Kinder Morgan Closes on the $1.815 Billion Acquisition of NextEra Energy Partners’ South Texas Assets

28 Décembre 2023 - 10:05PM

Business Wire

Pipeline systems complementary to KMI’s

existing South Texas footprint

Kinder Morgan, Inc. (NYSE: KMI) today closed on its previously

announced $1.815 billion acquisition of NextEra Energy Partners’

South Texas assets (STX Midstream), which includes a set of

integrated, large diameter high pressure natural gas pipeline

systems that connect the Eagle Ford basin to key growing Mexico and

Gulf Coast demand markets. The acquisition includes a 90% interest

in the NET Mexico pipeline (MGI Enterprises, a PEMEX affiliate,

owns the other 10%), Eagle Ford Midstream and a 50% interest in Dos

Caminos LLC (Howard Energy Partners (HEP) owns the remaining 50%

and will continue to operate the pipeline). Dos Caminos recently

placed in service a 62-mile pipeline connecting HEP’s existing

midstream pipeline and facilities in Webb County, Texas to KMI’s

new Eagle Ford pipeline, which was placed in service on November 1,

2023. This portfolio of assets is highly contracted, with an

average contract length of over 8 years. Approximately 75% of the

business is supported by take-or-pay contracts.

“We are pleased to add these assets to our natural gas portfolio

to serve growing LNG, industrial, Mexico export and power

generation demand markets on the U.S. Gulf Coast,” said KMI

President of Natural Gas Pipelines Sital Mody. “These assets

integrate well with our existing South Texas footprint and extend

our direct connectivity in the lean area of the Eagle Ford Basin,

allowing us to offer LNG customers greater access to desirable

low-nitrogen natural gas supply.”

KMI expects the acquisition to be accretive to its preliminary

2024 budget guidance with the purchase price equal to 8.6 times the

2024 EBITDA and a long-term investment-to-EBITDA multiple of

approximately 7.0-7.5 times, inclusive of commercial synergies.

Initially, we plan to fund the transaction with cash on hand and

short-term borrowings, increasing our expected Net Debt-to-Adjusted

EBITDA ratio for 2024 by approximately 0.1 times after including a

full year Adjusted EBITDA contribution from the asset. Expected

acquisition EBITDA multiples, Net Debt and Adjusted EBITDA are

non-GAAP measures. For definitions of these measures and

reconciliations to comparable GAAP measures, where applicable,

please refer to KMI’s Investor Presentation for 4Q 2023, which is

available at the Investor Relations Page of www.kindermorgan.com

under “Events and Presentations.”

About Kinder Morgan,

Inc.

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy

infrastructure companies in North America. Access to reliable,

affordable energy is a critical component for improving lives

around the world. We are committed to providing energy

transportation and storage services in a safe, efficient and

environmentally responsible manner for the benefit of the people,

communities and businesses we serve. We own an interest in or

operate approximately 82,000 miles of pipelines, 140 terminals, 700

billion cubic feet of working natural gas storage capacity and have

renewable natural gas generation capacity of approximately 5.4 Bcf

per year with an additional 1.5 Bcf in development. Our pipelines

transport natural gas, refined petroleum products, crude oil,

condensate, CO2, renewable fuels and other products, and our

terminals store and handle various commodities including gasoline,

diesel fuel, jet fuel, chemicals, metals, petroleum coke and

ethanol and other renewable fuels and feedstocks. Learn more about

our work advancing energy solutions on the lower carbon initiatives

page at www.kindermorgan.com.

Important Information Relating to

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 and Section 21E of the Securities and Exchange Act of 1934.

Generally, the words “expects,” “believes,” anticipates,” “plans,”

“will,” “shall,” “estimates,” and similar expressions identify

forward-looking statements, which are not historical in nature.

Forward-looking statements in this news release include express or

implied statements concerning the business of STX Midstream and the

anticipated benefits to KMI’s business and stockholders of the

acquisition transaction. Forward-looking statements are subject to

risks and uncertainties and are based on the beliefs and

assumptions of management, based on information currently available

to them. Although KMI believes that these forward-looking

statements are based on reasonable assumptions, it can give no

assurance as to when or if any such forward-looking statements will

materialize or their ultimate impact on KMI’s operations or

financial condition. Important factors that could cause actual

results to differ materially from those expressed in or implied by

these forward-looking statements include the timing and extent of

growth in demand for the products we transport and handle;

counterparty financial risk; and the risks and uncertainties

described in KMI’s reports filed with the Securities and Exchange

Commission (SEC), including its Annual Report on Form 10-K for the

year-ended December 31, 2022 (under the headings “Risk Factors” and

“Information Regarding Forward-Looking Statements” and elsewhere)

and its subsequent reports, which are available through the SEC’s

EDGAR system at www.sec.gov and on KMI’s website at

ir.kindermorgan.com. Forward-looking statements speak only as of

the date they were made, and except to the extent required by law,

KMI undertakes no obligation to update any forward-looking

statement because of new information, future events or other

factors. Because of these risks and uncertainties, readers should

not place undue reliance on these forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231228406793/en/

KINDER MORGAN CONTACTS Vicky

Oddi Media Relations newsroom@kindermorgan.com

Investor Relations (800) 348-7320 km_ir@kindermorgan.com

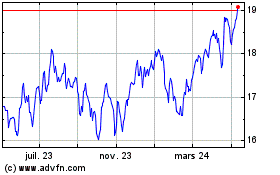

Kinder Morgan (NYSE:KMI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

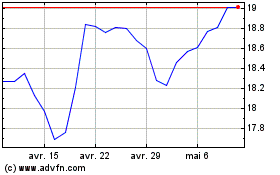

Kinder Morgan (NYSE:KMI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025