Earnings per Share (EPS) up 11% and Adjusted

EPS up 14%

Announces $1.7 billion Trident Intrastate

Pipeline Project

Kinder Morgan, Inc.’s (NYSE: KMI) board of directors today

approved a cash dividend of $0.2875 per share for the fourth

quarter ($1.15 annualized), payable on February 18, 2025, to

stockholders of record as of the close of business on February 3,

2025. This dividend is a 2% increase over the fourth quarter of

2023.

KMI is reporting:

- Fourth quarter earnings per share (EPS) of $0.30, up 11%

compared to the fourth quarter of 2023 and Adjusted EPS of $0.32,

up 14% compared to the fourth quarter of 2023.

- Net income attributable to KMI of $667 million, compared to

$594 million in the fourth quarter of 2023.

- Adjusted EBITDA of $2,063 million, up 7% versus the fourth

quarter of 2023.

“The company enjoyed another exceptional quarter, with very

strong operational and financial performance. We continued to

internally fund high-quality capital projects while generating cash

flow from operations of $1.5 billion and $0.7 billion in free cash

flow (FCF) after capital expenditures. With robust market

fundamentals and a new Administration committed to expediting

energy infrastructure projects, the future looks bright,” said

Executive Chairman Richard D. Kinder.

“KMI had a very strong fourth quarter on increased financial

contributions from our Natural Gas Pipelines, Products Pipelines

and Terminals business segments, with Adjusted EBITDA up 7% versus

the fourth quarter of 2023. Our balance sheet remains healthy, as

we ended the year with a Net Debt-to-Adjusted EBITDA ratio of 4.0

times,” said Chief Executive Officer Kim Dang.

“We are also today announcing the Trident Intrastate Pipeline

Project, an approximately 216-mile pipeline build underpinned by

long-term contracts that will provide approximately 1.5 billion

cubic feet per day (Bcf/d) of capacity from Katy, Texas to the LNG

and industrial corridor near Port Arthur, Texas,” continued

Dang.

“Further, during the quarter we secured additional long-term,

binding transportation agreements on our previously announced

Mississippi Crossing Project, resulting in a current project

subscription of approximately 1.8 Bcf/d. The estimated $1.6 billion

project is now designed to transport up to 2.1 Bcf/d of natural gas

through the construction of nearly 206 miles of 42-inch and 36-inch

pipeline and three new compressor stations.

“For several quarters now, we have pointed to expected

significant new natural gas demand for LNG, power plants, and

emerging opportunities such as artificial intelligence operations,

cryptocurrency mining, data centers and industrial re-shoring.

These expectations are being realized. Our commercial teams have

secured contracts to underpin three large natural gas projects -

South System Expansion 4, Mississippi Crossing and Trident,

totaling approximately $5 billion (KM share) in project costs.

These projects are all progressing and are expected to contribute

to significant future growth once in service,” said Dang.

“Our project backlog also reflects this strong natural gas

demand. At the end of the fourth quarter of 2024, the backlog stood

at $8.1 billion, a nearly 60% increase compared to $5.1 billion in

the third quarter of 2024. Natural gas projects account for

approximately 89% of the backlog. In calculating backlog Project

EBITDA multiples, we exclude both the capital and EBITDA from our

CO2 enhanced oil recovery projects and our gathering and processing

projects, where first full year multiples are more favorable but

the earnings are more uneven than with our other business segments.

We expect the remaining $7.0 billion of projects in the backlog,

when realized, to generate an aggregate first full year Project

EBITDA multiple of approximately 5.8 times (up 0.4 times versus the

previous quarter).

2025 Outlook

For 2025, KMI budgeted net income attributable to KMI of $2.8

billion, up 8% versus 2024 and Adjusted EPS of $1.27, up 10% from

2024. KMI expects to declare dividends of $1.17 per share for 2025,

a 2% increase from the dividends declared for 2024. The company

also budgeted 2025 Adjusted EBITDA of $8.3 billion, up 4% versus

2024, and to end 2025 with a Net Debt-to-Adjusted EBITDA ratio of

3.8 times. These amounts do not include contributions from the

Outrigger Energy II acquisition discussed below.

The budget assumes average annual prices for West Texas

Intermediate (WTI) crude oil and Henry Hub natural gas of $68 per

barrel and $3.00 per million British thermal units (MMBtu),

respectively, consistent with the published forward curve available

during the company’s annual budget process.

We plan to publish our annual outlook and budget presentation,

which will provide more detail on our 2025 budget, to KMI’s website

at:

https://ir.kindermorgan.com/events-and-presentations/default.aspx

on Wednesday, February 5, 2025.

This press release includes Adjusted Net Income Attributable to

KMI, Adjusted EPS, Adjusted Segment EBDA, Adjusted EBITDA, Net

Debt, FCF and Project EBITDA, all of which are non-GAAP financial

measures. For descriptions of these non-GAAP financial measures and

reconciliations to the most comparable measures prepared in

accordance with generally accepted accounting principles, please

see “Non-GAAP Financial Measures” and the tables accompanying our

preliminary financial statements. Historically, KMI has disclosed

budgeted distributable cash flow, or DCF, in the aggregate and per

share. Consistent with KMI’s December 9, 2024 press release

announcing 2025 financial expectations, this press release does not

include discussion of DCF, due to declining investor interest in

DCF as a primary performance measure. However, historical DCF is

provided in Table 6 as supplemental information for comparability

purposes.

Overview of Business

Segments

“The Natural Gas Pipelines business segment’s improved

financial performance in the fourth quarter of 2024 relative to the

fourth quarter of 2023 was due primarily to continued higher

contributions from our Texas Intrastate system, additional

contributions from our STX Midstream acquisition and continued

higher contributions from expansion projects on Tennessee Gas

Pipeline (TGP), partially offset by lower contributions from our

gathering systems due to lower volumes,” said KMI President Tom

Martin.

“Natural gas transport volumes were flat to the fourth quarter

of 2023. Natural gas gathering volumes were down 7% from the fourth

quarter of 2023, primarily from our Haynesville and Bakken

gathering systems due to lower commodity prices. On a full-year

basis, gathering volumes were up 6% versus 2023.

“Contributions from the Products Pipelines business

segment were up compared to the fourth quarter of 2023 on higher

rates in the fourth quarter of 2024 and the impact of declining

commodity prices in the prior year period, partially offset by

lower volumes on our Hiland gathering system. Total refined

products volumes were up 2%, and crude and condensate volumes were

down 5%, compared to the fourth quarter of 2023,” Martin said.

“Terminals business segment earnings were up compared to

the fourth quarter of 2023. The increase was led by our Jones Act

tanker fleet, which benefited from higher rates and remains fully

contracted under term charter agreements. Our bulk business

benefited from increased contributions from our petroleum coke

handling activities. Contributions from liquids terminals were

higher versus the prior year period largely owing to the impact of

expansion projects placed into service,” continued Martin.

“CO2 business segment earnings were down compared to the

fourth quarter of 2023 due to the divestiture of certain assets

earlier in the year and lower crude oil, CO2 and NGL volumes,

partially offset by contributions from the North McElroy Unit

acquired earlier in the year as well as lower power costs. Full

year crude net-to-KMI volumes were down 6% versus the prior year,

though within 1% of plan, and would have slightly exceeded plan

excluding acquisitions and divestitures,” said Martin.

Other News

Natural Gas Pipelines

- KMI is proceeding with its approximately $1.7 billion Trident

Intrastate Pipeline project. The approximately 216-mile project is

underpinned by long-term contracts and will provide approximately

1.5 Bcf/d of capacity from Katy, Texas to the LNG and industrial

corridor near Port Arthur, Texas. Pending receipt of all required

permits and approvals, KMI expects the project to be in service in

the first quarter of 2027.

- On January 13, 2025, KMI announced that its subsidiary, Hiland

Partners Holdings LLC, agreed to purchase a natural gas gathering

and processing system in North Dakota from Outrigger Energy II for

$640 million. The acquisition includes a 270 million cubic feet per

day (MMcf/d) processing facility and a 104-mile, large-diameter,

high-pressure rich gas gathering header pipeline with 350 MMcf/d of

capacity connecting supplies from the Williston Basin area to

high-demand markets. The gathering and processing system is backed

by long-term contracts with commitments from major customers in the

basin. KMI expects the acquisition to be immediately accretive to

its shareholders, with a 2025 Adjusted EBITDA multiple of

approximately 8 times on a full-year basis. Adjusted EBITDA does

not include approximately $20 million of expected cash payments in

2025 that receive deferred revenue recognition. The transaction is

subject to clearance under Hart-Scott-Rodino and is expected to

close in the first quarter of 2025.

- On December 19, 2024, TGP announced its decision to proceed

with its Mississippi Crossing (MSX) project after securing

long-term, binding transportation agreements for 1.5 Bcf/d of

capacity. Since then, TGP has secured additional long-term, binding

transportation agreements resulting in a current project

subscription of approximately 1.8 Bcf/d. The estimated $1.6 billion

project is now designed to transport up to 2.1 Bcf/d of natural gas

through the construction of nearly 206 miles of 42-inch and 36-inch

pipeline and three new compressor stations. The project will

originate near Greenville, Mississippi, and conclude near Butler,

Alabama, with connections to the existing TGP system and

third-party pipelines to provide critical supply access sourced

from multiple supply basins. Pending the receipt of all required

permits and clearances, the project is expected to be placed in

service in November 2028.

- Preliminary survey work is progressing on the South System

Expansion 4 (SSE4) project designed to increase Southern Natural

Gas’s (SNG) South Line capacity by approximately 1.2 Bcf/d. Upon

completion, the approximately $3 billion project will help meet

growing power generation and local distribution company demand in

the Southeast. SSE4 will be completed in two phases and is almost

entirely comprised of brownfield looping and horsepower compression

additions on the SNG and Elba Express (EEC) pipeline systems

(KM-share approximately $1.7 billion, including EEC). Subject to

all required approvals, KMI expects to place the first phase of the

project in service in the fourth quarter of 2028 and the second

phase in the fourth quarter of 2029.

- Preliminary construction activities are underway on the fully

contracted Gulf Coast Express Pipeline LLC (GCX) expansion project.

The $455 million expansion project (KM-share approximately $161

million) is designed to increase by 570 MMcf/d natural gas

deliveries from the Permian Basin to South Texas markets. Subject

to all required approvals, the project is expected to be in service

in mid-2026.

- Construction continues on the second phase of the approximately

$672 million Evangeline Pass project, which has an expected

in-service date of July 1, 2025. The two-phase project involves

modifications and enhancements to portions of the TGP and SNG

systems in Mississippi and Louisiana, resulting in the delivery of

approximately 2 Bcf/d of natural gas to Venture Global’s

Plaquemines LNG facility.

Terminals

- Construction is nearing completion on KMI’s latest expansion of

its industry-leading RD and SAF feedstock storage and logistics

offering at its lower Mississippi River hub. The approximately $54

million project at its Geismar River Terminal in Geismar, Louisiana

involves the construction of multiple tanks totaling approximately

250,000 barrels of heated storage capacity as well as various

marine, rail and pipeline infrastructure improvements. Due to

contractor delays, the project is now expected to be in service in

the first quarter of 2025.

Products

- In December 2024, the Kinder Morgan petroleum condensate

processing facility’s existing customer exercised its unilateral

right to extend its contract at existing rates for five years,

taking the term through 2030. The extension is a recognition of the

competitive value of the processing facility’s connectivity in the

Houston Ship Channel hub.

Energy Transition Ventures

- Autumn Hills RNG is expected to be placed into service in the

coming weeks. With a capacity of 0.8 Bcf of RNG annually, this

additional facility will bring KMI’s total RNG generation capacity

to 6.9 Bcf per year.

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy

infrastructure companies in North America. Access to reliable,

affordable energy is a critical component for improving lives

around the world. We are committed to providing energy

transportation and storage services in a safe, efficient and

environmentally responsible manner for the benefit of the people,

communities and businesses we serve. We own an interest in or

operate approximately 79,000 miles of pipelines, 139 terminals, 702

Bcf of working natural gas storage capacity and have renewable

natural gas generation capacity of approximately 6.1 Bcf per year

with an additional 0.8 Bcf in development. Our pipelines transport

natural gas, refined petroleum products, crude oil, condensate,

CO2, renewable fuels and other products, and our terminals store

and handle various commodities including gasoline, diesel fuel, jet

fuel, chemicals, metals, petroleum coke, and ethanol and other

renewable fuels and feedstocks. Learn more about our work advancing

energy solutions on the lower carbon initiatives page at

www.kindermorgan.com.

Please join Kinder Morgan, Inc. at 4:30 p.m. ET on Wednesday,

January 22, at www.kindermorgan.com for a LIVE webcast conference

call on the company’s fourth quarter earnings.

Non-GAAP Financial

Measures

As described in further detail below, our management evaluates

our performance primarily using Net income attributable to Kinder

Morgan, Inc. and Segment earnings before DD&A expenses

including amortization of excess cost of equity investments (EBDA),

along with the non-GAAP financial measures of Adjusted Net income

attributable to Common Stock, and distributable cash flow (DCF),

both in the aggregate and per share for each, Adjusted Segment

EBDA, Adjusted Net income attributable to Kinder Morgan, Inc.,

Adjusted earnings before interest, income taxes, DD&A expenses

including amortization of excess cost of equity investments

(EBITDA), and Net Debt.

Our non-GAAP financial measures described below should not be

considered alternatives to GAAP net income attributable to Kinder

Morgan, Inc. or other GAAP measures and have important limitations

as analytical tools. Our computations of these non-GAAP financial

measures may differ from similarly titled measures used by others.

You should not consider these non-GAAP financial measures in

isolation or as substitutes for an analysis of our results as

reported under GAAP. Management compensates for the limitations of

our consolidated non-GAAP financial measures by reviewing our

comparable GAAP measures identified in the descriptions of

consolidated non-GAAP measures below, understanding the differences

between the measures and taking this information into account in

its analysis and its decision-making processes.

Certain Items, as adjustments used

to calculate our non-GAAP financial measures, are items that are

required by GAAP to be reflected in net income attributable to

Kinder Morgan, Inc., but typically either (1) do not have a cash

impact (for example, unsettled commodity hedges and asset

impairments), or (2) by their nature are separately identifiable

from our normal business operations and in most cases are likely to

occur only sporadically (for example, certain legal settlements,

enactment of new tax legislation and casualty losses). (See the

accompanying Tables 2, 3, and 5.) We also include adjustments

related to joint ventures (see “Amounts from

Joint Ventures” below).

The following table summarizes our Certain Items for the three

and twelve months ended December 31, 2024 and 2023.

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

(In millions)

Certain Items

Change in fair value of derivative

contracts (1)

40

(33

)

72

(126

)

Loss (gain) on divestitures and

impairment, net

1

—

(69

)

67

Income tax Certain Items (2)

(4

)

27

(52

)

33

Other (3)

4

45

7

45

Total Certain Items (4)(5)

$

41

$

39

$

(42

)

$

19

Notes

(1)

Gains or losses are reflected

when realized.

(2)

Represents the income tax

provision on Certain Items plus discrete income tax items. Includes

the impact of KMI’s income tax provision on Certain Items affecting

earnings from equity investments and is separate from the related

tax provision recognized at the investees by the joint ventures

which are also taxable entities.

(3)

Three-month and twelve-month

periods of 2023 represent pension cost adjustments related to

settlements made by our pension plans.

(4)

Amount for the twelve-month

period ending December 31, 2023 includes the following amount

reported within “Earnings from equity investments” on the

accompanying Preliminary Consolidated Statements of Income: $67

million of “Loss (gain) on divestitures and impairment, net” for a

non-cash impairment related to our investment in Double Eagle

Pipeline LLC in our Products Pipelines business segment.

(5)

Amounts for the periods ending

December 31, 2024 and 2023 include the following amounts reported

within "Interest, net" on the accompanying Preliminary Consolidated

Statements of Income: $(10) million and $3 million for the

three-month periods, respectively, and $(5) million and $(7)

million for the twelve-month periods, respectively, of “Change in

fair value of derivative contracts.”

Adjusted Net Income Attributable to Kinder

Morgan, Inc. is calculated by adjusting net income

attributable to Kinder Morgan, Inc. for Certain Items. Adjusted Net

Income Attributable to Kinder Morgan, Inc. is used by us, investors

and other external users of our financial statements as a

supplemental measure that provides decision-useful information

regarding our period-over-period performance and ability to

generate earnings that are core to our ongoing operations. We

believe the GAAP measure most directly comparable to Adjusted Net

Income Attributable to Kinder Morgan, Inc. is net income

attributable to Kinder Morgan, Inc. (See the accompanying Tables 1

and 2.)

Adjusted Net Income Attributable to Common

Stock is calculated by adjusting Net income attributable to

Kinder Morgan, Inc., the most comparable GAAP measure, for Certain

Items, and further for net income allocated to participating

securities and adjusted net income in excess of distributions for

participating securities. We believe Adjusted Net Income

Attributable to Common Stock allows for calculation of adjusted

earnings per share (Adjusted EPS) on the most comparable basis with

earnings per share, the most comparable GAAP measure to Adjusted

EPS. Adjusted EPS is calculated as

Adjusted Net Income Attributable to Common Stock divided by our

weighted average shares outstanding. Adjusted EPS applies the same

two-class method used in arriving at basic earnings per share.

Adjusted EPS is used by us, investors and other external users of

our financial statements as a per-share supplemental measure that

provides decision-useful information regarding our

period-over-period performance and ability to generate earnings

that are core to our ongoing operations. (See the accompanying

Table 2.)

Adjusted Segment EBDA is calculated

by adjusting segment earnings before DD&A and amortization of

excess cost of equity investments, general and administrative

expenses and corporate charges, interest expense, and income taxes

(Segment EBDA) for Certain Items attributable to the segment.

Adjusted Segment EBDA is used by management in its analysis of

segment performance and management of our business. We believe

Adjusted Segment EBDA is a useful performance metric because it

provides management, investors and other external users of our

financial statements additional insight into performance trends

across our business segments, our segments’ relative contributions

to our consolidated performance and the ability of our segments to

generate earnings on an ongoing basis. Adjusted Segment EBDA is

also used as a factor in determining compensation under our annual

incentive compensation program for our business segment presidents

and other business segment employees. We believe it is useful to

investors because it is a measure that management uses to allocate

resources to our segments and assess each segment’s performance.

(See the accompanying Table 3.)

Adjusted EBITDA is calculated by

adjusting net income attributable to Kinder Morgan, Inc. for

Certain Items and further for DD&A and amortization of excess

cost of equity investments, income tax expense and interest. We

also include amounts from joint ventures for income taxes and

DD&A (see “Amounts from Joint

Ventures” below). Adjusted EBITDA (on a rolling 12-months

basis) is used by management, investors and other external users,

in conjunction with our Net Debt (as described further below), to

evaluate our leverage. Management and external users also use

Adjusted EBITDA as an important metric to compare the valuations of

companies across our industry. Our ratio of Net Debt-to-Adjusted

EBITDA is used as a supplemental performance target for purposes of

our annual incentive compensation program. We believe the GAAP

measure most directly comparable to Adjusted EBITDA is net income

attributable to Kinder Morgan, Inc. (See the accompanying Tables 2

and 5.)

Amounts from Joint Ventures -

Certain Items, DCF and Adjusted EBITDA reflect amounts from

unconsolidated joint ventures (JVs) and consolidated JVs utilizing

the same recognition and measurement methods used to record

“Earnings from equity investments” and “Noncontrolling interests

(NCI),” respectively. The calculations of DCF and Adjusted EBITDA

related to our unconsolidated and consolidated JVs include the same

items (DD&A and income tax expense, and for DCF only, also cash

taxes and sustaining capital expenditures) with respect to the JVs

as those included in the calculations of DCF and Adjusted EBITDA

for our wholly-owned consolidated subsidiaries; further, we remove

the portion of these adjustments attributable to non-controlling

interests. (See Tables 2, 5 and 6.) Although these amounts related

to our unconsolidated JVs are included in the calculations of DCF

and Adjusted EBITDA, such inclusion should not be understood to

imply that we have control over the operations and resulting

revenues, expenses or cash flows of such unconsolidated JVs.

Net Debt is calculated by

subtracting from debt (1) cash and cash equivalents, (2) debt fair

value adjustments, and (3) the foreign exchange impact on

Euro-denominated bonds for which we have entered into currency

swaps to convert that debt to U.S. dollars. Net Debt, on its own

and in conjunction with our Adjusted EBITDA (on a rolling 12-months

basis) as part of a ratio of Net Debt-to-Adjusted EBITDA, is a

non-GAAP financial measure that is used by management, investors

and other external users of our financial information to evaluate

our leverage. Our ratio of Net Debt-to-Adjusted EBITDA is also used

as a supplemental performance target for purposes of our annual

incentive compensation program. We believe the most comparable

measure to Net Debt is total debt as reconciled in the notes to the

accompanying Preliminary Consolidated Balance Sheets in Table

5.

DCF is calculated by adjusting net

income attributable to Kinder Morgan, Inc. for Certain Items, and

further for DD&A and amortization of excess cost of equity

investments, income tax expense, cash taxes, sustaining capital

expenditures and other items. We also adjust amounts from joint

ventures for income taxes, DD&A, cash taxes and sustaining

capital expenditures (see “Amounts from Joint

Ventures” below). DCF is used by us to evaluate our

performance and to measure and estimate the ability of our assets

to generate economic earnings after paying interest expense, paying

cash taxes and expending sustaining capital. DCF provides

additional insight into the specific costs associated with our

assets in the current period and facilitates period-to-period

comparisons of our performance from ongoing business activities.

DCF per share serves as the primary financial performance target

for purposes of annual bonuses under our annual incentive

compensation program and for performance-based vesting of equity

compensation grants under our long-term incentive compensation

program. DCF should not be used as an alternative to net cash

provided by operating activities computed under GAAP. We believe

the GAAP measure most directly comparable to DCF is net income

attributable to Kinder Morgan, Inc. DCF per share is DCF divided by

average outstanding shares, including restricted stock awards that

participate in dividends. (See the accompanying Table 6.)

Project EBITDA is calculated for an

individual capital project as earnings before interest expense,

taxes, DD&A and general and administrative expenses

attributable to such project, or for JV projects, consistent with

the methods described above under “Amounts from Joint Ventures,”

and in conjunction with capital expenditures for the project, is

the basis for our Project EBITDA multiple. Management, investors

and others use Project EBITDA to evaluate our return on investment

for capital projects before expenses that are generally not

controllable by operating managers in our business segments. We

believe the GAAP measure most directly comparable to Project EBITDA

is the portion of net income attributable to a capital project. We

do not provide the portion of budgeted net income attributable to

individual capital projects (the GAAP financial measure most

directly comparable to Project EBITDA) due to the impracticality of

predicting, on a project-by-project basis through the second full

year of operations, certain amounts required by GAAP, such as

projected commodity prices, unrealized gains and losses on

derivatives marked to market, and potential estimates for certain

contingent liabilities associated with the project completion.

FCF is calculated by reducing cash

flow from operations for capital expenditures (sustaining and

expansion), and FCF after dividends is calculated by further

reducing FCF for dividends paid during the period. FCF is used by

management, investors and other external users as an additional

leverage metric, and FCF after dividends provides additional

insight into cash flow generation. Therefore, we believe FCF is

useful to our investors. We believe the GAAP measure most directly

comparable to FCF is cash flow from operations. (See the

accompanying Table 7.)

Important Information Relating to

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 and Section 21E of the Securities Exchange Act of 1934.

Generally the words “expects,” “believes,” “anticipates,” “plans,”

“will,” “shall,” “estimates,” “projects,” and similar expressions

identify forward-looking statements, which are generally not

historical in nature. Forward-looking statements in this news

release include, among others, express or implied statements

pertaining to: the long-term demand for KMI’s assets and services;

energy evolution-related opportunities; KMI’s 2025 expectations;

anticipated dividends; and KMI’s capital projects, including

expected costs, completion timing and benefits of those projects.

Forward-looking statements are subject to risks and uncertainties

and are based on the beliefs and assumptions of management, based

on information currently available to them. Although KMI believes

that these forward-looking statements are based on reasonable

assumptions, it can give no assurance as to when or if any such

forward-looking statements will materialize nor their ultimate

impact on our operations or financial condition. Important factors

that could cause actual results to differ materially from those

expressed in or implied by these forward-looking statements

include: the timing and extent of changes in the supply of and

demand for the products we transport and handle; trends expected to

drive new natural gas demand for electricity generation; commodity

prices; counterparty financial risk; and the other risks and

uncertainties described in KMI’s reports filed with the Securities

and Exchange Commission (SEC), including its Annual Report on Form

10-K for the year-ended December 31, 2023 (under the headings “Risk

Factors” and “Information Regarding Forward-Looking Statements” and

elsewhere), and its subsequent reports, which are available through

the SEC’s EDGAR system at www.sec.gov and on our website at

ir.kindermorgan.com. Forward-looking statements speak only as of

the date they were made, and except to the extent required by law,

KMI undertakes no obligation to update any forward-looking

statement because of new information, future events or other

factors. Because of these risks and uncertainties, readers should

not place undue reliance on these forward-looking statements.

Table 1

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Consolidated

Statements of Income

(In millions, except per share

amounts, unaudited)

Three Months Ended

December 31,

% change

Year Ended

December 31,

% change

2024

2023

2024

2023

Revenues

$

3,987

$

4,038

$

15,100

$

15,334

Operating costs, expenses and other

Costs of sales (exclusive of items shown

separately below)

1,239

1,347

4,337

4,938

Operations and maintenance

761

745

2,972

2,807

Depreciation, depletion and

amortization

596

567

2,354

2,250

General and administrative

182

171

712

668

Taxes, other than income taxes

106

102

433

421

Other (income) expense, net

(5

)

5

(92

)

(13

)

Total operating costs, expenses and

other

2,879

2,937

10,716

11,071

Operating income

1,108

1,101

4,384

4,263

Other income (expense)

Earnings from equity investments

228

231

890

838

Amortization of excess cost of equity

investments

(13

)

(12

)

(50

)

(66

)

Interest, net

(442

)

(452

)

(1,844

)

(1,797

)

Other, net

10

(44

)

27

(37

)

Income before income taxes

891

824

3,407

3,201

Income tax expense

(197

)

(206

)

(687

)

(715

)

Net income

694

618

2,720

2,486

Net income attributable to NCI

(27

)

(24

)

(107

)

(95

)

Net income attributable to Kinder

Morgan, Inc.

$

667

$

594

$

2,613

$

2,391

Class P Shares

Basic and diluted earnings per share

$

0.30

$

0.27

11

%

$

1.17

$

1.06

10

%

Basic and diluted weighted average shares

outstanding

2,222

2,221

—

%

2,220

2,234

(1

)%

Declared dividends per share

$

0.2875

$

0.2825

2

%

$

1.15

$

1.13

2

%

Adjusted Net Income Attributable to

Kinder Morgan, Inc. (1)

$

708

$

633

12

%

$

2,571

$

2,410

7

%

Adjusted EPS (1)

$

0.32

$

0.28

14

%

$

1.15

$

1.07

7

%

Notes

(1)

Adjusted Net Income Attributable

to Kinder Morgan, Inc. is Net income attributable to Kinder Morgan,

Inc. adjusted for Certain Items. Adjusted EPS calculation uses

Adjusted Net Income Attributable to Common Stock. See Table 2 for

reconciliations.

Table 2

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Net Income

Attributable to Kinder Morgan, Inc. to Adjusted Net Income

Attributable to Kinder Morgan, Inc., to Adjusted Net Income

Attributable to Common Stock and to Adjusted EBITDA

Reconciliations

(In millions,

unaudited)

Three Months Ended

December 31,

% change

Year Ended

December 31,

% change

2024

2023

2024

2023

Net income attributable to Kinder

Morgan, Inc.

$

667

$

594

12

%

$

2,613

$

2,391

9

%

Certain Items (1)

Change in fair value of derivative

contracts

40

(33

)

72

(126

)

Loss (gain) on divestitures and

impairment, net

1

—

(69

)

67

Income tax Certain Items

(4

)

27

(52

)

33

Other

4

45

7

45

Total Certain Items

41

39

5

%

(42

)

19

(321

)%

Adjusted Net Income Attributable to

Kinder Morgan, Inc.

$

708

$

633

12

%

$

2,571

$

2,410

7

%

Net income attributable to Kinder

Morgan, Inc.

$

667

$

594

12

%

$

2,613

$

2,391

9

%

Total Certain Items (2)

41

39

(42

)

19

Net income allocated to participating

securities (3)

(3

)

(3

)

(15

)

(14

)

Other (4)

(1

)

—

1

—

Adjusted Net Income Attributable to

Common Stock

$

704

$

630

12

%

$

2,557

$

2,396

7

%

Net income attributable to Kinder

Morgan, Inc.

$

667

$

594

12

%

$

2,613

$

2,391

9

%

Total Certain Items (2)

41

39

(42

)

19

DD&A

596

567

2,354

2,250

Amortization of excess cost of equity

investments

13

12

50

66

Income tax expense (5)

201

179

739

682

Interest, net (6)

452

449

1,849

1,804

Amounts from joint ventures

Unconsolidated JV DD&A

88

82

359

323

Remove consolidated JV partners'

DD&A

(15

)

(16

)

(62

)

(63

)

Unconsolidated JV income tax expense

(7)

20

19

78

89

Adjusted EBITDA

$

2,063

$

1,925

7

%

$

7,938

$

7,561

5

%

Notes

(1)

See table included in “Non-GAAP

Financial Measures—Certain Items.”

(2)

For a detailed listing, see the

above reconciliation of Net Income Attributable to Kinder Morgan,

Inc. to Adjusted Net Income Attributable to Kinder Morgan, Inc.

(3)

Net income allocated to common

stock and participating securities is based on the amount of

dividends paid in the current period plus an allocation of the

undistributed earnings or excess distributions over earnings to the

extent that each security participates in earnings or excess

distributions over earnings, as applicable.

(4)

Adjusted net income in excess of

distributions for participating securities.

(5)

To avoid duplication, adjustments

for income tax expense for the periods ended December 31, 2024 and

2023 exclude $(4) million and $27 million for the three-month

periods, respectively, and $(52) million and $33 million for the

twelve-month periods, respectively, which amounts are already

included within “Certain Items.” See table included in “Non-GAAP

Financial Measures—Certain Items.”

(6)

To avoid duplication, adjustments

for interest, net for the periods ended December 31, 2024 and 2023

exclude $(10) million and $3 million for the three-month periods,

respectively, and $(5) million and $(7) million for the

twelve-month periods, respectively, which amounts are already

included within “Certain Items.” See table included in “Non-GAAP

Financial Measures—Certain Items.”

(7)

Includes the tax provision on

Certain Items recognized by the investees that are taxable entities

associated with our Citrus, NGPL and Products (SE) Pipe Line equity

investments. The impact of KMI’s income tax provision on Certain

Items affecting earnings from equity investments is included within

“Certain Items” above.

Table 3

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Reconciliation of

Segment EBDA to Adjusted Segment EBDA

(In millions,

unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Segment EBDA (1)

Natural Gas Pipelines Segment EBDA

$

1,392

$

1,353

$

5,427

$

5,282

Certain Items (2)

Change in fair value of derivative

contracts

46

(23

)

75

(122

)

Gain on divestiture

—

—

(29

)

—

Natural Gas Pipelines Adjusted Segment

EBDA

$

1,438

$

1,330

$

5,473

$

5,160

Products Pipelines Segment EBDA

$

302

$

282

$

1,173

$

1,062

Certain Items (2)

Change in fair value of derivative

contracts

—

(4

)

—

(1

)

Loss on impairment

—

—

—

67

Products Pipelines Adjusted Segment

EBDA

$

302

$

278

$

1,173

$

1,128

Terminals Segment EBDA

$

281

$

266

$

1,099

$

1,040

Certain Items (2)

Change in fair value of derivative

contracts

1

—

—

—

Terminals Adjusted Segment EBDA

$

282

$

266

$

1,099

$

1,040

CO2 Segment EBDA

$

158

$

179

$

692

$

689

Certain Items (2)

Change in fair value of derivative

contracts

3

(9

)

2

4

Loss (gain) on divestiture, net

1

—

(40

)

—

CO2 Adjusted Segment EBDA

$

162

$

170

$

654

$

693

Notes

(1)

Includes revenues, earnings from

equity investments, operating expenses, other (income) expense,

net, and other, net. Operating expenses include costs of sales,

operations and maintenance expenses, and taxes, other than income

taxes. The composition of Segment EBDA is not addressed nor

prescribed by generally accepted accounting principles.

(2)

See “Non-GAAP Financial

Measures—Certain Items.”

Table 4

Segment Volume and CO2 Segment

Hedges Highlights

(Historical data is pro forma

for acquired and divested assets, JV volumes at KMI share

(1))

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Natural Gas Pipelines

Transport volumes (BBtu/d)

44,507

44,722

44,252

44,132

Sales volumes (BBtu/d)

2,587

2,466

2,576

2,346

Gathering volumes (BBtu/d)

3,838

4,138

3,922

3,710

NGLs (MBbl/d)

40

35

38

34

Products Pipelines (MBbl/d)

Gasoline (2)

974

967

977

980

Diesel fuel

373

358

361

351

Jet fuel

297

288

294

285

Total refined product volumes

1,644

1,613

1,632

1,616

Crude and condensate

463

489

471

483

Total delivery volumes (MBbl/d)

2,107

2,102

2,103

2,099

Terminals

Liquids leasable capacity (MMBbl)

78.6

78.7

78.6

78.7

Liquids leased capacity %

95.2

%

93.3

%

94.6

%

93.6

%

Bulk transload tonnage (MMtons)

12.6

13.5

53.7

53.3

CO2

SACROC oil production

19.00

19.42

19.01

20.22

Yates oil production

6.26

6.58

6.13

6.63

Other

0.96

1.09

1.02

1.08

Total oil production - net (MBbl/d)

(3)

26.22

27.09

26.16

27.93

NGL sales volumes - net (MBbl/d) (3)

8.74

9.11

8.57

8.97

CO2 sales volumes - net (Bcf/d)

0.318

0.328

0.322

0.336

RNG sales volumes (BBtu/d)

11

7

9

6

Realized weighted average oil price ($ per

Bbl)

$

67.24

$

67.22

$

68.46

$

67.42

Realized weighted average NGL price ($ per

Bbl)

$

35.08

$

27.87

$

30.83

$

30.84

CO2 Segment Hedges

2025

2026

2027

2028

Crude Oil (4)

Price ($ per Bbl)$

$

66.61

$

65.94

$

65.71

$

64.55

Volume (MBbl/d)

20.90

13.40

8.10

3.70

NGLs

Price ($ per Bbl)$

$

48.98

Volume (MBbl/d)

3.13

Notes

(1)

Volumes for acquired assets are

included for all periods. However, EBDA contributions from

acquisitions are included only for periods subsequent to their

acquisition. Volumes for assets divested, idled and/or held for

sale are excluded for all periods presented.

(2)

Gasoline volumes include ethanol

pipeline volumes.

(3)

Net of royalties and outside

working interests.

(4)

Includes West Texas Intermediate

hedges.

Table 5

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Consolidated

Balance Sheets

(In millions,

unaudited)

December 31,

December 31,

2024

2023

Assets

Cash and cash equivalents

$

88

$

83

Other current assets

2,433

2,459

Property, plant and equipment, net

38,013

37,297

Investments

7,845

7,874

Goodwill

20,084

20,121

Deferred charges and other assets

2,944

3,186

Total assets

$

71,407

$

71,020

Liabilities and Stockholders'

Equity

Short-term debt

$

2,009

$

4,049

Other current liabilities

3,092

3,172

Long-term debt

29,779

27,880

Debt fair value adjustments

102

187

Other

4,558

4,003

Total liabilities

39,540

39,291

Other stockholders' equity

30,626

30,523

Accumulated other comprehensive loss

(95

)

(217

)

Total KMI stockholders' equity

30,531

30,306

Noncontrolling interests

1,336

1,423

Total stockholders' equity

31,867

31,729

Total liabilities and stockholders'

equity

$

71,407

$

71,020

Net Debt (1)

$

31,725

$

31,837

Adjusted EBITDA Twelve Months

Ended (2)

Reconciliation of Net Income

Attributable to Kinder Morgan, Inc. to Last Twelve Months Adjusted

EBITDA

December 31,

December 31,

2024

2023

Net income attributable to Kinder

Morgan, Inc.

$

2,613

$

2,391

Total Certain Items (3)

(42

)

19

DD&A

2,354

2,250

Amortization of excess cost of equity

investments

50

66

Income tax expense (4)

739

682

Interest, net (4)

1,849

1,804

Amounts from joint ventures

Unconsolidated JV DD&A

359

323

Less: Consolidated JV partners'

DD&A

(62

)

(63

)

Unconsolidated JV income tax expense

78

89

Adjusted EBITDA

$

7,938

$

7,561

Net Debt-to-Adjusted EBITDA (5)

4.0

4.2

Notes

(1)

Amounts calculated as total debt,

less (i) cash and cash equivalents; (ii) debt fair value

adjustments; and (ii) the foreign exchange impact on our Euro

denominated debt of $(25) million and $9 million as of December 31,

2024 and 2023, respectively, as we have entered into swaps to

convert that debt to U.S.$.

(2)

Reflects the rolling 12-month

amounts for each period above.

(3)

See table included in “Non-GAAP

Financial Measures—Certain Items.”

(4)

Amounts are adjusted for Certain

Items. See “Non-GAAP Financial Measures—Certain Items” for more

information.

(5)

Year-end 2023 net debt reflects

borrowings to fund the STX Midstream acquisition that closed on

December 28, 2023. Including a full year of Adjusted EBITDA from

the acquired assets on a Pro Forma basis, the leverage ratio would

have been 4.1x.

Table 6

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Net Income

Attributable to Kinder Morgan, Inc. to DCF Reconciliation

(In millions, except per share

amounts, unaudited)

Three Months Ended

December 31,

% change

Year Ended

December 31,

% change

2024

2023

2024

2023

Net income attributable to Kinder

Morgan, Inc.

$

667

$

594

12

%

$

2,613

$

2,391

9

%

Certain Items (1)

Change in fair value of derivative

contracts

40

(33

)

72

(126

)

Loss (gain) on divestitures and

impairment, net

1

—

(69

)

67

Income tax Certain Items

(4

)

27

(52

)

33

Other

4

45

7

45

Total Certain Items

41

39

5

%

(42

)

19

(321

)%

DD&A

596

567

2,354

2,250

Amortization of excess cost of equity

investments

13

12

50

66

Income tax expense (2)

201

179

739

682

Cash taxes

(8

)

(1

)

(33

)

(11

)

Sustaining capital expenditures (3)

(306

)

(275

)

(986

)

(868

)

Amounts from joint ventures

Unconsolidated JV DD&A

88

82

359

323

Remove consolidated JV partners'

DD&A

(15

)

(16

)

(62

)

(63

)

Unconsolidated JV income tax expense

(4)(5)

20

19

78

89

Unconsolidated JV cash taxes (4)

11

(3

)

(48

)

(76

)

Unconsolidated JV sustaining capital

expenditures

(57

)

(45

)

(189

)

(163

)

Remove consolidated JV partners'

sustaining capital expenditures

3

3

10

9

Other items (6)

9

16

38

67

DCF

$

1,263

$

1,171

8

%

$

4,881

$

4,715

4

%

Weighted average shares outstanding for

dividends (7)

2,235

2,234

2,233

2,247

DCF per share

$

0.57

$

0.52

10

%

$

2.19

$

2.10

4

%

Declared dividends per share

$

0.2875

$

0.2825

$

1.15

$

1.13

Notes

(1)

See table included in “Non-GAAP

Financial Measures—Certain Items.”

(2)

To avoid duplication, adjustments

for income tax expense for the periods ended December 31, 2024 and

2023 exclude $(4) million and $27 million for the three-month

periods, respectively, and $(52) million and $33 million for the

twelve-month periods, respectively, which amounts are already

included within “Certain Items.” See table included in “Non-GAAP

Financial Measures—Certain Items.”

(3)

Net of $9 million and $23 million

insurance reimbursements in the three and twelve-month periods

ended December 31, 2024, respectively, for a sustaining capital

expenditure project.

(4)

Associated with our Citrus, NGPL

and Products (SE) Pipe Line equity investments.

(5)

Includes the tax provision on

Certain Items recognized by the investees that are taxable

entities. The impact of KMI’s income tax provision on Certain Items

affecting earnings from equity investments is included within

“Certain Items” above. See table included in “Non-GAAP Financial

Measures—Certain Items.”

(6)

Includes non-cash pension

expense, non-cash compensation associated with our restricted stock

program and pension contributions.

(7)

Includes restricted stock awards

that participate in dividends.

Table 7

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Supplemental

Information

(In millions,

unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

KMI FCF

Net income attributable to Kinder Morgan,

Inc.

$

667

$

594

$

2,613

$

2,391

Net income attributable to noncontrolling

interests

27

24

107

95

DD&A

596

567

2,354

2,250

Amortization of excess cost of equity

investments

13

12

50

66

Deferred income taxes

193

215

647

710

Earnings from equity investments

(228

)

(231

)

(890

)

(838

)

Distribution of equity investment earnings

(1)

223

183

823

755

Working capital and other items (2)

19

958

(69

)

1,062

Cash flow from operations

1,510

2,322

5,635

6,491

Capital expenditures (GAAP)

(772

)

(628

)

(2,629

)

(2,317

)

FCF

738

1,694

3,006

4,174

Dividends paid

(642

)

(631

)

(2,557

)

(2,529

)

FCF after dividends

$

96

$

1,063

$

449

$

1,645

Notes

(1)

Periods ended December 31, 2024

and 2023 exclude distributions from equity investments in excess of

cumulative earnings of $60 million and $62 million for the

three-month periods, respectively, and $177 million and $228

million for the twelve-month periods, respectively. These are

included in cash flows from investing activities on our

consolidated statement of cash flows.

(2)

Three-month and twelve-month

periods of 2023 include $843 million for cash received related to

an agreement with a customer to prepay certain fixed reservation

charges under long-term transportation and terminaling contracts.

The prepayment related to contracts expiring from 2035 to 2040 and

was discounted to present value at a rate that was attractive to

our cost of issuing debt.

Table 8

Kinder Morgan, Inc. and

Subsidiaries

Reconciliation of Projected

Net Income Attributable to Kinder Morgan, Inc. to Projected

Adjusted EBITDA

(In billions,

unaudited)

2025 Budget

Net income attributable to Kinder

Morgan, Inc. (GAAP)

$

2.8

Total Certain Items (1)

—

DD&A

2.4

Income tax expense (2)

0.8

Interest, net

1.8

Amounts from joint ventures

Unconsolidated JV DD&A (3)

0.5

Remove consolidated JV partners'

DD&A

(0.1

)

Unconsolidated JV income tax expense

0.1

Adjusted EBITDA

$

8.3

Table 9

Kinder Morgan, Inc. and

Subsidiaries

Reconciliation of Projected

Net Income Attributable to Kinder Morgan, Inc. to Projected

Adjusted Net Income Attributable to Common Stock

(In billions,

unaudited)

2025 Budget

Net income attributable to Kinder

Morgan, Inc. (GAAP)

$

2.8

Total Certain Items (1)

—

Net income attributable to participating

securities (4)

—

Other (5)

—

Adjusted Net Income Attributable to

Common Stock (6)

$

2.8

Notes

(1)

Aggregate adjustments are

currently estimated to be less than $100 million.

(2)

Amounts are adjusted for Certain

Items.

(3)

Includes amortization of basis

differences related to our JVs.

(4)

Net income allocated to common

stock and participating securities is based on the amount of

dividends paid in the current period plus an allocation of the

undistributed earnings or excess distributions over earnings to the

extent that each security participates in earnings or excess

distributions over earnings, as applicable.

(5)

Adjusted net income in excess of

distributions for participating securities.

(6)

Adjusted Net Income Attributable

to Common Stock is used to calculate Adjusted EPS

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122821528/en/

Dave Conover Media Relations Newsroom@kindermorgan.com Investor

Relations (800) 348-7320 km_ir@kindermorgan.com

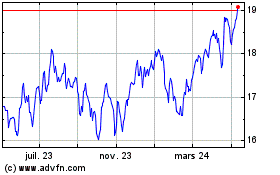

Kinder Morgan (NYSE:KMI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

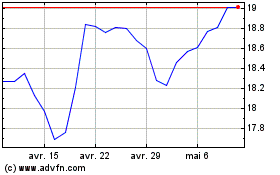

Kinder Morgan (NYSE:KMI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025