U.S. Medicines Spending Grew in 2023 as Greater Access Offset COVID-19-related Decline, Says IQVIA Institute

14 Mai 2024 - 2:00PM

Business Wire

- Overall spending in the U.S. market for medicines grew 2.5% in

2023, reaching $435Bn at net price level, reflecting a sharp

decline in COVID-19 vaccines and therapeutics

- Spending growth was 9.9% when COVID-19 vaccines and

therapeutics are excluded, driven by innovation in areas such as

oncology, immunology, diabetes, and obesity

- Patient out-of-pocket costs increased due to the increasing use

of GIP/GLP-1 agonists, which are approved and widely reimbursed for

diabetes but are less commonly covered for obesity

- The number of patient visits, diagnostics and elective

procedures fell 4-6% in 2023, while new prescriptions rose 4%

Overall spending in the U.S. market for medicines grew by 2.5%

and reached $435Bn in 2023. Excluding the contribution from

COVID-19 vaccines and therapeutics, spending grew at 9.9%,

according to a new report from the IQVIATM Institute for Human Data

Science, The Use of Medicines in the U.S. 2024: Usage and Spending

Trends and Outlook to 2028.

The drop in COVID-19 vaccines and therapeutics masks the

significant growth in medicines that are bringing new clinical

advances to larger patient populations in oncology, immunology,

diabetes, and obesity.

“This is a story of two countervailing trends: A sharp decline

in the use of COVID-19 vaccines and therapies, which is offset by a

shifting usage pattern and a rapid acceleration in spending growth

driven by innovation that is bringing more effective medicines to

more patients,” said Murray Aitken, Executive Director of the IQVIA

Institute for Human Data Science. “Over the next five years, we can

expect continued growth in spending on medicines in the U.S. driven

by innovation, but offset by notable expiration events and

biosimilar introductions.”

Additional key highlights in the report include:

- Health services utilization: The IQVIA Health Services

Utilization Index – developed to provide a composite view of

multiple types of health services over time – tracks patient

visits, screenings and diagnostic tests, elective procedures, new

prescriptions and vaccinations. The Index fell to 97 for 2023, a

decline of 3% from 2022, reflecting a 4-6% reduction across all

indicators except for new prescriptions, which were up 4%. New

prescriptions for chronic and acute conditions were both above

pre-pandemic levels in 2023, reflecting continued growth of chronic

prescriptions and a resurgence of seasonal respiratory ailments

driving higher acute prescriptions. Flu vaccination rates fell by

17% from the 2022 level, and other routine adult and pediatric

vaccination rates remain below pre-pandemic levels.

- Medicine use: In 2023, total prescription medicine use

increased by 4% and reached 210 billion days of therapy. Non-retail

medicine use, including a large portion of cancer treatment, was

disrupted early in the pandemic but has seen a sharp rise,

especially in clinics and doctors’ offices. Retail prescriptions

reached 6.9 billion, a 2.9% increase from 2022 and down slightly

from the prior year. Many therapy areas had high growth in days of

therapy in 2023, including GLP-1 agonists in obesity and diabetes,

immunology treatments, lipid regulators, and gastrointestinal

medicines, all of which had increased use of more than 9% in

2023.

- Patient out-of-pocket costs: In aggregate, patient

out-of-pocket costs reached $91Bn in 2023, an increase of $5Bn over

the prior year. This amount is after $23Bn in copay assistance

programs provided by manufacturers, with patients using copay cards

for nearly one-third of brand commercial prescriptions in the top

10 therapy areas and 63% of obesity prescriptions. Both commercial

and Medicare patients have seen drug out-of-pocket costs rise,

while the amount paid by uninsured patients has declined due to a

smaller uninsured population – even as rising list prices have

exposed them to higher costs. More than 90% of prescriptions costed

patients less than $20, but 1%, or 71 million prescriptions,

exceeded $125.

- Medicine spending and growth drivers: The U.S. market at

net prices grew to $435Bn in 2023. Spending at list prices has

increased faster than all-payer net spending but far slower than

the spending eligible for 340B discounts, which includes children’s

hospitals, cancer and safety net hospitals, and which are entitled

to purchase at the lowest prices in the market. Variations in

growth at differing price levels highlight the complex interaction

between list prices and the varied discounts applicable to

different stakeholders. Total spending grew $10.4Bn in 2023, driven

primarily by $19Bn in spending on new brands, a $22Bn impact on

changes in the mix of medicines toward higher value medicines, and

offset by a $28Bn decline in COVID-19 spending and $17Bn impact of

expiries.

- Outlook to 2028: The U.S. spending forecast reflects

continued growth driven by innovation, offset by notable expiry

events. The next five years are expected to bring an increasing gap

between list price spending, which will grow at 6-9%, and

manufacturer net revenues, which will grow at 4-7%, including the

expected impacts of price negotiation and other aspects of the

Inflation Reduction Act. Oncology and obesity will drive growth

through 2028 while diabetes, immunology and COVID-19 will

contribute to decline. Net spending on diabetes will be flat to

2028 as wider adoption of novel therapies is offset by both list

and net price cuts. Immunology spending growth is expected to slow

to 2-5% through 2028 from the impact of biosimilars, while volume

increases 75% over the same period. Next-generation biotherapeutics

– including cell and gene and RNA therapies – are expected to reach

$18Bn by 2028, more than 3.5 times the current level.

About the IQVIA Institute for Human Data Science

The IQVIA Institute for Human Data Science contributes to the

advancement of human health globally through timely research,

insightful analysis and scientific expertise applied to granular

non-identified patient-level data.

Fulfilling an essential need within healthcare, the Institute

delivers objective, relevant insights and research that accelerate

understanding and innovation critical to sound decision making and

improved human outcomes. With access to IQVIA’s institutional

knowledge, advanced analytics, technology and unparalleled data,

the Institute works in tandem with a broad set of healthcare

stakeholders to drive a research agenda focused on Human Data

Science, including government agencies, academic institutions, the

life sciences industry, and payers. More information about the

IQVIA Institute can be found at www.IQVIAInstitute.org.

About IQVIA

IQVIA (NYSE:IQV) is a leading global provider of advanced

analytics, technology solutions, and clinical research services to

the life sciences industry. IQVIA creates intelligent connections

across all aspects of healthcare through its analytics,

transformative technology, big data resources, extensive domain

expertise and network of partners. IQVIA Connected Intelligence™

delivers actionable insights and powerful solutions with speed and

agility — enabling customers to accelerate the clinical development

and commercialization of innovative medical treatments that improve

healthcare outcomes for patients. With approximately 87,000

employees, IQVIA conducts operations in more than 100

countries.

IQVIA is a global leader in protecting individual patient

privacy. The company uses a wide variety of privacy-enhancing

technologies and safeguards to protect individual privacy while

generating and analyzing information on a scale that helps

healthcare stakeholders identify disease patterns and correlate

with the precise treatment path and therapy needed for better

outcomes. IQVIA’s insights and execution capabilities help biotech,

medical device and pharmaceutical companies, medical researchers,

government agencies, payers and other healthcare stakeholders tap

into a deeper understanding of diseases, human behaviors and

scientific advances, in an effort to advance their path toward

cures. To learn more, visit www.iqvia.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514329279/en/

Kerri Joseph, IQVIA Investor Relations (kerri.joseph@IQVIA.com)

+1.973.541.3558

Trent Brown, IQVIA Media Relations (trent.brown@iqvia.com)

+1.919.780.3221

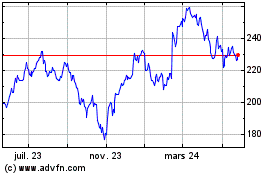

IQVIA (NYSE:IQV)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

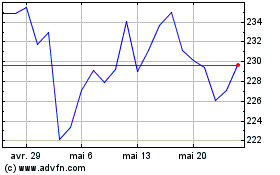

IQVIA (NYSE:IQV)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024