false

0001476034

0001476034

2025-03-12

2025-03-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): March 12, 2025

METROPOLITAN BANK HOLDING CORP.

(Exact Name of Registrant as Specified

in Its Charter)

| New York |

|

001-38282 |

|

13-4042724 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

| 99 Park Avenue, New

York, New York |

|

10016 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(212) 659-0600

(Registrant’s Telephone Number, Including

Area Code)

N/A

(Former Name, Former Address and Former Fiscal

Year, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c) |

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

MCB |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events

On March 12, 2025, Metropolitan Bank Holding Corp. (the “Company”)

announced that its board of directors approved a share repurchase program pursuant to which the Company is authorized to repurchase an

aggregate value of up to $50.0 million of its outstanding common stock, par value $0.01 per share (the “Share Repurchase Program”).

Repurchases under the Share Repurchase Program may be conducted from time to time on the open market or by other means in accordance with

applicable securities laws and other restrictions, including, in part, under a Rule 10b5-1 plan, which allows stock repurchases when the

Company might otherwise be precluded from doing so. The number of shares to be repurchased and the timing of repurchases, if any, will

depend on several factors, including market conditions, prevailing share price, corporate and regulatory requirements, and other considerations.

The Company intends to fund the Share Repurchase

Program with available cash. The Share Repurchase Program has no expiration date, may be discontinued or suspended at any time and does

not obligate the Company to acquire any amount of its common stock. A copy of the press release announcing the Share Repurchase Program

is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include

but are not limited to the Company’s future financial condition and capital ratios, results of operations, outlook, business, and

repurchases under the Share Repurchase Program. Forward-looking statements are not historical facts. Such statements may be identified

by the use of such words as “may,” “believe,” “expect,” “anticipate,” “plan,”

“continue” or similar terminology. These statements relate to future events or our future financial performance and involve

risks and uncertainties that are difficult to predict and are generally beyond our control and may cause our actual results, levels of

activity, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we caution you not to place undue reliance

on these forward-looking statements. Factors which may cause our forward-looking statements to be materially inaccurate include, but are

not limited to the following: the interest rate policies of the Federal Reserve and other regulatory bodies; an unexpected deterioration

in the performance of our loan or securities portfolios; changes in liquidity, including the size and composition of our deposit portfolio

and the percentage of uninsured deposits in the portfolio; unexpected increases in our expenses; different than anticipated growth and

our ability to manage our growth; global pandemics, or localized epidemics, could adversely affect the Company’s financial condition

and results of operations; potential recessionary conditions, including the related effects on our borrowers and on our financial condition

and results of operations; an unanticipated loss of key personnel or existing clients, or an inability to attract key employees; increases

in competitive pressures among financial institutions or from non-financial institutions which may result in unanticipated changes in

our loan or deposit rates; unanticipated increases in FDIC insurance premiums or future assessments; legislative, tax or regulatory changes

or actions, which may adversely affect the Company’s business; impacts related to or resulting from regional and community bank

failures and stresses to regional banks; changes in deposit flows, funding sources or loan demand, which may adversely affect the Company’s

business; changes in accounting principles, policies or guidelines may cause the Company’s financial condition or results of operation

to be reported or perceived differently; general economic conditions, including unemployment rates, either nationally or locally in some

or all of the areas in which the Company does business, or conditions in the securities markets or the banking industry being less favorable

than currently anticipated; inflation, which may lead to higher operating costs; declines in real estate values in the Company’s

market area, which may adversely affect our loan production; an unexpected adverse financial, regulatory, legal or bankruptcy event experienced

by our non-bank financial service clients; system failures or cybersecurity breaches of our information technology infrastructure and/or

confidential information or those of the Company’s third-party service providers or those of our non-bank financial service clients

for which we provide global payments infrastructure; emerging issues related to the development and use of artificial intelligence that

could give rise to legal or regulatory action, damage our reputation or otherwise materially harm our business or clients; failure to

maintain current technologies or technological changes that may be more difficult or expensive to implement than anticipated, and failure

to successfully implement future information technology enhancements; the costs, including the possible incurrence of fines, penalties,

or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory

enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results;

the current or anticipated impact of military conflict, terrorism or other geopolitical events; the successful implementation or consummation

of new business initiatives, which may be more difficult or expensive than anticipated; the timely and efficient development of new products

and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto,

and the perceived overall value and acceptance of these products and services by clients; changes in consumer spending, borrowing or savings

habits; the risks associated with adverse changes to credit quality; an unexpected failure to successfully manage our credit risk and

the sufficiency of our allowance for credit losses; credit and other risks from borrower and depositor concentrations (e.g., by geographic

area and by industry); difficulties associated with achieving or predicting expected future financial results; and the potential impact

on the Company’s operations and clients resulting from natural or man-made disasters, wars, acts of terrorism, cyberattacks and

pandemics, as well as those discussed under the heading “Risk Factors” in our Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q which have been filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

Forward-looking statements speak only as of the date of this Current Report on Form 8-K. We do not undertake (and expressly disclaim)

any obligation to update or revise any forward-looking statement, except as may be required by law.

Item 9.01. Financial Statements and

Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

METROPOLITAN BANK HOLDING CORP. |

| |

|

| Dated: March 12, 2025 |

By: |

/s/ Daniel F. Dougherty |

| |

|

Daniel F. Dougherty |

| |

|

Executive Vice President and Chief Financial

Officer |

Exhibit 99.1

Metropolitan Bank Holding Corp. Announces $50 million Stock Repurchase

Program

NEW YORK, N.Y. — March 12, 2025 — Metropolitan Bank Holding

Corp. (“Company”) the publicly traded holding company of Metropolitan Commercial Bank (“MCB” or the “Bank”)

is pleased to announce that its board of directors has approved a share repurchase plan with authorization to purchase up to fifty million

dollars ($50,000,000) of the common stock of the Company (NYSE: MCB). The purpose of the strategic initiative is to demonstrate the Company’s

commitment to delivering total return to its investors. “This move reflects our confidence in the Company’s long-term growth

trajectory and the strength of our balance sheet,” said Mark R. DeFazio, President and CEO of MCB and the Company. “I am excited

by the energy and focus our team has demonstrated, and in particular in the first few months of this year, and this program will be one

of the key drivers of our strategic direction.” The results of the program will be reflected in the Company’s periodic filings.

The Company may repurchase shares of common stock from time to time

on the open market or by other means in accordance with applicable securities laws and other restrictions, including, in part, under a

Rule 10b5-1 plan. The number of shares to be repurchased and the timing of repurchases, if any, will depend on several factors, including

market conditions, prevailing share price, corporate and regulatory requirements, and other considerations. The share repurchase plan

has no expiration date, may be discontinued or suspended at any time and does not obligate the Company to acquire any amount of its common

stock.

About Metropolitan Bank Holding Corp.

Metropolitan Bank Holding Corp. (NYSE: MCB) is the parent company of

Metropolitan Commercial Bank (the “Bank”), a New York City based full-service commercial bank. The Bank provides a broad range

of business, commercial and personal banking products and services to individuals, small businesses, private and public middle-market

and corporate enterprises and institutions, municipalities, and local government entities.

Metropolitan Commercial Bank was named one of Newsweek’s Best

Regional Banks and Credit Unions 2025. The Bank was ranked by Independent Community Bankers of America among the top ten successful loan

producers for 2024 by loan category and asset size for commercial banks with more than $1 billion in assets. Kroll affirmed a BBB+ (investment

grade) deposit rating on January 29, 2025. For the fourth time, MCB has earned a place in the Piper Sandler Bank Sm-All Stars Class of

2024.

The Bank is a New York State chartered commercial bank, a member of

the Federal Reserve System and the Federal Deposit Insurance Corporation, and an equal housing lender. For more information, please visit

the Bank’s website at MCBankNY.com.

Forward Looking Statement Disclaimer

This release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include but are not limited

to the Company’s future financial condition and capital ratios, results of operations, outlook, business and repurchases under the

program. Forward-looking statements are not historical facts. Such statements may be identified by the use of such words as “may,”

“believe,” “expect,” “anticipate,” “plan,” “continue” or similar terminology.

These statements relate to future events or our future financial performance and involve risks and uncertainties that are difficult to

predict and are generally beyond our control and may cause our actual results, levels of activity, performance or achievements to differ

materially from those expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we caution you not to place undue reliance on these forward-looking statements. Factors

which may cause our forward-looking statements to be materially inaccurate include, but are not limited to the following: the interest

rate policies of the Federal Reserve and other regulatory bodies; an unexpected deterioration in the performance of our loan or securities

portfolios; changes in liquidity, including the size and composition of our deposit portfolio and the percentage of uninsured deposits

in the portfolio; unexpected increases in our expenses; different than anticipated growth and our ability to manage our growth; global

pandemics, or localized epidemics, could adversely affect the Company’s financial condition and results of operations; potential

recessionary conditions, including the related effects on our borrowers and on our financial condition and results of operations; an unanticipated

loss of key personnel or existing clients, or an inability to attract key employees; increases in competitive pressures among financial

institutions or from non-financial institutions which may result in unanticipated changes in our loan or deposit rates; unanticipated

increases in FDIC insurance premiums or future assessments; legislative, tax or regulatory changes or actions, which may adversely affect

the Company’s business; impacts related to or resulting from regional and community bank failures and stresses to regional banks;

changes in deposit flows, funding sources or loan demand, which may adversely affect the Company’s business; changes in accounting

principles, policies or guidelines may cause the Company’s financial condition or results of operation to be reported or perceived

differently; general economic conditions, including unemployment rates, either nationally or locally in some or all of the areas in which

the Company does business, or conditions in the securities markets or the banking industry being less favorable than currently anticipated;

inflation, which may lead to higher operating costs; declines in real estate values in the Company’s market area, which may adversely

affect our loan production; an unexpected adverse financial, regulatory, legal or bankruptcy event experienced by our non-bank financial

service clients; system failures or cybersecurity breaches of our information technology infrastructure and/or confidential information

or those of the Company’s third-party service providers or those of our non-bank financial service clients for which we provide

global payments infrastructure; emerging issues related to the development and use of artificial intelligence that could give rise to

legal or regulatory action, damage our reputation or otherwise materially harm our business or clients; failure to maintain current technologies

or technological changes that may be more difficult or expensive to implement than anticipated, and failure to successfully implement

future information technology enhancements; the costs, including the possible incurrence of fines, penalties, or other negative effects

(including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions,

or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results; the current or

anticipated impact of military conflict, terrorism or other geopolitical events; the successful implementation or consummation of new

business initiatives, which may be more difficult or expensive than anticipated; the timely and efficient development of new products

and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto,

and the perceived overall value and acceptance of these products and services by clients; changes in consumer spending, borrowing or savings

habits; the risks associated with adverse changes to credit quality; an unexpected failure to successfully manage our credit risk and

the sufficiency of our allowance for credit losses; credit and other risks from borrower and depositor concentrations (e.g., by geographic

area and by industry); difficulties associated with achieving or predicting expected future financial results; and the potential impact

on the Company’s operations and clients resulting from natural or man-made disasters, wars, acts of terrorism, cyberattacks and

pandemics, as well as those discussed under the heading “Risk Factors” in our Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q which have been filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

Forward-looking statements speak only as of the date of this release. We do not undertake (and expressly disclaim) any obligation to update

or revise any forward-looking statement, except as may be required by law.

212-365-6721

IR@MCBankNY.com

Source: Metropolitan Commercial Bank

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

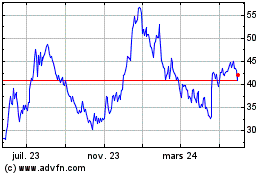

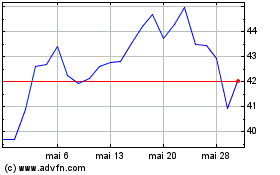

Metropolitan Bank (NYSE:MCB)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Metropolitan Bank (NYSE:MCB)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025