- Unlocks significant value for FedEx stockholders through

creation of a new publicly listed less-than-truckload (LTL)

industry leader

- Preserves commercial and operational synergies between both

companies

- Proposed separation enables greater strategic, operational, and

financial execution for each company and its stakeholders

FedEx Corp. (NYSE: FDX) today announced that its Board of

Directors has concluded a comprehensive assessment of the role of

FedEx Freight as part of its portfolio and has decided to pursue a

full separation of FedEx Freight through the capital markets,

creating a new publicly traded company.

The separation is expected to be achieved in a tax-efficient

manner for FedEx stockholders and executed within the next 18

months.

As two industry-leading public companies, FedEx and FedEx

Freight will continue to pursue their growth strategies. The

separation will allow for more customized operational execution

along with more tailored investment and capital allocation

strategies to serve the unique and evolving needs of both the

global parcel and LTL markets. They will also maintain the

strategic advantages of cooperation on key commercial, operational,

and technology initiatives. Customers of both businesses will

continue to enjoy the same superior service, speed, and coverage

they have come to expect from FedEx.

“This is the right time to pursue a separation as we respond to

the unique dynamics of the LTL market,” said Raj Subramaniam, FedEx

Corp. president and chief executive officer. “This announcement is

a testament to the strength of the business our team has built, and

to our dedication to doing what’s best for our customers, our team

members, and our stockholders. Through this process, we will unlock

value for our Freight business and position FedEx to create even

greater value for stockholders.”

“Over the last 50 years, FedEx has built an unmatched global

platform that has produced significant value for our stockholders

and opportunities for our team members,” said R. Brad Martin, vice

chairman of the Board and chairman of the Audit and Finance

Committee who led the Board’s oversight of the strategic analysis.

“Building upon that powerful foundation, and following a careful

assessment of our portfolio, the FedEx Corporation Board is

confident that a separation of FedEx Freight will drive continued

growth and value creation.”

Strategic Rationale

In its recently completed assessment, FedEx concluded there are

strategic opportunities that arise from separating FedEx Freight

into an independent company and substantial benefits from the

continuing commercial collaboration of FedEx and FedEx Freight.

Through a separation, both FedEx and FedEx Freight will benefit

from:

- Enhanced Operational Focus and Strategic Execution:

Deeper operational focus, accountability, and agility to meet

customer needs will better enable both companies to capture

profitable growth opportunities and unlock market value. FedEx will

continue executing its strategic initiatives, including DRIVE,

Network 2.0, and Tricolor.

- Distinct and Compelling Investment Profiles: Separate

public stock listings with distinct stockholder bases will enhance

the value proposition for each company.

- Strong Balance Sheet and Capital Allocation Optionality:

Each company will be well-capitalized, with flexibility to invest

in profitable growth and return capital to stockholders.

- Maintained Commercial, Operational, and Technology

Synergies: The benefits of the existing FedEx and FedEx Freight

relationships will be optimized through commercial agreements

between the two entities to maintain operational and service-level

continuity. Ongoing collaboration will be designed to improve the

value propositions of both companies by accelerating speed,

improving coverage, and driving efficiencies that will lower the

cost to serve.

- A Shared Brand: The FedEx brand represents speed,

reliability, and trust. These values will extend across both

businesses with the new company continuing to operate under the

FedEx Freight name.

FedEx Value Proposition

FedEx pioneered the express transportation industry more than 50

years ago and remains the industry leader today. In fiscal year

2024, FedEx revenue totaled $78.3 billion across its remaining

business segments. The Company provides a range of rapid, reliable,

time- and day-definite delivery and related supply chain technology

services to more than 220 countries and territories through an

integrated air-ground express network. FedEx is well-positioned to

continue to deliver significant value to its stockholders through

its transformation and strategic initiatives, focused on reducing

the company’s cost to serve while helping customers compete and win

with the world’s smartest and most efficient logistics ecosystem.

The initiatives underway through DRIVE are expected to create $4

billion in cost savings by the end of fiscal year 2025, while

Network 2.0 is targeted to generate savings of $2 billion by the

end of fiscal year 2027, supporting enhanced profitability and

driving greater flexibility and efficiency across the network.

FedEx remains committed to a continued strong balance sheet at both

entities while continuing to reduce capital intensity and increase

capital returns.

FedEx Freight Value

Proposition

With revenue of $9.4 billion in fiscal 2024, FedEx Freight is

the largest LTL carrier with the broadest network and fastest

transit times in its industry. The company has deep and

long-standing relationships with customers who value choice,

simplicity, and reliability. With a focus on safety, facility

utilization, revenue quality, and operational efficiency, FedEx

Freight has maintained its leading market share position while

increasing operating profit by nearly 25 percent on average per

year over the last five years. The business has delivered

approximately 1,100 basis points of operating margin expansion over

the same period. FedEx Freight is expected to benefit from a strong

balance sheet that will allow it to maintain and extend its

leadership position in the LTL market.

Transaction Process

The Company’s intent is to execute the planned separation

through a capital markets transaction, creating two independent

publicly listed, industry-leading companies. The transaction is

expected to qualify as a tax-free separation for U.S. federal

income tax purposes.

The Company expects to commence the separation process

immediately, with the intent to execute the transaction within 18

months, subject to regulatory and certain other conditions, and

final approval of the FedEx Board of Directors.

Goldman Sachs & Co. LLC is serving as the financial advisor

and Skadden, Arps, Slate, Meagher & Flom LLP is serving as

legal counsel.

Corporate Overview

FedEx Corp. (NYSE: FDX) provides customers and businesses

worldwide with a broad portfolio of transportation, e-commerce and

business services. With annual revenue of $87 billion, the company

offers integrated business solutions utilizing its flexible,

efficient, and intelligent global network. Consistently ranked

among the world's most admired and trusted employers, FedEx

inspires its more than 500,000 employees to remain focused on

safety, the highest ethical and professional standards, and the

needs of their customers and communities. FedEx is committed to

connecting people and possibilities around the world responsibly

and resourcefully, with a goal to achieve carbon-neutral operations

by 2040. To learn more, please visit fedex.com/about.

Certain statements in this press release may be considered

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act, such as statements regarding

expected benefits and synergies to be realized by FedEx and FedEx

Freight in the separation, the timing of the proposed separation,

future financial targets, business strategies, management’s views

with respect to future events and financial performance, and the

assumptions underlying such expected cost savings, targets,

strategies, and statements. Forward-looking statements include

those preceded by, followed by or that include the words “will,”

“may,” “could,” “would,” “should,” “believes,” “expects,”

“forecasts,” “anticipates,” “plans,” “estimates,” “targets,”

“projects,” “intends” or similar expressions. Such forward-looking

statements are subject to risks, uncertainties, and other factors

which could cause actual results to differ materially from

historical experience or from future results expressed or implied

by such forward-looking statements. Potential risks and

uncertainties include, but are not limited to, our ability to

successfully execute the separation transaction; our ability to

obtain any consents or approvals required to complete the

separation; potential uncertainty during the pendency of the

separation transaction that could affect FedEx’s financial

performance; the possibility that the separation transaction will

not be completed within the anticipated time period or at all; the

possibility that the separation transaction will not result in the

intended benefits; the possibility of disruption, including changes

to existing business relationships, disputes, litigation, or

unanticipated costs in connection with the separation transaction;

uncertainty of the expected financial performance of FedEx or FedEx

Freight following completion of the transaction; negative effects

of the announcement or pendency of the transactions on the market

price of FedEx’s securities and/or on the financial performance of

FedEx; evolving legal, regulatory, and tax regimes; changes in the

economic conditions in the global markets in which we operate;

actions by third parties, including government agencies; our

ability to successfully implement our business strategy and global

transformation program and optimize our network through Network

2.0; our ability to achieve our cost-reduction initiatives and

financial performance goals; and other factors which can be found

in FedEx Corp.’s and its subsidiaries’ press releases and FedEx

Corp.’s filings with the Securities and Exchange Commission. Any

forward-looking statement speaks only as of the date on which it is

made. We do not undertake or assume any obligation to update or

revise any forward-looking statement, whether as a result of new

information, future events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219594478/en/

Media Contact: Caitlin Maier 901-434-8100

Mediarelations@fedex.com Investor Relations Contact: Jeni

Hollander 901-818-7200 ir@fedex.com

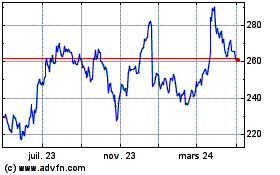

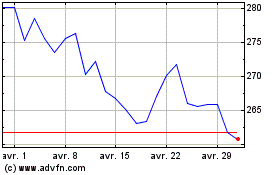

FedEx (NYSE:FDX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

FedEx (NYSE:FDX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024