CBRE Global Real Estate Income Fund (NYSE: IGR) Announces the Preliminary Results of Rights Offering

10 Avril 2023 - 2:15PM

Business Wire

The Board of Trustees (the “Board”) of the CBRE Global Real

Estate Income Fund (NYSE: IGR) (the “Fund”) today announced the

preliminary results of its transferable rights offering (the

“Offer”) which expired on April 6, 2023 (the “Expiration Date”).

The Offer entitled the rights holders to subscribe for up to

23,378,100 additional common shares of the Fund (“Common Shares”).

The subscription price for the Common Shares to be issued was $5.03

per Common Share, which was determined based on a formula equal to

95% of the average of the last reported sales price of a Common

Share on the NYSE on the Expiration Date and each of the four (4)

immediately preceding trading days. The gross proceeds of the Offer

are expected to be approximately $117.6 million (including

oversubscription requests and notices of guaranteed delivery).

The Offer was oversubscribed; however, the Fund will not

exercise the secondary oversubscription which would have increased

the number of Common Shares to be issued in the Offer. The

available oversubscription shares will be allocated pro rata among

those fully exercising record date shareholders who oversubscribed

based on the number of rights originally issued to them by the

Fund. The Fund will return to those investors that submitted

oversubscription requests the full amount of their excess

payments.

The Common Shares subscribed for are expected to be issued on or

about April 14, 2023, after completion of the pro-rata allocation

of Common Shares in respect of the oversubscription privilege and

receipt of all shareholder payments. The final subscription price

is lower than the original estimated subscription price.

Accordingly, any excess payments will be returned to subscribing

rights holders as soon as practicable, in accordance with the

prospectus supplement filed with the Securities Exchange Commission

on February 27, 2023.

About CBRE Investment

Management

CBRE Investment Management is a leading global real assets

investment management firm with $149.3 billion in assets under

management* as of December 31, 2022, operating in more than 30

offices and 20 countries around the world. Through its

investor-operator culture, the firm seeks to deliver sustainable

investment solutions across real assets categories, geographies,

risk profiles and execution formats so that its clients, people and

communities thrive.

CBRE Investment Management is an independently operated

affiliate of CBRE Group, Inc. (NYSE:CBRE), the world’s largest

commercial real estate services and investment firm (based on 2022

revenue). CBRE has approximately 115,000 employees (excluding

Turner & Townsend employees) serving clients in more than 100

countries. CBRE Investment Management harnesses CBRE’s data and

market insights, investment sourcing and other resources for the

benefit of its clients. For more information, please visit

www.cbreim.com.

*Assets under management (AUM) refers to the fair market value

of real assets-related investments with respect to which CBRE

Investment Management provides, on a global basis, oversight,

investment management services and other advice and which generally

consist of investments in real assets; equity in funds and joint

ventures; securities portfolios; operating companies and real

assets-related loans. This AUM is intended principally to reflect

the extent of CBRE Investment Management’s presence in the global

real assets market, and its calculation of AUM may differ from the

calculations of other asset managers and from its calculation of

regulatory assets under management for purposes of certain

regulatory filings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230410005139/en/

Analyst and Press Inquiries: David Leggette +1

610 995 7349 david.leggette@cbreim.com

Investor Relations: +1 888 711 4272

www.cbreim.com/igr

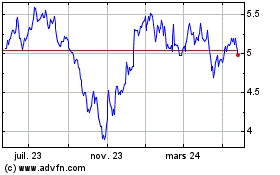

CBRE Global Real Estate ... (NYSE:IGR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

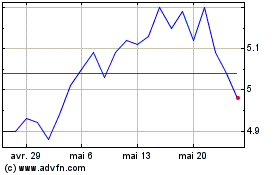

CBRE Global Real Estate ... (NYSE:IGR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025