0001506307false00015063072024-10-162024-10-160001506307kmi:ClassPMember2024-10-162024-10-160001506307kmi:A2.25DueMarch2027NotesMember2024-10-162024-10-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 16, 2024

KINDER MORGAN, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35081 | 80-0682103 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

1001 Louisiana Street, Suite 1000

Houston, Texas 77002

(Address of principal executive offices, including zip code)

713-369-9000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class P Common Stock | KMI | New York Stock Exchange |

| 2.250% Senior Notes due 2027 | KMI 27 A | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition |

In accordance with General Instruction B.2. of Form 8-K, the following information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

On October 16, 2024, Kinder Morgan, Inc. issued a press release announcing its preliminary financial results for the quarter ended September 30, 2024 and that it will hold a webcast conference call on October 16, 2024 discussing those results. The press release is furnished as Exhibit 99.1 to this report.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover page interactive data file pursuant to Rule 406 of Regulation S-T formatted as Inline XBRL. |

S I G N A T U R E

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | Kinder Morgan, Inc. |

| | | | | Registrant |

| | | | | | | | | | | | | | | | | | | | |

| Dated: October 16, 2024 | | | | By: | /s/ David P. Michels | |

| | | | | | David P. Michels

Vice President and Chief Financial Officer |

KINDER MORGAN REPORTS THIRD QUARTER 2024

FINANCIAL RESULTS

Final Investment Decision Reached for Gulf Coast Express Pipeline Expansion

Earnings per Share (EPS) up 17% Compared to Third Quarter 2023

Adjusted EPS flat to Third Quarter 2023

HOUSTON, October 16, 2024 - Kinder Morgan, Inc.’s (NYSE: KMI) board of directors today approved a cash dividend of $0.2875 per share for the third quarter ($1.15 annualized), payable on November 15, 2024 to stockholders of record as of the close of business on October 31, 2024. This dividend is a 2% increase over the third quarter of 2023.

The company is reporting:

•Third quarter earnings per share (EPS) of $0.28, up 17% compared to the third quarter of 2023, Adjusted EPS of $0.25, flat to the third quarter of 2023 and distributable cash flow (DCF) per share of $0.49, flat to the third quarter of 2023.

•Net income attributable to KMI of $625 million, compared to $532 million in the third quarter of 2023.

•Adjusted EBITDA of $1,880 million, up 2% from $1,835 million in the third quarter of 2023.

“With war continuing in Ukraine and conflict escalating in the Middle East, the centrality of energy security to national security has never been more clear. We are proud to be part of a sector that provides that energy security to our fellow citizens, and increasingly allows allies to forego dependence on those who use energy as a geopolitical weapon,” said Executive Chairman Richard D. Kinder.

“As for our company, we enjoyed another solid quarter of strong operational and financial performance. We continued to internally fund high-quality capital projects while generating cash flow from operations of $1.2 billion, and $0.6 billion in free cash flow (FCF) after capital expenditures. With substantial projected increases in natural gas demand both domestically and globally in the coming decades, we have many opportunities on the horizon,” Kinder concluded.

“The company had a solid third quarter on increased financial contributions from our Natural Gas Pipelines and Terminals business segments, with Adjusted EBITDA up 2% versus the third quarter of 2023,” said Chief Executive Officer Kim Dang.

“Further, KMI’s balance sheet remains very strong, as we ended the quarter with a Net Debt-to-Adjusted EBITDA ratio of 4.1 times,” continued Dang.

“We advanced a number of exciting projects during the quarter, including finalizing the investment decision with respect to a $455 million expansion on the Gulf Coast Express Pipeline that will increase natural gas deliveries by 570 million cubic feet per day (MMcf/d) from the Permian Basin to South Texas markets. We are also developing an NGPL Gulf Coast Storage Expansion project that will provide approximately 10 billion cubic feet (Bcf) of incremental natural gas storage capacity on NGPL’s high-growth Gulf Coast system. Storage assets have never been in greater demand to help smooth the intermittency of renewable resources on the electric grid and to provide balancing services to the growing LNG market,” Dang continued.

“Discussions around opportunities related to significant new natural gas demand for electric generation associated with coal conversions at power plants, artificial intelligence operations, cryptocurrency mining, data centers and industrial re-shoring also continued during the quarter, and we now see an opportunity set well in excess of 5 Bcf/d in that area,” said Dang.

“Our project backlog at the end of the third quarter was $5.1 billion versus $5.2 billion in the second quarter of 2024. Holding our backlog nearly flat is notable given that we put $484 million of projects into service during the quarter. In calculating backlog Project EBITDA multiples, we exclude both the capital and EBITDA from our CO2 enhanced oil recovery projects and gathering and processing (G&P) projects, where the earnings are more uneven than with our other business segments. To compensate for those uneven earnings profiles, we require higher return thresholds for those projects. We expect the remaining $3.8 billion of projects in the backlog (flat to last quarter) to generate an average Project EBITDA multiple of approximately 5.4 times (as in the previous quarter).

“We are devoting approximately 86% of our project backlog to lower-carbon energy investments, including 83% to conventional natural gas, and the remainder to renewable natural gas (RNG), renewable diesel (RD), feedstocks associated with RD and sustainable aviation fuel (SAF), as well as carbon capture and sequestration,” Dang concluded.

2024 Outlook

For 2024, including contributions from the acquired STX Midstream assets, KMI budgeted net income attributable to KMI of $2.7 billion ($1.22 per share), up 15% versus 2023, and expects to declare dividends of $1.15 per share for 2024, a 2% increase from the dividends declared for 2023. The company also budgeted 2024 DCF of $5 billion ($2.26 per share), Adjusted EBITDA of $8.16 billion, both up 8% versus 2023, and to end 2024 with a Net Debt-to-Adjusted EBITDA ratio of 3.9 times.

The budget assumes average annual prices for West Texas Intermediate (WTI) crude oil and Henry Hub natural gas of $82 per barrel and $3.50 per million British thermal unit (MMBtu), respectively, consistent with the published forward curve available during the company’s annual budget process.

“Due to lower than budgeted commodity prices and start-up delays on our RNG facilities, partially offset by higher contributions from natural gas transmission and storage, we now expect to be below budget on Adjusted EBITDA by approximately 2% and on Adjusted EPS by approximately 4%, although we expect Adjusted EBITDA to be up 5% and Adjusted EPS to be up 9% for the full year versus 2023. We expect to end the year with a Net Debt-to-Adjusted EBITDA ratio of 4.0 times,” said Dang.

This press release includes Adjusted Net Income Attributable to KMI and DCF, in each case in the aggregate and per share, Adjusted Segment EBDA, Adjusted EBITDA, Net Debt, FCF and Project EBITDA, all of which are non-GAAP financial measures. For descriptions of these non-GAAP financial measures and reconciliations to the most comparable measures prepared in accordance with generally accepted accounting principles, please see “Non-GAAP Financial Measures” and the tables accompanying our preliminary financial statements.

Overview of Business Segments

“The Natural Gas Pipelines business segment’s improved financial performance in the third quarter of 2024 relative to the third quarter of 2023 benefited from continued higher contributions from our Texas Intrastate system, additional contributions from our STX Midstream acquisition, and higher contributions from expansion projects on Tennessee Gas Pipeline (TGP), partially offset by lower contributions from our gathering systems due to asset divestitures and lower commodity prices,” said KMI President Tom Martin.

“Natural gas transport volumes were up 2% compared to the third quarter of 2023. Natural gas gathering volumes were up 5% from the third quarter of 2023, primarily from our Haynesville and Eagle Ford gathering systems.

“Contributions from the Products Pipelines business segment were down compared to the third quarter of 2023 largely due to lower commodity prices and the associated impact on inventory used to support our transmix and crude and condensate businesses. Total refined products volumes were up slightly, and crude and condensate volumes were down 4% compared to the third quarter of 2023,” Martin said.

“Terminals business segment earnings were up compared to the third quarter of 2023. Our liquids terminals benefited from expansion projects placed into service as well as higher rates and utilization at our New York Harbor hub facilities. Our bulk business benefited from increased petroleum coke and fertilizer volumes. Higher rates on our Jones Act tankers, which remain fully contracted under term charter agreements, also contributed to the segment’s performance for the quarter,” continued Martin.

“CO2 business segment earnings were down compared to the third quarter of 2023 due to lower crude volumes, higher power costs, and the divestiture of certain assets earlier this year, partially offset by contributions from KMI’s Energy Transition Ventures business as well as from the North McElroy Unit acquired earlier this year. Year-to-date crude net-to-KMI volumes were down 7%, though SACROC production is expected to be above plan for the year. Weighted average price movements across the segment’s three primary commodities netted out slightly

positively for the quarter versus the third quarter of 2023. KMI’s ETV contributions were higher due to RNG facilities being placed into service after the third quarter of 2023,” said Martin.

Other News

Corporate

•In July 2024, KMI issued $500 million of 5.10% senior notes due August 2029 and $750 million of 5.95% senior notes due August 2054 to repay outstanding commercial paper and maturing debt and for general corporate purposes. The interest rates on the notes were favorable compared to budgeted rates.

Natural Gas Pipelines

•On August 30, 2024, Gulf Coast Express Pipeline LLC (GCX) reached a final investment decision (FID) to proceed with its approximately $455 million expansion project (approximately $161 million KM-share) after securing the necessary binding firm long term transportation agreements. The project is designed to increase natural gas deliveries by 570 MMcf/d from the Permian Basin to South Texas markets. Subject to all required approvals, the project is expected to be in service mid-2026. GCX is jointly owned by a subsidiary of KMI, an affiliate of ArcLight Capital Partners, LLC and a subsidiary of Phillips 66. KMI is the operator of GCX.

•Preliminary survey work is underway on the South System Expansion 4 (SSE4) Project designed to increase SNG’s South Line capacity by approximately 1.2 Bcf/d. Upon completion, the approximately $3 billion project will help meet growing power generation and local distribution company demand in the Southeast markets. SSE4 will be almost entirely comprised of brownfield looping and horsepower compression additions on the SNG and Elba Express (EEC) pipeline systems (approximately $1.7 billion KM-share including EEC). Subject to all required approvals, KMI expects the project to be in service beginning in late 2028.

•Construction activities are ongoing for the Kinder Morgan Tejas Pipeline’s (Tejas) approximately $154 million South Texas to Houston Market expansion project. The first phase of the project will add compression on Tejas’ mainline, with a target in-service date in the first quarter of 2025. Tejas has also executed the definitive agreements necessary to proceed with the second phase of the project which predominantly involves 14 miles of pipeline looping. The expected in-service date for this portion of the project is the third quarter of 2025. Together these projects will provide approximately 500 MMcf/d to key markets.

•The Webb County Extension project, an approximately $158 million expansion of the Kinder Morgan Texas Pipeline (KMTP) system, was placed in service on October 1, 2024. The project provides additional treating and transport opportunities for lean natural gas Eagle Ford producers in Webb County. The project, supported by a long-term contract, delivers up to 400 MMcf/d of Eagle Ford natural gas supply into the company’s Texas Intrastate network.

•Construction is ongoing for the second phase of the approximately $670 million Evangeline Pass project, which has an expected in-service date of July 1, 2025. The two-phase project involves modifications and enhancements to portions of the TGP and Southern Natural Gas (SNG) systems in Mississippi and Louisiana, resulting in the delivery of approximately 2 Bcf/d of natural gas to Venture Global’s Plaquemines LNG facility. The approximately $283 million first phase of the project providing 900 mDth/d of capacity was placed in service July 1, 2024.

•NGPL has executed the definitive agreements necessary to proceed with its approximately $94 million Gulf Coast Storage Expansion project (approximately $35 million KM-share). This project will provide approximately 10 Bcf of incremental natural gas storage capacity on NGPL’s high-growth Gulf Coast system. Subject to all required approvals, NGPL expects the project to be placed in service in the first half of 2027.

Terminals

•Construction is nearing completion on KMI’s latest expansion of its industry-leading RD and SAF feedstock storage and logistics offering at its lower Mississippi River hub. The scope of work at its Geismar River Terminal in Geismar, Louisiana includes construction of multiple tanks totaling approximately 250,000 barrels of heated storage capacity as well as various marine, rail and pipeline infrastructure improvements. The approximately $54 million Geismar River Terminal project is supported by a long-term commercial commitment and is expected to be in service by the fourth quarter of 2024.

Products

•During the quarter, KMI’s SFPP pipeline secured necessary customer commitments in a binding open season to add 2,500 barrels per day of additional capacity on its East Line system for transportation of refined petroleum products from El Paso, Texas to Tucson, Arizona. SFPP has the ability to further expand its East Line system to Tucson without installing additional pipe should customers need additional capacity. The target in-service date is the third quarter of 2025.

Energy Transition Ventures

•Construction is substantially complete on the Autumn Hills RNG facility, and it is expected to be placed into service December 2024 with an expected capacity of 0.8 Bcf of RNG annually. Once complete and in service, this additional facility will bring KMI’s total RNG generation capacity to 6.9 Bcf per year.

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy infrastructure companies in North America. Access to reliable, affordable energy is a critical component for improving lives around the world. We are committed to providing energy transportation and storage services in a safe, efficient and environmentally responsible manner for the benefit of the people, communities and businesses we serve. We own an interest in or operate approximately 79,000 miles of pipelines, 139 terminals, 702 Bcf of working natural gas storage capacity and have renewable natural gas generation capacity of approximately 6.1 Bcf per year with an additional

0.8 Bcf in development. Our pipelines transport natural gas, refined petroleum products, crude oil, condensate, CO2, renewable fuels and other products, and our terminals store and handle various commodities including gasoline, diesel fuel, jet fuel, chemicals, metals, petroleum coke, and ethanol and other renewable fuels and feedstocks. Learn more about our work advancing energy solutions on the lower carbon initiatives page at www.kindermorgan.com.

Please join Kinder Morgan, Inc. at 4:30 p.m. ET on Wednesday, October 16, at www.kindermorgan.com for a LIVE webcast conference call on the company’s third quarter earnings.

Non-GAAP Financial Measures

As described in further detail below, our management evaluates our performance primarily using Net income attributable to Kinder Morgan, Inc. and Segment earnings before DD&A expenses, including amortization of excess cost of equity investments, (EBDA) along with the non-GAAP financial measures of Adjusted Net income attributable to Common Stock, and distributable cash flow (DCF), both in the aggregate and per share for each, Adjusted Segment EBDA, Adjusted Net income attributable to Kinder Morgan, Inc., Adjusted earnings before interest, income taxes, DD&A expenses, including amortization of excess cost of equity investments, (EBITDA) and Net Debt.

Our non-GAAP financial measures described below should not be considered alternatives to GAAP net income attributable to Kinder Morgan, Inc. or other GAAP measures and have important limitations as analytical tools. Our computations of these non-GAAP financial measures may differ from similarly titled measures used by others. You should not consider these non-GAAP financial measures in isolation or as substitutes for an analysis of our results as reported under GAAP. Management compensates for the limitations of our consolidated non-GAAP financial measures by reviewing our comparable GAAP measures identified in the descriptions of consolidated non-GAAP measures below, understanding the differences between the measures and taking this information into account in its analysis and its decision-making processes.

Certain Items, as adjustments used to calculate our non-GAAP financial measures, are items that are required by GAAP to be reflected in net income attributable to Kinder Morgan, Inc., but typically either (1) do not have a cash impact (for example, unsettled commodity hedges and asset impairments), or (2) by their nature are separately identifiable from our normal business operations and in most cases are likely to occur only sporadically (for example, certain legal settlements, enactment of new tax legislation and casualty losses). (See the accompanying Tables 2, 3, 4, and 6.) We also include adjustments related to joint ventures (see “Amounts from Joint Ventures” below).

The following table summarizes our Certain Items for the three and nine months ended September 30, 2024 and 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | | | | | | | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | | | | | | |

| (In millions) | | | | | | | | | |

| Certain Items | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Change in fair value of derivative contracts (1) | (20) | | | 37 | | | 32 | | | (93) | | | | | | | | | | |

| (Gain) loss on divestitures and impairment, net | — | | | — | | | (70) | | | 67 | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Income tax Certain Items (2) | (49) | | | (7) | | | (48) | | | 6 | | | | | | | | | | |

| Other | 1 | | | — | | | 3 | | | — | | | | | | | | | | |

| Total Certain Items (3)(4) | $ | (68) | | | $ | 30 | | | $ | (83) | | | $ | (20) | | | | | | | | | | |

| | | | | |

| Notes |

| (1) | Gains or losses are reflected when realized. |

| (2) | Represents the income tax provision on Certain Items plus discrete income tax items. Includes the impact of KMI’s income tax provision on Certain Items affecting earnings from equity investments and is separate from the related tax provision recognized at the investees by the joint ventures which are also taxable entities. |

| |

| (3) | Amounts for the periods ending September 30, 2023 include the following amounts reported within “Earnings from equity investments” on the accompanying Preliminary Consolidated Statements of Income: (i) $1 million for the three-month period only of “Change in fair value of derivative contracts” and (ii) $67 million for the nine-month period only of “(Gain) loss on divestitures and impairment, net” for a non-cash impairment related to our investment in Double Eagle Pipeline LLC in our Products Pipelines business segment. |

| (4) | Amounts for the periods ending September 30, 2024 and 2023 include the following amounts reported within "Interest, net" on the accompanying Preliminary Consolidated Statements of Income: $4 million and $3 million for the three-month periods, respectively, and $5 million and $(10) million for the nine-month periods, respectively, of “Change in fair value of derivative contracts.” |

Adjusted Net Income Attributable to Kinder Morgan, Inc. is calculated by adjusting net income attributable to Kinder Morgan, Inc. for Certain Items. Adjusted Net Income Attributable to Kinder Morgan, Inc. is used by us, investors and other external users of our financial statements as a supplemental measure that provides decision-useful information regarding our period-over-period performance and ability to generate earnings that are core to our ongoing operations. We believe the GAAP measure most directly comparable to Adjusted Net Income Attributable to Kinder Morgan, Inc. is net income attributable to Kinder Morgan, Inc. (See the accompanying Tables 1 and 2.)

Adjusted Net Income Attributable to Common Stock and Adjusted EPS is calculated by adjusting Net income attributable to Kinder Morgan, Inc., the most comparable GAAP measure, for Certain Items, and further for net income allocated to participating securities and adjusted net income in excess of distributions for participating securities. We believe Adjusted Net Income Attributable to Common Stock allows for calculation of adjusted earnings per share (Adjusted EPS) on the most comparable basis with earnings per share, the most comparable GAAP measure to Adjusted EPS. Adjusted EPS is calculated as Adjusted Net Income Attributable to Common Stock divided by our weighted average shares outstanding. Adjusted EPS applies the same two-class method used in arriving at basic earnings per share. Adjusted EPS is used by us, investors and other external users of our financial statements as a per-share supplemental measure that provides decision-useful information regarding our period-over-period performance and ability to generate earnings that are core to our ongoing operations. (See the accompanying Table 2.)

DCF is calculated by adjusting net income attributable to Kinder Morgan, Inc. for Certain Items, and further for DD&A and amortization of excess cost of equity investments, income tax expense, cash taxes, sustaining capital expenditures and other items. We also adjust amounts from joint ventures for income taxes, DD&A, cash taxes and sustaining capital expenditures (see “Amounts from Joint Ventures” below). DCF is a significant performance measure used by us, investors and other external users of our financial statements to evaluate our performance and to measure and estimate the ability of our assets to generate economic earnings after paying interest expense, paying cash taxes and expending sustaining capital. DCF provides additional insight into the specific costs associated with our assets in the current period and facilitates period-to-period comparisons of our performance from ongoing business activities. DCF is also used by us, investors, and other external users to compare the performance of companies across our industry. DCF per share serves as the primary financial performance target for purposes of annual bonuses under our annual incentive compensation program and for performance-based vesting of equity compensation grants under our long-term incentive compensation program. DCF should not be used as an alternative to net cash provided by operating activities computed under GAAP. We believe the GAAP measure most directly comparable to DCF is net income attributable to Kinder Morgan, Inc. DCF per share is DCF divided by average outstanding shares, including restricted stock awards that participate in dividends. (See the accompanying Table 2.)

Adjusted Segment EBDA is calculated by adjusting segment earnings before DD&A and amortization of excess cost of equity investments, general and administrative expenses and corporate charges, interest expense, and income taxes (Segment EBDA) for Certain Items attributable to the segment. Adjusted Segment EBDA is used by management in its analysis of segment performance and management of our business. We believe Adjusted Segment EBDA is a useful performance metric because it provides management, investors and other external users of our financial statements additional insight into performance trends across our business segments, our segments’ relative contributions to our consolidated performance and the ability of our segments to generate earnings on an ongoing basis. Adjusted Segment EBDA is also used as a factor in determining compensation under our annual incentive compensation program for our business segment presidents and other business segment employees. We believe it is useful to investors because it is a measure that management uses to allocate resources to our segments and assess each segment’s performance. (See the accompanying Table 4.)

Adjusted EBITDA is calculated by adjusting net income attributable to Kinder Morgan, Inc. for Certain Items and further for DD&A and amortization of excess cost of equity investments, income tax expense and interest. We also include amounts from joint ventures for income taxes and DD&A (see “Amounts from Joint Ventures” below). Adjusted EBITDA (on a rolling 12-months basis) is used by management, investors and other external users, in conjunction with our Net Debt (as described further below), to evaluate our leverage. Management and external users also use Adjusted EBITDA as an important metric to compare the valuations of companies across our industry. Our ratio of Net Debt-to-Adjusted EBITDA is used as a supplemental performance target for purposes of our annual incentive compensation program. We believe the GAAP measure most directly comparable to Adjusted EBITDA is net income attributable to Kinder Morgan, Inc. (See the accompanying Tables 3 and 6.)

Amounts from Joint Ventures - Certain Items, DCF and Adjusted EBITDA reflect amounts from unconsolidated joint ventures (JVs) and consolidated JVs utilizing the same recognition and measurement methods used to record “Earnings from equity investments” and “Noncontrolling interests (NCI),” respectively. The calculations of DCF and Adjusted EBITDA related to our unconsolidated and consolidated JVs include the same items (DD&A and income tax expense, and for DCF only, also cash taxes and sustaining capital expenditures) with respect to the JVs as those included in the calculations of DCF and Adjusted EBITDA for our wholly-owned consolidated subsidiaries; further, we remove the portion of these adjustments attributable to non-controlling interests. (See Tables 2, 3, and 6.) Although these amounts related to our unconsolidated JVs are included in the calculations of DCF and Adjusted EBITDA, such inclusion should not be understood to imply that we have control over the operations and resulting revenues, expenses or cash flows of such unconsolidated JVs.

Net Debt is calculated by subtracting from debt (1) cash and cash equivalents, (2) debt fair value adjustments, and (3) the foreign exchange impact on Euro-denominated bonds for which we have entered into currency swaps to convert that debt to U.S. dollars. Net Debt, on its own and in conjunction with our Adjusted EBITDA (on a rolling 12-months basis) as part of a ratio of Net Debt-to-Adjusted EBITDA, is a non-GAAP financial measure that is used by management, investors and other external users of our financial information to evaluate our leverage. Our ratio of Net Debt-to-Adjusted EBITDA is also used as a supplemental performance target for purposes of our annual incentive compensation program. We believe the most comparable measure to Net Debt is total debt as reconciled in the notes to the accompanying Preliminary Consolidated Balance Sheets in Table 6.

Project EBITDA is calculated for an individual capital project as earnings before interest expense, taxes, DD&A and general and administrative expenses attributable to such project, or for JV projects, consistent with the methods described above under “Amounts from Joint Ventures,” and in conjunction with capital expenditures for the project, is the basis for our Project EBITDA multiple. Management, investors and others use Project EBITDA to evaluate our return on investment for capital projects before expenses that are generally not controllable by operating managers in our business segments. We believe the GAAP measure most directly comparable to Project EBITDA is the portion of net income attributable to a capital project. We do not provide the portion of budgeted net income attributable to individual capital projects (the GAAP financial measure most directly comparable to Project EBITDA) due to the impracticality of predicting, on a project-by-project basis through the second full year of operations, certain amounts required by GAAP, such as projected commodity prices, unrealized gains and losses on derivatives marked to market, and potential estimates for certain contingent liabilities associated with the project completion.

FCF is calculated by reducing cash flow from operations for capital expenditures (sustaining and expansion), and FCF after dividends is calculated by further reducing FCF for dividends paid during the period. FCF is used by management, investors and other external users as an additional leverage metric, and FCF after dividends provides additional insight into cash flow generation. Therefore, we believe FCF is useful to our investors. We believe the GAAP measure most directly comparable to FCF is cash flow from operations. (See the accompanying Table 7.)

Important Information Relating to Forward-Looking Statements

This news release includes forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934. Generally the words “expects,” “believes,” “anticipates,” “plans,” “will,” “shall,” “estimates,” “projects,” and similar expressions identify forward-looking statements, which are generally not historical in nature. Forward-looking statements in this news release include, among others, express or implied statements pertaining to: the long-term demand for KMI’s assets and services; energy evolution-related opportunities; KMI’s 2024 expectations; anticipated dividends; and KMI’s capital projects, including expected costs, completion timing and benefits of those projects. Forward-looking statements are subject to risks and uncertainties and are based on the beliefs and assumptions of management, based on information currently available to them. Although KMI believes that these forward-looking statements are based on reasonable assumptions, it can give no assurance as to when or if any such forward-looking statements will materialize nor their ultimate impact on our operations or financial condition. Important factors that could cause actual results to differ materially from those expressed in or implied by these forward-looking statements include: the timing and extent of changes in the supply of and demand for the products we transport and handle; trends expected to drive new natural gas demand for electricity generation; commodity prices; counterparty financial risk; and the other risks and uncertainties described in KMI’s reports filed with the Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K for the year-ended December 31, 2023 (under the headings “Risk Factors” and “Information Regarding Forward-Looking Statements” and elsewhere), and its subsequent reports, which are available through the SEC’s EDGAR system at www.sec.gov and on our website at ir.kindermorgan.com. Forward-looking statements speak only as of the date they were made, and except to the extent required by law, KMI undertakes no obligation to update any forward-looking statement because of new information, future events or other factors. Because of these risks and uncertainties, readers should not place undue reliance on these forward-looking statements.

| | | | | | | | |

| CONTACTS | | |

| Dave Conover | | Investor Relations |

| Media Relations | | (800) 348-7320 |

| Newsroom@kindermorgan.com | | km_ir@kindermorgan.com |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 1 |

| Kinder Morgan, Inc. and Subsidiaries |

| Preliminary Consolidated Statements of Income |

| (In millions, except per share amounts, unaudited) |

| | | | | | | | | | | |

| Three Months Ended

September 30, | | % change | | Nine Months Ended

September 30, | | % change |

| | 2024 | | 2023 | | | 2024 | | 2023 | |

| Revenues | $ | 3,699 | | | $ | 3,907 | | | | | $ | 11,113 | | | $ | 11,296 | | | |

| Operating costs, expenses and other | | | | | | | | | | | |

| Costs of sales (exclusive of items shown separately below) | 1,024 | | | 1,405 | | | | | 3,098 | | | 3,591 | | | |

| Operations and maintenance | 790 | | | 738 | | | | | 2,211 | | | 2,062 | | | |

| Depreciation, depletion and amortization | 587 | | | 561 | | | | | 1,758 | | | 1,683 | | | |

| General and administrative | 176 | | | 162 | | | | | 530 | | | 497 | | | |

| Taxes, other than income taxes | 107 | | | 106 | | | | | 327 | | | 319 | | | |

| Loss (gain) on divestitures, net | 1 | | | (3) | | | | | (76) | | | (16) | | | |

| Other income, net | (1) | | | — | | | | | (11) | | | (2) | | | |

| Total operating costs, expenses and other | 2,684 | | | 2,969 | | | | | 7,837 | | | 8,134 | | | |

| Operating income | 1,015 | | | 938 | | | | | 3,276 | | | 3,162 | | | |

| Other income (expense) | | | | | | | | | | | |

| Earnings from equity investments | 211 | | | 234 | | | | | 662 | | | 607 | | | |

| Amortization of excess cost of equity investments | (12) | | | (18) | | | | | (37) | | | (54) | | | |

| Interest, net | (466) | | | (457) | | | | | (1,402) | | | (1,345) | | | |

| Other, net | 16 | | | 3 | | | | | 17 | | | 7 | | | |

| Income before income taxes | 764 | | | 700 | | | | | 2,516 | | | 2,377 | | | |

| Income tax expense | (113) | | | (145) | | | | | (490) | | | (509) | | | |

| Net income | 651 | | | 555 | | | | | 2,026 | | | 1,868 | | | |

| Net income attributable to NCI | (26) | | | (23) | | | | | (80) | | | (71) | | | |

| Net income attributable to Kinder Morgan, Inc. | $ | 625 | | | $ | 532 | | | | | $ | 1,946 | | | $ | 1,797 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Class P Shares | | | | | | | | | | | |

| Basic and diluted earnings per share | $ | 0.28 | | | $ | 0.24 | | | 17 | % | | $ | 0.87 | | | $ | 0.80 | | | 9 | % |

| Basic and diluted weighted average shares outstanding | 2,221 | | | 2,230 | | | — | % | | 2,220 | | | 2,238 | | | (1) | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Declared dividends per share | $ | 0.2875 | | | $ | 0.2825 | | | 2 | % | | $ | 0.8625 | | | $ | 0.8475 | | | 2 | % |

| Adjusted Net Income Attributable to Kinder Morgan, Inc. (1) | $ | 557 | | | $ | 562 | | | (1) | % | | $ | 1,863 | | | $ | 1,777 | | | 5 | % |

| Adjusted EPS (1) | $ | 0.25 | | | $ | 0.25 | | | — | % | | $ | 0.83 | | | $ | 0.79 | | | 5 | % |

| | | | | |

| Notes |

| (1) | Adjusted Net Income Attributable to Kinder Morgan, Inc. is Net income attributable to Kinder Morgan, Inc. adjusted for Certain Items. Adjusted EPS calculation uses Adjusted Net Income Attributable to Common Stock. See Table 2 for reconciliations. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 2 | | | | | | | | | |

| Kinder Morgan, Inc. and Subsidiaries | | | | | | | | | |

| Preliminary Net Income Attributable to Kinder Morgan, Inc. to Adjusted Net Income Attributable to Kinder Morgan, Inc., to Adjusted Net Income Attributable to Common Stock and to DCF Reconciliations | | | | | | | | | |

| (In millions, except per share amounts, unaudited) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | % change | | Nine Months Ended

September 30, | | % change | | | | | | | | | |

| 2024 | | 2023 | | | 2024 | | 2023 | | | | | | | | | | |

| Net income attributable to Kinder Morgan, Inc. | $ | 625 | | | $ | 532 | | | 17 | % | | $ | 1,946 | | | $ | 1,797 | | | 8 | % | | | | | | | | | |

| Certain Items (1) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Change in fair value of derivative contracts | (20) | | | 37 | | | | | 32 | | | (93) | | | | | | | | | | | | |

| (Gain) loss on divestitures and impairment, net | — | | | — | | | | | (70) | | | 67 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Income tax Certain Items | (49) | | | (7) | | | | | (48) | | | 6 | | | | | | | | | | | | |

| Other | 1 | | | — | | | | | 3 | | | — | | | | | | | | | | | | |

| Total Certain Items | (68) | | | 30 | | | (327) | % | | (83) | | | (20) | | | (315) | % | | | | | | | | | |

| Adjusted Net Income Attributable to Kinder Morgan, Inc. | $ | 557 | | | $ | 562 | | | (1) | % | | $ | 1,863 | | | $ | 1,777 | | | 5 | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net income attributable to Kinder Morgan, Inc. | $ | 625 | | | $ | 532 | | | 17 | % | | $ | 1,946 | | | $ | 1,797 | | | 8 | % | | | | | | | | | |

| Total Certain Items (2) | (68) | | | 30 | | | | | (83) | | | (20) | | | | | | | | | | | | |

| Net income allocated to participating securities (3) | (4) | | | (4) | | | | | (11) | | | (11) | | | | | | | | | | | | |

| Other (4) | — | | | (1) | | | | | 1 | | | — | | | | | | | | | | | | |

| Adjusted Net Income Attributable to Common Stock | $ | 553 | | | $ | 557 | | | (1) | % | | $ | 1,853 | | | $ | 1,766 | | | 5 | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net income attributable to Kinder Morgan, Inc. | $ | 625 | | | $ | 532 | | | 17 | % | | $ | 1,946 | | | $ | 1,797 | | | 8 | % | | | | | | | | | |

| Total Certain Items (2) | (68) | | | 30 | | | (327) | % | | (83) | | | (20) | | | (315) | % | | | | | | | | | |

| DD&A | 587 | | | 561 | | | | | 1,758 | | | 1,683 | | | | | | | | | | | | |

| Amortization of excess cost of equity investments | 12 | | | 18 | | | | | 37 | | | 54 | | | | | | | | | | | | |

| Income tax expense (5) | 162 | | | 152 | | | | | 538 | | | 503 | | | | | | | | | | | | |

| Cash taxes | (14) | | | (1) | | | | | (25) | | | (10) | | | | | | | | | | | | |

| Sustaining capital expenditures (6) | (270) | | | (242) | | | | | (680) | | | (593) | | | | | | | | | | | | |

| Amounts from joint ventures | | | | | | | | | | | | | | | | | | | | |

| Unconsolidated JV DD&A | 99 | | | 80 | | | | | 271 | | | 241 | | | | | | | | | | | | |

| Remove consolidated JV partners' DD&A | (16) | | | (16) | | | | | (47) | | | (47) | | | | | | | | | | | | |

| Unconsolidated JV income tax expense (7)(8) | 17 | | | 24 | | | | | 58 | | | 70 | | | | | | | | | | | | |

| Unconsolidated JV cash taxes (7) | (6) | | | (21) | | | | | (59) | | | (73) | | | | | | | | | | | | |

| Unconsolidated JV sustaining capital expenditures | (43) | | | (43) | | | | | (132) | | | (118) | | | | | | | | | | | | |

| Remove consolidated JV partners' sustaining capital expenditures | 2 | | | 2 | | | | | 7 | | | 6 | | | | | | | | | | | | |

| Other items (9) | 9 | | | 18 | | | | | 29 | | | 51 | | | | | | | | | | | | |

| DCF | $ | 1,096 | | | $ | 1,094 | | | — | % | | $ | 3,618 | | | $ | 3,544 | | | 2 | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Weighted average shares outstanding for dividends (10) | 2,235 | | | 2,244 | | | | | 2,233 | | | 2,251 | | | | | | | | | | | | |

| DCF per share | $ | 0.49 | | | $ | 0.49 | | | — | % | | $ | 1.62 | | | $ | 1.57 | | | 3 | % | | | | | | | | | |

| Declared dividends per share | $ | 0.2875 | | | $ | 0.2825 | | | | | $ | 0.8625 | | | $ | 0.8475 | | | | | | | | | | | | |

| | | | | |

| Notes |

| (1) | See table included in “Non-GAAP Financial Measures—Certain Items.” |

| (2) | For a detailed listing, see the above reconciliation of Net Income Attributable to Kinder Morgan, Inc. to Adjusted Net Income Attributable to Kinder Morgan, Inc. |

| (3) | Net income allocated to common stock and participating securities is based on the amount of dividends paid in the current period plus an allocation of the undistributed earnings or excess distributions over earnings to the extent that each security participates in earnings or excess distributions over earnings, as applicable. |

| (4) | Adjusted net income in excess of distributions for participating securities. |

| (5) | To avoid duplication, adjustments for income tax expense for the periods ended September 30, 2024 and 2023 exclude $(49) million and $(7) million for the three-month periods, respectively, and $(48) million and $6 million for the nine-month periods, respectively, which amounts are already included within “Certain Items.” See table included in “Non-GAAP Financial Measures—Certain Items.” |

| (6) | Net of a $14 million insurance reimbursement in both the three and nine-month periods ended September 30, 2024 for a sustaining capital expenditure project. |

| (7) | Associated with our Citrus, NGPL and Products (SE) Pipe Line equity investments. |

| (8) | Includes the tax provision on Certain Items recognized by the investees that are taxable entities. The impact of KMI’s income tax provision on Certain Items affecting earnings from equity investments is included within “Certain Items” above. See table included in “Non-GAAP Financial Measures—Certain Items.” |

| (9) | Includes non-cash pension expense, non-cash compensation associated with our restricted stock program and pension contributions. |

| (10) | Includes restricted stock awards that participate in dividends. |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 3 | | | | | | | | | |

| Kinder Morgan, Inc. and Subsidiaries | | | | | | | | | |

| Preliminary Net Income Attributable to Kinder Morgan, Inc. to Adjusted EBITDA Reconciliation | | | | | | | | | |

| (In millions, unaudited) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | % change | | Nine Months Ended

September 30, | | % change | | | | | | | | | |

| | 2024 | | 2023 | | | 2024 | | 2023 | | | | | | | | | | |

| Net income attributable to Kinder Morgan, Inc. | $ | 625 | | | $ | 532 | | | 17 | % | | $ | 1,946 | | | $ | 1,797 | | | 8 | % | | | | | | | | | |

| Certain Items (1) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Change in fair value of derivative contracts | (20) | | | 37 | | | | | 32 | | | (93) | | | | | | | | | | | | |

| (Gain) loss on divestitures and impairment, net | — | | | — | | | | | (70) | | | 67 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Income tax Certain Items | (49) | | | (7) | | | | | (48) | | | 6 | | | | | | | | | | | | |

| Other | 1 | | | — | | | | | 3 | | | — | | | | | | | | | | | | |

| Total Certain Items | (68) | | | 30 | | | | | (83) | | | (20) | | | | | | | | | | | | |

| DD&A | 587 | | | 561 | | | | | 1,758 | | | 1,683 | | | | | | | | | | | | |

| Amortization of excess cost of equity investments | 12 | | | 18 | | | | | 37 | | | 54 | | | | | | | | | | | | |

| Income tax expense (2) | 162 | | | 152 | | | | | 538 | | | 503 | | | | | | | | | | | | |

| Interest, net (3) | 462 | | | 454 | | | | | 1,397 | | | 1,355 | | | | | | | | | | | | |

| Amounts from joint ventures | | | | | | | | | | | | | | | | | | | | |

| Unconsolidated JV DD&A | 99 | | | 80 | | | | | 271 | | | 241 | | | | | | | | | | | | |

| Remove consolidated JV partners' DD&A | (16) | | | (16) | | | | | (47) | | | (47) | | | | | | | | | | | | |

| Unconsolidated JV income tax expense (4) | 17 | | | 24 | | | | | 58 | | | 70 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | $ | 1,880 | | | $ | 1,835 | | | 2 | % | | $ | 5,875 | | | $ | 5,636 | | | 4 | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Notes |

| (1) | See table included in “Non-GAAP Financial Measures—Certain Items.” |

| (2) | To avoid duplication, adjustments for income tax expense for the periods ended September 30, 2024 and 2023 exclude $(49) million and $(7) million for the three-month periods, respectively, and $(48) million and $6 million for the nine-month periods, respectively, which amounts are already included within “Certain Items.” See table included in “Non-GAAP Financial Measures—Certain Items.” |

| (3) | To avoid duplication, adjustments for interest, net for the periods ended September 30, 2024 and 2023 exclude $4 million and $3 million for the three-month periods, respectively, and $5 million and $(10) million for the nine-month periods, respectively, which amounts are already included within “Certain Items.” See table included in “Non-GAAP Financial Measures—Certain Items.” |

| (4) | Includes the tax provision on Certain Items recognized by the investees that are taxable entities associated with our Citrus, NGPL and Products (SE) Pipe Line equity investments. The impact of KMI’s income tax provision on Certain Items affecting earnings from equity investments is included within “Certain Items” above. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 4 |

| Kinder Morgan, Inc. and Subsidiaries | | | | | |

| Preliminary Reconciliation of Segment EBDA to Adjusted Segment EBDA | | | | | |

| (In millions, unaudited) | | | | | |

| | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | | | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | | |

| Segment EBDA (1) | | | | | | | | | | | | |

| Natural Gas Pipelines Segment EBDA | $ | 1,294 | | | $ | 1,179 | | | $ | 4,035 | | | $ | 3,929 | | | | | | |

| Certain Items (2) | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Change in fair value of derivative contracts | (14) | | | 20 | | | 29 | | | (99) | | | | | | |

| Gain on divestiture | — | | | — | | | (29) | | | — | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Natural Gas Pipelines Adjusted Segment EBDA | $ | 1,280 | | | $ | 1,199 | | | $ | 4,035 | | | $ | 3,830 | | | | | | |

| | | | | | | | | | | | |

| Products Pipelines Segment EBDA | $ | 278 | | | $ | 311 | | | $ | 871 | | | $ | 780 | | | | | | |

| Certain Items (2) | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Change in fair value of derivative contracts | (1) | | | 2 | | | — | | | 3 | | | | | | |

| Loss on impairment | — | | | — | | | — | | | 67 | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Products Pipelines Adjusted Segment EBDA | $ | 277 | | | $ | 313 | | | $ | 871 | | | $ | 850 | | | | | | |

| | | | | | | | | | | | |

| Terminals Segment EBDA | $ | 268 | | | $ | 259 | | | $ | 818 | | | $ | 774 | | | | | | |

| Certain Items (2) | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Change in fair value of derivative contracts | (1) | | | — | | | (1) | | | — | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Terminals Adjusted Segment EBDA | $ | 267 | | | $ | 259 | | | $ | 817 | | | $ | 774 | | | | | | |

| | | | | | | | | | | | |

CO2 Segment EBDA | $ | 170 | | | $ | 163 | | | $ | 534 | | | $ | 510 | | | | | | |

| Certain Items (2) | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Change in fair value of derivative contracts | (8) | | | 12 | | | (1) | | | 13 | | | | | | |

| Gain on divestitures | — | | | — | | | (41) | | | — | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

CO2 Adjusted Segment EBDA | $ | 162 | | | $ | 175 | | | $ | 492 | | | $ | 523 | | | | | | |

| | | | | |

| Notes |

| (1) | Includes revenues, earnings from equity investments, operating expenses, (loss) gain on divestitures, net, other income, net, and other, net. Operating expenses include costs of sales, operations and maintenance expenses, and taxes, other than income taxes. The composition of Segment EBDA is not addressed nor prescribed by generally accepted accounting principles. |

| (2) | See “Non-GAAP Financial Measures—Certain Items.” |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 5 | | | | | | | |

Segment Volume and CO2 Segment Hedges Highlights | | | | | | | |

| (Historical data is pro forma for acquired and divested assets, JV volumes at KMI share (1)) | | | | | | | |

| | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, | | | | | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | | | | |

| Natural Gas Pipelines | | | | | | | | | | | | | | |

| Transport volumes (BBtu/d) | 44,824 | | | 43,937 | | | 44,161 | | | 43,933 | | | | | | | | |

| Sales volumes (BBtu/d) | 2,656 | | | 2,574 | | | 2,559 | | | 2,306 | | | | | | | | |

| Gathering volumes (BBtu/d) | 3,825 | | | 3,637 | | | 3,950 | | | 3,566 | | | | | | | | |

| NGLs (MBbl/d) | 34 | | | 35 | | | 38 | | | 34 | | | | | | | | |

| Products Pipelines (MBbl/d) | | | | | | | | | | | | | | |

| Gasoline (2) | 1,003 | | | 1,002 | | | 978 | | | 985 | | | | | | | | |

| Diesel fuel | 376 | | | 362 | | | 357 | | | 349 | | | | | | | | |

| Jet fuel | 297 | | | 292 | | | 293 | | | 285 | | | | | | | | |

| Total refined product volumes | 1,676 | | | 1,656 | | | 1,628 | | | 1,619 | | | | | | | | |

| Crude and condensate | 472 | | | 490 | | | 474 | | | 481 | | | | | | | | |

| Total delivery volumes (MBbl/d) | 2,148 | | | 2,146 | | | 2,102 | | | 2,100 | | | | | | | | |

| Terminals | | | | | | | | | | | | | | |

| Liquids leasable capacity (MMBbl) | 78.6 | | | 78.7 | | | 78.6 | | | 78.7 | | | | | | | | |

| Liquids leased capacity % | 94.9 | % | | 94.6 | % | | 94.3 | % | | 93.6 | % | | | | | | | |

| Bulk transload tonnage (MMtons) | 13.4 | | | 12.6 | | | 41.1 | | | 39.7 | | | | | | | | |

CO2 | | | | | | | | | | | | | | |

| SACROC oil production | 19.02 | | | 19.94 | | | 19.01 | | | 20.49 | | | | | | | | |

| Yates oil production | 5.90 | | | 6.66 | | | 6.08 | | | 6.65 | | | | | | | | |

| Other | 1.00 | | | 1.07 | | | 1.04 | | | 1.08 | | | | | | | | |

| Total oil production - net (MBbl/d) (3) | 25.92 | | | 27.67 | | | 26.13 | | | 28.22 | | | | | | | | |

| NGL sales volumes - net (MBbl/d) (3) | 8.69 | | | 8.98 | | | 8.51 | | | 8.93 | | | | | | | | |

CO2 sales volumes - net (Bcf/d) | 0.319 | | | 0.311 | | | 0.323 | | | 0.338 | | | | | | | | |

| RNG sales volumes (BBtu/d) | 6 | | | 5 | | | 7 | | | 5 | | | | | | | | |

| Realized weighted average oil price ($ per Bbl) | $ | 68.42 | | | $ | 67.60 | | | $ | 68.86 | | | $ | 67.49 | | | | | | | | |

| Realized weighted average NGL price ($ per Bbl) | $ | 32.38 | | | $ | 30.74 | | | $ | 29.36 | | | $ | 31.87 | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CO2 Segment Hedges | Remaining

2024 | | 2025 | | 2026 | | 2027 | | 2028 | | |

| Crude Oil (4) | | | | | | | | | | | |

| Price ($ per Bbl) | $ | 66.38 | | | $ | 65.86 | | | $ | 65.88 | | | $ | 65.71 | | | $ | 64.45 | | | |

| Volume (MBbl/d) | 23.40 | | | 17.50 | | | 12.20 | | | 8.10 | | | 2.50 | | | |

| NGLs | | | | | | | | | | | |

| Price ($ per Bbl) | $ | 48.60 | | | $ | 48.99 | | | | | | | | | |

| Volume (MBbl/d) | 5.08 | | | 1.87 | | | | | | | | | |

| | | | | |

| Notes |

| (1) | Volumes for acquired assets are included for all periods. However, EBDA contributions from acquisitions are included only for periods subsequent to their acquisition. Volumes for assets divested, idled and/or held for sale are excluded for all periods presented. |

| (2) | Gasoline volumes include ethanol pipeline volumes. |

| (3) | Net of royalties and outside working interests. |

| (4) | Includes West Texas Intermediate hedges. |

| |

| | | | | | | | | | | | | | |

| Table 6 |

| Kinder Morgan, Inc. and Subsidiaries |

| Preliminary Consolidated Balance Sheets |

| (In millions, unaudited) |

| | | | | | |

| September 30, | | December 31, | | | |

| 2024 | | 2023 | | | |

| Assets | | | | | | |

| Cash and cash equivalents | $ | 108 | | | $ | 83 | | | | |

| Other current assets | 2,069 | | | 2,459 | | | | |

| Property, plant and equipment, net | 37,709 | | | 37,297 | | | | |

| Investments | 7,882 | | | 7,874 | | | | |

| Goodwill | 20,084 | | | 20,121 | | | | |

| Deferred charges and other assets | 3,027 | | | 3,186 | | | | |

| Total assets | $ | 70,879 | | | $ | 71,020 | | | | |

| Liabilities and Stockholders' Equity | | | | | | |

| Short-term debt | $ | 1,984 | | | $ | 4,049 | | | | |

| Other current liabilities | 2,747 | | | 3,172 | | | | |

| Long-term debt | 29,825 | | | 27,880 | | | | |

| Debt fair value adjustments | 222 | | | 187 | | | | |

| Other | 4,355 | | | 4,003 | | | | |

| Total liabilities | 39,133 | | | 39,291 | | | | |

| Other stockholders' equity | 30,581 | | | 30,523 | | | | |

| Accumulated other comprehensive loss | (175) | | | (217) | | | | |

| Total KMI stockholders' equity | 30,406 | | | 30,306 | | | | |

| Noncontrolling interests | 1,340 | | | 1,423 | | | | |

| Total stockholders' equity | 31,746 | | | 31,729 | | | | |

| Total liabilities and stockholders' equity | $ | 70,879 | | | $ | 71,020 | | | | |

| | | | | | |

| Net Debt (1) | $ | 31,687 | | | $ | 31,837 | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| Table 6 (continued) |

| Kinder Morgan, Inc. and Subsidiaries |

| Preliminary Consolidated Balance Sheets |

| (In millions, unaudited) |

| | | | | | |

| Adjusted EBITDA Twelve Months Ended (2) | | | |

| Reconciliation of Net Income Attributable to Kinder Morgan, Inc. to Last Twelve Months Adjusted EBITDA | September 30, | | December 31, | | | |

| 2024 | | 2023 | | | |

| Net income attributable to Kinder Morgan, Inc. | $ | 2,540 | | | $ | 2,391 | | | | |

| Total Certain Items (3) | (43) | | | 19 | | | | |

| DD&A | 2,325 | | | 2,250 | | | | |

| Amortization of excess cost of equity investments | 49 | | | 66 | | | | |

| Income tax expense (4) | 717 | | | 682 | | | | |

| Interest, net (4) | 1,845 | | | 1,804 | | | | |

| Amounts from joint ventures | | | | | | |

| Unconsolidated JV DD&A | 353 | | | 323 | | | | |

| Less: Consolidated JV partners' DD&A | (63) | | | (63) | | | | |

| Unconsolidated JV income tax expense | 78 | | | 89 | | | | |

| Adjusted EBITDA | $ | 7,801 | | | $ | 7,561 | | | | |

| | | | | | |

| Net Debt-to-Adjusted EBITDA (5) | 4.1 | | | 4.2 | | | | |

| | | | | |

| Notes |

| (1) | Amounts calculated as total debt, less (i) cash and cash equivalents; (ii) debt fair value adjustments; and (ii) the foreign exchange impact on our Euro denominated debt of $14 million and $9 million as of September 30, 2024 and December 31, 2023, respectively, as we have entered into swaps to convert that debt to U.S.$. |

| (2) | Reflects the rolling 12-month amounts for each period above. |

| (3) | See table included in “Non-GAAP Financial Measures—Certain Items.” |

| (4) | Amounts are adjusted for Certain Items. See “Non-GAAP Financial Measures—Certain Items” for more information. |

| (5) | Year-end 2023 net debt reflects borrowings to fund the STX Midstream acquisition that closed on December 28, 2023. Including a full year of Adjusted EBITDA from the acquired assets on a Pro Forma basis, the leverage ratio would have been 4.1x. |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Table 7 |

| Kinder Morgan, Inc. and Subsidiaries |

| Preliminary Supplemental Information |

| (In millions, unaudited) |

| | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| KMI FCF | | | | | | | |

| Net income attributable to Kinder Morgan, Inc. | $ | 625 | | | $ | 532 | | | $ | 1,946 | | | $ | 1,797 | |

| Net income attributable to noncontrolling interests | 26 | | | 23 | | | 80 | | | 71 | |

| DD&A | 587 | | | 561 | | | 1,758 | | | 1,683 | |

| Amortization of excess cost of equity investments | 12 | | | 18 | | | 37 | | | 54 | |

| Deferred income taxes | 97 | | | 141 | | | 454 | | | 495 | |

| Earnings from equity investments | (211) | | | (234) | | | (662) | | | (607) | |

| Distribution of equity investment earnings (1) | 184 | | | 205 | | | 600 | | | 572 | |

| Working capital and other items | (71) | | | 40 | | | (88) | | | 104 | |

| Cash flow from operations | 1,249 | | | 1,286 | | | 4,125 | | | 4,169 | |

| Capital expenditures (GAAP) | (657) | | | (647) | | | (1,857) | | | (1,689) | |

| FCF | 592 | | | 639 | | | 2,268 | | | 2,480 | |

| Dividends paid | (643) | | | (634) | | | (1,915) | | | (1,898) | |

| FCF after dividends | $ | (51) | | | $ | 5 | | | $ | 353 | | | $ | 582 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | |

| Notes |

| (1) | Periods ended September 30, 2024 and 2023 exclude distributions from equity investments in excess of cumulative earnings of $36 million and $48 million for the three-month periods, respectively, and $117 million and $166 million for the nine-month periods, respectively. These are included in cash flows from investing activities on our consolidated statement of cash flows. |

| |

| |

Document and Entity Information

|

Oct. 16, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 16, 2024

|

| Entity Registrant Name |

KINDER MORGAN, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35081

|

| Entity Tax Identification Number |

80-0682103

|

| Entity Address, Address Line One |

1001 Louisiana Street

|

| Entity Address, Address Line Two |

Suite 1000

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| City Area Code |

713

|

| Local Phone Number |

369-9000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001506307

|

| Amendment Flag |

false

|

| Class P |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class P Common Stock

|

| Trading Symbol |

KMI

|

| Security Exchange Name |

NYSE

|

| 2.25%, Due March 2027 Notes |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.250% Senior Notes due 2027

|

| Trading Symbol |

KMI 27 A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kmi_ClassPMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kmi_A2.25DueMarch2027NotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

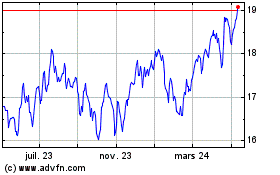

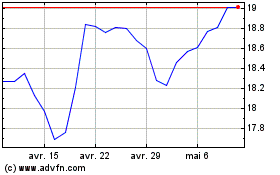

Kinder Morgan (NYSE:KMI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Kinder Morgan (NYSE:KMI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024