance sector’s

exposure to climate-related impacts and risks. As one example, in April 2020, New York City Comptroller Scott Stringer, sent letters to

insurance companies, including Berkshire Hathaway, raising concern over the company’s continued underwriting of coal projects and

companies.16

| 2) | Berkshire Hathaway does not provide shareholders with sufficient analysis and disclosure of whether and how it will measure, disclose,

and reduce the significant GHG emissions associated with its underwriting and investment activities, so

as to be aligned with the Paris Agreement’s goals. |

_____________________________

9 https://insureourfuture.co/wp-content/uploads/2020/06/InsureOurFuture-Oil-and-Gas-Insuance-Briefing-0620.pdf

p.6

10 https://www.coalexit.org/investor/berkshire-hathaway

11 https://www.mckinsey.com/industries/financial-services/our-insights/climate-change-and-p-and-c-insurance-the-threat-and-opportunity

12 https://www.mckinsey.com/industries/financial-services/our-insights/climate-change-and-p-and-c-insurance-the-threat-and-opportunity

13 https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/businesses-call-on-us-insurers-to-join-global-trend-of-ditching-fossil-fuels-60386527

14 https://us.insure-our-future.com/2021-3-25-senators-whitehouse-warren-merkley-and-van-hollen-call-on-us-insurance-companies-to-act-on-climate-change/

15 https://www.businessinsurance.com/article/20210617/NEWS06/912342605/Connecticut-bill-calls-for-regulation-of-insurers%E2%80%99-climate-risks

16 https://us.insure-our-future.com/2020-4-24-nyc-pension-funds-demand-insurance-giants-sever-ties-to-coal-industry-1/

|

Main Post Office, P.O. Box 751 |

www.asyousow.org |

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

Shareholders continue to be concerned over the lack of transparency

Berkshire has shown with regard to disclosing and reducing the full range of its GHG emissions, including the Scope 3 emissions related

to its underwriting and investment activities. The emissions associated with insurer’s underwriting and investment activities, often

called “financed emissions,” constitute approximately 97% of total emissions, highlighting the potential scale of Berkshire’s

insured emissions.17 The United Nations Environment Program Finance Initiative (UNEP FI) states that financial institutions

must set a benchmark for credible net zero commitments, including Scope 3 emissions, and underscores that “addressing emissions

associated with the financial institutions underlying portfolio exposures (companies, projects, etc.) is the top priority.”18

Berkshire has not measured or disclosed emissions associated with its underwriting or investment activities. This leaves investors with

insufficient knowledge of the climate intensity of the company’s underwriting and investment portfolios.

The Partnership for Carbon Accounting Financials’ global greenhouse

gas accounting and reporting standard for the financial industry is intended to be used by insurance companies for calculating the emissions

associated with their investments.19 In September 2021, Liberty Mutual became the first U.S. insurer to sign up to PCAF.20

Work is currently being undertaken by PCAF to establish a methodology for measuring emissions associated with underwriting activities.

These examples highlight that leaders in the insurance industry are actively working to measure and disclose their insured emissions.

| 3) | Berkshire Hathaway compares poorly to peers in addressing the climate impact of its insuring activities. |

Berkshire is quickly becoming a laggard in

comparison to its peers as the global insurance sector gains momentum toward the net zero transition. Berkshire has not set emission reduction

targets for its underwriting and investment activities. Further, Berkshire scored in the bottom in a survey of the 30 largest global insurers,

due largely to its lack of restrictions on fossil fuel underwriting and investments.21

Comparatively, the global insurance and financial

community is embracing net zero commitments. Members of the Net Zero Insurance Alliance (NZIA) have made an overarching commitment to

reach net zero emissions from their insurance and reinsurance underwriting portfolios by 2050.22 The NZIA currently has 22

members, seven of which are in the top 30 largest global insurers by market cap.23

In March 2021, American International Group

(AIG) committed to achieving net zero greenhouse gas emissions across its global underwriting and investments portfolios by 2050, or sooner.

This includes a commitment to using science-based emission reduction targets, aligning with the latest climate science to meet the goals

of the Paris Agreement, and commitments to prohibit and phase out a range of coal, oil sand, and Arctic

investment and underwriting activities.24

_____________________________

17 https://g20sfwg.org/wp-content/uploads/2021/10/2021-UNEP-FI.-Recommendations-for-Credible-Net-Zero-Commitments.pdf

p.7

18 https://g20sfwg.org/wp-content/uploads/2021/10/2021-UNEP-FI.-Recommendations-for-Credible-Net-Zero-Commitments.pdf

p.7

19 https://carbonaccountingfinancials.com/files/downloads/PCAF-Global-GHG-Standard.pdf

p.16

20 https://www.prnewswire.com/news-releases/liberty-mutual-insurance-commits-to-50-reduction-of-scope-1-and-2-global-emissions-by-2030-301375345.html

21 https://insure-our-future.com/scorecard

22 https://www.unepfi.org/net-zero-insurance/

23 https://companiesmarketcap.com/insurance/largest-insurance-companies-by-market-cap/

24 https://aig.gcs-web.com/node/53226/pdf

|

Main Post Office, P.O. Box 751 |

www.asyousow.org |

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

Lloyd’s, the world’s largest insurance marketplace, recently

announced it is joining the UN-convened Net Zero Insurance Alliance (NZIA), further affirming

its commitment to cross industry collaboration to mitigate and manage the impacts of climate change and support the speed of the transition

to net zero.25

RESPONSE TO BOARD’S

OPPOSITION STATEMENT

The Board states that it is not necessary

for Berkshire to measure, disclose, and reduce the GHG emissions associated with its underwriting, insuring, investment activities. It

states that the insurance risks associated with climate change are already assessed within the enterprise’s risk management framework,

which includes climate specific risk management procedures. These general risk management actions do not adequately address the proposal.

Investors seek information on the emissions associated with Berkshire’s underwriting and investment activities, and a plan to begin

reducing those emissions in alignment with the global 1.5 degree goal. Berkshire does not disclose its financed emissions associated with

these activities nor has it developed and disclosed targets or to reduce these emissions in alignment with the Paris goal. Berkshire has

not responded to the Proposal’s clear request.

CONCLUSION

Vote “Yes”

on this Shareholder Proposal. Berkshire Hathaway’s underwriting and investing activities are climate intensive, the company

has failed to set clear goals to reduce its GHG emissions footprint in line with the Paris goal, and it is currently lagging peers on

climate action. Berkshire does not give shareholders full transparency on its climate footprint and lacks a roadmap for how it plans to

transition successfully to a low carbon economy. We urge a “Yes” vote on this resolution.

--

For questions,

please contact Danielle Fugere, As You Sow, dfugere@asyousow.org

THE FOREGOING INFORMATION

MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT

BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION

TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED

BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

_____________________________

25 https://www.lloyds.com/about-lloyds/media-centre/press-releases/lloyds-joins-the-net-zero-insurance-alliance-and-becomes-part-of-the-glasgow-financial-alliance-for-net-zero

5

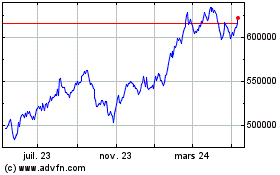

Berkshire Hathaway (NYSE:BRK.A)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

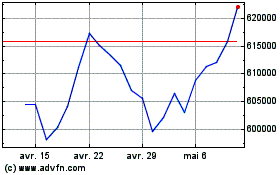

Berkshire Hathaway (NYSE:BRK.A)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024