Form N-CEN - Annual Report for Registered Investment Companies

13 Octobre 2023 - 7:12PM

Edgar (US Regulatory)

BLACKROCK

MUNIHOLDINGS QUALITY FUND II, INC.

ARTICLES

OF AMENDMENT

AMENDING THE ARTICLES SUPPLEMENTARY ESTABLISHING AND FIXING THE RIGHTS AND

PREFERENCES OF

VARIABLE RATE MUNI TERM PREFERRED SHARES

This is to

certify that:

First: The

charter of BlackRock MuniHoldings Quality Fund II, Inc., a Maryland corporation

(the “Corporation”), is amended by these Articles of Amendment, which amend the

Articles Supplementary Establishing and Fixing the Rights and Preferences of

Variable Rate Muni Term Preferred Shares, dated as of December 15, 2011, as

amended to date (the “Articles Supplementary”).

Second: The

charter of the Corporation is hereby amended by deleting the definition of

“Applicable Base Rate” in the Articles Supplementary and replacing it with the

following definition:

“Applicable Base

Rate” means (i) with respect to the initial Rate Period beginning on

December 1, 2022 and ending on December 7, 2022, the rate as calculated

pursuant to the Articles Supplementary as in place immediately prior to the

effectiveness of the Articles of Amendment dated December 1, 2022 and (ii) for

every succeeding Rate Period, 75% of Daily SOFR on the applicable Rate

Determination Date.

Third: The

charter of the Corporation is hereby amended by deleting the definition of

“LIBOR Dealer” in the Articles Supplementary.

Fourth: The

charter of the Corporation is hereby amended by deleting the definition of

“LIBOR Rate” in the Articles Supplementary.

Fifth: The

charter of the Corporation is hereby amended by deleting the definition of

“London Business Day” in the Articles Supplementary.

Sixth: The

charter of the Corporation is hereby amended by deleting the definition of

“Redemption Premium” in the Articles Supplementary and replacing it with the

following:

“Redemption Premium”

means with respect of a VMTP Preferred Share rated above A1/A+ and its

equivalent by all Rating Agencies then rating such VMTP Preferred Share at the

request of the Corporation and subject to any redemption, other than redemptions

required to comply with Minimum Asset Coverage requirements or exceed

compliance with the Minimum Asset Coverage requirements up to 240%, an amount

equal to the product of 1% and the Liquidation Preference of the VMTP Preferred

Shares subject to redemption if the Redemption Date is greater than or equal to

15 months from the Term Redemption Date, provided, up to 25% of the

Corporation’s VMTP Preferred Shares Outstanding as of

December 1, 2022 may be redeemed at any time without a Redemption Premium.

Any VMTP Preferred

Share exchanged for the preferred share of a surviving entity in connection

with a reorganization, merger, or redomestication of the Corporation in another

state that had been previously approved by the Holders of VMTP Preferred Shares

or that otherwise does not require the vote or consent of the Holders of VMTP

Preferred Shares shall not be subject to the Redemption Premium.

Seventh: The charter of the Corporation is

hereby amended by deleting the definition of “Reference Banks” in the Articles

Supplementary.

Eighth: The charter of the Corporation is

hereby amended by adding the definition for “Daily SOFR” in the Articles

Supplementary:

“Daily SOFR” means:

(1)

With respect to any Business Day means the secured overnight financing

rate published

for such day by the Federal Reserve Bank of New York, as the administrator of the benchmark (or a

successor administrator) on the Federal Reserve Bank of New York’s website (or any

successor source) as of 4:00 p.m. New York City time (such rate being initially

published for such day at 8:00 a.m. and may be revised until 2:30 p.m., New

York City time).

(2)

If the secured overnight financing rate cannot be determined with

respect to such any Business Day as specified in paragraph (1), unless both a

SOFR Index Cessation Event and a SOFR Index Cessation Date have occurred, then

the Redemption and Paying Agent shall use the secured overnight financing rate

in respect of the last Business Day for which such secured overnight financing rate

was published on the Federal Reserve Bank of New York’s website.

(3)

If a SOFR Index Cessation Event and SOFR Index Cessation Date have

occurred, the Redemption and Paying Agent shall determine the Applicable Base

Rate as if the reference to “75% of Daily SOFR” were a reference to the rate

that was recommended as the replacement for the secured overnight financing rate

by the Federal Reserve Board and/or the Federal Reserve Bank of New York or a

committee officially endorsed or convened by the Federal Reserve Board and/or

the Federal Reserve Bank of New York for the purpose of recommending a

replacement for the secured overnight financing rate (which rate may be

produced by a Federal Reserve Bank or other designated administrator, which

rate may include any adjustments or spreads, and which rate will be reasonably

expected to measure contemporaneous variations in the cost of newly borrowed

funds in U.S. dollars). If no such rate has been recommended within one

Business Day of the SOFR Index Cessation Event, then the Redemption and Paying Agent

shall use the OBFR published on the Federal Reserve Bank of New York’s website for any Business

Day after the SOFR Index Cessation Date (it being understood that the OBFR for

any such Business Day will be

the Overnight Bank

Funding Rate on the Federal Reserve Bank of New York’s website as of 4:00 p.m., New

York City time).

(4)

If the Redemption and Paying Agent is required to use the OBFR in

paragraph (3) above and an OBFR Index Cessation Event has occurred, then for

any Business Day after the OBFR Index Cessation Date, the Redemption and Paying

Agent shall use the short-term interest rate target set by the Federal Open

Market Committee and published on the Federal Reserve Bank of New York’s website, or if the

Federal Open Market Committee has not set a single rate, the mid-point of the

short-term interest rate target range set by the Federal Open Market Committee

and published on the Federal Reserve Bank of New York’s website (calculated as the

arithmetic average of the upper bound of the target range and the lower bound

of the target range).

(5)

If Daily

SOFR determined as above would be less than zero, then such rate shall be

deemed to be zero.

Ninth: The charter of the Corporation is

hereby amended by adding the definitions for “SOFR Index Cessation Date” and “SOFR

Index Cessation Event” in the Articles Supplementary:

“SOFR Index Cessation Date” means, in

respect of a SOFR Index Cessation Event, the date on which the Federal Reserve

Bank of New York (or any successor administrator of the secured overnight

financing rate) ceases to publish the secured overnight financing rate or the

date as of which the secured overnight financing rate may no longer be used.

“SOFR Index Cessation Event” means the

occurrence of one or more of the following events as it relates to Daily SOFR:

(1)

a public statement by the Federal Reserve Bank of New York

(or a successor administrator of the secured overnight financing rate)

announcing that it has ceased to publish or provide the secured overnight

financing rate permanently or indefinitely, provided that, at that time, there

is no successor administrator that will continue to publish or provide a

secured overnight financing rate; or

(2)

the publication of information which reasonably confirms

that the Federal Reserve Bank of New York (or a successor administrator of the

secured overnight financing rate) has ceased to provide the secured overnight

financing rate permanently or indefinitely, provided that, at that time, there

is no successor administrator that will continue to publish or provide the secured

overnight financing rate.

Tenth: The charter of the Corporation is

hereby amended by adding the definitions for “OBFR”, “OBFR Index Cessation Date”,

and “OBFR Index Cessation Event” in the Articles Supplementary:

“OBFR” means, with respect to any Business

Day, the Overnight Bank Funding Rate on the Federal Reserve Bank of New York’s

website as of 4:00 p.m., New York City time.

“OBFR Index Cessation

Date” means, in respect of an OBFR Index Cessation Event, the date on which

the Federal Reserve Bank of New York (or any successor administrator of the

OBFR), ceases to publish the OBFR, or the date as of which the OBFR may no

longer be used.

“OBFR Index Cessation Event” means the

occurrence of one or more of the following events:

(1)

a public statement by the Federal Reserve Bank of New York

(or a successor administrator of the OBFR) announcing that it has ceased to

publish or provide the OBFR permanently or indefinitely, provided that, at that

time, there is no successor administrator that will continue to publish or

provide an OBFR; or

(2)

the publication of information which reasonably confirms

that the Federal Reserve Bank of New York (or a successor administrator of the

OBFR) has ceased to provide the OBFR permanently or indefinitely, provided

that, at that time, there is no successor administrator that will continue to

publish or provide the OBFR.

Eleventh: The charter of the Corporation

is hereby amended by deleting the definition of “Substitute LIBOR Dealer” in

the Articles Supplementary.

Twelfth: These Articles of Amendment

shall be effective as of December 1, 2022.

Thirteenth:

The amendment to the charter of the Corporation as set forth above in these

Articles of Amendment has been duly advised by the board of directors of the

Corporation and approved by the stockholders of the Corporation as and to the

extent required by law and in accordance with the charter of the Corporation.

[remainder

of page intentionally left blank]

IN WITNESS WHEREOF, BlackRock MuniHoldings Quality Fund

II, Inc. has caused these Articles of Amendment to be signed as of November 29,

2022 in its name and on its behalf by the person named below who acknowledges

that these Articles of Amendment are the act of the Corporation and, to the

best of such person’s knowledge, information and belief and under penalties for

perjury, all matters and facts contained in these Articles of Amendment are

true in all material respects.

BlackRock MuniHoldings Quality Fund II, Inc.

By: /s/ Jonathan Diorio

Name: Jonathan Diorio

Title: Vice President

ATTEST:

/s/ Janey Ahn

Name: Janey Ahn

Title: Secretary

[Signature Page to

Amendment to Articles Supplementary – MUE]

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Shareholders and the Board of Trustees of BlackRock California Municipal Income

Trust, BlackRock Municipal 2030 Target Term Trust, BlackRock MuniHoldings

California Quality Fund, Inc., and BlackRock MuniHoldings Quality Fund II,

Inc.:

In

planning and performing our audits of the financial statements of BlackRock

California Municipal Income Trust, BlackRock Municipal 2030 Target Term Trust,

BlackRock MuniHoldings California Quality Fund, Inc., and BlackRock

MuniHoldings Quality Fund II, Inc. (the “Funds”) as of and for the year ended July 31,

2023, in accordance with the standards of the Public Company Accounting

Oversight Board (United States) (PCAOB), we considered the Funds’ internal

control over financial reporting, including controls over safeguarding

securities, as a basis for designing our auditing procedures for the purpose of

expressing our opinion on the financial statements and to comply with the

requirements of Form N-CEN, but not for the purpose of expressing an opinion on

the effectiveness of the Funds’ internal control over financial reporting.

Accordingly, we express no such opinion.

The management of the Funds is responsible for

establishing and maintaining effective internal control over financial

reporting. In fulfilling this responsibility, estimates and judgments by

management are required to assess the expected benefits and related costs of

controls. A company's internal control over financial reporting is a process

designed to provide reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external purposes in

accordance with generally accepted accounting principles. A company's internal

control over financial reporting includes those policies and procedures that

(1) pertain to the maintenance of records that, in reasonable detail,

accurately and fairly reflect the transactions and dispositions of the assets

of the company; (2) provide reasonable assurance that transactions are recorded

as necessary to permit preparation of financial statements in accordance with

generally accepted accounting principles, and that receipts and expenditures of

the company are being made only in accordance with authorizations of management

and directors of the company; and (3) provide reasonable assurance regarding

prevention or timely detection of unauthorized acquisition, use, or disposition

of a company's assets that could have a material effect on the financial

statements.

Because of its inherent limitations, internal control

over financial reporting may not prevent or detect misstatements. Also,

projections of any evaluation of effectiveness to future periods are subject to

the risk that controls may become inadequate because of changes in conditions

or that the degree of compliance with the policies or procedures may

deteriorate.

A deficiency in internal control over financial

reporting exists when the design or operation of a control does not allow

management or employees, in the normal course of performing their assigned

functions, to prevent or detect misstatements on a timely basis. A material

weakness is a deficiency, or a combination of deficiencies, in internal control

over financial reporting, such that there is a reasonable possibility that a

material misstatement of the company’s annual or interim financial statements

will not be prevented or detected on a timely basis.

Our consideration of the Funds’ internal control over

financial reporting was for the limited purpose described in the first

paragraph and would not necessarily disclose all deficiencies in internal

control that might be material weaknesses under standards established by the

PCAOB. However, we noted no deficiencies in the Funds’ internal control over

financial reporting and its operation, including controls over safeguarding securities,

that we consider to be a material weakness, as defined above, as of July 31, 2023.

This report is intended solely for the information and

use of management and the Board of Trustees of the Funds and the Securities and

Exchange Commission and is not intended to be and should not be used by anyone

other than these specified parties.

/s/Deloitte & Touche

LLP

Boston, Massachusetts

September 22, 2023

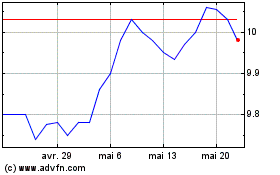

BlackRock MuniHoldings Q... (NYSE:MUE)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

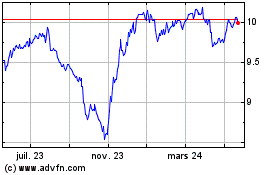

BlackRock MuniHoldings Q... (NYSE:MUE)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024