As filed with the Securities and Exchange Commission on February 21, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CARVANA CO.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 81-4549921 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

300 E. Rio Salado Parkway

Tempe, Arizona | | 85281 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Carvana Co. 2017 Omnibus Incentive Plan

(Full title of the Plan)

Ernest C. Garcia, III

President, Chief Executive Officer and Chairman

300 E. Rio Salado Parkway

Tempe, Arizona 85281

Telephone: (602) 922-9866

(Name, address and telephone number, including area code, of agent for service)

Copies to:

Robert M. Hayward, P.C.

Robert E. Goedert, P.C.

Michael P. Keeley, P.C.

Kirkland & Ellis LLP

333 West Wolf Point Plaza

Chicago, Illinois 60654

(312) 862-2000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer

| ☐ | |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |

| | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨ |

EXPLANATORY NOTE

Carvana Co. (the “Company”) is filing this Registration Statement on Form S-8 with the United States Securities and Exchange Commission (the “SEC”) to register up to 2,665,416 additional shares of the Company’s Class A common stock, par value $0.001 per share (“Class A Common Stock”), which have been authorized and reserved for issuance under the Carvana Co. 2017 Omnibus Incentive Plan (as amended on June 5, 2017, August 22, 2017, and May 1, 2023, the “Plan”) as a result of the annual evergreen increase under the Plan and shares of Class A common stock that may again become available for delivery with respect to awards under the Plan pursuant to the share counting, share recycling and other terms and conditions of the Plan. In accordance with General Instruction E of Form S-8, this Registration Statement hereby incorporates by reference the contents of (i) the Registration Statement on Form S-8 (File No. 333-217520), filed by the Company with the SEC on April 28, 2017, (ii) the Registration Statement on Form S-8 (File No. 333-269560), filed by the Company with the SEC on February 3, 2023, (iii) the Registration Statement on Form S-8 (File No. 333-271690), filed by the Company with the SEC on May 5, 2023 and (iv) the Registration Statement on Form S-8 (File No. 333-277329), filed by the Company with the SEC on February 23, 2024.

Item 8. Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Tempe, State of Arizona, on this 21st day of February, 2025.

| | | | | | | | |

| CARVANA CO. |

| | |

| By: | /s/ Ernest C. Garcia, III |

| Name: | Ernest C. Garcia, III |

| Title: | President, Chief Executive Officer and Chairman |

POWERS OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Paul Breaux and Stephen Palmer and each or any one of them, his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this Registration Statement on Form S-8, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the United States Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their or his or her substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on February 21, 2025.

| | | | | | | | |

Name | | Position |

| | |

| /s/ Ernest C. Garcia, III | | President, Chief Executive Offer and Chairman |

| Ernest C. Garcia, III | | (Principal Executive Officer) |

| | |

| /s/ Mark Jenkins | | Chief Financial Officer |

| Mark Jenkins | | (Principal Financial Officer) |

| | |

| /s/ Stephen Palmer | | Vice President of Accounting and Finance |

| Stephen Palmer | | (Principal Accounting Officer) |

| | |

| /s/ Michael Maroone | | Director |

| Michael Maroone | | |

| | |

| /s/ Dan Quayle | | Director |

| Dan Quayle | | |

| | |

| /s/ Neha Parikh | | Director |

| Neha Parikh | | |

| | |

| /s/ Ira Platt | | Director |

| Ira Platt | | |

| | |

| /s/ Greg Sullivan | | Director |

| Greg Sullivan | | |

S-8

S-8

EX-FILING FEES

0001690820

CARVANA CO.

Fees to be Paid

0001690820

2025-02-20

2025-02-20

0001690820

1

2025-02-20

2025-02-20

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

CARVANA CO.

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Class A Common Stock

|

Other

|

2,665,416

|

$

268.80

|

$

716,463,820.80

|

0.0001531

|

$

109,690.61

|

|

Total Offering Amounts:

|

|

$

716,463,820.80

|

|

$

109,690.61

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

109,690.61

|

|

1

|

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the "Securities Act"), this registration

statement on Form S-8 (the "Registration Statement") shall also cover any additional shares of the Registrant's Class A

common stock, $0.001 par value per share (the "Class A Common Stock"), that become issuable under the Carvana

Co. 2017 Omnibus Incentive Plan (as amended on June 5, 2017, August 22, 2017 and May 1, 2023) (the "Plan") by

reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of

consideration that increases the number of the Registrant's outstanding shares of Common Stock.

(2) This Registration Statement covers an additional 2,665,416 shares of the Registrant's Class A Common Stock,

which are issuable pursuant to the Plan, which includes shares of Class A Common Stock that may again become

available for delivery with respect to awards under the Plan pursuant to the share counting, share recycling and other

terms and conditions of the Plan.

(3) Estimated in accordance with Rule 457(c) and (h) under the Securities Act solely for the purpose of calculating the

registration fee on the basis of $268.80 the average of the high and low prices of the Registrant's Class A Common

Stock as reported on The New York Stock Exchange on February 13, 2025 which date is within five business days

prior to the filing of this Registration Statement.

|

|

|

Exhibit 5.1

| | | | | | | | |

| 333 West Wolf Point Plaza | |

| Chicago, IL 60654 | |

| United States | |

| | |

| +1 312 862 2000 | Facsimile: +1 312 862 2200

|

| |

| www.kirkland.com | |

February 21, 2025

Carvana Co.

300 E. Rio Salado Parkway

Tempe, AZ 85281

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We are acting as special counsel to Carvana Co., a Delaware corporation (the “Company”), in connection with the filing by the Company of a Registration Statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Act”), with the Securities and Exchange Commission (the “Commission”) covering the offering of up to 2,665,416 shares of the Company’s Class A common stock, par value $0.001 per share (the “Shares”), under the Carvana Co. 2017 Omnibus Incentive Plan (as amended on June 5, 2017, August 22, 2017 and May 1, 2023, the “Omnibus Plan”), including Shares that may again become available for delivery with respect to awards under the Omnibus Plan pursuant to the share counting, share recycling and other terms and conditions of the Omnibus Plan.

In reaching the opinions set forth herein, we have examined such documents, records, certificates, resolutions and other instruments as we have considered necessary or advisable for purposes of this opinion letter, including (i) the organizational documents of the Company, including the Amended and Restated Certificate of Incorporation, (ii) minutes and records of the corporate proceedings of the Company, including certain resolutions adopted by the Board of Directors of the Company (the “Board”), (iii) the Omnibus Plan, and (iv) the Registration Statement and the exhibits thereto.

For purposes of this opinion, we have assumed (i) the authenticity of all documents submitted to us as originals, (ii) the conformity to the originals of all documents submitted to us as copies and the authenticity of the originals of all documents submitted to us as copies, (iii) the legal capacity of all natural persons, (iv) the genuineness of all signatures, (v) the authority of all persons signing all documents submitted to us on behalf of the parties thereto, (vi) that all information contained in all documents reviewed by us is true, correct and complete, and (vii) that the Shares will be issued in accordance with the terms of the Omnibus Plan. We have not independently established or verified any facts relevant to our opinion expressed herein, but have relied upon statements and representations of officers or other representatives of the Company.

Based upon and subject to the foregoing qualifications, assumptions and limitations and the further limitations set forth herein and having due regard for the legal considerations we deem relevant, we are of the opinion that the Shares are duly authorized and when (i) the Registration Statement becomes effective under the Act, and (ii) the Shares are issued in accordance with the terms of the Amended and Restated Certificate of Incorporation, the Omnibus Plan and the instruments executed thereunder, the Shares will be validly issued, fully paid and non-assessable.

Our opinions expressed above are subject to the qualification that we express no opinion as to the applicability of, compliance with, or effect of any laws except the General Corporation Law of the State of Delaware.

Austin Bay Area Beijing Boston Brussels Dallas Frankfurt Hong Kong Houston London Los Angeles Miami Munich New York Paris Riyadh Salt Lake City Shanghai Washington, D.C.

Carvana Co.

February 21, 2025

Page 2

We have relied without independent investigation upon, among other things, an assurance from the Company that the number of shares which the Company is authorized to issue in its Amended and Restated Certificate of Incorporation exceeds the number of shares outstanding and the number of shares which the Company is obligated to issue (or had otherwise reserved for issuance) for any purposes other than issuances of the Shares by at least the number of Shares and we have assumed that such condition will remain true at all future times relevant to this opinion.

We hereby consent to the filing of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission.

We do not find it necessary for the purposes of this opinion, and accordingly we do not purport to cover herein, the application of the securities or “Blue Sky” laws of the various states to the issuance and sale of the Shares.

This opinion is limited to the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein. This opinion speaks only as of the date hereof. We assume no obligation to revise or supplement this opinion should the General Corporation Law of the State of Delaware be changed by legislative action, judicial decision or otherwise. This opinion is furnished to you in connection with the filing of the Registration Statement in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Act and is not to be used, circulated, quoted or otherwise relied upon for any other purposes.

Sincerely,

| | |

| /s/ Kirkland & Ellis LLP |

| KIRKLAND & ELLIS LLP |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our reports dated February 19, 2025 with respect to the consolidated financial statements and internal control over financial reporting of Carvana Co. included in the Annual Report on Form 10-K for the year ended December 31, 2024, which are incorporated by reference in this Registration Statement. We consent to the incorporation by reference of the aforementioned reports in this Registration Statement.

/s/ GRANT THORNTON LLP

Southfield, Michigan

February 21, 2025

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

Offerings - Offering: 1

|

Feb. 20, 2025

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Class A Common Stock

|

| Amount Registered | shares |

2,665,416

|

| Proposed Maximum Offering Price per Unit |

268.80

|

| Maximum Aggregate Offering Price |

$ 716,463,820.80

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 109,690.61

|

| Offering Note |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the "Securities Act"), this registration

statement on Form S-8 (the "Registration Statement") shall also cover any additional shares of the Registrant's Class A

common stock, $0.001 par value per share (the "Class A Common Stock"), that become issuable under the Carvana

Co. 2017 Omnibus Incentive Plan (as amended on June 5, 2017, August 22, 2017 and May 1, 2023) (the "Plan") by

reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of

consideration that increases the number of the Registrant's outstanding shares of Common Stock.

(2) This Registration Statement covers an additional 2,665,416 shares of the Registrant's Class A Common Stock,

which are issuable pursuant to the Plan, which includes shares of Class A Common Stock that may again become

available for delivery with respect to awards under the Plan pursuant to the share counting, share recycling and other

terms and conditions of the Plan.

(3) Estimated in accordance with Rule 457(c) and (h) under the Securities Act solely for the purpose of calculating the

registration fee on the basis of $268.80 the average of the high and low prices of the Registrant's Class A Common

Stock as reported on The New York Stock Exchange on February 13, 2025 which date is within five business days

prior to the filing of this Registration Statement.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

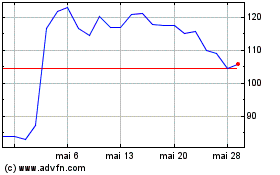

Carvana (NYSE:CVNA)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Carvana (NYSE:CVNA)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025