Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Novembre 2023 - 5:16PM

Edgar (US Regulatory)

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

—

94.9%

Aerospace

—

1.3%

7,370

Allient

Inc.

......................

$

227,880

1,950

BAE

Systems

plc,

ADR

.............

96,428

200

General

Dynamics

Corp.

............

44,194

13,500

HEICO

Corp.

.....................

2,186,055

75,000

Howmet

Aerospace

Inc.

.............

3,468,750

70,000

Kaman

Corp.

....................

1,375,500

59,250

L3Harris

Technologies

Inc.

...........

10,316,610

2,325

Mercury

Systems

Inc.†

.............

86,234

213

Northrop

Grumman

Corp.

...........

93,760

1,200,000

Rolls-Royce

Holdings

plc†

...........

3,234,241

440

RTX

Corp.

......................

31,667

400

Thales

SA

......................

56,288

56,000

The

Boeing

Co.†

..................

10,734,080

31,951,687

Agriculture

—

0.0%

5,000

Corteva

Inc.

.....................

255,800

Automotive

—

0.9%

15,000

Daimler

Truck

Holding

AG

...........

520,484

50,000

Ford

Motor

Co.

...................

621,000

67,500

General

Motors

Co.

................

2,225,475

306,000

Iveco

Group

NV†

.................

2,867,021

100,000

PACCAR

Inc.

....................

8,502,000

22,800

Tesla

Inc.†

......................

5,705,016

46,000

Traton

SE

.......................

969,266

21,410,262

Automotive:

Parts

and

Accessories

—

2.8%

48,676

Aptiv

plc†

......................

4,798,967

276,432

Dana

Inc.

.......................

4,055,257

200,000

Dowlais

Group

plc

.................

262,078

276,015

Garrett

Motion

Inc.†

...............

2,174,998

270,400

Genuine

Parts

Co.

.................

39,040,352

6,000

Lear

Corp.

......................

805,200

30,000

Modine

Manufacturing

Co.†

..........

1,372,500

6,000

Monro

Inc.

......................

166,620

15,000

O'Reilly

Automotive

Inc.†

............

13,632,900

12,000

Visteon

Corp.†

...................

1,656,840

67,965,712

Aviation:

Parts

and

Services

—

0.0%

2,428

Astronics

Corp.†

..................

38,508

Broadcasting

—

0.6%

705,000

Grupo

Televisa

SAB,

ADR

............

2,150,250

32,121

Liberty

Broadband

Corp.,

Cl. C†

.......

2,933,290

323,000

Liberty

Global

plc,

Cl. C†

............

5,994,880

100,000

Liberty

Media

Corp.-Liberty

SiriusXM†

..

2,546,000

145,000

Sinclair

Inc.

.....................

1,626,900

Shares

Market

Value

20,000

TEGNA

Inc.

.....................

$

291,400

15,542,720

Building

and

Construction

—

1.8%

9,000

Arcosa

Inc.

......................

647,100

82,000

Carrier

Global

Corp.

...............

4,526,400

78,200

Fortune

Brands

Innovations

Inc.

.......

4,860,912

4,500

H&E

Equipment

Services

Inc.

.........

194,355

121,693

Herc

Holdings

Inc.

................

14,474,165

211,700

Johnson

Controls

International

plc

.....

11,264,557

36,090

Masterbrand

Inc.†

.................

438,493

11,000

Sika

AG

........................

2,801,224

8,500

United

Rentals

Inc.

................

3,778,845

42,986,051

Business

Services

—

2.9%

45,000

Diebold

Nixdorf

Inc.†

..............

0

15,000

Jardine

Matheson

Holdings

Ltd.

.......

696,300

66,000

JCDecaux

SE†

...................

1,117,852

1,000

Loomis

AB

......................

26,964

144,620

Mastercard

Inc.,

Cl. A

..............

57,256,504

32,000

Rentokil

Initial

plc,

ADR

.............

1,185,600

30,503

Steel

Partners

Holdings

LP†

..........

1,296,991

25,000

Stericycle

Inc.†

...................

1,117,750

41,600

Visa

Inc.,

Cl. A

...................

9,568,416

72,266,377

Cable

and

Satellite

—

1.1%

15,000

AMC

Networks

Inc.,

Cl. A†

...........

176,700

7,445

Charter

Communications

Inc.,

Cl. A†

....

3,274,460

15,000

Cogeco

Inc.

.....................

544,119

388,000

Comcast

Corp.,

Cl. A

...............

17,203,920

20,000

EchoStar

Corp.,

Cl. A†

..............

335,000

10,000

Liberty

Latin

America

Ltd.,

Cl. A†

......

81,600

69,000

Liberty

Latin

America

Ltd.,

Cl. C†

......

563,040

95,000

Rogers

Communications

Inc.,

Cl. B

.....

3,647,050

90,000

WideOpenWest

Inc.†

...............

688,500

26,514,389

Communications

Equipment

—

0.4%

24,200

Arista

Networks

Inc.†

..............

4,451,106

106,000

Corning

Inc.

.....................

3,229,820

7,500

QUALCOMM

Inc.

.................

832,950

85,000

Telesat

Corp.†

...................

1,215,500

9,729,376

Computer

Hardware

—

0.9%

123,650

Apple

Inc.

......................

21,170,117

10,000

Dell

Technologies

Inc.,

Cl. C

..........

689,000

5,000

HP

Inc.

........................

128,500

17,500

Micron

Technology

Inc.

.............

1,190,525

23,178,142

Computer

Software

and

Services

—

7.8%

5,000

3D

Systems

Corp.†

................

24,550

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Computer

Software

and

Services

(Continued)

1,000

Activision

Blizzard

Inc.

..............

$

93,630

16,800

Adobe

Inc.†

.....................

8,566,320

1,000

Akamai

Technologies

Inc.†

...........

106,540

1,000

Alibaba

Group

Holding

Ltd.,

ADR†

.....

86,740

88,780

Alphabet

Inc.,

Cl. A†

...............

11,617,751

315,100

Alphabet

Inc.,

Cl. C†

...............

41,545,935

174,900

Amazon.com

Inc.†

................

22,233,288

5,000

Avid

Technology

Inc.†

..............

134,350

8,520

Backblaze

Inc.,

Cl. A†

..............

46,860

4,000

Check

Point

Software

Technologies

Ltd.†

.

533,120

23,000

Cisco

Systems

Inc.

................

1,236,480

22,700

CrowdStrike

Holdings

Inc.,

Cl. A†

......

3,799,526

30,000

eBay

Inc.

.......................

1,322,700

150,610

Edgio

Inc.†

......................

128,335

5,000

Fastly

Inc.,

Cl. A†

.................

95,850

6,600

Fiserv

Inc.†

.....................

745,536

2,500

Gen

Digital

Inc.

...................

44,200

500,000

Hewlett

Packard

Enterprise

Co.

........

8,685,000

4,790

Intuit

Inc.

.......................

2,447,403

59,000

Kyndryl

Holdings

Inc.†

.............

890,900

38,750

Meta

Platforms

Inc.,

Cl. A†

..........

11,633,137

142,800

Microsoft

Corp.

..................

45,089,100

12,000

MKS

Instruments

Inc.

..............

1,038,480

75,000

N-able

Inc.†

.....................

967,500

2,500

Oracle

Corp.

.....................

264,800

40,000

Oxford

Metrics

plc

................

44,168

67,000

Rockwell

Automation

Inc.

...........

19,153,290

4,500

SAP

SE,

ADR

....................

581,940

10,200

ServiceNow

Inc.†

.................

5,701,392

88,854

SolarWinds

Corp.†

................

838,782

12,000

Stratasys

Ltd.†

...................

163,320

39,514

Vimeo

Inc.†

.....................

139,879

8,000

VMware

Inc.,

Cl. A†

................

1,331,840

191,332,642

Consumer

Products

—

1.7%

30,000

Church

&

Dwight

Co.

Inc.

...........

2,748,900

341,000

Edgewell

Personal

Care

Co.

..........

12,603,360

57,000

Energizer

Holdings

Inc.

.............

1,826,280

99,000

Hanesbrands

Inc.

.................

392,040

2,081

HNI

Corp.

.......................

72,065

700

Johnson

Outdoors

Inc.,

Cl. A

.........

38,283

80

Kering

SA

......................

36,530

3,000

Kimberly-Clark

Corp.

...............

362,550

3,995

Nintendo

Co.

Ltd.,

ADR

.............

41,348

137,000

Philip

Morris

International

Inc.

........

12,683,460

2,870

Spectrum

Brands

Holdings

Inc.

.......

224,864

250

The

Estee

Lauder

Companies

Inc.,

Cl. A

..

36,138

73,000

The

Procter

&

Gamble

Co.

...........

10,647,780

Shares

Market

Value

5,000

The

Scotts

Miracle-Gro

Co.

..........

$

258,400

41,971,998

Consumer

Services

—

0.2%

86,530

Arlo

Technologies

Inc.†

.............

891,259

23,000

Ashtead

Group

plc

................

1,403,676

750

Booking

Holdings

Inc.†

.............

2,312,962

150,000

Rentokil

Initial

plc

.................

1,116,758

7,000

Travel

+

Leisure

Co.

................

257,110

72

Vroom

Inc.†

.....................

81

5,981,846

Diversified

Industrial

—

3.7%

500

Agilent

Technologies

Inc.

............

55,910

10,555

American

Outdoor

Brands

Inc.†

.......

103,228

237,000

Ampco-Pittsburgh

Corp.†

...........

623,310

10,845

AZZ

Inc.

........................

494,315

95,000

Bouygues

SA

....................

3,328,540

4,800

Crane

Co.

.......................

426,432

3,000

Crane

NXT

Co.

...................

166,710

38,400

Eaton

Corp.

plc

...................

8,189,952

10,600

General

Electric

Co.

................

1,171,830

3,500

Graham

Corp.†

...................

58,100

176,000

Griffon

Corp.

....................

6,981,920

178,800

Honeywell

International

Inc.

..........

33,031,512

11,000

Hyster-Yale

Materials

Handling

Inc.

.....

490,380

2,300

Intevac

Inc.†

....................

7,153

39,350

ITT

Inc.

........................

3,852,759

10,000

nVent

Electric

plc

.................

529,900

15,000

Pentair

plc

......................

971,250

10,678

Proto

Labs

Inc.†

..................

281,899

6,500

Sulzer

AG

.......................

622,412

289,000

Textron

Inc.

.....................

22,582,460

15,225

The

Sherwin-Williams

Co.

...........

3,883,136

300,000

Toray

Industries

Inc.

...............

1,561,831

36,000

Trinity

Industries

Inc.

...............

876,600

90,291,539

Electronics

—

2.8%

13,000

Bel

Fuse

Inc.,

Cl. B

................

620,360

45,000

Flex

Ltd.†

.......................

1,214,100

58,000

Intel

Corp.

......................

2,061,900

765

Kimball

Electronics

Inc.†

............

20,946

158,000

Resideo

Technologies

Inc.†

..........

2,496,400

1,650

Signify

NV

......................

44,501

382,000

Sony

Group

Corp.,

ADR

.............

31,480,620

38,000

TE

Connectivity

Ltd.

...............

4,694,140

78,000

Texas

Instruments

Inc.

.............

12,402,780

23,800

Thermo

Fisher

Scientific

Inc.

.........

12,046,846

3,500

Universal

Display

Corp.

.............

549,465

67,632,058

Energy

and

Utilities:

Electric

—

0.4%

11,000

ALLETE

Inc.

.....................

580,800

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Energy

and

Utilities:

Electric

(Continued)

5,000

American

Electric

Power

Co.

Inc.

......

$

376,100

29,000

Electric

Power

Development

Co.

Ltd.

....

469,232

129,000

Evergy

Inc.

......................

6,540,300

12,000

Pinnacle

West

Capital

Corp.

..........

884,160

6,000

Portland

General

Electric

Co.

.........

242,880

61,600

The

AES

Corp.

...................

936,320

6,500

WEC

Energy

Group

Inc.

.............

523,575

10,553,367

Energy

and

Utilities:

Integrated

—

1.2%

10,000

Avangrid

Inc.

....................

301,700

20,000

Chubu

Electric

Power

Co.

Inc.

........

255,220

20,000

Endesa

SA

......................

407,570

228,000

Enel

SpA

.......................

1,402,928

52,000

Eversource

Energy

................

3,023,800

23,000

Hawaiian

Electric

Industries

Inc.

.......

283,130

410,000

Hera

SpA

.......................

1,122,694

16,000

Hokkaido

Electric

Power

Co.

Inc.

......

69,829

45,000

Iberdrola

SA,

ADR

.................

2,013,300

115,000

Korea

Electric

Power

Corp.,

ADR†

......

740,600

23,000

Kyushu

Electric

Power

Co.

Inc.†

.......

150,122

27,500

MGE

Energy

Inc.

..................

1,884,025

103,000

NextEra

Energy

Inc.

................

5,900,870

40,650

NextEra

Energy

Partners

LP

..........

1,207,305

49,000

NiSource

Inc.

....................

1,209,320

4,000

Northwestern

Energy

Group

Inc.

.......

192,240

57,500

OGE

Energy

Corp.

.................

1,916,475

11,000

Ormat

Technologies

Inc.

............

769,120

240,000

PG&E

Corp.†

....................

3,871,200

18,000

PNM

Resources

Inc.

...............

802,980

30,000

Public

Service

Enterprise

Group

Inc.

....

1,707,300

50,000

Shikoku

Electric

Power

Co.

Inc.

.......

342,445

44,000

The

Chugoku

Electric

Power

Co.

Inc.

....

270,907

18,000

The

Kansai

Electric

Power

Co.

Inc.

.....

250,234

50,000

Tohoku

Electric

Power

Co.

Inc.

........

323,742

30,419,056

Energy

and

Utilities:

Natural

Gas

—

1.2%

16,000

APA

Corp.

......................

657,600

200,000

Enterprise

Products

Partners

LP

.......

5,474,000

47,000

Kinder

Morgan

Inc.

................

779,260

171,500

National

Fuel

Gas

Co.

..............

8,902,565

30,000

National

Grid

plc

..................

358,709

22,000

National

Grid

plc,

ADR

..............

1,333,860

14,300

ONEOK

Inc.

.....................

907,049

75,000

Sempra

........................

5,102,250

62,000

Southwest

Gas

Holdings

Inc.

.........

3,745,420

74,000

UGI

Corp.

.......................

1,702,000

28,962,713

Shares

Market

Value

Energy

and

Utilities:

Oil

—

4.8%

82,900

Chevron

Corp.

...................

$

13,978,598

208,300

ConocoPhillips

...................

24,954,340

65,000

Devon

Energy

Corp.

...............

3,100,500

123,000

Eni

SpA,

ADR

....................

3,926,160

375,000

Equinor

ASA,

ADR

................

12,296,250

112,000

Exxon

Mobil

Corp.

................

13,168,960

15,700

Hess

Corp.

......................

2,402,100

129,500

Marathon

Petroleum

Corp.

...........

19,598,530

68,585

Occidental

Petroleum

Corp.

..........

4,449,795

100,000

PetroChina

Co.

Ltd.,

Cl. H

...........

75,342

25,000

Petroleo

Brasileiro

SA,

ADR

..........

374,750

52,000

Phillips

66

......................

6,247,800

75,000

Repsol

SA,

ADR

..................

1,233,750

97,800

Shell

plc,

ADR

...................

6,296,364

1,000

Texas

Pacific

Land

Corp.

............

1,823,560

70,000

TotalEnergies

SE,

ADR

..............

4,603,200

2,891

Woodside

Energy

Group

Ltd.,

ADR

.....

67,331

118,597,330

Energy

and

Utilities:

Services

—

1.6%

2,000

Baker

Hughes

Co.

.................

70,640

30,000

Dril-Quip

Inc.†

...................

845,100

556,325

Halliburton

Co.

...................

22,531,163

117,975

Oceaneering

International

Inc.†

.......

3,034,317

211,000

Schlumberger

NV

.................

12,301,300

38,782,520

Energy

and

Utilities:

Water

—

0.2%

11,000

American

States

Water

Co.

...........

865,480

6,000

American

Water

Works

Co.

Inc.

.......

742,980

14,000

Essential

Utilities

Inc.

..............

480,620

51,000

Mueller

Water

Products

Inc.,

Cl. A

.....

646,680

34,000

Severn

Trent

plc

..................

981,082

22,000

SJW

Group

.....................

1,322,420

7,500

The

York

Water

Co.

................

281,175

8,000

United

Utilities

Group

plc,

ADR

........

186,400

5,506,837

Entertainment

—

2.4%

222,000

Atlanta

Braves

Holdings

Inc.,

Cl. A†

....

8,673,540

50,000

Atlanta

Braves

Holdings

Inc.,

Cl. C†

....

1,786,500

6,000

Caesars

Entertainment

Inc.†

..........

278,100

61,333

Fox

Corp.,

Cl. A

...................

1,913,589

68,000

Fox

Corp.,

Cl. B

...................

1,963,840

3,000

International

Game

Technology

plc

.....

90,960

20,000

Liberty

Media

Corp.-Liberty

Live,

Cl. C†

..

642,000

59,880

Madison

Square

Garden

Entertainment

Corp.†

.......................

1,970,651

49,500

Madison

Square

Garden

Sports

Corp.

...

8,726,850

20,200

Netflix

Inc.†

.....................

7,627,520

92,000

Paramount

Global,

Cl. A

.............

1,452,680

300,000

Paramount

Global,

Cl. B

.............

3,870,000

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Entertainment

(Continued)

3,000

Penn

Entertainment

Inc.†

............

$

68,850

59,880

Sphere

Entertainment

Co.†

..........

2,225,141

16,000

Take-Two

Interactive

Software

Inc.†

....

2,246,240

25,000

The

Walt

Disney

Co.†

..............

2,026,250

107,200

Universal

Music

Group

NV

...........

2,802,829

605,000

Vivendi

SE

......................

5,306,422

420,000

Warner

Bros

Discovery

Inc.†

.........

4,561,200

58,233,162

Environmental

Services

—

2.3%

181,000

Republic

Services

Inc.

..............

25,794,310

29,180

Veolia

Environnement

SA

............

846,231

97,222

Waste

Connections

Inc.

.............

13,056,914

117,000

Waste

Management

Inc.

............

17,835,480

57,532,935

Equipment

and

Supplies

—

2.0%

83,000

CIRCOR

International

Inc.†

..........

4,627,250

3,000

CTS

Corp.

......................

125,220

9,700

Danaher

Corp.

...................

2,406,570

126,765

Flowserve

Corp.

..................

5,041,444

126,000

Graco

Inc.

......................

9,182,880

135,000

Mueller

Industries

Inc.

..............

10,146,600

456,825

RPC

Inc.

.......................

4,084,016

70,000

Sealed

Air

Corp.

..................

2,300,200

25,800

The

L.S.

Starrett

Co.,

Cl. A†

..........

277,350

96,000

The

Timken

Co.

...................

7,055,040

17,000

Valmont

Industries

Inc.

.............

4,083,570

49,330,140

Financial

Services

—

14.3%

4,500

AJ

Bell

plc

......................

15,066

297,408

American

Express

Co.

..............

44,370,300

120,000

American

International

Group

Inc.

......

7,272,000

314,600

Bank

of

America

Corp.

..............

8,613,748

60,000

Berkshire

Hathaway

Inc.,

Cl. B†

.......

21,018,000

16,200

BlackRock

Inc.

...................

10,473,138

76,300

Blackstone

Inc.

...................

8,174,782

7,174

Brookfield

Asset

Management

Ltd.,

Cl. A

.

239,181

28,500

Brookfield

Corp.

..................

891,195

196

Brookfield

Reinsurance

Ltd.

..........

6,168

2,300

Brooks

Macdonald

Group

plc

.........

46,724

22,000

Cannae

Holdings

Inc.†

..............

410,080

219,000

Citigroup

Inc.

....................

9,007,470

5,000

Cohen

&

Steers

Inc.

...............

313,450

18,500

Cullen/Frost

Bankers

Inc.

............

1,687,385

11,000

EXOR

NV

.......................

976,201

140

Farmers

&

Merchants

Bank

of

Long

Beach

680,120

37,000

Fidelity

National

Financial

Inc.

.........

1,528,100

80,000

FTAI

Aviation

Ltd.

.................

2,844,000

135,000

Graf

Acquisition

Corp.

IV†

...........

1,120,500

Shares

Market

Value

23,000

HSBC

Holdings

plc,

ADR

............

$

907,580

23,249

Interactive

Brokers

Group

Inc.,

Cl. A

....

2,012,433

20,450

Intercontinental

Exchange

Inc.

........

2,249,909

155,000

Invesco

Ltd.

.....................

2,250,600

12,500

Janus

Henderson

Group

plc

..........

322,750

324,747

JPMorgan

Chase

&

Co.

.............

47,094,810

65,000

KeyCorp.

.......................

699,400

30,000

Kinnevik

AB,

Cl. B†

................

299,848

55,000

KKR

&

Co.

Inc.

...................

3,388,000

85,000

Loews

Corp.

.....................

5,381,350

42,000

M&T

Bank

Corp.

..................

5,310,900

189,726

Morgan

Stanley

..................

15,494,922

4,000

MSCI

Inc.

.......................

2,052,320

70,000

National

Australia

Bank

Ltd.,

ADR

......

651,700

128,000

Navient

Corp.

....................

2,204,160

60,000

New

York

Community

Bancorp

Inc.

.....

680,400

91,000

Northern

Trust

Corp.

...............

6,322,680

158,761

Oaktree

Specialty

Lending

Corp.

.......

3,194,280

12,000

PayPal

Holdings

Inc.†

..............

701,520

80,000

Resona

Holdings

Inc.

..............

443,415

15,000

S&P

Global

Inc.

..................

5,481,150

90,000

SLM

Corp.

......................

1,225,800

154,000

State

Street

Corp.

.................

10,311,840

123,000

T.

Rowe

Price

Group

Inc.

............

12,899,010

621,000

The

Bank

of

New

York

Mellon

Corp.

....

26,485,650

34,000

The

Goldman

Sachs

Group

Inc.

.......

11,001,380

90,000

The

Hartford

Financial

Services

Group

Inc.

6,381,900

141,000

The

PNC

Financial

Services

Group

Inc.

..

17,310,570

75,500

The

Travelers

Companies

Inc.

.........

12,329,905

60,000

W.

R.

Berkley

Corp.

................

3,809,400

551,000

Wells

Fargo

&

Co.

.................

22,513,860

2,300

Willis

Towers

Watson

plc

............

480,608

351,581,658

Food

and

Beverage

—

10.3%

12,000

Ajinomoto

Co.

Inc.

................

462,848

98,117

BellRing

Brands

Inc.†

..............

4,045,364

12,500

Brown-Forman

Corp.,

Cl. B

..........

721,125

148,000

Campbell

Soup

Co.

................

6,079,840

950,000

China

Mengniu

Dairy

Co.

Ltd.

.........

3,184,480

48,000

Chr.

Hansen

Holding

A/S

............

2,942,143

226,000

Conagra

Brands

Inc.

...............

6,196,920

8,000

Constellation

Brands

Inc.,

Cl. A

........

2,010,640

157,500

Danone

SA

......................

8,702,172

1,950,000

Davide

Campari-Milano

NV

..........

23,018,183

1,250

Diageo

plc

......................

46,272

112,000

Diageo

plc,

ADR

..................

16,708,160

70,954

Flowers

Foods

Inc.

................

1,573,760

194,200

General

Mills

Inc.

.................

12,426,858

2,000

Glanbia

plc

......................

33,007

18,000

Heineken

Holding

NV

...............

1,358,778

5,000

Hostess

Brands

Inc.†

..............

166,550

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Food

and

Beverage

(Continued)

260,000

ITO

EN

Ltd.

.....................

$

8,366,836

110,000

Keurig

Dr

Pepper

Inc.

..............

3,472,700

332,000

Kikkoman

Corp.

..................

17,426,445

2,000

Lamb

Weston

Holdings

Inc.

..........

184,920

10,000

Lifecore

Biomedical

Inc.†

............

75,450

108,000

Maple

Leaf

Foods

Inc.

..............

2,075,317

6,000

McCormick

&

Co.

Inc.

..............

473,280

35,000

Molson

Coors

Beverage

Co.,

Cl. B

......

2,225,650

517,000

Mondelēz

International

Inc.,

Cl. A

......

35,879,800

30,000

Morinaga

Milk

Industry

Co.

Ltd.

.......

1,129,617

10,000

Nathan's

Famous

Inc.

..............

706,600

4,000

National

Beverage

Corp.†

............

188,080

22,000

Nestlé

SA

.......................

2,493,341

35,000

Nestlé

SA,

ADR

...................

3,960,950

128,000

Nissin

Foods

Holdings

Co.

Ltd.

........

10,642,398

69,982

Nomad

Foods

Ltd.†

................

1,065,126

70,250

PepsiCo

Inc.

.....................

11,903,160

61,000

Pernod

Ricard

SA

.................

10,180,102

42,000

Post

Holdings

Inc.†

................

3,601,080

24,500

Remy

Cointreau

SA

................

2,995,639

18,000

Suntory

Beverage

&

Food

Ltd.

........

548,046

2,500

The

Boston

Beer

Co.

Inc.,

Cl. A†

.......

973,825

265,000

The

Coca-Cola

Co.

................

14,834,700

50,000

The

Hain

Celestial

Group

Inc.†

........

518,500

5,000

The

J.M.

Smucker

Co.

..............

614,550

379,000

The

Kraft

Heinz

Co.

................

12,749,560

6,000

TreeHouse

Foods

Inc.†

.............

261,480

25,000

Unilever

plc,

ADR

.................

1,235,000

470,000

Yakult

Honsha

Co.

Ltd.

.............

11,426,057

251,885,309

Health

Care

—

11.1%

30,500

Abbott

Laboratories

...............

2,953,925

58,850

AbbVie

Inc.

.....................

8,772,181

42,486

AstraZeneca

plc,

ADR

..............

2,877,152

185,987

Avantor

Inc.†

....................

3,920,606

89,727

Bausch

+

Lomb

Corp.†

.............

1,520,873

80,000

Baxter

International

Inc.

.............

3,019,200

1,000

Bayer

AG

.......................

48,052

10,000

Becton

Dickinson

&

Co.

.............

2,585,300

2,500

BioMarin

Pharmaceutical

Inc.†

........

221,200

9,000

Bio-Rad

Laboratories

Inc.,

Cl. A†

......

3,226,050

130,800

Bristol-Myers

Squibb

Co.

............

7,591,632

55,000

Catalent

Inc.†

....................

2,504,150

45,000

Cencora

Inc.

.....................

8,098,650

9,000

Charles

River

Laboratories

International

Inc.†

........................

1,763,820

12,888

Chemed

Corp.

...................

6,697,894

35,000

DaVita

Inc.†

.....................

3,308,550

1,000

Demant

A/S†

....................

41,477

Shares

Market

Value

100,000

DENTSPLY

SIRONA

Inc.

............

$

3,416,000

55,000

Elanco

Animal

Health

Inc.†

...........

618,200

13,000

Elevance

Health

Inc.

...............

5,660,460

50,900

Eli

Lilly

&

Co.

....................

27,339,917

225,000

Evolent

Health

Inc.,

Cl. A†

...........

6,126,750

24,500

Fortrea

Holdings

Inc.†

..............

700,455

2,967

GE

HealthCare

Technologies

Inc.

.......

201,875

12,510

Gerresheimer

AG

.................

1,315,345

18,319

Halozyme

Therapeutics

Inc.†

.........

699,786

32,500

HCA

Healthcare

Inc.

...............

7,994,350

38,500

Henry

Schein

Inc.†

................

2,858,625

30,000

ICU

Medical

Inc.†

.................

3,570,300

8,000

Incyte

Corp.†

....................

462,160

47,371

Integer

Holdings

Corp.†

.............

3,715,307

15,900

Intuitive

Surgical

Inc.†

..............

4,647,411

105,636

Johnson

&

Johnson

...............

16,452,807

3,727

Kenvue

Inc.

.....................

74,839

24,500

Laboratory

Corp.

of

America

Holdings

...

4,925,725

12,000

McKesson

Corp.

..................

5,218,200

40,000

Medtronic

plc

....................

3,134,400

133,000

Merck

&

Co.

Inc.

..................

13,692,350

191,042

Option

Care

Health

Inc.†

............

6,180,209

1,000

Organon

&

Co.

...................

17,360

20,000

Owens

&

Minor

Inc.†

..............

323,200

100,000

Pacific

Biosciences

of

California

Inc.†

...

835,000

68,000

Patterson

Cos.

Inc.

................

2,015,520

78,000

Perrigo

Co.

plc

...................

2,492,100

75,000

PetIQ

Inc.†

......................

1,477,500

388,588

Pfizer

Inc.

......................

12,889,464

11,127

QuidelOrtho

Corp.†

................

812,716

200

Roche

Holding

AG

.................

54,722

25,000

Silk

Road

Medical

Inc.†

.............

374,750

17,500

Stryker

Corp.

....................

4,782,225

3,600

Teladoc

Health

Inc.†

...............

66,924

150,000

Tenet

Healthcare

Corp.†

.............

9,883,500

62,000

The

Cigna

Group

..................

17,736,340

12,000

The

Cooper

Companies

Inc.

..........

3,816,120

21,252

Treace

Medical

Concepts

Inc.†

........

278,614

23,900

UnitedHealth

Group

Inc.

............

12,050,141

10,000

Vertex

Pharmaceuticals

Inc.†

.........

3,477,400

25,000

Viatris

Inc.

......................

246,500

35,000

Zimmer

Biomet

Holdings

Inc.

.........

3,927,700

105,038

Zoetis

Inc.

......................

18,274,511

273,988,490

Hotels

and

Gaming

—

0.4%

19,000

Accor

SA

.......................

641,603

80,800

Boyd

Gaming

Corp.

................

4,915,064

29,500

Entain

plc

.......................

335,742

400

Flutter

Entertainment

plc†

...........

65,349

4,700

Gambling.com

Group

Ltd.†

..........

61,476

18,500

Las

Vegas

Sands

Corp.

.............

848,040

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Hotels

and

Gaming

(Continued)

400,000

Mandarin

Oriental

International

Ltd.

....

$

682,000

40,400

MGM

Resorts

International

..........

1,485,104

15,000

Ryman

Hospitality

Properties

Inc.,

REIT

.

1,249,200

5,000

Wyndham

Hotels

&

Resorts

Inc.

.......

347,700

500

Wynn

Resorts

Ltd.

................

46,205

10,677,483

Machinery

—

2.7%

57,000

Astec

Industries

Inc.

...............

2,685,270

140,000

CNH

Industrial

NV

.................

1,708,093

1,508,000

CNH

Industrial

NV,

New

York

.........

18,246,800

64,000

Deere

&

Co.

.....................

24,152,320

7,500

Generac

Holdings

Inc.†

.............

817,200

5,500

Otis

Worldwide

Corp.

..............

441,705

1,500

Tennant

Co.

.....................

111,225

40,000

Twin

Disc

Inc.†

...................

548,800

179,905

Xylem

Inc.

......................

16,376,752

65,088,165

Metals

and

Mining

—

1.2%

59,585

Agnico

Eagle

Mines

Ltd.

............

2,708,138

20,000

Alliance

Resource

Partners

LP

........

450,600

119,190

Barrick

Gold

Corp.

................

1,734,215

8,000

BHP

Group

Ltd.,

ADR

..............

455,040

6,800

Cameco

Corp.

....................

269,552

36,000

Franco-Nevada

Corp.

...............

4,806,096

860

Franco-Nevada

Corp.,

New

York

.......

114,801

200,000

Freeport-McMoRan

Inc.

.............

7,458,000

270,620

Newmont

Corp.

..................

9,999,409

9,615

Osisko

Gold

Royalties

Ltd.,

New

York

...

112,976

3,645

Wheaton

Precious

Metals

Corp.

.......

147,805

28,256,632

Paper

and

Forest

Products

—

0.0%

200

Keweenaw

Land

Association

Ltd.†

.....

4,450

Publishing

—

0.0%

1,200

Graham

Holdings

Co.,

Cl. B

..........

699,600

Real

Estate

Investment

Trust

—

0.5%

36,500

American

Tower

Corp.

..............

6,002,425

16,000

Crown

Castle

Inc.

.................

1,472,480

3,000

Equinix

Inc.

.....................

2,178,780

1,300

VICI

Properties

Inc.

................

37,830

85,000

Weyerhaeuser

Co.

.................

2,606,100

12,297,615

Retail

—

3.6%

101,808

AutoNation

Inc.†

..................

15,413,731

1,300

AutoZone

Inc.†

...................

3,301,987

19,000

Bassett

Furniture

Industries

Inc.

.......

278,350

40,000

CarMax

Inc.†

....................

2,829,200

Shares

Market

Value

1,290

Chipotle

Mexican

Grill

Inc.†

..........

$

2,363,061

200,000

Conn's

Inc.†

.....................

790,000

11,000

Costco

Wholesale

Corp.

.............

6,214,560

288,000

CVS

Health

Corp.

.................

20,108,160

30,000

EVgo

Inc.†

......................

101,400

98,500

Ingles

Markets

Inc.,

Cl. A

............

7,420,005

34,530

Lowe's

Companies

Inc.

.............

7,176,715

6,000

Macy's

Inc.

.....................

69,660

7,900

MSC

Industrial

Direct

Co.

Inc.,

Cl. A

....

775,385

56,250

Rush

Enterprises

Inc.,

Cl. B

..........

2,547,563

250,000

Sally

Beauty

Holdings

Inc.†

..........

2,095,000

118,000

Seven

&

i

Holdings

Co.

Ltd.

..........

4,623,193

50,000

Starbucks

Corp.

..................

4,563,500

12,000

The

Home

Depot

Inc.

...............

3,625,920

70,000

Walgreens

Boots

Alliance

Inc.

........

1,556,800

20,000

Walmart

Inc.

....................

3,198,600

89,052,790

Semiconductors

—

1.0%

31,000

Advanced

Micro

Devices

Inc.†

........

3,187,420

6,100

ASML

Holding

NV

.................

3,590,826

3,000

Entegris

Inc.

.....................

281,730

36,000

Lattice

Semiconductor

Corp.†

........

3,093,480

29,500

NVIDIA

Corp.

....................

12,832,205

1,500

NXP

Semiconductors

NV

............

299,880

34,804

SkyWater

Technology

Inc.†

..........

209,520

11,000

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.,

ADR

.....................

955,900

24,450,961

Specialty

Chemicals

—

1.7%

18,000

Air

Products

and

Chemicals

Inc.

.......

5,101,200

30,000

Ashland

Inc.

.....................

2,450,400

10,000

Axalta

Coating

Systems

Ltd.†

.........

269,000

5,000

Dow

Inc.

.......................

257,800

400

DSM-Firmenich

AG

................

33,887

316,000

DuPont

de

Nemours

Inc.

............

23,570,440

27,000

FMC

Corp.

......................

1,808,190

83,000

Olin

Corp.

......................

4,148,340

16,500

Rogers

Corp.†

...................

2,169,255

5,000

Sensient

Technologies

Corp.

.........

292,400

65,000

Valvoline

Inc.

....................

2,095,600

42,196,512

Telecommunications

—

2.1%

83,000

AT&T

Inc.

.......................

1,246,660

168,000

BCE

Inc.

........................

6,412,560

15,000

Comtech

Telecommunications

Corp.

....

131,250

430,000

Deutsche

Telekom

AG,

ADR

..........

9,012,800

73,750

Eurotelesites

AG†

.................

322,805

62,279

GCI

Liberty

Inc.,

Escrow†

...........

0

195,000

Hellenic

Telecommunications

Organization

SA,

ADR

......................

1,366,950

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Telecommunications

(Continued)

50,000

Orange

SA,

ADR

..................

$

574,500

50,000

Pharol

SGPS

SA†

.................

2,210

40,000

Proximus

SA

....................

325,548

30,000

Telefonica

SA,

ADR

................

122,100

295,000

Telekom

Austria

AG

................

2,058,466

25,000

Telenet

Group

Holding

NV

...........

559,814

100,000

Telephone

and

Data

Systems

Inc.

......

1,831,000

110,000

Telstra

Group

Ltd.,

ADR

.............

1,362,900

270,000

TELUS

Corp.

....................

4,411,800

70,000

T-Mobile

US

Inc.†

.................

9,803,500

12,000

VEON

Ltd.,

ADR†

.................

234,000

295,086

Verizon

Communications

Inc.

.........

9,563,737

131,000

Vodafone

Group

plc,

ADR

...........

1,241,880

50,584,480

Transportation

—

0.9%

28,840

Canadian

Pacific

Kansas

City

Ltd.

......

2,145,984

180,000

GATX

Corp.

.....................

19,589,400

21,735,384

Wireless

Communications

—

0.1%

68,000

United

States

Cellular

Corp.†

.........

2,921,960

TOTAL

COMMON

STOCKS

.........

2,332,388,656

CLOSED-END

FUNDS

—

0.0%

40,000

Altaba

Inc.,

Escrow†

...............

93,600

PREFERRED

STOCKS

—

0.1%

Consumer

Services

—

0.1%

58,000

Qurate

Retail

Inc.,

8.000%,

03/15/31

....

1,661,700

Health

Care

—

0.0%

2,296

XOMA

Corp.,

Ser.

A,

8.625%

.........

54,645

TOTAL

PREFERRED

STOCKS

........

1,716,345

MANDATORY

CONVERTIBLE

SECURITIES(a)

—

0.2%

Energy

and

Utilities

—

0.2%

123,000

El

Paso

Energy

Capital

Trust

I,

4.750%,

03/31/28

...............

5,585,430

WARRANTS

—

0.0%

Diversified

Industrial

—

0.0%

32,000

Ampco-Pittsburgh

Corp.,

expire

08/01/25†

10,240

Energy

and

Utilities:

Oil

—

0.0%

12,257

Occidental

Petroleum

Corp.,

expire

08/03/27†

.....................

530,115

Shares

Market

Value

Energy

and

Utilities:

Services

—

0.0%

3,081

Weatherford

International

plc,

expire

12/13/23†

.....................

$

7,395

TOTAL

WARRANTS

..............

547,750

Principal

Amount

CONVERTIBLE

CORPORATE

BONDS

—

0.0%

Cable

and

Satellite

—

0.0%

$

600,000

DISH

Network

Corp.,

3.375%,

08/15/26

...............

363,600

U.S.

GOVERNMENT

OBLIGATIONS

—

4.8%

118,580,000

U.S.

Treasury

Bills,

5.109%

to

5.446%††,

10/19/23

to

03/14/24

......................

117,327,604

TOTAL

INVESTMENTS

—

100.0%

....

(Cost

$1,615,034,711)

............

$

2,458,022,985

(a)

Mandatory

convertible

securities

are

required

to

be

converted

on

the

dates

listed;

they

generally

may

be

converted

prior

to

these

dates

at

the

option

of

the

holder.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

ADR

American

Depositary

Receipt

REIT

Real

Estate

Investment

Trust

Geographic

Diversification

%

of

Total

Investments

Market

Value

North

America

......................

87.3

%

$

2,147,262,805

Europe

..............................

8.5

208,992,460

Japan

...............................

3.7

90,284,387

Asia/Pacific

.........................

0.4

8,958,333

Latin

America

.......................

0.1

2,525,000

Total

Investments

...................

100.0%

$

2,458,022,985

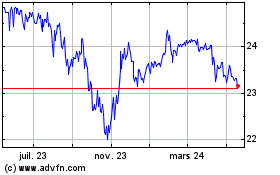

Gabelli Dividend and Inc... (NYSE:GDV-H)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

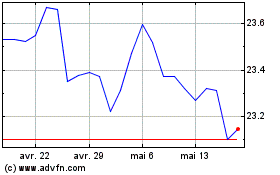

Gabelli Dividend and Inc... (NYSE:GDV-H)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024