false

N-2

0001319183

0001319183

2022-10-31

2023-10-31

0001319183

2023-10-31

0001319183

FMY:CollateralizedMortgageObligationsRiskMember

2022-10-31

2023-10-31

0001319183

FMY:CreditAgencyRiskMember

2022-10-31

2023-10-31

0001319183

FMY:CreditAndBelowInvestmentGradeSecuritiesRiskMember

2022-10-31

2023-10-31

0001319183

FMY:CurrentMarketConditionsRiskMember

2022-10-31

2023-10-31

0001319183

FMY:CyberSecurityRiskMember

2022-10-31

2023-10-31

0001319183

FMY:ExtensionRiskMember

2022-10-31

2023-10-31

0001319183

FMY:FixedIncomeSecuritiesRiskMember

2022-10-31

2023-10-31

0001319183

FMY:FuturesContractsRiskMember

2022-10-31

2023-10-31

0001319183

FMY:IlliquidAndRestrictedSecuritiesRiskMember

2022-10-31

2023-10-31

0001319183

FMY:InflationRiskMember

2022-10-31

2023-10-31

0001319183

FMY:InterestRateAndDurationRiskMember

2022-10-31

2023-10-31

0001319183

FMY:LeverageRiskMember

2022-10-31

2023-10-31

0001319183

FMY:ManagementRiskAndRelianceOnKeyPersonnelMember

2022-10-31

2023-10-31

0001319183

FMY:MarketDiscountFromNetAssetValueMember

2022-10-31

2023-10-31

0001319183

FMY:MarketRiskMember

2022-10-31

2023-10-31

0001319183

FMY:MortgageBackedSecuritiesRiskMember

2022-10-31

2023-10-31

0001319183

FMY:NonAgencySecuritiesRiskMember

2022-10-31

2023-10-31

0001319183

FMY:OperationalRiskMember

2022-10-31

2023-10-31

0001319183

FMY:PotentialConflictsOfInterestRiskMember

2022-10-31

2023-10-31

0001319183

FMY:TBATransactionsRiskMember

2022-10-31

2023-10-31

0001319183

FMY:ValuationRiskMember

2022-10-31

2023-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21727

First Trust Mortgage Income Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios

L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name

and address of agent for service)

Registrant’s telephone number, including

area code: 630-765-8000

Date of fiscal year end: October

31

Date of reporting period: October

31, 2023

Form N-CSR is to be used by management investment

companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required

to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use

the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information

specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection

of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”)

control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing

the burden to Secretary, Securities and Exchange Commission, 100 F Street NE, NW, Washington, DC 20549. The OMB has reviewed this collection

of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The

Report to Shareholders is attached herewith.

First

Trust

Mortgage

Income Fund (FMY)

Annual

Report

For

the Year Ended

October

31, 2023

First

Trust Mortgage Income Fund (FMY)

Annual

Report

October

31, 2023

|

1

|

|

2

|

|

3

|

|

7

|

|

14

|

|

15

|

|

16

|

|

17

|

|

18

|

|

26

|

|

27

|

|

31

|

|

37

|

|

39

|

Caution

Regarding Forward-Looking Statements

This

report contains certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange

Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of

First Trust Advisors L.P. (“First Trust” or the “Advisor”) and its representatives, taking into account the information

currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact.

For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,”

“expect,” “believe,” “plan,” “may,” “should,” “would” or other

words that convey uncertainty of future events or outcomes.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements

of First Trust Mortgage Income Fund (the “Fund”) to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not

to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and its representatives only as

of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances

that arise after the date hereof.

Performance

and Risk Disclosure

There

is no assurance that the Fund will achieve its investment objectives. The Fund is subject to market risk, which is the possibility that

the market values of securities owned by the Fund will decline and that the value of the Fund’s shares may therefore be less than

what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Principal Risks” in the Investment

Objectives, Policies and Risks section of this report for a discussion of certain other risks of investing in the Fund.

Performance

data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than

the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com

or speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when

sold, may be worth more or less than their original cost.

The

Advisor may also periodically provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

How

to Read This Report

This

report contains information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data

and analysis that provide insight into the Fund’s performance and investment approach.

By

reading the portfolio commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment

affected the Fund’s performance. The statistical information that follows may help you understand the Fund’s performance compared

to that of a relevant market benchmark.

It

is important to keep in mind that the opinions expressed by personnel of the Advisor are just that: informed opinions. They should not

be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of this report.

The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and

other Fund regulatory filings.

First

Trust Mortgage Income Fund (FMY)

Annual

Letter from the Chairman and CEO

October

31, 2023

Dear

Shareholders,

First

Trust is pleased to provide you with the annual report for the First Trust Mortgage Income Fund (the “Fund”), which contains

detailed information about the Fund for the twelve months ended October 31, 2023.

The

Bureau of Economic Analysis recently announced that U.S. real gross domestic product (“GDP”) grew by a staggering 4.9% in

the third quarter of 2023 and is now up 2.9% on a year-over-year basis from where it stood in the third quarter of 2022. The most recent

quarter’s GDP data represents the fastest growth rate for any quarter since 2014. Consumer spending, which rose by 4.0% over the

period, was responsible for 2.7 percentage points of the total increase in GDP. Whether the consumer can keep up this pace of spending

remains to be seen, especially given recent news that excess savings from the pandemic-era stimulus have likely been depleted. From a

global perspective, the International Monetary Fund (“IMF”) notes that progress in fighting inflation has led to lower economic

growth. In their October 2023 publication of the World Economic Outlook, the IMF projected that the growth in world economic output is

expected to slow from 3.5% in 2022 to 2.9% in 2024. The economic growth in advanced economies is projected to plummet from 2.6% in 2022

to 1.4% in 2024.

In

the notes to their September 2023 meeting, the Federal Open Market Committee revealed that they may need to keep interest rates “higher

for longer” as they continue to battle stubbornly high inflation. As many investors are likely aware, a higher Federal Funds target

rate can have deep implications for consumers, such as driving up the cost of borrowing for homes, automobiles, and other large purchases.

The American consumer has yet to feel the full weight of those burdens, in my opinion. That said, the data reveals a different story among

corporate America. S&P Global Market Intelligence reported that a total of 516 U.S. corporations filed for bankruptcy protection on

a year-to-date basis through September 30, 2023, up from a total of 263 corporate bankruptcy filings over the same period last year. Higher

interest rates and Treasury bond yields have also sapped demand for commercial property loans. Data from Trepp, LLC, a leading provider

of data and analytics to the commercial real estate and banking markets, revealed that just $28.2 billion of loans converted into commercial

mortgage-backed securities have been issued in 2023, the lowest figure since 2011.

The

financial markets battled a myriad of headwinds over the past year, from geopolitical uncertainty resulting from war (the conflicts between

Israel and Hamas and Russia and Ukraine), to slowing global economic growth and sticky inflation. Brian Wesbury, Chief Economist at First

Trust, notes that a U.S. economic recession is likely to begin at some point early next year. While calls for a recession may concern

some investors, the following may offer solace. Data from Bloomberg reveals that the S&P 500®

Index has posted positive total returns over the 3-year period following every recession since 1948.

Thank

you for giving First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report

on the Fund again in six months.

Sincerely,

James

A. Bowen

Chairman

of the Board of Trustees

Chief

Executive Officer of First Trust Advisors L.P.

First

Trust Mortgage Income Fund (FMY)

“AT

A GLANCE”

As

of October 31, 2023 (Unaudited)

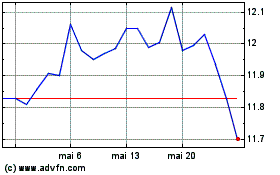

| Fund

Statistics |

|

| Symbol

on New York Stock Exchange |

FMY

|

| Common

Share Price |

$10.88

|

| Common

Share Net Asset Value (“NAV”) |

$11.72

|

| Premium

(Discount) to NAV |

(7.17)%

|

| Net

Assets Applicable to Common Shares |

$49,398,421

|

| Current

Distribution per Common Share(1) |

$0.0675

|

| Current

Annualized Distribution per Common Share |

$0.8100

|

| Current

Distribution Rate on Common Share Price(2) |

7.44%

|

| Current

Distribution Rate on NAV(2) |

6.91%

|

Common

Share Price & NAV (weekly closing price)

| Performance

|

|

|

|

|

|

|

|

Average

Annual Total Returns |

|

|

1

Year Ended

10/31/23 |

5

Years Ended

10/31/23 |

10

Years Ended

10/31/23 |

Inception

(5/25/05)

to 10/31/23 |

| Fund

Performance(3) |

|

|

|

|

| NAV

|

2.88%

|

0.53%

|

1.70%

|

4.21%

|

| Market

Value |

4.88%

|

1.85%

|

2.07%

|

3.53%

|

| Index

Performance |

|

|

|

|

| Bloomberg

U.S. Mortgage Backed Securities (MBS) Index |

-0.82%

|

-1.06%

|

0.34%

|

2.38%

|

| Portfolio

Characteristics |

|

| Weighted

Average Effective Duration |

6.8

Years |

| Weighted

Average Effective Maturity |

10.7

Years |

| Fund

Allocation |

%

of Net Assets |

| Mortgage-Backed

Securities |

56.8%

|

| U.S.

Government Agency Mortgage-Backed Securities |

56.4

|

| Asset-Backed

Securities |

4.2

|

| Money

Market Funds |

3.5

|

| Put

Options Written |

(0.0)*

|

| Net

Other Assets and Liabilities(4) |

(20.9)

|

| Total

|

100.0%

|

| *

|

Amount

is less than 0.1%. |

| Credit

Quality(5) |

%

of Total

Fixed-Income

Investments |

| AAA

|

13.0%

|

| AA+

|

1.1

|

| AA

|

0.3

|

| AA-

|

1.5

|

| A+

|

0.5

|

| A

|

0.0*

|

| A-

|

4.6

|

| BBB

|

1.8

|

| BBB-

|

8.2

|

| BB

|

0.2

|

| BB-

|

1.8

|

| B

|

0.9

|

| CCC

|

0.0*

|

| CCC-

|

0.0*

|

| CC

|

0.7

|

| Not

Rated |

28.1

|

| Government

|

37.3

|

| Cash

& Cash Equivalents |

0.0*

|

| Total

|

100.0%

|

| *

|

Amount

is less than 0.1%. |

| (1)

|

Most

recent distribution paid through October 31, 2023. Subject to change in the future. |

| (2)

|

Distribution

rates are calculated by annualizing the most recent distribution paid through the report date and then dividing by Common Share Price

or NAV, as applicable, as of October 31, 2023. Subject to change in the future. |

| (3)

|

Total

return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained

by the Dividend Reinvestment Plan and changes in NAV per share for NAV returns and changes in Common Share Price for market value returns.

Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of

future results. |

| (4)

|

Includes

variation margin on futures contracts. |

| (5)

|

The

credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating

organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO.

For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment

grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown

relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. U.S. Treasury,

U.S. Agency and U.S. Agency mortgage-backed securities appear under “Government.” Credit ratings are subject to change. |

Portfolio

Commentary

First

Trust Mortgage Income Fund (FMY)

Annual

Report

October

31, 2023 (Unaudited)

Advisor

First

Trust Advisors L.P. (“First Trust” or the “Advisor”) serves as the investment advisor to the First Trust Mortgage

Income Fund (the “Fund” or “FMY”) and offers customized portfolio management using its structured, quantitative

approach to security selection.

Portfolio

Management Team

Jeremiah

Charles – Senior Vice President and Senior Portfolio Manager, First Trust Government & Securitized Products Group

James

Snyder – Senior Vice President and Senior Portfolio Manager, First Trust Government & Securitized Products Group

Owen

Aronson – Vice President and Portfolio Manager of the Fund, First Trust Government & Securitized Products Group

The

following information is a summary of certain changes during the fiscal year ended October 31, 2023 relating to the portfolio managers

of the Fund. This information may not reflect all of the changes that have occurred since you purchased shares of the Fund.

Effective

June 1, 2023, Owen Aronson was added as a portfolio manager to the Fund. Mr. Aronson is a Senior Investment Analyst for the First Trust

Government & Securitized Products Group. He has over 15 years of investment research and trading experience. At First Trust, he focuses

primarily on the Commercial Mortgage-Backed Securities (“CMBS”) sector and contributes to the management of the non-agency

sectors. Prior to joining First Trust in 2020, Owen spent the majority of his career in the Securitized Products team at Neuberger Berman

where he was responsible for CMBS investments. He began his career at Lehman Brothers Asset Management as an Analyst. Mr. Aronson holds

a B.A. in Economics from the University of Chicago.

Commentary

First

Trust Mortgage Income Fund

The

Fund’s primary investment objective is to seek a high level of current income. As a secondary objective the Fund seeks to preserve

capital. The Fund pursues its objectives by investing primarily in mortgage-backed securities (“MBS”) representing part ownership

in a pool of either residential or commercial mortgage loans that, in the opinion of the Fund’s investment advisor, offer an attractive

combination of credit quality, yield and maturity. There can be no assurance the Fund will achieve its investment objectives. The Fund

may not be appropriate for all investors.

Market

Recap

The

12-month period ended October 31, 2023 began with markets under considerable strain as the Federal Reserve (the “Fed”) continued

with its aggressive interest rate hiking campaign to combat soaring inflation. With volatility high and liquidity challenged as bond market

participants suffered through outflows, bond market spreads remained under pressure. The market began to once again price in just how

quickly inflation would cool, and how quickly the Fed would be “forced” to cut rates, just as the market incorrectly had done

several times over the preceding year. Contrary to the market belief however, the labor market showed significant strength, and the Fed

stood resolute pushing yields on the front end north of 5% in early March 2023, putting significant pressure on an already inverted curve,

until it all unraveled mere days later as the first of the large banks, Silicon Valley Bank (“SVB”), began to fail. Front

end Treasury yields plunged, which saw the 2-Year Treasury yield fall from 5.07% to sub 4%, while spreads gapped wider, with Option-Adjusted

Spreads (“OAS”) on Agency MBS widening approximately 20 basis points (“bps”), almost immediately. Ultimately,

the Federal Deposit Insurance Corporation took control of two banks, SVB and Signature Bank, and ultimately liquidated nearly $100 billion

worth of high-quality bond assets. As markets found their footing following these relatively contained bank failures, the labor market

remained stubbornly robust. And despite many forecasts, the housing market, and even the broader economy, have shown significant resilience

in spite of the proverbial Fed punch bowl being removed. As such, front end Treasury yields began to climb back toward 5% once again and

it would not take long for the longer maturity segment of the yield curve to follow suit. We believe the market was simply wrong in its

call for the timing of a recession. As such, as this resilient, and sometimes robust, economic data came in, the market was forced to

push back its call on rate cuts. After all, the Fed had not even stopped interest rate hiking. This change has reshaped the term “premium”

across the curve. Couple that with a newly acquired market appreciation for just how poorly managed we believe the fiscal house of the

United States continues to be post-pandemic, and the next stage, and perhaps even the final stage, of the ongoing bear market in rates

made its appearance known. Volatility remains high. Spreads remain wide relative to historical data. The 2-Year Treasury yield breached

5%. The 30-Year Treasury yield breached 5%. Agency MBS spreads breached the 80 bps OAS level, with nominal spreads setting multi-decade

wides near 180 bps. While the market is off these highs in rates, and wides in MBS spreads, it seems like a new world in fixed income

relative to the post-Great Financial Crisis of 2008 era, which was defined by heavy-handed government intervention and artificially suppressed

volatility. Yes, we believe it is safe to say that the aggressive campaign the Fed was forced to undertake when it was too late to respond

to the impending inflation debacle helped cause the banking issues and subsequent fallout. Less talked about, however, is the importance

of understanding the duration gap, and convexity

Portfolio

Commentary (Continued)

First

Trust Mortgage Income Fund (FMY)

Annual

Report

October

31, 2023 (Unaudited)

embedded

in a bond portfolio. These issues have been front and center in bond portfolios for the last 24 months as rates have risen so significantly

in such a short amount of time. The ability to understand and manage these risks, properly and with skill, has never been more important,

in our view.

Performance

Analysis

|

|

|

Average

Annual Total Returns |

|

|

1

Year Ended

10/31/23 |

5

Years Ended

10/31/23 |

10

Years Ended

10/31/23 |

Inception

(5/25/05)

to 10/31/23 |

| Fund Performance(1)

|

|

|

|

|

| NAV

|

2.88%

|

0.53%

|

1.70%

|

4.21%

|

| Market

Value |

4.88%

|

1.85%

|

2.07%

|

3.53%

|

| Index

Performance |

|

|

|

|

| Bloomberg

U.S. Mortgage Backed Securities (MBS) Index |

-0.82%

|

-1.06%

|

0.34%

|

2.38%

|

Performance figures assume reinvestment of all distributions and do not reflect the deduction of taxes that a shareholder would pay on

Fund distributions or the redemption or sale of Fund shares. An index is a statistical composite that tracks a specified financial market

or sector. Unlike the Fund, the index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred

by the Fund. These expenses negatively impact the performance of the Fund. The Fund’s past performance does not predict future performance.

Performance

in securitized product investment strategies can be impacted from the benefits of purchasing odd lot positions. The impact of these investments

can be particularly meaningful when funds have limited assets under management and may not be a sustainable source of performance as a

fund grows in size.

For

the 12-month period ended October 31, 2023, the Fund returned 2.88% on a net asset value (“NAV”) basis and 4.88% on a market

price basis.

For

the same period, the Bloomberg U.S. Mortgage Backed Securities (MBS) Index (the “Benchmark”) returned -0.82%. On a NAV basis,

the Fund outperformed the Benchmark by 370 bps, net of fees.

Typically,

the Fund is structured with a lower and more stable duration profile, which in a broader bond market rally, would likely cause it to underperform

its longer duration Benchmark. However, with bond market yields at levels not experienced in over a decade, the decision was made to increase

the duration of the Fund, predominantly by using Treasury futures. On the asset side, the Fund continued to reduce its holdings in Agency

Residential interest-only bonds (“IO”), maintained its Agency CMBS IO positioning, and took advantage of very spready opportunities

in both Non-Agency Residential Mortgage-Backed Securities (“RMBS”) and CMBS. CMBS, and more broadly commercial real estate,

faces challenges ahead, and has already experienced significant spread widening.

| (1)

|

Total

return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained

by the Dividend Reinvestment Plan and changes in NAV per share for NAV returns and changes in Common Share Price for market value returns.

Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of

future results. |

Portfolio

Commentary (Continued)

First

Trust Mortgage Income Fund (FMY)

Annual

Report

October

31, 2023 (Unaudited)

The

portfolio management team put capital to work in bonds that were believed to be money good and that would benefit from extension or workout

scenarios, and such challenges were already reflected in the asset pricing. We believe this reallocation allowed the Fund to take advantage

of opportunities in the market and allowed the Fund to achieve its primary objective of a high level of current income more easily, as

evidenced by multiple dividend increases during the period. Given the relative perceived cheapness of the Agency MBS sector, the Fund

is also now using a modest amount of To-Be-Announced (“TBA”) leverage to take positions in Agency MBS. The Fund’s usage

of futures to extend or add duration was not beneficial to the strategy during the period as interest rates continued to climb. The Fund’s

use of options had minimal impact on the Fund’s performance during the period. As a reminder, over the last 3 years through October

31, 2023, which includes this most recent bear market cycle, the Fund has outperformed its Benchmark by nearly 1,100 bps on a NAV basis.

The

Fund has a practice of seeking to maintain a relatively stable monthly distribution, which may be changed at any time. The practice has

no impact on the Fund’s investment strategy and may reduce the Fund’s NAV. However, the Advisor believes the practice helps

maintain the Fund’s competitiveness and may benefit the Fund’s market price and premium/discount to the Fund’s NAV.

The monthly distribution rate began the period at $0.0550 per share and ended at $0.0675 per share. At the $0.0675 per share monthly distribution

rate, the annualized distribution rate at October 31, 2023 was 6.91% at NAV and 7.44% at market price. For the 12-month period ended October

31, 2023, 100.00% of the distributions were characterized as ordinary income. The final determination of the source and tax status of

all 2023 distributions will be made after the end of 2023 and will be provided on Form 1099-DIV. Not to be construed as tax advice. Please

consult your tax advisor for further information regarding tax matters.

Market

and Fund Outlook

In

the Fed tightening cycle of 2004-2006 and subsequent pause, the funding rate peaked in early October 2007. It had been 2+ years of consistent

Federal Funds target rate tightening but at a much slower rate than the recent cycle. Unlike that period, most homeowners of today locked

into long-dated mortgages and the loan underwriting of housing has been vastly superior to that deployed nearly two decades ago. The tsunami

that hit the mortgage market and banks that were leveraged to it in the 2007-2009 period does not exist in this cycle, and, as such, the

economy remains very resilient to the Fed’s interest rate increases. Further, corporations are also not exposed in the very near

term to significant funding cost increases. The implications are that the Fed’ s expectation of the economy’s reaction function

to its interest rate increases has been significantly overestimated leading it to the necessity of raising rates further than most market

participants, or the Fed itself, would have expected necessary. So, in this world, with less sensitivity to interest rate rises and still

healthy U.S. hiring, where is the forward economic contraction going to come from? In short, how does this cycle end? We think the answer

lies in both the government and U.S. corporations and interestingly, we believe it is likely to have similar timing as the cycle two decades

ago. We believe there will be three sources of future U.S. contraction that are baked in and all of them highly foreseeable. First, corporations

will likely start to see their funding costs go up as new projects become more expensive, but also starting in 2025, we believe we will

see meaningful amounts of corporate debt that need to be refinanced, and now, at much higher costs. Second, there will likely be cost

pressures on U.S. corporations at full U.S. employment as workers’ look to recoup real wage losses experienced over the last several

years as wages did not keep pace with inflation amidst government spending and Fed quantitative easing. We anticipate this financial pressure

will negatively impact the economy but will be, and has been, more delayed in timing this cycle than prior ones. Lastly, and likely the

most important fact, is the U.S. government’s debt as a percentage of gross domestic product is much higher than any other period

in modern U.S. history, short of the height of the pandemic when the country was shut down. Further, funding costs were near zero during

the pandemic but now are approximately 400 to 500 plus bps higher across the government’s borrowing maturities. In short, current

U.S. government interest costs are much higher than in the last 25 years and are comparable to those in the 1980s through late 1990s when

U.S. inflation was much higher. In earlier periods however, entitlement programs were in much better shape such that very large tax increases,

spending cuts, or both, were less necessary than today. We believe the contraction is coming; the timing is not as clear, but it is inevitable,

in our opinion. The continued rise in U.S. Treasury longer maturity interest rates (10 years and longer) in the third quarter of 2023

indicates there is little place for anyone borrowing to hide, least of all the U.S. government. We believe a recession is likely in our

future, and one only needs to wait for the foreseeable events to play out.

We

remain committed to finding value across the various credit sectors of the mortgage and securitized market, but also along the term spectrum

of the U.S. yield curve. Given the massive increase in interest rates over the last 24 months, we have increased the interest rate sensitivity

in the Fund as duration risks feel more balanced, and perhaps at 5%, more skewed to go lower. We are buyers of longer bonds and will extend

duration as the long maturity sector moves toward, and through, 5.0 % yield levels. To us, these real yield levels compensate us adequately

for the inflation risk and equally importantly the expected slow-down in the U.S. economy. As mentioned above, we expect further interest

rate rises from here to hinder growth, and more likely, over a strategic period, to push interest rates lower. We remain committed to

actively managing the convexity component in the portfolio and will look to continue to manage the Fund to a more stable duration target

than its Benchmark; meaning we do not want to extend in duration as rates rise, and conversely,

Portfolio

Commentary (Continued)

First

Trust Mortgage Income Fund (FMY)

Annual

Report

October

31, 2023 (Unaudited)

and,

at this point in the cycle, most importantly, we do not want to shorten or lose duration into a rally. From an asset allocation perspective,

we plan to take advantage of very wide spreads in select CMBS, RMBS and Asset-Backed Securities credit opportunities that the portfolio

managers find to be attractively priced in the short to intermediate part of the curve, while capturing longer maturity opportunities

in Agency MBS TBA and Treasury futures. In our view, this approach would provide higher current yield, income, total return, and spread

protection for shareholders. As an ongoing reminder, as part of the investment team’s ongoing Agency MBS strategy, a portion of

the agency securities have been, and will continue to be, invested in the interest-only sectors in an attempt to increase the income and

economic earnings of the portfolio. We believe this strategy can be very effective with proper security selection, particularly when combined

with appropriate yield curve management. We plan to continue to maintain a tradeable portfolio as that is critical to being able to act

should opportunities arise.

First

Trust Mortgage Income Fund (FMY)

Portfolio

of Investments

October

31, 2023

Principal

Value |

|

Description

|

|

Stated

Coupon |

|

Stated

Maturity |

|

Value

|

| MORTGAGE-BACKED

SECURITIES – 56.8% |

|

|

|

Collateralized

Mortgage Obligations – 18.1% |

|

|

|

|

|

|

|

|

|

Banc

of America Mortgage Trust |

|

|

|

|

|

|

| $44,186

|

|

Series 2002-L, Class 1A1 (a)

|

|

3.55%

|

|

12/01/32

|

|

$32,736

|

|

|

|

Citigroup

Mortgage Loan Trust |

|

|

|

|

|

|

| 70,344

|

|

Series 2005-6, Class A1, US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 2.10% (b)

|

|

6.15%

|

|

09/01/35

|

|

69,175

|

| 10,095

|

|

Series 2009-10, Class 1A1 (a) (c)

|

|

5.68%

|

|

09/01/33

|

|

9,870

|

|

|

|

Connecticut

Avenue Securities Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2019-R01, Class 2B1, 30 Day Average SOFR + CSA + 4.35% (b) (c)

|

|

9.79%

|

|

07/25/31

|

|

1,066,505

|

|

|

|

Countrywide

Home Loan Mortgage Pass-Through Trust |

|

|

|

|

|

|

| 238,040

|

|

Series 2006-HYB5, Class 3A1A (a)

|

|

4.97%

|

|

09/01/36

|

|

203,241

|

|

|

|

DSLA

Mortgage Loan Trust |

|

|

|

|

|

|

| 235,042

|

|

Series 2004-AR3, Class 2A2A, 1 Mo. CME Term SOFR + CSA + 0.74% (b)

|

|

6.19%

|

|

07/19/44

|

|

210,947

|

|

|

|

GSR

Mortgage Loan Trust |

|

|

|

|

|

|

| 2,350

|

|

Series 2003-10, Class 1A12 (a)

|

|

5.71%

|

|

10/01/33

|

|

2,208

|

| 79,085

|

|

Series 2005-AR1, Class 4A1 (a)

|

|

3.18%

|

|

01/01/35

|

|

66,576

|

|

|

|

JP

Morgan Mortgage Trust |

|

|

|

|

|

|

| 214,323

|

|

Series 2006-A2, Class 4A1 (a)

|

|

5.59%

|

|

08/01/34

|

|

210,378

|

| 32,550

|

|

Series 2006-A2, Class 5A3 (a)

|

|

5.74%

|

|

11/01/33

|

|

31,006

|

|

|

|

LHOME

Mortgage Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2023-RTL2, Class M (c) (d)

|

|

9.00%

|

|

06/25/28

|

|

899,804

|

|

|

|

MASTR

Alternative Loan Trust |

|

|

|

|

|

|

| 3,544,974

|

|

Series 2006-2, Class 2A3, 1 Mo. CME Term SOFR + CSA + 0.35% (b)

|

|

5.79%

|

|

03/25/36

|

|

376,533

|

|

|

|

MASTR

Asset Securitization Trust |

|

|

|

|

|

|

| 14,675

|

|

Series 2003-11, Class 6A16

|

|

5.25%

|

|

12/01/33

|

|

13,668

|

|

|

|

MortgageIT

Trust |

|

|

|

|

|

|

| 158,385

|

|

Series 2005-2, Class 2A, 1 Mo. CME Term SOFR + CSA + 1.65% (b)

|

|

7.08%

|

|

05/01/35

|

|

145,051

|

|

|

|

Pretium

Mortgage Credit Partners I LLC |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2021-NPL2, Class A2 (c) (d)

|

|

3.84%

|

|

06/27/60

|

|

778,515

|

|

|

|

PRKCM

Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2021-AFC1, Class B2 (c)

|

|

3.95%

|

|

08/01/56

|

|

507,170

|

|

|

|

Residential

Accredit Loans, Inc. |

|

|

|

|

|

|

| 72,609

|

|

Series 2006-QO1, Class 2A1, 1 Mo. CME Term SOFR + CSA + 0.54% (b)

|

|

5.98%

|

|

02/25/46

|

|

43,883

|

| 673,459

|

|

Series 2006-QS6, Class 1AV, IO (a)

|

|

0.77%

|

|

06/01/36

|

|

14,008

|

|

|

|

Residential

Asset Securitization Trust |

|

|

|

|

|

|

| 19,007

|

|

Series 2004-A3, Class A7

|

|

5.25%

|

|

06/01/34

|

|

16,431

|

|

|

|

Roc

Mortgage Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2021-RTL1, Class M (c)

|

|

5.68%

|

|

08/25/26

|

|

888,603

|

|

|

|

RUN

Trust |

|

|

|

|

|

|

| 873,759

|

|

Series 2022-NQM1, Class A1 (c)

|

|

4.00%

|

|

03/01/67

|

|

790,056

|

|

|

|

Starwood

Mortgage Residential Trust |

|

|

|

|

|

|

| 889,034

|

|

Series 2022-3, Class A1 (c)

|

|

4.16%

|

|

03/01/67

|

|

781,359

|

|

|

|

Structured

Asset Securities Corp. Mortgage Pass-Through

Certificates |

|

|

|

|

|

|

| 7,318

|

|

Series 2001-SB1, Class A2

|

|

3.38%

|

|

08/01/31

|

|

7,282

|

|

|

|

VCAT

LLC |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2021-NPL5, Class A2 (c) (d)

|

|

3.84%

|

|

08/25/51

|

|

778,846

|

| 1,000,000

|

|

Series 2021-NPL6, Class A2 (c) (d)

|

|

3.97%

|

|

09/25/51

|

|

778,306

|

|

|

|

Washington

Mutual Alternative Mortgage Pass-Through Certificates |

|

|

|

|

|

|

| 9,982

|

|

Series 2007-5, Class A11, (1 Mo. CME Term SOFR + CSA) x -6 + 39.48% (e)

|

|

6.85%

|

|

06/25/37

|

|

8,649

|

See

Notes to Financial Statements

Page

7

First

Trust Mortgage Income Fund (FMY)

Portfolio

of Investments (Continued)

October

31, 2023

Principal

Value |

|

Description

|

|

Stated

Coupon |

|

Stated

Maturity |

|

Value

|

| MORTGAGE-BACKED

SECURITIES (Continued) |

|

|

|

Collateralized

Mortgage Obligations (Continued) |

|

|

|

|

|

|

|

|

|

WinWater

Mortgage Loan Trust |

|

|

|

|

|

|

| $213,378

|

|

Series 2015-3, Class B1 (a) (c)

|

|

3.84%

|

|

03/01/45

|

|

$191,676

|

|

|

|

|

|

8,922,482

|

|

|

|

Commercial

Mortgage-Backed Securities – 38.7% |

|

|

|

|

|

|

|

|

|

1211

Avenue of the Americas Trust |

|

|

|

|

|

|

| 935,000

|

|

Series 2015-1211, Class C (a) (c)

|

|

4.14%

|

|

08/01/35

|

|

841,716

|

|

|

|

Aventura

Mall Trust |

|

|

|

|

|

|

| 1,250,000

|

|

Series 2018-AVM, Class D (a) (c)

|

|

4.11%

|

|

07/01/40

|

|

1,014,983

|

|

|

|

BAMLL

Commercial Mortgage Securities Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2013-WBRK, Class A (a) (c)

|

|

3.53%

|

|

03/01/37

|

|

872,126

|

|

|

|

BANK

|

|

|

|

|

|

|

| 22,342,755

|

|

Series 2017-BNK7, Class XA, IO (a)

|

|

0.72%

|

|

09/01/60

|

|

464,506

|

| 2,160,500

|

|

Series 2020-BNK30, Class E (c)

|

|

2.50%

|

|

12/01/53

|

|

1,038,969

|

|

|

|

BBCMS

Mortgage Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2018-TALL, Class B, 1 Mo. CME Term SOFR + CSA + 1.12% (b) (c)

|

|

6.50%

|

|

03/15/37

|

|

870,682

|

|

|

|

Benchmark

Mortgage Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2020-IG2, Class UBRD (a) (c)

|

|

3.51%

|

|

09/01/48

|

|

848,005

|

|

|

|

CCRE

Commercial Mortgage Securities L.P. |

|

|

|

|

|

|

| 7,919,618

|

|

CFCRE Mortgage Trust Commercial Mortgage Pass-Through Certificates, Series 2017-C8, Class XA, IO (a)

|

|

1.48%

|

|

06/01/50

|

|

307,017

|

|

|

|

CD

Mortgage Trust |

|

|

|

|

|

|

| 8,622,086

|

|

Series 2018-CD7, Class XA, IO (a)

|

|

0.64%

|

|

08/01/51

|

|

220,659

|

|

|

|

Citigroup

Commercial Mortgage Trust |

|

|

|

|

|

|

| 4,177,399

|

|

Series 2015-GC29, Class XA, IO (a)

|

|

1.01%

|

|

04/01/48

|

|

45,088

|

| 8,608,812

|

|

Series 2016-GC37, Class XA, IO (a)

|

|

1.65%

|

|

04/01/49

|

|

249,455

|

| 5,515,032

|

|

Series 2016-P4, Class XA, IO (a)

|

|

1.89%

|

|

07/01/49

|

|

204,890

|

|

|

|

COMM

Mortgage Trust |

|

|

|

|

|

|

| 122,774,000

|

|

Series 2014-UBS6, Class XB, IO (a) (c)

|

|

0.04%

|

|

12/01/47

|

|

60,491

|

| 3,829,000

|

|

Series 2015-CCRE26, Class XD, IO (a) (c)

|

|

1.21%

|

|

10/01/48

|

|

77,816

|

| 14,711,211

|

|

Series 2015-LC21, Class XA, IO (a)

|

|

0.64%

|

|

07/01/48

|

|

114,016

|

|

|

|

Credit

Suisse Mortgage Capital Certificates |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2021-980M, Class G (a) (c)

|

|

3.54%

|

|

07/15/31

|

|

733,716

|

|

|

|

Credit

Suisse Mortgage Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2022-CNTR, Class A, 1 Mo. CME Term SOFR + CSA + 3.94%, 4.09% Floor (b) (c)

|

|

9.28%

|

|

01/15/24

|

|

867,235

|

|

|

|

CSAIL

Commercial Mortgage Trust |

|

|

|

|

|

|

| 5,883,588

|

|

Series 2020-C19, Class XA, IO (a)

|

|

1.10%

|

|

03/01/53

|

|

294,185

|

|

|

|

FIVE

Mortgage Trust |

|

|

|

|

|

|

| 28,958,917

|

|

Series 2023-V1, Class XA, IO (b)

|

|

0.83%

|

|

02/01/56

|

|

852,336

|

|

|

|

GS

Mortgage Securities Corp Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2018-3PCK, Class C, 1 Mo. CME Term SOFR + CSA + 3.50% (b) (c)

|

|

8.95%

|

|

09/15/31

|

|

967,384

|

|

|

|

GS

Mortgage Securities Trust |

|

|

|

|

|

|

| 823,474

|

|

Series 2012-GCJ9, Class D (a) (c)

|

|

4.60%

|

|

11/01/45

|

|

745,214

|

|

|

|

Houston

Galleria Mall Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2015-HGLR, Class D (c)

|

|

3.98%

|

|

03/01/37

|

|

914,007

|

|

|

|

Hudsons

Bay Simon JV Trust |

|

|

|

|

|

|

| 156,152

|

|

Series 2015-HBFL, Class DFL, 1 Mo. CME Term SOFR + CSA + 3.90% (b) (c)

|

|

9.34%

|

|

08/05/34

|

|

132,646

|

|

|

|

JP

Morgan Chase Commercial Mortgage Securities Trust |

|

|

|

|

|

|

| 20,237,120

|

|

Series 2016-JP4, Class XA, IO (a)

|

|

0.58%

|

|

12/01/49

|

|

269,111

|

| 969,086

|

|

Series 2018-PHH, Class A, 1 Mo. CME Term SOFR + CSA + 1.21%, 2.71% Floor (b) (c)

|

|

6.59%

|

|

06/15/35

|

|

857,040

|

Page

8

See

Notes to Financial Statements

First

Trust Mortgage Income Fund (FMY)

Portfolio

of Investments (Continued)

October

31, 2023

Principal

Value |

|

Description

|

|

Stated

Coupon |

|

Stated

Maturity |

|

Value

|

| MORTGAGE-BACKED

SECURITIES (Continued) |

|

|

|

Commercial

Mortgage-Backed Securities (Continued) |

|

|

|

|

|

|

|

|

|

LSTAR

Commercial Mortgage Trust |

|

|

|

|

|

|

| $1,500,000

|

|

Series 2017-5, Class D (a) (c)

|

|

4.67%

|

|

03/01/50

|

|

$1,034,949

|

| 23,596,467

|

|

Series 2017-5, Class X, IO (a) (c)

|

|

0.80%

|

|

03/01/50

|

|

405,998

|

|

|

|

LUXE

Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2021-TRIP, Class F, 1 Mo. CME Term SOFR + CSA + 3.25% (b) (c)

|

|

8.70%

|

|

10/15/38

|

|

973,026

|

|

|

|

Morgan

Stanley Bank of America Merrill Lynch Trust |

|

|

|

|

|

|

| 14,448,664

|

|

Series 2014-C16, Class XA, IO (a)

|

|

0.87%

|

|

06/01/47

|

|

20,368

|

| 1,863,910

|

|

Series 2014-C19, Class XA, IO (a)

|

|

0.95%

|

|

12/01/47

|

|

9,691

|

| 5,632,500

|

|

Series 2014-C19, Class XE, IO (a) (c)

|

|

1.18%

|

|

12/01/47

|

|

68,845

|

| 429,743

|

|

Series 2016-C31, Class XA, IO (a)

|

|

1.26%

|

|

11/01/49

|

|

12,123

|

|

|

|

Morgan

Stanley Capital I Trust |

|

|

|

|

|

|

| 2,180,000

|

|

Series 2016-UBS9, Class XD, IO (a) (c)

|

|

1.59%

|

|

03/01/49

|

|

71,016

|

| 1,320,000

|

|

Series 2019-L2, Class C (a)

|

|

4.97%

|

|

03/01/52

|

|

978,146

|

|

|

|

VMC

Finance |

|

|

|

|

|

|

| 820,463

|

|

Series 2021-HT1, Class A, 1 Mo. CME Term SOFR + CSA + 1.65% (b) (c)

|

|

7.10%

|

|

01/18/37

|

|

801,060

|

|

|

|

Wells

Fargo Commercial Mortgage Trust |

|

|

|

|

|

|

| 1,255,060

|

|

Series 2015-C26, Class XA, IO (a)

|

|

1.18%

|

|

02/01/48

|

|

13,054

|

| 1,034,000

|

|

Series 2016-NXS6, Class C (a)

|

|

4.39%

|

|

11/01/49

|

|

870,665

|

|

|

|

|

|

19,122,234

|

|

|

|

Total Mortgage-Backed Securities

|

|

28,044,716

|

|

|

|

(Cost

$31,793,510) |

|

|

|

|

|

|

| U.S.

GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES – 56.4% |

|

|

|

Collateralized

Mortgage Obligations – 19.3% |

|

|

|

|

|

|

|

|

|

Federal

Home Loan Mortgage Corp. |

|

|

|

|

|

|

| 450

|

|

Series 2303, Class SW, IO, ECOFIN x -15.87 + 121.11%, Capped at 10.00% (e)

|

|

10.00%

|

|

03/01/24

|

|

5

|

| 117,942

|

|

Series 2439, Class XI, IO, if 1 Mo. LIBOR x -1 + 7.74% is less than 7.50%, then 6.50%, otherwise 0.00% (e)

|

|

6.50%

|

|

03/01/32

|

|

15,859

|

| 593,792

|

|

Series 2975, Class SJ, IO, (30 Day Average SOFR + CSA) x -1 + 6.65% (e)

|

|

1.22%

|

|

05/15/35

|

|

33,544

|

| 14,051

|

|

Series 3451, Class SB, IO, (30 Day Average SOFR + CSA) x -1 + 6.03% (e)

|

|

0.60%

|

|

05/15/38

|

|

705

|

| 208,187

|

|

Series 3471, Class SD, IO, (30 Day Average SOFR + CSA) x -1 + 6.08% (e)

|

|

0.65%

|

|

12/15/36

|

|

12,253

|

| 9,670

|

|

Series 4021, Class IP, IO

|

|

3.00%

|

|

03/01/27

|

|

310

|

| 169,972

|

|

Series 4057, Class YI, IO

|

|

3.00%

|

|

06/01/27

|

|

5,873

|

| 337,638

|

|

Series 4082, Class PI, IO

|

|

3.00%

|

|

06/01/27

|

|

11,598

|

| 229,423

|

|

Series 4206, Class IA, IO

|

|

3.00%

|

|

03/01/33

|

|

18,115

|

|

|

|

Federal

Home Loan Mortgage Corp. STACR REMIC Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2020-DNA1, 30 Day Average SOFR + CSA + 5.25% (b) (c)

|

|

10.69%

|

|

01/25/50

|

|

1,016,062

|

| 1,000,000

|

|

Series 2020-DNA2, Class B2, 30 Day Average SOFR + CSA + 4.80% (b) (c)

|

|

10.24%

|

|

02/25/50

|

|

1,003,031

|

| 1,000,000

|

|

Series 2020-HQA1, 30 Day Average SOFR + CSA + 5.10% (b) (c)

|

|

10.54%

|

|

01/25/50

|

|

997,772

|

| 1,000,000

|

|

Series 2020-HQA2, Class B2, 30 Day Average SOFR + CSA + 7.60% (b) (c)

|

|

13.04%

|

|

03/25/50

|

|

1,090,675

|

|

|

|

Federal

Home Loan Mortgage Corp. STACR Trust |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2019-DNA3, Class B2, 30 Day Average SOFR + CSA + 8.15% (b) (c)

|

|

13.59%

|

|

07/25/49

|

|

1,111,099

|

See

Notes to Financial Statements

Page

9

First

Trust Mortgage Income Fund (FMY)

Portfolio

of Investments (Continued)

October

31, 2023

Principal

Value |

|

Description

|

|

Stated

Coupon |

|

Stated

Maturity |

|

Value

|

| U.S.

GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES (Continued) |

|

|

|

Collateralized

Mortgage Obligations (Continued) |

|

|

|

|

|

|

|

|

|

Federal

Home Loan Mortgage Corp. STACR Trust (Continued) |

|

|

|

|

|

|

| $1,000,000

|

|

Series 2019-DNA4, Class B2, 30 Day Average SOFR + CSA + 6.25% (b) (c)

|

|

11.69%

|

|

10/25/49

|

|

$1,065,983

|

|

|

|

Federal

Home Loan Mortgage Corp. Structured Pass-Through

Certificates |

|

|

|

|

|

|

| 44,295

|

|

Series T-56, Class APO, PO

|

|

(f)

|

|

05/01/43

|

|

32,683

|

|

|

|

Federal

Home Loan Mortgage Corp., STRIPS |

|

|

|

|

|

|

| 16,492

|

|

Series 177, IO

|

|

7.00%

|

|

07/01/26

|

|

985

|

|

|

|

Federal

National Mortgage Association |

|

|

|

|

|

|

| 12,689

|

|

Series 1996-46, Class ZA

|

|

7.50%

|

|

11/01/26

|

|

12,690

|

| 6,040

|

|

Series 1997-85, Class M, IO

|

|

6.50%

|

|

12/01/27

|

|

55

|

| 16,328

|

|

Series 2002-80, Class IO, IO

|

|

6.00%

|

|

09/01/32

|

|

1,081

|

| 43,808

|

|

Series 2003-15, Class MS, IO, (30 Day Average SOFR + CSA) x -1 + 8.00% (e)

|

|

2.56%

|

|

03/25/33

|

|

3,938

|

| 50,753

|

|

Series 2003-44, Class IU, IO

|

|

7.00%

|

|

06/01/33

|

|

7,901

|

| 51,222

|

|

Series 2005-6, Class SE, IO, (30 Day Average SOFR + CSA) x -1 + 6.70% (e)

|

|

1.26%

|

|

02/25/35

|

|

3,060

|

| 26,477

|

|

Series 2007-100, Class SM, IO, (30 Day Average SOFR + CSA) x -1 + 6.45% (e)

|

|

1.01%

|

|

10/25/37

|

|

1,765

|

| 153,017

|

|

Series 2007-37, Class SB, IO, (30 Day Average SOFR + CSA) x -1 + 6.75% (e)

|

|

1.31%

|

|

05/25/37

|

|

12,240

|

| 294,177

|

|

Series 2008-17, Class BE

|

|

5.50%

|

|

10/01/37

|

|

275,627

|

| 596,095

|

|

Series 2010-103, Class ID, IO

|

|

5.00%

|

|

09/01/40

|

|

96,382

|

| 36,439

|

|

Series 2010-99, Class SG, (30 Day Average SOFR + CSA) x -5 + 25.00%, 0.00% Floor (b) (e)

|

|

0.00%

|

|

09/01/40

|

|

34,246

|

| 313,231

|

|

Series 2011-81, Class PI, IO

|

|

3.50%

|

|

08/01/26

|

|

8,019

|

| 208,010

|

|

Series 2012-112, Class BI, IO

|

|

3.00%

|

|

09/01/31

|

|

3,671

|

| 1,275,563

|

|

Series 2012-125, Class MI, IO

|

|

3.50%

|

|

11/01/42

|

|

177,516

|

| 16,897

|

|

Series 2013-132, Class SW, (30 Day Average SOFR + CSA) x -2.67 + 10.67%, 0.00% Floor (b) (e)

|

|

0.00%

|

|

01/01/44

|

|

9,719

|

| 1,589,806

|

|

Series 2013-32, Class IG, IO

|

|

3.50%

|

|

04/01/33

|

|

165,218

|

| 1,300,064

|

|

Series 2015-20, Class ES, IO, (30 Day Average SOFR + CSA) x -1 + 6.15% (e)

|

|

0.71%

|

|

04/25/45

|

|

114,947

|

| 84,786

|

|

Series 2015-76, Class BI, IO

|

|

4.00%

|

|

10/01/39

|

|

1,796

|

| 168,142

|

|

Series 2016-74, Class LI, IO

|

|

3.50%

|

|

09/01/46

|

|

41,857

|

| 2,364,481

|

|

Series 2017-109, Class SJ, IO, (30 Day Average SOFR + CSA) x -1 + 6.20% (e)

|

|

0.76%

|

|

01/25/48

|

|

214,222

|

| 1,939,915

|

|

Series 5179, Class GZ

|

|

2.00%

|

|

01/01/52

|

|

854,239

|

|

|

|

Federal

National Mortgage Association, STRIPS |

|

|

|

|

|

|

| 15,947

|

|

Series 305, Class 12, IO (g)

|

|

6.50%

|

|

12/01/29

|

|

1,394

|

| 31,057

|

|

Series 355, Class 18, IO

|

|

7.50%

|

|

11/01/33

|

|

4,321

|

| 434,515

|

|

Series 406, Class 6, IO (g)

|

|

4.00%

|

|

01/01/41

|

|

71,876

|

|

|

|

Government

National Mortgage Association |

|

|

|

|

|

|

| 108,661

|

|

Series 2005-33, Class AY

|

|

5.50%

|

|

04/01/35

|

|

107,540

|

| 133,858

|

|

Series 2007-68, Class PI, IO, (1 Mo. CME Term SOFR + CSA) x -1 + 6.65% (e)

|

|

1.20%

|

|

11/20/37

|

|

3,176

|

| 100,000

|

|

Series 2008-2, Class HB

|

|

5.50%

|

|

01/01/38

|

|

96,601

|

| 110,129

|

|

Series 2008-73, Class SK, IO, (1 Mo. CME Term SOFR + CSA) x -1 + 6.74% (e)

|

|

1.29%

|

|

08/20/38

|

|

5,353

|

| 210,067

|

|

Series 2013-104, Class YS, IO, (1 Mo. CME Term SOFR + CSA) x -1 + 6.15% (e)

|

|

0.70%

|

|

07/16/43

|

|

10,269

|

| 3,543,476

|

|

Series 2015-158, Class KS, IO, (1 Mo. CME Term SOFR + CSA) x -1 + 6.25% (e)

|

|

0.80%

|

|

11/20/45

|

|

314,292

|

| 76,284

|

|

Series 2016-139, Class MZ

|

|

1.50%

|

|

07/01/45

|

|

53,740

|

| 161,588

|

|

Series 2017-4, Class CZ

|

|

3.00%

|

|

01/01/47

|

|

114,339

|

Page

10

See

Notes to Financial Statements

First

Trust Mortgage Income Fund (FMY)

Portfolio

of Investments (Continued)

October

31, 2023

Principal

Value |

|

Description

|

|

Stated

Coupon |

|

Stated

Maturity |

|

Value

|

| U.S.

GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES (Continued) |

|

|

|

Collateralized

Mortgage Obligations (Continued) |

|

|

|

|

|

|

|

|

|

Government

National Mortgage Association (Continued) |

|

|

|

|

|

|

| $132,257

|

|

Series 2017-H18, Class DZ (g)

|

|

4.63%

|

|

09/01/67

|

|

$115,940

|

| 9,996,077

|

|

Series 2020-13, Class BT, IO, (1 Mo. CME Term SOFR + CSA) x -1 + 6.20%, Capped at 0.50% (e)

|

|

0.50%

|

|

11/20/45

|

|

199,310

|

|

|

|

|

|

9,554,892

|

|

|

|

Commercial

Mortgage-Backed Securities – 14.9% |

|

|

|

|

|

|

|

|

|

Federal

Home Loan Mortgage Corp. Multifamily Structured

Pass-Through Certificates |

|

|

|

|

|

|

| 30,000,000

|

|

Series K043, Class X3, IO (a)

|

|

1.63%

|

|

02/01/43

|

|

550,479

|

| 14,500,000

|

|

Series K071, Class X3, IO (a)

|

|

2.01%

|

|

11/01/45

|

|

1,020,382

|

| 4,000,000

|

|

Series K110, Class X3, IO (a)

|

|

3.40%

|

|

06/01/48

|

|

663,421

|

| 4,605,411

|

|

Series K115, Class X3, IO (a)

|

|

2.96%

|

|

09/01/48

|

|

680,819

|

| 4,326,216

|

|

Series K118, Class X3, IO (a)

|

|

2.69%

|

|

10/25/48

|

|

594,308

|

| 1,900,000

|

|

Series K122, Class X3, IO (a)

|

|

2.63%

|

|

01/01/49

|

|

259,838

|

| 5,000,000

|

|

Series K124, Class X3, IO (a)

|

|

2.62%

|

|

02/01/49

|

|

693,239

|

| 3,343,856

|

|

Series K128, Class X3, IO (a)

|

|

2.78%

|

|

04/01/31

|

|

501,017

|

| 1,831,144

|

|

Series K739, Class X3, IO (a)

|

|

2.81%

|

|

11/25/48

|

|

160,151

|

| 341,978,793

|

|

Series KBX1, Class X1, IO (a)

|

|

0.09%

|

|

01/01/26

|

|

444,299

|

| 4,571,896

|

|

Series KG06, Class X3, IO (a)

|

|

2.73%

|

|

10/01/31

|

|

678,627

|

|

|

|

Federal

National Mortgage Association, ACES |

|

|

|

|

|

|

| 13,100,000

|

|

Series 2019-M29, Class X4, IO

|

|

0.70%

|

|

03/01/29

|

|

362,596

|

|

|

|

Freddie

Mac Multiclass Certificates |

|

|

|

|

|

|

| 5,782,630

|

|

Series 2021-P011, Class X1, IO (a)

|

|

1.78%

|

|

09/01/45

|

|

666,270

|

|

|

|

Government

National Mortgage Association |

|

|

|

|

|

|

| 2,187,863

|

|

Series 2016-11, Class IO, IO (g)

|

|

0.78%

|

|

01/01/56

|

|

74,672

|

|

|

|

|

|

7,350,118

|

|

|

|

Pass-through

Security – 22.2% |

|

|

|

|

|

|

|

|

|

Fannie

Mae or Freddie Mac |

|

|

|

|

|

|

| 2,000,000

|

|

Pool TBA (h)

|

|

3.50%

|

|

11/01/53

|

|

1,665,573

|

| 3,000,000

|

|

Pool TBA (h)

|

|

5.00%

|

|

11/01/53

|

|

2,765,859

|

| 1,500,000

|

|

Pool TBA (h)

|

|

5.50%

|

|

11/01/53

|

|

1,422,774

|

| 2,000,000

|

|

Pool TBA (h)

|

|

3.50%

|

|

12/01/53

|

|

1,667,448

|

| 4,000,000

|

|

Pool TBA (h)

|

|

4.00%

|

|

12/01/53

|

|

3,458,125

|

|

|

|

|

|

10,979,779

|

|

|

|

Total U.S. Government Agency Mortgage-Backed Securities

|

|

27,884,789

|

|

|

|

(Cost

$31,647,281) |

|

|

|

|

|

|

| ASSET-BACKED

SECURITIES – 4.2% |

|

|

|

Adams

Outdoor Advertising LP |

|

|

|

|

|

|

| 1,000,000

|

|

Series 2023-1, Class B (c)

|

|

8.81%

|

|

07/15/53

|

|

994,988

|

|

|

|

CoreVest

American Finance Trust |

|

|

|

|

|

|

| 8,938,703

|

|

Series 2021-3, Class XA, IO (a) (c)

|

|

2.38%

|

|

10/01/54

|

|

510,283

|

|

|

|

Mid-State

Capital Corp. Trust |

|

|

|

|

|

|

| 116,540

|

|

Series 2005-1, Class A

|

|

5.75%

|

|

01/01/40

|

|

113,949

|

|

|

|

PAGAYA

AI Debt Trust |

|

|

|

|

|

|

| 447,246

|

|

Series 2022-3, Class A (c)

|

|

6.06%

|

|

03/15/30

|

|

445,186

|

|

|

|

Total Asset-Backed Securities

|

|

2,064,406

|

|

|

|

(Cost

$2,115,223) |

|

|

|

|

|

|

See

Notes to Financial Statements

Page

11

First

Trust Mortgage Income Fund (FMY)

Portfolio

of Investments (Continued)

October

31, 2023

| Shares

|

|

Description

|

|

Value

|

| MONEY

MARKET FUNDS – 3.5% |

| 1,748,885

|

|

Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional Class - 5.22% (i)

|

|

$1,748,885

|

| |

|

(Cost

$1,748,885) |

|

|

|

|

Total Investments – 120.9%

|

|

59,742,796

|

|

|

(Cost

$67,304,899) |

|

|

|

|

| Number

of Contracts |

|

Description

|

|

Notional

Amount |

|

Exercise

Price |

|

Expiration

Date |

|

Value

|

| PUT

OPTIONS WRITTEN – (0.0)% |

| (10)

|

|

U.S. 10-Year Treasury Futures Put

|

|

$(1,061,719)

|

|

$104.50

|

|

11/24/23

|

|

(2,813)

|

| |

|

(Premiums

received $7,005) |

|

|

|

|

|

|

|

|

|

|

Net Other Assets and Liabilities – (20.9)%

|

|

(10,341,562)

|

|

|

Net Assets – 100.0%

|

|

$49,398,421

|

Futures

Contracts (See Note 2C - Futures Contracts in the Notes to Financial Statements):

| Futures

Contracts |

|

Position

|

|

Number

of

Contracts |

|

Expiration

Date |

|

Notional

Value |

|

Unrealized

Appreciation

(Depreciation)/

Value |

| US

Treasury 10 Year Note Future |

|

Long

|

|

6

|

|

Dec

2023 |

|

$

637,031 |

|

$1,781

|

| US

Treasury 2 Year Note Future |

|

Long

|

|

8

|

|

Dec

2023 |

|

1,619,350

|

|

(187)

|

| US

Treasury 5 Year Note Future |

|

Long

|

|

26

|

|

Dec

2023 |

|

2,716,391

|

|

(656)

|

| US

Treasury Bond Future |

|

Long

|

|

33

|

|

Dec

2023 |

|

3,611,437

|

|

13,906

|

| US

Treasury Ultra 10 Year Note Future |

|

Long

|

|

54

|

|

Dec

2023 |

|

5,876,719

|

|

(216,828)

|

|

|

|

|

|

|

|

|

|

$14,460,928

|

|

$(201,984)

|

| (a)

|

Collateral

Strip Rate security. Coupon is based on the weighted net interest rate of the investment’s underlying collateral. The interest rate

resets periodically. |

| (b)

|

Floating

or variable rate security. |

| (c)

|

This

security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A of the Securities

Act of 1933, as amended, and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant

to procedures adopted by the Fund’s Board of Trustees, this security has been determined to be liquid by First Trust Advisors L.P.,

the Fund’s investment advisor. Although market instability can result in periods of increased overall market illiquidity, liquidity

for each security is determined based on security specific factors and assumptions, which require subjective judgment. At October 31,

2023, securities noted as such amounted to $29,902,713 or 60.5% of net assets. |

| (d)

|

Step-up