false

0001839839

0001839839

2025-03-05

2025-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 5, 2025

JANUS

INTERNATIONAL GROUP, INC.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

001-40456 |

|

86-1476200 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS

Employer

Identification Number) |

135 Janus International Blvd., Temple, GA 30179

(Address of Principal

Executive Offices, Zip Code)

Registrant’s

telephone number, including area code: (866)

562-2580

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, par value $0.0001 per share |

|

JBI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

March 5, 2025, the Compensation Committee (the “Committee”) of the Board of Directors of Janus International Group, Inc.

(the “Company”) approved the payment of discretionary cash incentive bonuses to certain key employees of the Company, including

Ramey Jackson, Chief Executive Officer, Anselm Wong, Executive Vice President and Chief Financial Officer, Morgan Hodges, Executive Vice

President, Vic Nettie, Vice President of Manufacturing, and Peter Frayser, Chief Commercial Officer in the amounts of $447,500,

$205,031, $163,200, $151,763, and $71,100 (representing, 50%, or in the case of Mr. Frayser, 25%, of the executive’s target annual

incentive amount for fiscal 2024 under the Company’s annual incentive plan, the Janus Bonus Program). Upon determining that the

performance targets for fiscal 2024 had not been achieved and that annual incentive bonuses otherwise would not be payable for 2024 under

the Janus Bonus Program, the Committee approved these discretionary incentive bonus payments in order to encourage the retention of its

executive team, which has deep industry knowledge and expertise, recognize the executives’ contributions to the Company’s

accomplishments in the challenging market environment of fiscal 2024, and motivate the executives to focus on executing on the Company’s

business objectives for fiscal 2025.

Item 7.01. Regulation FD Disclosure.

On

March 7, 2025, the Company issued a press release with respect to the prepayment described in Item 8.01 of this Current Report, which

Item 8.01 is incorporated herein by reference. The press release is furnished as Exhibit 99.1 hereto and incorporated herein by

reference.

The information included under this Item 7.01 (including

Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference

in such filing.

Item 8.01. Other Events.

On March 5, 2025, the Company voluntarily prepaid

$40,000,000 toward the Company’s Amended and Restated First Lien Credit and Guarantee Agreement, dated as of February 12, 2018 (as

amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”), by

and among Janus International Group, LLC, a Delaware limited liability company, Janus Intermediate, LLC, a Delaware limited liability

company, the Subsidiary Guarantors from time to time party thereto, each of the lenders from time to time party thereto (each, a “Lender”

and, collectively, the “Lenders”), and Goldman Sachs Bank USA, as Administrative Agent for the Lenders from time to time party

to the Credit Agreement and the other parties thereto. Capitalized terms used in this Item 8.01 and not defined herein shall have the meanings

assigned to such terms in the Credit Agreement.

Item 9.01. Financial Statement and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

Dated: March 7, 2025

| |

JANUS

INTERNATIONAL GROUP, INC. |

| |

|

| |

By: |

/s/ Anselm Wong |

| |

Name:

Anselm Wong |

| |

Title:

Chief Financial Officer |

Exhibit 99.1

Janus International

Announces $40 million Debt Paydown

TEMPLE, GA,

March 7, 2025 – Janus International Group, Inc. (NYSE: JBI) (“Janus” or the “Company”), a leading provider

of access control technologies and building product solutions for the self-storage and other commercial and industrial sectors,

today announced that it paid down $40 million in debt using cash on hand. The $40 million was paid against the Company’s first

lien term loan facility.

“We continue to generate strong cash flow

in our business, enabling us to deploy capital opportunistically,” said Anselm Wong, Chief Financial Officer. “This voluntary

paydown is another proactive step to ensure we are well positioned to have the financial flexibility to execute on our long-term outlook

and drive total shareholder return.”

About Janus International Group

Janus International Group, Inc. (www.JanusIntl.com)

is a leading global manufacturer and supplier of turn-key self-storage, commercial and industrial building solutions, including roll-up

and swing doors, hallway systems, relocatable storage units and facility and door automation technologies. The Janus team operates out

of several U.S. and international locations.

Forward Looking Statements

Certain statements in this communication may be

considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact included in this communication

are forward-looking statements, including, but not limited to statements regarding Janus’s belief regarding the demand outlook for

Janus’s products and the strength of the industrials markets. When used in this communication, words such as “plan,”

“believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,”

“forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict,” “should,” “would,” and other similar words and expressions or

the negative of such terms or other similar expressions, as they relate to the management team, identify forward-looking statements. The

forward-looking statements contained in this communication are based on our current expectations and beliefs concerning future developments

and their potential effects on us. We cannot assure you that future developments affecting us will be those that we have anticipated.

These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions

that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary

in material respects from those projected in these forward-looking statements. Some factors that could cause actual results to differ

materially from forward-looking statements or historical performance: (i) risks of the self-storage industry; (ii) the highly competitive

nature of the self-storage industry and Janus’s ability to compete therein; (iii) litigation, complaints, and/or adverse publicity;

(iv) cyber incidents or directed attacks that could result in information theft, data corruption, operational disruption, and/or financial

loss; (v) the risk that our share repurchase program will be fully consummated or that it will enhance shareholder value; and (vi) the

risk that the demand outlook for Janus’s products may not be as strong as anticipated. There can be no assurance that the events,

results, trends or guidance regarding financial outlook identified in these forward-looking statements will occur or be achieved. Forward-looking

statements speak only as of the date they are made, and Janus is not under any obligation and expressly disclaims any obligation, to update,

alter, or otherwise revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as

required by law. This communication is not intended to be all-inclusive or to contain all the information that a person may desire in

considering an investment in Janus and is not intended to form the basis of an investment decision in Janus. All subsequent written and

oral forward-looking statements concerning Janus or other matters and attributable to Janus or any person acting on its behalf are expressly

qualified in their entirety by the cautionary statements above and under the heading “Risk Factors” in Janus’s most

recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q, as updated from time to time in amendments and its subsequent

filings with the SEC.

Investor Contact

Sara Macioch

Senior Director, Investor Relations

(770) 562-6399

IR@janusintl.com

Media Contact

Suzanne Reitz

Vice President of Marketing

770-746-9576

Marketing@Janusintl.com

Source: Janus International Group, Inc.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

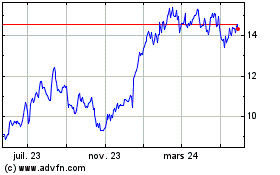

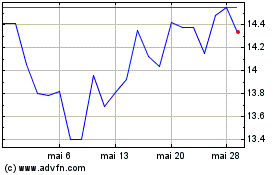

Janus (NYSE:JBI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Janus (NYSE:JBI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025