Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 Juin 2023 - 5:31PM

Edgar (US Regulatory)

Nuveen

Preferred

and

Income

Fund

Portfolio

of

Investments

April

30,

2023

(Unaudited)

Principal

Amount

(000)

/

Shares

Description

(1)

Coupon

Maturity

Ratings

(2)

Value

LONG-TERM

INVESTMENTS

-

148.6%

(99.1%

of

Total

Investments)

X

63,303,972

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

-

78.8%

(52.6%

of

Total

Investments)

X

63,303,972

Automobiles

-

2.2%

$

550

General

Motors

Financial

Co

Inc

5.700%

N/A

(3)

BB+

$

480,562

1,479

General

Motors

Financial

Co

Inc

5.750%

N/A

(3)

BB+

1,255,331

Total

Automobiles

1,735,893

Banks

-

28.4%

240

Bank

of

America

Corp

6.100%

N/A

(3)

BBB+

235,500

550

Bank

of

America

Corp

6.250%

N/A

(3)

BBB+

537,680

685

Bank

of

America

Corp

6.500%

N/A

(3)

BBB+

682,890

365

Bank

of

America

Corp

4.375%

N/A

(3)

BBB+

311,162

730

Bank

of

America

Corp

6.300%

N/A

(3)

BBB+

735,148

1,455

Citigroup

Inc

6.300%

N/A

(3)

BBB-

1,372,502

1,337

Citigroup

Inc

5.950%

N/A

(3)

BBB-

1,253,461

420

Citigroup

Inc

4.150%

N/A

(3)

BBB-

345,450

630

Citigroup

Inc

5.000%

N/A

(3)

BBB-

590,625

240

Citigroup

Inc

7.375%

N/A

(3)

BBB-

237,000

900

Citigroup

Inc

6.250%

N/A

(3)

BBB-

882,693

444

Citizens

Financial

Group

Inc

6.375%

N/A

(3)

Baa3

384,060

880

CoBank

ACB

6.450%

N/A

(3)

BBB+

829,332

833

CoBank

ACB

6.250%

N/A

(3)

BBB+

784,103

200

Fifth

Third

Bancorp

4.500%

N/A

(3)

Baa3

177,130

475

First

Citizens

BancShares

Inc/NC

(3-Month

LIBOR

reference

rate

+

3.972%

spread)

(4)

8.838%

N/A

(3)

Ba1

440,563

775

Huntington

Bancshares

Inc/OH

5.625%

N/A

(3)

Baa3

691,319

1,290

JPMorgan

Chase

&

Co

5.000%

N/A

(3)

BBB+

1,236,292

345

JPMorgan

Chase

&

Co

6.100%

N/A

(3)

BBB+

341,367

1,910

JPMorgan

Chase

&

Co

6.750%

N/A

(3)

BBB+

1,907,708

315

KeyCorp

5.000%

N/A

(3)

Baa3

248,850

220

M&T

Bank

Corp

3.500%

N/A

(3)

Baa2

144,650

515

M&T

Bank

Corp

5.125%

N/A

(3)

Baa2

398,854

345

M&T

Bank

Corp

6.450%

N/A

(3)

Baa2

312,441

170

PNC

Financial

Services

Group

Inc/The

6.200%

N/A

(3)

Baa2

160,090

420

PNC

Financial

Services

Group

Inc/The

6.000%

N/A

(3)

Baa2

389,550

485

PNC

Financial

Services

Group

Inc/The

3.400%

N/A

(3)

Baa2

371,061

875

PNC

Financial

Services

Group

Inc/The

6.250%

N/A

(3)

Baa2

801,937

266

PNC

Financial

Services

Group

Inc/The

5.000%

N/A

(3)

Baa2

242,060

310

Regions

Financial

Corp

5.750%

N/A

(3)

Baa3

293,026

525

Truist

Financial

Corp

(3-Month

LIBOR

reference

rate

+

3.102%

spread)

(4)

7.968%

N/A

(3)

Baa2

504,000

605

Truist

Financial

Corp

5.100%

N/A

(3)

Baa2

533,648

1,265

Truist

Financial

Corp

4.800%

N/A

(3)

Baa2

1,098,969

885

Wells

Fargo

&

Co

5.900%

N/A

(3)

Baa2

834,466

805

Wells

Fargo

&

Co

7.950%

11/15/29

Baa1

897,304

1,040

Wells

Fargo

&

Co

5.875%

N/A

(3)

Baa2

1,017,349

355

Zions

Bancorp

NA

7.200%

N/A

(3)

BB+

304,767

355

Zions

Bancorp

NA

5.800%

N/A

(3)

BB+

278,351

Total

Banks

22,807,358

Capital

Markets

-

3.2%

205

Bank

of

New

York

Mellon

Corp/The

4.700%

N/A

(3)

Baa1

199,619

595

Charles

Schwab

Corp/The

5.375%

N/A

(3)

Baa2

566,366

878

Goldman

Sachs

Group

Inc/The

5.500%

N/A

(3)

BBB-

847,155

360

Goldman

Sachs

Group

Inc/The

4.125%

N/A

(3)

BBB-

301,758

Nuveen

Preferred

and

Income

Fund

(continued)

Portfolio

of

Investments

April

30,

2023

(Unaudited)

Principal

Amount

(000)

/

Shares

Description

(1)

Coupon

Maturity

Ratings

(2)

Value

Capital

Markets

(continued)

$

709

Goldman

Sachs

Group

Inc/The

5.300%

N/A

(3)

BBB-

$

672,689

Total

Capital

Markets

2,587,587

Consumer

Finance

-

2.3%

470

Ally

Financial

Inc

4.700%

N/A

(3)

Ba2

346,625

475

Ally

Financial

Inc

4.700%

N/A

(3)

Ba2

333,688

435

American

Express

Co

3.550%

N/A

(3)

Baa2

365,478

500

Capital

One

Financial

Corp

3.950%

N/A

(3)

Baa3

368,819

335

Discover

Financial

Services

6.125%

N/A

(3)

Ba1

317,138

145

Discover

Financial

Services

5.500%

N/A

(3)

Ba1

110,200

Total

Consumer

Finance

1,841,948

Electric

Utilities

-

2.7%

345

American

Electric

Power

Co

Inc

3.875%

2/15/62

BBB

276,112

370

Edison

International

5.000%

N/A

(3)

BB+

316,282

160

Edison

International

5.375%

N/A

(3)

BB+

142,484

1,125

Emera

Inc

6.750%

6/15/76

BB+

1,071,464

360

Southern

Co/The

4.000%

1/15/51

BBB-

338,256

Total

Electric

Utilities

2,144,598

Financial

Services

-

4.9%

305

American

AgCredit

Corp,

144A

5.250%

N/A

(3)

BB+

265,350

425

Capital

Farm

Credit

ACA,

144A

5.000%

N/A

(3)

BB

382,500

250

Compeer

Financial

ACA,

144A

4.875%

N/A

(3)

BB+

220,000

2

Compeer

Financial

ACA,

144A

6.750%

N/A

(3)

BB+

1,990,032

630

Equitable

Holdings

Inc

4.950%

N/A

(3)

BBB-

574,123

560

Voya

Financial

Inc

6.125%

N/A

(3)

BBB-

539,381

Total

Financial

Services

3,971,386

Food

Products

-

5.9%

2,005

Dairy

Farmers

of

America

Inc,

144A

7.125%

N/A

(3)

BB+

1,704,250

1,275

Land

O'

Lakes

Inc,

144A

7.000%

N/A

(3)

BB

1,083,750

620

Land

O'

Lakes

Inc,

144A

7.250%

N/A

(3)

BB

533,200

1,550

Land

O'

Lakes

Inc,

144A

8.000%

N/A

(3)

BB

1,426,000

Total

Food

Products

4,747,200

Independent

Power

and

Renewable

Electricity

Producers

-

1.1%

355

AES

Andes

SA,

144A

7.125%

3/26/79

BB

334,410

245

AES

Andes

SA,

144A

6.350%

10/07/79

BB

227,333

200

Vistra

Corp,

144A

8.000%

N/A

(3)

Ba3

188,500

195

Vistra

Corp,

144A

7.000%

N/A

(3)

Ba3

174,881

Total

Independent

Power

and

Renewable

Electricity

Producers

925,124

Industrial

Conglomerates

-

0.6%

465

General

Electric

Co

(3-Month

LIBOR

reference

rate

+

3.330%

spread)

(4)

8.196%

N/A

(3)

BBB-

464,186

Total

Industrial

Conglomerates

464,186

Insurance

-

15.6%

280

Aegon

NV

5.500%

4/11/48

Baa1

271,544

260

American

International

Group

Inc

5.750%

4/01/48

BBB-

250,250

1,490

Assurant

Inc

7.000%

3/27/48

Baa3

1,421,389

3,390

Assured

Guaranty

Municipal

Holdings

Inc,

144A

(5)

6.400%

12/15/66

BBB+

3,034,050

440

AXIS

Specialty

Finance

LLC

4.900%

1/15/40

BBB

353,653

375

Enstar

Finance

LLC

5.500%

1/15/42

BBB-

269,961

220

Enstar

Finance

LLC

5.750%

9/01/40

BBB-

183,667

845

Markel

Corp

6.000%

N/A

(3)

BBB-

821,025

205

MetLife

Inc

5.875%

N/A

(3)

BBB

190,229

Principal

Amount

(000)

/

Shares

Description

(1)

Coupon

Maturity

Ratings

(2)

Value

Insurance

(continued)

$

900

MetLife

Inc,

144A

9.250%

4/08/38

BBB

$

1,059,750

450

PartnerRe

Finance

B

LLC

4.500%

10/01/50

Baa1

378,066

750

Provident

Financing

Trust

I

7.405%

3/15/38

BB+

753,750

200

Prudential

Financial

Inc

5.125%

3/01/52

BBB+

180,946

125

Prudential

Financial

Inc

3.700%

10/01/50

BBB+

107,120

268

QBE

Insurance

Group

Ltd

,

Reg

S

6.750%

12/02/44

BBB

265,434

840

QBE

Insurance

Group

Ltd,

144A

7.500%

11/24/43

Baa1

839,908

940

QBE

Insurance

Group

Ltd,

144A

5.875%

N/A

(3)

Baa2

887,533

1,290

SBL

Holdings

Inc,

144A

7.000%

N/A

(3)

BB

832,050

740

SBL

Holdings

Inc,

144A

6.500%

N/A

(3)

BB

430,821

Total

Insurance

12,531,146

Media

-

0.3%

295

Paramount

Global

6.375%

3/30/62

Baa3

253,039

Total

Media

253,039

Multi-Utilities

-

2.7%

225

Algonquin

Power

&

Utilities

Corp

4.750%

1/18/82

BB+

181,969

840

CenterPoint

Energy

Inc

6.125%

N/A

(3)

BBB-

800,100

75

CMS

Energy

Corp

4.750%

6/01/50

BBB-

65,625

304

NiSource

Inc

5.650%

N/A

(3)

BBB-

288,466

440

Sempra

Energy

4.875%

N/A

(3)

BBB-

413,759

475

Sempra

Energy

4.125%

4/01/52

BBB-

384,675

Total

Multi-Utilities

2,134,594

Oil,

Gas

&

Consumable

Fuels

-

2.5%

350

Enbridge

Inc

7.625%

1/15/83

BBB-

356,503

220

Enbridge

Inc

5.500%

7/15/77

BBB-

194,689

630

Enbridge

Inc

5.750%

7/15/80

BBB-

576,713

155

Enbridge

Inc

6.000%

1/15/77

BBB-

144,858

295

Energy

Transfer

LP

6.500%

N/A

(3)

BB

261,075

60

Energy

Transfer

LP

7.125%

N/A

(3)

BB

50,550

223

Transcanada

Trust

5.500%

9/15/79

BBB-

188,947

300

Transcanada

Trust

5.600%

3/07/82

BBB-

253,662

Total

Oil,

Gas

&

Consumable

Fuels

2,026,997

Trading

Companies

&

Distributors

-

3.9%

2,600

AerCap

Global

Aviation

Trust,

144A

6.500%

6/15/45

Baa3

2,442,133

255

AerCap

Holdings

NV

5.875%

10/10/79

BB+

236,525

580

Air

Lease

Corp

4.650%

N/A

(3)

BB+

476,295

Total

Trading

Companies

&

Distributors

3,154,953

U.S.

Agency

-

1.4%

615

Farm

Credit

Bank

of

Texas,

144A

6.200%

N/A

(3)

BBB+

539,663

640

Farm

Credit

Bank

of

Texas,

144A

5.700%

N/A

(3)

Baa1

556,800

Total

U.S.

Agency

1,096,463

Wireless

Telecommunication

Services

-

1.1%

860

Vodafone

Group

PLC

7.000%

4/04/79

BB+

881,500

Total

Wireless

Telecommunication

Services

881,500

Total

$1,000

Par

(or

similar)

Institutional

Preferred

(cost

$70,339,924)

63,303,972

Nuveen

Preferred

and

Income

Fund

(continued)

Portfolio

of

Investments

April

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

,(6)

Coupon

Maturity

Ratings

(2)

Value

X

33,515,696

CONTINGENT

CAPITAL

SECURITIES

-

41.7%

(27.8%

of

Total

Investments)

X

33,515,696

Banks

-

33.9%

$

225

Banco

Bilbao

Vizcaya

Argentaria

SA

6.125%

N/A

(3)

Ba2

$

179,342

1,355

Banco

Bilbao

Vizcaya

Argentaria

SA

6.500%

N/A

(3)

Ba2

1,235,665

740

Banco

Mercantil

del

Norte

SA/Grand

Cayman,

144A

7.500%

N/A

(3)

Ba2

653,050

1,600

Banco

Santander

SA

,

Reg

S

7.500%

N/A

(3)

Ba1

1,536,000

745

Barclays

PLC

8.000%

N/A

(3)

BBB-

687,188

1,600

Barclays

PLC

7.750%

N/A

(3)

BBB-

1,505,632

1,000

Barclays

PLC

6.125%

N/A

(3)

BBB-

858,900

675

Barclays

PLC

8.000%

N/A

(3)

BBB-

591,233

1,890

BNP

Paribas

SA,

144A

6.625%

N/A

(3)

BBB

1,800,981

740

BNP

Paribas

SA,

144A

7.750%

N/A

(3)

BBB

706,700

250

BNP

Paribas

SA,

144A

9.250%

N/A

(3)

BBB

257,100

1,835

Credit

Agricole

SA,

144A

8.125%

N/A

(3)

BBB

1,818,122

2,730

HSBC

Holdings

PLC

6.375%

N/A

(3)

BBB

2,587,016

1,655

HSBC

Holdings

PLC

6.000%

N/A

(3)

BBB

1,462,193

285

ING

Groep

NV

,

Reg

S

6.750%

N/A

(3)

BBB

267,188

2,545

ING

Groep

NV

6.500%

N/A

(3)

BBB

2,352,126

3,200

Lloyds

Banking

Group

PLC

7.500%

N/A

(3)

Baa3

3,033,888

580

Macquarie

Bank

Ltd/London,

144A

6.125%

N/A

(3)

BB+

499,985

1,880

NatWest

Group

PLC

6.000%

N/A

(3)

Baa3

1,762,312

480

Nordea

Bank

Abp,

144A

6.625%

N/A

(3)

BBB+

449,506

250

Societe

Generale

SA,

144A

9.375%

N/A

(3)

BB+

237,350

1,730

Societe

Generale

SA,

144A

7.875%

N/A

(3)

BB+

1,652,842

345

Standard

Chartered

PLC,

144A

4.300%

N/A

(3)

BBB-

243,259

365

Standard

Chartered

PLC,

144A

6.000%

N/A

(3)

BBB-

344,212

550

UniCredit

SpA

,

Reg

S

8.000%

N/A

(3)

BB-

530,887

Total

Banks

27,252,677

Capital

Markets

-

7.8%

2,900

Credit

Suisse

Group

AG,

144A

7.500%

N/A

(3)

C

108,750

620

Credit

Suisse

Group

AG,

144A

9.750%

N/A

(3)

C

23,250

1,000

Credit

Suisse

Group

AG,

144A

6.375%

N/A

(3)

Ba2

37,500

2,000

Deutsche

Bank

AG

6.000%

N/A

(3)

Ba2

1,489,800

1,570

UBS

Group

AG,

144A

7.000%

N/A

(3)

BBB

1,471,875

3,475

UBS

Group

AG

,

Reg

S

6.875%

N/A

(3)

BBB

3,131,844

Total

Capital

Markets

6,263,019

Total

Contingent

Capital

Securities

(cost

$42,012,415)

33,515,696

Shares

Description

(1)

Coupon

Ratings

(2)

Value

X

21,285,964

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

-

26.5%

(17.7%

of

Total

Investments)

X

21,285,964

Banks

-

7.6%

4,740

CoBank

ACB

6.200%

BBB+

$

452,670

15,000

Farm

Credit

Bank

of

Texas,

144A

6.750%

Baa1

1,462,500

19,366

Fifth

Third

Bancorp

6.625%

Baa3

474,467

43,000

KeyCorp

6.200%

Baa3

954,600

8,100

KeyCorp

6.125%

Baa3

182,169

31,600

New

York

Community

Bancorp

Inc

6.375%

Ba2

739,756

21,268

Regions

Financial

Corp

6.375%

Baa3

509,581

10,600

Regions

Financial

Corp

5.700%

Baa3

245,284

11,558

Synovus

Financial

Corp

5.875%

BB-

244,567

16,400

Wells

Fargo

&

Co

4.750%

Baa2

329,968

7,900

Western

Alliance

Bancorp

4.250%

Ba3

124,820

15,308

Wintrust

Financial

Corp

6.875%

BB

362,341

Total

Banks

6,082,723

Shares

Description

(1)

Coupon

Ratings

(2)

Value

Capital

Markets

-

3.0%

5,207

Goldman

Sachs

Group

Inc/The

5.500%

BB+

$

130,696

19,451

Morgan

Stanley

6.875%

BBB

493,666

33,800

Morgan

Stanley

5.850%

BBB

845,338

7,300

Morgan

Stanley

6.500%

BBB

190,822

16,433

Morgan

Stanley

6.375%

BBB

412,961

12,974

Morgan

Stanley

7.125%

BBB

330,578

Total

Capital

Markets

2,404,061

Consumer

Finance

-

0.2%

11,900

Synchrony

Financial

5.625%

BB-

201,705

Total

Consumer

Finance

201,705

Diversified

Telecommunication

Services

-

0.2%

8,700

AT&T

Inc

4.750%

BBB-

181,656

Total

Diversified

Telecommunication

Services

181,656

Financial

Services

-

3.1%

12,213

AgriBank

FCB

6.875%

BBB+

1,221,300

18,500

Equitable

Holdings

Inc

5.250%

BBB-

397,195

35,623

Voya

Financial

Inc

5.350%

BBB-

869,201

Total

Financial

Services

2,487,696

Food

Products

-

2.3%

31,207

CHS

Inc

7.100%

N/R

773,934

31,132

CHS

Inc

6.750%

N/R

780,791

10,959

CHS

Inc

7.875%

N/R

286,687

Total

Food

Products

1,841,412

Insurance

-

7.4%

43,600

American

Equity

Investment

Life

Holding

Co

5.950%

BB

1,005,416

23,700

American

Equity

Investment

Life

Holding

Co

6.625%

BB

565,956

38,688

Aspen

Insurance

Holdings

Ltd

5.950%

BB+

933,154

16,280

Aspen

Insurance

Holdings

Ltd

5.625%

BB+

333,740

12,000

Assurant

Inc

5.250%

Baa3

255,240

24,100

Athene

Holding

Ltd

6.375%

BBB

543,455

27,700

Athene

Holding

Ltd

6.350%

BBB

600,813

23,000

Enstar

Group

Ltd

7.000%

BBB-

526,700

26,902

Reinsurance

Group

of

America

Inc

5.750%

BBB+

681,428

11,600

Reinsurance

Group

of

America

Inc

7.125%

BBB+

304,500

9,463

Selective

Insurance

Group

Inc

4.600%

BBB-

164,183

Total

Insurance

5,914,585

Oil,

Gas

&

Consumable

Fuels

-

2.1%

5,100

Energy

Transfer

LP

7.600%

BB

117,912

31,634

NuStar

Energy

LP

12.065%

B2

783,574

24,163

NuStar

Energy

LP

10.942%

B2

557,440

10,020

NuStar

Logistics

LP

11.994%

B

255,911

Total

Oil,

Gas

&

Consumable

Fuels

1,714,837

Trading

Companies

&

Distributors

-

0.6%

11,571

Air

Lease

Corp

6.150%

BB+

253,289

7,500

WESCO

International

Inc

10.625%

B+

204,000

Total

Trading

Companies

&

Distributors

457,289

Total

$25

Par

(or

similar)

Retail

Preferred

(cost

$23,269,586)

21,285,964

Nuveen

Preferred

and

Income

Fund

(continued)

Portfolio

of

Investments

April

30,

2023

(Unaudited)

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Principal

Amount

(000)

Description

(1)

Coupon

Maturity

Ratings

(2)

Value

X

1,268,077

CORPORATE

BONDS

-

1.6%

(1.0%

of

Total

Investments)

X

1,268,077

Banks

-

1.2%

$

1,000

Commerzbank

AG,

144A

8.125%

9/19/23

Baa3

$

989,302

Total

Banks

989,302

Insurance

-

0.4%

295

Fidelis

Insurance

Holdings

Ltd,

144A

6.625%

4/01/41

BB+

278,775

Total

Insurance

278,775

Total

Corporate

Bonds

(cost

$1,446,250)

1,268,077

Total

Long-Term

Investments

(cost

$137,068,175)

119,373,709

Principal

Amount

(000)

Description

(1)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

1.3% (0.9%

of

Total

Investments)

X

1,031,677

REPURCHASE

AGREEMENTS

-

1.3%

(0.9%

of

Total

Investments)

X

1,031,677

$

1,032

Repurchase

Agreement

with

Fixed

Income

Clearing

Corporation,

dated

4/28/23,

repurchase

price

$1,031,801,

collateralized

by

$1,150,800,

U.S.

Treasury

Note,

0.750%,

due

5/31/26,

value

$1,052,334

1.440%

5/01/23

$

1,031,677

Total

Repurchase

Agreements

(cost

$1,031,677)

1,031,677

Total

Short-Term

Investments

(cost

$1,031,677)

1,031,677

Total

Investments

(cost

$

138,099,852

)

-

149

.9

%

120,405,386

Borrowings

-

(49.2)%

(7),(8)

(

39,500,000

)

Reverse

Repurchase

Agreements,

including

accrued

interest

-

(1.9)%(9)

(

1,515,656

)

Other

Assets

&

Liabilities,

Net

- 1.2%

945,397

Net

Assets

Applicable

to

Common

Shares

-

100%

$

80,335,127

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

$1,000

Par

(or

similar)

Institutional

Preferred

$

1,990,032

$

61,313,940

$

–

$

63,303,972

Contingent

Capital

Securities

–

33,515,696

–

33,515,696

$25

Par

(or

similar)

Retail

Preferred

19,611,994

1,673,970

–

21,285,964

Corporate

Bonds

–

1,268,077

–

1,268,077

Short-Term

Investments:

Repurchase

Agreements

–

1,031,677

–

1,031,677

Total

$

21,602,026

$

98,803,360

$

–

$

120,405,386

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(1)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(2)

For

financial

reporting

purposes,

the

ratings

disclosed

are

the

highest

of

Standard

&

Poor’s

Group

(“Standard

&

Poor’s”),

Moody’s

Investors

Service,

Inc.

(“Moody’s”)

or

Fitch,

Inc.

(“Fitch”)

rating.

This

treatment

of

split-rated

securities

may

differ

from

that

used

for

other

purposes,

such

as

for

Fund

investment

policies.

Ratings

below

BBB

by

Standard

&

Poor’s,

Baa

by

Moody’s

or

BBB

by

Fitch

are

considered

to

be

below

investment

grade.

Holdings

designated

N/R

are

not

rated

by

any

of

these

national

rating

agencies.

(3)

Perpetual

security.

Maturity

date

is

not

applicable.

(4)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(5)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

reverse

repurchase

agreements.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$1,991,375

have

been

pledged

as

collateral

for

reverse

repurchase

agreements.

(6)

Contingent

Capital

Securities

(“CoCos”)

are

hybrid

securities

with

loss

absorption

characteristics

built

into

the

terms

of

the

security

for

the

benefit

of

the

issuer.

For

example,

the

terms

may

specify

an

automatic

write-down

of

principal

or

a

mandatory

conversion

into

the

issuer’s

common

stock

under

certain

adverse

circumstances,

such

as

the

issuer’s

capital

ratio

falling

below

a

specified

level.

(7)

Borrowings

as

a

percentage

of

Total

Investments

is

32.8%.

(8)

The

Fund

segregates

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

(9)

Reverse

Repurchase

Agreements,

including

accrued

interest

as

a

percentage

of

Total

investments

is

1.3%.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

LIBOR

London

Inter-Bank

Offered

Rate

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

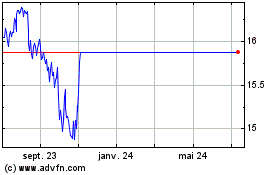

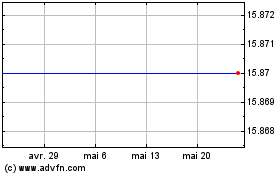

Nuveen Preferred and Inc... (NYSE:JPT)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Nuveen Preferred and Inc... (NYSE:JPT)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024