MetLife Recognized as 2024 ENERGY STAR® Partner of the Year for Sixth Consecutive Year

26 Mars 2024 - 3:02PM

Business Wire

MetLife, Inc. (NYSE: MET) today announced that it has received

the 2024 ENERGY STAR® Partner of the Year Sustained Excellence

Award from the U.S. Environmental Protection Agency (EPA). MetLife

has been honored as an ENERGY STAR Partner of the Year recipient

for six consecutive years and continues to partner with ENERGY STAR

on adopting energy-efficient practices and tracking data across all

owned and managed properties. In addition to recertifying 32

existing certifications across MetLife and MetLife Investment

Management (MIM) portfolios in 2023, MetLife received new ENERGY

STAR Building Certifications for two buildings and MIM certified

four new buildings.

ENERGY STAR Partner of the Year is the highest level of EPA

recognition for corporate and asset manager’s energy management

programs. To earn this recognition, companies must demonstrate

superior levels of energy management with respect to exhibiting

best practices, proven energy savings, and active participation and

communication about ENERGY STAR programs and strategies.

Organizations like MetLife, which have consistently earned Partner

of the Year, are eligible for the Sustained Excellence distinction.

This distinction requires that annual achievements continue to

surpass those in previous years.

“Implementing energy efficiency best practices across our

corporate offices and real estate investment portfolios drives

operational savings that we reinvest into our business and

communities, ultimately driving more value for our stakeholders,”

said MetLife Vice President, Global Sustainability & Climate

Lead, Josh Wiener. “Our continued partnership with ENERGY STAR

equips us with the resources and data needed to manage building

performance and find new opportunities for better energy management

and conservation.”

MetLife leverages ENERGY STAR tools, including its Portfolio

Manager, to improve data management capabilities and identify

energy savings opportunities across its corporate office and

managed real estate equity portfolios.

“By upholding a superior level of energy management across our

real estate portfolio, we deliver value to our clients while

bettering the communities and environments around these

properties,” said MetLife Investment Management, Global Head of

Real Estate and Agriculture, Robert Merck. “ENERGY STAR remains a

resource in helping us measure, manage and improve performance

across our entire real estate portfolio.”

To learn more about MetLife’s commitment to sustainability,

visit MetLife.com/Sustainability. For more information about ENERGY

STAR, visit EnergyStar.gov/about.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help individual and institutional

customers build a more confident future. Founded in 1868, MetLife

has operations in more than 40 markets globally and holds leading

positions in the United States, Japan, Latin America, Asia, Europe

and the Middle East. For more information, visit

www.metlife.com.

About MetLife Investment Management

MetLife Investment Management, the institutional asset

management business of MetLife, Inc. (NYSE: MET), is a global

public fixed income, private capital and real estate investment

manager providing tailored investment solutions to institutional

investors worldwide. MetLife Investment Management provides public

and private pension plans, insurance companies, endowments, funds

and other institutional clients with a range of bespoke investment

and financing solutions that seek to meet a range of long-term

investment objectives and risk-adjusted returns over time. MetLife

Investment Management has over 150 years of investment experience

and, as of December 31, 2023, had over $600 billion in total assets

under management.1

Endnotes 1Total assets under

management is comprised of all MetLife general account and separate

account assets and unaffiliated/third party assets, at estimated

fair value, managed by MIM.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240325046061/en/

For Media: Olivia Janicelli (212) 578-3547

ojanicelli@metlife.com

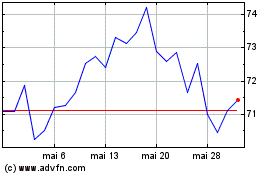

MetLife (NYSE:MET)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

MetLife (NYSE:MET)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025