UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number 001-36433

GasLog Partners LP

(Translation of registrant’s name into English)

c/o GasLog LNG Services Ltd.

69 Akti Miaouli, 18537

Piraeus, Greece

(Address of principal executive

office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F þ

Form 40-F ¨

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): |

¨ |

| |

|

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): |

¨ |

The unaudited condensed consolidated statements

of financial position, the unaudited condensed consolidated statements of profit or loss and the related selected notes to the unaudited

condensed consolidated financial statements for the six months ended June 30, 2023 issued by GasLog Partners LP on August 3,

2023 are attached hereto as Exhibits 99.1, 99.2 and 99.3, respectively.

EXHIBIT LIST

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: August 3, 2023 |

|

|

|

| |

|

|

|

| |

GASLOG PARTNERS LP |

| |

|

|

|

| |

by |

/s/ Paolo Enoizi |

| |

|

Name: |

Paolo Enoizi |

| |

|

Title: |

Chief Executive Officer |

Exhibit 99.1

GasLog Partners LP

Unaudited condensed consolidated statements of financial position

As of December 31, 2022 and June 30, 2023

(All amounts expressed in thousands of U.S. Dollars, except unit

data)

| | |

December 31, 2022 | | |

June 30, 2023 |

| Assets | |

| | | |

| |

| Non-current assets | |

| | | |

| |

| Other non-current assets | |

| 169 | | |

| 1,059 |

| Derivative financial instruments—non-current portion | |

| 1,136 | | |

| 594 |

| Tangible fixed assets | |

| 1,677,771 | | |

| 1,500,308 |

| Right-of-use assets | |

| 93,325 | | |

| 148,150 |

| Total non-current assets | |

| 1,772,401 | | |

| 1,650,111 |

| Current assets | |

| | | |

| |

| Trade and other receivables | |

| 11,185 | | |

| 18,068 |

| Inventories | |

| 2,894 | | |

| 3,107 |

| Due from related parties | |

| — | | |

| 2,413 |

| Prepayments and other current assets | |

| 3,392 | | |

| 3,328 |

| Derivative financial instruments—current portion | |

| 2,440 | | |

| 3,264 |

| Short-term cash deposits | |

| 25,000 | | |

| 21,500 |

| Cash and cash equivalents | |

| 198,122 | | |

| 285,602 |

| Total current assets | |

| 243,033 | | |

| 337,282 |

| Total assets | |

| 2,015,434 | | |

| 1,987,393 |

| Partners’ equity and liabilities | |

| | | |

| |

| Partners’ equity | |

| | | |

| |

| Common unitholders (51,687,865 units issued and outstanding as of December 31, 2022 and 51,796,759 units issued and outstanding as of June 30, 2023) | |

| 668,953 | | |

| 725,532 |

| General partner (1,080,263 units issued and outstanding as of December 31, 2022 and June 30, 2023) | |

| 12,608 | | |

| 13,789 |

| Preference unitholders (5,084,984 Series A Preference Units, 3,496,382 Series B Preference Units and 3,061,045 Series C Preference Units issued and outstanding as of December 31, 2022 and June 30, 2023) | |

| 279,349 | | |

| 280,012 |

| Total partners’ equity | |

| 960,910 | | |

| 1,019,333 |

| Current liabilities | |

| | | |

| |

| Trade accounts payable | |

| 9,300 | | |

| 8,176 |

| Due to related parties | |

| 2,873 | | |

| 1,373 |

| Other payables and accruals | |

| 57,266 | | |

| 59,543 |

| Borrowings—current portion | |

| 90,358 | | |

| 220,111 |

| Lease liabilities—current portion | |

| 17,433 | | |

| 28,133 |

| Total current liabilities | |

| 177,230 | | |

| 317,336 |

| Non-current liabilities | |

| | | |

| |

| Borrowings—non-current portion | |

| 831,588 | | |

| 570,521 |

| Lease liabilities—non-current portion | |

| 45,136 | | |

| 79,752 |

| Other non-current liabilities | |

| 570 | | |

| 451 |

| Total non-current liabilities | |

| 877,294 | | |

| 650,724 |

| Total partners’ equity and liabilities | |

| 2,015,434 | | |

| 1,987,393 |

Exhibit 99.2

GasLog Partners LP

Unaudited condensed consolidated statements of profit or loss

For the three and six months ended June 30, 2022 and 2023

(All amounts expressed in thousands of U.S. Dollars, except per

unit data)

| | |

For the three months ended | | |

For the six months ended | |

| | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2022 | | |

June 30, 2023 | |

| Revenues | |

| 84,922 | | |

| 96,961 | | |

| 170,381 | | |

| 196,030 | |

| Voyage expenses and commissions | |

| (2,172 | ) | |

| (2,642 | ) | |

| (3,633 | ) | |

| (4,638 | ) |

| Vessel operating costs | |

| (19,047 | ) | |

| (15,754 | ) | |

| (37,621 | ) | |

| (31,680 | ) |

| Depreciation | |

| (22,224 | ) | |

| (24,815 | ) | |

| (44,211 | ) | |

| (47,527 | ) |

| General and administrative expenses | |

| (4,380 | ) | |

| (6,219 | ) | |

| (9,071 | ) | |

| (11,866 | ) |

| Loss on disposal of vessel | |

| — | | |

| — | | |

| — | | |

| (1,033 | ) |

| Impairment loss on vessel | |

| (28,027 | ) | |

| — | | |

| (28,027 | ) | |

| (142 | ) |

| Profit from operations | |

| 9,072 | | |

| 47,531 | | |

| 47,818 | | |

| 99,144 | |

| Financial costs | |

| (9,778 | ) | |

| (17,044 | ) | |

| (18,559 | ) | |

| (34,397 | ) |

| Financial income | |

| 221 | | |

| 3,510 | | |

| 260 | | |

| 5,792 | |

| Gain on derivatives | |

| 1,246 | | |

| 1,706 | | |

| 6,223 | | |

| 1,539 | |

| Total other expenses, net | |

| (8,311 | ) | |

| (11,828 | ) | |

| (12,076 | ) | |

| (27,066 | ) |

| Profit and total comprehensive income for the period | |

| 761 | | |

| 35,703 | | |

| 35,742 | | |

| 72,078 | |

Exhibit 99.3

GasLog Partners LP

Selected notes to the unaudited condensed consolidated financial

statements

For the six months ended June 30, 2022 and 2023

(All amounts expressed in thousands of U.S. Dollars, except unit

data)

1. Organization and Operations

GasLog Partners LP (“GasLog Partners”

or the “Partnership”) was formed as a limited partnership under the laws of the Marshall Islands on January 23, 2014,

as a wholly owned subsidiary of GasLog Ltd. (“GasLog”) for the purpose of initially acquiring the interests in three liquefied

natural gas (“LNG”) carriers that were contributed to the Partnership by GasLog in connection with the initial public offering

of its common units (the “IPO”).

The Partnership’s principal business is

the acquisition and operation of LNG vessels, providing LNG transportation services on a worldwide basis. GasLog LNG Services Ltd. (“GasLog

LNG Services” or the “Manager”), a related party and a wholly owned subsidiary of GasLog, incorporated under the laws

of Bermuda, provides technical and commercial services to the Partnership. As of June 30, 2023, the Partnership wholly owned 11 LNG

vessels and operated three LNG vessels leased back under bareboat charters.

On January 24, 2023, the Partnership’s

board of directors received an unsolicited non-binding proposal from GasLog to acquire all of the outstanding common units representing

limited partner interests of the Partnership not already beneficially owned by GasLog. On April 6, 2023, the Partnership entered

into an Agreement and Plan of Merger (the “Merger Agreement”) with GasLog Partners GP LLC, the general partner of the Partnership,

GasLog and Saturn Merger Sub LLC, a wholly owned subsidiary of GasLog (“Merger Sub”). Pursuant to the Merger Agreement, (i) Merger

Sub would merge with and into the Partnership, with the Partnership surviving as a direct subsidiary of GasLog, and (ii) GasLog would

acquire the outstanding common units of the Partnership not beneficially owned by GasLog for overall consideration of $8.65 per common

unit in cash (the “Transaction”), consisting in part of a special distribution by the Partnership of $3.28 per common unit

in cash (the “Special Distribution”) that would be distributed to the Partnership’s unitholders in connection with the

closing of the Transaction and the remainder to be paid by GasLog as merger consideration at the closing of the Transaction.

The conflicts committee (the “Conflicts

Committee”) of the Partnership’s board of directors, comprised solely of independent directors and advised by its own independent

legal and financial advisors, unanimously recommended that the Partnership’s board of directors approve the Merger Agreement and

determined that the Transaction was in the best interests of the Partnership and the holders of its common units unaffiliated with GasLog.

Acting upon the recommendation and approval of the Conflicts Committee, the Partnership’s board of directors unanimously approved

the Merger Agreement and the Transaction and recommended that the common unitholders of the Partnership vote in favor of the Transaction.

The Transaction was approved at the special meeting

of the common unitholders of the Partnership held on July 7, 2023, based on the affirmative vote (in person or by proxy) of the holders

of at least a majority of the common units of the Partnership entitled to vote thereon, voting as a single class, subject to a cutback

for certain unitholders beneficially owning more than 4.9% of the outstanding common units (as provided for in the Partnership’s

Seventh Amended and Restated Agreement of Limited Partnership and described in the proxy statement of the Partnership dated June 5,

2023 as filed with the Securities and Exchange Commission, or “SEC”). The payment date for the Special Distribution was July 12,

2023. The Transaction closed on July 13, 2023 at 6:30 a.m. Eastern Time (the “Effective Time”) upon the filing of

the certificate of merger with the Marshall Islands Registrar of Corporations. At the Effective Time, each common unit that was issued

and outstanding immediately prior to the Effective Time (other than common units that, as of immediately prior to the Effective Time,

were held by GasLog) was converted into the right to receive $5.37 in cash, without interest and reduced by any applicable tax withholding,

for each Common Unit. Accordingly, holders of common units not already beneficially owned by GasLog who held their common units both on

the Special Distribution record date of July 10, 2023 (subject to the applicability of due-bill trading) and at the Effective Time

received overall consideration of $8.65 per common unit. Trading in the Partnership’s common units on the New York Stock Exchange

(“NYSE”) was suspended on July 13, 2023, and delisting of the common units took place on July 24, 2023. The Partnership’s

8.625% Series A Cumulative Redeemable Perpetual Fixed to Floating Rate Preference Units (the “Series A Preference Units”),

8.200% Series B Cumulative Redeemable Perpetual Fixed to Floating Rate Preference Units (the “Series B Preference Units”)

and 8.500% Series C Cumulative Redeemable Perpetual Fixed to Floating Rate Preference Units (the “Series C Preference

Units”) remain outstanding and continue to trade on the NYSE.

The merger consideration was partially financed

by the borrowing of a term loan in an aggregate principal amount of $50,000 under a Bridge Facility Agreement dated July 3, 2023

(the “Bridge Facility Agreement”), among Merger Sub, as the original borrower, GasLog, as guarantor, DNB (UK) Ltd., as arranger

and bookrunner, the lenders party thereto and DNB Bank ASA, London Branch, as agent, with the Partnership succeeding to the obligations

of Merger Sub upon the consummation of the Transaction. The aggregate principal amount outstanding under the Bridge Facility Agreement

was repaid in full, together with accrued and unpaid interest, on July 26, 2023.

No new subsidiaries of the Partnership were established

or acquired in the six months ended June 30, 2023.

2. Tangible Fixed Assets

The movement in tangible fixed assets (i.e. vessels

and their associated depot spares) is reported in the following table:

| | |

Vessels | | |

Other tangible

assets | | |

Total tangible fixed

assets | |

| Cost | |

| | | |

| | | |

| | |

| As of January 1, 2023 | |

| 2,358,896 | | |

| 5,612 | | |

| 2,364,508 | |

| Additions/(write-offs), net | |

| 1,749 | | |

| 1,141 | | |

| 2,890 | |

| Disposal | |

| (203,884 | ) | |

| — | | |

| (203,884 | ) |

| Write-off of fully amortized drydocking component | |

| (3,577 | ) | |

| — | | |

| (3,577 | ) |

| As of June 30, 2023 | |

| 2,153,184 | | |

| 6,753 | | |

| 2,159,937 | |

| | |

| | | |

| | | |

| | |

| Accumulated depreciation

and impairment loss | |

| | | |

| | | |

| | |

| As of January 1, 2023 | |

| 686,737 | | |

| — | | |

| 686,737 | |

| Depreciation | |

| 30,011 | | |

| — | | |

| 30,011 | |

| Disposal | |

| (53,542 | ) | |

| — | | |

| (53,542 | ) |

| Write-off of fully amortized drydocking component | |

| (3,577 | ) | |

| — | | |

| (3,577 | ) |

| As of June 30, 2023 | |

| 659,629 | | |

| — | | |

| 659,629 | |

| | |

| | | |

| | | |

| | |

| Net book value | |

| | | |

| | | |

| | |

| As of December 31, 2022 | |

| 1,672,159 | | |

| 5,612 | | |

| 1,677,771 | |

| As of June 30, 2023 | |

| 1,493,555 | | |

| 6,753 | | |

| 1,500,308 | |

All vessels have been pledged as collateral under

the terms of the Partnership’s credit facilities.

On

March 30, 2023, GAS-five Ltd. completed the sale and lease-back of the GasLog Sydney with a wholly owned subsidiary of China

Development Bank Leasing Co., Ltd. (“CDBL”). All criteria outlined by IFRS 5 Non-current Assets Held for Sale and

Discontinued Operations were deemed to have been met and as a result, the carrying amount of the GasLog Sydney ($150,342) was

remeasured at the lower between carrying amount and fair value less costs to sell, resulting in the recognition of an impairment loss

of $142 in the six months ended June 30, 2023. Upon completion of the transaction, a loss on disposal of $1,033 was also recognized

in profit or loss.

As of June 30, 2023, the Partnership concluded

that there were no events or circumstances triggering the existence of potential impairment or reversal of impairment for any of its vessels.

3. Leases

The movements in right-of-use assets are reported

in the following table:

| Right-of-Use Assets | |

Vessels | | |

Vessels’

Equipment | | |

Total | |

| As of January 1, 2023 | |

| 93,158 | | |

| 167 | | |

| 93,325 | |

| Additions, net | |

| 72,226 | | |

| 115 | | |

| 72,341 | |

| Depreciation | |

| (17,390) | | |

| (126) | | |

| (17,516) | |

| As of June 30, 2023 | |

| 147,994 | | |

| 156 | | |

| 148,150 | |

An analysis of the lease liabilities is as follows:

| | |

Lease Liabilities | |

| As of January 1, 2023 | |

| 62,569 | |

| Additions, net | |

| 54,652 | |

| Interest expense on leases (Note 13) | |

| 1,394 | |

| Payments | |

| (10,730 | ) |

| As of June 30, 2023 | |

| 107,885 | |

| Lease liabilities—current portion | |

| 28,133 | |

| Lease liabilities—non-current portion | |

| 79,752 | |

| Total | |

| 107,885 | |

On March 30, 2023, GasLog Partners completed

the sale and lease-back of the GasLog Sydney with a wholly-owned subsidiary of CDBL. The vessel was sold to CDBL for $140,000 and

leased back under a bareboat charter for a period of five years with no repurchase option or obligation. This sale and lease-back met

the definition of a lease under IFRS 16 Leases, resulting in the recognition of a right-of-use asset of $67,779 and a corresponding

lease liability of $55,800.

4. Borrowings

| |

|

December 31,

2022 |

|

|

June 30,

2023 |

|

| Amounts due within one year |

|

|

93,964 |

|

|

|

223,177 |

|

| Less: unamortized deferred loan issuance costs |

|

|

(3,606 |

) |

|

|

(3,066 |

) |

| Borrowings – current portion |

|

|

90,358 |

|

|

|

220,111 |

|

| Amounts due after one year |

|

|

837,186 |

|

|

|

574,756 |

|

| Less: unamortized deferred loan issuance costs |

|

|

(5,598 |

) |

|

|

(4,235 |

) |

| Borrowings – non-current portion |

|

|

831,588 |

|

|

|

570,521 |

|

| Total |

|

|

921,946 |

|

|

|

790,632 |

|

The

main terms of the credit facilities, including financial covenants, have been disclosed in the annual consolidated financial statements

for the year ended December 31, 2022. Refer to Note 7 “Borrowings”.

On March 30, 2023, the outstanding indebtedness

of GAS-five Ltd. under the credit facility with Credit Suisse AG, Nordea Bank Abp, filial i Norge, Iyo Bank Ltd., Singapore Branch

and Development Bank of Japan, Inc. in the amount of $87,780 was prepaid pursuant to the sale and lease-back agreement entered into

with a wholly-owned subsidiary of CDBL. The relevant advance of the loan agreement was cancelled and the respective unamortized loan fees

of $229 written-off to the consolidated statement of profit or loss. As of June 30, 2023, the amount outstanding under the credit

facility of $152,461, maturing in February 2024, was classified under current liabilities.

In the six months ended June 30, 2023, the

Partnership repaid $45,437 in accordance with the repayment terms under its credit facilities.

GasLog Partners was in compliance with its financial

covenants as of June 30, 2023.

5. Subsequent Events

On July 3, 2023, GasLog Partners issued 415,000

common units in connection with GasLog’s election to convert its Class B-4 units issued upon the elimination of GasLog’s

incentive distribution rights in June 2019.

As further described in Note 1, on July 7,

2023, the Partnership’s common unitholders voted to approve the previously announced merger, with GasLog acquiring all of the outstanding

common units of the Partnership not already beneficially owned by GasLog. The payment date for the Special Distribution was July 12,

2023, and the Transaction closed on July 13, 2023 at the Effective Time upon the filing of the certificate of merger with the Marshall

Islands Registrar of Corporations. Holders of common units not already beneficially owned by GasLog who held their common units both on

the Special Distribution record date of July 10, 2023 (subject to the applicability of due-bill trading) and at the Effective Time

received overall consideration of $8.65 per common unit. Trading in the Partnership’s common units on the NYSE was suspended on

July 13, 2023, and delisting of the common units took place on July 24, 2023.

On July 17, 2023, Curtis V. Anastasio, Roland

Fisher and Kristin H. Holth stepped down from the board of directors (the “Board”) of the Partnership, effective immediately.

On July 19, 2023, the Partnership appointed James Berner as a director of the Partnership and a member of the audit committee of

the Board. Following these changes, the Board currently consists of three directors.

On July 21, 2023, the Board subsequently

approved an amendment to the Partnership’s Seventh Amended and Restated Agreement of Limited Partnership that makes certain changes

relating to the composition of the Board and other changes to reflect the ownership of all outstanding common units of the Partnership

by GasLog, following the consummation of the previously announced merger involving GasLog and the Partnership on July 13, 2023.

On July 21, 2023, the Board also approved

the termination of the Omnibus Agreement with GasLog, its general partner and certain other subsidiaries. The omnibus agreement governed

among other things (i) when and the extent to which the Partnership and GasLog might compete against each other, (ii) the time

and the value at which the Partnership might exercise the right to purchase certain offered vessels by GasLog, (iii) certain rights

of first offer granted to GasLog to purchase any of its vessels on charter for less than five full years from the Partnership and vice

versa and (iv) GasLog’s provisions of certain indemnities to the Partnership.

On August 2, 2023, the board of directors

of GasLog Partners approved and declared a distribution on the Series A Preference Units of $0.5390625 per preference unit, a distribution

on the Series B Preference Units of $0.7249747 per preference unit and a distribution on the Series C Preference Units of $0.53125

per preference unit. The cash distributions are payable on September 15, 2023 to all unitholders of record as of September 8,

2023.

On June 30, 2023, Intercontinental

Exchange (“ICE”) Benchmark Administration, the administrator of the London Interbank Offered Rate (“LIBOR”),

ceased to publish the overnight and one, three, six and twelve month USD LIBOR settings on a representative basis. Effective

September 15, 2023, in accordance with the terms of the Series B Preference Units, the three month LIBOR currently

utilized as the base rate for the calculation of the floating rate distributions payable with respect to the Series B

Preference Units will be replaced by the Term Secured Overnight Financing Rate ("SOFR") for a three month tenor published by the

Chicago Mercantile Exchange (“CME”) plus a credit spread

adjustment of 0.26161% (“Credit Adjusted Term SOFR”). Credit Adjusted Term SOFR will be used as the base rate for the

first time with respect to the distributions payable for the distribution period beginning September 15, 2023 and ending

December 15, 2023 and will be calculated every three months going forward.

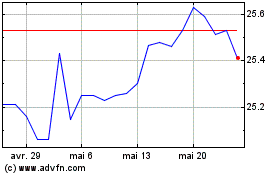

Gaslog Partners (NYSE:GLOP-C)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Gaslog Partners (NYSE:GLOP-C)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024