IronNet Announces Intention to Voluntarily Delist Securities from New York Stock Exchange

17 Juillet 2023 - 10:24PM

Business Wire

IronNet, Inc. (together with its subsidiaries, “IronNet”, “we”,

“us” or the “Company”) (NYSE: IRNT) announced today its intention

to voluntarily delist from the New York Stock Exchange

(“NYSE”).

This announcement follows the Company’s receipt of notice from

the NYSE that the Company is not in compliance with the NYSE’s

continued listing standards. The Company has been evaluating its

options with respect to its NYSE listing. After discussions and

deliberations on these matters, the Company’s board of directors

has approved a resolution authorizing the Company to voluntarily

delist from the NYSE.

On July 17, 2023, the Company notified NYSE of its intent to

voluntarily delist its securities from NYSE. The Company currently

anticipates that it will file a Form 25 with the Securities and

Exchange Commission (the “SEC”) relating to the delisting on or

about July 27, 2023, and anticipates that the delisting of its

securities will become effective on or about August 6, 2023.

Following delisting, the Company expects that its common stock will

be traded on over-the-counter markets.

The Company does not expect that the delisting will have any

adverse effects on its business operations, and the Company will

remain subject to the periodic reporting requirements of the

Securities Exchange Act of 1934, as amended.

About IronNet, Inc.

Founded in 2014 by GEN (Ret.) Keith Alexander, IronNet, Inc.

(NYSE: IRNT) is a global cybersecurity leader that is transforming

how organizations secure their networks by delivering the

first-ever collective defense platform operating at scale.

Employing a number of former NSA cybersecurity operators with

offensive and defensive cyber experience, IronNet integrates deep

tradecraft knowledge into its industry-leading products to solve

the most challenging cyber problems facing the world today.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995, including,

without limitation, statements regarding IronNet’s ability to

provide visibility and detection of malicious behaviors and to help

defend against increased cyber threats facing the globe. When used

in this press release, the words “estimates,” “projected,”

“expects,” “anticipates,” “forecasts,” “plans,” “intends,”

“believes,” “seeks,” “may,” “will,” “should,” “future,” “propose”

and variations of these words or similar expressions (or the

negative versions of such words or expressions) are intended to

identify forward-looking statements. These forward-looking

statements are not guarantees of future performance, conditions, or

results, and involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of

which are outside IronNet’s management’s control, that could cause

actual results or outcomes to differ materially from those

discussed in the forward-looking statements. Important factors,

among others, that may affect actual results or outcomes include:

IronNet’s ability to continue as a going concern; IronNet’s ability

to access additional sources of liquidity; the impact of the

voluntary delisting of the Company’s securities from the NYSE on

the Company’s business operations; whether following the voluntary

delisting of the Company’s securities from the NYSE trading of the

securities will continue on the over-the-counter markets; risks and

uncertainties associated with a potential filing for relief under

the United States Bankruptcy Code; IronNet’s inability to recognize

the anticipated benefits of collaborations with IronNet’s partners

and customers; IronNet’s ability to execute on its plans to develop

and market new products and the timing of these development

programs; the rate and degree of market acceptance of IronNet’s

products; the success of other competing technologies that may

become available; the performance of IronNet’s products; potential

litigation involving IronNet; and general economic and market

conditions impacting demand for IronNet’s products. The foregoing

list of factors is not exhaustive. You should carefully consider

the foregoing factors and the other risks and uncertainties

described under the heading “Risk Factors” in IronNet’s Annual

Report on Form 10-K for the year ended January 31, 2022, filed with

the Securities and Exchange Commission (the “SEC”) on May 2, 2022,

IronNet’s most recent Quarterly Report on Form 10-Q for the quarter

ended October 31, 2022, filed with the SEC on May 2, 2023, and

other documents that IronNet files with the SEC from time to time.

These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and IronNet does not undertake any obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230717777258/en/

IronNet Contacts:

Investor Contact: IR@ironnet.com Media Contact:

Media@ironnet.com

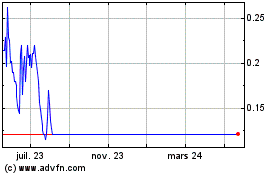

IronNet (NYSE:IRNT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

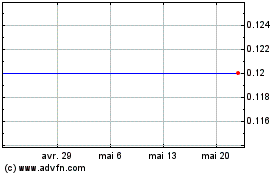

IronNet (NYSE:IRNT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024