0001944013false00019440132024-01-032024-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 3, 2024

CRANE COMPANY

(Exact name of registrant as specified in its charter)

DELAWARE

(State or other jurisdiction of incorporation)

| | | | | | | | | | | |

Delaware | 1-41570 | 88-2846451 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

| 100 First Stamford Place | Stamford | CT | 06902 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 203-363-7300

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $1.00 | CR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 8 – OTHER EVENTS

On January 3, 2024, Crane Company issued a press release (the “Press Release”) announcing, among other things, the acquisition of Vian Enterprises, Inc. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated into this Item 8.01 by reference.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| | |

| (a) | | None |

| |

| (b) | | None |

| |

| (c) | | None |

| |

| (d) | | Exhibits |

| | |

| 99.1 | | | |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | CRANE COMPANY |

| | | |

| January 3, 2024 | | | | | |

| | | |

| | | By: | | /s/ Anthony M. D'lorio |

| | | | | Anthony M. D'lorio |

| | | | | Executive Vice President, General Counsel and Secretary |

| | | | | |

| | |

| Contact: |

| Jason D. Feldman |

| Vice President, Treasury & Investor Relations |

| 203-363-7329 |

| www.craneco.com |

Crane Company Announces Acquisition of Vian Enterprises, Inc.

Significantly Strengthens Breadth of Aerospace & Electronics’ Fluid Solution Capabilities

STAMFORD, CT, (January 3, 2024) – Crane Company (“Crane,” NYSE: CR) today announced that it has acquired Vian Enterprises, Inc. (“Vian”) for approximately $103 million on a cash free and debt free basis.

Founded in 1968, Vian is a global designer and manufacturer of multi-stage lubrication pumps and lubrication system components technology for critical aerospace and defense applications with sole-sourced and proprietary content on the highest volume commercial and military aircraft platforms. Through August 2023, we estimate that Vian had trailing 12-month sales of approximately $33 million and adjusted EBITDA of approximately $8 million, with an order backlog exceeding $100 million. Crane financed the acquisition primarily with proceeds from its revolving credit facility. (Please see the Non-GAAP Explanation).

Crane’s President and CEO, Max Mitchell, said: “We are very excited to announce this transaction. Vian is highly complementary to our Fluid Solution within the Aerospace & Electronics segment, significantly expanding our portfolio of mission critical aerospace flow control products. Vian has strong positions on the most attractive commercial and military aircraft platforms today, and combined with our existing fluid and thermal management capabilities, further strengthens our positioning for future content opportunities on engines, gearboxes and auxiliary power units. We expect that Vian’s margins will be accretive to the Aerospace & Electronics’ segment EBITDA margins immediately, with a long-term sales growth rate in line with the segment’s previously disclosed 7% to 9% long-term CAGR. Vian, along with the other acquisitions that we continue to pursue, meets our clearly defined strict financial and strategic acquisition criteria.”

Mr. Mitchell concluded: “I would like to personally thank Chris and Elizabeth Vian and the Vian family for entrusting Crane as the stewards of this great business moving forward. I also would like to welcome the Vian team to Crane, and to acknowledge the effort and success of all of Vian’s valued employees, who have grown this business into a leading industry supplier of aerospace lubrication solutions and related products. We look forward to working together in the years ahead, investing for further growth and building on the strong legacy and track record of both companies.”

Crane will provide further updates on the Vian acquisition during the fourth quarter earnings call.

Announces Date for Fourth Quarter 2023 Earnings Release and Teleconference

Crane announces the following schedule and teleconference information for its fourth quarter 2023 earnings release:

•Earnings Release: January 29, 2024 after close of market by public distribution and the Crane Company website at www.craneco.com.

•Teleconference: January 30, 2024 at 10:00 AM (Eastern) hosted by Max H. Mitchell, President & CEO, and Richard A. Maue, Executive Vice President & CFO. The call can be accessed in a listen-only mode via the Company’s website www.craneco.com. An accompanying slide presentation will also be available on the Company’s website.

•Web Replay: Will be available on the Company’s website shortly after completion of the live call.

About Crane Company

Crane Company has delivered innovation and technology-led solutions to its customers since its founding in 1855. Today, Crane is a leading manufacturer of highly engineered components for challenging, mission-critical applications focused on the aerospace, defense, space and process flow industry end markets. The Company is comprised of two strategic growth platforms, Aerospace & Electronics and Process Flow Technologies, as well as the Engineered Materials segment. Crane has approximately 7,000 employees in the Americas, Europe, the Middle East, Asia and Australia. For more information, visit www.craneco.com.

Forward-Looking Statements Disclaimer

This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations, including, but not limited to: statements regarding Crane’s portfolio following the business separation; benefits and synergies of the separation transaction; strategic and competitive advantages of Crane; future financing plans and opportunities; and business strategies, prospects and projected operating and financial results. We caution investors not to place undue reliance on any such forward-looking statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),” “believe(s),” “plan(s),” “may,” “will,” “would,” “could,” “should,” “seek(s),” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These statements are based on management’s current expectations and beliefs and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained.

Risks and uncertainties that could cause actual results to differ materially from our expectations include, but are not limited to: changes in global economic conditions (including inflationary pressures) and geopolitical risks, including macroeconomic fluctuations that may harm our business, results of operation and stock price; the continuing effects from the COVID-19 pandemic on our business and the global and U.S. economies generally; information systems and technology networks failures and breaches in data security, theft of personally identifiable and other information, non-compliance with our contractual or other legal obligations regarding such information; our ability to source components and raw materials from suppliers, including disruptions and delays in our supply chain; demand for our products, which is variable and subject to factors beyond our control; governmental

regulations and failure to comply with those regulations; fluctuations in the prices of our components and raw materials; loss of personnel or being able to hire and retain additional personnel needed to sustain and grow our business as planned; risks from environmental liabilities, costs, litigation and violations that could adversely affect our financial condition, results of operations, cash flows and reputation; risks associated with conducting a substantial portion of our business outside the U.S.; being unable to identify or complete acquisitions, or to successfully integrate the businesses we acquire, or complete dispositions; adverse impacts from intangible asset impairment charges; potential product liability or warranty claims; being unable to successfully develop and introduce new products, which would limit our ability to grow and maintain our competitive position and adversely affect our financial condition, results of operations and cash flow; significant competition in our markets; additional tax expenses or exposures that could affect our financial condition, results of operations and cash flows; inadequate or ineffective internal controls; specific risks relating to our reportable segments, including Aerospace & Electronics, Process Flow Technologies and Engineered Materials; the ability and willingness of Crane Company and Crane NXT, Co. to meet and/or perform their obligations under any contractual arrangements that were entered into among the parties in connection with the separation transaction and any of their obligations to indemnify, defend and hold the other party harmless from and against various claims, litigation and liabilities; and the ability to achieve some or all the benefits that we expect to achieve from the separation transaction.

Readers should carefully review Crane’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Crane’s Annual Report on Form 10-K for the year ended December 31, 2022 and the other documents Crane and its subsidiaries file from time to time with the SEC. Readers should also carefully review the “Risk Factors” section of the information statement filed as an exhibit to Crane’s registration statement on Form 10. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

These forward-looking statements reflect management’s judgment as of this date, and Crane assumes no (and disclaims any) obligation to revise or update them to reflect future events or circumstances.

We make no representations or warranties as to the accuracy of any projections, statements or information contained in this document. It is understood and agreed that any such projections, targets, statements and information are not to be viewed as facts and are subject to significant business, financial, economic, operating, competitive and other risks, uncertainties and contingencies many of which are beyond our control, that no assurance can be given that any particular financial projections ranges, or targets will be realized, that actual results may differ from projected results and that such differences may be material. While all financial projections, estimates and targets are necessarily speculative, we believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets. The inclusion of financial projections, estimates and targets in this press release should not be regarded as an indication that we or our representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events.

Non-GAAP Explanation

Crane Company reports its financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). This press release includes a non-GAAP financial measure, adjusted EBITDA, for the recently acquired Vian that is not prepared in accordance with GAAP. This non-GAAP measure is in addition to, and not a substitute

for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to operating income, net income or any other performance measures derived in accordance with GAAP. We believe that this non-GAAP measures of financial results (including on a forward-looking or projected basis) provides useful supplemental information to investors about Vian. Our management uses this forward-looking non-GAAP measure, among other GAAP and non-GAAP measures, to evaluate and assess the projected financial and operating results of Vian. However, there are a number of limitations related to the use of this non-GAAP measure and its nearest GAAP equivalent. For example, other companies may calculate non-GAAP measures differently or may use other measures to calculate their financial performance, and therefore our non-GAAP measures may not be directly comparable to similarly titled measures of other companies.

Reconciliations of certain forward-looking and projected non-GAAP measures for Vian, including Adjusted EBITDA, to the closest corresponding GAAP measure are not available without unreasonable efforts due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures, which could have a potentially significant impact on our future GAAP results. In the case of Vian specifically, access to certain information necessary to fully reconcile forecasts of non-GAAP measures to their nearest GAAP equivalent measure is not yet available. The forward looking and projected non-GAAP measure is calculated as follows:

"Adjusted EBITDA" adds back to net income: net interest expense, income tax expense, depreciation and amortization, and Special Items such as transaction related expenses, certain non-recurring facility move and lease expenses, and prior owner personal and discretionary expenses. We believe that adjusted EBITDA provides investors with an alternative metric that may be a meaningful indicator of Vian’s performance and provides useful information to investors regarding its financial conditions that is complementary to GAAP metrics. Further, for Vian, adjusted EBITDA may also be a useful complementary measure to GAAP metrics because it excludes certain items, namely net interest expense, income tax expense, and amortization, that could vary significantly when forecasted for Vian pre-acquisition as a standalone entity compared to what those results may be with Vian under Crane’s ownership.

Source: Crane Company

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

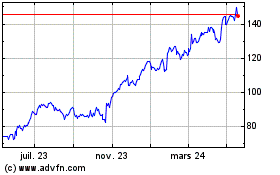

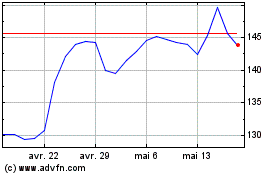

Crane (NYSE:CR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Crane (NYSE:CR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024