| |

Filed by Equitrans Midstream Corporation |

| |

Pursuant to Rule 425 under the Securities Act of 1933 |

| |

and deemed filed pursuant to Rule 14a-12 |

| |

under the Securities Exchange Act of 1934 |

| |

Subject Company: Equitrans Midstream Corporation |

| |

Commission File No. 001-38629 |

| |

Date: March 11, 2024 |

The following was made available to employees of Equitrans Midstream

Corporation on March 11, 2024 to provide information regarding the proposed transaction between Equitrans Midstream Corporation and

EQT Corporation, pursuant to that certain Agreement and Plan of Merger, dated as of March 10, 2024, by and among EQT Corporation,

Humpty Merger Sub Inc., Humpty Merger Sub LLC and Equitrans Midstream Corporation.

On March 11, 2024, Equitrans Midstream announced that it had entered

into a definitive merger agreement with EQT Corporation (EQT), whereby EQT would acquire Equitrans Midstream Corporation (NYSE: ETRN)

in an all-stock transaction. The closing of the transaction is subject to certain conditions described in the merger agreement, including

the approval of EQT shareholders and Equitrans shareholders and regulatory clearance. The transaction is expected to close during the

fourth quarter of 2024.

Upon close of the transaction, EQT will acquire all aspects of Equitrans’

existing gathering, transmission, and water businesses, as well as its ownership interest in the Mountain Valley Pipeline, LLC joint

venture and related joint venture projects, and its ownership interest in Eureka Midstream Holdings, LLC.

Equitrans and EQT are committed to the highest standards of corporate

social responsibility. During the period prior to the closing of the transaction, Equitrans and EQT will continue to operate “business

as usual,” which includes serving their customers while remaining committed to safety, security, environmental stewardship, and

ethics and compliance.

WHY EQT :: TRANSACTION RATIONALE

As our largest customer, EQT represents the majority of Equitrans’

revenue – and similarly, Equitrans represents a majority of EQT’s transportation costs. Given the overlap of each company’s

assets and the significant operational connectivity between our businesses, integration of our businesses is expected to enhance operational

execution for the combined company and unlock opportunities for future value creation, aided by the lower cost of capital through combining

with EQT’s investment grade balance sheet. Furthermore, we expect the integrated company will be positioned to maximize the potential

of both organization’s existing assets, including in a low-price environment and during the transition to a lower-carbon economy.

We believe EQT’s management operates with the same focus

on safety as Equitrans. Both companies share the same commitment to landowners and support for communities, as well as a mutual respect

for the protection and preservation of the environment.

QUESTIONS and WHAT’S NEXT

What is happening between Equitrans and EQT?

EQT Corporation is acquiring 100% of Equitrans Midstream.

How did you decide on a transaction with EQT? Were there other

options?

Our transaction with EQT is the culmination of a robust process

to maximize value, and the premium value we are delivering to shareholders reflects the hard work of our team to become the premier midstream

services company in North America. As a standalone public company for nearly six years, Equitrans has been relentlessly focused on providing

safe, reliable, and innovative infrastructure solutions for the energy industry, and we have built an outstanding organization. Our Board

and management team conducted a methodical review of our business and industry and, after evaluating a number of opportunities, it became

clear that there is no better partner with which to grow than EQT.

Is the acquisition of Equitrans Midstream final?

No. The acquisition is subject to regulatory

approvals and other closing conditions. The deal is expected to close during the fourth quarter of 2024. Until closing, each company

will remain independent and continue to operate “business as usual," which includes maintaining their high levels of performance

related to safety, security, and the environment, as well as their high standards of ethics and compliance.

What must happen in order for the transaction to close?

The acquisition is subject to regulatory approvals and other

closing conditions. The deal is expected to close during the fourth quarter of 2024.

How does this merger affect my job?

Until closing, each company will remain independent and

continue to operate “business as usual." As part of the transition and integration process, EQT will align staffing plans

with Equitrans’ employee roster and will provide more detailed information as the process evolves.

Should I have discussions with EQT employees?

Unless your job duties include communications with EQT employees

in the ordinary course of business, you should only have discussions with EQT employees if specifically directed by your manager or a

member of Equitrans’ legal team. It is important to note that prior to the close of a merger transaction the parties to the

planned merger must remain independent, and certain coordinated actions between employees of such companies before the close of a planned

merger, therefore, can violate the law. Violations may occur if activities among employees of the two companies are aimed at operating

the entities jointly before the merger or do not serve the purpose of independently advancing the interests of each separate company.

Improper “gun jumping” communications could include the sharing of unauthorized sensitive information or the coordination

of business activities and decisions prior to the close. If you are unsure whether activities could violate gun jumping laws, please

contact Equitrans’ Legal Department.

If someone from EQT contacts me, what should I do?

No one from EQT should be contacting you regarding the

transaction. If you have any questions or are contacted by EQT personnel, please contact a member of Equitrans' legal team.

Where will the combined company be headquartered?

Upon closing, the go forward business will be headquartered

in Pittsburgh, Pennsylvania.

Who will lead the combined company?

The EQT management team will lead the combined business.

An integration planning team consisting of representatives from both companies will be formed to ensure required business processes and

programs are implemented seamlessly post-closing. Additionally, the Board of Directors of the combined company will comprise the current

EQT Board of Directors and three directors from the current Equitrans Board of Directors.

What is the timeline for integrating the two companies?

Over the coming weeks and months, we will be working through

the customary regulatory processes to allow the transaction to close. An integration planning team consisting of representatives from

both companies will be formed to ensure required business processes and programs are implemented seamlessly post-closing. Prior to closing,

each of Equitrans and EQT will continue to operate “business as usual.” Equitrans will update its employees, landowners,

community members, and local officials, as appropriate, regarding the transaction and integration process.

Important Information for Investors

and Security Holders

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking

statements” within the meaning of the federal securities laws. Forward-looking statements may be identified by words such as “anticipates,”

“believes,” “cause,” “continue,” “could,” “depend,” “develop,”

“estimates,” “expects,” “forecasts,” “goal,” “guidance,” “have,”

“impact,” “implement,” “increase,” “intends,” “lead,” “maintain,”

“may,” “might,” “plans,” “potential,” “possible,” “projected,”

“reduce,” “remain,” “result,” “scheduled,” “seek,” “should,”

“will,” “would” and other similar words or expressions. The absence of such words or expressions does not necessarily

mean the statements are not forward-looking. Forward-looking statements are not statements of historical fact and reflect the Company’s

and Parent’s current views about future events. These forward-looking statements include, but are not limited to, statements regarding

the proposed transaction between the Company and Parent, the expected closing of the proposed transaction and the timing thereof and

the pro forma combined company and its operations, strategies and plans, integration, debt levels and leverage ratio, capital expenditures,

cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, expected accretion to earnings

and free cash flow and anticipated dividends. Information adjusted for the proposed transaction should not be considered a forecast of

future results. Although we believe our forward-looking statements are reasonable, statements made regarding future results are not guarantees

of future performance and are subject to numerous assumptions, uncertainties and risks that are difficult to predict. Actual outcomes

and results may be materially different from the results stated or implied in such forward-looking statements included in this communication.

Actual outcomes and

results may differ materially from those included in the forward-looking statements in this communication due to a number of

factors, including, but not limited to: the occurrence of any event, change or other circumstances that could give rise to the

termination of the merger agreement, the possibility that our shareholders may not adopt the merger agreement, the possibility that

the shareholders of Parent may not approve the issuance of Parent common stock in connection with the proposed transaction, the risk

that the Company or Parent may be unable to obtain governmental and regulatory approvals required for the proposed transaction, or

required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the

parties to abandon the merger the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a

timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed

transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of

the Company’s common stock or Parent’s common stock, the risk of any unexpected costs or expenses resulting from the

proposed transaction, the risk of any litigation relating to the proposed transaction, the risk that the proposed transaction and

its announcement could have an adverse effect on the ability of the Company and Parent to retain and hire key personnel, on the

ability of the Company to attract third-party customers and maintain its relationships with derivatives and joint venture

counterparties and on the Company’s operating results and businesses generally, the risk that problems may arise in

successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and

efficiently as expected, the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the

proposed transaction or it may take longer than expected to achieve those synergies or benefits and other important factors that

could cause actual results to differ materially from those projected, the volatility in commodity prices for crude oil and natural

gas, the ability to construct, complete and place in service the Mountain Valley Pipeline project; the effect of future regulatory

or legislative actions on the companies or the industry in which they operate, including the risk of new restrictions with respect

to oil and natural gas development activities; the risk that the credit ratings of the combined business may be different from what

the companies expect; the ability of management to execute its plans to meet its goals and other risks inherent in the

Company’s and Parent’s businesses; public health crises, such as pandemics and epidemics, and any related government

policies and actions; the potential disruption or interruption of Company’s or Parent’s operations due to war,

accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond

the Company’s or Parent’s control; and the combined company’s ability to identify and mitigate the risks and

hazards inherent in operating in the global energy industry; and other factors detailed in the Company’s and Parent’s

Annual Reports on Form 10-K for the year ended December 31, 2023 and subsequent Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K. All such factors are difficult to predict and are beyond the Company’s and Parent’s control. Additional

risks or uncertainties that are not currently known to the Company or Parent, that Company or Parent currently deem to be

immaterial, or that could apply to any company could also cause actual outcomes and results to differ materially from those included

in the forward-looking statements in this communication. The Company and Parent undertake no obligation to publicly correct or

update the forward-looking statements in this communication, in other documents or on their respective websites to reflect new

information, future events or otherwise, except as required by applicable law. All such statements are expressly qualified by this

cautionary statement. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of

the date hereof.

Important Information For Investors And Shareholders;

Additional Information And Where To Find It

In connection with the proposed transaction

between the Company and Parent, Parent intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a

registration statement on Form S-4 (the “registration statement”) that will include a joint proxy statement of the

Company and Parent and that will also constitute a prospectus of Parent (the “joint proxy statement/prospectus”). The

Company and Parent also intend to file other documents regarding the proposed transaction with the SEC. This document is not a

substitute for the joint proxy statement/prospectus or the registration statement or any other document that the Company or Parent

may file with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, THE

JOINT PROXY STATEMENT/PROSPECTUS, AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT MAY BE FILED WITH THE SEC IN CONNECTION WITH THE

PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, PARENT, THE PROPOSED TRANSACTION, THE RISKS THERETO AND RELATED MATTERS. After

the registration statement has been declared effective, a definitive joint proxy statement/prospectus will be mailed to the

shareholders of the Company and the shareholders of Parent. Investors will be able to obtain free copies of the registration

statement and joint proxy statement/prospectus and other relevant documents filed or that will be filed with the SEC by the Company

or Parent through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by the Company

may be obtained free of charge on the Company’s website at www.ir.equitransmidstream.com. Copies of the documents filed

with the SEC by Parent may be obtained free of charge on Parent’s website at www.ir.eqt.com/investor-relations.

Participants In The Solicitation

The Company and Parent and their respective

directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies

in connection with the proposed transaction contemplated by the joint proxy statement/prospectus. Information regarding the Company’s

directors and executive officers and their ownership of the Company’s securities is set forth in the Company’s filings with

the SEC, including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and its Definitive Proxy

Statement on Schedule 14A that was filed with the SEC on March 4, 2024. To the extent such person’s ownership of the Company’s

securities has changed since the filing of such proxy statement, such changes have been or will be reflected on Statements of Changes

in Beneficial Ownership on Form 4 filed with the SEC. Information regarding Parent’s directors and executive officers and their

ownership of Parent’s securities is set forth in Parent’s filings with the SEC, including Parent’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2023 and its Definitive Proxy Statement on Schedule 14A that was filed with the SEC

on March 1, 2024. To the extent such person’s ownership of Parent’s securities has changed since the filing of such proxy

statement, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC.

Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction

may be obtained by reading the joint proxy statement/prospectus and other relevant materials that will be filed with the SEC regarding

the proposed transaction when such documents become available. You may obtain free copies of these documents as described in the preceding

paragraph.

No Offer OR Solicitation

This communication relates to the proposed

transaction between the Company and Parent. This communication is for informational purposes only and shall not constitute an offer to

sell or exchange, or the solicitation of an offer to buy or exchange, any securities or a solicitation of any vote or approval, in any

jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities

referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

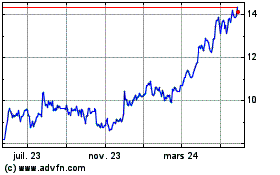

Equitrans Midstream (NYSE:ETRN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

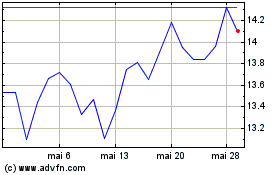

Equitrans Midstream (NYSE:ETRN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024