UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 3)

ASPEN TECHNOLOGY, INC.

(Name of Subject Company (Issuer))

EMERSUB CXV, INC.

a wholly owned subsidiary of

EMERSON ELECTRIC CO.

(Names of Filing Persons (Offeror))

EMR HOLDINGS, INC.

EMR WORLDWIDE INC.

EMR US HOLDINGS LLC

(Names of Filing Persons (Other Persons))

Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

29109X106

(Cusip Number of Class of Securities)

Michael Tang

Senior Vice President, Secretary & Chief Legal Officer

Emerson Electric Co.

8027 Forsyth Boulevard

St. Louis, MO 63105

314-553-2000

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Phillip R. Mills

Cheryl Chan

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

212-450-4000

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

☒

|

third-party tender offer subject to Rule 14d-1.

|

|

☐

|

issuer tender offer subject to Rule 13e-4.

|

|

☒

|

going-private transaction subject to Rule 13e-3.

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer. ☐

This Amendment No. 3 (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO, filed by Emersub CXV, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Purchaser”), Emerson Electric Co., a Missouri

corporation (“Parent”), EMR Holdings, Inc., a Delaware corporation, EMR Worldwide Inc., a Delaware corporation, and EMR US Holdings LLC, a Delaware limited liability company, on February 10, 2025 (together with any amendments and supplements thereto,

the “Schedule TO”). The Schedule TO relates to the offer by Purchaser to purchase all outstanding shares of common stock, par value $0.0001 per share (“Shares”), of Aspen Technology, Inc., a Delaware corporation (“AspenTech”), at a price per Share of

$265.00, net to the seller in cash, without interest (the “Offer Price”), and subject to any withholding of taxes, upon the terms and subject to the conditions described in the Offer to Purchase dated February 10, 2025 (together with any amendments or

supplements thereto, the “Offer to Purchase”) and in the accompanying Letter of Transmittal (together with any amendments or supplements thereto and with the Offer to Purchase, the “Offer”), copies of which are incorporated by reference to Exhibits

(a)(1)(i) and (a)(1)(ii) of the Schedule TO respectively.

Except as otherwise set forth in this Amendment, the information set forth in the Offer to Purchase, including all schedules thereto, is hereby expressly incorporated by reference in response to all of the items of the Schedule TO, including,

without limitation, all of the information required by Schedule 13E-3 that is not included in or covered by the items in the Schedule TO, and is supplemented by the information specifically provided herein. Capitalized terms used but not defined herein

have the applicable meanings ascribed to them in the Schedule TO or the Offer to Purchase.

Item 1 through 9, Item 11 and Item 13.

Items 1 through 9, Item 11 and Item 13 of the Schedule TO, to the extent such Items incorporate by reference the information contained in the Offer to Purchase, are hereby amended and supplemented as follows:

The information set forth in the section entitled “21. Source and Amount of Funds” on page 62 of the Offer to Purchase is amended and supplemented by revising certain portions starting from the subheader “Debt Financing”

as follows (deletions are struck through and additions are underlined):

“Debt Financing

The financing of the funds to pay for Shares accepted for the payment in the Offer and the consideration in connection with the Merger is expected to come in part from issuances under Parent’s existing U.S. dollar

commercial paper program, which is expected to be expanded from approximately $4 billion to approximately $7 billion. The placement agent for the commercial paper program is JPMorgan Securities LLC. Parent has an existing

U.S. dollar commercial paper program, for which the placement agents are J.P. Morgan Securities LLC, Barclays Capital Inc., Goldman Sachs & Co. LLC, Wells Fargo Securities, LLC and BofA Securities, Inc. Under the program, Parent may issue

unsecured commercial paper notes, ranking pari passu with Parent’s other unsubordinated and unsecured indebtedness with maturities not exceeding twelve months from the date of issuance. The commercial paper will be issued at par less a discount

representing an interest factor or, if interest bearing, at par. In connection with the Offer and the Merger, Parent increased the maximum amount of commercial paper that it could issue under this program from approximately $4 billion to

approximately $7 billion. The proceeds from the commercial paper issued under this program will be used to fund a portion of the payment for Shares accepted for payment in the Offer and the consideration in connection with the Merger and Parent’s

day-to-day operations.

On February 11, 2025, Parent entered into a $3 billion 364-Day Credit Agreement (the “364-Day Back-Up Credit Facility”), dated as of February 11, 2025, with JPMorgan Chase Bank, N.A., as agent, Bank of America, N.A. and

Goldman Sachs Bank USA, as syndication agents, and the lenders named therein. The 364-Day Back-Up Credit Facility expires on February 10, 2026. There are no outstanding loans or letters of credit under the 364-Day Back-Up Credit Facility. The 364-Day

Back-Up Credit Facility supports general corporate purposes, including, without limitation, as a liquidity back-up for Parent’s commercial paper borrowings, which is expected to be expanded is intended to provide

liquidity to repay the commercial paper as it matures, and to provide Parent liquidity in the event the issuance of commercial paper is unavailable. The 364-Day Back-Up Credit Facility is a separate facility from Parent’s commercial paper program.

The 364-Day Back-Up Credit Facility is unsecured and may be accessed under a floating rate of interest based on SOFR plus a margin and includes a base rate option. Parent may from time to time designate any of its eligible

subsidiaries as subsidiary borrowers under the 364-Day Back-Up Credit Facility. Parent has unconditionally and irrevocably guaranteed the obligations of each of its subsidiaries in the event a subsidiary is named a borrower under the 364-Day Back-Up

Credit Facility. Loans are denominated in U.S. dollars. Parent must pay facility fees on the aggregate amounts available under the 364-Day Back-Up Credit Facility, as specified in the credit agreement. The 364-Day Back-Up Credit Facility contains

customary representations, warranties, covenants and events of default.

The foregoing summary of the 364-Day Back-Up Credit Facility is not complete and is qualified in its entirety by reference to the actual credit agreement, which is attached as Exhibit (d)(x) to the Schedule TO and is

incorporated herein by reference.

To the extent any borrowings are incurred under the 364-Day Back-Up Facility, Parent will repay such borrowings as promptly as practicable.

Parent is expected to issue, on March 4, 2025, €500,000,000 aggregate principal amount of 3.000% notes due 2031 (the “2031 Euro Notes”), €500,000,000 aggregate principal amount of 3.500% notes due 2037 (the “2037 Euro Notes”

and, together with the 2031 Euro Notes, the “Euro Notes”) and $500,000,000 aggregate principal amount of 5.000% notes due 2035 (the “Dollar Notes”), pursuant to Parent’s registration statement on Form S-3 (Registration Statement No. 333-275526) filed

with the SEC (the Euro Notes and the Dollar Notes, collectively, the “Notes”). The Notes are unsecured. The joint book-running managers for the 2031 Euro Notes are J.P. Morgan Securities plc, Goldman Sachs & Co. LLC, Merrill Lynch International,

Barclays Bank PLC and HSBC Bank plc, and the co-managers for the 2031 Euro Notes are BNP PARIBAS, Deutsche Bank AG, London Branch, Wells Fargo Securities International Limited, Mischler Financial Group, Inc. and Stern Brothers & Co. The joint

book-running managers for the 2037 Euro Notes are J.P. Morgan Securities plc, Goldman Sachs & Co. LLC, Merrill Lynch International, BNP PARIBAS and Deutsche Bank AG, London Branch, and the co-managers for the 2037 Euro Notes are Barclays Bank

PLC, HSBC Bank plc, Wells Fargo Securities International Limited, Mischler Financial Group, Inc. and Stern Brothers & Co. The joint book-running managers for the Dollar Notes are J.P. Morgan Securities LLC, Goldman Sachs & Co. LLC, BofA

Securities, Inc. and Wells Fargo Securities, LLC, and the co-managers for the Dollar Notes are Barclays Capital Inc., BNP Paribas Securities Corp., Deutsche Bank Securities Inc., HSBC Securities (USA) Inc., Mischler Financial Group, Inc. and Stern

Brothers & Co. The form, terms and provisions of the Notes are further described in the prospectus supplements of Parent, each dated February 25, 2025, as filed with the SEC under Rule 424(b) of the Securities Act of 1933, as amended, on February

27, 2025, which descriptions are incorporated herein by reference. The proceeds from the Notes issuances are expected to be used for general corporate purposes, the repayment of Parent’s commercial paper borrowings and to fund a portion of the

payment for Shares accepted for payment in the Offer and the consideration in connection with the Merger and payment of related fees and expenses.”

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 27, 2025

| |

|

EMERSON ELECTRIC CO.

|

| |

|

|

|

|

| |

|

By:

|

|

|

| |

|

|

|

Name:

|

|

John A. Sperino

|

| |

|

|

|

Title:

|

|

Vice President and Assistant Secretary

|

| |

|

|

| |

|

|

| |

|

EMR HOLDINGS, INC. |

| |

|

|

| |

|

By:

|

|

|

| |

|

|

|

Name:

|

|

John A. Sperino

|

| |

|

|

|

Title:

|

|

Vice President and Secretary

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

EMR WORLDWIDE INC.

|

| |

|

|

|

|

| |

|

By:

|

|

|

| |

|

|

|

Name:

|

|

John A. Sperino

|

| |

|

|

|

Title:

|

|

President and Secretary

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

EMR US HOLDINGS LLC

|

| |

|

|

|

|

| |

|

By:

|

|

|

| |

|

|

|

Name:

|

|

John A. Sperino

|

| |

|

|

|

Title:

|

|

Authorized Signatory

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

EMERSUB CXV, INC.

|

| |

|

|

|

|

| |

|

By:

|

|

|

| |

|

|

|

Name:

|

|

John A. Sperino

|

| |

|

|

|

Title:

|

|

Vice President and Secretary

|

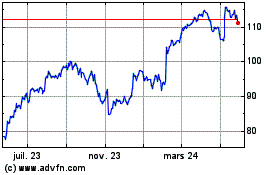

Emerson Electric (NYSE:EMR)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

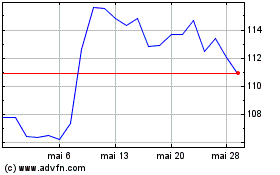

Emerson Electric (NYSE:EMR)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025