| |

FILED

PURSUANT TO RULE 424(b)(5) |

| |

REGISTRATION

FILE NO.: 333-277142 |

| |

|

PROSPECTUS SUPPLEMENT

(to prospectus dated February 16, 2024)

Up to $350,000,000

Shares of Beneficial Interest Classified

as Common Stock

We have entered into an amendment (the “Amendment”)

to the equity sales agreement, dated as of November 27, 2019, as amended on February 19, 2021 (the “Sales Agreement”), relating

to our shares of beneficial interest classified as common stock, par value $0.0001 per share, which we refer to as common shares, that

may be offered in accordance with this prospectus supplement and the accompanying prospectus, with Jefferies LLC (“Jefferies”),

KeyBanc Capital Markets Inc. (“KeyBanc”), Regions Securities LLC (“Regions”), BofA Securities, Inc. (“BofA”),

Mizuho Securities USA LLC (“Mizuho”) and Evercore Group L.L.C. (“Evercore”). We refer to Jefferies, KeyBanc, Regions,

BofA, Mizuho and Evercore collectively as the “Sales Agents,” and individually as a “Sales Agent.” The Amendment

increased the aggregate offering price of common shares we may offer and sell from time to time under the Sales Agreement to up to an

aggregate of $350,000,000.

The Sales Agreement provides that, in addition

to the offer and sale of our common shares by us through the Sales Agents, we may also enter into one or more forward sale agreements

with any of Jefferies, KeyBanc, Mizuho Markets Americas LLC, Bank of America, N.A., or Regions or one of their respective agents or affiliates.

We refer to these entities, when acting in such capacity, as a “Forward Purchaser,” and collectively, in such capacity, as

the “Forward Purchasers,” and we refer to the Sales Agents, when acting as agents for Forward Purchasers as “Forward

Sellers.” In connection with any forward sale agreement, the relevant Forward Purchaser will, at our request, use commercially reasonable

efforts, consistent with its normal sales and trading practices for similar transactions and applicable laws and regulations, to borrow

from third parties and, through the relevant Forward Seller, sell a number of common shares equal to the number of common shares underlying

the particular forward sale agreement. In no event will the aggregate number of common shares sold through the Sales Agents, each as an

agent for us, as principal and as Forward Seller under the Sales Agreement and under any terms agreement (as described below) have an

aggregate gross sales price in excess of $350,000,000 on or after the date of this prospectus supplement. The offering of common shares

pursuant to the Sales Agreement will terminate upon the earlier of (1) the sale of our common shares subject to the Sales Agreement having

an aggregate offering price of $350,000,000 (including shares sold by us to or through the Sales Agents and borrowed shares sold by the

Forward Sellers) on and after the date of this prospectus supplement, and (2) the termination of the Sales Agreement, pursuant to its

terms.

Sales of common shares, if any, made through

the Sales Agents, acting as our sales agents, or as the Forward Sellers or as principal, as contemplated by this prospectus supplement

and the accompanying prospectus, may be made by means of ordinary brokers’ transactions on the New York Stock Exchange in negotiated

transactions or transactions that are deemed to be “at-the-market” offerings as defined in Rule 415 under the Securities Act

of 1933, as amended (the “Securities Act”), including transactions with a market maker for sales other than on an exchange,

at prices related to the prevailing market prices or at negotiated prices, or as otherwise agreed with the applicable Sales Agent or Forward

Seller. None of the Sales Agents, acting as our sales agents or as Forward Sellers, is required to sell any specific number or dollar

amount of common shares, but each has agreed to use its commercially reasonable efforts to sell the common shares offered as instructed

by us when acting as Sales Agent, or when as agent for a Forward Purchaser, as applicable, and in each case, consistent with

its normal sales and trading practices for similar transactions and applicable laws and regulations and on the terms and subject to the

conditions of the Sales Agreement.

The common shares offered and sold through

the Sales Agents, as our sales agents, or Forward Sellers, as agents for the Forward Purchasers, pursuant to this prospectus

supplement and the accompanying prospectus, will be offered and sold through only one Sales Agent or Forward Seller on any given day.

Each Sales Agent acting as our sales agent

will be entitled to compensation up to 2.0% of the gross sales price per share for any common shares sold through it as our sales agent.

In connection with any forward sale agreement, the Sales Agent acting as the Forward Seller will receive, in the form of a forward

price that will be reduced from the initial forward price payable by the relevant Forward Purchaser under the terms of such forward sale

agreement, plus a commission at a mutually agreed rate that will not exceed 2.0% of the gross sales price of all borrowed common shares

sold during the applicable forward hedge selling period by it as a Forward Seller. In connection with the sale of common shares effected

in an “at the market” offering, each Sales Agent, Forward Seller or Forward Purchaser may be deemed to be an “underwriter”

within the meaning of the Securities Act, and the compensation of the Sales Agents, Forward Sellers and Forward Purchasers may be deemed

to be underwriting commissions or discounts. We have agreed to indemnify the Sales Agents, the Forward Sellers and the Forward Purchasers

against certain civil liabilities, including liabilities under the Securities Act.

Under the terms of the Sales Agreement, we

also may sell our common shares to each of the Sales Agents as principal for its own account, at a price to be agreed upon at the time

of sale. If we sell shares to any of the Sales Agents as principal, we will enter into a separate terms agreement with such Sales Agent

and we will describe the agreement in a separate prospectus supplement or pricing supplement.

The net proceeds we receive from the sale

of our common shares in this offering will be the gross proceeds received from such sales less the commissions and any other costs we

may incur in issuing and/or selling the common shares; provided, however, that we will not initially receive any proceeds from the sale

of borrowed common shares by any Forward Seller. We expect to receive proceeds from the sale of common shares, subject to certain adjustments,

upon future physical settlement(s) of the relevant forward sale agreement with the relevant Forward Purchaser on dates specified by us

on or prior to the maturity date of such forward sale agreement (no later than a date that is up to two years from entry into such forward

sale agreement). Unless otherwise expressly stated or the context otherwise requires, references herein to the “relevant”

or “applicable” Forward Purchaser mean, with respect to any Sales Agent, the agent or affiliate of such Sales Agent that

is acting as Forward Purchaser or, if applicable, such Sales Agent acting in its capacity as Forward Purchaser, and vice versa mutatis

mutandis with respect to references herein to the “relevant” or “applicable” Sales Agent (except with respect

to Evercore, in which case the “relevant” or “applicable” Forward Purchaser may be any of the Forward Purchasers

and Evercore may act, in its capacity as a Forward Seller, as agent for any of the Forward Purchasers). We expect to physically settle

each forward sale agreement. We also have the ability to elect to cash settle or net share settle all or a portion of our obligations

under any forward sale agreement. If we elect to cash settle any forward sale agreement, we may not receive any proceeds, and we may

owe cash to the relevant Forward Purchaser in certain circumstances. If we elect to net share settle any forward sale agreement, we will

not receive any proceeds, and we may owe common shares to the relevant Forward Purchaser in certain circumstances. See “Plan of

Distribution” on page S-10 of this prospectus supplement.

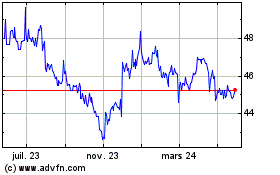

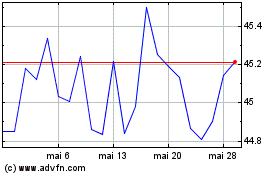

Our common shares are listed on the New York

Stock Exchange under the symbol “LXP.” On February 15, 2024, the last sale price of our common shares as reported on the New

York Stock Exchange was $8.75 per share.

Investing in our common shares involves

risks. See “Risk Factors” beginning on page S-6 of this prospectus supplement and in the section titled “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2023, and in our periodic reports and other information that we file

from time to time with the Securities and Exchange Commission, which are incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Jefferies |

KeyBanc Capital Markets |

| Regions Securities LLC |

BofA Securities |

| Mizuho |

Evercore ISI |

This Prospectus Supplement is dated February

16, 2024.

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS

SUPPLEMENT

All references to “the Company,”

“we,” “our” and “us” in this prospectus supplement mean LXP Industrial Trust and all entities owned

or controlled by us except where it is made clear that the term means only the parent company. The term "you" refers to a prospective

participant in the plan. When we use the term “REIT,” we mean real estate investment trust under Sections 856 through 860

of the Code.

You should read this prospectus supplement

along with the accompanying prospectus, as well as the information incorporated by reference herein and therein, carefully before you

invest. These documents contain important information you should consider before making your investment decision. This prospectus supplement

and the accompanying prospectus contain the terms of this offering of common shares. The accompanying prospectus contains information

about our securities generally, some of which does not apply to the common shares covered by this prospectus supplement. This prospectus

supplement may add, update or change information contained in or incorporated by reference in the accompanying prospectus. If the information

in this prospectus supplement is inconsistent with any information contained in or incorporated by reference in the accompanying prospectus,

the information in this prospectus supplement will apply and will supersede the inconsistent information contained in or incorporated

by reference in the accompanying prospectus.

It is important for you to read and consider

all information contained in this prospectus supplement and the accompanying prospectus in making your investment decision. You should

also read and consider the additional information incorporated by reference in this prospectus supplement and the accompanying prospectus.

See “Where You Can Find More Information” in the prospectus.

CAUTIONARY STATEMENTS

CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus supplement

and the information incorporated by reference in this prospectus supplement include “forward-looking statements” within the

meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. We intend such forward-looking statements to be covered

by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include

this statement for purposes of complying with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions

and describe our future plans, strategies and expectations, are generally identifiable by use of the words “believes,” “expects,”

“intends,” “anticipates,” “estimates,” “projects,” “may,” “plans,”

“predicts,” “will,” “will likely result” or similar expressions. Readers should not rely on forward-looking

statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and

which could materially affect actual results, performances or achievements. In particular, among the factors that could cause actual results,

performances or achievements to differ materially from current expectations, strategies or plans include, among others:

| ● | changes in our industry and changes in the real estate market particularly, either nationally or regionally; |

| ● | changes in economic conditions generally and the real estate market specifically; |

| ● | adverse developments with respect to our tenants, including defaults or non-renewals of significant tenant

leases; |

| ● | impairments in the value of our real estate investments; |

| ● | failure to consummate the transactions described in this prospectus or the failure of any transactions

to perform to our expectations; |

| ● | legislative/regulatory/accounting changes, including changes to laws governing and policies and guidelines

applicable to the taxation of REITs; |

| ● | any material legal proceedings; |

| ● | availability of debt and equity capital; |

| ● | increases in real estate construction costs; |

| ● | changes in interest rates; |

| ● | supply and demand for properties in our current and proposed market areas; |

| ● | a downgrade in our credit ratings; |

| ● | direct and indirect impacts of climate change; |

| ● | the other risk factors set forth in our Annual Report on Form 10-K filed with the SEC on February 15,

2024, the section titled “Risk Factors” beginning on page 15 of this prospectus supplement and our the other documents incorporated

by reference herein, including documents that we file with the SEC in the future that are incorporated by reference herein. |

These risks and uncertainties

should be considered in evaluating any forward-looking statements contained or incorporated by reference in this prospectus supplement.

We caution you that any forward-looking statement reflects only our belief at the time the statement is made. Although we believe that

the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee our future results, levels of activity,

performance or achievements. Except as required by law, we undertake no obligation to publicly release the results of any revisions to

these forward-looking statements which may be made to reflect events or circumstances after the date hereof or to reflect the occurrence

of unanticipated events. Accordingly, there is no assurance that our expectations will be realized.

PROSPECTUS SUPPLEMENT

SUMMARY

This summary highlights selected information

contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. Because this is a summary,

it does not contain all of the information that is important to you. Before making a decision to invest in our common shares, you should

read carefully this entire prospectus supplement, the accompanying prospectus, any free writing prospectus relating to this offering and

the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, as provided in “Where You

Can Find More Information” in the prospectus, especially the risk factors set forth in (i) our Annual Report on Form 10-K for the

year ended December 31, 2023, filed with the Securities and Exchange Commission, or the Commission, on February 15, 2024, which we refer

to as our Annual Report, (ii) the information under the caption “Risk Factors” on page S-6 of this prospectus supplement and

(iii) the information in any documents subsequently filed with the Commission that are incorporated by reference herein as provided in

“Where You Can Find More Information” in the prospectus for a discussion of factors you should consider carefully before making

an investment decision to purchase our common shares.

The Company

We are a Maryland real estate investment trust, which

has elected to qualify to be taxed as a real estate investment trust for U.S. federal income tax purposes (a “REIT”), focused

on single-tenant warehouse/distribution real estate investments. A majority of our properties are subject to net or similar leases, where

the tenant bears all or substantially all of the costs, including cost increases, for real estate taxes, utilities, insurance and ordinary

repairs. However, certain leases provide that the landlord is responsible for certain operating expenses.

As of December 31, 2023, we had equity ownership interests

in approximately 115 consolidated real estate properties, located in 18 states and containing an aggregate of approximately 54.6 million

square feet of space, approximately 99.8% of which was leased.

As of December 31, 2023, our portfolio consisted of

112 warehouse/distribution facilities and three other properties. Our warehouse/distribution portfolio is primarily focused in our target

markets within the Sunbelt and Midwest. We expect to grow these markets by executing on our development pipeline, including through build-to-suits,

and opportunistically acquiring facilities in these markets.

Our common shares and Series C preferred shares

are traded on the New York Stock Exchange, or NYSE, under the symbols “LXP” and “LXPPRC,” respectively.

We elected to be taxed as a REIT under Sections

856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), commencing with our taxable year ended December

31, 1993. We intend to continue to qualify as a REIT. If we qualify for taxation as a REIT, we generally will not be subject to federal

corporate income taxes on our net taxable income that is currently distributed to our shareholders. We conduct certain taxable activities

through our taxable REIT subsidiary, Lexington Realty Advisors, Inc.

Our principal executive offices are located

at One Penn Plaza, Suite 4015, New York, New York 10119-4015; our telephone number is (212) 692-7200.

We maintain a website at www.lxp.com, which

contains information about us and our subsidiaries. We have not incorporated by reference into this prospectus supplement or the accompanying

prospectus the information included or referred to in, or that can be accessed through, our website, and you should not consider it to

be a part of this prospectus supplement or the accompanying prospectus.

| THE OFFERING |

| |

| Issuer |

LXP Industrial Trust, a Maryland real estate investment trust. |

| |

|

| Shares to be offered from time to time |

Shares of beneficial interest classified as common stock, par value $0.0001 per share, and referred to as common shares, with an aggregate offering price of up to $350,000,000 from the date of this prospectus. |

| |

|

| Manner of offering |

“At-the-market” offering that may be made from time to time through Jefferies, KeyBanc, Regions, BofA, Mizuho and Evercore as Sales Agents or as principals, and if we enter into a forward sale agreement, the Forward Sellers may offer and sell borrowed common shares using commercially reasonable efforts. If we enter into a forward sale agreement, we will not initially receive any proceeds from any sale of borrowed common shares by a Forward Seller. See “Plan of Distribution” on page S-10 of this prospectus supplement. |

| |

|

| Use of proceeds |

We intend to use the net proceeds of this offering

for general corporate purposes, including, without limitation, unspecified future acquisitions and to repay amounts outstanding on our

unsecured credit facility, as the same may be amended, modified or replaced from time to time.

One or more affiliates of KeyBanc, Regions, BofA,

and Mizuho are lenders under our unsecured credit facility and as such may receive a portion of the proceeds from this offering. See

“Use of Proceeds” on page S-9 and “Other Relationships” on page S-14 of this prospectus supplement.

In addition, if we enter into a forward sale agreement

with any Forward Purchaser, the Sales Agent acting as the Forward Seller will use commercially reasonable efforts, consistent

with its normal sales and trading practices for similar transactions and applicable laws and regulations, to borrow from third parties

and sell our common shares to hedge such Forward Purchaser’s exposure under such forward sale agreement. All of the net proceeds

from the sale of any such borrowed common shares will be paid to the applicable Forward Purchaser. We will not initially receive any proceeds

from the sale of borrowed common shares by any Forward Seller in connection with any forward sale agreement as a hedge of such forward

sale agreement. See “Use of Proceeds” on page S-9 and “Other Relationships” on page S-14 of this prospectus supplement.

|

| |

|

| Accounting Treatment |

In the event we enter into any forward sale agreement, before any issuance of common shares upon physical settlement of that particular forward sale agreement, such forward sale agreement will be reflected in our diluted earnings per share calculations using the treasury stock method. Under this method, the number of common shares used in calculating diluted earnings per share is deemed to be increased by the excess, if any, of the number of common shares that we would issue if we elected full physical settlement of such forward sale agreement over the number of common shares that could be purchased by us in the market (based on the average market price during the period) using the proceeds receivable upon full physical settlement (based on the adjusted forward sale price at the end of the reporting period). Consequently, prior to physical settlement or net share settlement of a particular forward sale agreement and subject to the occurrence of certain events, we anticipate there will be no dilutive effect on our earnings per share except during periods when the average market price of our common shares is above the applicable adjusted forward sale price under that particular forward sale agreement, and subject to adjustment based on a floating interest rate factor equal to a specified daily rate less a spread, and subject to decrease by an amount per share specified in that particular forward sale agreement on each of certain dates specified in that particular forward sale agreement. However, if we elect to physically settle or net share settle a particular forward sale agreement, delivery of our common shares on any physical settlement or net share settlement (if any) of such forward sale agreement will result in dilution to our earnings per share and return on equity. |

| |

|

| Risk factors |

Investing in our common shares involves risks. See “Risk Factors” beginning on page S-6 of this prospectus supplement and in the section entitled “Risk Factors” in our Annual Report and in our periodic reports and other information that we file from time to time with the Commission, which are incorporated by reference into this prospectus supplement. |

| |

|

| NYSE symbol |

LXP |

RISK FACTORS

Investing in our common shares involves

risks. You should consider carefully the risks described and discussed under the caption “Risk Factors” included in our Annual

Report and in any other documents incorporated by reference in this prospectus supplement before making a decision to purchase our common

shares. These risk factors may be amended, supplemented or superseded from time to time by risk factors contained in any prospectus supplement

or post-effective amendment we may file or in other reports we file with the Commission in the future. In addition, new risks may emerge

at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance.

This offering may be dilutive, and there may be future dilution

of our common shares.

This offering may have a dilutive effect on

our expected earnings per share and funds from operations per share for the year ending December 31, 2024 or in future years when shares

are sold pursuant to this offering. The actual amount of such dilution, if any, cannot be determined at this time and will be based on

numerous factors, including, without limitation, the amount of shares issued in this offering and the ultimate application of the proceeds

thereof. We are not restricted from issuing in the future additional common shares or preferred shares, including any securities that

are convertible into or exchangeable for, or that represent the right to receive, common shares or preferred shares or any substantially

similar securities. The market price of our common shares could decline as a result of sales of a large number of our common shares in

the market after this offering or the perception that such sales could occur.

Securities eligible for future sale may have adverse effects

on our share price.

Our board of trustees is authorized, without

shareholder approval, to cause us to issue additional common shares or to raise capital through the issuance of preferred shares (including

equity or debt securities convertible into common shares), options, warrants and other rights, on terms and for consideration as our board

of trustees in its sole discretion may determine. Sales of substantial amounts of our common shares or securities convertible of exercisable

for our common shares, or the perception that such sales or issuances could occur, could cause the market price of our common shares to

decrease significantly. We cannot predict the effect, if any, of future sales of our common shares or securities convertible of exercisable

for our common shares will have on the value of our common shares.

We may change the dividend policy for

our common shares in the future.

As of the date of this prospectus supplement,

our annual dividend rate on our common shares is $0.52 per common share, based on our most recently announced quarterly dividend for the

quarter ending December 31, 2023. The decision to declare and pay dividends on our common shares in the future, as well as the timing,

amount and composition of any such future dividends, will be at the sole discretion of our board of trustees in light of conditions then

existing, including our earnings, financial condition, capital requirements, debt maturities, the availability of debt and equity capital,

applicable REIT and legal restrictions and the general overall economic conditions and other factors. The actual dividend payable will

be determined by our board of trustees based upon the circumstances at the time of declaration and the actual dividend payable may vary

from such expected amount. Any change in our dividend policy could have a material adverse effect on the market price of our common shares.

A downgrade in our credit ratings could materially

adversely affect our business and financial condition.

The credit ratings assigned to our debt could

change based upon, among other things, our results of operations and financial condition or the real estate industry generally. These

ratings are subject to ongoing evaluation by credit rating agencies, and we cannot assure you that any rating will not be changed or withdrawn

by a rating agency in the future if, in its judgment, circumstances warrant. Moreover, these credit ratings do not apply to our common

shares and are not recommendations to buy, sell or hold any other securities, but any downgrade of our debt could also materially adversely

affect the market price of our common shares. If any of the credit rating agencies that have rated our debt downgrades or lowers its credit

rating, or if any credit rating agency indicates that it has placed any such rating on a so-called “watch list” for a possible

downgrading or lowering or otherwise indicates that its outlook for that rating is negative, it could have a material adverse effect on

our costs and availability of capital, which could in turn have a material adverse effect on our financial condition, results of operations,

cash flows and our ability to satisfy our debt service obligations and to make dividends and distributions on our common shares and preferred

shares.

Provisions contained in a forward sale

agreement could result in substantial dilution to our earnings per share and return on equity or result in substantial cash payment obligations.

If we enter into one or more forward sale agreements,

the relevant Forward Purchaser will have the right to accelerate its forward sale agreement (with respect to all or any portion of the

transaction under such forward sale agreement that such Forward Purchaser determines is affected by an event described below) and require

us to physically settle on a date specified by such Forward Purchaser if:

| ● | in its commercially reasonable judgement, it, or its agent or affiliate, (i) is unable, after using commercially

reasonable efforts, to hedge its exposure under such forward sale agreement because of the lack of sufficient common shares of ours being

made available for borrowing by securities lenders, or (ii) would incur a stock loan cost in excess of a specified threshold to hedge

its exposure under such forward sale agreement; |

| ● | we declare any dividend, issue or distribution on our common shares (i) payable in cash in excess of specified

amounts or with an earlier ex-dividend date than specified (unless it is an extraordinary dividend), (ii) payable in securities of another

company as a result of a spin-off or similar transaction or (iii) payable in any other type of securities (other than our common shares),

rights, warrants or other assets for payment (cash or other consideration) at less than the prevailing market price; |

| ● | certain ownership thresholds applicable to such Forward Purchaser and its affiliates are exceeded; |

| ● | an event (i) is announced that, if consummated, would result in a specified extraordinary event (including

certain mergers or tender offers, as well as certain events involving our nationalization, or insolvency, or a delisting of our common

shares) or (ii) occurs that would constitute a delisting or change in law; or |

| ● | certain other events of default, termination events or other specified events occur, including, among

others, any material misrepresentation made in connection with such forward sale agreement or our insolvency or change in law (each as

more fully described in each forward sale agreement) and such Forward Purchaser notifies us that such Forward Purchaser has designated

an early termination date. |

A Forward Purchaser’s decision to exercise

its right to accelerate the settlement of a forward sale agreement will be made irrespective of our interests, including our need for

capital. In such cases, we could be required to issue and deliver common shares under the physical settlement provisions of the applicable

forward sale agreement irrespective of our capital needs, which would result in dilution to our earnings per share and return on equity.

We expect that each forward sale agreement

will settle no later than a date that is up to two years from entry into such forward sale agreement. However, any forward sale agreement

may be settled earlier in whole or in part at our option, subject to the satisfaction of certain conditions. Subject to certain conditions,

we generally have the right to elect physical, cash or net share settlement under each forward sale agreement. We expect that each forward

sale agreement will be physically settled by delivery of common shares, unless we elect to cash settle or net share settle such forward

sale agreement. Delivery of common shares upon physical settlement (or, if we elect net share settlement, upon such settlement to the

extent we are obligated to deliver common shares) will result in dilution to our earnings per share and return on equity. If we elect

cash settlement or net share settlement with respect to all or a portion of the common shares underlying a particular forward sale agreement,

we expect the applicable Forward Purchaser (or an agent or affiliate thereof) to purchase a number of common shares in secondary market

transactions over an unwind period to:

| ● | return common shares to securities lenders in order to unwind such Forward Purchaser’s hedge positions

(after taking into consideration any common shares to be delivered by us to such Forward Purchaser, if applicable, in the case of net

share settlement); and |

| ● | if applicable, in the case of net share settlement, deliver common shares to us to the extent required in settlement of such forward

sale agreement. |

The purchase of common shares in connection

with a Forward Purchaser or its agent or affiliate unwinding its hedge positions could cause the price of common shares to increase over

such time (or reduce the amount of a decrease over

such time), thereby increasing the amount of

cash we would owe to such Forward Purchaser (or decreasing the amount of cash that such Forward Purchaser would owe us) upon a cash settlement

of the relevant forward sale agreement or increasing the number of common shares we would deliver to such Forward Purchaser (or decreasing

the number of common shares that such Forward Purchaser would deliver to us) upon net share settlement of the relevant forward sale agreement.

The forward sale price that we expect to receive

upon physical settlement of any forward sale agreement will be subject to adjustment on a daily basis based on a floating interest rate

factor equal to a specified daily rate less a spread and will be decreased based on amounts related to expected dividends on our common

shares during the term of the applicable forward sale agreement. If the specified daily rate is less than the spread for a particular

forward sale agreement on any day, the interest rate factor will result in a daily reduction of the forward sale price. If the prevailing

market price for our common shares during the applicable unwind period under a particular forward sale agreement is above the relevant

forward sale price, in the case of cash settlement, we would pay the applicable Forward Purchaser under such forward sale agreement an

amount in cash equal to the difference or, in the case of net share settlement, we would deliver to such Forward Purchaser a number of

common shares having a value equal to the difference, and, in each case, such difference would include a commission to such Forward Purchaser.

Thus, we could be responsible for a potentially substantial cash payment in the case of cash settlement of any forward sale agreement.

See “Other Relationships” on page S-14 of this prospectus supplement for information on the forward sale agreements.

In case of our bankruptcy or insolvency,

any forward sale agreement that is in effect will automatically terminate, and we would not receive the expected proceeds from the sale

of our common shares under any such agreement.

If we institute, or a regulatory authority

with jurisdiction over us institutes, or we consent to, a proceeding seeking a judgment in bankruptcy or insolvency or any other relief

under any bankruptcy or insolvency law or other similar law affecting creditors’ rights, or we or a regulatory authority with jurisdiction

over us presents a petition for our winding-up or liquidation, or we consent to such a petition, any forward sale agreement that is then

in effect will automatically terminate. If any such forward sale agreement so terminates, we would not be obligated to deliver to the

relevant Forward Purchaser any common shares not previously delivered, and such Forward Purchaser would be discharged from its obligation

to pay the applicable forward sale price per share in respect of any common shares not previously settled under the applicable forward

sale agreement. Therefore, to the extent that there are any common shares with respect to which any forward sale agreement has not been

settled at the time of the commencement of any such bankruptcy or insolvency proceedings, we would not receive the relevant forward sale

price per share in respect of those common shares.

Uncertainty regarding the U.S. federal

income tax treatment of the cash that we might receive from cash settlement of a forward sale agreement, and such payments impact on our

ability to meet the REIT qualification requirements, may preclude us from electing to cash settle a forward sale agreement.

The treatment of any cash settlement payment

we may receive upon our election to cash settle a forward sale agreement for purposes of the gross income tests applicable to REITs is

unclear. Therefore, we may only elect to cash settle a forward sale agreement if we determine that we can satisfy the gross income requirements

for REITs while treating such cash settlement payment as nonqualifying income. In the event we are not able to make such determination,

we may be precluded from electing to cash settle a forward agreement even if the cash settlement may be the optimal business decision.

USE OF PROCEEDS

We intend to use the net proceeds of this offering

of common shares for general corporate purposes, including, without limitation, unspecified acquisitions and to repay amounts outstanding

on our unsecured credit facility, as the same may be amended, modified or replaced from time to time. Pending the use of these proceeds,

we may repay future amounts outstanding under our unsecured credit facility, which amounts may be re-borrowed from time to time. As of

the date of this prospectus supplement, nothing is outstanding under our unsecured credit facility. The interest rate of our unsecured

credit facility ranges from Adjusted Daily Simple SOFR or Adjusted Term SOFR plus 0.725% to 1.40% depending on our unsecured debt rating

and matures on July 5, 2026, but can be extended to July 5, 2027 at our option subject to certain conditions.

One or more affiliates of KeyBanc, Regions,

BofA, and Mizuho are lenders under our unsecured credit facility and as such may receive a portion of the proceeds from this offering

as a result of any repayment of the outstanding balance of such facility with the proceeds from this offering. See “Other Relationships”

on page S-14 of this prospectus supplement.

We will not initially receive any proceeds

from the sale of borrowed common shares by any Forward Seller. We expect to receive proceeds from the sale of common shares, subject to

certain adjustments, upon future physical settlement(s) of the relevant forward sale agreement with the relevant Forward Purchaser on

dates specified by us on or prior to the maturity date of such forward sale agreement (no later than a date that is two years from entry

into such forward sale agreement). We expect to physically settle each forward sale agreement. We also have the right to elect to cash

settle or net share settle all or a portion of our obligations under any forward sale agreement subject to certain conditions. If we elect

to cash settle any forward sale agreement, we may not receive any proceeds, and we may owe cash to the relevant Forward Purchaser in certain

circumstances. If we elect to net share settle any forward sale agreement, we will not receive any proceeds, and we may owe common shares

to the relevant Forward Purchaser in certain circumstances. The forward sale price that we expect to receive upon physical settlement

of any forward sale agreement will (i) initially be equal to the gross sales prices of all borrowed common shares sold by the relevant

Forward Seller in connection with such forward sale agreement during the applicable forward hedge selling period less a forward hedge

selling commission not to exceed 2.0%, (ii) be subject to adjustment on a daily basis based on a floating interest rate factor equal to

a specified daily rate less a spread and (iii) be decreased based on amounts related to expected dividends on our common shares during

the term of such forward sale agreement. If the specified daily rate is less than the spread on any day, the interest rate factor will

result in a daily reduction of the forward sale price. We intend to use any cash proceeds that we receive upon physical settlement of

any forward sale agreement, if physical settlement applies, or upon cash settlement of any forward sale agreement, if we elect cash settlement,

for the purposes discussed above.

We will have significant discretion in the

use of the net proceeds of this offering. The net proceeds may be invested temporarily in interest-bearing accounts and short-term interest-bearing

securities that are consistent with our qualification as a REIT until other uses can be identified.

PLAN OF DISTRIBUTION

On February 16, 2024, we entered into the Amendment

to the Sales Agreement with the Sales Agents and the Forward Purchasers, pursuant to which we may issue and sell up to $350,000,000 of

our common shares from time to time through the Sales Agents, acting as our sales agents, or by the Forward Sellers, acting as agents

for the relevant Forward Purchasers, or by us directly to the Sales Agents, acting as principal, following the date of this prospectus

supplement. The Sales Agreement provides that, in connection with any forward sale agreement, we may deliver instructions to any Sales

Agent specifying that such Sales Agent, as Forward Seller, will use commercially reasonable efforts, consistent with its normal sales

and trading practices for similar transactions and applicable laws and regulations, to borrow and sell a number of common shares equal

to the number of common shares underlying the particular forward sale agreement.

Sales of common shares, if any, made through

the Sales Agents, acting as our sales agents, or acting as Forward Sellers (as agents for the Forward Purchasers), or acting

as principal, as contemplated by this prospectus supplement and the accompanying prospectus, may be made by means of ordinary brokers’

transactions on the New York Stock Exchange in negotiated transactions or transactions that are deemed to be “at-the-market”

offerings as defined in Rule 415 under the Securities Act of 1933, as amended, including transactions with a market maker for sales other

than on an exchange, at prices related to the prevailing market prices or at negotiated prices, or as otherwise agreed with the applicable

Sales Agent or Forward Seller.

As of

the date of this prospectus supplement, we have sold common shares having an aggregate offering price of $177,803,271 under the Sales

Agreement and the forward sale agreements, and common shares having an aggregate offering price of $294,984,839 remain unsold hereunder.

The Amendment increased the aggregate offering price of common shares we may offer and sell pursuant to the Sales Agreement by $55,015,161

to $350,000,000.

None of the Sales Agents, acting as our sales

agents or acting as Forward Sellers (as agents for the Forward Purchasers), is required to sell any specific number or dollar

amount of common shares, but each has agreed as our sales agent or as Forward Seller, as applicable, to use commercially reasonable efforts,

consistent with its normal sales and trading practices for similar transactions and applicable laws and regulations and on the terms and

subject to the conditions of the Sales Agreement, to sell the common shares offered as instructed by us. The common shares offered and

sold through the Sales Agents, as our sales agents, or as Forward Sellers (as agents for the Forward Purchasers) pursuant to

this prospectus supplement and the accompanying prospectus, will be offered and sold through only one Sales Agent (whether acting as our

sales agent or acting as a Forward Seller) on any given day.

In connection with the sale of the common shares

on our behalf, the Sales Agents, Forward Sellers and Forward Purchasers may be deemed “underwriters” within the meaning of

the Securities Act, and the compensation paid to them may be deemed to be an underwriting commission or discount. If any Sales Agent and/or

Forward Seller, as applicable, engages in “special selling efforts”, as that term is used in Regulation M under the Exchange

Act, such Sales Agent and/or Forward Seller, as applicable, will receive from us a commission to be agreed upon at the time of sale. We

have agreed in the Sales Agreement to provide indemnification and contribution to the Sales Agents, Forward Sellers and Forward Purchasers,

as applicable, against certain civil liabilities, including liabilities under the Securities Act and Exchange Act.

If we or any Sales Agent or Forward Seller

have reason to believe that our common shares are no longer an “actively-traded security” as defined under Rule 101(c)(1)

of Regulation M under the Exchange Act, such party will promptly so notify the other party, and sales of our common shares under the Sales

Agreement will be suspended until that or other exemptive provisions have been satisfied in such party’s judgment.

The offering of common shares pursuant to the

Sales Agreement will terminate upon the earlier of (1) the sale of our common shares subject to the Sales Agreement having an aggregate

offering price of $350,000,000 (including shares sold by us to or through the Sales Agents and borrowed shares sold by the Forward Sellers)

from and after the date of this prospectus supplement and (2) the termination of the Sales Agreement, pursuant to its terms.

We estimate that the total expenses of the

offering payable by us, excluding commissions payable to the Sales Agents or the Forward Sellers under the Sales Agreement, will be approximately

$150,000.

Sales Through or To Sales Agents

From time to time during the term of the Sales

Agreement, when requested by us, the Sales Agents will offer our common shares subject to the terms and conditions of the Sales Agreement,

which may be on a daily basis for periods of time, or otherwise, or as we may otherwise agree with the Sales Agents. We will designate

the maximum amount of common shares to be sold through each Sales Agent. Each Sales Agent has agreed, subject to the terms and conditions

of the Sales Agreement, to use its commercially reasonable efforts to place on our behalf all of the designated common shares. On any

given day, only one Sales Agent may sell the common shares to which this prospectus supplement and the accompanying prospectus relate.

We may instruct the Sales Agents not to place common shares at or below a price designated by us. We or the Sales Agents may suspend the

offering of common shares under the Sales Agreement upon proper notice to the other party.

We will pay each Sales Agent a commission up

to 2.0% of the gross proceeds of any common shares sold through it pursuant to this prospectus supplement.

The Sales Agents will provide written confirmation

to us following the close of trading on the NYSE each day on which common shares are sold under the Sales Agreement. Each confirmation

will include the number of shares sold on that day, the aggregate gross proceeds of such sales and the commission payable by us to the

applicable Sales Agent. Settlement for sales of common shares will occur, unless otherwise agreed, on the second business day (or on such

other date as is the industry practice at that time for regular-way trading) following the date on which such sales were made. For example,

effective May 2024, under Exchange Act Rule 15c6-1, the standard settlement cycle will be shortened to one trading day

following the date sales are made.

We will report at least quarterly the number

of common shares sold through the Sales Agents pursuant to the Sales Agreement, the net proceeds to us and the compensation paid by us

to the Sales Agents in connection with the sales of our common shares.

Sales Through Forward Sellers

From time to time during the term of the Sales

Agreement, and subject to the terms and conditions set forth therein, we may enter into one or more forward sale agreements with a Forward

Purchaser and deliver an instruction to a Forward Seller and Forward Purchaser. Upon acceptance by a Forward Seller and Forward Purchaser of an instruction from us requesting that such Forward Seller execute sales of borrowed common shares in

connection with a forward sale agreement, subject to the terms and conditions of the Sales Agreement and the applicable forward sale agreement,

the relevant Forward Seller will use commercially reasonable efforts, consistent with its normal sales and trading practices for similar

transactions and applicable laws and regulations, to borrow and sell common shares on such terms to hedge the relevant Forward Purchaser’s

exposure under that particular forward sale agreement. We or the relevant Forward Seller may immediately suspend the offering of borrowed

common shares in connection with a forward sale agreement at any time upon proper notice to the other; provided, however, such suspension

shall not affect the parties’ obligations with respect to the delivery of borrowed common shares sold in connection with any forward

sale agreement prior to such notice. The obligation of the relevant Forward Seller under the Sales Agreement to execute such sales of

borrowed common shares is subject to a number of conditions, which such Forward Seller reserves the right to waive in its sole discretion.

In connection with any forward sale agreement,

the relevant Forward Seller will receive, in the form of a forward price that will be reduced from the initial forward price payable by

the relevant Forward Purchaser under the related forward sale agreement, plus commissions at a mutually agreed rate that will not exceed

2.0% of the gross sales price of all borrowed common shares sold during the applicable forward hedge selling period by it as a Forward

Seller. We refer to this commission rate as the forward selling commission.

The forward sale price per common share under

each forward sale agreement will initially equal the product of (i) an amount equal to one minus the applicable forward selling commission

and (ii) the volume-weighted average price per share at which the borrowed common shares were sold pursuant to the Sales Agreement by

the relevant Forward Seller. Thereafter, the forward sale price will be subject to adjustment as described below.

Any forward sale agreement, the term of which

may not exceed two years, will provide that the forward sale price, as well as the sales prices used to calculate the initial forward

sale price, will be subject to adjustment on a daily basis based on a floating interest rate factor equal to a specified daily rate less

a spread and will be decreased based on amounts related to expected dividends on our common shares during the term of the applicable forward

sale agreement. If the specified daily rate is less than the spread before settlement of a particular forward sale agreement, we expect

that the common shares issuable upon settlement of that particular forward sale agreement will be reflected in our diluted earnings per

share, return on equity and dividends per share calculations using the treasury stock method. Under this method, the number of common

shares used in calculating diluted earnings per share, return on equity and dividends per share is deemed to be increased by the excess,

if any, of the number of common shares that would be issued upon full physical settlement of that particular forward sale agreement over

the number of common shares that could be purchased by us in the market (based on the average market price during the relevant period)

using the proceeds receivable upon full physical settlement (based on the adjusted forward sale price at the end of the relevant reporting

period). Consequently, before physical or net share settlement of a particular forward sale agreement and subject to the occurrence of

certain events, we anticipate there will be no dilutive effect on our earnings per share, except during periods when the average market

price of our common shares is above the applicable forward sale price.

Except under limited circumstances described

below and subject to certain conditions, we have the right in lieu of physical settlement, to elect cash or net share settlement under

any forward sale agreement. If we elect net share settlement, delivery of common shares upon such settlement (to the extent we are obligated

to make such delivery) will result in dilution to our earnings per share and return on equity. If we elect cash settlement or net share

settlement with respect to all or a portion of our common shares underlying a forward sale agreement, we expect the Forward

Purchaser (or an agent or affiliate thereof) to purchase a number of common shares in secondary market transactions over an unwind period

to:

| ● | return common shares to securities lenders in order to unwind such Forward Purchaser’s hedge (after

taking into consideration any common shares to be delivered by us to such Forward Purchaser, if applicable, in the case of net share settlement);

and |

| ● | if applicable, in the case of net share settlement, deliver common shares to us to the extent required

in settlement of such forward sale agreement. |

If the prevailing market price for our common

shares during the applicable unwind period under a forward sale agreement is above the relevant forward sale price, in the case of cash

settlement, we would pay the relevant Forward Purchaser under such forward sale agreement an amount in cash equal to the difference or,

in the case of net share settlement, we would deliver to such Forward Purchaser a number of common shares having a value equal to the

difference and, in each case, such difference would include a commission to such Forward Purchaser. Thus, we could be responsible for

a potentially substantial cash payment in the case of cash settlement. If the prevailing market price for our common shares during the

applicable unwind period under a forward sale agreement is below the relevant forward sale price, in the case of cash settlement, we would

be paid the difference in cash by the relevant Forward Purchaser under such forward sale agreement or, in the case of net share settlement,

we would receive from such Forward Purchaser a number of common shares having a value equal to the difference.

In addition, the purchase of common shares

in connection with a Forward Purchaser or its agent or affiliate unwinding its hedge positions could cause the price of common shares

to increase over such time (or reduce the amount of a decrease over such time), thereby increasing the amount of cash we would owe to

such Forward Purchaser (or decreasing the amount of cash that such Forward Purchaser would owe us) upon a cash settlement of the relevant

forward sale agreement or increasing the number of common shares we would deliver to such Forward Purchaser (or decreasing the number

of common shares that such Forward Purchaser would deliver to us) upon net share settlement of the relevant forward sale agreement. See

“Risk Factors” on page S-6 of this prospectus supplement.

A Forward Purchaser will have the right to

accelerate its forward sale agreement (with respect to all or any portion of the transaction under such forward sale agreement that such

Forward Purchaser determines is affected by an event described below) and require us to physically settle on a date specified by such

Forward Purchaser if:

| ● | in its commercially reasonable judgement, it, or its agent or affiliate, (i) is unable, after using commercially

reasonable efforts, to hedge its exposure under such forward sale agreement because of the lack of sufficient common shares of ours being

made available for borrowing by securities lenders, or (ii) would incur a stock loan cost in excess of a specified threshold to hedge

its exposure under such forward sale agreement; |

| ● | we declare any dividend, issue or distribution on our common shares (i) payable in cash in excess of specified

amounts or with an earlier ex-dividend date than specified (unless it is an extraordinary dividend), (ii) payable in securities of another

company as a result of a spin-off or similar transaction, or (iii) payable in any other type of securities (other than our common shares),

rights, warrants or other assets for payment (cash or other consideration) at less than the prevailing market price; |

| ● | certain ownership thresholds applicable to such Forward Purchaser and its affiliates are exceeded; |

| ● | an event (i) is announced that, if consummated, would result in a specified extraordinary event (including

certain mergers or tender offers, as well as certain events involving our nationalization, or insolvency, or a delisting of our common

shares) or (ii) occurs that would constitute a delisting or change in law; or |

| ● | certain other events of default, termination events or other specified events occur, including, among

others, any material misrepresentation made in connection with such forward sale agreement or our insolvency or change in law (each as

more fully described in each forward sale agreement) and such Forward Purchaser notifies us that such Forward Purchaser has designated

an early termination date. |

A Forward Purchaser’s decision to exercise

its right to accelerate the settlement of a forward sale agreement will be made irrespective of our interests, including our need for

capital. In such cases, we could be required to issue and deliver common shares under the physical settlement provisions of the applicable

forward sale agreement irrespective of our capital needs, which would result in dilution to our earnings per share and return on equity.

In addition, upon certain events of bankruptcy, insolvency or reorganization relating to us, any forward sale agreement will terminate

without further liability of either party. Following any such termination, we would not issue any common shares and we would not receive

any proceeds pursuant to any forward sale agreement.

OTHER RELATIONSHIPS

Each Sales Agent, Forward Seller and Forward

Purchaser and/or their respective agents or affiliates are full service financial institutions that have provided, and may in the future

provide, securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal

investment, hedging, financing and brokerage activities, and various other services to us and our agents or affiliates for which services

they have received, and may in the future receive, customary fees. In the course of its business, each Sales Agent, Forward Seller and

Forward Purchaser and/or their respective agents or affiliates may make or hold a broad array of investments and actively trade debt and

equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the

accounts of their customers, and such investment and securities activities may involve securities and/or instruments of ours. Each Sales

Agent, Forward Seller and Forward Purchaser and/or their respective agents or affiliates may also make investment recommendations and/or

publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients

that they acquire, long and/or short positions in such securities and instruments.

Certain of the net proceeds from the sale of

our common shares, not including commissions, may be paid to one or more affiliates of KeyBanc, Regions, BofA, or Mizuho in connection

with the repayment of debt owed under our unsecured credit facility. To the extent that we use the net proceeds from the sale of our common

shares to repay or reduce any outstanding indebtedness under our unsecured credit facility, the affiliates of KeyBanc, Regions, BofA,

or Mizuho will receive their pro rata portion of such payments.

If we enter into a forward sale agreement with

any Forward Purchaser, the Sales Agent acting as the Forward Seller will use commercially reasonable efforts, consistent with

its normal sales and trading practices for similar transactions and applicable laws and regulations, to borrow and sell our common shares

to hedge such Forward Purchaser’s exposure under such forward sale agreement. All of the net proceeds from the sale of any such

borrowed common shares will be paid to the applicable Forward Purchaser.

LEGAL MATTERS

Certain

legal matters, including the legality of certain of the securities covered by this prospectus, will be passed upon for us by Hogan Lovells

US LLP. Certain legal matters related to this offering will be passed upon for the Sales Agents, Forward Sellers and the Forward Purchasers

by Goodwin Procter LLP, New York, New York.

PROSPECTUS

LXP Industrial Trust

Common Shares of Beneficial Interest Classified as Common Stock

Preferred Shares of Beneficial Interest Classified as Preferred Stock

Debt Securities, Depositary Shares, Warrants

Subscription Rights or Units

This prospectus contains

a general description of the equity and debt securities that we may offer for sale. We may from time to time offer, in one or more series

or classes, separately or together, the following:

| ● | common shares of beneficial interest classified as common stock (“common shares”); |

| ● | preferred shares of beneficial interest classified as preferred stock (“preferred shares”); |

| ● | debt securities which may be either senior debt securities or subordinated debt securities (“debt

securities”); |

| ● | depositary shares representing preferred shares (“depositary shares”); |

| ● | units consisting of combinations of any of the foregoing (“units”). |

We will offer our securities

in amounts, at prices and on terms to be determined at the time we offer those securities. We will provide the specific terms of the securities

in supplements to this prospectus. We are organized and conduct our operations so as to qualify as a real estate investment trust for

federal income tax purposes (“REIT”). The specific terms of the securities may include limitations on actual, beneficial or

constructive ownership and restrictions on transfer of the securities that may be appropriate to preserve our status as a REIT. To ensure

that we maintain our qualification as a REIT under the applicable provisions of the Internal Revenue Code of 1986, as amended (the “Code”),

among other purposes, ownership of our equity securities by any person is subject to certain limitations. See “Restrictions on Transfers

of Capital Stock and Anti-Takeover Provisions” in this prospectus.

The securities may be offered

on a delayed or continuous basis directly by us, through agents, underwriters or dealers as designated from time to time, through a combination

of these methods or any other method as provided in the applicable prospectus supplement. You should read this prospectus and any applicable

prospectus supplement carefully before you invest.

In addition, certain selling

shareholders may be identified from time to time in a prospectus supplement relating to that sale of our securities that they own. We

will not receive proceeds from any sale of our securities by selling shareholders.

Our common shares and our

6.50% Series C Cumulative Convertible Preferred Stock, or Series C Preferred Shares, are traded on The New York Stock Exchange under the

symbols “LXP” and “LXPPRC”, respectively. On February 15, 2024, the last reported sale price of our common shares,

as reported on The New York Stock Exchange, was $8.75 per share.

INVESTING IN OUR SECURITIES

INVOLVES RISKS. IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, WHICH ARE INCORPORATED BY REFERENCE IN THIS PROSPECTUS, WE

IDENTIFY AND DISCUSS RISK FACTORS THAT YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES. SEE “RISK FACTORS” BEGINNING

ON PAGE 11 OF OUR FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2023 AND THE “RISK FACTORS” SECTION BEGINNING ON PAGE 5 OF THIS

PROSPECTUS. BEFORE BUYING OUR SECURITIES, YOU SHOULD READ AND CONSIDER THE RISK FACTORS INCLUDED IN OUR PERIODIC REPORTS, IN THE

PROSPECTUS SUPPLEMENTS OR ANY OFFERING

MATERIAL RELATING TO ANY SPECIFIC OFFERING, AND IN OTHER INFORMATION THAT WE FILE WITH THE SECURITIES AND EXCHANGE COMMISSION WHICH IS

INCORPORATED BY REFERENCE IN THIS PROSPECTUS. SEE “WHERE YOU CAN FIND MORE INFORMATION.”

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY

OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is February 16,

2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part

of a registration statement that we filed with the Securities and Exchange Commission (the “SEC” or “Commission”),

using a “shelf” registration process or continuous offering process. Under this shelf registration process, we may, from time

to time, sell any combination of the securities described in this prospectus in one or more offerings and selling securityholders may

from time to time offer such securities owned by them. This prospectus provides you with a general description of the securities that

may be offered by us and/or selling securityholders. We may also file, from time to time, a prospectus supplement or an amendment to the

registration statement of which this prospectus forms a part containing additional information about us and/or selling securityholders

and the terms of the offering of the securities. That prospectus supplement or amendment may include additional risk factors or other

special considerations applicable to the securities. Any prospectus supplement or amendment may also add, update or change information

in this prospectus. If there is any supplement or amendment, you should rely on the information in that prospectus supplement or amendment.

This prospectus and any

accompanying prospectus supplement do not contain all of the information included in the registration statement. For further information,

we refer you to the registration statement and any amendments to such registration statement, including its exhibits and schedules. Statements

contained in this prospectus and any accompanying prospectus supplement about the provisions or contents of any agreement or other document

are not necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to

the registration statement, please refer to the actual exhibit for a complete description of these matters.

You should read both this

prospectus and any prospectus supplement together with additional information described below under the heading “Where You Can Find

More Information.” Federal securities laws and the SEC’s rules and regulations require us to file reports under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) (including annual, quarterly and current reports) for LXP Industrial

Trust, as further described under the heading “Where You Can Find More Information.”

Information incorporated

by reference from filings with the SEC after the date of this prospectus or after the date of any prospectus supplement, or information

included in any prospectus supplement or an amendment to the registration statement of which this prospectus forms a part, may add, update

or change information included or incorporated by reference in this prospectus or any prospectus supplement. Any statement contained in

this prospectus, any prospectus supplement or in any document incorporated by reference will be deemed to be amended, modified or superseded

for the purposes of this prospectus to the extent that a statement contained in this prospectus, any prospectus supplement or a later

document that is or is considered to be incorporated by reference herein amends, modifies or supersedes such statement. Any statements

so amended, modified or superseded will not be deemed to constitute a part of this prospectus, except as so amended, modified or superseded.

You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date

on the respective covers of this prospectus and any such prospectus supplement.

We have not authorized

anyone else to give any information or to make any representation other than those contained or incorporated by reference in this prospectus

or any prospectus supplement. You must not rely upon any information or representation not contained or incorporated by reference in this

prospectus or any prospectus supplement as if we had authorized it. This prospectus and any prospectus supplement do not constitute an

offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate. Nor does

this prospectus or any prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction

to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

All references to the

“Company,” “we,” “our” and “us” in this prospectus mean LXP Industrial Trust and its consolidated

subsidiaries, except as otherwise provided or where it is made clear that the term means only LXP Industrial Trust. When we use the term

“LXP” in this prospectus, we are referring to LXP Industrial Trust by itself and not including any of its subsidiaries. References

to “common shares” or similar references refer to the shares of beneficial interest classified as common stock, par value

$0.0001 per share, of LXP. The term “you” refers to a prospective investor.

CAUTIONARY STATEMENTS

CONCERNING FORWARD-LOOKING INFORMATION

This prospectus and the

information incorporated by reference in this prospectus include “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. We intend such

forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions. Forward-looking

statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identifiable

by use of the words “believes,” “expects,” “intends,” “anticipates,” “estimates,”

“projects,” “may,” “plans,” “predicts,” “will,” “will likely result”

or similar expressions. Readers should not rely on forward-looking statements since they involve known and unknown risks, uncertainties

and other factors which are, in some cases, beyond our control and which could materially affect actual results, performances or achievements.

In particular, among the factors that could cause actual results, performances or achievements to differ materially from current expectations,

strategies or plans include, among others:

| ● | changes in our industry and changes in the real estate market particularly, either nationally or regionally; |

| ● | changes in economic conditions generally and the real estate market specifically; |

| ● | adverse developments with respect to our tenants, including defaults or non-renewals of significant tenant

leases; |

| ● | impairments in the value of our real estate investments; |

| ● | failure to consummate the transactions described in this prospectus or the failure of any transactions

to perform to our expectations; |

| ● | legislative/regulatory/accounting changes, including changes to laws governing and policies and guidelines

applicable to the taxation of REITs; |

| ● | any material legal proceedings; |

| ● | availability of debt and equity capital; |

| ● | increases in real estate construction costs; |

| ● | changes in interest rates; |

| ● | supply and demand for properties in our current and proposed market areas; |

| ● | a downgrade in our credit ratings; |

| ● | direct and indirect impacts of climate change; |

| ● | the other risk factors set forth in our Annual Report on Form 10-K filed with the SEC on February 15,

2024, the section titled “Risk Factors” beginning on page 5 of this prospectus and the other documents incorporated by reference

herein, including documents that we file with the SEC in the future that are incorporated by reference herein. |

These risks and uncertainties

should be considered in evaluating any forward-looking statements contained or incorporated by reference in this prospectus. We caution

you that any forward-looking statement reflects only our belief at the time the statement is made. Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee our future results, levels of activity, performance or

achievements.

Except as required by law, we undertake no

obligation to publicly release the results of any revisions to these forward-looking statements which may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of unanticipated events. Accordingly, there is no assurance that our

expectations will be realized.

OUR COMPANY

We are a Maryland real estate investment trust, which

has elected to qualify to be taxed as a REIT for federal income tax purposes, focused on single-tenant warehouse/distribution real estate

investments. A majority of our properties are subject to net or similar leases, where the tenant bears all or substantially all of the

costs, including cost increases, for real estate taxes, utilities, insurance and ordinary repairs. However, certain leases provide that

the landlord is responsible for certain operating expenses.

As of December 31, 2023, we had equity ownership interests

in approximately 115 consolidated real estate properties, located in 18 states and containing an aggregate of approximately 54.6 million

square feet of space, approximately 99.8% of which was leased.

As of December 31, 2023, our portfolio consisted of

112 warehouse/distribution facilities and three other properties. Our warehouse/distribution portfolio is primarily focused in our target

markets within the Sunbelt and Midwest. We expect to grow these markets by executing on our development pipeline, including through build-to-suits,

and opportunistically acquiring facilities in these markets.

Our common shares and Series C preferred shares

are traded on the New York Stock Exchange, or NYSE, under the symbols “LXP” and “LXPPRC,” respectively.

We elected to be taxed as a REIT under Sections

856 through 860 of the Code, commencing with our taxable year ended December 31, 1993. We intend to continue to qualify as a REIT. If

we qualify for taxation as a REIT, we generally will not be subject to federal corporate income taxes on our net taxable income. We conduct

certain taxable activities through our taxable REIT subsidiary, Lexington Realty Advisors, Inc.

Our principal executive offices are located

at One Penn Plaza, Suite 4015, New York, New York 10119-4015; our telephone number is (212) 692-7200.

We maintain a website at www.lxp.com, which

contains information about us and our subsidiaries. We have not incorporated by reference into this prospectus supplement or the accompanying

prospectus the information included or referred to in, or that can be accessed through, our website, and you should not consider it to

be a part of this prospectus supplement or the accompanying prospectus.

RISK FACTORS

Investing in our securities