EARNINGS RELEASE SUPPLEMENT THIRD QUARTER 2023 (UNAUDITED) NOVEMBER 1, 2023

Table of Contents Section I Forward-Looking Statements and Non-GAAP Financial Measure Disclosures Section II Corporate Financial Schedules Section III Operating & Property-Level Schedules Section IV Capitalization and Debt Schedules Section V Asset Listing 2

Forward-Looking Statements We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans, and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,” or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking by their nature: • our ability to increase our dividend per share of common stock; • the state of the U.S. economy generally or in specific geographic regions in which we operate, and the effect of general economic conditions on the lodging industry and our business in particular; • market trends in our industry, interest rates, real estate values and the capital markets; • our business and investment strategy and, particularly, our ability to identify and complete hotel acquisitions and dispositions; • our projected operating results; • actions and initiatives of the U.S. government and changes to U.S. government policies and the execution and impact of such actions, initiatives and policies; • our ability to manage our relationships with our management companies and franchisors; • our ability to maintain our existing and future financing arrangements; • changes in the value of our properties; • the impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; • our ability to satisfy the requirements for qualification as a REIT under the U.S. Tax Code; • our ability to repay or refinance our indebtedness as it matures or becomes callable by lenders; • the availability of qualified personnel; • our ability to make distributions to our stockholders in the future; • the general volatility of the market price of our securities; and • the degree and nature of our competition. Forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account information currently available to us. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. These factors are discussed under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, and in other documents we have filed with the Securities and Exchange Commission. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement is effective only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law we are not obligated to, and do not intend to, publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, this presentation contains certain unaudited historical and pro forma information and metrics which are based or calculated from historical data that is maintained or produced by Summit Hotel Properties, Inc. or third parties. This presentation contain statistics and other data that may have been obtained from, or compiled from, information made available by third-parties. 3

Non-GAAP Financial Measures We disclose certain “non-GAAP financial measures,” which are measures of our historical financial performance. Non-GAAP financial measures are financial measures not prescribed by Generally Accepted Accounting Principles ("GAAP"). These measures are as follows: (i) Funds From Operations (“FFO”) and Adjusted Funds from Operations ("AFFO"), (ii) Earnings before Interest, Taxes, Depreciation and Amortization ("EBITDA"), Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate ("EBITDAre") and Adjusted EBITDAre (as described below). We caution investors that amounts presented in accordance with our definitions of non-GAAP financial measures may not be comparable to similar measures disclosed by other companies, since not all companies calculate these non-GAAP financial measures in the same manner. Our non-GAAP financial measures should be considered along with, but not as alternatives to, net income (loss) as a measure of our operating performance. Our non-GAAP financial measures may include funds that may not be available for our discretionary use due to functional requirements to conserve funds for capital expenditures, property acquisitions, debt service obligations and other commitments and uncertainties. Although we believe that our non-GAAP financial measures can enhance the understanding of our financial condition and results of operations, these non-GAAP financial measures are not necessarily better indicators of any trend as compared to a comparable measure prescribed by GAAP such as net income (loss). FFO and AFFO As defined by Nareit, FFO represents net income or loss (computed in accordance with GAAP), excluding preferred dividends, gains (or losses) from sales of real property, impairment losses on real estate assets, items classified by GAAP as extraordinary, the cumulative effect of changes in accounting principles, plus depreciation and amortization related to real estate assets, and adjustments for unconsolidated partnerships, and joint ventures. AFFO represents FFO excluding amortization of deferred financing costs, franchise fees, equity-based compensation expense, transaction costs, debt transaction costs, premiums on redemption of preferred shares, losses from net casualties, non-cash interest income and non-cash income tax related adjustments to our deferred tax asset. Unless otherwise indicated, we present FFO and AFFO applicable to our common shares and common units. We present FFO and AFFO because we consider FFO and AFFO an important supplemental measure of our operational performance and believe it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO and AFFO when reporting their results. FFO and AFFO are intended to exclude GAAP historical cost depreciation and amortization, which assumes that the value of real estate assets diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO and AFFO exclude depreciation and amortization related to real estate assets, gains and losses from real property dispositions and impairment losses on real estate assets, and certain transaction costs related to lodging property acquisition activities and debt, FFO and AFFO provide performance measures that, when compared year over year, reflect the effect to operations from trends in occupancy, guestroom rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income. Our computation of FFO differs slightly from the computation of Nareit-defined FFO related to the reporting of depreciation and amortization expense on assets at our corporate offices, which is de minimus. Our computation of FFO may also differ from the methodology for calculating FFO used by other equity REITs and, accordingly, may not be comparable to such other REITs. FFO and AFFO should not be considered as an alternative to net income (loss) (computed in accordance with GAAP) as an indicator of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. Where indicated in this Earnings Release Supplement, FFO is based on our computation of FFO and not the computation of Nareit-defined FFO unless otherwise noted. 4

Non-GAAP Financial Measures (cont.) EBITDAre and Adjusted EBITDAre In September 2017, Nareit proposed a standardized performance measure, called EBITDAre, which is based on EBITDA and is expected to provide additional relevant information about REITs as real estate companies in support of growing interest among generalist investors. The conclusion was reached that, while dedicated REIT investors have long been accustomed to utilizing the industry’s supplemental measures such as FFO and net operating income (“NOI”) to evaluate the investment quality of REITs as real estate companies, it would be helpful to generalist investors for REITs as real estate companies to also present EBITDAre as a more widely known and understood supplemental measure of performance. EBITDAre is intended to be a supplemental non-GAAP performance measure that is independent of a company’s capital structure and will provide a uniform basis for one measurement of the enterprise value of a company compared to other REITs. EBITDAre, as defined by Nareit, is calculated as EBITDA, excluding: (i) loss and gains on disposition of property and (ii) asset impairments, if any. We believe EBITDAre is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures and to fund other cash needs or reinvest cash into our business. We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results. We make additional adjustments to EBITDAre when evaluating our performance because we believe that the exclusion of certain additional non- recurring or unusual items described below provides useful supplemental information to investors regarding our ongoing operating performance. We believe that the presentation of Adjusted EBITDAre, when combined with the primary GAAP presentation of net income, is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to meet general operating expenses, to make capital expenditures and to fund other cash needs, or reinvest cash into our business. We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results. 5

Table of Contents Section I Forward-Looking Statements and Non-GAAP Financial Measure Disclosures Section II Corporate Financial Schedules Section III Operating & Property-Level Schedules Section IV Capitalization and Debt Schedules Section V Asset Listing 6

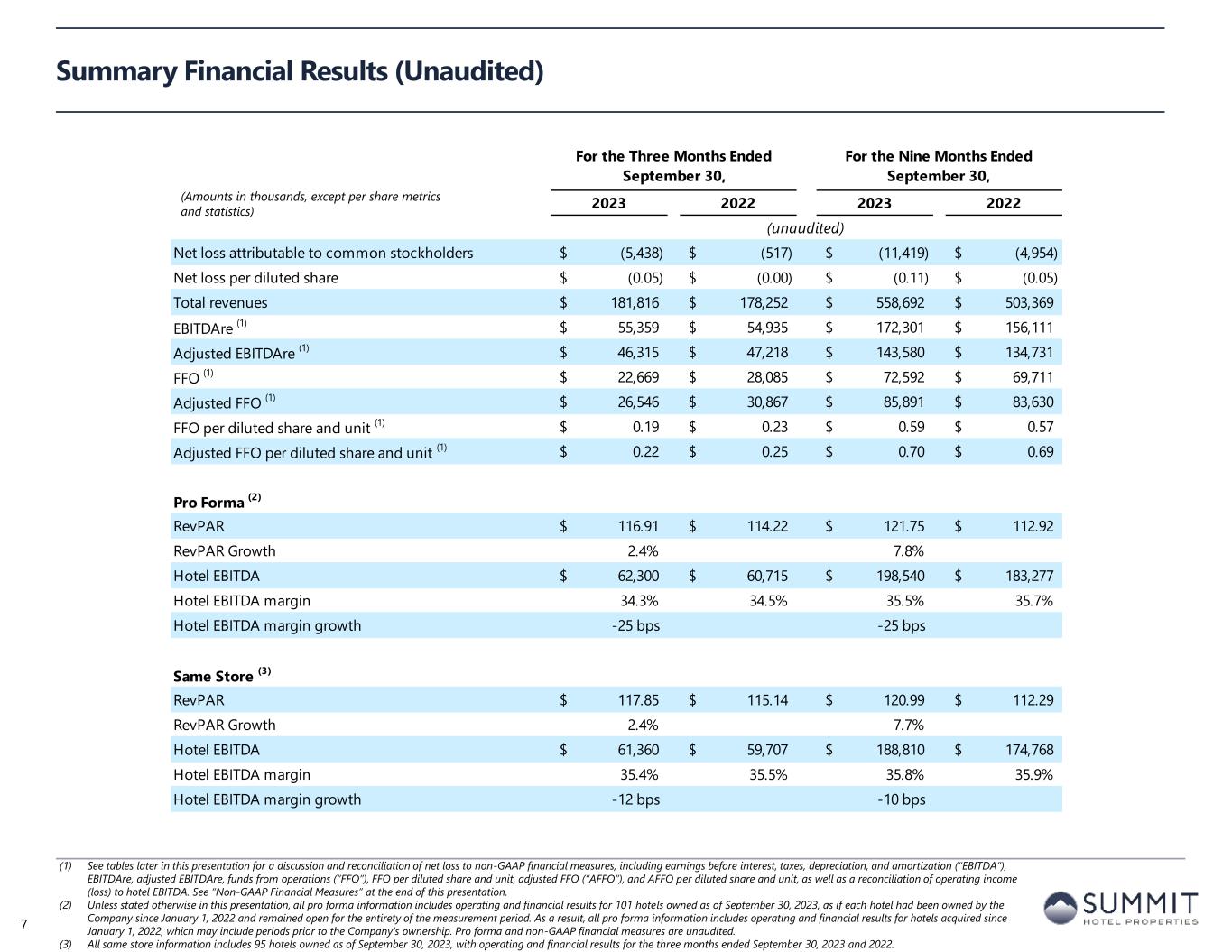

For the Three Months Ended September 30, For the Nine Months Ended September 30, 2023 2022 2023 2022 (unaudited) Net loss attributable to common stockholders (5,438)$ (517)$ (11,419)$ (4,954)$ Net loss per diluted share (0.05)$ (0.00)$ (0.11)$ (0.05)$ Total revenues 181,816$ 178,252$ 558,692$ 503,369$ EBITDAre (1) 55,359$ 54,935$ 172,301$ 156,111$ Adjusted EBITDAre (1) 46,315$ 47,218$ 143,580$ 134,731$ FFO (1) 22,669$ 28,085$ 72,592$ 69,711$ Adjusted FFO (1) 26,546$ 30,867$ 85,891$ 83,630$ FFO per diluted share and unit (1) 0.19$ 0.23$ 0.59$ 0.57$ Adjusted FFO per diluted share and unit (1) 0.22$ 0.25$ 0.70$ 0.69$ Pro Forma (2) RevPAR 116.91$ 114.22$ 121.75$ 112.92$ RevPAR Growth 2.4% 7.8% Hotel EBITDA 62,300$ 60,715$ 198,540$ 183,277$ Hotel EBITDA margin 34.3% 34.5% 35.5% 35.7% Hotel EBITDA margin growth -25 bps -25 bps Same Store (3) RevPAR 117.85$ 115.14$ 120.99$ 112.29$ RevPAR Growth 2.4% 7.7% Hotel EBITDA 61,360$ 59,707$ 188,810$ 174,768$ Hotel EBITDA margin 35.4% 35.5% 35.8% 35.9% Hotel EBITDA margin growth -12 bps -10 bps Summary Financial Results (Unaudited) (1) See tables later in this presentation for a discussion and reconciliation of net loss to non-GAAP financial measures, including earnings before interest, taxes, depreciation, and amortization (“EBITDA”), EBITDAre, adjusted EBITDAre, funds from operations (“FFO”), FFO per diluted share and unit, adjusted FFO (“AFFO”), and AFFO per diluted share and unit, as well as a reconciliation of operating income (loss) to hotel EBITDA. See “Non-GAAP Financial Measures” at the end of this presentation. (2) Unless stated otherwise in this presentation, all pro forma information includes operating and financial results for 101 hotels owned as of September 30, 2023, as if each hotel had been owned by the Company since January 1, 2022 and remained open for the entirety of the measurement period. As a result, all pro forma information includes operating and financial results for hotels acquired since January 1, 2022, which may include periods prior to the Company’s ownership. Pro forma and non-GAAP financial measures are unaudited. (3) All same store information includes 95 hotels owned as of September 30, 2023, with operating and financial results for the three months ended September 30, 2023 and 2022. (Amounts in thousands, except per share metrics and statistics) 7

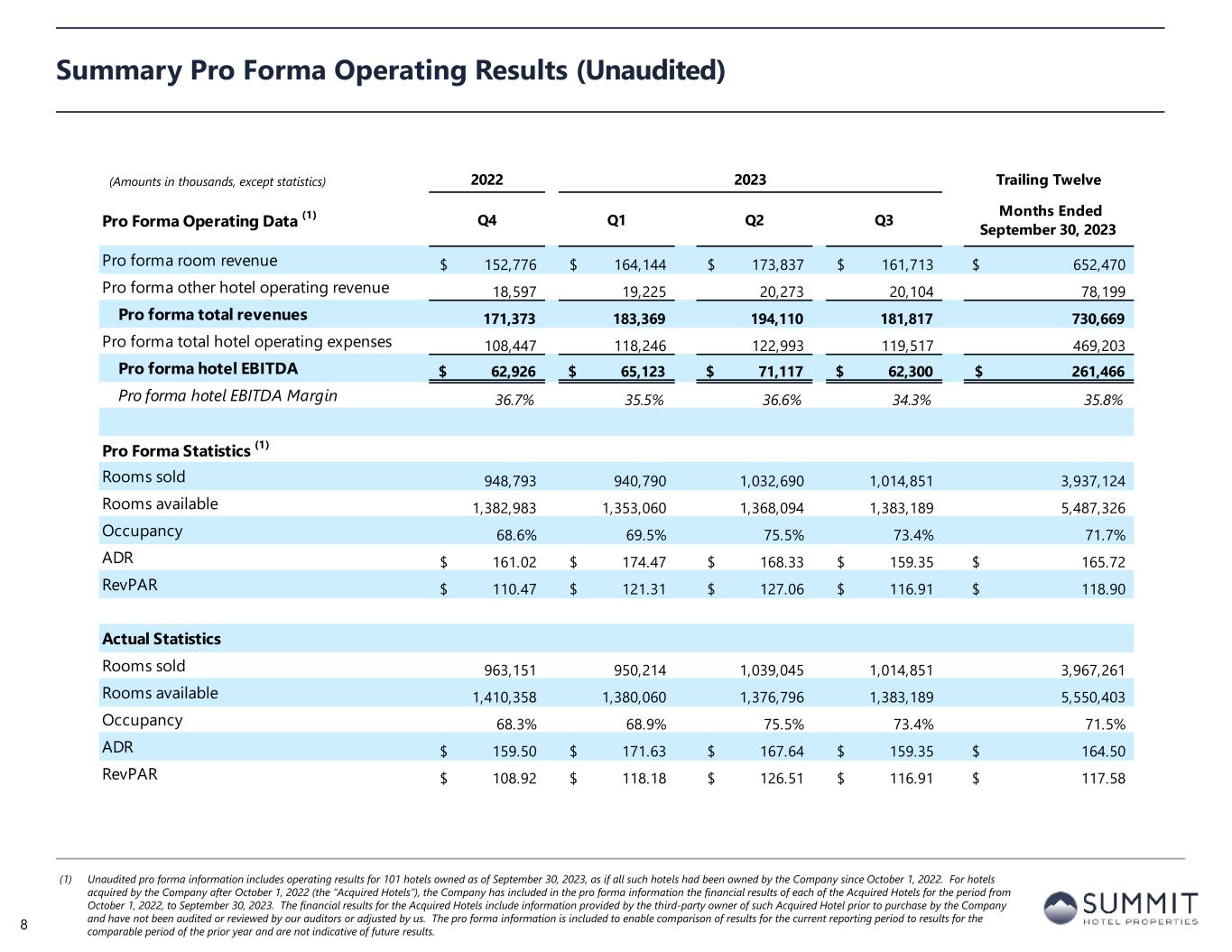

2022 2023 Trailing Twelve Pro Forma Operating Data (1) Q4 Q1 Q2 Q3 Months Ended September 30, 2023 Pro forma room revenue 152,776$ 164,144$ 173,837$ 161,713$ 652,470$ Pro forma other hotel operating revenue 18,597 19,225 20,273 20,104 78,199 Pro forma total revenues 171,373 183,369 194,110 181,817 730,669 Pro forma total hotel operating expenses 108,447 118,246 122,993 119,517 469,203 Pro forma hotel EBITDA 62,926$ 65,123$ 71,117$ 62,300$ 261,466$ Pro forma hotel EBITDA Margin 36.7% 35.5% 36.6% 34.3% 35.8% Pro Forma Statistics (1) Rooms sold 948,793 940,790 1,032,690 1,014,851 3,937,124 Rooms available 1,382,983 1,353,060 1,368,094 1,383,189 5,487,326 Occupancy 68.6% 69.5% 75.5% 73.4% 71.7% ADR 161.02$ 174.47$ 168.33$ 159.35$ 165.72$ RevPAR 110.47$ 121.31$ 127.06$ 116.91$ 118.90$ Actual Statistics Rooms sold 963,151 950,214 1,039,045 1,014,851 3,967,261 Rooms available 1,410,358 1,380,060 1,376,796 1,383,189 5,550,403 Occupancy 68.3% 68.9% 75.5% 73.4% 71.5% ADR 159.50$ 171.63$ 167.64$ 159.35$ 164.50$ RevPAR 108.92$ 118.18$ 126.51$ 116.91$ 117.58$ Summary Pro Forma Operating Results (Unaudited) (1) Unaudited pro forma information includes operating results for 101 hotels owned as of September 30, 2023, as if all such hotels had been owned by the Company since October 1, 2022. For hotels acquired by the Company after October 1, 2022 (the “Acquired Hotels”), the Company has included in the pro forma information the financial results of each of the Acquired Hotels for the period from October 1, 2022, to September 30, 2023. The financial results for the Acquired Hotels include information provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results. 8 (Amounts in thousands, except statistics)

For the Three Months Ended September 30, For the Nine Months Ended September 30, 2023 2022 2023 2022 Net (loss) income (5,769)$ (1,041)$ (6,849)$ 13,299$ Depreciation and amortization 37,882 38,130 112,300 112,462 Interest expense 22,020 17,645 65,177 46,202 Interest income (150) (14) (390) (20) Income tax expense 1,360 210 1,679 4,647 EBITDA 55,343$ 54,930$ 171,917$ 176,590$ Loss (gain) on disposal of assets and other dispositions, net 16 5 384 (20,479) EBITDAre 55,359$ 54,935$ 172,301$ 156,111$ Recoveries of credit losses (250) (850) (500) (1,100) Amortization of key money liabilities (121) (144) (378) (267) Equity-based compensation 1,867 1,231 5,913 7,070 Transaction costs and other - 56 24 737 Debt transaction costs 90 1,131 352 1,166 Non-cash interest (income) expense, net (1) (134) - (397) (113) Non-cash lease expense, net 106 115 368 374 Casualty losses, net 380 750 1,851 1,054 Loss (income) related to non-controlling interests in consolidated joint ventures 4,442 3,730 8,093 (5,219) Other non-cash items, net - - 713 - Adjustments related to non-controlling interests in consolidated joint ventures (15,424) (13,736) (44,760) (25,082) Adjusted EBITDAre 46,315$ 47,218$ 143,580$ 134,731$ Adjusted EBITDAre Reconciliation (1) Non-cash interest income relates to the amortization of the discount on certain notes receivable. The discount on these notes receivable was recorded at inception of the related loans based on the estimated value of the embedded purchase options in the notes receivable. 9 (Amounts in thousands)

For the Three Months Ended September 30, For the Nine Months Ended September 30, 2023 2022 2023 2022 Net (loss) income (5,769)$ (1,041)$ (6,849)$ 13,299$ Preferred dividends (3,968) (3,968) (11,906) (11,906) Distributions to and accretion of redeemable non-controlling interests (656) (656) (1,970) (1,866) Loss (income) related to non-controlling interests in consolidated joint ventures 4,442 3,730 8,093 (5,219) Net loss applicable to Common Stock and Common Units (5,951)$ (1,935)$ (12,632)$ (5,692)$ Real estate-related depreciation 36,697 36,804 108,751 108,959 Loss (gain) on disposal of assets and other dispositions, net 16 5 384 (20,479) Adjustments related to non-controlling interests in consolidated joint ventures (8,093) (6,789) (23,911) (13,077) FFO applicable to Common Stock and Common Units 22,669$ 28,085$ 72,592$ 69,711$ Recoveries of credit losses (250) (850) (500) (1,100) Amortization of debt issuance costs 1,594 1,413 4,379 4,238 Amortization of franchise fees 153 167 439 504 Amortization of intangible assets, net 911 892 2,733 2,732 Equity-based compensation 1,867 1,231 5,913 7,070 Transaction costs and other - 56 24 737 Debt transaction costs 90 1,131 352 1,166 Non-cash interest expense, net (1) (134) - (397) (113) Non-cash lease expense, net 106 115 368 374 Casualty losses, net 380 750 1,851 1,054 Other non-cash items, net - - 768 - Adjustments related to non-controlling interests in consolidated joint ventures (840) (2,123) (2,631) (2,743) AFFO applicable to Common Stock and Common Units 26,546$ 30,867$ 85,891$ 83,630$ FFO per share of Common Stock and Common Units 0.19$ 0.23$ 0.59$ 0.57$ AFFO per share of Common Stock and Common Units 0.22$ 0.25$ 0.70$ 0.69$ Weighted average diluted shares of Common Stock and Common Units FFO and AFFO (2) 122,513 121,265 122,312 121,289 Adjusted FFO Reconciliation (1) Non-cash interest income relates to the amortization of the discount on certain notes receivable. The discount on these notes receivable was recorded at inception of the related loans based on the estimated value of the embedded purchase options in the notes receivable. (2) The Company includes the outstanding OP units issued by Summit Hotel OP, LP, the Company’s operating partnership, held by limited partners other than the Company because the OP units are redeemable for cash or, at the Company’s option, shares of the Company’s common stock on a one-for-one basis. 10 (Amounts in thousands, except per share metrics)

Summit Wholly-Owned GIC Joint Venture (2) Other Joint Ventures (2) Combined GIC JV Pro Rata Adj Other JVs Pro Rata Adj Pro Rata SEC Filing - 10Q/K Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Rooms sold 621,599 650,417 375,622 344,959 17,630 15,620 1,014,851 1,010,996 Rooms available 844,437 887,340 513,452 498,088 25,300 24,288 1,383,189 1,409,716 Occupancy 73.6% 73.3% 73.2% 69.3% 69.7% 64.3% 73.4% 71.7% ADR 165.03$ 163.85$ 149.97$ 148.42$ 158.59$ 151.28$ 159.35$ 158.39$ RevPAR 121.48$ 120.10$ 109.71$ 102.79$ 110.51$ 97.29$ 116.91$ 113.59$ Room revenue 102,585 106,570 56,331 51,200 2,796 2,363 161,712 160,133 Other revenue 10,714 9,743 6,884 6,268 2,506 2,108 20,104 18,119 Total revenue 113,299$ 116,313$ 63,215$ 57,468$ 5,302$ 4,471$ 181,816$ 178,252$ Hotel EBITDA 38,498$ 40,662$ 23,162$ 19,950$ 590$ 491$ 62,250$ 61,103$ % margin 34.0% 35.0% 36.6% 34.7% 11.1% 11.0% 34.2% 34.3% Net (loss) income 4,561$ 7,411$ (8,854)$ (7,322)$ (1,476)$ (1,130)$ (5,769)$ (1,041)$ 4,294$ 3,617$ 148$ 113$ (1,327)$ 2,689$ Depreciation and amortization 19,493 20,567 17,343 16,560 1,046 1,003 37,882 38,130 (8,498) (8,114) (105) (100) 29,279 29,916 Interest expense 8,791 8,655 12,217 8,349 1,012 641 22,020 17,645 (5,986) (4,091) (101) (64) 15,933 13,490 Interest income (142) (14) (8) - - - (150) (14) 4 - - - (146) (14) Income tax expense - (1,605) 1,360 1,815 - - 1,360 210 (666) (889) - - 694 (679) EBITDA 32,703$ 35,014$ 22,058$ 19,402$ 582$ 514$ 55,343$ 54,930$ (10,852)$ (9,477)$ (58)$ (51)$ 44,433$ 45,402$ Loss (gain) on disposal of assets and other dispositions, net 8 5 8 - - - 16 5 (4) - - - 12 5 EBITDAre 32,711$ 35,019$ 22,066$ 19,402$ 582$ 514$ 55,359$ 54,935$ (10,856)$ (9,477)$ (58)$ (51)$ 44,445$ 45,407$ Recoveries of credit losses (250) (850) - - - - (250) (850) - - - - (250) (850) Amortization of key money liabilities (52) (69) (51) (51) (18) (24) (121) (144) 25 25 2 2 (94) (117) Equity-based compensation 1,867 1,231 - - - - 1,867 1,231 - - - - 1,867 1,231 Transaction costs and other - (1) - 57 - - - 56 - (28) - - - 28 Debt transaction costs 90 1,129 - 2 - - 90 1,131 - (1) - - 90 1,130 Non-cash interest (income) expense, net (1) (134) - - - - - (134) - - - - - (134) - Non-cash lease expense, net 97 119 9 (4) - - 106 115 (4) 2 - - 102 117 Casualty losses, net 251 529 115 221 14 - 380 750 (56) (108) (1) - 323 642 Other 2 2 (1) (1) (1) (1) - - (34) (370) - - (34) (370) Adjusted EBITDAre 34,582$ 37,109$ 22,138$ 19,626$ 577$ 489$ 57,297$ 57,224$ (10,925)$ (9,957)$ (57)$ (49)$ 46,315$ 47,218$ Reconciliation to Adjusted EBITDAre – By Ownership Interest (Unaudited) Q3 2023 (1) Non-cash interest income relates to the amortization of the discount on certain notes receivable. The discount on these notes receivable was recorded at inception of the related loans based on the estimated value of the embedded purchase options in the notes receivable. (2) GIC Joint Venture is 51% owned by Summit while Other Joint Ventures are 90% owned by Summit. 11 (Amounts in thousands, except statistics)

Summit Wholly-Owned GIC Joint Venture (2) Other Joint Ventures (2) Combined GIC JV Pro Rata Adj Other JVs Pro Rata Adj Pro Rata SEC Filing - 10Q/K YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 Rooms sold 1,837,662 1,847,336 1,108,514 1,012,872 57,934 19,194 3,004,110 2,879,402 Rooms available 2,567,608 2,633,054 1,497,362 1,443,164 75,075 29,832 4,140,045 4,106,050 Occupancy 71.6% 70.2% 74.0% 70.2% 77.2% 64.3% 72.6% 70.1% ADR 168.91$ 162.31$ 158.93$ 151.00$ 214.16$ 154.21$ 166.10$ 158.28$ RevPAR 120.89$ 113.87$ 117.66$ 105.98$ 165.26$ 99.22$ 120.53$ 110.99$ Room revenue 310,398 299,839 176,177 152,948 12,407 2,960 498,982 455,747 Other revenue 31,089 26,413 20,920 18,644 7,701 2,565 59,710 47,622 Total revenue 341,487$ 326,252$ 197,097$ 171,592$ 20,108$ 5,525$ 558,692$ 503,369$ Hotel EBITDA 113,397$ 111,609$ 76,419$ 64,182$ 5,928$ 621$ 195,744$ 176,412$ % margin 33.2% 34.2% 38.8% 37.4% 29.5% 11.2% 35.0% 35.0% Net (loss) income 10,218$ 3,934$ (16,910)$ 10,721$ (157)$ (1,356)$ (6,849)$ 13,299$ 8,077$ (5,355)$ 16$ 136$ 1,244$ 8,080$ Depreciation and amortization 57,949 61,169 51,265 50,049 3,086 1,244 112,300 112,462 (25,120) (24,524) (309) (124) 86,871 87,814 Interest expense 25,781 27,130 36,509 18,314 2,887 758 65,177 46,202 (17,889) (8,974) (289) (76) 46,999 37,152 Interest income (354) (18) (36) (2) - - (390) (20) 18 1 - - (372) (19) Income tax expense 26 2,816 1,653 1,831 - - 1,679 4,647 (810) (897) - - 869 3,750 EBITDA 93,620$ 95,031$ 72,481$ 80,913$ 5,816$ 646$ 171,917$ 176,590$ (35,724)$ (39,749)$ (582)$ (64)$ 135,611$ 136,777$ Loss (gain) on disposal of assets and other dispositions, net 345 13 39 (20,492) - - 384 (20,479) (19) 10,041 - - 365 (10,438) EBITDAre 93,965$ 95,044$ 72,520$ 60,421$ 5,816$ 646$ 172,301$ 156,111$ (35,743)$ (29,708)$ (582)$ (64)$ 135,976$ 126,339$ Recoveries of credit losses (500) (1,100) - - - - (500) (1,100) - - - - (500) (1,100) Amortization of key money liabilities (170) (101) (154) (142) (54) (24) (378) (267) 75 70 5 2 (298) (195) Equity-based compensation 5,913 7,070 - - - - 5,913 7,070 - - - - 5,913 7,070 Transaction costs and other 13 - 11 737 - - 24 737 (5) (361) - - 19 376 Debt transaction costs 293 1,130 59 36 - - 352 1,166 (29) (18) - - 323 1,148 Non-cash interest (income) expense, net (1) (397) (113) - - - - (397) (113) - - - - (397) (113) Non-cash lease expense, net 335 355 33 19 - - 368 374 (16) (9) - - 352 365 Casualty losses, net 1,071 623 671 431 109 - 1,851 1,054 (329) (211) (11) - 1,511 843 Other 712 - 1 1 - (1) 713 - (32) (2) - - 681 (2) Adjusted EBITDAre 101,235$ 102,908$ 73,141$ 61,503$ 5,871$ 621$ 180,247$ 165,032$ (36,079)$ (30,239)$ (588)$ (62)$ 143,580$ 134,731$ Reconciliation to Adjusted EBITDAre – By Ownership Interest (Unaudited) YTD 2023 (1) Non-cash interest income relates to the amortization of the discount on certain notes receivable. The discount on these notes receivable was recorded at inception of the related loans based on the estimated value of the embedded purchase options in the notes receivable. (2) GIC Joint Venture is 51% owned by Summit while Other Joint Ventures are 90% owned by Summit. 12 (Amounts in thousands, except statistics)

Summit Wholly-Owned GIC Joint Venture (3) Other Joint Ventures (3) Combined GIC JV Pro Rata Adj Other JVs Pro Rata Adj Pro Rata Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Q3 2023 Q3 2022 Net (loss) income 4,561$ 7,411$ (8,854)$ (7,322)$ (1,476)$ (1,130)$ (5,769)$ (1,041)$ 4,294 3,617 148 113 (1,327)$ 2,689$ Preferred dividends (3,968) (3,968) - - - - (3,968) (3,968) - - - - (3,968) (3,968) Distributions to and accretion of redeemable non-controlling interests (656) (656) - - - - (656) (656) - - - - (656) (656) Net loss applicable to Common Stock and Common Units (63)$ 2,787$ (8,854)$ (7,322)$ (1,476)$ (1,130)$ (10,393)$ (5,665)$ 4,294$ 3,617$ 148$ 113$ (5,951)$ (1,935)$ Real estate-related depreciation 19,370 20,307 16,299 15,518 1,028 979 36,697 36,804 (7,986) (6,691) (103) (98) 28,608 30,015 Loss (gain) on disposal of assets and other dispositions, net 8 5 8 - - - 16 5 (4) - - - 12 5 FFO applicable to Common Stock and Common Units 19,315$ 23,099$ 7,453$ 8,196$ (448)$ (151)$ 26,320$ 31,144$ (3,696)$ (3,074)$ 45$ 15$ 22,669$ 28,085$ Recoveries of credit losses (250) (850) - - - - (250) (850) - - - - (250) (850) Amortization of debt issuance costs 1,054 924 525 469 15 20 1,594 1,413 (257) (230) (2) (2) 1,335 1,181 Amortization of franchise fees 71 86 82 81 - - 153 167 (40) (40) - - 113 127 Amortization of intangible assets, net - (19) 911 911 - - 911 892 (446) (446) - - 465 446 Equity-based compensation 1,867 1,231 - - - - 1,867 1,231 - - - - 1,867 1,231 Transaction costs and other - (1) - 57 - - - 56 - (28) - - - 28 Debt transaction costs 90 1,129 - 2 - - 90 1,131 - (1) - - 90 1,130 Non-cash interest expense, net (1) (134) - - - - - (134) - - - - - (134) - Non-cash lease expense, net 97 119 9 (4) - - 106 115 (4) 2 - - 102 117 Casualty losses, net 251 529 115 221 14 - 380 750 (56) (108) (1) - 323 642 Other 1 2 (1) (2) - - - - (34) (1,270) - - (34) (1,270) AFFO applicable to Common Stock and Common Units 22,362$ 26,249$ 9,094$ 9,931$ (419)$ (131)$ 31,037$ 36,049$ (4,533)$ (5,195)$ 42$ 13$ 26,546$ 30,867$ FFO per Common Stock and Common Units 0.19$ 0.23$ AFFO per Common Stock and Common Units 0.22$ 0.25$ Weighted average diluted shares of Common Stock and Common Units FFO and AFFO (2) 122,513 121,265 Reconciliation to Adjusted FFO – By Ownership Interest (Unaudited) Q3 2023 (1) Non-cash interest income relates to the amortization of the discount on certain notes receivable. The discount on these notes receivable was recorded at inception of the related loans based on the estimated value of the embedded purchase options in the notes receivable. (2) The Company includes the outstanding OP units issued by Summit Hotel OP, LP, the Company’s operating partnership, held by limited partners other than the Company because the OP units are redeemable for cash or, at the Company’s option, shares of the Company’s common stock on a one-for-one basis. (3) GIC Joint Venture is 51% owned by Summit while Other Joint Ventures are 90% owned by Summit. 13 (Amounts in thousands, except per share metrics)

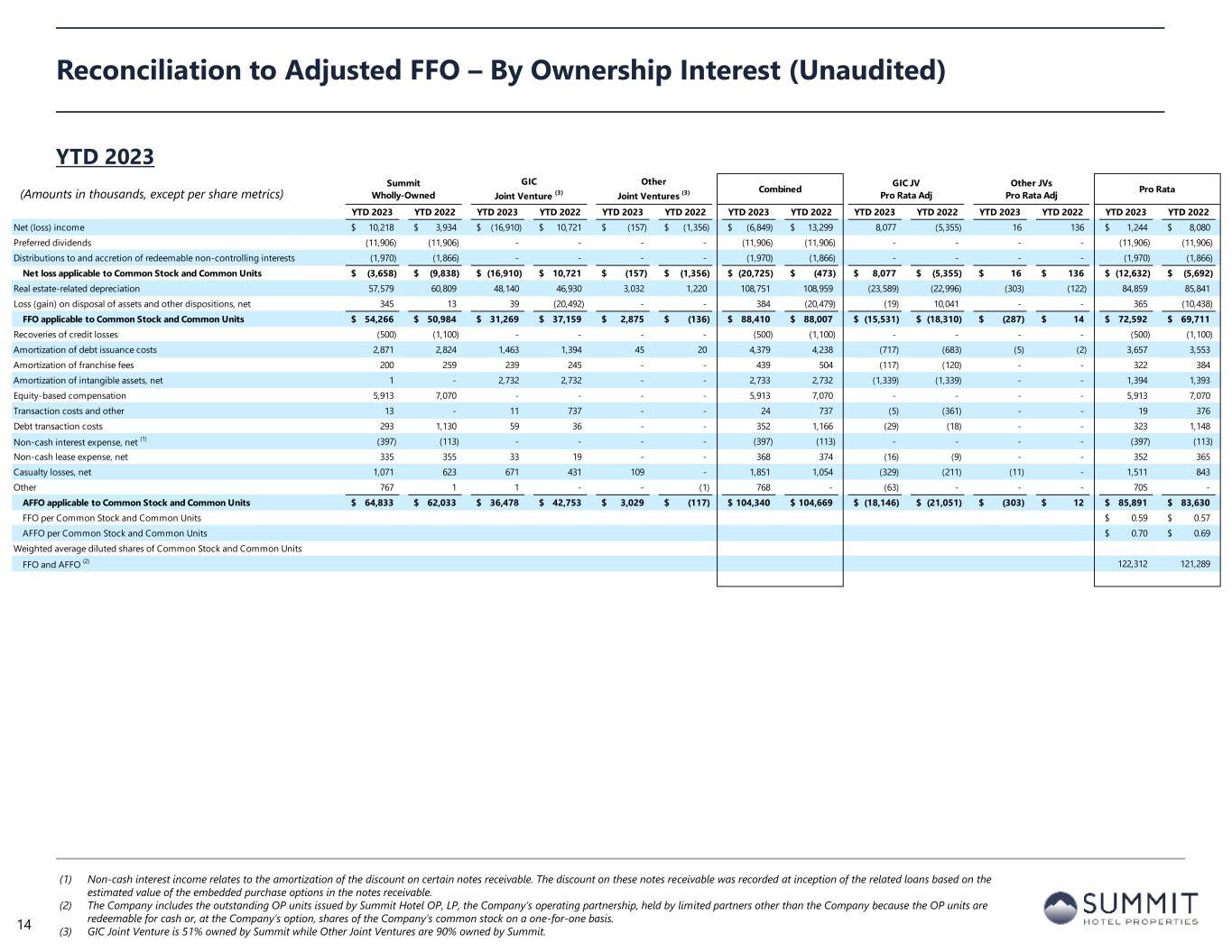

Summit Wholly-Owned GIC Joint Venture (3) Other Joint Ventures (3) Combined GIC JV Pro Rata Adj Other JVs Pro Rata Adj Pro Rata YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 YTD 2023 YTD 2022 Net (loss) income 10,218$ 3,934$ (16,910)$ 10,721$ (157)$ (1,356)$ (6,849)$ 13,299$ 8,077 (5,355) 16 136 1,244$ 8,080$ Preferred dividends (11,906) (11,906) - - - - (11,906) (11,906) - - - - (11,906) (11,906) Distributions to and accretion of redeemable non-controlling interests (1,970) (1,866) - - - - (1,970) (1,866) - - - - (1,970) (1,866) Net loss applicable to Common Stock and Common Units (3,658)$ (9,838)$ (16,910)$ 10,721$ (157)$ (1,356)$ (20,725)$ (473)$ 8,077$ (5,355)$ 16$ 136$ (12,632)$ (5,692)$ Real estate-related depreciation 57,579 60,809 48,140 46,930 3,032 1,220 108,751 108,959 (23,589) (22,996) (303) (122) 84,859 85,841 Loss (gain) on disposal of assets and other dispositions, net 345 13 39 (20,492) - - 384 (20,479) (19) 10,041 - - 365 (10,438) FFO applicable to Common Stock and Common Units 54,266$ 50,984$ 31,269$ 37,159$ 2,875$ (136)$ 88,410$ 88,007$ (15,531)$ (18,310)$ (287)$ 14$ 72,592$ 69,711$ Recoveries of credit losses (500) (1,100) - - - - (500) (1,100) - - - - (500) (1,100) Amortization of debt issuance costs 2,871 2,824 1,463 1,394 45 20 4,379 4,238 (717) (683) (5) (2) 3,657 3,553 Amortization of franchise fees 200 259 239 245 - - 439 504 (117) (120) - - 322 384 Amortization of intangible assets, net 1 - 2,732 2,732 - - 2,733 2,732 (1,339) (1,339) - - 1,394 1,393 Equity-based compensation 5,913 7,070 - - - - 5,913 7,070 - - - - 5,913 7,070 Transaction costs and other 13 - 11 737 - - 24 737 (5) (361) - - 19 376 Debt transaction costs 293 1,130 59 36 - - 352 1,166 (29) (18) - - 323 1,148 Non-cash interest expense, net (1) (397) (113) - - - - (397) (113) - - - - (397) (113) Non-cash lease expense, net 335 355 33 19 - - 368 374 (16) (9) - - 352 365 Casualty losses, net 1,071 623 671 431 109 - 1,851 1,054 (329) (211) (11) - 1,511 843 Other 767 1 1 - - (1) 768 - (63) - - - 705 - AFFO applicable to Common Stock and Common Units 64,833$ 62,033$ 36,478$ 42,753$ 3,029$ (117)$ 104,340$ 104,669$ (18,146)$ (21,051)$ (303)$ 12$ 85,891$ 83,630$ FFO per Common Stock and Common Units 0.59$ 0.57$ AFFO per Common Stock and Common Units 0.70$ 0.69$ Weighted average diluted shares of Common Stock and Common Units FFO and AFFO (2) 122,312 121,289 Reconciliation to Adjusted FFO – By Ownership Interest (Unaudited) YTD 2023 (1) Non-cash interest income relates to the amortization of the discount on certain notes receivable. The discount on these notes receivable was recorded at inception of the related loans based on the estimated value of the embedded purchase options in the notes receivable. (2) The Company includes the outstanding OP units issued by Summit Hotel OP, LP, the Company’s operating partnership, held by limited partners other than the Company because the OP units are redeemable for cash or, at the Company’s option, shares of the Company’s common stock on a one-for-one basis. (3) GIC Joint Venture is 51% owned by Summit while Other Joint Ventures are 90% owned by Summit. 14 (Amounts in thousands, except per share metrics)

FYE 2023 Outlook Low High Variance to Prior Midpoint % Change to Prior Midpoint Pro Forma RevPAR (1) 119.25$ 121.00$ -$ - Pro Forma RevPAR Growth (1) 6.25% 7.75% - - Adjusted EBITDAre 186,500$ 191,600$ 1,050$ 0.6% Adjusted FFO 109,000$ 114,200$ 1,450$ 1.3% Adjusted FFO per Diluted Unit 0.89$ 0.93$ 0.01$ 1.2% Capital Expenditures, Pro Rata 65,000$ 75,000$ - - Full Year 2023 Outlook (Unaudited) (1) All pro forma information includes operating and financial results for 101 lodging assets owned as of November 1, 2023, as if each property had been owned by the Company since January 1, 2022, and will continue to be owned through the entire year ending December 31, 2023. As a result, the pro forma information includes operating and financial results for lodging assets acquired since January 1, 2022, which may include periods prior to the Company’s ownership. Pro forma and non-GAAP financial measures are unaudited. 15 (Amounts in thousands, except per share metrics and statistics)

Table of Contents Section I Forward-Looking Statements and Non-GAAP Financial Measure Disclosures Section II Corporate Financial Schedules Section III Operating & Property-Level Schedules Section IV Capitalization and Debt Schedules Section V Asset Listing 16

INN Wholly-Owned (57 Hotels) GIC Joint Venture (41 Hotels) Other Joint Ventures (3 Hotels) Pro Forma (101 Hotels) 2023 2022 2023 2022 2023 2022 2023 2022 Pro Forma Operating Data (1) Occupancy 73.6% 73.2% 73.2% 69.1% 69.7% 64.9% 73.4% 71.5% ADR 165.04$ 165.88$ 149.97$ 148.67$ 158.57$ 166.13$ 159.35$ 159.71$ RevPAR 121.48$ 121.38$ 109.71$ 102.77$ 110.50$ 107.81$ 116.91$ 114.22$ Occupancy change 0.6% 5.8% 7.4% 2.6% ADR change -0.5% 0.9% -4.6% -0.2% RevPAR change 0.1% 6.8% 2.5% 2.4% Pro forma total revenues 113,299$ 112,051$ 63,215$ 59,058$ 5,302$ 4,815$ 181,817$ 175,924$ Pro forma hotel EBITDA 38,549$ 39,471$ 23,162$ 20,518$ 590$ 725$ 62,300$ 60,715$ Pro forma hotel EBITDA Margin 34.0% 35.2% 36.6% 34.7% 11.1% 15.1% 34.3% 34.5% Pro Forma Operating Results – By Ownership Interest (Unaudited) (1) Unaudited pro forma information includes operating results for 101 hotels owned as of September 30, 2023, as if all such hotels had been owned by the Company since January 1, 2022. For any hotels acquired by the Company after January 1, 2022 (the “Acquired Hotels”), the Company has included in the pro forma information the financial results of each of the Acquired Hotels for the period from January 1, 2022, to the date the Acquired Hotels were purchased by the Company (the “Pre-acquisition Period”). The financial results for the Pre-acquisition Period were provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results. Q3 2023 17 (Amounts in thousands, except statistics)

INN Wholly-Owned (57 Hotels) GIC Joint Venture (41 Hotels) Other Joint Ventures (3 Hotels) Pro Forma (101 Hotels) 2023 2022 2023 2022 2023 2022 2023 2022 Pro Forma Operating Data (1) Occupancy 71.9% 70.4% 74.1% 69.9% 77.2% 71.1% 72.8% 70.2% ADR 170.09$ 164.68$ 160.22$ 151.75$ 214.15$ 212.37$ 167.22$ 160.81$ RevPAR 122.31$ 115.91$ 118.68$ 106.07$ 165.26$ 150.94$ 121.75$ 112.92$ Occupancy change 2.2% 6.0% 8.6% 3.7% ADR change 3.3% 5.6% 0.8% 4.0% RevPAR change 5.5% 11.9% 9.5% 7.8% Pro forma total revenues 337,376$ 316,392$ 201,812$ 179,134$ 20,108$ 17,233$ 559,296$ 512,759$ Pro forma hotel EBITDA 113,756$ 110,223$ 78,856$ 67,528$ 5,928$ 5,526$ 198,540$ 183,277$ Pro forma hotel EBITDA Margin 33.7% 34.8% 39.1% 37.7% 29.5% 32.1% 35.5% 35.7% Pro Forma Operating Results – By Ownership Interest (Unaudited) (1) Unaudited pro forma information includes operating results for 101 hotels owned as of September 30, 2023, as if all such hotels had been owned by the Company since January 1, 2022. For any hotels acquired by the Company after January 1, 2022 (the “Acquired Hotels”), the Company has included in the pro forma information the financial results of each of the Acquired Hotels for the period from January 1, 2022, to the date the Acquired Hotels were purchased by the Company (the “Pre-acquisition Period”). The financial results for the Pre-acquisition Period were provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results. YTD 2023 18 (Amounts in thousands, except statistics)

Summary Pro Forma Operating Results (Unaudited) (1) Unaudited pro forma information includes operating results for 101 hotels owned as of September 30, 2023, as if all such hotels had been owned by the Company since January 1, 2019. For any hotels acquired by the Company after January 1, 2019 (the “Acquired Hotels”), the Company has included in the pro forma information the financial results of each of the Acquired Hotels for the period from January 1, 2019, to the date the Acquired Hotels were purchased by the Company (the “Pre-acquisition Period”). The financial results for the Pre-acquisition Period were provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable periods of the prior years and are not indicative of future results. 19 Pro Forma (101) Hotels - 2023 (1) Q1 Q2 Jul Aug Sep Q3 YTD Occupancy 69.5% 75.5% 73.8% 71.6% 74.7% 73.4% 72.8% ADR 174.47$ 168.33$ 158.76$ 153.69$ 165.55$ 159.35$ 167.22$ RevPAR 121.31$ 127.06$ 117.23$ 110.10$ 123.63$ 116.91$ 121.75$ 2022 Variance Occupancy change vs 2022 7.5% 1.6% 2.0% 2.6% 3.2% 2.6% 3.7% ADR change vs 2022 11.2% 1.9% 0.2% -1.3% 0.3% -0.2% 4.0% RevPAR change vs 2022 19.4% 3.5% 2.2% 1.2% 3.6% 2.4% 7.8% 2019 Variance Occupancy change vs 2019 -9.9% -7.8% -8.3% -10.1% -3.3% -7.3% -8.3% ADR change vs 2019 6.6% 4.4% 3.1% 2.7% 5.0% 3.7% 4.9% RevPAR change vs 2019 -3.9% -3.8% -5.5% -7.7% 1.5% -3.9% -3.8%

Same Store (95) Hotels - 2023 (1) Q1 Q2 Jul Aug Sep Q3 YTD Occupancy 69.2% 75.7% 74.3% 72.1% 74.9% 73.7% 72.9% ADR 170.89$ 167.70$ 159.08$ 154.17$ 166.21$ 159.83$ 166.01$ RevPAR 118.24$ 126.89$ 118.18$ 111.08$ 124.51$ 117.85$ 120.99$ 2022 Variance Occupancy change vs 2022 7.5% 1.3% 1.7% 2.3% 2.9% 2.3% 3.5% ADR change vs 2022 11.1% 2.2% 0.5% -1.2% 0.7% 0.0% 4.1% RevPAR change vs 2022 19.3% 3.6% 2.2% 1.1% 3.6% 2.4% 7.7% 2019 Variance Occupancy change vs 2019 -10.2% -8.0% -8.1% -10.0% -3.3% -7.2% -8.4% ADR change vs 2019 4.8% 3.9% 3.2% 2.9% 5.2% 3.9% 4.2% RevPAR change vs 2019 -5.9% -4.4% -5.2% -7.3% 1.7% -3.6% -4.6% Summary Same Store Operating Results (Unaudited) (1) Unaudited same store information includes operating results for 95 same store hotels owned as of September 30, 2023, as if all such hotels had been owned by the Company since January 1, 2019. For any hotels acquired by the Company after January 1, 2019 (the “Acquired Hotels”), the Company has included in the same store information the financial results of each of the Acquired Hotels for the period from January 1, 2019, to the date the Acquired Hotels were purchased by the Company (the “Pre-acquisition Period”). The financial results for the Pre-acquisition Period were provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The same store information is included to enable comparison of results for the current reporting period to results for the comparable periods of the prior years and are not indicative of future results. 20

Comparable (90) Hotels - 2023 (1) Q1 Q2 Jul Aug Sep Q3 YTD Occupancy 69.1% 75.8% 74.9% 72.5% 74.9% 74.1% 73.0% ADR 170.67$ 167.49$ 158.36$ 153.46$ 165.64$ 159.15$ 165.63$ RevPAR 117.99$ 127.02$ 118.56$ 111.27$ 124.07$ 117.90$ 120.97$ 2022 Variance Occupancy change vs 2022 6.8% 1.0% 1.6% 2.6% 2.9% 2.4% 3.2% ADR change vs 2022 10.6% 1.6% -0.2% -1.7% -0.1% -0.6% 3.5% RevPAR change vs 2022 18.1% 2.6% 1.5% 0.8% 2.8% 1.7% 6.8% 2019 Variance Occupancy change vs 2019 -10.4% -7.4% -7.1% -10.6% -4.4% -7.4% -8.4% ADR change vs 2019 4.3% 3.9% 2.8% 2.7% 5.0% 3.6% 3.9% RevPAR change vs 2019 -6.6% -3.8% -4.5% -8.2% 0.3% -4.1% -4.8% Summary Comparable 2019 Portfolio Operating Results (Unaudited) (1) Unaudited comparable information includes operating results for 90 comparable hotels owned as of September 30, 2023, as if all such hotels had been owned by the Company since January 1, 2019. For any hotels acquired by the Company after January 1, 2019 (the “Acquired Hotels”), the Company has included in the comparable information the financial results of each of the Acquired Hotels for the period from January 1, 2019, to the date the Acquired Hotels were purchased by the Company (the “Pre-acquisition Period”). The financial results for the Pre-acquisition Period were provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The comparable information is included to enable comparison of results for the current reporting period to results for the comparable periods of the prior years and are not indicative of future results. 21

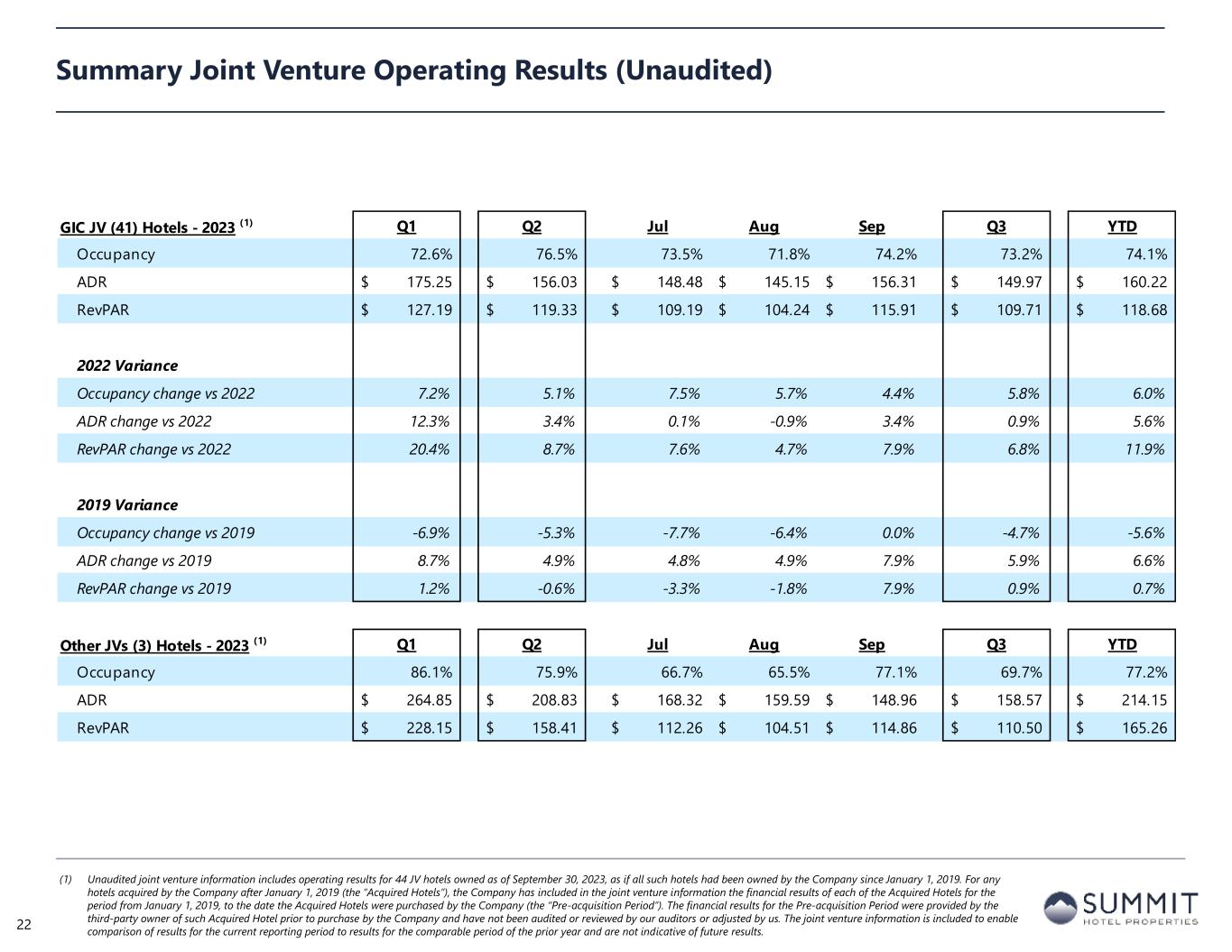

Summary Joint Venture Operating Results (Unaudited) (1) Unaudited joint venture information includes operating results for 44 JV hotels owned as of September 30, 2023, as if all such hotels had been owned by the Company since January 1, 2019. For any hotels acquired by the Company after January 1, 2019 (the “Acquired Hotels”), the Company has included in the joint venture information the financial results of each of the Acquired Hotels for the period from January 1, 2019, to the date the Acquired Hotels were purchased by the Company (the “Pre-acquisition Period”). The financial results for the Pre-acquisition Period were provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The joint venture information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results. 22 GIC JV (41) Hotels - 2023 (1) Q1 Q2 Jul Aug Sep Q3 YTD Occupancy 72.6% 76.5% 73.5% 71.8% 74.2% 73.2% 74.1% ADR 175.25$ 156.03$ 148.48$ 145.15$ 156.31$ 149.97$ 160.22$ RevPAR 127.19$ 119.33$ 109.19$ 104.24$ 115.91$ 109.71$ 118.68$ 2022 Variance Occupancy change vs 2022 7.2% 5.1% 7.5% 5.7% 4.4% 5.8% 6.0% ADR change vs 2022 12.3% 3.4% 0.1% -0.9% 3.4% 0.9% 5.6% RevPAR change vs 2022 20.4% 8.7% 7.6% 4.7% 7.9% 6.8% 11.9% 2019 Variance Occupancy change vs 2019 -6.9% -5.3% -7.7% -6.4% 0.0% -4.7% -5.6% ADR change vs 2019 8.7% 4.9% 4.8% 4.9% 7.9% 5.9% 6.6% RevPAR change vs 2019 1.2% -0.6% -3.3% -1.8% 7.9% 0.9% 0.7% Other JVs (3) Hotels - 2023 (1) Q1 Q2 Jul Aug Sep Q3 YTD Occupancy 86.1% 75.9% 66.7% 65.5% 77.1% 69.7% 77.2% ADR 264.85$ 208.83$ 168.32$ 159.59$ 148.96$ 158.57$ 214.15$ RevPAR 228.15$ 158.41$ 112.26$ 104.51$ 114.86$ 110.50$ 165.26$

Table of Contents Section I Forward-Looking Statements and Non-GAAP Financial Measure Disclosures Section II Corporate Financial Schedules Section III Operating & Property-Level Schedules Section IV Capitalization and Debt Schedules Section V Asset Listing 23

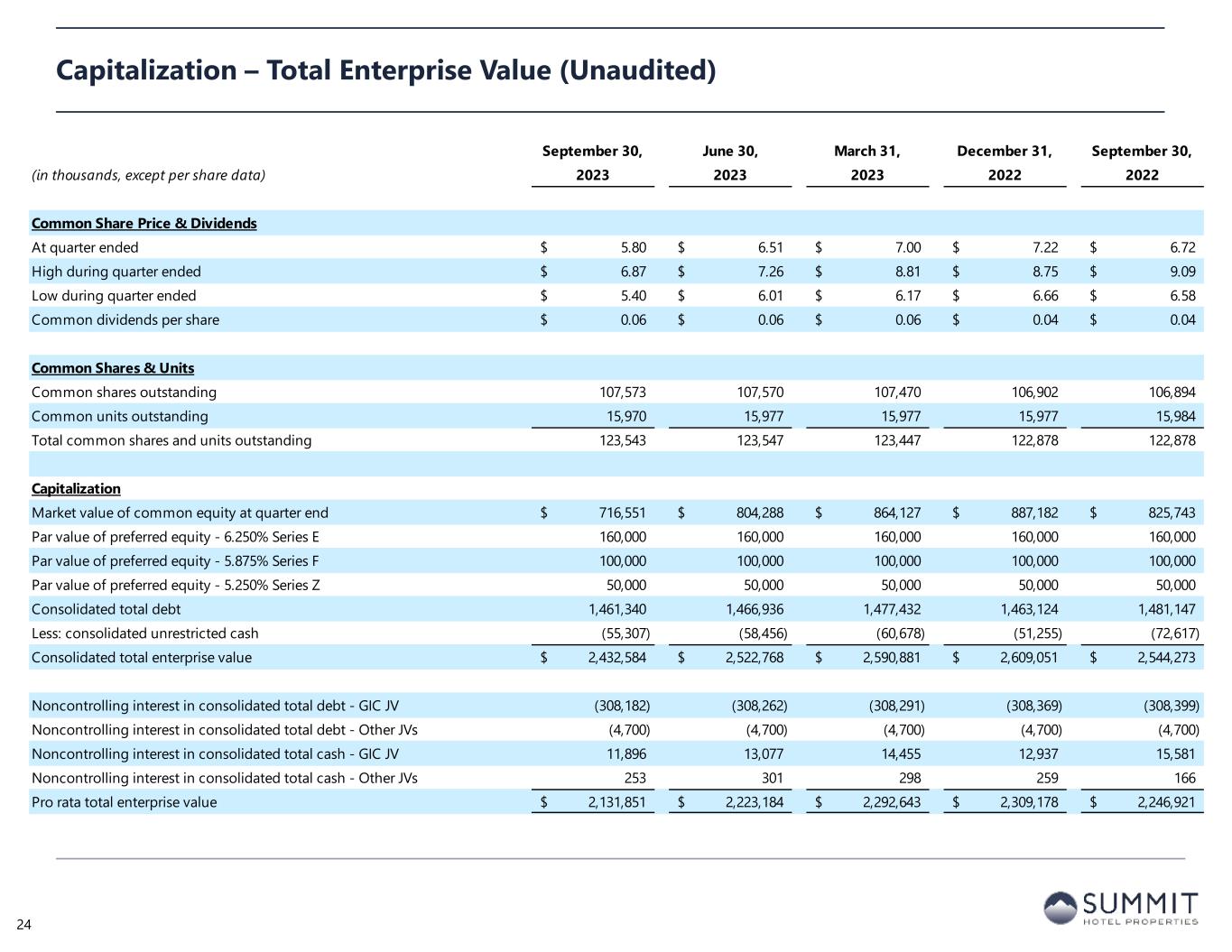

September 30, June 30, March 31, December 31, September 30, (in thousands, except per share data) 2023 2023 2023 2022 2022 Common Share Price & Dividends At quarter ended 5.80$ 6.51$ 7.00$ 7.22$ 6.72$ High during quarter ended 6.87$ 7.26$ 8.81$ 8.75$ 9.09$ Low during quarter ended 5.40$ 6.01$ 6.17$ 6.66$ 6.58$ Common dividends per share 0.06$ 0.06$ 0.06$ 0.04$ 0.04$ Common Shares & Units Common shares outstanding 107,573 107,570 107,470 106,902 106,894 Common units outstanding 15,970 15,977 15,977 15,977 15,984 Total common shares and units outstanding 123,543 123,547 123,447 122,878 122,878 Capitalization Market value of common equity at quarter end 716,551$ 804,288$ 864,127$ 887,182$ 825,743$ Par value of preferred equity - 6.250% Series E 160,000 160,000 160,000 160,000 160,000 Par value of preferred equity - 5.875% Series F 100,000 100,000 100,000 100,000 100,000 Par value of preferred equity - 5.250% Series Z 50,000 50,000 50,000 50,000 50,000 Consolidated total debt 1,461,340 1,466,936 1,477,432 1,463,124 1,481,147 Less: consolidated unrestricted cash (55,307) (58,456) (60,678) (51,255) (72,617) Consolidated total enterprise value 2,432,584$ 2,522,768$ 2,590,881$ 2,609,051$ 2,544,273$ Noncontrolling interest in consolidated total debt - GIC JV (308,182) (308,262) (308,291) (308,369) (308,399) Noncontrolling interest in consolidated total debt - Other JVs (4,700) (4,700) (4,700) (4,700) (4,700) Noncontrolling interest in consolidated total cash - GIC JV 11,896 13,077 14,455 12,937 15,581 Noncontrolling interest in consolidated total cash - Other JVs 253 301 298 259 166 Pro rata total enterprise value 2,131,851$ 2,223,184$ 2,292,643$ 2,309,178$ 2,246,921$ Capitalization – Total Enterprise Value (Unaudited) 24

(amounts in thousands) Spread Base Rate Interest Rate Fixed / Variable Fully-Extended Maturity Date Number of Encumbered Properties Principal Outstanding Noncontrolling Interests Pro Rata Principal Outstanding Senior Credit Facility $400 Million Revolver (1) 1.95% 5.42% 7.37% Variable June 21, 2028 n/a 15,000 - 15,000 $200 Million Term Loan (1) 1.90% 5.42% 7.32% Variable June 21, 2028 n/a 200,000 - 200,000 Total Senior Credit and Term Loan Facility 215,000$ -$ 215,000$ $225 Million Unsecured Term Loan (2) 1.75% 5.41% 7.16% Variable February 14, 2025 n/a 225,000$ -$ 225,000$ Convertible Notes n/a n/a 1.50% Fixed February 15, 2026 n/a 287,500$ -$ 287,500$ Secured Mortgage Indebtedness Metabank (Bayside) n/a n/a 4.44% Fixed July 01, 2027 3 42,915 - 42,915 Bank of the Cascades (First Interstate Bank) (2) 2.00% 5.31% 7.31% Variable December 19, 2024 1 7,491 - 7,491 n/a n/a 4.30% Fixed December 19, 2024 7,491 - 7,491 Total Mortgage Loans 4 57,897$ -$ 57,897$ 4 785,397$ -$ 785,397$ Brickell Joint Venture Mortgage Loan City National Bank of Florida (3) 3.00% 5.33% 8.33% Variable May 30, 2025 2 47,000 (4,700) 42,300 GIC Joint Venture Credit Facility and Term Loans $125 Million Revolver (2) 2.15% 5.43% 7.58% Variable September 15, 2028 n/a 125,000 (61,250) 63,750 $75 Million Term Loan (2) 2.10% 5.43% 7.53% Variable September 15, 2028 n/a 75,000 (36,750) 38,250 $410 Million Term Loan (2) 2.75% 5.43% 8.18% Variable January 13, 2027 n/a 410,000 (200,900) 209,100 Wells Fargo CMBS Loan n/a n/a 4.99% Fixed June 06, 2028 1 12,848 (6,296) 6,552 Twain Financial PACE Loan n/a n/a 6.10% Fixed July 31, 2040 1 6,095 (2,986) 3,109 Total GIC Joint Venture Credit Facility and Term Loans 2 628,943$ (308,182)$ 320,761$ Total Joint Venture Debt 4 675,943$ (312,882)$ 363,061$ Total Debt 8 1,461,340$ (312,882)$ 1,148,458$ Debt Schedule – Part I (Unaudited) (1) Interest rate is based on a variable spread plus 1-month term SOFR plus a 0.1% SOFR adjustment after being converted from a 30-day LIBOR-based loan. (2) Interest rate is based on a spread plus 1-month term SOFR. As of September 30, 2023 25

(amounts in thousands) Principal Amount Outstanding Fixed Debt Outstanding Variable Debt Outstanding Effective Interest Rate Total Debt 1,461,340$ 454,848$ 1,006,492$ 6.33% Noncontrolling Interests in Joint Ventures (312,882) (107,281) (205,601) Pro Rata Debt 1,148,458$ 347,567$ 800,891$ 5.90% % of Pro Rata Debt 100% 30% 70% Adjustment for Effective Swaps 0 502,000 (502,000) Pro Rata Debt Including Swaps 1,148,458$ 849,567$ 298,891$ 4.79% % of Pro Rata Debt Including Swaps 100% 74% 26% % of Pro Rata Debt Including Swaps - Pro Forma (1) 100% 74% 26% Interest Rate Swaps Notional Value Swap Rate Effective Date Maturity Date Regions - 2018 - $75mm 75,000 2.8570% September 28, 2018 September 30, 2024 Regions - 2018 - $125mm 125,000 2.9170% December 31, 2018 December 31, 2025 Capital One - 2022 - $100mm 100,000 2.6000% January 31, 2023 January 31, 2027 Regions - 2022 - $100mm 100,000 2.5625% January 31, 2023 January 31, 2029 Current Wholly-Owned Swaps 400,000$ 2.7379% October 22, 2026 Capital One - 2023 - $100mm 100,000 3.3540% July 01, 2023 January 13, 2026 Wells Fargo - 2023 - $100mm 100,000 3.3540% July 01, 2023 January 13, 2026 Current JV Swaps 200,000$ 3.3540% January 13, 2026 Total Swaps 600,000$ 2.9433% July 20, 2026 Debt Schedule – Part II (Unaudited) As of September 30, 2023 26

$15 $200$225 $288 $0 $102 $209 $7 $3 $42 $15 $43 $0 $100 $200 $300 $400 $500 2023 2024 2025 2026 2027 2028 2029+ Pro Rata Debt Maturity Ladder $400M Senior Revolver $200M Senior Term Loan $225M Senior Term Loan Convertible Senior Notes $200M GIC JV Credit Facility $410M GIC JV Term Loan GIC JV Mortgage Debt Brickell JV Mortgage Debt Mortgage Debt Debt Schedule – Part III (Unaudited) (1) Amounts are in millions ($) and assumes fully-extended maturities for all loans. Reflects pro rata debt totals 27 As of September 30, 2023

Table of Contents Section I Forward-Looking Statements and Non-GAAP Financial Measure Disclosures Section II Corporate Financial Schedules Section III Operating & Property-Level Schedules Section IV Capitalization and Debt Schedules Section V Asset Listing 28

Hotels Rooms STR Chain Scale STR Location INN Wholly-Owned (100% Ownership) Courtyard - New Orleans/Metairie 1 153 Upscale Airport Doubletree by Hilton San Francisco Airport North Bayfront 1 210 Upscale Airport Four Points - San Francisco Airport 1 101 Upscale Airport Hyatt House - Miami Airport 1 163 Upscale Airport Hyatt Place - Portland Airport/Cascade Station 1 136 Upscale Airport Residence Inn - New Orleans/Metairie 1 120 Upscale Airport Residence Inn - Portland Airport at Cascade Station 1 124 Upscale Airport Courtyard - Fort Lauderdale Beach 1 261 Upscale Resort Hyatt House - Across From Universal Orlando Resort 1 168 Upscale Resort Hyatt Place - Orlando/Convention Center 1 151 Upscale Resort Hyatt Place - Orlando/Universal 1 150 Upscale Resort Hyatt Place - Scottsdale/Old Town 1 126 Upscale Resort Hotel Indigo - Asheville Downtown 1 116 Upper Upscale Small Metro/Town Courtyard - Atlanta Decatur Downtown/Emory 1 179 Upscale Suburban Courtyard - Dallas/Arlington South 1 103 Upscale Suburban Courtyard - Kansas City Country Club Plaza 1 123 Upscale Suburban Hampton Inn & Suites - Camarillo 1 116 Upper Midscale Suburban Hampton Inn & Suites - San Diego/Poway 1 108 Upper Midscale Suburban Hilton Garden Inn - Greenville 1 120 Upscale Suburban Hilton Garden Inn - Houston/Energy Corridor 1 190 Upscale Suburban Hilton Garden Inn - Waltham 1 148 Upscale Suburban Hyatt House - Denver Tech Center 1 135 Upscale Suburban Hyatt Place - Baltimore/Owings Mills 1 123 Upscale Suburban Hyatt Place - Denver South/Park Meadows 1 127 Upscale Suburban Hyatt Place - Denver Tech Center 1 126 Upscale Suburban Hyatt Place - Garden City 1 122 Upscale Suburban Hyatt Place - Phoenix/Mesa 1 152 Upscale Suburban Residence Inn - Baltimore/Hunt Valley 1 141 Upscale Suburban Residence Inn - Boston/Watertown 1 150 Upscale Suburban Residence Inn - Bridgewater/Branchburg 1 101 Upscale Suburban Residence Inn - Dallas/Arlington South 1 96 Upscale Suburban Asset Listing (Unaudited) 29

Hotels Rooms STR Chain Scale STR Location INN Wholly-Owned (100% Ownership), (cont.) Staybridge Suites - Denver/Cherry Creek 1 121 Upscale Suburban AC Hotel - Atlanta Downtown 1 255 Upscale Urban Courtyard - Atlanta Downtown 1 150 Upscale Urban Courtyard - Charlotte City Center 1 181 Upscale Urban Courtyard - Fort Worth Downtown/Blackstone 1 203 Upscale Urban Courtyard - Indianapolis Downtown 1 297 Upscale Urban Courtyard - Nashville Vanderbilt/West End 1 226 Upscale Urban Courtyard - New Haven at Yale 1 207 Upscale Urban Courtyard - New Orleans Downtown Near the French Quarter 1 140 Upscale Urban Courtyard - New Orleans Downtown/Convention Center 1 202 Upscale Urban Fairfield Inn & Suites - Louisville Downtown 1 140 Upper Midscale Urban Hampton Inn & Suites - Austin/Downtown/Convention Center 1 209 Upper Midscale Urban Hampton Inn & Suites - Baltimore Inner Harbor 1 116 Upper Midscale Urban Hampton Inn & Suites - Minneapolis/Downtown 1 211 Upper Midscale Urban Hilton Garden Inn - Houston/Galleria Area 1 182 Upscale Urban Holiday Inn Express & Suites - San Francisco/Fisherman's Wharf 1 252 Upper Midscale Urban Hyatt Place - Chicago/Downtown-The Loop 1 206 Upscale Urban Hyatt Place - Minneapolis/Downtown 1 213 Upscale Urban Marriott - Boulder 1 165 Upper Upscale Urban Residence Inn - Atlanta Midtown/Peachtree at 17th 1 160 Upscale Urban Residence Inn - Baltimore Downtown/Inner Harbor 1 189 Upscale Urban Residence Inn - Cleveland Downtown 1 175 Upscale Urban SpringHill Suites - Indianapolis Downtown 1 156 Upscale Urban SpringHill Suites - Louisville Downtown 1 198 Upscale Urban Springhill Suites - Nashville MetroCenter 1 78 Upscale Urban SpringHill Suites - New Orleans Downtown 1 208 Upscale Urban INN Wholly-Owned (100% Ownership) 57 9,179 Asset Listing (Unaudited) 30

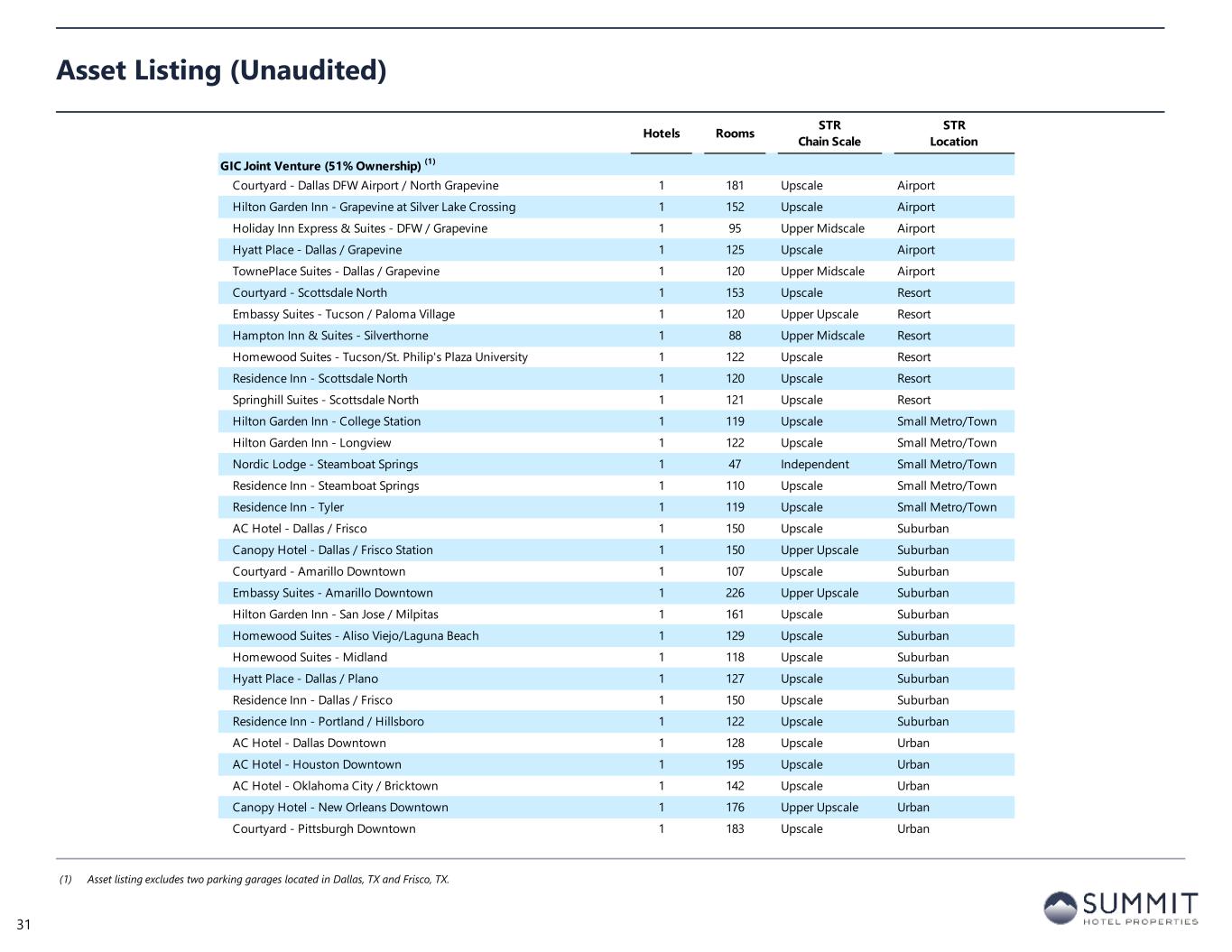

Hotels Rooms STR Chain Scale STR Location GIC Joint Venture (51% Ownership) (1) Courtyard - Dallas DFW Airport / North Grapevine 1 181 Upscale Airport Hilton Garden Inn - Grapevine at Silver Lake Crossing 1 152 Upscale Airport Holiday Inn Express & Suites - DFW / Grapevine 1 95 Upper Midscale Airport Hyatt Place - Dallas / Grapevine 1 125 Upscale Airport TownePlace Suites - Dallas / Grapevine 1 120 Upper Midscale Airport Courtyard - Scottsdale North 1 153 Upscale Resort Embassy Suites - Tucson / Paloma Village 1 120 Upper Upscale Resort Hampton Inn & Suites - Silverthorne 1 88 Upper Midscale Resort Homewood Suites - Tucson/St. Philip's Plaza University 1 122 Upscale Resort Residence Inn - Scottsdale North 1 120 Upscale Resort Springhill Suites - Scottsdale North 1 121 Upscale Resort Hilton Garden Inn - College Station 1 119 Upscale Small Metro/Town Hilton Garden Inn - Longview 1 122 Upscale Small Metro/Town Nordic Lodge - Steamboat Springs 1 47 Independent Small Metro/Town Residence Inn - Steamboat Springs 1 110 Upscale Small Metro/Town Residence Inn - Tyler 1 119 Upscale Small Metro/Town AC Hotel - Dallas / Frisco 1 150 Upscale Suburban Canopy Hotel - Dallas / Frisco Station 1 150 Upper Upscale Suburban Courtyard - Amarillo Downtown 1 107 Upscale Suburban Embassy Suites - Amarillo Downtown 1 226 Upper Upscale Suburban Hilton Garden Inn - San Jose / Milpitas 1 161 Upscale Suburban Homewood Suites - Aliso Viejo/Laguna Beach 1 129 Upscale Suburban Homewood Suites - Midland 1 118 Upscale Suburban Hyatt Place - Dallas / Plano 1 127 Upscale Suburban Residence Inn - Dallas / Frisco 1 150 Upscale Suburban Residence Inn - Portland / Hillsboro 1 122 Upscale Suburban AC Hotel - Dallas Downtown 1 128 Upscale Urban AC Hotel - Houston Downtown 1 195 Upscale Urban AC Hotel - Oklahoma City / Bricktown 1 142 Upscale Urban Canopy Hotel - New Orleans Downtown 1 176 Upper Upscale Urban Courtyard - Pittsburgh Downtown 1 183 Upscale Urban Asset Listing (Unaudited) (1) Asset listing excludes two parking garages located in Dallas, TX and Frisco, TX. 31

Hotels Rooms STR Chain Scale STR Location GIC Joint Venture (51% Ownership) (1) Hampton Inn & Suites - Dallas Downtown 1 176 Upper Midscale Urban Hampton Inn & Suites - Tampa/Ybor City/Downtown 1 138 Upper Midscale Urban Holiday Inn Express & Suites - Oklahoma City Downtown / Bricktown 1 124 Upper Midscale Urban Hyatt Place - Lubbock 1 125 Upscale Urban Hyatt Place - Oklahoma City / Bricktown 1 134 Upscale Urban Residence Inn - Dallas Downtown 1 121 Upscale Urban Residence Inn - Portland Downtown / Riverplace 1 258 Upscale Urban SpringHill Suites - Dallas Downtown 1 148 Upscale Urban SpringHill Suites - New Orleans Downtown / Canal Street 1 74 Upscale Urban TownePlace Suites - New Orleans Downtown / Canal Street 1 105 Upper Midscale Urban GIC Joint Venture (51% Ownership) (1) 41 5,581 Other Joint Ventures (90% Ownership) Onera - Fredericksburg 1 11 Non-Hotel Non-Hotel AC Hotel - Miami Downtown / Brickell 1 156 Upscale Urban Element - Miami Downtown / Brickell 1 108 Upscale Urban Other Joint Ventures (90% Ownership) 3 275 Pro Forma 101 15,035 Asset Listing (Unaudited) (1) Asset listing excludes two parking garages located in Dallas, TX and Frisco, TX. 32