J.P. Morgan Increases Direct Lending Commitment to $50 Billion

24 Février 2025 - 2:35PM

Business Wire

J.P. Morgan dedicates balance sheet and adds

co-lenders to provide private credit to clients

J.P. Morgan announced today at its 30th annual Global Leveraged

Finance Conference a significant expansion to its private credit

commitment. The firm is allocating $50 billion from its balance

sheet, along with nearly $15 billion from multiple co-lenders. This

strategic move is designed to extend the firm’s direct lending

capabilities and provide tailored private credit solutions to meet

the evolving needs of clients.

Since 2021, J.P. Morgan has successfully deployed over $10

billion across more than 100 private credit transactions, serving

both corporate and sponsor clients. This latest commitment

underscores the bank’s dedication to being a leader in both the

broadly syndicated and private credit markets.

“We aim to support our clients with products and solutions that

best meet their capital structure needs, whether that’s a direct or

syndicated loan or a bond,” said Kevin Foley, global head of

Capital Markets at J.P. Morgan. “Our vast client relationships,

paired with the size and scale of our origination capabilities,

enable us to be a trusted financing source through a company’s

entire growth cycle.”

The convergence of the broadly syndicated and private financing

markets is creating unprecedented opportunities for clients,

offering greater optionality and customized solutions to address

their unique financing needs. As the leading investment bank with

the #1 debt capital markets franchise and thousands of clients

across the middle market and global corporate ecosystem, J.P.

Morgan is uniquely positioned at the forefront of this

evolution.

“We proudly bank 80,000 companies globally through our

Commercial and Investment Bank, including 32,000 middle market

clients across the U.S.,” said Jamie Dimon, Chairman and CEO of

JPMorganChase. “Extending this effort provides them with more

options and flexibility from a bank they already know and see in

their communities, and is known for being there during all market

environments.”

J.P. Morgan’s enhanced direct lending platform is poised to

drive significant impact, helping clients navigate today’s dynamic

financial landscape. The firm’s strategic relationships with

co-lenders further amplifies its ability to deliver comprehensive

and competitive financing solutions.

As private credit has grown exponentially to a $2 trillion

market, direct lenders are sitting on hundreds of billions of

dollars of dry powder to deploy. “Pairing our vast origination

platform with our lender client base has super charged our ability

to deliver in size for borrowers and increased deal flow for

lenders. Given our current success from our co-lending initiative,

we continue to look for opportunities with new partners to augment

our capabilities on large deals,” said Foley.

Additional details around the co-lending arrangements have not

been disclosed.

About J.P. Morgan’s Commercial & Investment Bank

J.P. Morgan’s Commercial & Investment Bank is a global

leader in banking, payments, markets and securities services.

Start-ups, companies, governments and institutions entrust us with

their business in more than 100 countries worldwide. With $35.3

trillion of assets under custody and $1.01 trillion in deposits,

the Commercial & Investment Bank provides strategic advice,

raises capital, manages risk, offers payment solutions, safeguards

assets and extends liquidity in global markets. Further information

about J.P. Morgan is available at www.jpmorgan.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224176509/en/

Media Contact: Tasha Pelio 212-270-7441

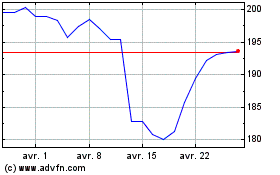

JP Morgan Chase (NYSE:JPM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

JP Morgan Chase (NYSE:JPM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025