UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

| For the month of |

May |

|

2024 |

| |

|

|

|

| Commission File Number |

001-41722 |

|

|

METALS ACQUISITION LIMITED

| (Translation of registrant’s name into English) |

| |

|

3rd Floor, 44 Esplanade, St.

St. Helier, Jersey, JE49WG

Tel: +(817) 698-9901 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

METALS

ACQUISITION LIMITED |

| |

|

(Registrant) |

| |

|

|

| Date: |

May 28,

2024 |

|

By: |

/s/

Michael James McMullen |

| |

|

|

|

Name: |

Michael James McMullen |

| |

|

|

|

Title: |

Chief Executive Officer |

Exhibit 99.1

27 May 2024

Metals

Acquisition Limited Announces Strategic Investment in Polymetals Resources Limited (ASX:POL)

ST. HELIER, Jersey – (BUSINESS WIRE) –

Metals Acquisition Limited (NYSE: MTAL; ASX: MAC)

Metals Acquisition Limited ARBN 671 963 198 (NYSE:

MTAL; ASX: MAC) (“MAC” or the “Company”) is pleased to announce that it has signed a subscription

agreement representing a strategic investment with Polymetals Resources Limited (“POL”).

Highlights of the investment include:

| · | MAC to invest an initial A$2.5 million in total

at a price of A$0.35/share for an initial 4.31% interest in POL. |

| · | MAC to invest an additional A$2.5 million in

total at a price of A$0.35/share subject to satisfaction of certain conditions precedent including: |

| o | POL securing sufficient funding to restart the Endeavour mine and processing plant; |

| o | POL and MAC entering into a tolling agreement to treat zinc ore delivered by MAC to POL (with a treatment

charge of costs + 35%); |

| o | POL and MAC entering into a Water Offtake agreement whereby POL will allow MAC to draw 150ML of water

annually from the Endeavor mine pipeline for a term of 4.5 years. MAC will have an option to extend beyond the initial 4.5 years on terms

to be agreed in good faith between the parties; and |

| o | MAC securing any necessary third-party consents (including from its secured lenders and Glencore Plc)

to undertake the transactions contemplated. |

| · | MAC will have the right to appoint one director

to the POL board whilst MAC holds >7% of the issued shares in POL. |

POL holds the rights to the Endeavor silver zinc

lead Mine approximately 40km to the north of the CSA Copper Mine. Endeavor produced approximately 92M oz Ag, 2.6Mt Zn and 1.6Mt Pb over

a 38-year mine life and is one of the more prolific producers in the Cobar Basin.

Strategically having the option to treat potential

high grade zinc mineralisation near surface from the CSA Copper Mine at Endeavor can potentially create significant value for our shareholders.

Additionally with securing 150ML of water offtake for the next 4.5 years (with an option to extend) also increases the potential throughput

we can achieve at the CSA Copper Mine for a low cost.

The POL management team has over 30 years of experience

exploring, developing and operating mines in the Cobar Basin and have acquired the mine with a view to restarting operations. The asset

comes with significant infrastructure including an underground mine with a decline and hoisting system, 1.2MTPA processing plant, grid

power, water, railway, and workshop facilities.

MAC CEO, Mick McMullen commented “We

believe that this kind of transaction is an example of how cooperation in the Cobar Basin has the potential to extract the best value

in the Basin. As recently announced, the CSA Copper Mine appears to host high grade zinc mineralisation near surface and adjacent to existing

development. Subject to exploration success, modifying factors and some permitting, we think that having the option to treat this material

at Endeavor can potentially create significant value for our shareholders. This is a logical way of securing a processing option for any

zinc ore we might mine without distracting our operations from the core business of mining and recovering copper.

Having secured 150ML of water offtake for the

next 4.5 years (with an option to extend) from the pipeline that runs right past our site also increases the potential throughput we can

achieve at the CSA Copper Mine for a low cost.

By investing in POL, we are creating a partnership

to achieve better outcomes for both companies. We have known the POL management team for over 20 years, they bring a wealth of experience

to the area and have the ability to operate mines very efficiently and we are very supportive of their efforts to reopen the Endeavor

mine as well as exploring their immediate mine environment which like the CSA Copper Mine is very underexplored for all base metals including

copper.

We continue to evaluate opportunities to add

value to our business both organically and inorganically.”

MAC’s rights to extend the initial 4.5 year

term of the Water Offtake Agreement is subject to Foreign Investment Review Board (FIRB) approval (to the extent required). MAC’s

subscription for POL shares does not require FIRB approval.

This announcement has been approved for release

by the Board of Directors.

Contacts

|

Mick McMullen

Chief Executive Officer

Metals Acquisition Limited.

investors@metalsacqcorp.com

|

Dan Vujcic

Chief Development Officer

Metals Acquisition Limited

|

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC) is a company focused

on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification

and decarbonization of the global economy.

Forward Looking Statements

This release has been prepared by Metals Acquisition

Limited (“Company” or “MAC”) and includes “forward-looking statements.” The forward-looking information

is based on the Company’s expectations, estimates, projections and opinions of management made in light of its experience and its

perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes

to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions

have been made by the Company regarding, among other things: the price of copper, continuing commercial production at the CSA Copper

Mine without any major disruption, the receipt of required governmental approvals, the accuracy of capital and operating cost estimates,

the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as

and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions

which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented

by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate.

MAC’s actual results may differ from expectations,

estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events.

Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words

or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation,

MAC’s expectations with respect to future performance of the CSA Copper Mine. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but

are not limited to: the supply and demand for copper; the future price of copper; the timing and amount of estimated future production,

costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated

reclamation expenses; claims and limitations on insurance coverage; the uncertainty in Mineral Resource estimates; the uncertainty in

geological, metallurgical and geotechnical studies and opinions; infrastructure risks; and other risks and uncertainties indicated from

time to time in MAC’s other filings with the SEC and the ASX. MAC cautions that the foregoing list of factors is not exclusive.

MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not

undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect

any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could

affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports filed with

the SEC and the ASX. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that

MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date

of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC

may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so,

except as required by law. These forward-looking statements should not be relied upon as representing MAC’s assessment as of any

date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

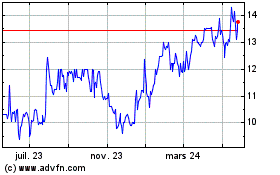

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

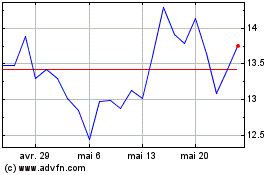

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025