UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: November 2024 Commission File Number: 1-31402

CAE INC.

(Translation of registrant’s name into English)

8585 Cote de Liesse

Saint-Laurent, Quebec

Canada H4T 1G6

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ___ Form 40-F X

INCORPORATION BY REFERENCE

This report on Form 6-K and the exhibits hereto are specifically incorporated by reference into the registration statements on Form S-8 (File Nos. 333-97185, 333-155366, 333-213708, 333-267775 and 333-275323), of CAE Inc.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

CAE Inc.

Date: November 12, 2024 By: /s/ Mark Hounsell

Name: Mark Hounsell

Title: Chief Legal and Compliance Officer, and Corporate Secretary

EXHIBIT INDEX

Press Release

Press Release CAE reports second quarter fiscal 2025 results

•Revenue of $1,136.6 million vs. $1,050.0 million in prior year

•Earnings per share (EPS) from continuing operations of $0.16 vs. $0.17 in prior year

•Adjusted EPS(1) of $0.24 vs. $0.26 in prior year

•Operating income of $118.1 million vs. $97.7 million in prior year

•Adjusted segment operating income(1) of $149.0 million vs. $135.6 million in prior year

•Free cash flow(1) of $140.0 million vs. $147.4 million in prior year

•Adjusted order intake(1) of $3.0 billion for a record $18.0 billion adjusted backlog(1)

•Successfully concludes AirCentre integration and enterprise-wide restructuring program

•Post quarter, CAE purchased a majority stake in SIMCOM for US$230 million and extend an exclusive business aviation training agreement with Flexjet and its affiliates to 15 years

Montreal, Canada, November 12, 2024 - (NYSE: CAE; TSX: CAE) - CAE Inc. (CAE or the Company) today reported its financial results for the fiscal second quarter ended September 30, 2024. The Company also announced the conclusion of its integration of Sabre’s AirCentre airline operations portfolio (AirCentre) and its enterprise-wide restructuring program to streamline CAE's operating model and portfolio, optimize its cost structure and create efficiencies.

“I am very pleased with our progress this quarter, which underscores our strong execution and the robust market demand for our Civil Aviation and Defense and Security solutions. In Defense, by leveraging our structural improvements and streamlined organization, we achieved notable growth and margin improvements,” said Marc Parent, CAE’s President and Chief Executive Officer. “We also made significant strides to retire risk by completing a Legacy Contract from our Defense backlog and to secure future growth with a $1.7 billion transformative award under Canada’s Future Aircrew Training Program.

“Despite the near-term supply chain challenges that have been impacting the airline industry, the long-term growth outlook for Civil remains strong, underscoring CAE’s compelling investment thesis. The important organic investment we announced last week to increase our stake in SIMCOM will strengthen our presence in the core business aviation training market, increase recurring revenue, and further our commitment to delivering world-class training solutions to an essential customer segment. Backed by $3.0 billion in consolidated adjusted order intake and a record $18.0 billion adjusted backlog this quarter, CAE's future is exceptionally bright.”

Consolidated results

Second quarter fiscal 2025 revenue was $1,136.6 million, compared with $1,050.0 million in the second quarter last year. Second quarter EPS from continuing operations was $0.16 compared to $0.17 last year. Adjusted EPS in the second quarter was $0.24 compared to $0.26 last year.

Operating income this quarter was $118.1 million (10.4% of revenue(1)), compared to $97.7 million (9.3% of revenue) last year. Second quarter adjusted segment operating income was $149.0 million (13.1% of revenue(1)) compared to $135.6 million (12.9% of revenue) last year. All financial information is in Canadian dollars and results are presented on a continuing operations basis, unless otherwise indicated. Comparative figures have been reclassified to reflect discontinued operations.

| | | | | | | | | | | | | | | | | | | | |

| Summary of consolidated results | | | | | | |

| (amounts in millions, except per share amounts) | | Q2-2025 | | Q2-2024 | | Variance % |

| Revenue | $ | 1,136.6 | | $ | 1,050.0 | | | 8 | % |

| Operating income | $ | 118.1 | | $ | 97.7 | | | 21 | % |

Adjusted segment operating income(1) | $ | 149.0 | | $ | 135.6 | | | 10 | % |

As a % of revenue(1) | % | 13.1 | | % | 12.9 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Net income attributable to equity holders of the Company | $ | 52.5 | | $ | 58.4 | | | (10 | %) |

| Earnings per share (EPS) from continuing operations | $ | 0.16 | | $ | 0.17 | | | (6 | %) |

| | | | | | |

Adjusted EPS(1) | $ | 0.24 | | $ | 0.26 | | | (8 | %) |

| | | | | | |

| | | | | | |

| | | | | | |

Adjusted order intake(1) | $ | 2,955.3 | | $ | 1,145.1 | | | 158 | % |

Adjusted backlog(1) | $ | 18,041.2 | | $ | 11,773.1 | | | 53 | % |

(1) This press release includes non-IFRS financial measures, non-IFRS ratios, capital management measures and supplementary financial measures. These measures are not standardized financial measures prescribed under IFRS and therefore should not be confused with, or used as an alternative for, performance measures calculated according to IFRS. Furthermore, these measures should not be compared with similarly titled measures provided or used by other issuers. Refer to the Non-IFRS and other financial measures section of this press release for the definitions and a reconciliation of these measures to the most directly comparable measure under IFRS.

Civil Aviation (Civil)

Second quarter Civil revenue was $640.7 million vs. $572.6 million in the second quarter last year. Operating income was $94.7 million (14.8% of revenue) compared to $88.4 million (15.4% of revenue) in the same quarter last year. Adjusted segment operating income was $115.9 million (18.1% of revenue) compared to $114.3 million (20.0% of revenue) in the second quarter last year. During the quarter, Civil delivered 18 full-flight simulators (FFSs) to customers and second quarter Civil training centre utilization was 70%.

During the quarter, Civil signed training solutions contracts valued at $693.3 million, including a range of long-term commercial and business aviation training agreements, digital flight services contracts, and 16 FFS sales, including four involving the COMAC C919 narrow-body airliner.

The Civil book-to-sales ratio(1) was a 1.08 times for the quarter and 1.23 times for the last 12 months. The Civil adjusted backlog at the end of the quarter was $6.7 billion.

After the end of the quarter, CAE announced that it increased its ownership stake in its existing SIMCOM Aviation Training (SIMCOM) joint venture by purchasing a majority of SIMCOM shares from Volo Sicuro for US$230 million, subject to customary adjustments, to be financed with CAE’s existing credit facility and cash on hand. As part of the transaction, Flexjet, LLC, a related party of Volo Sicuro, has retained a minority stake in SIMCOM. Additionally, CAE and SIMCOM have each extended their respective exclusive business aviation training services agreement with Flexjet and its affiliates by 5 years, resulting in a remaining exclusivity period of 15 years for both agreements.

| | | | | | | | | | | | | | | | | | | | |

| Summary of Civil Aviation results |

| (amounts in millions) | | Q2-2025 | | Q2-2024 | | Variance % |

| Revenue | $ | 640.7 | | $ | 572.6 | | | 12 | % |

| Operating income | $ | 94.7 | | $ | 88.4 | | | 7 | % |

| Adjusted segment operating income | $ | 115.9 | | $ | 114.3 | | | 1 | % |

| As a % of revenue | % | 18.1 | | % | 20.0 | | | |

| | | | | | |

| | | | | | |

| Adjusted order intake | $ | 693.3 | | $ | 617.8 | | | 12 | % |

| Adjusted backlog | $ | 6,663.1 | | $ | 5,903.1 | | | 13 | % |

| | | | | | |

| Supplementary non-financial information | | | | | | |

| Simulator equivalent unit | | 276 | | | 268 | | | 3 | % |

FFSs in CAE’s network | | 355 | | | 331 | | | 7 | % |

| FFS deliveries | | 18 | | | 11 | | | 64 | % |

| Utilization rate | % | 70 | | % | 71 | | | (1 | %) |

Defense and Security (Defense)

Second quarter Defense revenue was $495.9 million vs. $477.4 million in the second quarter last year. Operating income was $23.4 million (4.7% of revenue) compared to $9.3 million (1.9% of revenue) in the same quarter last year. Adjusted segment operating income was $33.1 million (6.7% of revenue), compared to $21.3 million (4.5% of revenue) in the second quarter last year.

Defense booked orders for $2.3 billion this quarter for a book-to-sales ratio of 4.56 times. The ratio for the last 12 months was 2.04 times. The Defense adjusted backlog, including unfunded contract awards and CAE’s interest in joint ventures, at the end of the quarter was $11.4 billion, up from $10.4 billion at the end of the first quarter of fiscal 2025. During the second quarter of fiscal 2025, $1.7 billion was added to adjusted order intake following CAE's award of a 25-year subcontract from SkyAlyne to support Canada's Future Aircrew Training (FAcT) program. As part of this subcontract, CAE will initially develop and deliver a range of simulators and training devices for the various aircraft fleets being procured under the FAcT program. These training devices are expected to be delivered over the next 5 years. As announced, in addition to this initial approximately $1.7 billion sub-contract, CAE is also expected to sign a follow-on order in the near-term involving sustainment-related in-service support services. Notably for the Defense segment overall, the pipeline remains strong with some $7.2 billion of bids and proposals pending.

| | | | | | | | | | | | | | | | | | | | |

| Summary of Defense and Security results |

| (amounts in millions) | | Q2-2025 | | Q2-2024 | | Variance % |

| Revenue | $ | 495.9 | | $ | 477.4 | | | 4 | % |

| Operating income | $ | 23.4 | | $ | 9.3 | | | 152 | % |

| Adjusted segment operating income | $ | 33.1 | | $ | 21.3 | | | 55 | % |

| As a % of revenue | % | 6.7 | | % | 4.5 | | | |

| | | | | | |

| | | | | | |

| Adjusted order intake | $ | 2,262.0 | | $ | 527.3 | | | 329 | % |

| Adjusted backlog | $ | 11,378.1 | | $ | 5,870.0 | | | 94 | % |

Additional financial highlights

CAE incurred $5.1 million of costs related to the integration of AirCentre, which was completed this quarter, and $25.8 million in connection with its restructuring program to streamline CAE’s operating model and portfolio, optimize its cost structure and create efficiencies. This restructuring program was completed in the second quarter of fiscal 2025 and no further restructuring expenses are expected. CAE expects to fully achieve annual run rate cost savings of approximately $20 million by the end of the next fiscal year.

Net finance expense this quarter amounted to $52.9 million, compared to $49.5 million in the preceding quarter and $47.1 million in the second quarter last year.

Income tax expense this quarter amounted to $10.4 million, representing an effective tax rate of 16%, compared to negative 16% for the second quarter last year. The adjusted effective tax rate(1), which is the income tax rate used to determine adjusted net income and adjusted EPS, was 18% this quarter as compared to 1% in the second quarter of last year. The increase in the adjusted effective tax rate was mainly attributable to the recognition, last year, of previously unrecognized deferred tax assets and the current year mix of income from various jurisdictions.

Net cash provided by operating activities was $162.1 million for the quarter, compared to $180.2 million in the second quarter last year. Free cash flow(1) was $140.0 million for the quarter compared to $147.4 million in the second quarter last year. The decrease was mainly due to a lower contribution from non-cash working capital.

Growth and maintenance capital expenditures(1) totaled $57.0 million this quarter.

Net debt(1) at the end of the quarter was $3,064.9 million for a net debt-to-adjusted EBITDA(1) of 3.25 times (2.97 times excluding Legacy Contracts(1)(2)). This compares to net debt of $3,129.7 million and a net debt-to-adjusted EBITDA of 3.41 times (3.11 times excluding Legacy Contracts) at the end of the preceding quarter.

Adjusted return on capital employed(1) was 5.5% this quarter compared to 5.7% last quarter and 7.1% in the second quarter last year.

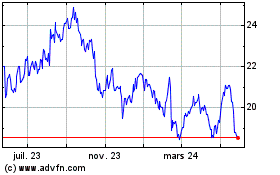

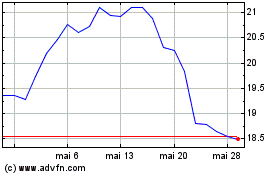

During the quarter, CAE repurchased and cancelled a total of 392,730 common shares under its normal course issuer bid (NCIB), which began on May 30, 2024, at a weighted average price of $24.43 per common share, for a total consideration of $9.6 million.

(1) This press release includes non-IFRS financial measures, non-IFRS ratios, capital management measures and supplementary financial measures. These measures are not standardized financial measures prescribed under IFRS and therefore should not be confused with, or used as an alternative for, performance measures calculated according to IFRS. Furthermore, these measures should not be compared with similarly titled measures provided or used by other issuers. Refer to the Non-IFRS and other financial measures section of this press release for the definitions and a reconciliation of these measures to the most directly comparable measure under IFRS.

(2) Within Defense there are a number of fixed-price contracts which offer certain potential advantages and efficiencies but can also be negatively impacted by adverse changes to general economic conditions, including unforeseen supply chain disruptions, inflationary pressures, availability of labour, and execution difficulties. These risks can result in cost overruns and reduced profit margins or losses. While these risks can often be managed or mitigated, there are eight distinct legacy contracts entered into prior to the COVID-19 pandemic that are firm fixed price in structure, with little to no provision for cost escalation, and that have been more significantly impacted by these risks (the Legacy Contracts).

Sustainability

This quarter, CAE received approval from the Science Based Targets initiative (SBTi) for its decarbonization targets, committing to reduce Scope 1 and 2 emissions by 85.7% and Scope 3 emissions by 32.5% by FY33. This achievement underscores CAE’s commitment to sustainability and environmental stewardship. Central to this success is CAE's engagement with its value chain on its sustainability journey through the International Aerospace Environment Group (IAEG) and as one of the launch partners of Decarbone+, a non-profit aimed at accelerating decarbonization efforts of organizations across Quebec. These collaborative initiatives highlight CAE's leadership in fostering sustainable practices and change across its value chain.

Additionally, CAE was honored with the 2024 Altitude Award by the Black Aviation Professionals Network, recognizing its contributions and leadership in advancing diversity and inclusion within the Aerospace sector.

For more information on CAE’s sustainability roadmap and achievements, the report can be downloaded at https://www.cae.com/sustainability/.

Management outlook

Civil

The secular demand picture for aviation training solutions remains compelling and the Company continues to be well positioned. Aircraft OEM supply issues have affected airline training demand forecasts and remain a near-term headwind for a portion of CAE’s commercial training business. Notwithstanding the delays this causes to expected revenue from initial training of commercial pilots, Management still targets approximately 10 percent annual growth in Civil adjusted segment operating income, with stronger performance anticipated in the second half of the fiscal year. The positive elements that Management expects to help offset the impact of OEM supply issues, include accretion from its now larger stake in SIMCOM, the benefits of its cost savings initiatives, and positive seasonality in the second half of the fiscal year, which is customary for both commercial and business aviation. Also expected to drive stronger second-half performance are higher profitability in Flight Operations Solutions, and higher volume and profitability from full-flight simulator (FFS) deliveries. Annual Civil adjusted segment operating income margin is expected to be in the range of 22 to 23 percent, with ample room to grow beyond the current year on volume, efficiencies and mix.

Defense

Management believes CAE is well positioned for long-term growth and increased profitability in Defense, as the sector moves into a prolonged up-cycle with increased budgets across NATO and allied nations. Rising geopolitical tensions are driving a focus on near-peer threats, defence modernization, and readiness, fueling demand for the training and simulation solutions that CAE offers. Demand for CAE’s Defense training solutions remains strong, driven by a global shortage of uniformed personnel, prompting militaries to partner with CAE to support readiness. Having recently re-baselined the Defense business and substantially accounted for the previously identified programmatic risk, Management expects Defense annual revenue growth in the low- to mid-single-digit percentage range and annual Defense adjusted segment operating income margin to increase to the 6- to 7-percent range in fiscal 2025, also with room to grow beyond the current year. Similarly, Management expects annual Defense performance to be more heavily weighted to the second half. Furthermore, having successfully completed one of its Defense Legacy Contacts in the second quarter, Management expects to complete another two such contracts by the end of the fiscal year.

For CAE overall, Management continues to target three-year EPS growth (FY22-25) in the low- to mid-teens-percentage range.

Finance expense and tax expense

Management expects annual finance expense to be similar to fiscal 2024. The run-rate effective income tax rate is expected to be approximately 25%, considering the income expected from various jurisdictions and the implementation of global minimum tax policies.

Balanced capital allocation priorities, accretive growth investments

CAE now expects total CAPEX for fiscal 2025 to be slightly below Management’s prior estimated range of $50 to $100 million higher than the fiscal 2024 amount, which was $329.8 million. Commensurate with CAE’s ongoing success to capture market opportunities in training, approximately three-quarters of this relates to organic growth investments in simulator capacity to be deployed to CAE’s global network of aviation-related training centres and backed by multiyear customer contracts.

Solid financial position

A tenet of CAE’s capital management priorities includes the maintenance of a solid financial position, and it expects to continue to bolster its balance sheet through ongoing deleveraging, commensurate with its investment grade profile. CAE is targeting a leverage ratio of net-debt to adjusted EBITDA of below three-times (3x) by the end of the current fiscal year.

Current returns to shareholders

Given CAE’s progress over the last year to strengthen its financial position, an NCIB was established as part of its capital management strategy and is currently intended to be used opportunistically over time with excess free cash flow. Given the Company’s outlook and cash generative nature of its highly recurring business, CAE’s Board of Directors will also continue to evaluate the possibility of reintroducing a shareholder dividend.

Caution concerning outlook

Management’s outlook for fiscal 2025 and the above targets and expectations constitute forward-looking statements within the meaning of applicable securities laws, and are based on a number of assumptions, including in relation to prevailing market conditions, macroeconomic and geopolitical factors, supply chains and labor markets. Expectations are also subject to a number of risks and uncertainties and based on assumptions about customer receptivity to CAE’s training solutions and operational support solutions as well as material assumptions contained in this press release, quarterly Management’s Discussion and Analysis (MD&A) and in CAE’s fiscal 2024 MD&A, all available on our website (www.cae.com), SEDAR+ (www.SEDARplus.ca) and EDGAR (www.sec.gov). Please see the sections below entitled: “Caution concerning forward-looking statements”, “Material assumptions” and “Material risks”.

Detailed information

Readers are strongly advised to view a more detailed discussion of our results by segment in the MD&A and CAE’s consolidated financial statements for the quarter ended September 30, 2024, which are available on our website (www.cae.com), SEDAR+ (www.SEDARplus.ca) and EDGAR (www.sec.gov). Holders of CAE’s securities may also request a printed copy of the Company's consolidated financial statements and MD&A free of charge by contacting Investor Relations (investor.relations@cae.com).

Conference call Q2 FY2025

Marc Parent, CAE President and CEO; Constantino Malatesta, interim CFO; and Andrew Arnovitz, Senior Vice President, Investor Relations and Enterprise Risk Management, will conduct an earnings conference call tomorrow at 8:00 a.m. ET. The call is intended for analysts, institutional investors and the media. Participants can listen to the conference by dialing+ 1-844-763-8274 or +1-647-484-8814. The conference call will also be audio webcast live at www.cae.com.

About CAE

At CAE, we equip people in critical roles with the expertise and solutions to create a safer world. As a technology company, we digitalize the physical world, deploying software-based simulation training and critical operations support solutions. Above all else, we empower pilots, cabin crew, maintenance technicians, airlines, business aviation operators and defence and security forces to perform at their best every day and when the stakes are the highest. Around the globe, we’re everywhere customers need us to be with approximately 13,000 employees in more than 240 sites and training locations in over 40 countries. CAE represents more than 75 years of industry firsts–the highest-fidelity flight and mission simulators as well as training programs powered by digital technologies. We embed sustainability in everything we do. Today and tomorrow, we’ll make sure our customers are ready for the moments that matter.

Caution concerning limitations of summary earnings press release

This summary earnings press release contains limited information meant to assist the reader in assessing CAE’s performance, but it is not a suitable source of information for readers who are unfamiliar with CAE and is not in any way a substitute for the Company’s financial statements, notes to the financial statements, and MD&A reports.

Caution concerning forward-looking statements

This press release includes forward-looking statements about our activities, events and developments that we expect to or anticipate may occur in the future including, for example, statements about our vision, strategies, market trends and outlook, future revenues, earnings, cash flow growth, profit trends, growth capital spending, expansions and new initiatives, including initiatives that pertain to environmental, social and governance (ESG) matters, financial obligations, available liquidities, expected sales, general economic and political outlook, inflation trends, prospects and trends of an industry, expected annual recurring cost savings from operational excellence programs, our management of the supply chain, estimated addressable markets, demands for CAE’s products and services, our access to capital resources, our financial position, the expected accretion in various financial metrics, the expected capital returns to shareholders, our business outlook, business opportunities, objectives, development, plans, growth strategies and other strategic priorities, and our competitive and leadership position in our markets, the expansion of our market shares, CAE's ability and preparedness to respond to demand for new technologies, the sustainability of our operations, our ability to retire the Legacy Contracts as expected and to manage and mitigate the risks associated therewith, the impact of the retirement of the Legacy Contracts, and other statements that are not historical facts.

Since forward-looking statements and information relate to future events or future performance and reflect current expectations or beliefs regarding future events, they are typically identified by words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “likely”, “may”, “plan”, “seek”, “should”, “will”, "strategy", "future" or the negative thereof or other variations thereon suggesting future outcomes or statements regarding an outlook. All such statements constitute "forward-looking statements" within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995.

By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties associated with our business which may cause actual results in future periods to differ materially from results indicated in forward-looking statements. While these statements are based on management’s expectations and assumptions regarding historical trends, current conditions and expected future developments, as well as other factors that we believe are reasonable and appropriate in the circumstances, readers are cautioned not to place undue reliance on these forward-looking statements as there is a risk that they may not be accurate. The forward-looking statements contained in this press release describe our expectations as of November 12, 2024 and, accordingly, are subject to change after such date. Except as required by law, we disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. The forward-looking information and statements contained in this press release are expressly qualified by this cautionary statement. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this press release. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements. Except as otherwise indicated by CAE, forward-looking statements do not reflect the potential impact of any special items or of any dispositions, monetizations, mergers, acquisitions, other business combinations or other transactions that may occur after November 12, 2024. The financial impact of these transactions and special items can be complex and depends on the facts particular to each of them. We therefore cannot describe the expected impact in a meaningful way or in the same way we present known risks affecting our business. Forward-looking statements are presented in this press release for the purpose of assisting investors and others in understanding certain key elements of our expected fiscal 2025 financial results and in obtaining a better understanding of our anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes.

Material assumptions

The forward-looking statements set out in this press release are based on certain assumptions including, without limitation: the prevailing market conditions, geopolitical instability, the customer receptivity to our training and operational support solutions, the accuracy of our estimates of addressable markets and market opportunity, the realization of anticipated annual recurring cost savings and other intended benefits from restructuring initiatives and operational excellence programs, the ability to respond to anticipated inflationary pressures and our ability to pass along rising costs through increased prices, the actual impact to supply, production levels, and costs from global supply chain logistics challenges, the stability of foreign exchange rates, the ability to hedge exposures to fluctuations in interest rates and foreign exchange rates, the availability of borrowings to be drawn down under, and the utilization, of one or more of our senior credit agreements, our available liquidity from cash and cash equivalents, undrawn amounts on our revolving credit facility, the balance available under our receivable purchase facility, the assumption that our cash flows from operations and continued access to debt funding will be sufficient to meet financial requirements in the foreseeable future, access to expected capital resources within anticipated timeframes, no material financial, operational or competitive consequences from changes in regulations affecting our business, our ability to retain and attract new business, our ability to effectively execute and retire the Legacy Contracts while managing the risks associated therewith, our ability to defend our position in the dispute with the buyer of the CAE Healthcare business, and the realization of the expected strategic, financial and other benefits of the increase of our ownership stake in SIMCOM Aviation Training in the timeframe anticipated. Air travel is a major driver for CAE's business and management relies on analysis from the International Air Transport Association (IATA) to inform its assumptions about the rate and profile of recovery in its key civil aviation market. Accordingly, the assumptions outlined in this press release and, consequently, the forward‑looking statements based on such assumptions, may turn out to be inaccurate.

Material risks

Important risks that could cause actual results or events to differ materially from those expressed in or implied by our forward-looking statements are set out in CAE’s MD&A for the fiscal year ended March 31, 2024 and MD&A for the three months ended September 30, 2024, available on our website (www.cae.com), SEDAR+ (www.SEDARplus.ca) and EDGAR (www.sec.gov). Readers are cautioned that any of the disclosed risks could have a material adverse effect on our forward-looking statements. We caution that the disclosed list of risk factors is not exhaustive and other factors could also adversely affect our results.

Non-IFRS and other financial measures

This press release includes non-IFRS financial measures, non-IFRS ratios, capital management measures and supplementary financial measures. These measures are not standardized financial measures prescribed under IFRS and therefore should not be confused with, or used as an alternative for, performance measures calculated according to IFRS. Furthermore, these measures should not be compared with similarly titled measures provided or used by other issuers. Management believes that these measures provide additional insight into our operating performance and trends and facilitate comparisons across reporting periods.

Certain non-IFRS and other financial measures are provided on a consolidated basis and separately for each of our segments (Civil Aviation and Defense and Security) since we analyze their results and performance separately.

Reconciliations and calculations of non-IFRS measures to the most directly comparable measures under IFRS are also set forth below in the section Reconciliations and Calculations of this press release.

Performance measures

Operating income margin (or operating income as a % of revenue)

Operating income margin is a supplementary financial measure calculated by dividing our operating income by revenue for a given period. We track it because we believe it provides an enhanced understanding of our operating performance and facilitates the comparison across reporting periods.

Adjusted segment operating income or loss

Adjusted segment operating income or loss is a non-IFRS financial measure that gives us an indication of the profitability of each segment because it does not include the impact of any items not specifically related to the segment’s performance. We calculate adjusted segment operating income by taking operating income and adjusting for restructuring, integration and acquisition costs, and impairments and other gains and losses arising from significant strategic transactions or specific events. Impairments and other gains and losses arising from significant strategic transactions or specific events consist of the impairment of goodwill (as described in Note 14 of our consolidated financial statements for the year ended March 31, 2024), the impairment of technology and other non-financial assets (as described in Note 5 of our consolidated financial statements for the year ended March 31, 2024) and the impairment reversal of non-financial assets following their repurposing and optimization (as described in Note 5 of our consolidated financial statements for the year ended March 31, 2023). We track adjusted segment operating income because we believe it provides an enhanced understanding of our operating performance and facilitates the comparison across reporting periods. Adjusted segment operating income on a consolidated basis is a total of segments measure since it is the profitability measure employed by management for making decisions about allocating resources to segments and assessing segment performance.

Adjusted segment operating income margin (or adjusted segment operating income as a % of revenue)

Adjusted segment operating income margin is a non-IFRS ratio calculated by dividing our adjusted segment operating income by revenue for a given period. We track it because we believe it provides an enhanced understanding of our operating performance and facilitates the comparison across reporting periods.

Adjusted effective tax rate

Adjusted effective tax rate is a supplementary financial measure that represents the effective tax rate on adjusted net income or loss. It is calculated by dividing our income tax expense by our earnings before income taxes, adjusting for the same items used to determine adjusted net income or loss. We track it because we believe it provides an enhanced understanding of the impact of changes in income tax rates and the mix of income on our operating performance and facilitates the comparison across reporting periods.

Adjusted net income or loss

Adjusted net income or loss is a non-IFRS financial measure we use as an alternate view of our operating results. We calculate it by taking our net income attributable to equity holders of the Company from continuing operations and adjusting for restructuring, integration and acquisition costs, and impairments and other gains and losses arising from significant strategic transactions or specific events, after tax, as well as significant one-time tax items. Impairments and other gains and losses arising from significant strategic transactions or specific events consist of the impairment of goodwill (as described in Note 14 of our consolidated financial statements for the year ended March 31, 2024), the impairment of technology and other non-financial assets (as described in Note 5 of our consolidated financial statements for the year ended March 31, 2024) and the impairment reversal of non-financial assets following their repurposing and optimization (as described in Note 5 of our consolidated financial statements for the year ended March 31, 2023). We track adjusted net income because we believe it provides an enhanced understanding of our operating performance and facilitates the comparison across reporting periods.

Adjusted earnings or loss per share (EPS)

Adjusted earnings or loss per share is a non-IFRS ratio calculated by dividing adjusted net income or loss by the weighted average number of diluted shares. We track it because we believe it provides an enhanced understanding of our operating performance on a per share basis and facilitates the comparison across reporting periods.

EBITDA and Adjusted EBITDA

EBITDA is a non-IFRS financial measure which comprises net income or loss from continuing operations before income taxes, finance expense – net, depreciation and amortization. Adjusted EBITDA further adjusts for restructuring, integration and acquisition costs, and impairments and other gains and losses arising from significant strategic transactions or specific events. Impairments and other gains and losses arising from significant strategic transactions or specific events consist of the impairment of goodwill (as described in Note 14 of our consolidated financial statements for the year ended March 31, 2024), the impairment of technology and other non-financial assets (as described in Note 5 of our consolidated financial statements for the year ended March 31, 2024) and the impairment reversal of non-financial assets following their repurposing and optimization (as described in Note 5 of our consolidated financial statements for the year ended March 31, 2023). We use EBITDA and adjusted EBITDA to evaluate our operating performance, by eliminating the impact of non-operational or non-cash items.

Free cash flow

Free cash flow is a non-IFRS financial measure that shows us how much cash we have available to invest in growth opportunities, repay debt and meet ongoing financial obligations. We use it as an indicator of our financial strength and liquidity. We calculate it by taking the net cash generated by our continuing operating activities, subtracting maintenance capital expenditures, intangible assets expenditures excluding capitalized development costs, other investing activities not related to growth and dividends paid and adding proceeds from the disposal of property, plant and equipment, dividends received from equity accounted investees and proceeds, net of payments, from equity accounted investees.

Liquidity and Capital Structure measures

Adjusted return on capital employed (ROCE)

Adjusted ROCE is a non-IFRS ratio calculated over a rolling four-quarter period by taking net income attributable to equity holders of the Company from continuing operations adjusting for net finance expense, after tax, restructuring, integration and acquisition costs, and impairments and other gains and losses arising from significant strategic transactions or specific events divided by the average capital employed from continuing operations. Impairments and other gains and losses arising from significant strategic transactions or specific events consist of the impairment of goodwill (as described in Note 14 of our consolidated financial statements for the year ended March 31, 2024), the impairment of technology and other non-financial assets (as described in Note 5 of our consolidated financial statements for the year ended March 31, 2024) and the impairment reversal of non-financial assets following their repurposing and optimization (as described in Note 5 of our consolidated financial statements for the year ended March 31, 2023). We use adjusted ROCE to evaluate the profitability of our invested capital.

Net debt

Net debt is a capital management measure we use to monitor how much debt we have after taking into account cash and cash equivalents. We use it as an indicator of our overall financial position, and calculate it by taking our total long-term debt, including the current portion of long-term debt, and subtracting cash and cash equivalents.

Net debt-to-EBITDA and net debt-to-adjusted EBITDA

Net debt-to-EBITDA and net debt-to-adjusted EBITDA are non-IFRS ratios calculated as net debt divided by the last twelve months EBITDA (or adjusted EBITDA). We use net debt-to-EBITDA and net debt-to-adjusted EBITDA because they reflect our ability to service our debt obligations.

Net debt-to-adjusted EBITDA excluding Legacy Contracts further excludes the impact from accelerated risk recognition on the Legacy Contracts recorded in the fourth quarter of fiscal 2024. Net debt-to-adjusted EBITDA excluding Legacy Contracts is also useful because it provides a better understanding of the specific and impact from accelerated risk recognition on the Legacy Contracts on our ability to service our debt obligations.

Maintenance and growth capital expenditures

Maintenance capital expenditure is a supplementary financial measure we use to calculate the investment needed to sustain the current level of economic activity. Growth capital expenditure is a supplementary financial measure we use to calculate the investment needed to increase the current level of economic activity. The sum of maintenance capital expenditures and growth capital expenditures represents our total property, plant and equipment expenditures.

Growth measures

Adjusted order intake

Adjusted order intake is a supplementary financial measure that represents the expected value of orders we have received:

–For the Civil Aviation segment, we consider an item part of our adjusted order intake when we have a legally binding commercial agreement with a client that includes enough detail about each party’s obligations to form the basis for a contract. Additionally, expected future revenues from customers under short-term and long-term training contracts are included when these customers commit to pay us training fees, or when we reasonably expect the revenue to be generated;

–For the Defense and Security segment, we consider an item part of our adjusted order intake when we have a legally binding commercial agreement with a client that includes enough detail about each party’s obligations to form the basis for a contract. Defense and Security contracts are usually executed over a long-term period but some of them must be renewed each year. For this segment, we only include a contract item in adjusted order intake when the customer has authorized the contract item and has received funding for it.

Adjusted backlog

Adjusted backlog is a supplementary financial measure that represents expected future revenues and includes obligated backlog, joint venture backlog and unfunded backlog and options:

–Obligated backlog represents the value of our adjusted order intake not yet executed and is calculated by adding the adjusted order intake of the current period to the balance of the obligated backlog at the end of the previous fiscal year, subtracting the revenue recognized in the current period and adding or subtracting backlog adjustments. If the amount of an order already recognized in a previous fiscal year is modified, the backlog is revised through adjustments;

–Joint venture backlog is obligated backlog that represents the expected value of our share of orders that our joint ventures have received but have not yet executed. Joint venture backlog is determined on the same basis as obligated backlog described above, but excludes any portion of orders that have been directly subcontracted to a CAE subsidiary, which are already reflected in the determination of obligated backlog;

–Unfunded backlog represents legally binding Defense and Security orders with the U.S. government that we have received but have not yet executed and for which funding authorization has not yet been obtained. The uncertainty relates to the timing of the funding authorization, which is influenced by the government’s budget cycle, based on a September year-end. Options are included in adjusted backlog when there is a high probability of being exercised, which we define as at least 80% probable, but multi-award indefinite-delivery/indefinite-quantity (ID/IQ) contracts are excluded. When an option is exercised, it is considered adjusted order intake in that period, and it is removed from unfunded backlog and options.

Book-to-sales ratio

The book-to-sales ratio is a supplementary financial measure calculated by dividing adjusted order intake by revenue in a given period. We use it to monitor the level of future growth of the business over time.

Supplementary non-financial information definitions

Full-flight simulators (FFSs) in CAE's network

A FFS is a full-size replica of a specific make, model and series of an aircraft cockpit, including a motion system. In our count of FFSs in the network, we generally only include FFSs that are of the highest fidelity and do not include any fixed based training devices, or other lower-level devices, as these are typically used in addition to FFSs in the same approved training programs.

Simulator equivalent unit (SEU)

SEU is a measure we use to show the total average number of FFSs available to generate earnings during the period. For example, in the case of a 50/50 flight training joint venture, we will report only 50% of the FFSs under this joint venture as a SEU. If a FFS is being powered down and relocated, it will not be included as a SEU until the FFS is re-installed and available to generate earnings.

Utilization rate

Utilization rate is a measure we use to assess the performance of our Civil simulator training network. While utilization rate does not perfectly correlate to revenue recognized, we track it, together with other measures, because we believe it is an indicator of our operating performance. We calculate it by taking the number of training hours sold on our simulators during the period divided by the practical training capacity available for the same period.

Reconciliations and Calculations

Reconciliation of adjusted segment operating income

| | | | | | | | | | | | | | | | | | | | | | |

| | Defense | | | | |

| (amounts in millions) | Civil Aviation | and Security | | | Total |

Three months ended September 30 | 2024 | 2023 | 2024 | 2023 | | | 2024 | 2023 |

| Operating income | $ | 94.7 | | $ | 88.4 | | $ | 23.4 | | $ | 9.3 | | | | $ | 118.1 | | $ | 97.7 | |

| Restructuring, integration and acquisition costs | 21.2 | | 25.9 | | 9.7 | | 12.0 | | | | 30.9 | | 37.9 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted segment operating income | $ | 115.9 | | $ | 114.3 | | $ | 33.1 | | $ | 21.3 | | | | $ | 149.0 | | $ | 135.6 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Reconciliation of adjusted net income and adjusted EPS

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three months ended |

| | | September 30 |

| (amounts in millions, except per share amounts) | | | | | 2024 | | 2023 |

| Net income attributable to equity holders of the Company | | $ | 52.5 | | | $ | 58.4 | |

| Net income from discontinued operations | | | | | — | | | (2.2) | |

| | | | | | | |

| Restructuring, integration and acquisition costs, after tax | | | | | 23.7 | | | 29.0 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted net income | | | | | $ | 76.2 | | | $ | 85.2 | |

| | | | | | | |

| | | | |

| | | | | | | |

| Average number of shares outstanding (diluted) | | | | | 319.1 | | | 319.2 | |

| | | | | | | |

| Adjusted EPS | | | | | $ | 0.24 | | | $ | 0.26 | |

| | | | |

Calculation of adjusted effective tax rate

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Three months ended |

| | | | | | | | | September 30 |

| (amounts in millions, except effective tax rates) | | | | | | | | | | | 2024 | | 2023 |

| Earnings before income taxes | | | | | | | | | | $ | 65.2 | | $ | 50.6 | |

| Restructuring, integration and acquisition costs | | | | | | | | | | | 30.9 | | | 37.9 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Adjusted earnings before income taxes | | | | | | | | | | $ | 96.1 | | $ | 88.5 | |

| | | | | | | | | | | | | |

| Income tax expense (recovery) | | | | | | | | | | $ | 10.4 | | $ | (8.3) | |

| Tax impact on restructuring, integration and acquisition costs | | | | | | | | | | | 7.2 | | | 8.9 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Adjusted income tax expense | | | | | | | | | | $ | 17.6 | $ | 0.6 | |

| | | | | | | | | | | | | |

| Effective tax rate | | | | | | | | | | % | 16 | | % | (16) | |

| Adjusted effective tax rate | | | | | | | | | | % | 18 | | % | 1 | |

Reconciliation of free cash flow

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Three months ended |

| | | | | | September 30 |

| (amounts in millions) | | | | | | | | 2024 | | 2023 |

| Cash provided by operating activities* | | | | | | | | $ | 117.6 | | | $ | 113.1 | |

| Changes in non-cash working capital | | | | | | | | 44.5 | | | 67.1 | |

| Net cash provided by operating activities | | | | | | $ | 162.1 | | | $ | 180.2 | |

| Maintenance capital expenditures | | | | | | | | (20.6) | | | (22.9) | |

| Change in ERP and other assets | | | | | | (7.7) | | | (3.6) | |

| Proceeds from the disposal of property, plant and equipment | | | | | | 0.2 | | | 0.2 | |

| Net proceeds from (payments to) equity accounted investees | | | | | | 0.3 | | | (12.9) | |

| Dividends received from equity accounted investees | | | | | | | | 6.8 | | | 10.5 | |

| | | | | | | | | | |

| Other investing activities | | | | | | | | (1.1) | | | (4.0) | |

| Impact of discontinued operations | | | | | | | | — | | | (0.1) | |

| Free cash flow | | | | | | | | $ | 140.0 | | | $ | 147.4 | |

| | | | | | | | | | |

| * before changes in non-cash working capital | | | | | | | | | | |

Reconciliation of EBITDA, adjusted EBITDA, net debt-to-EBITDA and net debt-to-adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Last twelve months ended |

| | | September 30 |

| (amounts in millions, except net debt-to-EBITDA ratios) | | | | | 2024 | | 2023 |

| Operating (loss) income | | | | | $ | (184.7) | | | $ | 546.4 | |

| | | | | | | |

| Depreciation and amortization | | | | | 388.4 | | | 350.6 | |

| EBITDA | | | | | $ | 203.7 | | | $ | 897.0 | |

| | | | | | | |

| Restructuring, integration and acquisition costs | | | | | 135.0 | | | 72.9 | |

| Impairments and other gains and losses arising from | | | | | | | |

| significant strategic transactions or specific events: | | | | | | | |

| Impairment of goodwill | | | | | 568.0 | | | — | |

| Impairment of technology and other financial assets | | | | | 35.7 | | | — | |

Impairment reversal of non-financial assets | | | | | | | |

| following their repurposing and optimization | | | | | — | | | 9.8 | |

| Adjusted EBITDA | | | $ | 942.4 | | | $ | 979.7 | |

| | | | | | | |

| Net debt | | | | | $ | 3,064.9 | | | $ | 3,184.5 | |

| | | | | | | |

| Net debt-to-EBITDA | | | | | 15.05 | | | 3.55 | |

| Net debt-to-adjusted EBITDA | | | | | 3.25 | | | 3.25 | |

| | | | | | | |

| | | Last twelve months ended |

| | | September 30 |

| (amounts in millions, except net debt-to-EBITDA ratios) | | | | | 2024 | | 2023 |

| Adjusted EBITDA | | | | | $ | 942.4 | | | $ | 979.7 | |

| Impact from accelerated risk recognition on the Legacy Contracts | | | | 90.3 | | | — | |

| Adjusted EBITDA excluding Legacy Contracts | | | $ | 1,032.7 | | | $ | 979.7 | |

| | | | | | | |

| Net debt-to-adjusted EBITDA excluding Legacy Contracts | | | 2.97 | | | 3.25 | |

Reconciliation of capital employed and net debt

| | | | | | | | | | | | | | | | | | | | | | |

| | | As at September 30 | | As at March 31 |

| (amounts in millions) | | | | 2024 | | | | 2024 |

| Use of capital: | | | | | | | | |

| Current assets | | | $ | 2,113.6 | | | | $ | 2,006.5 | |

| Less: cash and cash equivalents | | | | (179.7) | | | | | (160.1) | |

| | | | | | | | |

| Current liabilities | | | | (2,513.0) | | | | | (2,358.4) | |

| Less: current portion of long-term debt | | | | 487.0 | | | | | 308.9 | |

| Non-cash working capital | | | $ | (92.1) | | | | $ | (203.1) | |

| | | | | | | | |

| Property, plant and equipment | | | | 2,623.0 | | | | | 2,515.6 | |

| Intangible assets | | | | 3,279.0 | | | | | 3,271.9 | |

| Other long-term assets | | | | 2,111.2 | | | | | 2,040.1 | |

| Other long-term liabilities | | | | (392.0) | | | | | (407.7) | |

| Capital employed | | | $ | 7,529.1 | | | | $ | 7,216.8 | |

| Source of capital: | | | | | | | | |

| Current portion of long-term debt | | | $ | 487.0 | | | | $ | 308.9 | |

| Long-term debt | | | | 2,757.6 | | | | | 2,765.4 | |

| Less: cash and cash equivalents | | | | (179.7) | | | | | (160.1) | |

| Net debt | | | $ | 3,064.9 | | | | $ | 2,914.2 | |

| Equity attributable to equity holders of the Company | | | | 4,382.2 | | | | | 4,224.9 | |

| Non-controlling interests | | | | 82.0 | | | | | 77.7 | |

| Capital employed | | | $ | 7,529.1 | | | | $ | 7,216.8 | |

For non-IFRS and other financial measures monitored by CAE, and a reconciliation of such measures to the most directly comparable measure under IFRS, please refer to Section 11 of CAE’s MD&A for the quarter ended September 30, 2024 (which is incorporated by reference into this press release) available on our website (www.cae.com), SEDAR+ (www.SEDARplus.ca) and EDGAR (www.sec.gov).

Consolidated Income Statement

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| (Unaudited) | | | Three months ended

September 30 | | | Six months ended

September 30 |

| | | | | | | | | | |

| (amounts in millions of Canadian dollars, except per share amounts) | | | 2024 | | 2023 | | | 2024 | | 2023 |

| | | | | | | | |

| Continuing operations | | | | | | | | | | |

| Revenue | | $ | 1,136.6 | | $ | 1,050.0 | | | $ | 2,209.1 | | $ | 2,062.0 | |

| Cost of sales | | | 845.5 | | | 765.3 | | | | 1,639.3 | | | 1,491.6 | |

| Gross profit | | $ | 291.1 | | $ | 284.7 | | | $ | 569.8 | | $ | 570.4 | |

| Research and development expenses | | | 37.2 | | | 33.3 | | | | 73.1 | | | 70.0 | |

| Selling, general and administrative expenses | | | 127.6 | | | 132.3 | | | | 261.1 | | | 256.0 | |

| Other (gains) and losses | | | (2.7) | | | (2.2) | | | | (3.6) | | | (3.6) | |

| Share of after-tax profit of equity accounted investees | | | (20.0) | | | (14.3) | | | | (44.0) | | | (30.9) | |

| Restructuring, integration and acquisition costs | | | 30.9 | | | 37.9 | | | | 56.5 | | | 52.9 | |

| Operating income | | $ | 118.1 | | $ | 97.7 | | | $ | 226.7 | | $ | 226.0 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Finance expense – net | | | 52.9 | | | 47.1 | | | | 102.4 | | | 100.2 | |

| Earnings before income taxes | | $ | 65.2 | | $ | 50.6 | | | $ | 124.3 | | $ | 125.8 | |

| Income tax expense (recovery) | | | 10.4 | | | (8.3) | | | | 18.7 | | | (0.4) | |

Net income from continuing operations | | $ | 54.8 | | $ | 58.9 | | | $ | 105.6 | | $ | 126.2 | |

| | | | | | | | | | |

Net income from discontinued operations | | | — | | | 2.2 | | | | — | | | 2.7 | |

| Net income | | $ | 54.8 | | $ | 61.1 | | | $ | 105.6 | | $ | 128.9 | |

| Attributable to: | | | | | | | | | | |

| Equity holders of the Company | | $ | 52.5 | | $ | 58.4 | | | $ | 100.8 | | $ | 123.7 | |

| Non-controlling interests | | | 2.3 | | | 2.7 | | | | 4.8 | | | 5.2 | |

| | | | | | | | | | |

| Earnings per share attributable to equity holders of the Company | | | | | | | | | | |

| Basic and diluted – continuing operations | | $ | 0.16 | | $ | 0.17 | | | $ | 0.32 | | $ | 0.38 | |

| Basic and diluted – discontinued operations | | | — | | | 0.01 | | | | — | | | 0.01 | |

| | | | | | | | | | |

Consolidated Statement of Comprehensive Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| (Unaudited) | | | Three months ended

September 30 | | | Six months ended

September 30 |

| | | | | | | | | | |

| (amounts in millions of Canadian dollars) | | | 2024 | | 2023 | | | 2024 | | 2023 |

| | | | | | | | |

| Net income from continuing operations | | $ | 54.8 | | $ | 58.9 | | | $ | 105.6 | | $ | 126.2 | |

| Items that may be reclassified to net income | | | | | | | | | | |

| Foreign currency exchange differences on translation of foreign operations | | $ | 15.4 | | $ | 68.7 | | | $ | 66.9 | | $ | (27.5) | |

| Net gain (loss) on hedges of net investment in foreign operations | | | 24.4 | | | (29.1) | | | | 5.3 | | | (1.6) | |

| Reclassification to income of gains on foreign currency exchange differences | | | — | | | — | | | | (0.1) | | | (0.1) | |

| Net gain (loss) on cash flow hedges | | | 5.7 | | | (14.3) | | | | (1.1) | | | (0.9) | |

| Reclassification to income of losses on cash flow hedges | | | 1.6 | | | 2.5 | | | | 4.9 | | | 3.1 | |

| Income taxes | | | (1.1) | | | 3.3 | | | | (2.1) | | | (4.0) | |

| | | $ | 46.0 | | $ | 31.1 | | | $ | 73.8 | | $ | (31.0) | |

| Items that will never be reclassified to net income | | | | | | | | | | |

| Remeasurement of defined benefit pension plan obligations | | $ | (56.5) | | $ | 33.4 | | | $ | (54.2) | | $ | 12.0 | |

| | | | | | | | | | |

| Income taxes | | | 15.0 | | | (8.9) | | | | 14.4 | | | (3.2) | |

| | | $ | (41.5) | | $ | 24.5 | | | $ | (39.8) | | $ | 8.8 | |

| Other comprehensive income (loss) from continuing operations | | $ | 4.5 | | $ | 55.6 | | | $ | 34.0 | | $ | (22.2) | |

| Net income from discontinued operations | | | — | | | 2.2 | | | | — | | | 2.7 | |

| Other comprehensive income from discontinued operations | | | — | | | 3.0 | | | | — | | | 1.4 | |

| Total comprehensive income | | $ | 59.3 | | $ | 119.7 | | | $ | 139.6 | | $ | 108.1 | |

| Attributable to: | | | | | | | | | | |

| Equity holders of the Company | | $ | 56.9 | | $ | 116.0 | | | $ | 134.2 | | $ | 103.2 | |

| Non-controlling interests | | | 2.4 | | | 3.7 | | | | 5.4 | | | 4.9 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Consolidated Statement of Financial Position

| | | | | | | | | | | | | | | | | | | |

| (Unaudited) | September 30 | March 31 | | |

| (amounts in millions of Canadian dollars) | | | 2024 | 2024 | | |

| | | | | |

Assets | | | | | | | |

| Cash and cash equivalents | | $ | 179.7 | | $ | 160.1 | | | |

| | | | | | | |

| Accounts receivable | | | 577.6 | | | 624.7 | | | |

| Contract assets | | | 555.5 | | | 537.6 | | | |

| Inventories | | | 633.8 | | | 573.6 | | | |

| Prepayments | | | 86.0 | | | 68.0 | | | |

| Income taxes recoverable | | | 71.4 | | | 35.3 | | | |

| Derivative financial assets | | | 9.6 | | | 7.2 | | | |

| | | | | | | |

Total current assets | | $ | 2,113.6 | | $ | 2,006.5 | | | |

| Property, plant and equipment | | | 2,623.0 | | | 2,515.6 | | | |

| Right-of-use assets | | | 629.7 | | | 545.8 | | | |

| Intangible assets | | | 3,279.0 | | | 3,271.9 | | | |

| Investment in equity accounted investees | | | 622.2 | | | 588.8 | | | |

| Employee benefits assets | | | 11.9 | | | 65.7 | | | |

| Deferred tax assets | | | 256.3 | | | 233.3 | | | |

| Derivative financial assets | | | 6.8 | | | 4.2 | | | |

| Other non-current assets | | | 584.3 | | | 602.3 | | | |

Total assets | | $ | 10,126.8 | | $ | 9,834.1 | | | |

| | | | | | | |

Liabilities and equity | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 955.3 | | $ | 1,035.3 | | | |

| Provisions | | | 47.3 | | | 42.6 | | | |

| Income taxes payable | | | 29.5 | | | 31.1 | | | |

| Contract liabilities | | | 978.0 | | | 911.7 | | | |

| Current portion of long-term debt | | | 487.0 | | | 308.9 | | | |

| | | | | | | |

| Derivative financial liabilities | | | 15.9 | | | 28.8 | | | |

| | | | | | | |

Total current liabilities | | $ | 2,513.0 | | $ | 2,358.4 | | | |

| Provisions | | | 13.6 | | | 14.0 | | | |

| Long-term debt | | | 2,757.6 | | | 2,765.4 | | | |

| Royalty obligations | | | 65.8 | | | 74.4 | | | |

| Employee benefits obligations | | | 116.4 | | | 98.7 | | | |

| Deferred tax liabilities | | | 38.8 | | | 36.6 | | | |

| Derivative financial liabilities | | | 0.8 | | | 2.9 | | | |

| Other non-current liabilities | | | 156.6 | | | 181.1 | | | |

Total liabilities | | $ | 5,662.6 | | $ | 5,531.5 | | | |

Equity | | | | | | | |

| Share capital | | $ | 2,275.3 | | $ | 2,252.9 | | | |

| Contributed surplus | | | 71.3 | | | 55.4 | | | |

| Accumulated other comprehensive income | | | 227.2 | | | 154.0 | | | |

| Retained earnings | | | 1,808.4 | | | 1,762.6 | | | |

| Equity attributable to equity holders of the Company | | $ | 4,382.2 | | $ | 4,224.9 | | | |

| Non-controlling interests | | | 82.0 | | | 77.7 | | | |

Total equity | | $ | 4,464.2 | | $ | 4,302.6 | | | |

Total liabilities and equity | | $ | 10,126.8 | | $ | 9,834.1 | | | |

Consolidated Statement of Changes in Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | Attributable to equity holders of the Company | | | | |

| Six months ended September 30, 2024 | | Common shares | | | Accumulated other | | | | | | | | |

(amounts in millions of Canadian dollars, | | Number of | | Stated | Contributed | comprehensive | Retained | | | Non-controlling | | Total |

| except number of shares) | | shares | | value | | surplus | income | | earnings | | Total | | interests | | equity |

Balances as at March 31, 2024 | | 318,312,233 | | $ | 2,252.9 | | $ | 55.4 | | $ | 154.0 | | $ | 1,762.6 | | $ | 4,224.9 | | $ | 77.7 | | $ | 4,302.6 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net income | | — | | $ | — | | $ | — | | $ | — | | $ | 100.8 | | $ | 100.8 | | $ | 4.8 | | $ | 105.6 | |

| Other comprehensive income (loss) | | — | | | — | | | — | | | 73.2 | | | (39.8) | | | 33.4 | | | 0.6 | | | 34.0 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total comprehensive income | | — | | $ | — | | $ | — | | $ | 73.2 | | $ | 61.0 | | $ | 134.2 | | $ | 5.4 | | $ | 139.6 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Exercise of stock options | | 1,092,050 | | | 27.3 | | | (3.5) | | | — | | | — | | | 23.8 | | | — | | | 23.8 | |

| Settlement of equity-settled awards | | 42,086 | | | 1.2 | | | (1.2) | | | — | | | — | | | — | | | — | | | — | |

| Repurchase and cancellation of common shares | | (856,230) | | | (6.1) | | | — | | | — | | | (15.2) | | | (21.3) | | | — | | | (21.3) | |

| Equity-settled share-based payments expense | | — | | | — | | | 20.6 | | | — | | | — | | | 20.6 | | | — | | | 20.6 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Transactions with non-controlling interests | | — | | | — | | | — | | | — | | | — | | | — | | | (1.1) | | | (1.1) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Balances as at September 30, 2024 | | 318,590,139 | | $ | 2,275.3 | | $ | 71.3 | | $ | 227.2 | | $ | 1,808.4 | | $ | 4,382.2 | | $ | 82.0 | | $ | 4,464.2 | |

| | | | | | | | | | | | | | | | |

| | Attributable to equity holders of the Company | | | | |

| Six months ended September 30, 2023 | | Common shares | | | Accumulated other | | | | | | | | |

(amounts in millions of Canadian dollars, | | Number of | | Stated | Contributed | comprehensive | Retained | | | Non-controlling | | Total |

| except number of shares) | | shares | | value | | surplus | income | | earnings | | Total | | interests | | equity |

Balances as at March 31, 2023 | | 317,906,290 | | $ | 2,243.6 | | $ | 42.1 | | $ | 167.2 | | $ | 2,054.8 | | $ | 4,507.7 | | $ | 81.2 | | $ | 4,588.9 | |

| Net income | | — | | $ | — | | $ | — | | $ | — | | $ | 123.7 | | $ | 123.7 | | $ | 5.2 | | $ | 128.9 | |

| Other comprehensive (loss) income | | — | | | — | | | — | | | (29.3) | | | 8.8 | | | (20.5) | | | (0.3) | | | (20.8) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total comprehensive (loss) income | | — | | $ | — | | $ | — | | $ | (29.3) | | $ | 132.5 | | $ | 103.2 | | $ | 4.9 | | $ | 108.1 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Exercise of stock options | | 364,268 | | | 8.2 | | | (1.3) | | | — | | | — | | | 6.9 | | | — | | | 6.9 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Equity-settled share-based payments expense | | — | | | — | | | 15.1 | | | — | | | — | | | 15.1 | | | — | | | 15.1 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Transactions with non-controlling interests | | — | | | — | | | — | | | — | | | — | | | — | | | (3.1) | | | (3.1) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Balances as at September 30, 2023 | | 318,270,558 | | $ | 2,251.8 | | $ | 55.9 | | $ | 137.9 | | $ | 2,187.3 | | $ | 4,632.9 | | $ | 83.0 | | $ | 4,715.9 | |

Consolidated Statement of Cash Flows

| | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | | Six months ended September 30 |

| | | | | | |

(amounts in millions of Canadian dollars) | | | | 2024 | | 2023 |

| | | | | | |

Operating activities | | | | | | |

| Net income | | | $ | 105.6 | | $ | 128.9 | |

| Adjustments for: | | | | | | |

| Depreciation and amortization | | | | 197.9 | | | 183.4 | |

| | | | | | |

| Share of after-tax profit of equity accounted investees | | | | (44.0) | | | (30.9) | |

| Deferred income taxes | | | | (8.0) | | | (39.2) | |

| Investment tax credits | | | | (8.7) | | | (2.3) | |

| Equity-settled share-based payments expense | | | | 20.6 | | | 15.1 | |

| Defined benefit pension plans | | | | 17.2 | | | 1.1 | |

| Other non-current liabilities | | | | (4.7) | | | (4.8) | |

| Derivative financial assets and liabilities – net | | | | (13.6) | | | (18.2) | |

| | | | | | |

| | | | | | |

| Other | | | | (17.5) | | | 10.4 | |

| Changes in non-cash working capital | | | | (95.6) | | | (112.6) | |

| Net cash provided by operating activities | | | $ | 149.2 | | $ | 130.9 | |

Investing activities | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Property, plant and equipment expenditures | | | $ | (149.6) | | $ | (152.5) | |

| Proceeds from disposal of property, plant and equipment | | | | 1.9 | | | 3.6 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Intangible assets expenditures | | | | (53.0) | | | (72.3) | |

| Net proceeds from (payments to) equity accounted investees | | | | 0.4 | | | (25.6) | |

| Dividends received from equity accounted investees | | | | 17.3 | | | 17.1 | |

| Other | | | | (0.8) | | | (1.3) | |

| Net cash used in investing activities | | | $ | (183.8) | | $ | (231.0) | |

Financing activities | | | | | | |

| Net proceeds from (repayment of) borrowing under revolving credit facilities | | | $ | 87.0 | | $ | (279.5) | |

| | | | | | |

| | | | | | |

| Proceeds from long-term debt | | | | 19.5 | | | 417.5 | |

| Repayment of long-term debt | | | | (36.3) | | | (33.5) | |

| Repayment of lease liabilities | | | | (27.7) | | | (44.7) | |

| | | | | | |

| Net proceeds from the issuance of common shares | | | | 23.8 | | | 6.9 | |

| Repurchase and cancellation of common shares | | | | (21.3) | | | — | |

| | | | | | |

| | | | | | |

| Net cash provided by financing activities | | | $ | 45.0 | | $ | 66.7 | |

Effect of foreign currency exchange differences on cash and cash equivalents | | | $ | 9.2 | | $ | (2.7) | |

| Net increase (decrease) in cash and cash equivalents | | | $ | 19.6 | | $ | (36.1) | |

Cash and cash equivalents, beginning of period | | | | 160.1 | | | 217.6 | |

Cash and cash equivalents, end of period | | | $ | 179.7 | | $ | 181.5 | |

Contacts

Media:

Samantha Golinski, Vice President, Public Affairs and Global Communications, +1 438-805-5856, samantha.golinski@cae.com

Investor Relations:

Andrew Arnovitz, Senior Vice President, Investor Relations and Enterprise Risk Management, 1-514-734-5760, andrew.arnovitz@cae.com

| | | | | | | | |

| | |

Table of Contents | |

| Management’s Discussion and Analysis | |

| 1. | Highlights | |

| 2. | | |

| 3. | | |

| 4. | | |

| 5. | | |

| 6. | | |

| 7. | | |

| 8. | | |

| 9. | Discontinued operations | |

| | |

| 10. | Business risk and uncertainty | |

| 11. | | |

| 12. | Event after the reporting period | |

| 13. | | |

| 14. | | |

| 15. | | |

| Consolidated Interim Financial Statements | |

| Consolidated income statement | |

| Consolidated statement of comprehensive income | |

| Consolidated statement of financial position | |

| Consolidated statement of changes in equity | |

| Consolidated statement of cash flows | |

| Notes to the Consolidated Interim Financial Statements | |

| Note 1 - Nature of operations and summary of material accounting policies | |

| |

| |

| |

| Note 2 - Discontinued operations | |

| Note 3 - Operating segments and geographic information | |

| Note 4 - Other (gains) and losses | |

| Note 5 - Restructuring, integration and acquisitions costs | |

| Note 6 - Debt facilities and finance expense - net | |

| |

| Note 7 - Global minimum tax (Pillar Two) | |

| Note 8 - Share capital and earnings per share | |

| |

| Note 9 - Supplementary cash flows information | |

| Note 10 - Contingencies | |

| Note 11 - Fair value of financial instruments | |

| |

| Note 12 - Event after the reporting period | |

Management’s Discussion and Analysis

for the three months ended September 30, 2024

1. HIGHLIGHTS

FINANCIAL

SECOND QUARTER OF FISCAL 2025

| | | | | | | | | | | | | | | | | | | | | | | | |

| (amounts in millions, except per share amounts, adjusted ROCE and book-to-sales ratio) | | Q2-2025 | | Q2-2024 | Variance $ | Variance % | |

| Performance | | | | | | | | |

| Revenue | $ | 1,136.6 | | $ | 1,050.0 | | $ | 86.6 | | 8 | % | |

| Operating income | $ | 118.1 | | $ | 97.7 | | $ | 20.4 | | 21 | % | |

| Adjusted segment operating income1 | $ | 149.0 | | $ | 135.6 | | $ | 13.4 | | 10 | % | |

| Net income attributable to equity holders of the Company | $ | 52.5 | | $ | 58.4 | | $ | (5.9) | | (10 | %) | |

| Basic and diluted earnings per share (EPS) – continuing operations | $ | 0.16 | | $ | 0.17 | | $ | (0.01) | | (6 | %) | |

| | | | | | | | |

| | | | | | | | |

Adjusted EPS1 | $ | 0.24 | | $ | 0.26 | | $ | (0.02) | | (8 | %) | |

| Net cash provided by operating activities | $ | 162.1 | | $ | 180.2 | | $ | (18.1) | | (10 | %) | |

Free cash flow1 | $ | 140.0 | | $ | 147.4 | | $ | (7.4) | | (5 | %) | |

| Liquidity and Capital Structure | | | | | | | | |

Capital employed1 | $ | 7,529.1 | | $ | 7,900.4 | | $ | (371.3) | | (5 | %) | |

| | | | | | | | |

Adjusted return on capital employed (ROCE)1 | % | 5.5 | | % | 7.1 | | | | | |

| Total debt | $ | 3,244.6 | | $ | 3,366.0 | | $ | (121.4) | | (4 | %) | |

| | | | | | | | |

Net debt1 | $ | 3,064.9 | | $ | 3,184.5 | | $ | (119.6) | | (4 | %) | |

| Growth | | | | | | | | |

Adjusted order intake1 | $ | 2,955.3 | | $ | 1,145.1 | | $ | 1,810.2 | | 158 | % | |

Adjusted backlog1 | $ | 18,041.2 | | $ | 11,773.1 | | $ | 6,268.1 | | 53 | % | |

Book-to-sales ratio1 | | 2.60 | | | 1.09 | | | | | |

| Book-to-sales ratio for the last 12 months | | 1.57 | | | 1.11 | | | | | |

| | | | | | | | |

FISCAL 2025 YEAR TO DATE | | | | | | | | |

| | | | | | | | |

| (amounts in millions, except per share amounts) | | Q2-2025 | | Q2-2024 | Variance $ | Variance % | |

| Performance | | | | | | | | |

| Revenue | $ | 2,209.1 | | $ | 2,062.0 | | $ | 147.1 | | 7 | % | |

| Operating income | $ | 226.7 | | $ | 226.0 | | $ | 0.7 | | — | % | |

| Adjusted segment operating income | $ | 283.2 | | $ | 278.9 | | $ | 4.3 | | 2 | % | |

| Net income attributable to equity holders of the Company | $ | 100.8 | | $ | 123.7 | | $ | (22.9) | | (19 | %) | |

| Basic and diluted EPS – continuing operations | $ | 0.32 | | $ | 0.38 | | $ | (0.06) | | (16 | %) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted EPS | $ | 0.45 | | $ | 0.51 | | $ | (0.06) | | (12 | %) | |

| Net cash provided by operating activities | $ | 149.2 | | $ | 130.9 | | $ | 18.3 | | 14 | % | |

| Free cash flow | $ | 114.7 | | $ | 37.1 | | $ | 77.6 | | 209 | % | |

Comparative figures have been reclassified to reflect discontinued operations.

EVENT AFTER THE REPORTING PERIOD

On November 5, 2024, we increased our ownership stake in our existing SIMCOM Aviation Training (SIMCOM) joint venture by purchasing an additional interest from Volo Sicuro for a cash consideration of US$230 million, subject to customary adjustments, financed with our existing credit facility and cash on hand. As a result, we obtained control over SIMCOM’s four training centres located in the U.S. providing pilot training across multiple business aviation aircraft platforms. Additionally, CAE and SIMCOM have extended their current exclusive business aviation training services agreement with Flexjet, LLC, a related party of Volo Sicuro, and its affiliates by five years, bringing the remaining exclusivity period to 15 years.

1 Non-IFRS financial measure, non-IFRS ratio, capital management measure, or supplementary financial measure. Refer to Section 11 “Non-IFRS and other financial measures and supplementary non-financial information” of this MD&A for the definitions and reconciliation of these measures to the most directly comparable measure under IFRS.

CAE Second Quarter Report 2025 I 1

Management’s Discussion and Analysis

2. INTRODUCTION

In this management’s discussion and analysis (MD&A), we, us, our, CAE and Company refer to CAE Inc. and its subsidiaries. Unless we have indicated otherwise:

–This year and 2025 mean the fiscal year ending March 31, 2025;

–Last year, prior year and a year ago mean the fiscal year ended March 31, 2024;

–Dollar amounts are in Canadian dollars.

This MD&A was prepared as of November 12, 2024. It is intended to enhance the understanding of our unaudited consolidated interim financial statements and notes for the second quarter ended September 30, 2024 and should therefore be read in conjunction with this document and our annual audited consolidated financial statements for the year ended March 31, 2024. We have prepared it to help you understand our business, performance and financial condition for the second quarter of fiscal 2025. Except as otherwise indicated, all financial information has been reported in accordance with IFRS Accounting Standards (IFRS), as issued by the International Accounting Standards Board (IASB), and based on unaudited figures.

For additional information, please refer to our annual MD&A for the year ended March 31, 2024 which provides you with a view of CAE as seen through the eyes of management and helps you understand the Company from a variety of perspectives:

–Our mission;

–Our vision;

–Our strategy;

–Our operations;

–Foreign exchange;

–Consolidated results;

–Results by segment;

–Consolidated cash movements and liquidity;

–Consolidated financial position;

–Discontinued operations;

–Business risk and uncertainty;

–Related party transactions;

–Non-IFRS and other financial measures and supplementary non-financial information;

–Changes in accounting policies;

–Internal control over financial reporting;

–Oversight role of Audit Committee and Board of Directors (the Board).

You will find our most recent financial report and Annual Information Form (AIF) on our website (www.cae.com), SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov). Holders of CAE’s securities may also request a printed copy of the Company’s consolidated financial statements and MD&A free of charge by contacting Investor Relations (investor.relations@cae.com).

NON-IFRS AND OTHER FINANCIAL MEASURES