REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Participants and Plan Administrator of the Crane Savings and Investment Plan (formerly known as the Amended and Restated Crane Co. Savings and Investment Plan)

Opinion on the Financial Statements

We have audited the accompanying statements of assets available for benefits of the Crane Savings and Investment Plan (formerly known as the Amended and Restated Crane Co. Savings and Investment Plan) (the “Plan”) as of December 31, 2022 and 2021, the related statements of changes in assets available for benefits for the years then ended, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the assets available for benefits of the Plan as of December 31, 2022 and 2021, and the changes in assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Schedule

The supplemental schedule of assets (held at the end of year) as of December 31, 2022, has been subjected to audit procedures performed in conjunction with the audits of the Plan's financial statements. The supplemental schedule is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in compliance with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, such schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Deloitte & Touche LLP

Stamford, Connecticut

June 15, 2023

We have served as the Plan's auditor since at least 1986; however, an earlier year could not be reliably determined.

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

STATEMENTS OF ASSETS AVAILABLE FOR BENEFITS

As of December 31, 2022 AND 2021

| | | | | | | | | | | | | | |

| | 2022 | | 2021 |

| ASSETS | | | | |

| | | | |

| INVESTMENTS, AT FAIR VALUE: | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Participant-directed investments | | $ | 1,196,414,828 | | | $ | 1,441,375,368 | |

| | | | |

| RECEIVABLES: | | | | |

| Company contributions | | 21,024 | | | 37,838 | |

| Participant contributions | | 51,453 | | | 54,952 | |

| Notes receivable from participants | | 15,620,628 | | | 15,638,862 | |

| Total receivables | | 15,693,105 | | | 15,731,652 | |

| ASSETS AVAILABLE FOR BENEFITS | | $ | 1,212,107,933 | | | $ | 1,457,107,020 | |

See notes to financial statements.

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

STATEMENTS OF CHANGES IN ASSETS AVAILABLE FOR BENEFITS

FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

| | | | | | | | | | | | | | |

| | 2022 | | 2021 |

| ADDITIONS: | | | | |

| Contributions: | | | | |

| Participant | | $ | 42,809,662 | | | $ | 39,550,281 | |

| Company | | 26,865,098 | | | 22,019,752 | |

| Rollover | | 4,079,928 | | | 4,670,142 | |

| Total contributions | | 73,754,688 | | | 66,240,175 | |

| Investment income (loss): | | | | |

| Interest income | | 2,182,079 | | | 2,054,811 | |

| Dividends | | 20,097,371 | | | 40,094,137 | |

| Net (depreciation) appreciation in fair value of investments | | (238,499,501) | | | 138,661,960 | |

| Net investment (loss) income | | (216,220,051) | | | 180,810,908 | |

| Interest income on notes receivable from participants | | 875,973 | | | 901,772 | |

| Other additions | | 164,005 | | | 154,468 | |

| | (141,425,385) | | | 248,107,323 | |

| DEDUCTIONS: | | | | |

| Benefits paid to participants | | (102,405,120) | | | (124,997,813) | |

| Administrative and other expenses | | (1,168,582) | | | (1,039,982) | |

| Total deductions | | (103,573,702) | | | (126,037,795) | |

| | | | |

| (DECREASE) INCREASE IN ASSETS | | (244,999,087) | | | 122,069,528 | |

| | | | |

| ASSETS AVAILABLE FOR BENEFITS: | | | | |

| Beginning of year | | 1,457,107,020 | | | 1,335,037,492 | |

| End of year | | $ | 1,212,107,933 | | | $ | 1,457,107,020 | |

See notes to financial statements.

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

NOTE 1 - DESCRIPTION OF THE PLAN

The following description of the Amended and Restated Crane Co. Savings and Investment Plan, which is now known as the Crane Savings and Investment Plan (the “Plan”), describes the Plan’s provisions as in effect on December 31, 2022 and is provided for general information purposes only. Participants should refer to the Plan document for a more complete description of the Plan’s information.

General — The Plan is a defined contribution plan covering certain United States of America (“U.S.”) employees of Crane Holdings, Co. and its subsidiaries (the “Company”) as of December 31, 2022 and includes a qualified cash or deferred arrangement under Section 401(k) of the Internal Revenue Code of 1986, as amended (the “Code”). The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Vanguard Fiduciary Trust Company (“Vanguard”) serves as the trustee and recordkeeper of the Plan. Since the Plan offers the Crane Holdings, Co. Stock Fund as an investment option as of December 31, 2022, the Plan also operates as an Employee Stock Ownership Plan.

Plan Amendments — The Plan was adopted and established on January 1, 1985 and was restated in 2019. The restated Plan has been further amended as follows:

In April 2020, the Plan adopted several provisions from the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act, including allowing coronavirus-related distributions and the suspension of loan repayments throughout the remainder of 2020. In accordance with the CARES Act, the Plan allowed certain Plan participants impacted by COVID-19 to withdraw up to $100,000 from the Plan. Additionally, in accordance with the CARES Act, Plan participants were entitled to suspend their Plan loan repayments through the remainder of 2020, with loans being re-amortized and loan repayments starting in 2021. The Plan was amended to incorporate the CARES Act provisions on December 30, 2021.

On May 16, 2022, Crane Co., a Delaware corporation (“Crane Co.”) and, the sponsor of the Plan as of such date, completed a reorganization merger pursuant to the Agreement and Plan of Merger, dated as of February 28, 2022 (the “Reorganization”). The Reorganization resulted in Crane Co. becoming a wholly-owned subsidiary of Crane Holdings, Co., with Crane Co., on the same day, distributing certain of its operating assets and liabilities to Crane Holdings, Co., including its rights and obligations as Plan sponsor. Accordingly, effective as of May 16, 2022, Crane Holdings, Co. became the Plan sponsor.

Administration of the Plan — The authority to manage, control and interpret the Plan as of December 31, 2022 is vested in the Crane Companies’ Savings Plan Committee (the “Committee”), which was appointed by the Board of Directors of Crane Holdings, Co. and is a named fiduciary within the meaning of ERISA.

Participation — Subject to certain conditions, as of December 31, 2022, U.S. employees of the Company are eligible to participate in the Plan. New or rehired employees are automatically enrolled in the Plan, unless the employee affirmatively opts out of participation, at a pre-tax deferral rate of 3% of the employee’s eligible compensation. An employee who is automatically enrolled may affirmatively elect a different rate or to make all or a portion of his or her deferrals on a Roth after-tax or after-tax basis. Automatic contributions are invested in the Vanguard Target Retirement Fund option with a target retirement date closest to the year in which the participant will reach age 65, unless the participant affirmatively elects to invest his or her deferrals into one or more of the other Plan investment options. Temporary employees may become eligible to participate in the Plan upon completing six months of service, regardless of the number of hours of service completed.

Contributions and Funding Policy — Participants may elect to contribute to the Plan from one to 75% of their annual compensation on a pre-tax basis, an after-tax basis, a Roth after-tax basis, or a combination of these three, as defined by the Plan. The contribution limit for highly compensated employees, defined as those whose annual earnings equal at least $135,000 in 2022 and $130,000 in 2021, is 10% of annual compensation. Those participants who meet the eligibility requirements may contribute additional amounts (age 50 catch-up contributions), which are not eligible for a Company matching contribution. Contributions are invested in the Plan investment options selected by the participant and are subject to certain Code limitations.

The Company contributes on a matching basis 50% of the first 6% of each participant’s pre-tax or Roth after-tax contributions.

In accordance with the Code, participant pre-tax and Roth after-tax contributions could not exceed $20,500 in 2022 and $19,500 in 2021. Pre-tax catch-up contributions could not exceed $6,500 in 2022 and 2021. Discrimination tests are

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

performed annually, and any test discrepancies are resolved in accordance with applicable Internal Revenue Service (“IRS”) guidance.

In addition to participant deferral contributions and Company matching contributions on those deferrals, the Plan provided a 3% non-matching Company contribution to eligible participants in 2022 and 2021.

Rollover Contributions — Rollover contributions from other qualified plans are accepted by the Plan. Rollover contributions represent participant account balances of employees transferred from other non-company qualified plans.

Investments — Participants direct the investment of contributions into various investment options offered by the Plan. The Plan offers registered investment companies (including a money market fund), collective trust funds (including a stable value fund) and, as of December 31, 2022, the Crane Holdings, Co. Stock Fund as investment options for participants.

Participants are not permitted to invest more than 20% of their Plan account balance in the Crane Holdings, Co. Stock Fund investment option. Participants with more than 20% of their Plan account balance in the Crane Holdings, Co. Stock Fund investment option are not permitted to contribute to, or transfer money from, other Plan investments to the Crane Holdings, Co. Stock Fund while the fund balance exceeds the 20% limit.

Participant Accounts — Individual accounts are maintained for each participant in the Plan. Each participant’s account is credited with the participant’s contributions and related matching and non-matching Company contributions and Plan earnings. Participant accounts are also charged with withdrawals and an allocation of Plan losses and administrative fees that are paid by the Plan. Allocations are based on participant earnings or account balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting — Participant contributions plus actual earnings thereon are immediately vested. Vesting for matching and non-matching Company contributions generally is as follows:

| | | | | | | | |

| Years of Service | | Vested Interest |

| Less than 1 year | | None |

| 1 year but fewer than 2 | | 20% |

| 2 years but fewer than 3 | | 40% |

| 3 years but fewer than 4 | | 60% |

| 4 years but fewer than 5 | | 80% |

| 5 years or more | | 100% |

Participants whose employment terminates by reason of death, permanent disability or retirement are fully vested. Participants also are fully vested upon the attainment of age 65. Certain accounts that were merged into the Plan from other plans are subject to different vesting schedules.

Forfeited Accounts — When certain terminations of participation in the Plan occur, the non-vested portion of the participant's account, as defined by the Plan, represents a forfeiture. These forfeited non-vested accounts may be used to reduce future Company contributions. During the years ended December 31, 2022 and 2021, Company contributions were reduced by $1,805,008 and $4,252,053, respectively, from forfeited non-vested accounts. As of December 31, 2022 and 2021, the remaining balance in forfeited non-vested accounts totaled $732,728 and $459,115, respectively.

Payment of Benefits — Upon retirement, disability, termination of employment or death, a participant or designated beneficiary will receive a distribution in the form of a lump sum, installment or partial payment equal to all or a portion of the participant’s account balance. If the participant’s account balance is greater than $1,000, the participant may elect to defer the withdrawal until reaching the age of 72. A participant may apply to the Committee for a distribution in cases of hardship. The Committee has the sole discretion to approve or disapprove hardship withdrawal requests, in accordance with the Code.

Notes Receivable from Participants — Participants may borrow from their accounts a minimum of $1,000 up to a maximum equal to $50,000 or 50% of their vested account balance, whichever is less. Loans are secured by an assignment of the

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

participant’s vested interest in the Plan, and bear interest at the prevailing prime lending rate as of the date the loan is made, plus 2%. Principal and interest are paid ratably through payroll deductions. Loan terms range from one to five years or up to 15 years for the purchase of a primary residence. Certain participant accounts that were merged into the Plan from other plans are subject to different loan terms. Participants may not have more than two loans outstanding at any time. As of December 31, 2022, participant loans have maturities through 2037 at interest rates ranging from 3.25% to 10.0%, which includes loans that were transferred from the Company's acquisitions that maintained their historical provisions.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed in preparation of the financial statements of the Plan.

Basis of Accounting — The financial statements of the Plan have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Use of Estimates — The preparation of financial statements in conformity with GAAP requires Plan management to make estimates and assumptions that affect the reported amounts of assets available for benefits and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risks and Uncertainties — The Plan utilizes various investment instruments, including registered investment companies (including a money market fund), collective trust funds (including a stable value fund) and as of December 31, 2022, a Crane Holdings, Co. Stock Fund. Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the financial statements.

Concentration of Investments — Included in investments at December 31, 2022 and 2021, were shares of Crane Holdings, Co. common stock amounting to $72,123,885 and shares of Crane Co. common stock amounting to $77,175,611, respectively. See Note 1. for more information regarding the Reorganization of Crane Co. This investment represents 6% and 5% of total investments at December 31, 2022 and 2021 respectively. A significant decline in the market value of the Crane Holdings, Co. common stock or its successors thereafter would significantly affect the assets available for benefits.

Investment Valuation — The Plan’s investments are stated at fair value. Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Investment Transactions and Income Recognition — Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Notes Receivable from Participants — Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent participant loans are recorded as benefits paid to participants based on the terms of the Plan document.

Administrative Expenses — Plan administrative expenses are paid out of the Plan assets or by the Company in compliance with the terms of the Plan document and ERISA guidance. Participants pay administrative costs for loans, withdrawals, beneficiary determinations, and hardship distributions, as well as qualified domestic relations orders.

All investment management and transaction fees directly related to the Plan investments are paid by the Plan. Management fees and operating expenses charged to the Plan for investments are deducted from income earned and are not separately reflected. Consequently, investment management fees and operating expenses are reflected as a reduction of investment return for such investments. The Plan also has a revenue-sharing agreement with non-Vanguard investments whereby certain investment managers return a portion of the investment fees to the recordkeeper, which are then credited on a quarterly basis to the participants who are invested in those funds. There were no unallocated amounts related to the revenue sharing agreements on December 31, 2022 or 2021. Personnel and facilities of the Company used by the Plan for its accounting and other activities are provided at no charge to the Plan.

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

Payment of Benefits — Benefit payments to participants are recorded upon distribution. There were no participants who requested a distribution from the Plan, but who had not yet been paid such distribution as of December 31, 2022 and 2021.

NOTE 3. FAIR VALUE MEASUREMENTS

ASC 820, Fair Value Measurements and Disclosures, provides a framework for measuring fair value. Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value, as follows: Level 1, which refers to securities valued using unadjusted quoted prices from active markets for identical assets; Level 2, which refers to securities not traded on an active market but for which observable market inputs are readily available; and Level 3, which refers to securities valued based on significant unobservable inputs. Assets are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The Plan’s policy is to recognize significant transfers between levels at the end of the reporting period.

The following is a description of the valuation methodologies used for assets measured at fair value:

Investments in Registered Investment Companies: Valued at the daily closing price as reported by the respective funds based on quoted market prices from active markets and categorized as Level 1.

Money Market Fund: Short-term money market accounts are categorized as Level 1. They are valued at amortized cost, which approximates fair value.

Crane Holdings, Co. Stock Fund: A separately managed account that is a valued daily and based on the underlying stock's closing price on its primary exchange. The fund owns the underlying securities of the separately managed account and is generally considered separately as individual investments for accounting, auditing and financial statement reporting purposes. Crane Holdings, Co. common stock is categorized as Level 1.

Crane Co. Stock Fund: A separately managed account that is a valued daily and based on the underlying stock's closing price on its primary exchange. The fund owns the underlying securities of the separately managed account and is generally considered separately as individual investments for accounting, auditing and financial statement reporting purposes. Crane Co. common stock is categorized as Level 1.

Collective Trust Funds: Valued at the net asset value ("NAV") of shares of a bank collective trust held by the Plan at year-end. The NAV is used as a practical expedient to estimate fair value and is based on the fair value of the underlying investments held by the fund less its liabilities. Participant transactions (issuances and redemptions) may occur daily. Were the Plan to initiate a full redemption of the collective trust, the investment advisor reserves the right to temporarily delay withdrawal from the trust in order to ensure the securities liquidations will be carried out in an orderly business manner.

Stable Value Fund - The stable value fund is composed primarily of fully benefit-responsive investment contracts and is valued at the NAV of units of the collective trust. The net asset value is used as a practical expedient to estimate fair value. This practical expedient would not be used if it is determined to be probable that the fund will sell the investment for an amount different from the reported net asset value. Participant transactions (issuances and redemptions) may occur daily. If the Plan initiates a full redemption of the collective trust, the issuer reserves the right to require 12 months’ notification in order to confirm that securities liquidations will be carried out in an orderly business manner.

The following tables set forth by level within the fair value hierarchy a summary of the Plan’s investments measured at fair value on a recurring basis as of December 31, 2022 and 2021.

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value Measurements as of December 31, 2022 Using: |

| | | Active Markets

for Identical

Assets (Level 1) | | Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| Registered Investment Companies: | | | | | | | | |

| Domestic stock funds | | $ | 328,040,689 | | | $ | — | | | $ | — | | | $ | 328,040,689 | |

| International stock funds | | 78,248,986 | | | — | | | — | | | 78,248,986 | |

| Bond fund | | 73,568,149 | | | — | | | — | | | 73,568,149 | |

| Money market fund | | 732,728 | | | — | | | — | | | 732,728 | |

| Crane Holdings, Co. Stock Fund | | 72,123,885 | | | — | | | — | | | 72,123,885 | |

| Total | | $ | 552,714,437 | | | $ | — | | | $ | — | | | $ | 552,714,437 | |

| Investments measured at NAV: | | | | | | | | |

| Collective Trust Funds | | | | | | | | $ | 506,242,918 | |

| Stable Value Fund | | | | | | | | 137,457,473 | |

| Total investments | | | | | | | | $ | 1,196,414,828 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value Measurements as of December 31, 2021 Using: |

| | | Active Markets

for Identical

Assets (Level 1) | | Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| Registered Investment Companies: | | | | | | | | |

| Domestic stock funds | | $ | 522,869,154 | | | $ | — | | | $ | — | | | $ | 522,869,154 | |

| International stock funds | | 96,435,623 | | | — | | | — | | | 96,435,623 | |

| Bond fund | | 87,964,114 | | | — | | | — | | | 87,964,114 | |

| Money market fund | | 459,115 | | | — | | | — | | | 459,115 | |

| Crane Co. Stock Fund | | 77,175,611 | | | — | | | — | | | 77,175,611 | |

| Total | | $ | 784,903,617 | | | $ | — | | | $ | — | | | $ | 784,903,617 | |

| Investments measured at NAV: | | | | | | | | |

| Collective Trust Funds | | | | | | | | $ | 524,295,353 | |

| Stable Value Funds | | | | | | | | 132,176,398 | |

| Total investments | | | | | | | | $ | 1,441,375,368 | |

NOTE 4. STABLE VALUE FUND

The Vanguard Retirement Savings Trust III is a collective trust fund sponsored by Vanguard. The beneficial interest of each participant is represented by units. Units are issued and redeemed daily at the Fund’s constant NAV of $1 per unit. Distribution to the Fund’s unit holders is declared daily from the net investment income and automatically reinvested in the Fund on a monthly basis, when paid. It is the policy of the Fund to use best efforts to maintain a stable NAV of $1 per unit; although there is no guarantee that the Funds will be able to maintain this value.

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

NOTE 5. NET ASSET VALUE PER SHARE

The following tables set forth a summary of the Plan’s investments whose values were estimated using a reported NAV at December 31, 2022 and 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value Estimated Using NAV as of December 31, 2022 |

| Investment | | Fair Value1 | | Unfunded

Commitment | | Redemption

Frequency | | Other

Redemption

Restrictions | | Redemption

Notice

Period |

| Vanguard Retirement Savings Trust III | | $ | 137,457,473 | | | None | | Immediate | | see Note 4 | | None |

| | | | | | | | | | |

| T. Rowe Price Blue Chip Growth Trust; T2 Class | | $ | 77,483,422 | | | None | | Immediate | | None | | None |

| Target date retirement collective trust funds | | $ | 428,759,496 | | | None | | Immediate | | None | | None |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value Estimated Using NAV as of December 31, 2021 |

| Investment | | Fair Value1 | | Unfunded

Commitment | | Redemption

Frequency | | Other

Redemption

Restrictions | | Redemption

Notice

Period |

| Vanguard Retirement Savings Trust III | | $ | 132,176,397 | | | None | | Immediate | | see Note 4 | | None |

| Target date retirement collective trust funds | | $ | 524,295,353 | | | None | | Immediate | | see Note 4 | | None |

| | | | | |

| 1 | The fair values of the investments have been estimated using the NAV of the investment |

| |

NOTE 6. EXEMPT PARTY-IN-INTEREST TRANSACTIONS

Certain Plan investments are shares of Crane Holdings, Co. common stock and registered investment companies and collective trust funds managed by Vanguard. As of December 31,2022, Crane Holdings, Co. was the Plan sponsor and Vanguard was a trustee as defined by the Plan (see Note 1), and, therefore, these transactions qualify as exempt party-in-interest transactions. Balances of these funds as of December 31, 2022 and 2021 were $1,036,893,912 and $1,203,305,660, respectively. These funds had net investment loss of $147,564,069 and net investment income of $148,918,659 for the years ended December 31, 2022 and 2021, respectively. Fees incurred for investment management services, if any, were paid by the Plan as a reduction in the return on investment.

As of December 31, 2022 the Plan held 718,007 shares, of common stock of Crane Holdings, Co., the Plan sponsor as of December 31, 2022, with a cost basis of $35,424,776 and fair value of $72,123,885. During the year ended December 31, 2022 the Plan recorded investment income of $501,506 related to its investment in the common stock of Crane Holdings, Co.

As of December 31, 2021, the Plan held 758,632 shares of common stock of Crane Co., the Plan sponsor as of December 31, 2021, with a cost basis of $35,770,358 and fair value of $77,175,611. During the year ended December 31, 2021, the Plan recorded investment income of $21,840,997 related to its investment in the common stock of Crane Co.

Certain officers and employees of the Company (who may also be participants in the Plan) perform administrative services related to the operation and financial reporting of the Plan. The Company pays these individuals salaries and also pays other administrative expenses on behalf of the Plan.

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

NOTE 7. PLAN TERMINATION

The Company expects to continue the Plan indefinitely, but reserves the right to modify, suspend or terminate the Plan at any time, which includes the right to vary the amount of, or to terminate, the Company’s contributions to the Plan. In the event of the Plan’s termination or discontinuance of contributions thereunder, the interest of each participant in benefits earned to such date, to the extent then funded, is fully vested and non-forfeitable. Subject to the requirements of the Code, the Board of Directors shall thereupon direct either (i) Vanguard to hold the accounts of participants in accordance with the provisions of the Plan without regard to such termination until all funds in such accounts have been distributed in accordance with such provisions, or (ii) Vanguard to immediately distribute to each participant all amounts then credited to the participant’s account as a lump sum.

NOTE 8. FEDERAL INCOME TAX STATUS

The IRS has determined and informed the Company by letter dated June 23, 2020 that the Plan and related trust are designed in accordance with applicable sections of the Code. The Company and the Plan Administrator believe that the Plan was designed and was being operated in compliance with the applicable requirements of the Code and the Plan and related trust continued to be tax-exempt. Therefore, no provision for income taxes is included in the Plan’s financial statements.

NOTE 9. RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of assets available for benefits and changes in assets available for benefits per the financial statements to the Form 5500 as of December 31, 2022 and 2021:

| | | | | | | | | | | | | | |

| | 2022 | | 2021 |

| Statements of Assets Available for Benefits: | | | | |

| Assets available for benefits per the financial statements | | $ | 1,212,107,933 | | | $ | 1,457,107,020 | |

| Deemed distributions | | (333,339) | | | (256,027) | |

| Net Assets per the Form 5500, at fair value | | $ | 1,211,774,594 | | | $ | 1,456,850,993 | |

| | | | |

| | | 2022 | | 2021 |

| Statements of Changes in Assets Available for Benefits: | | | | |

| (Decrease) Increase in assets available for benefits per the financial statements | | $ | (244,999,087) | | | $ | 122,069,528 | |

| Deemed distributions | | (77,312) | | | (35,169) | |

| Net (loss) income per Form 5500 | | $ | (245,076,399) | | | $ | 122,034,359 | |

NOTE 10. SUBSEQUENT EVENT

In anticipation of the spin-off of Crane Company from Crane Holdings, Co. (the "Spin-Off”), Crane Holdings, Co. transferred sponsorship of the Plan to Crane Company effective as of January 1, 2023. In connection with this change in Plan sponsorship, Crane Holdings, Co. became a participating employer in the Plan effective as of January 1, 2023 and, on and after January 1, 2023, the Plan became known as the Crane Savings and Investment Plan.

In connection with the Spin-Off, effective April 3, 2023, Crane Holdings, Co. became Crane NXT, Co. (“Crane NXT”) and ceased its participation in the Plan. Contemporaneously, Crane NXT established the Crane NXT Savings and Investment Plan (the “Crane NXT Plan”) to provide benefits to its eligible employees and the eligible employees of its participating affiliates that were identical to those in effect under the Plan immediately prior to the Spin-Off. In connection with the Spin-Off, the account balance of each eligible employee of Crane NXT and its participating affiliates who was a participant in the Plan immediately prior to the completion of the Spin-Off was spun-off from the Plan and transferred to the Crane NXT Plan.

CRANE SAVINGS AND INVESTMENT PLAN (formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

The Plan was amended and restated effective April 3, 2023 to reflect the cessation of Crane NXT’s participation in the Plan and the spin-off of the account balances of eligible employees of Crane NXT and its participating affiliates from the Plan to the Crane NXT Plan, and to otherwise meet current needs.

As part of the Spin-Off total assets of $298,849,780 and 1,974 active accounts were transferred from the plan to the Crane NXT plan.

Post Spin Off the Plan includes the Crane Company Stock Fund, an employer stock fund, as well as the Crane NXT, Co. Stock Fund, a single stock fund.

CRANE SAVINGS AND INVESTMENT PLAN

(formerly known as the AMENDED AND RESTATED CRANE CO. SAVINGS AND INVESTMENT PLAN)

FORM 5500, SCHEDULE H, PART IV, LINE 4i—SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EMPLOYER ID NO: 88-2846451

PLAN ID NO: 038

December 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| ( a ) | | ( b ) | | ( c ) | | ( d ) | | ( e ) |

| | | Identity of Issue, Borrower, Lessor or Similar Party | | Description of Investment,

Including Maturity Date, Rate of

Interest, Collateral, and Par or

Maturity Value | | Cost | | Current Value |

| | American Funds EuroPacific Growth Fund; Class R-6 | | Registered Investment Company | | | | $ | 19,202,148 | |

| | Carillon Eagle Mid Cap Growth Fund; Class R6 | | Registered Investment Company | | ** | | 23,693,361 | |

| | JP Morgan Mid Cap Value Fund; Class L | | Registered Investment Company | | ** | | 26,263,920 | |

| | PIMCO Total Return Fund; Institutional Class | | Registered Investment Company | | ** | | 12,878,065 | |

| * | | Vanguard Equity Income Fund Admiral Shares | | Registered Investment Company | | ** | | 67,465,135 | |

| * | | Vanguard Federal Money Market Fund | | Registered Investment Company | | ** | | 732,728 | |

| * | | Vanguard Institutional Index Fund Instl Plus Shares | | Registered Investment Company | | ** | | 131,854,780 | |

| * | | Vanguard Mid-Cap Index Fund Institutional Shares | | Registered Investment Company | | ** | | 31,590,978 | |

| * | | Vanguard Small-Cap Index Fund Institutional Shares | | Registered Investment Company | | ** | | 34,294,450 | |

| * | | Vanguard Total Bond Market Index Fund: Inst'l Shr | | Registered Investment Company | | ** | | 73,568,149 | |

| * | | Vanguard Total International Stock Index Fund: Inst'l Shr | | Registered Investment Company | | ** | | 59,046,838 | |

| | TRP Blue Chip Growth T2 | | Common/Collective Trust | | ** | | 77,483,422 | |

| * | | Vanguard Retirement Savings Trust III | | Common/Collective Trust | | ** | | 137,457,473 | |

| * | | Vanguard Target Retirement 2020 Trust I | | Common/Collective Trust | | ** | | 41,039,860 | |

| * | | Vanguard Target Retirement 2025 Trust I | | Common/Collective Trust | | ** | | 83,367,314 | |

| * | | Vanguard Target Retirement 2030 Trust I | | Common/Collective Trust | | ** | | 80,888,224 | |

| * | | Vanguard Target Retirement 2035 Trust I | | Common/Collective Trust | | ** | | 62,660,916 | |

| * | | Vanguard Target Retirement 2040 Trust I | | Common/Collective Trust | | ** | | 45,993,011 | |

| * | | Vanguard Target Retirement 2045 Trust I | | Common/Collective Trust | | ** | | 32,092,870 | |

| * | | Vanguard Target Retirement 2050 Trust I | | Common/Collective Trust | | ** | | 29,860,584 | |

| * | | Vanguard Target Retirement 2055 Trust I | | Common/Collective Trust | | ** | | 16,463,739 | |

| * | | Vanguard Target Retirement 2060 Trust I | | Common/Collective Trust | | ** | | 10,433,296 | |

| * | | Vanguard Target Retirement 2065 Trust I | | Common/Collective Trust | | ** | | 2,132,688 | |

| * | | Vanguard Target Retirement 2070 Trust I | | Common/Collective Trust | | ** | | 14,582 | |

| * | | Vanguard Target Retirement Income Trust I | | Common/Collective Trust | | ** | | 23,812,412 | |

| * | | Crane Holdings, Co. Stock Fund | | Company Stock Fund | | ** | | 72,123,885 | |

| | Loan Fund | | Participant Loans (Loans have interest rates ranging from 3.25% - 10.0% and mature in 2023 through 2037) | | *** | | 15,620,628 | |

| | | | | | | | $ | 1,212,035,456 | |

| | | | | |

| * | Represents a party-in-interest to the plan. |

| ** | Cost information is not required for participant-directed investments and therefore is not included. |

| *** | Represents total loans outstanding, net of $333,339 of deemed distributions. |

| | | | | |

| | See accompanying Report of Independent Registered Public Accounting Firm. |

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Crane Companies' Savings Plan Committee of Crane Savings and Investment Plan has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| CRANE COMPANIES' SAVINGS PLAN COMMITTEE OF THE |

| CRANE SAVINGS AND INVESTMENT PLAN |

| | |

|

| /s/ Richard A. Maue |

| Richard A. Maue |

| On behalf of the Committee |

Stamford, CT

June 15, 2023

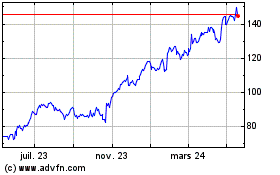

Crane (NYSE:CR)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

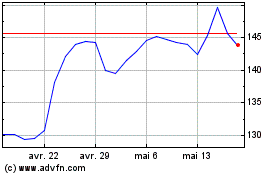

Crane (NYSE:CR)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024