0000092380false00000923802024-02-062024-02-060000092380exch:XNYS2024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2024

| | |

| SOUTHWEST AIRLINES CO. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Texas | | 1-7259 | | 74-1563240 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| P. O. Box 36611 | | |

| Dallas, | Texas | | 75235-1611 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (214) 792-4000

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock ($1.00 par value) | LUV | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 25, 2024, Southwest Airlines Co. (the “Company”) issued a press release announcing its financial results for the fourth quarter and full year 2023 (the “2023 Earnings Release”), referencing a change in estimate related to the the ratification bonus for its Pilots which was recorded in fourth quarter 2023. The change in estimate represented the Company's best estimate, at that time, with regards to the ratification bonus that is to be paid to each eligible Pilot, as determined as of the January 22, 2024, ratification date of the collective bargaining agreement with the Southwest Airlines Pilots’ Association.

Since the issue date of the 2023 Earnings Release, the Company was able to complete additional and detailed analysis to refine its Pilot ratification bonus accrual estimates as of December 31, 2023, including the related payroll taxes. As a result of this assessment, the Company accrued an additional $51 million expense (compared to the amount stated in the 2023 Earnings Release), as reflected in Salaries, wages, and benefits within Operating expenses, in the Updated Fourth Quarter and Fiscal Year 2023 Financial Results (the “Updated 2023 Financial Results”). The Company is providing the Updated 2023 Financial Results to update results furnished in the 2023 Earnings Release.

The Updated 2023 Financial Results are furnished herewith as Exhibit 99.1 and are incorporated by reference into this Item 2.02.

Item 7.01 Regulation FD Disclosure.

The Company is also updating guidance furnished in the 2023 Earnings Release regarding its first quarter and full year 2024 operating expenses per available seat mile, excluding fuel and oil expense, special items, and profitsharing. Please refer to the Updated 2023 Financial Results, which are furnished herewith as Exhibit 99.1 and are incorporated by reference into this Item 2.02, for more information.

The information furnished in these Items 2.02 and 7.01 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SOUTHWEST AIRLINES CO. |

| | | |

| February 6, 2024 | By: | /s/ Tammy Romo |

| | | |

| | | Tammy Romo |

| | | Executive Vice President & Chief Financial Officer |

| | | (Principal Financial and Accounting Officer) |

Southwest Airlines Co. (the "Company") is providing updated fourth quarter and full year 2023 financial results to update the results furnished in its Form 8-K dated January 25, 2024.

As the Company referenced in its Form 8-K dated January 25, 2024, covering its fourth quarter and full year 2023 financial results (the “2023 Earnings Release”), the amount associated with the ratification bonus that is to be paid to each eligible Pilot, as determined as of the January 22, 2024 ratification date of the collective bargaining agreement with the Southwest Airlines Pilots’ Association ("SWAPA"), was subject to change because of the complexity of making the estimate and the short time between the Pilots’ ratification of the new collective bargaining agreement and the date of the 2023 Earnings Release. Since the 2023 Earnings Release, the Company completed additional and detailed analysis to refine its Pilot ratification bonus accrual estimates as of December 31, 2023, including the related payroll taxes. As a result of this final assessment, the Company recorded incremental expense of $51 million, before the offsetting impact of Profitsharing expense, within Salaries, wages, and benefits, as reflected in Operating expenses, in its 2023 financial statements that will be included in the Company's Annual Report on Form 10-K.

The Company's final assessment of its Pilot ratification bonus accrual estimates in fourth quarter 2023, including the related payroll taxes, also resulted in an offsetting decrease to the Company's outlook for Salaries, wages, and benefits within Operating expenses in first quarter 2024. Therefore, the Company has now adjusted its guidance for first quarter 2024 operating expenses per available seat mile, excluding fuel and oil expense, special items, and profitsharing (“CASM-X”)1,2 to increase in the range of 5 percent to 6 percent, year-over-year, compared with its previous guidance in the range of 6 percent to 7 percent, year-over-year. Further, the Company has now adjusted its guidance for full year 2024 CASM-X1,2 to increase in the range of 5.5 percent to 7 percent, year-over-year, compared with its previous guidance in the range of 6 percent to 7 percent, year-over-year. The Company’s remaining guidance, as provided below and in its 2023 Earnings Release, is not being updated herein:

| | | | | | | | | |

| | | 1Q 2024 Estimation |

| RASM (a), year-over-year | | | Up 2.5% to 4.5% |

| ASMs (b), year-over-year | | | Up ~10% |

Economic fuel costs per gallon1,3 | | | $2.70 to $2.80 |

| Fuel hedging premium expense per gallon | | | $0.08 |

| Fuel hedging cash settlement gains per gallon | | | $0.02 |

| ASMs per gallon (fuel efficiency) | | | 79 to 81 |

CASM-X (c), year-over-year1,2 | | | Up 5% to 6% |

| Scheduled debt repayments (millions) | | | ~$7 |

| Interest expense (millions) | | | ~$62 |

| | | | | | | | | |

| | |

2024 Estimation |

| ASMs (b), year-over-year | | | Up ~6% |

Economic fuel costs per gallon1,3 | | | $2.55 to $2.65 |

| Fuel hedging premium expense per gallon | | | $0.07 |

| Fuel hedging cash settlement gains per gallon | | | $0.01 |

CASM-X (c), year-over-year1,2 | | | Up 5.5% to 7% |

| Scheduled debt repayments (millions) | | | ~$29 |

| Interest expense (millions) | | | ~$249 |

| Aircraft (d) | | | 847 |

| Effective tax rate | | | 23% to 24% |

| Capital spending (billions) | | | $3.5 to $4.0 |

(a) Operating revenue per available seat mile ("RASM" or "unit revenues").

(b) Available seat miles ("ASMs" or "capacity"). The Company's flight schedule is currently published for sale through October 2, 2024. The Company currently expects second quarter 2024 capacity to increase in the range of 8 percent to 10 percent, year-over-year, and third quarter 2024 capacity to increase in the range of 3 percent to 5 percent, year-over-year.

(c) Operating expenses per available seat mile, excluding fuel and oil expense, special items, and profitsharing ("CASM-X").

(d) Aircraft on property, end of period. The Company currently plans for approximately 79 Boeing 737 MAX ("MAX") aircraft deliveries and 49 aircraft retirements in 2024, including 45 Boeing 737-700s ("-700") and four Boeing 737-800s ("-800"). The delivery schedule for the 737-7 ("-7") is dependent on the Federal Aviation Administration ("FAA") issuing required certifications and approvals to The Boeing Company ("Boeing") and the Company. The FAA will ultimately determine the timing of the -7 certification and entry into service, and Boeing may continue to experience supply chain challenges, so the Company offers no assurances that current estimations and timelines will be met.

The following tables provide the line items impacted by the change described above in the Company's unaudited Condensed Consolidated Statement of Income (Loss) previously furnished in its 2023 Earnings Release, for both the three months ended and twelve months ended December 31, 2023. The amounts provided are in accordance with accounting principles generally accepted in the United States ("GAAP"), followed by supplemental Non-GAAP information. See the accompanying Reconciliation of Reported Amounts to Non-GAAP Items (excluding special items) as well as the Company's Note Regarding Use of Non-GAAP Financial Measures.

| | | | | | | | |

| (in millions, except per share amounts) | |

| (unaudited) | GAAP |

| Three months ended | Year ended |

| December 31, 2023 | December 31, 2023 |

| | |

| Total operating expenses - as previously reported | $ | 7,183 | | $ | 25,824 | |

| Additional Pilot contract ratification bonus accrual impact | 51 | | 51 | |

| Less Profitsharing expense impact (a) | (8) | | (8) | |

| Total operating expenses - updated | $ | 7,226 | | $ | 25,867 | |

| | |

| Operating income (loss) - as previously reported | $ | (361) | | $ | 267 | |

| Additional Pilot contract ratification bonus accrual impact, net | (43) | | (43) | |

| Operating income (loss) - updated | $ | (404) | | $ | 224 | |

| | |

| Income (loss) before income taxes - as previously reported | $ | (243) | | $ | 676 | |

| Additional Pilot contract ratification bonus accrual impact, net | (43) | | (43) | |

| Income (loss) before income taxes - updated | $ | (286) | | $ | 633 | |

| | |

| Provision (benefit) for income taxes - as previously reported | $ | (24) | | $ | 178 | |

| Additional Pilot contract ratification bonus accrual impact | (10) | | (10) | |

| Provision (benefit) for income taxes - updated | $ | (34) | | $ | 168 | |

| | |

| Net income (loss) - as previously reported | $ | (219) | | $ | 498 | |

| Additional Pilot contract ratification bonus accrual impact | (33) | | (33) | |

| Net income (loss) - updated | $ | (252) | | $ | 465 | |

| | |

| Net income (loss) per share, diluted - as previously reported | $ | (0.37) | | $ | 0.81 | |

| Additional Pilot contract ratification bonus accrual impact | (0.05) | | (0.05) | |

| Net income (loss) per share, diluted - updated | $ | (0.42) | | $ | 0.76 | |

(a) The fourth quarter 2023 additional Pilot ratification bonus accrual results in an $8 million decrease in Profitsharing expense, which results in full year 2023 Profitsharing of approximately $110 million.

| | | | | | | | |

| (in millions, except per share amounts) | |

| (unaudited) | Non-GAAP |

| Three months ended | Year ended |

| December 31, 2023 | December 31, 2023 |

| | |

| Total operating expenses, excluding special items - as previously reported | $ | 6,645 | | $ | 25,191 | |

| Additional Pilot contract ratification bonus accrual impact | 3 | | 15 | |

| Less Profitsharing expense impact (a) | (8) | | (8) | |

| Total operating expenses, excluding special items - updated | $ | 6,640 | | $ | 25,198 | |

| | |

| Operating income, excluding special items - as previously reported | $ | 177 | | $ | 900 | |

| Additional Pilot contract ratification bonus accrual impact, net | 5 | | (7) | |

| Operating income, excluding special items - updated | $ | 182 | | $ | 893 | |

| | |

| Income before income taxes, excluding special items - as previously reported | $ | 304 | | $ | 1,288 | |

| Additional Pilot contract ratification bonus accrual impact, net | 5 | | (7) | |

| Income before income taxes, excluding special items - updated | $ | 309 | | $ | 1,281 | |

| | |

| Provision for income taxes, excluding special items - as previously reported | $ | 71 | | $ | 302 | |

| Additional Pilot contract ratification bonus accrual impact | 1 | | (1) | |

| Provision for income taxes, excluding special items - updated | $ | 72 | | $ | 301 | |

| | |

| Net income, excluding special items - as previously reported | $ | 233 | | $ | 986 | |

| Additional Pilot contract ratification bonus accrual impact | 4 | | (6) | |

| Net income, excluding special items - updated | $ | 237 | | $ | 980 | |

| | |

| Net income per share, diluted, excluding special items - as previously reported | $ | 0.37 | | $ | 1.57 | |

| Additional Pilot contract ratification bonus accrual impact | 0.01 | | (0.01) | |

| Net income per share, diluted, excluding special items - updated | $ | 0.38 | | $ | 1.56 | |

(a) The fourth quarter 2023 additional Pilot ratification bonus accrual results in an $8 million decrease in Profitsharing expense, which results in full year 2023 Profitsharing of approximately $110 million.

Footnotes

1See Note Regarding Use of Non-GAAP Financial Measures for additional information on special items. In addition, information regarding special items and economic results is included in the accompanying table Reconciliation of Reported Amounts to Non-GAAP Items (also referred to as "excluding special items").

2Projections do not reflect the potential impact of fuel and oil expense, special items, and profitsharing because the Company cannot reliably predict or estimate those items or expenses or their impact to its financial statements in future periods, especially considering the significant volatility of the fuel and oil expense line item. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for these projected results is not meaningful or available without unreasonable effort.

3Based on the Company's existing fuel derivative contracts and market prices as of January 17, 2024, first quarter and full year 2024 economic fuel costs per gallon are estimated to be in the range of $2.70 to $2.80 and $2.55 to $2.65, respectively. Economic fuel cost projections do not reflect the potential impact of special items because the Company cannot reliably predict or estimate the hedge accounting impact associated with the volatility of the energy markets, or the impact to its financial statements in future periods. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for projected results is not meaningful or available without unreasonable effort. See Note Regarding Use of Non-GAAP Financial Measures.

Cautionary Statement Regarding Forward-Looking Statements

This update contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Specific forward-looking statements include, without limitation, statements related to (i) the Company's financial and operational outlook, expectations, and projected results of operations; (ii) the Company's plans and expectations with respect to capacity; (iii) the Company's expectations with respect to fuel costs, hedging gains, and fuel efficiency, and the Company's related management of risks associated with changing jet fuel prices, including factors underlying the Company's expectations; (iv) the Company's plans, estimates, and assumptions related to repayment of debt obligations, interest expense, effective tax rate, and capital spending, including factors and assumptions underlying the Company's expectations and projections; and (v) the Company's plans, expectations, and goals regarding its fleet and fleet delivery schedule, including with respect to deliveries and retirements, and including factors and assumptions underlying the Company's plans and expectations. These forward-looking statements are based on the Company's current estimates, intentions, beliefs, expectations, goals, strategies, and projections for the future and are not guarantees of future performance. Forward-looking statements involve risks, uncertainties, assumptions, and other factors that are difficult to predict and that could cause actual results to vary materially from those expressed in or indicated by them. Factors include, among others, (i) the impact of fears or actual outbreaks of diseases, extreme or severe weather and natural disasters, actions of competitors (including, without limitation, pricing, scheduling, capacity, and network decisions, and consolidation and alliance activities), consumer perception, economic conditions, banking conditions, fears or actual acts of terrorism or war, sociodemographic trends, and other factors beyond the Company's control, on consumer behavior and the Company's results of operations and business decisions, plans, strategies, and results; (ii) the Company's ability to timely and effectively implement, transition, and maintain the necessary information technology systems and infrastructure to support its operations and initiatives; (iii) the emergence of additional costs or effects associated with the cancelled flights in December 2022, including litigation, government investigation and actions, and internal actions; (iv) the Company's dependence on its workforce, including its ability to employ and retain sufficient numbers of qualified Employees to effectively and efficiently maintain its operations; (v) the Company's ability to obtain and maintain adequate infrastructure and equipment to support its operations and initiatives; (vi) the impact of fuel price changes, fuel price volatility, volatility of commodities used by the Company for hedging jet fuel, and any changes to the Company's fuel hedging strategies and positions, on the Company's business plans and results of operations; (vii) the Company's dependence on Boeing and Boeing suppliers with respect to the Company's aircraft deliveries, fleet and capacity plans, operations, maintenance, strategies, and goals; (viii) the Company's dependence on Boeing and the Federal Aviation Administration with respect to the certification of the Boeing MAX 7 aircraft and Boeing production volumes; (ix) the Company's dependence on other third parties, in particular with respect to its technology plans, fuel supply, maintenance, environmental sustainability; Global Distribution Systems, and the impact on the Company's operations and results of operations of any third party delays or non-performance; (x) the Company's ability to timely and effectively prioritize its initiatives and focus areas and related expenditures; (xi) the impact of labor matters on the Company's business decisions, plans, strategies, and results; (xii) the impact of governmental regulations and other governmental actions on the Company's business plans, results, and operations; and (xiii) other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10- K for the fiscal year ended December 31, 2022.

Southwest Airlines Co.

Condensed Consolidated Statement of Income (Loss)

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Year ended | | |

| December 31, | | | | December 31, | | |

| 2023 | | 2022 | | Percent Change | | 2023 | | 2022 | | Percent Change |

| OPERATING REVENUES: | | | | | | | | | | | |

| Passenger | $ | 6,211 | | | $ | 5,541 | | | 12.1 | | $ | 23,637 | | | $ | 21,408 | | | 10.4 |

| Freight | 44 | | | 43 | | | 2.3 | | 175 | | | 177 | | | (1.1) |

| Other | 567 | | | 588 | | | (3.6) | | 2,279 | | | 2,229 | | | 2.2 |

| Total operating revenues | 6,822 | | | 6,172 | | | 10.5 | | 26,091 | | | 23,814 | | | 9.6 |

| | | | | | | | | | | |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Salaries, wages, and benefits | 3,161 | | | 2,605 | | | 21.3 | | 11,152 | | | 9,376 | | | 18.9 |

| Fuel and oil | 1,703 | | | 1,585 | | | 7.4 | | 6,217 | | | 5,975 | | | 4.1 |

| Maintenance materials and repairs | 351 | | | 228 | | | 53.9 | | 1,188 | | | 852 | | | 39.4 |

| Landing fees and airport rentals | 465 | | | 380 | | | 22.4 | | 1,789 | | | 1,508 | | | 18.6 |

| Depreciation and amortization | 415 | | | 367 | | | 13.1 | | 1,522 | | | 1,351 | | | 12.7 |

| Other operating expenses | 1,131 | | | 1,393 | | | (18.8) | | 3,999 | | | 3,735 | | | 7.1 |

| Total operating expenses | 7,226 | | | 6,558 | | | 10.2 | | 25,867 | | | 22,797 | | | 13.5 |

| | | | | | | | | | | |

| OPERATING INCOME (LOSS) | (404) | | | (386) | | | 4.7 | | 224 | | | 1,017 | | | (78.0) |

| | | | | | | | | | | |

| OTHER EXPENSES (INCOME): | | | | | | | | | | | |

| Interest expense | 66 | | | 68 | | | (2.9) | | 259 | | | 340 | | | (23.8) |

| Capitalized interest | (8) | | | (8) | | | — | | (23) | | | (39) | | | (41.0) |

| Interest income | (159) | | | (116) | | | 37.1 | | (583) | | | (217) | | | 168.7 |

| Loss on extinguishment of debt | — | | | 1 | | | n.m. | | — | | | 193 | | | n.m. |

| Other (gains) losses, net | (17) | | | (45) | | | (62.2) | | (62) | | | 12 | | | n.m. |

| Total other expenses (income) | (118) | | | (100) | | | 18.0 | | (409) | | | 289 | | | n.m. |

| | | | | | | | | | | |

| INCOME (LOSS) BEFORE INCOME TAXES | (286) | | | (286) | | | — | | 633 | | | 728 | | | (13.0) |

| PROVISION (BENEFIT) FOR INCOME TAXES | (34) | | | (66) | | | (48.5) | | 168 | | | 189 | | | (11.1) |

| NET INCOME (LOSS) | $ | (252) | | | $ | (220) | | | 14.5 | | $ | 465 | | | $ | 539 | | | (13.7) |

| | | | | | | | | | | |

| NET INCOME (LOSS) PER SHARE: | | | | | | | | | | | |

| Basic | $ | (0.42) | | | $ | (0.37) | | | 13.5 | | $ | 0.78 | | | $ | 0.91 | | | (14.3) |

| Diluted | $ | (0.42) | | | $ | (0.37) | | | 13.5 | | $ | 0.76 | | | $ | 0.87 | | | (12.6) |

| | | | | | | | | | | |

| WEIGHTED AVERAGE SHARES OUTSTANDING: | | | | | | | | | | |

| Basic | 596 | | | 594 | | | 0.3 | | 595 | | | 593 | | | 0.3 |

| Diluted | 596 | | | 594 | | | 0.3 | | 640 | | | 642 | | | (0.3) |

Southwest Airlines Co.

Reconciliation of Reported Amounts to Non-GAAP Items (excluding special items)

(See Note Regarding Use of Non-GAAP Financial Measures)

(in millions, except per share amounts) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | Year ended | | |

| December 31, | | | | December 31, | | |

| 2023 | | 2022 | | Percent Change | | 2023 | | 2022 | | Percent Change |

| Fuel and oil expense, unhedged | $ | 1,738 | | | $ | 1,701 | | | | | $ | 6,346 | | | $ | 6,780 | | | |

| Add: Premium cost of fuel contracts designated as hedges | 30 | | | 26 | | | | | 121 | | | 105 | | | |

| Deduct: Fuel hedge gains included in Fuel and oil expense, net | (65) | | | (142) | | | | | (250) | | | (910) | | | |

| Fuel and oil expense, as reported | $ | 1,703 | | | $ | 1,585 | | | | | $ | 6,217 | | | $ | 5,975 | | | |

| Deduct: Fuel hedge contracts settling in the current period, but for which gains were reclassified from AOCI | (5) | | | (28) | | | | | (16) | | | (40) | | | |

| Deduct: Premium benefit of fuel contracts not designated as hedges | — | | | (14) | | | | | — | | | (28) | | | |

| Fuel and oil expense, excluding special items (economic) | $ | 1,698 | | | $ | 1,543 | | | 10.0 | | $ | 6,201 | | | $ | 5,907 | | | 5.0 |

| | | | | | | | | | | |

| Total operating expenses, as reported | $ | 7,226 | | | $ | 6,558 | | | | | $ | 25,867 | | | $ | 22,797 | | | |

| | | | | | | | | | | |

| Deduct: TWU 556 Labor contract adjustment (a) | — | | | — | | | | | (180) | | | — | | | |

| Deduct: SWAPA Labor contract adjustment (b) | (474) | | | — | | | | | (354) | | | — | | | |

| Deduct: Fuel hedge contracts settling in the current period, but for which gains were reclassified from AOCI | (5) | | | (28) | | | | | (16) | | | (40) | | | |

| | | | | | | | | | | |

| Deduct: Premium benefit of fuel contracts not designated as hedges | — | | | (14) | | | | | — | | | (28) | | | |

| | | | | | | | | | | |

| Deduct: Impairment of long-lived assets | — | | | — | | | | | — | | | (35) | | | |

| Deduct: DOT settlement | (107) | | | — | | | | | (107) | | | — | | | |

| Deduct: Litigation settlement | — | | | — | | | | | (12) | | | — | | | |

| Total operating expenses, excluding special items | $ | 6,640 | | | $ | 6,516 | | | 1.9 | | $ | 25,198 | | | $ | 22,694 | | | 11.0 |

| Deduct: Fuel and oil expense, excluding special items (economic) | (1,698) | | | (1,543) | | | | | (6,201) | | | (5,907) | | | |

| Operating expenses, excluding Fuel and oil expense and special items | $ | 4,942 | | | $ | 4,973 | | | (0.6) | | $ | 18,997 | | | $ | 16,787 | | | 13.2 |

| Add (Deduct): Profitsharing expense | 49 | | | 49 | | | | | (110) | | | (127) | | | |

| Operating expenses, excluding Fuel and oil expense, special items, and profitsharing | $ | 4,991 | | | $ | 5,022 | | | (0.6) | | $ | 18,887 | | | $ | 16,660 | | | 13.4 |

| | | | | | | | | | | |

| Operating income (loss), as reported | $ | (404) | | | $ | (386) | | | | | $ | 224 | | | $ | 1,017 | | | |

| | | | | | | | | | | |

| Add: TWU 556 contract adjustment (a) | — | | | — | | | | | 180 | | | — | | | |

| Add: SWAPA contract adjustment (b) | 474 | | | — | | | | | 354 | | | — | | | |

| Add: Fuel hedge contracts settling in the current period, but for which gains were reclassified from AOCI | 5 | | | 28 | | | | | 16 | | | 40 | | | |

| | | | | | | | | | | |

| Add: Premium benefit of fuel contracts not designated as hedges | — | | | 14 | | | | | — | | | 28 | | | |

| | | | | | | | | | | |

| Add: Impairment of long-lived assets | — | | | — | | | | | — | | | 35 | | | |

| Add: DOT settlement | 107 | | | — | | | | | 107 | | | — | | | |

| Add: Litigation settlement | — | | | — | | | | | 12 | | | — | | | |

| Operating income (loss), excluding special items | $ | 182 | | | $ | (344) | | | n.m. | | $ | 893 | | | $ | 1,120 | | | (20.3) |

| | | | | | | | | | | |

| Other (gains) losses, net, as reported | $ | (17) | | | $ | (45) | | | | | $ | (62) | | | $ | 12 | | | |

| Add: Mark-to-market impact from fuel contracts settling in current periods | (9) | | | 17 | | | | | 17 | | | 41 | | | |

| Add: Premium benefit of fuel contracts not designated as hedges | — | | | 14 | | | | | — | | | 28 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Add (Deduct): Unrealized mark-to-market adjustment on available for sale securities | — | | | 3 | | | | | 4 | | | (4) | | | |

| Other (gains) losses, net, excluding special items | $ | (26) | | | $ | (11) | | | 136.4 | | $ | (41) | | | $ | 77 | | | n.m. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Year ended | | |

| December 31, | | | | December 31, | | |

| 2023 | | 2022 | | Percent Change | | 2023 | | 2022 | | Percent Change |

| Income (loss) before income taxes, as reported | $ | (286) | | | $ | (286) | | | | | $ | 633 | | | $ | 728 | | | |

| | | | | | | | | | | |

| Add: TWU 556 contract adjustment (a) | — | | | — | | | | | 180 | | | — | | | |

| Add: SWAPA contract adjustment (b) | 474 | | | — | | | | | 354 | | | — | | | |

| Add: Fuel hedge contracts settling in the current period, but for which gains were reclassified from AOCI | 5 | | | 28 | | | | | 16 | | | 40 | | | |

| | | | | | | | | | | |

| Add: Impairment of long-lived assets | — | | | — | | | | | — | | | 35 | | | |

| Add (Deduct): Mark-to-market impact from fuel contracts settling in current periods | 9 | | | (17) | | | | | (17) | | | (41) | | | |

| | | | | | | | | | | |

| Add (Deduct): Unrealized mark-to-market adjustment on available for sale securities | — | | | (3) | | | | | (4) | | | 4 | | | |

| Add: Loss on extinguishment of debt | — | | | 1 | | | | | — | | | 193 | | | |

| Add: DOT settlement | 107 | | | — | | | | | 107 | | | — | | | |

| Add: Litigation settlement | — | | | — | | | | | 12 | | | — | | | |

| Income (loss) before income taxes, excluding special items | $ | 309 | | | $ | (277) | | | n.m. | | $ | 1,281 | | | $ | 959 | | | 33.6 |

| | | | | | | | | | | |

| Provision (benefit) for income taxes, as reported | $ | (34) | | | $ | (66) | | | | | $ | 168 | | | $ | 189 | | | |

| Add: Net income tax impact of fuel and special items (c) | 106 | | | 15 | | | | | 133 | | | 47 | | | |

| | | | | | | | | | | |

| Provision (benefit) for income taxes, net, excluding special items | $ | 72 | | | $ | (51) | | | n.m. | | $ | 301 | | | $ | 236 | | | 27.5 |

| | | | | | | | | | | |

| Net income (loss), as reported | $ | (252) | | | $ | (220) | | | | | $ | 465 | | | $ | 539 | | | |

| | | | | | | | | | | |

| Add: TWU 556 contract adjustment (a) | — | | | — | | | | | 180 | | | — | | | |

| Add: SWAPA contract adjustment (b) | 474 | | | — | | | | | 354 | | | — | | | |

| Add: Fuel hedge contracts settling in the current period, but for which gains were reclassified from AOCI | 5 | | | 28 | | | | | 16 | | | 40 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Add: Impairment of long-lived assets | — | | | — | | | | | — | | | 35 | | | |

| Add (Deduct): Mark-to-market impact from fuel contracts settling in current periods | 9 | | | (17) | | | | | (17) | | | (41) | | | |

| | | | | | | | | | | |

| Add: Loss on extinguishment of debt | — | | | 1 | | | | | — | | | 193 | | | |

| Add (Deduct): Unrealized mark-to-market adjustment on available for sale securities | — | | | (3) | | | | | (4) | | | 4 | | | |

| Add: DOT settlement | 107 | | | — | | | | | 107 | | | — | | | |

| Add: Litigation settlement | — | | | — | | | | | 12 | | | — | | | |

| Deduct: Net income (loss) tax impact of fuel and special items (c) | (106) | | | (15) | | | | | (133) | | | (47) | | | |

| | | | | | | | | | | |

| Net income (loss), excluding special items | $ | 237 | | | $ | (226) | | | n.m. | | $ | 980 | | | $ | 723 | | | 35.5 |

| | | | | | | | | | | |

| Net income (loss) per share, diluted, as reported | $ | (0.42) | | | $ | (0.37) | | | | | $ | 0.76 | | | $ | 0.87 | | | |

| Add (Deduct): Impact of special items | 0.90 | | | (0.01) | | | | | 1.01 | | | 0.36 | | | |

| Add: Net impact of net income (loss) above from fuel contracts divided by dilutive shares | 0.02 | | | 0.02 | | | | | — | | | — | | | |

| Deduct: Net income (loss) tax impact of special items (c) | (0.15) | | | (0.02) | | | | | (0.21) | | | (0.07) | | | |

| | | | | | | | | | | |

| Add: GAAP to Non-GAAP diluted weighted average shares difference (d) | 0.03 | | | — | | | | | — | | | — | | | |

| Net income (loss) per share, diluted, excluding special items | $ | 0.38 | | | $ | (0.38) | | | n.m. | | $ | 1.56 | | | $ | 1.16 | | | 34.5 |

| | | | | | | | | | | |

| Operating expenses per ASM (cents) | ¢ | 15.88 | | | ¢ | 17.49 | | | | | ¢ | 15.19 | | | ¢ | 15.36 | | | |

| Deduct: Impact of special items | (8.55) | | | (8.20) | | | | | (7.82) | | | (0.03) | | | |

| Add (Deduct): Fuel and oil expense divided by ASMs | 3.74 | | | 4.23 | | | | | 3.65 | | | (4.03) | | | |

| Add (Deduct): Profitsharing expense divided by ASMs | (0.10) | | | (0.13) | | | | | 0.07 | | | (0.08) | | | |

| Operating expenses per ASM, excluding Fuel and oil expense, profitsharing, and special items (cents) | ¢ | 10.97 | | | ¢ | 13.39 | | | (18.1) | | ¢ | 11.09 | | | ¢ | 11.22 | | | (1.2) |

(a) Represents changes in estimate related to the contract ratification bonus for the Company’s Flight Attendants as part of the tentative agreement reached in October 2023 with the Transport Workers Union 556 ("TWU 556"). The Company began accruing for all of its open labor contracts on April 1, 2022, and this incremental $180 million expense extends the timeframe covered by the ratification bonus to the date the Flight Attendant contract became amendable on November 1, 2018, to compensate for missed wage increases over that time period. The Company’s consolidated financial statements for the year ended December 31, 2023 include market rate wage accruals for all workgroups with open collective bargaining agreements. See the Note Regarding Use of Non-GAAP Financial Measures for further information.

(b) Represents changes in estimate related to the contract ratification bonus for the Company’s Pilots as part of the tentative agreement reached in December 2023 with SWAPA. The Company began accruing for all of its open labor contracts on April 1, 2022, and this incremental $474 million expense for the three months ended December 31, 2023 represents an increase in retroactive pay associated with wage rates for purposes of calculating the ratification bonus agreed to for Pilots for periods prior to fourth quarter 2023. The Company’s consolidated financial results for all periods prior to the fourth quarter of 2023 included estimated market rate wage accruals for Pilots; however, the tentative agreement includes higher pay rates for those periods in the amounts of $354 million for periods prior to 2023 and $60 million, $27 million, and $33 million for the first, second, and third quarters of 2023, respectively. See the Note Regarding Use of Non-GAAP Financial Measures for further information.

(c) Tax amounts for each individual special item are calculated at the Company's effective rate for the applicable period and totaled in this line item.

(d) Adjustment related to GAAP and Non-GAAP diluted weighted average shares difference, due to the Company being in a Net loss position on a GAAP basis versus a Net income position on a Non-GAAP basis for the three months ended December 31, 2023.

Southwest Airlines Co.

Comparative Consolidated Operating Statistics

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Year ended | | |

| December 31, | | Percent | | December 31, | | Percent |

| | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Revenue passengers carried (000s) | 35,983 | | | 32,899 | | | 9.4 | | 137,279 | | | 126,586 | | | 8.4 |

| Enplaned passengers (000s) | 44,766 | | | 40,536 | | | 10.4 | | 171,817 | | | 156,982 | | | 9.5 |

| Revenue passenger miles (RPMs) (in millions) (a) | 35,580 | | | 31,303 | | | 13.7 | | 136,256 | | | 123,843 | | | 10.0 |

| Available seat miles (ASMs) (in millions) (b) | 45,513 | | | 37,490 | | | 21.4 | | 170,323 | | | 148,467 | | | 14.7 |

| Load factor (c) | 78.2 | % | | 83.5 | % | | (5.3) pts. | | 80.0 | % | | 83.4 | % | | (3.4) pts. |

| Average length of passenger haul (miles) | 989 | | | 952 | | | 3.9 | | 993 | | | 978 | | | 1.5 |

| Average aircraft stage length (miles) | 739 | | | 713 | | | 3.6 | | 730 | | | 728 | | | 0.3 |

| Trips flown | 385,291 | | | 332,402 | | | 15.9 | | 1,459,427 | | | 1,298,219 | | | 12.4 |

| Seats flown (000s) (d) | 61,293 | | | 52,000 | | | 17.9 | | 231,409 | | | 201,913 | | | 14.6 |

| Seats per trip (e) | 159.1 | | | 156.4 | | | 1.7 | | 158.6 | | | 155.5 | | | 2.0 |

| Average passenger fare | $ | 172.60 | | | $ | 168.42 | | | 2.5 | | $ | 172.18 | | | $ | 169.12 | | | 1.8 |

| Passenger revenue yield per RPM (cents) (f) | 17.46 | | | 17.70 | | | (1.4) | | 17.35 | | | 17.29 | | | 0.3 |

| RASM (cents) (g) | 14.99 | | | 16.46 | | | (8.9) | | 15.32 | | | 16.04 | | | (4.5) |

| PRASM (cents) (h) | 13.65 | | | 14.78 | | | (7.6) | | 13.88 | | | 14.42 | | | (3.7) |

| CASM (cents) (i) | 15.88 | | | 17.49 | | | (9.2) | | 15.19 | | | 15.36 | | | (1.1) |

| CASM, excluding Fuel and oil expense (cents) | 12.14 | | | 13.26 | | | (8.4) | | 11.54 | | | 11.33 | | | 1.9 |

| CASM, excluding special items (cents) | 14.59 | | | 17.38 | | | (16.1) | | 14.79 | | | 15.29 | | | (3.3) |

CASM, excluding Fuel and oil expense and

special items (cents) | 10.86 | | | 13.26 | | | (18.1) | | 11.15 | | | 11.31 | | | (1.4) |

| CASM, excluding Fuel and oil expense, special items, and profitsharing expense (cents) | 10.97 | | | 13.39 | | | (18.1) | | 11.09 | | | 11.22 | | | (1.2) |

Fuel costs per gallon, including fuel tax

(unhedged) | $ | 3.07 | | | $ | 3.50 | | | (12.3) | | $ | 2.95 | | | $ | 3.52 | | | (16.2) |

| Fuel costs per gallon, including fuel tax | $ | 3.01 | | | $ | 3.27 | | | (8.0) | | $ | 2.89 | | | $ | 3.10 | | | (6.8) |

Fuel costs per gallon, including fuel tax

(economic) | $ | 3.00 | | | $ | 3.18 | | | (5.7) | | $ | 2.89 | | | $ | 3.07 | | | (5.9) |

| Fuel consumed, in gallons (millions) | 565 | | | 484 | | | 16.7 | | 2,143 | | | 1,922 | | | 11.5 |

| Active fulltime equivalent Employees | 74,806 | | | 66,656 | | | 12.2 | | 74,806 | | | 66,656 | | | 12.2 |

| Aircraft at end of period (j) | 817 | | | 770 | | | 6.1 | | 817 | | | 770 | | | 6.1 |

(a) A revenue passenger mile is one paying passenger flown one mile. Also referred to as "traffic," which is a measure of demand for a given period.

(b) An available seat mile is one seat (empty or full) flown one mile. Also referred to as "capacity," which is a measure of the space available to carry passengers in a given period.

(c) Revenue passenger miles divided by available seat miles.

(d) Seats flown is calculated using total number of seats available by aircraft type multiplied by the total trips flown by the same aircraft type during a particular period.

(e) Seats per trip is calculated by dividing seats flown by trips flown.

(f) Calculated as passenger revenue divided by revenue passenger miles. Also referred to as "yield," this is the average cost paid by a paying passenger to fly one mile, which is a measure of revenue production and fares.

(g) RASM (unit revenue) - Operating revenue yield per ASM, calculated as operating revenue divided by available seat miles. Also referred to as "operating unit revenues," this is a measure of operating revenue production based on the total available seat miles flown during a particular period.

(h) PRASM (Passenger unit revenue) - Passenger revenue yield per ASM, calculated as passenger revenue divided by available seat miles. Also referred to as “passenger unit revenues,” this is a measure of passenger revenue production based on the total available seat miles flown during a particular period.

(i) CASM (unit costs) - Operating expenses per ASM, calculated as operating expenses divided by available seat miles. Also referred to as "unit costs" or "cost per available seat mile," this is the average cost to fly an aircraft seat (empty or full) one mile, which is a measure of cost efficiencies.

(j) Included four Boeing 737 Next Generation aircraft in temporary storage as of December 31, 2022.

Southwest Airlines Co.

Non-GAAP Return on Invested Capital (ROIC)

(See Note Regarding Use of Non-GAAP Financial Measures, and see note below)

(in millions)

(unaudited)

| | | | | | | | | | |

| | | | |

| Twelve Months Ended | | | |

| December 31, 2023 | | | |

| Operating income, as reported | $ | 224 | | | | |

| TWU 556 contract adjustment | 180 | | | | |

| SWAPA contract adjustment | 354 | | | | |

| Net impact from fuel contracts | 16 | | | | |

| | | | |

| | | | |

| DOT settlement | 107 | | | | |

| Litigation settlement | 12 | | | | |

| Operating income, non-GAAP | $ | 893 | | | | |

| Net adjustment for aircraft leases (a) | 128 | | | | |

| | | | |

| Adjusted operating income, non-GAAP (A) | $ | 1,021 | | | | |

| | | | |

| Non-GAAP tax rate (B) | 23.5 | % | (d) | | |

| | | | |

| Net operating profit after-tax, NOPAT (A* (1-B) = C) | $ | 781 | | | | |

| | | | |

| Debt, including finance leases (b) | $ | 8,033 | | | | |

| Equity (b) | 10,669 | | | | |

| Net present value of aircraft operating leases (b) | 1,029 | | | | |

| Average invested capital | $ | 19,731 | | | | |

| Equity adjustment (c) | (168) | | | | |

| Adjusted average invested capital (D) | $ | 19,563 | | | | |

| | | | |

| Non-GAAP ROIC, pre-tax (A/D) | 5.2 | % | | | |

| | | | |

| Non-GAAP ROIC, after-tax (C/D) | 4.0 | % | | | |

(a) Net adjustment related to presumption that all aircraft in fleet are owned (i.e., the impact of eliminating aircraft rent expense and replacing with estimated depreciation expense for those same aircraft). The Company makes this adjustment to enhance comparability to other entities that have different capital structures by utilizing alternative financing decisions.

(b) Calculated as an average of the five most recent quarter end balances or remaining obligations. The Net present value of aircraft operating leases represents the assumption that all aircraft in the Company’s fleet are owned, as it reflects the remaining contractual commitments discounted at the Company's estimated incremental borrowing rate as of the time each individual lease was signed.

(c) The Equity adjustment in the denominator adjusts for the cumulative impacts, in Accumulated other comprehensive income and Retained earnings, of gains and/or losses that will settle in future periods, including those associated with the Company's fuel hedges. The current period impact of these gains and/or losses is reflected in the Net impact from fuel contracts in the numerator.

(d) The GAAP full year tax rate as of December 31, 2023, was 26.5 percent, and the full year Non-GAAP tax rate was 23.5 percent. See Note Regarding Use of Non-GAAP Financial Measures for additional information.

Southwest Airlines Co.

Condensed Consolidated Balance Sheet

(in millions)

(unaudited)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 9,288 | | | $ | 9,492 | |

| Short-term investments | 2,186 | | | 2,800 | |

| Accounts and other receivables | 1,154 | | | 1,040 | |

| Inventories of parts and supplies, at cost | 807 | | | 790 | |

| Prepaid expenses and other current assets | 520 | | | 686 | |

| Total current assets | 13,955 | | | 14,808 | |

| Property and equipment, at cost: | | | |

| Flight equipment | 26,060 | | | 23,725 | |

| Ground property and equipment | 7,460 | | | 6,855 | |

| Deposits on flight equipment purchase contracts | 236 | | | 376 | |

| Assets constructed for others | 62 | | | 28 | |

| | 33,818 | | | 30,984 | |

| Less allowance for depreciation and amortization | 14,443 | | | 13,642 | |

| | 19,375 | | | 17,342 | |

| Goodwill | 970 | | | 970 | |

| Operating lease right-of-use assets | 1,223 | | | 1,394 | |

| Other assets | 964 | | | 855 | |

| | $ | 36,487 | | | $ | 35,369 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,862 | | | $ | 2,004 | |

| Accrued liabilities | 3,606 | | | 2,043 | |

| Current operating lease liabilities | 208 | | | 225 | |

| Air traffic liability | 6,551 | | | 6,064 | |

| Current maturities of long-term debt | 29 | | | 42 | |

| Total current liabilities | 12,256 | | | 10,378 | |

| | | |

| Long-term debt less current maturities | 7,978 | | | 8,046 | |

| Air traffic liability - noncurrent | 1,728 | | | 2,186 | |

| Deferred income taxes | 2,044 | | | 1,985 | |

| | | |

| Noncurrent operating lease liabilities | 985 | | | 1,118 | |

| Other noncurrent liabilities | 981 | | | 969 | |

| Stockholders' equity: | | | |

| Common stock | 888 | | | 888 | |

| Capital in excess of par value | 4,153 | | | 4,037 | |

| Retained earnings | 16,297 | | | 16,261 | |

| Accumulated other comprehensive income | — | | | 344 | |

| Treasury stock, at cost | (10,823) | | | (10,843) | |

| Total stockholders' equity | 10,515 | | | 10,687 | |

| | $ | 36,487 | | | $ | 35,369 | |

Southwest Airlines Co.

Condensed Consolidated Statement of Cash Flows

(in millions) (unaudited) | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended

December 31, | |

| 2023 | | 2022 | | 2023 | | 2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net income (loss) | $ | (252) | | | $ | (220) | | | $ | 465 | | | $ | 539 | | |

| Adjustments to reconcile net income (loss) to cash provided by operating activities: | | | | | | | | |

| Depreciation and amortization | 415 | | | 367 | | | 1,522 | | | 1,351 | | |

| Impairment of long-lived assets | — | | | — | | | — | | | 35 | | |

| Unrealized mark-to-market adjustment on available for sale securities | — | | | (3) | | | (4) | | | 4 | | |

| Unrealized/realized (gain) loss on fuel derivative instruments | 14 | | | (44) | | | — | | | (2) | | |

| Deferred income taxes | (52) | | | 32 | | | 159 | | | 228 | | |

| | | | | | | | |

| Loss on extinguishment of debt | — | | | 1 | | | — | | | 193 | | |

| Changes in certain assets and liabilities: | | | | | | | | |

| Accounts and other receivables | 316 | | | 259 | | | (89) | | | 422 | | |

| Other assets | (14) | | | (51) | | | 60 | | | (66) | | |

| Accounts payable and accrued liabilities | 740 | | | 500 | | | 1,386 | | | 936 | | |

| Air traffic liability | (721) | | | (175) | | | 29 | | | 525 | | |

| Other liabilities | 43 | | | (43) | | | (137) | | | (334) | | |

| Cash collateral provided to derivative counterparties | (50) | | | (28) | | | (56) | | | (69) | | |

| Other, net | (14) | | | (16) | | | (171) | | | 28 | | |

| Net cash provided by operating activities | 425 | | | 579 | | | 3,164 | | | 3,790 | | |

| | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Capital expenditures | (707) | | | (1,355) | | | (3,520) | | | (3,924) | | |

| | | | | | | | |

| | | | | | | | |

| Assets constructed for others | (11) | | | (9) | | | (33) | | | (22) | | |

| Purchases of short-term investments | (1,623) | | | (1,379) | | | (6,970) | | | (5,592) | | |

| Proceeds from sales of short-term and other investments | 1,677 | | | 1,810 | | | 7,591 | | | 5,792 | | |

| | | | | | | | |

| Net cash used in investing activities | (664) | | | (933) | | | (2,932) | | | (3,746) | | |

| | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Proceeds from Employee stock plans | 12 | | | 12 | | | 48 | | | 45 | | |

| | | | | | | | |

| Payments of long-term debt and finance lease obligations | (7) | | | (611) | | | (85) | | | (2,437) | | |

| | | | | | | | |

| | | | | | | | |

| Payments of cash dividends | — | | | — | | | (428) | | | — | | |

| Proceeds of terminated interest rate derivative instruments | 23 | | | — | | | 23 | | | — | | |

| Payments for repurchases and conversions of convertible debt | — | | | — | | | — | | | (648) | | |

| | | | | | | | |

| | | | | | | | |

| Other, net | 2 | | | 2 | | | 6 | | | 8 | | |

| Net cash provided by (used in) financing activities | 30 | | | (597) | | | (436) | | | (3,032) | | |

| | | | | | | | |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | (209) | | | (951) | | | (204) | | | (2,988) | | |

| | | | | | | | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 9,497 | | | 10,443 | | | 9,492 | | | 12,480 | | |

| | | | | | | | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 9,288 | | | $ | 9,492 | | | $ | 9,288 | | | $ | 9,492 | | |

NOTE REGARDING USE OF NON-GAAP FINANCIAL MEASURES

The Company's unaudited Condensed Consolidated Financial Statements are prepared in accordance with accounting principles generally accepted in the United States ("GAAP"). These GAAP financial statements may include (i) unrealized noncash adjustments and reclassifications, which can be significant, as a result of accounting requirements and elections made under accounting pronouncements relating to derivative instruments and hedging and (ii) other charges and benefits the Company believes are unusual and/or infrequent in nature and thus may make comparisons to its prior or future performance difficult.

As a result, the Company also provides financial information in this update that was not prepared in accordance with GAAP and should not be considered as an alternative to the information prepared in accordance with GAAP. The Company provides supplemental non-GAAP financial information (also referred to as "excluding special items"), including results that it refers to as "economic," which the Company's management utilizes to evaluate its ongoing financial performance and the Company believes provides additional insight to investors as supplemental information to its GAAP results. The non-GAAP measures provided that relate to the Company’s performance on an economic fuel cost basis include Fuel and oil expense, non-GAAP; Total operating expenses, non-GAAP; Operating expenses, non-GAAP excluding Fuel and oil expense; Operating expenses, non-GAAP excluding Fuel and oil expense and profitsharing; Operating income (loss), non-GAAP; Other (gains) losses, net, non-GAAP; Income (loss) before income taxes, non-GAAP; Provision (benefit) for income taxes, net, non-GAAP; Net income (loss), non-GAAP; Net income (loss) per share, diluted, non-GAAP; and Operating expenses per ASM, non-GAAP, excluding Fuel and oil expense and profitsharing (cents). The Company's economic Fuel and oil expense results differ from GAAP results in that they only include the actual cash settlements from fuel hedge contracts - all reflected within Fuel and oil expense in the period of settlement. Thus, Fuel and oil expense on an economic basis has historically been utilized by the Company, as well as some of the other airlines that utilize fuel hedging, as it reflects the Company’s actual net cash outlays for fuel during the applicable period, inclusive of settled fuel derivative contracts. Any net premium costs paid related to option contracts that are designated as hedges are reflected as a component of Fuel and oil expense, for both GAAP and non-GAAP (including economic) purposes in the period of contract settlement. The Company believes these economic results provide further insight into the impact of the Company's fuel hedges on its operating performance and liquidity since they exclude the unrealized, noncash adjustments and reclassifications that are recorded in GAAP results in accordance with accounting guidance relating to derivative instruments, and they reflect all cash settlements related to fuel derivative contracts within Fuel and oil expense. This enables the Company's management, as well as investors and analysts, to consistently assess the Company's operating performance on a year-over-year or quarter-over-quarter basis after considering all efforts in place to manage fuel expense. However, because these measures are not determined in accordance with GAAP, such measures are susceptible to varying calculations, and not all companies calculate the measures in the same manner. As a result, the aforementioned measures, as presented, may not be directly comparable to similarly titled measures presented by other companies.

Further information on (i) the Company's fuel hedging program, (ii) the requirements of accounting for derivative instruments, and (iii) the causes of hedge ineffectiveness and/or mark-to-market gains or losses from derivative instruments is included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and subsequent filings.

The Company’s GAAP results in the applicable periods may include other charges or benefits that are also deemed “special items” that the Company believes make its results difficult to compare to prior periods, anticipated future periods, or industry trends. Financial measures identified as non-GAAP (or as "excluding special items") have been adjusted to exclude special items. For the periods presented, in addition to the items discussed above, special items include:

1.Accruals associated with ongoing labor contract negotiations with TWU 556, which represents the Company’s Flight Attendants. These amounts accrued in 2023 relate to additional compensation for services performed by Employees outside of fiscal year 2023;

2.Accruals associated with the recently ratified Pilot contract. These amounts accrued during the fourth quarter 2023 and/or for the fiscal year 2023, relate to additional compensation for services performed by Employees outside of those applicable fiscal periods;

3.Noncash impairment charges, primarily associated with adjustments to the salvage values for previously retired airframes;

4.A charge associated with a settlement reached with the Department of Transportation as a result of the Company's December 2022 operational disruption;

5.A charge associated with a tentative litigation settlement regarding certain California state meal-and-rest-break regulations for flight attendants;

6.Unrealized mark-to-market adjustment associated with certain available for sale securities; and

7.Losses associated with the partial extinguishment of the Company's Convertible Notes and early prepayment of debt. Such losses are incurred as a result of opportunistic decisions made by the Company to prepay portions of its debt, most of which was incurred during the pandemic in order to provide liquidity during the prolonged downturn in air travel.

Because management believes special items can distort the trends associated with the Company’s ongoing performance as an airline, the Company believes that evaluation of its financial performance can be enhanced by a supplemental presentation of results that exclude the impact of special items in order to enhance consistency and comparativeness with results in prior periods that do not include such items and as a basis for evaluating operating results in future periods. The following measures are often provided, excluding special items, and utilized by the Company’s management, analysts, and investors to enhance comparability of year-over-year results, as well as to industry trends: Fuel and oil expense, non-GAAP; Total operating expenses, non-GAAP; Operating expenses, non-GAAP excluding Fuel and oil expense; Operating expenses, non-GAAP excluding Fuel and oil expense and profitsharing; Operating income (loss), non-GAAP; Other (gains) losses, net, non-GAAP; Income (loss) before income taxes, non-GAAP; Provision (benefit) for income taxes, net, non-GAAP; Net income (loss), non-GAAP; Net income (loss) per share, diluted, non-GAAP; and Operating expenses per ASM, non-GAAP, excluding Fuel and oil expense and profitsharing (cents).

The Company has also provided its calculation of return on invested capital, which is a measure of financial performance used by management to evaluate its investment returns on capital. Return on invested capital is not a substitute for financial results as reported in accordance with GAAP and should not be utilized in place of such GAAP results. Although return on invested capital is not a measure defined by GAAP, it is calculated by the Company, in part, using non-GAAP financial measures. Those non-GAAP financial measures are utilized for the same reasons as those noted above for Net income (loss), non-GAAP and Operating income (loss), non-GAAP. The comparable GAAP measures include charges or benefits that are deemed "special items" that the Company believes make its results difficult to compare to prior periods, anticipated future periods, or industry trends, and the Company’s profitability targets and estimates, both internally and externally, are based on non-GAAP results since "special items" cannot be reliably predicted or estimated. The Company believes non-GAAP return on invested capital is a meaningful measure because it quantifies the Company's effectiveness in generating returns relative to the capital it has invested in its business. Although return on invested capital is commonly used as a measure of capital efficiency, definitions of return on invested capital differ; therefore, the Company is providing an explanation of its calculation for non-GAAP return on invested capital in the accompanying reconciliation in order to allow investors to compare and contrast its calculation to the calculations provided by other companies.

The Company has also provided adjusted debt, invested capital, and adjusted debt to invested capital (leverage), which are non-GAAP measures of financial performance. Management believes these supplemental measures can provide a more accurate view of the Company's leverage and risk, since they consider the Company’s debt and debt-like obligation profile and capital. Leverage ratios are widely used by investors, analysts, and rating agencies in the valuation, comparison, rating, and investment recommendations of companies. Although adjusted debt, invested capital, and leverage ratios are commonly-used financial measures, definitions of each differ; therefore, the Company is providing an explanation of its calculations for non-GAAP adjusted debt and adjusted equity in the accompanying reconciliation below in order to allow investors to compare and contrast its calculations to the calculations provided by other companies. Invested capital is adjusted debt plus adjusted equity. Leverage is calculated as adjusted debt divided by invested capital.

| | | | | |

| December 31, 2023 |

| (in millions) | |

| Current maturities of long-term debt, as reported | $ | 29 | |

| Long-term debt less current maturities, as reported | 7,978 | |

| Total debt, including finance leases | 8,007 | |

| Add: Net present value of aircraft operating leases | 950 | |

| Adjusted debt (A) | $ | 8,957 | |

| |

| Total stockholders' equity, as reported | $ | 10,515 | |

| Deduct: Equity Adjustment (a) | 4 | |

| Adjusted equity (B) | $ | 10,511 | |

| |

| Invested capital (A+B) | $ | 19,468 | |

| |

| Leverage: Adjusted debt to invested capital (A/(A+B)) | 46 | % |

(a) The Equity adjustment adjusts for the cumulative impacts, in Accumulated other comprehensive income and Retained earnings, of gains and/or losses that will settle in future periods, including those associated with the Company's fuel hedges.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

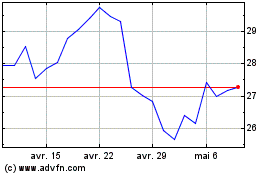

Southwest Airlines (NYSE:LUV)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Southwest Airlines (NYSE:LUV)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024