Financially Superior Offer with Closing

Certainty Represents 18.2% Premium to WMC’s Stock

Book-for-Book Transaction Also Includes Cash

Consideration to WMC Stockholders and Establishes a Company that is

Meaningfully More Efficient Through Significant Cost Synergies and

Earnings Accretion Post-Close

Strong Support from MITT’s External Manager,

Angelo Gordon, Through $7 Million Cash Contribution Towards

Transaction

Urges WMC’s Board to Promptly Engage with MITT

to Accept its Superior Proposal

AG Mortgage Investment Trust, Inc. (NYSE: MITT) (“MITT”) today

announced that it submitted a proposal to the Board of Directors of

Western Asset Mortgage Capital Corporation (NYSE: WMC) (“WMC”) to

acquire WMC for a fixed exchange ratio, representing an implied

price of $9.88 per share, consisting of a stock consideration of

$8.90 per share and cash consideration of $0.98 per share. The

offer represents an 18.2% premium to WMC’s closing share price, all

based on MITT and WMC stock prices as of July 12, 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230712848940/en/

Key highlights of MITT’s acquisition proposal, as noted in

its letter to the WMC Board of Directors (the “WMC Board”),

include:

- WMC and MITT are highly complementary businesses, creating

significant business and cost synergies;

- WMC stockholders will receive a portion of the transaction

consideration in cash;

- MITT’s proposal provides speed and certainty of transaction

closing and avoids accelerating payment of WMC’s convertible

debt;

- The proposed transaction eliminates post-closing selling

pressure given MITT stockholders already have liquidity; and

- MITT’s stock trades on the NYSE with an observable value with

strong support from its external manager, Angelo Gordon, a leading

alternative investment firm with $73 billion of assets under

management.

The full text of MITT’s letter to the WMC Board follows. A

presentation with additional details regarding MITT’s offer is

available at

https://www.agmit.com/news-events-presentations/presentations.

July 13, 2023

Board of Directors Western Asset Mortgage Capital Corporation

11601 Wilshire Blvd., Suite 1920 Los Angeles, CA 90025

Dear Members of the Board,

I am writing on behalf of the Board of Directors of AG Mortgage

Investment Trust, Inc. (“MITT”), a publicly traded residential

mortgage REIT managed by AG REIT Management, LLC, an affiliate of

Angelo, Gordon & Co., L.P. (“Angelo Gordon”), a leading $73

billion alternative investment firm. We have carefully evaluated

the merits of a combination between MITT and Western Asset Mortgage

Capital Corporation (“WMC”) and concluded that such a transaction

would be value maximizing for the stockholders of both WMC and

MITT.

Accordingly, MITT is pleased to submit this non-binding

proposal to purchase WMC for an implied value of $9.88 per share,

representing an 18.2% premium to WMC’s closing share price as of

July 12, 2023. Notably, we are submitting our proposal

following WMC’s proposed merger (the “TPT transaction”) with Terra

Property Trust, Inc. (“TPT”), a non-traded REIT, which has been

followed by a 10.1% decline in WMC’s share price since being

announced on June 28, 2023.

We believe combining WMC with MITT would result in a focused,

residential mortgage REIT with an optimized capital structure and

significant growth potential and value-creating opportunities for

the combined company’s stockholders. Our complementary core

competences in residential mortgage credit would establish an even

more efficient and competitive company. Importantly, our proposal

provides closing certainty and does not accelerate WMC’s

convertible notes, while also benefiting WMC stockholders,

particularly given the cash consideration we describe in greater

detail below, significant opportunities for cost synergies, and

expected earnings accretion following the transaction’s close.

We stand ready to engage meaningfully with the WMC Board of

Directors (the “WMC Board”) and request that the WMC Board properly

and expeditiously evaluate our offer given its substantial benefits

to all stockholders.

Key Terms of the MITT Proposal

- MITT to acquire WMC based on a book-for-book exchange, with

each company’s book value adjusted for transaction expenses,

pursuant to which each share of WMC common stock would be converted

at closing into the right to receive:

- 1.468 shares of MITT common stock pursuant to a fixed exchange

ratio, subject to adjustment based on the companies’ respective

transaction expenses;1 and

- a cash payment from Angelo Gordon equal to the lesser of $7.0

million or approximately 9.9% of the aggregate per share merger

consideration.

- If the cash consideration to WMC’s stockholders is less than

$7.0 million due to the 9.9% cap, Angelo Gordon will pay the

difference to MITT to benefit the combined company by offsetting

transaction expenses and/or waiving expense reimbursements payable

to MITT’s manager.

- The pro forma combined company to pay a $7.0 million

termination fee due to WMC’s external manager, the break fee, and

the cost of WMC’s D&O tail insurance.

- MITT’s manager to waive $2.4 million of management fees

post-close.

- MITT’s Board of Directors to be expanded to include up to two

additional members from WMC’s independent directors.

- Transaction to not require any financing condition.

For illustration, based on the companies’ respective March 31,

2023 book values per share and MITT’s closing stock price as of

July 12, 2023, the implied value of the equity portion of the

merger consideration would be $8.90 per share and the additional

cash payment would be $0.98 per share. In addition, based on the

foregoing, Angelo Gordon would contribute $1.0 million to MITT to

offset transaction expenses and/or waive expense

reimbursements.

We are not aware of any material regulatory impediments to the

proposed transaction and believe the transaction can be consummated

expeditiously. A copy of our proposed merger agreement is being

provided under separate cover, and we will make ourselves available

immediately to discuss, negotiate, and finalize its terms.

Superior Benefits of the MITT Proposal

We believe our acquisition proposal offers WMC stockholders

substantial upside, while eliminating many risks posed by the TPT

transaction. Specifically:

- MITT’s stock trades on the NYSE with an observable value, while

TPT’s shares are not listed and have never been valued by public

markets through a stock exchange listing.

- There is no post-closing selling pressure given MITT

stockholders already have liquidity.

- WMC and MITT are highly complementary businesses, eliminating

any need for strategy shift and creating significant business and

cost synergies.

- WMC stockholders would receive a portion of the transaction

consideration in cash.

- MITT’s proposal provides speed and certainty of closing.

- MITT’s proposal avoids accelerating payment of WMC’s

convertible debt.

- MITT has strong support from external manager, Angelo Gordon, a

leading alternative investment firm with $73 billion of assets

under management.

A Combined WMC and MITT: A Transformative Transaction

Combining WMC and MITT, two publicly traded REITs, presents a

value-enhancing investment opportunity for WMC’s stockholders,

which we believe is superior to the TPT transaction.

We urge the WMC Board to consider its fiduciary duty and its

contractual rights under the TPT merger agreement and enter into

discussions with us to finalize the terms of our proposed superior

transaction. We believe doing so would be in the best interests of

WMC and all WMC stockholders. Our Board of Directors and

external manager have unanimously approved this non-binding

proposal and are prepared to work towards an accelerated

closing.

We and our advisors stand ready to engage with you and your team

as quickly and intensively as possible. We are confident that we

will be able to significantly enhance the value of the combined

entity and generate substantial long-term value for both WMC and

MITT stockholders.

We hope that the WMC Board shares our enthusiasm and look

forward to a prompt and favorable reply.

Sincerely yours,

T.J. Durkin President, CEO, and Member of the Board AG Mortgage

Investment Trust, Inc.

Piper Sandler is acting as financial advisor and Hunton Andrews

Kurth LLP is acting as legal counsel to MITT in connection with the

proposed transaction.

About AG Mortgage Investment Trust,

Inc.

AG Mortgage Investment Trust, Inc. is a residential mortgage

REIT with a focus on investing in a diversified risk-adjusted

portfolio of residential mortgage-related assets in the U.S.

mortgage market. AG Mortgage Investment Trust, Inc. is externally

managed and advised by AG REIT Management, LLC, a subsidiary of

Angelo, Gordon & Co., L.P., a leading alternative investment

firm focusing on credit and real estate strategies.

Additional information can be found on MITT’s website at

www.agmit.com.

About Angelo, Gordon & Co.,

L.P.

Angelo, Gordon & Co., L.P. (“Angelo Gordon”) is a leading

alternative investment firm founded in November 1988. The firm

currently manages approximately $73 billion* with a primary focus

on credit and real estate strategies. Angelo Gordon has over 650

employees, including more than 200 investment professionals, and is

headquartered in New York, with associated offices elsewhere in the

U.S., Europe and Asia. For more information, visit

www.angelogordon.com.

*Angelo Gordon’s (the "firm") currently stated assets under

management (“AUM”) of approximately $73 billion as of December 31,

2022 reflects fund-level asset-related leverage. Prior to May 15,

2023, the firm calculated its AUM as net assets under management

excluding leverage, which resulted in firm AUM of approximately $53

billion as of December 31, 2022. The difference reflects a change

in the firm’s AUM calculation methodology and not any material

change to the firm’s investment advisory business. For a

description of the factors the firm considers when calculating AUM,

please see the disclosure linked here.

Additional Information

This communication relates to a proposal which MITT has made for

an acquisition of WMC. In furtherance of this proposal and subject

to future developments, MITT (and, if a negotiated transaction is

agreed, WMC) may file one or more registration statements, proxy

statements, tender or exchange offer statements, prospectuses or

other documents with the United States Securities and Exchange

Commission (the “SEC”). This communication is not a substitute for

any proxy statement, registration statement, tender or exchange

offer statement, prospectus or other document MITT or WMC may file

with the SEC in connection with the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF MITT AND WMC ARE URGED TO READ

ANY SUCH PROXY STATEMENT, REGISTRATION STATEMENT, TENDER OR

EXCHANGE OFFER STATEMENT, PROSPECTUS AND/OR OTHER DOCUMENTS FILED

WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY

BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION. Any definitive proxy statement or

prospectus (if and when available) will be delivered to

shareholders of WMC or MITT, as applicable. Investors and security

holders will be able to obtain free copies of these documents (if

and when available) and other documents filed with the SEC by MITT

through the website maintained by the SEC at

http://www.sec.gov.

This communication is neither a solicitation of a proxy nor a

substitute for any proxy statement or other filings that may be

made with the SEC. Nonetheless, MITT and its directors and

executive officers and other members of management and Angelo

Gordon employees may be deemed to be participants in the

solicitation of proxies in respect of the proposed transaction. You

can find information about MITT’s executive officers and directors

in MITT’s definitive proxy statement filed with the SEC on March

22, 2023, and Annual Report on Form 10-K filed with the SEC on

February 27, 2023. Additional information regarding the interests

of such potential participants will be included in one or more

registration statements, proxy statements, tender or exchange offer

statements or other documents filed with the SEC if and when they

become available. You may obtain free copies of these documents (if

and when available) using the sources indicated above.

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

Forward-Looking

Statements

This communication may include “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements include, but are not

limited to, statements regarding MITT’s offer to acquire WMC, the

consideration in the proposed transaction, its expected future

performance (including expected results of operations and financial

guidance) and the combined company’s future financial condition,

operating results, strategy and plans. Forward-looking statements

may be identified by the use of the words “anticipates,” “expects,”

“intends,” “plans,” “should,” “could,” “would,” “may,” “will,”

“believes,” “estimates,” “potential,” “target,” “opportunity,”

“tentative,” “positioning,” “designed,” “create,” “predict,”

“project,” “seek,” “ongoing,” “upside,” “increases” or “continue”

and variations or similar expressions. These statements are based

upon the current expectations and beliefs of management and are

subject to numerous assumptions, risks and uncertainties that

change over time and could cause actual results to differ

materially from those described in the forward-looking statements.

These assumptions, risks and uncertainties include, but are not

limited to, assumptions, risks and uncertainties discussed in

MITT’s most recent annual or quarterly report filed with the SEC

and assumptions, risks and uncertainties relating to the proposed

transaction, as detailed from time to time in MITT’s and WMC’s

filings with the SEC, which factors are incorporated herein by

reference. Important factors that could cause actual results to

differ materially from the forward-looking statements made in this

communication are set forth in other reports or documents that MITT

may file from time to time with the SEC, and include, but are not

limited to: (i) the ultimate outcome of any possible transaction

between MITT and WMC, including the possibility that WMC will not

respond or will reject a transaction with MITT; (ii) the risk that

anticipated cost synergies and any other benefits or savings from

the transaction may not be fully realized or may take longer to

realize than expected; (iii) the amount and impact of the

transaction expenses that will be incurred by MITT and WMC; (iv)

the ability to meet any closing conditions to any possible

transaction, including the necessary shareholder approvals; (v)

market volatility in stock prices of MITT and WMC; and (vi) general

economic conditions that are less favorable than expected.

Additional risks and uncertainties related to MITT’s business are

included under the headings “Forward-Looking Statements” and “Risk

Factors” in MITT’s Annual Report on Form 10-K for the year ended

December 31, 2022 and in other reports and documents filed with the

SEC from time to time. All forward-looking statements attributable

to MITT or any person acting on MITT’s behalf are expressly

qualified in their entirety by this cautionary statement. Readers

are cautioned not to place undue reliance on any of these

forward-looking statements. These forward-looking statements speak

only as of the date hereof. Except as required by law, MITT

undertakes no obligation to update any of these forward-looking

statements to reflect events or circumstances after the date of

this communication or to reflect actual outcomes.

1 Exchange ratio is based on 6.122 million

outstanding shares of WMC common stock on a fully-diluted

basis.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230712848940/en/

Investors AG Mortgage Investment Trust, Inc. Investor

Relations (212) 692-2110 ir@agmit.com

Media Jonathan Gasthalter/Amanda Shpiner Gasthalter &

Co. 212 257 4170

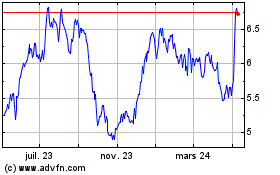

AG Mortgage Investment (NYSE:MITT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

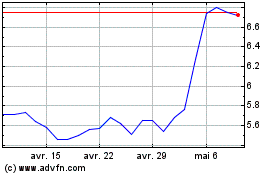

AG Mortgage Investment (NYSE:MITT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025