As filed with the Securities and Exchange Commission on February 27, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NEXTDOOR HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 86-1776836 (I.R.S. Employer Identification No.) |

420 Taylor Street San Francisco, California (Address of Principle Executive Offices) |

94102

(Zip Code) |

NEXTDOOR HOLDINGS, INC. 2021 EQUITY INCENTIVE PLAN

NEXTDOOR HOLDINGS, INC. 2021 EMPLOYEE STOCK PURCHASE PLAN

(Full Title of the Plans)

Sarah Friar

Chief Executive Officer, President and Chairperson of the Board

420 Taylor Street

San Francisco, California 94102

(Name and Address of Agent for Service)

(415) 344-0333

(Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Cynthia C. Hess

Ran D. Ben-Tzur

Joshua W. Damm

Fenwick & West LLP

801 California Street

Mountain View, California 94041

(650) 988-8500

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ |

Non-accelerated filer ☐ | Smaller reporting company ☐ |

Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Pursuant to General Instruction E of Form S-8, Nextdoor Holdings, Inc., (the “Registrant”) is filing this Registration Statement on Form S-8 (this “Registration Statement”) with the Securities and Exchange Commission (the “Commission”) to register (a) 19,418,753 additional shares of the Registrant’s Class A common stock, par value $0.0001 per share (the “Class A common stock”) under the Registrant’s 2021 Equity Incentive Plan and (b) 3,883,750 additional shares of the Registrant’s Class A common stock under the Registrant’s 2021 Employee Stock Purchase Plan pursuant to the provisions in those plans providing for an automatic annual increase in the number of shares reserved for issuance under such plans on January 1, 2024. This Registration Statement hereby incorporates by reference the contents of the Registrant’s previous registration statement on Form S-8 filed with the Commission on January 11, 2022 (Registration No. 333-262102) and February 28, 2023 (File No. 333-270095) to the extent not superseded hereby. PART I

INFORMATION REQUIRED IN THE SECTION 10(A) PROSPECTUS

The information called for by Part I of Form S-8 is omitted from this Registration Statement in accordance with Rule 428 of the Securities Act of 1933, as amended (the “Securities Act”), and the instructions to Form S-8. In accordance with the rules and regulations of the Commission and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424. The documents containing the information specified in Part I of Form S-8 will be delivered to the participants in the equity benefit plans covered by this Registration Statement as specified by Rule 428(b)(1) under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Registrant with the Commission pursuant to the Securities Act, and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated herein by reference:

(a) the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Annual Report”), filed with the Commission on February 27, 2024; (b) all other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Registrant’s Annual Report referred to in (a) above; and

(c) the description of the Registrant’s Class A common stock contained in the Registrant’s Registration Statement on Form 8-A filed with the Commission on November 5, 2021, as updated by the description of the Registrant’s Class A common stock contained in Exhibit 4.2 to the 2023 Annual Report, including any amendments or reports filed for the purpose of updating such description. All documents subsequently filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, prior to the filing of a post-effective amendment to the Registration Statement which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of the filing of such documents, except that information furnished to the Commission under Item 2.02 or Item 7.01 in Current Reports on Form 8-K and any exhibit relating to such information, shall not be deemed to be incorporated by reference in this Registration Statement.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference in this Registration Statement shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in this Registration Statement, or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this Registration Statement, modifies or supersedes such earlier statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits.

| | | | | | | | | | | | | | | | | | | | |

| | Incorporated by Reference |

| Exhibit Number | Exhibit Description | Form | File No. | Exhibit | Filing Date | Filed Herewith |

| 3.1 | | 8-K | 001-40246 | 3.1 | November 12, 2021 | |

| 3.2 | | 8-K | 001-40246 | 3.1 | December 1, 2022 | |

| 4.1 | | 8-K | 001-40246 | 4.1 | November 12, 2021 | |

| 5.1 | | | | | | X |

| 23.1 | | | | | | X |

| 23.2 | | | | | | X |

| 24.1 | | | | | | X |

| 99.1 | | S-4 | 333-258033 | 10.24 | July 20, 2021 | |

| 99.2 | | S-4 | 333-258033 | 10.26 | July 20, 2021 | |

| 99.3 | | S-4 | 333-258033 | 10.27 | July 20, 2021 | |

| 99.4 | | S-4 | 333-258033 | 10.25 | July 20, 2021 | |

| 99.5 | | S-4 | 333-258033 | 10.28 | July 20, 2021 | |

| 99.6 | | S-4 | 333-258033 | 10.29 | July 20, 2021 | |

| 99.7 | | 8-K | 001-40246 | 10.18 | November 12, 2021 | |

| 99.8 | | 8-K | 001-40246 | 10.7 | November 12, 2021 | |

| 99.9 | | S-4 | 333-258033 | 10.15 | July 20, 2021 | |

| 99.10 | | S-4 | 333-258033 | 10.16 | July 20, 2021 | |

| 99.11 | | 8-K | 001-40246 | 10.10 | November 12, 2021 | |

| 107 | | | | | | X |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Francisco, State of California, on the 27th day of February, 2024.

NEXTDOOR HOLDINGS, INC.

By: /s/ Sarah Friar

Sarah Friar

Chief Executive Officer, President and Chairperson of the Board

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Sarah Friar and Matthew Anderson, and each of them, as his or her true and lawful attorneys-in-fact, proxies and agents, each with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this Registration Statement, including post-effective amendments and to file the same, with any exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, or any state securities department or any other federal or state agency or governmental authority granting unto such attorneys-in-fact, proxies and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact, proxies and agents, or their or his or her substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons on behalf of the Registrant in the capacities and on the dates indicated.

| | | | | | | | |

| Signature | Title | Date |

/s/ Sarah Friar |

Chief Executive Officer, President and |

February 27, 2024 |

| Sarah Friar | Chairperson of the Board (Principal Executive Officer)

| |

| /s/ Matt Anderson | Chief Financial Officer and Treasurer | February 27, 2024 |

| Matt Anderson | (Principal Financial and Accounting Officer)

| |

| /s/ John Hope Bryant | Director | February 27, 2024 |

John Hope Bryant

| | |

| /s/ Dana Evan | Director | February 27, 2024 |

Dana Evan

| | |

| /s/ J. William Gurley | Director | February 27, 2024 |

J. William Gurley

| | |

| /s/ Mary Meeker | Director | February 27, 2024 |

Mary Meeker

| | |

| /s/ Jason Pressman | Director | February 27, 2024 |

Jason Pressman

| | |

| /s/ David Sze | Director | February 27, 2024 |

David Sze

| | |

| /s/ Nirav Tolia | Director | February 27, 2024 |

Nirav Tolia

| | |

| /s/ Chris Varelas | Director | February 27, 2024 |

| Chris Varelas | | |

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Nextdoor Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered(1) | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

| Equity | Class A common stock, par value $0.0001 per share | Rule 457(c) and Rule 457(h) | 19,418,753(2) | $1.70(3) | $33,011,880.10 | 0.00014760 | $4,872.56 |

Equity | Class A common stock, par value $0.0001 per share | Rule 457(c) and Rule 457(h) | 3,883,750(4) | $1.45(5) | $5,631,437.50 | 0.00014760 | $831.21 |

| Total Offering Amounts | | $38,643,317.60 | | $ 5,703.77 |

Total Fee Offsets(6) | | | | - |

| Net Fee Due | | | | $ 5,703.77 |

(1) Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers such additional and indeterminate number of securities as may become issuable pursuant to the provisions of the Nextdoor Holdings, Inc. 2021 Equity Incentive Plan (the “2021 Plan”) and the Nextdoor Holdings, Inc. 2021 Employee Stock Purchase Plan (the “ESPP”) by reason of any stock dividend, stock split, recapitalization or any other similar transaction effected without the Registrant’s receipt of consideration which results in an increase in the number of outstanding shares of Class A common stock, par value $0.0001 per share (the “Class A common stock”), of Nextdoor Holdings, Inc., a Delaware corporation (the “Registrant”).

(2) Represents additional shares of Class A common stock to be registered and available for grant under the 2021 Plan resulting from the annual 5% automatic increase in the number of authorized shares available for issuance under the 2021 Plan.

(3) Estimated pursuant to Rules 457(c) and 457(h) under the Securities Act, solely for the purposes of calculating the registration fee and based on the average of the high and low prices of the Registrant’s Class A common stock as reported on the New York Stock Exchange on February 21, 2024, which date is within five business days prior to the filing of this Registration Statement.

(4) Represents additional shares of Class A common stock to be registered and available for grant under the ESPP resulting from the annual 1% automatic increase in the number of authorized shares available for issuance under the ESPP.

(5) Estimated pursuant to Rules 457(c) and 457(h) under the Securities Act, solely for the purposes of calculating the registration fee and based on the average of the high and low prices of the Registrant’s Class A common stock as reported on the New York Stock Exchange on February 21, 2024, which date is within five business days prior to the filing of this Registration Statement, multiplied by 85%, which is the percentage of the price per share applicable to purchases under the ESPP.

(6) The Registrant does not have any fee offsets.

EXHIBIT 5.1

February 27, 2024

Nextdoor Holdings, Inc.

420 Taylor Street

San Francisco, California 94012

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

As counsel to Nextdoor Holdings, Inc., a Delaware corporation (the “Company”), we have examined the Registration Statement on Form S-8 (the “Registration Statement”) to be filed by the Company with the Securities and Exchange Commission (the “Commission”) on or about February 27, 2024, in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”), of an aggregate of 23,302,503 shares (the “Shares”) of the Company’s Class A Common Stock, $0.0001 par value per share (the “Class A Common Stock”), subject to issuance by the Company (a) upon the exercise or settlement of equity awards to be granted under the Company’s 2021 Equity Incentive Plan (the “2021 EIP”) and (b) pursuant to purchase rights to acquire shares of Class A Common Stock to be granted under the Company’s 2021 Employee Stock Purchase Plan (the “ESPP”, and together with the 2021 EIP, the “Plans”).

As to matters of fact relevant to the opinions rendered herein, we have examined such documents, certificates and other instruments which we have deemed necessary or advisable, including a certificate addressed to us and dated the date hereof executed by the Company. We have not undertaken any independent investigation to verify the accuracy of any such information, representations or warranties or to determine the existence or absence of any fact, and no inference as to our knowledge of the existence or absence of any fact should be drawn from our representation of the Company or the rendering of the opinion set forth below. We have not considered parol evidence in connection with any of the agreements or instruments reviewed by us in connection with this letter.

In our examination of documents for purposes of this letter, we have assumed, and express no opinion as to, the genuineness and authenticity of all signatures on original documents, the authenticity and completeness of all documents submitted to us as originals, that each document is what it purports to be, the conformity to originals of all documents submitted to us as copies or facsimile copies, the absence of any termination, modification or waiver of or amendment to any document reviewed by us (other than as has been disclosed to us), the legal competence or capacity of all persons or entities (other than the Company) executing the same and (other than the Company) the due authorization, execution and delivery of all documents by each party thereto. We have also assumed the conformity of the documents filed with the Commission via the Electronic Data Gathering, Analysis and Retrieval System (“EDGAR”), except for required EDGAR formatting changes, to physical copies submitted for our examination.

The opinions in this letter are limited to the existing General Corporation Law of the State of Delaware now in effect. We express no opinion with respect to any other laws.

Based upon, and subject to, the foregoing, it is our opinion that the Shares, when issued and sold by the Company in accordance with the terms (including, without limitation, payment and authorization provisions) of the applicable Plan and the applicable form of award agreement thereunder, against the Company’s receipt of payment therefor (in an amount and type of consideration not less than the par value per Share), and duly registered on the books of the transfer agent and registrar for the Shares in the name or on behalf of the holders thereof, will be validly issued, fully paid and non-assessable.

We consent to the use of this opinion as an exhibit to the Registration Statement and further consent to all references to us, if any, in the Registration Statement, the prospectuses constituting a part thereof and any amendments thereto. We do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

This opinion is intended solely for your use in connection with the issuance and sale of the Shares subject to the Registration Statement and is not to be relied upon for any other purpose. In providing this letter, we are opining only as to the specific legal issues expressly set forth above, and no opinion shall be inferred as to any other matter or matters. This opinion is rendered on, and speaks only as of, the date of this letter first written above, and does not address any potential change in facts or law that may occur after the date of this opinion letter. We assume no obligation to advise you of any fact, circumstance, event or change in the law or the facts that may hereafter be brought to our attention, whether or not such occurrence would affect or modify any of the opinions expressed herein.

Very truly yours,

/s/ Fenwick & West LLP

FENWICK & WEST LLP

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the 2021 Equity Incentive Plan and 2021 Employee Stock Purchase Plan of Nextdoor Holdings, Inc. of our reports dated February 27, 2024, with respect to the consolidated financial statements of Nextdoor Holdings, Inc., and the effectiveness of internal control over financial reporting of Nextdoor Holdings, Inc. included in its Annual Report (Form 10-K) for the year ended December 31, 2023, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

San Mateo, California

February 27, 2024

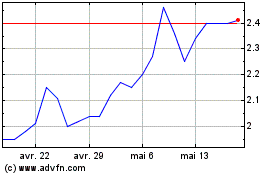

Nextdoor (NYSE:KIND)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Nextdoor (NYSE:KIND)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024