UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(RULE 14D-100)

Tender Offer Statement Pursuant to Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 6)

Eneti Inc.

(Name of Subject Company)

Cadeler A/S

(Offeror)

(Name of Filing Person)

Common stock, par value $0.01 per share

(Title of Class of Securities)

Y2294C107

(CUSIP Number of Class of Securities)

Puglisi & Associates

850 Library Ave., Suite 204

Newark, DE 19711

Tel.: (302)-738-6680

(Name, address and telephone number of person authorized

to receive notices and communications on behalf of filing persons)

with copies to:

|

Connie I. Milonakis

Davis Polk & Wardwell London LLP

5 Aldermanbury Square

London, EC2V 7HR

United Kingdom

Tel.: +44-20-7418-1327 |

Emanuele Lauro

Eneti Inc.

L’Exotique

99 Boulevard Jardin Exotique

98000 Monaco

Tel: +377-9798-5715 |

Edward S. Horton

Nick Katsanos

Seward & Kissel LLP

One Battery Park Plaza

New York, NY 10004

Tel: (212) 574-1265 |

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to

which the statement relates:

☒ third-party

tender offer subject to Rule 14d-1.

☐ issuer

tender offer subject to Rule 13e-4.

☐ going-private

transaction subject to Rule 13e-3.

☐ amendment

to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting

the results of the tender offer: ☒

This Amendment No. 6 (this “Amendment”) amends and supplements

the Tender Offer Statement on Schedule TO, originally filed with the Securities and Exchange Commission (the “SEC”) on November

7, 2023 (together with any amendments and supplements thereto, the “Schedule TO”), by Cadeler A/S, a company incorporated

under the laws of Denmark (“Cadeler” or the “Offeror”). The Schedule TO relates to the offer by the Offeror to

exchange for each outstanding share of Eneti Inc., a company incorporated under the laws of the Republic of the Marshall Islands (“Eneti”),

par value $0.01 per share (“Eneti Common Stock”), validly tendered and not validly withdrawn in the offer, American Depositary

Shares (“ADSs”), representing, in the aggregate, 3.409 shares of Cadeler, nominal value DKK 1 per share (the “Cadeler

Shares”) with each ADS representing four (4) Cadeler Shares (the “Cadeler ADSs”), subject to payment of cash compensation

with respect to any fractional Cadeler ADSs, without interest and subject to reduction for any applicable withholding taxes (such consideration,

the “Transaction Consideration,” and such offer, on the terms and subject to the conditions and procedures set forth in the

prospectus/offer to exchange, dated November 7, 2023 (the “Prospectus/Offer to Exchange”), and in the related letter of transmittal

(the “Letter of Transmittal”), together with any amendments or supplements thereto, the “Offer”).

Cadeler has filed with the SEC a Registration Statement on Form F-4

dated October 31, 2023 and which became effective on November 7, 2023, relating to the offer and sale of the Cadeler Shares and a Registration

Statement on Form F-6 relating to the registration of the Cadeler ADSs to be issued to holders of shares of Eneti Common Stock validly

tendered and not validly withdrawn in the Offer (the “Registration Statement”). The terms and conditions of the Offer are

set forth in the Prospectus/Offer to Exchange, which is a part of the Registration Statement, and the Letter of Transmittal, which are

filed as Exhibits (a)(1)(A) and (a)(1)(B), respectively, to the Schedule TO.

All information regarding the Offer as set forth in the Schedule TO,

including all exhibits and annexes thereto that were previously filed with the Schedule TO, is hereby expressly incorporated by reference

into this Amendment, except that such information is hereby amended and supplemented to the extent specifically provided for herein and

to the extent amended and supplemented by the exhibits filed herewith. Capitalized terms used but not defined in this Amendment have the

meanings ascribed to them in the Schedule TO.

Item 4, Items 6 through 8 and Item 11.

The Offeror's previous amendment to the Schedule TO (Amendment No. 5), filed with the SEC on December 15, 2023, incorrectly stated that

the Offer expired at 4:30 p.m. Eastern time, on December 7, 2023. In fact, following an extension of the Offer in accordance with its

terms, the Offer expired at 5:30 p.m. Eastern time on December 15, 2023 and Item 4, Items 6 through 8 and Item 11 are hereby amended accordingly.

In addition, Item 4, Items 6 through 8 and Item 11 of the Schedule TO, to the extent

such items incorporated by reference information contained in the Prospectus/Offer to Exchange, are hereby amended and supplemented by

adding the following information:

The Offeror has received the final results of the Offer from the

Exchange Agent. A total of 33,385,714 shares of Eneti Common Stock were validly tendered and not validly withdrawn in the Offer,

representing approximately 86.39% of the aggregate voting power of the Eneti Common Stock outstanding. Subject only to the Danish

Business Authority’s registration of the Cadeler Share Issuance (as defined in the Prospectus/Offer to Exchange), which is

expected to be completed today, December 18, 2023, a total of 28,452,467 Cadeler ADSs will be issued and approximately $6,774 will be payable in cash compensation with respect to fractional Cadeler ADSs.

As disclosed in the Prospectus/Offer to Exchange, Cadeler intends to

complete its acquisition of the entire equity interest in Eneti by effecting a squeeze-out merger, to be governed by the laws and regulations

of the Republic of the Marshall Islands, and pursuant to which a wholly owned subsidiary of Cadeler (the “Merger Sub”) will

merge with and into Eneti, with Merger Sub surviving the Merger. The purpose of the Merger is for Cadeler to acquire all of the shares

of Eneti Common Stock that it did not acquire in the Offer. Upon the consummation of the Merger, the Eneti business will be held by a

wholly owned subsidiary of Cadeler.

On December 18, 2023, Cadeler issued a press release announcing the

final results of the Offer. A copy of the press release is attached as Exhibit (a)(5)(T) hereto and incorporated by reference herein.

Item 12. Exhibits.

Item

12 of the Schedule TO is hereby amended and supplemented by adding the following exhibit:

SIGNATURES

After due inquiry and to the best of their knowledge and belief, each

of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: December 18, 2023

| |

CADELER A/S |

| |

|

| |

|

| |

By: |

/s/ Mikkel Gleerup |

| |

|

Name: Mikkel Gleerup |

| |

|

Title: Chief Executive Officer |

Exhibit (a)(5)(T)

CADELER A/S ANNOUNCES SUCCESSFUL FINAL RESULTS OF ITS SHARE EXCHANGE

OFFER FOR ALL OF THE OUTSTANDING SHARES OF ENETI INC.

Copenhagen, December 18, 2023: With reference

to the stock exchange announcement of December 15, 2023 published by Cadeler A/S (OSE: CADLR, NYSE: CDLR) (“Cadeler”)

regarding the preliminary results of the share exchange offer for all of the outstanding shares of the common stock of Eneti Inc. (NYSE:

NETI) (“Eneti”) (the “Share Exchange Offer”), Cadeler today announces the final results of the Share

Exchange Offer.

Further, Cadeler has submitted a prospectus for

approval to the Danish Financial Supervisory Authority (the “Danish FSA”) regarding the new Cadeler shares to be issued,

and admitted to trading on the Oslo Stock Exchange, in connection with the completion and settlement of the Share Exchange Offer (the

“EU/EEA Listing Prospectus”).

Final results of the Share Exchange Offer

The offer period for the Share Exchange Offer

expired on December 14, 2023, at 5:30 p.m. (ET) / 11:30 p.m. (CET). Based on the exchange agent’s final count, 33,385,714 shares

of Eneti common stock have been validly tendered and not validly withdrawn in the Share Exchange Offer, corresponding to an acceptance

rate of approximately 86.39% of the total number of outstanding shares of Eneti common stock (excluding treasury shares held by Eneti).

The acceptance rate satisfies the minimum acceptance

rate as set out in the business combination agreement between Cadeler and Eneti dated June 16, 2023. All conditions to the Share Exchange

Offer having been satisfied or waived, subject only to registration of the capital increase in Cadeler with the Danish Business Authority,

which is expected to be completed on December 19, 2023, Cadeler will accept for payment and promptly pay for all shares of Eneti common

stock validly tendered and not validly withdrawn in the Share Exchange Offer.

All holders of shares of Eneti common stock validly

tendered and not validly withdrawn in the Share Exchange Offer will receive, for each such tendered share, 0.85225 American Depositary

Shares (the “Cadeler ADSs”), each one (1) Cadeler ADS representing four (4) shares of Cadeler, nominal value DKK 1

per share, providing for the previously agreed and announced exchange ratio of 3.409 shares of Cadeler for each share of Eneti common

stock, subject to payment of cash compensation in lieu of any fractional Cadeler ADSs, without interest and subject to reduction for any

applicable withholding taxes.

An aggregate of 113,809,868 new Cadeler shares

will be issued, corresponding to the delivery of 28,452,467 Cadeler ADSs. The aggregate amount of cash compensation in lieu of fractional

Cadeler ADSs is a total of approx. USD 6.8 thousand.

Cadeler intends to complete its acquisition of

the entire equity interest in Eneti by effecting a squeeze-out merger, to be governed by the laws of the Republic of the Marshall Islands,

pursuant to which a wholly owned subsidiary of Cadeler (the “Merger Sub”) will merge with and into Eneti, with the

Merger Sub surviving the Merger. The purpose of the Merger is for Cadeler to acquire all of the shares of Eneti common stock that it did

not acquire in the Share Exchange Offer. Upon the consummation of the merger, the Eneti business will be held by a wholly owned subsidiary

of Cadeler.

Following the announcement of the preliminary

results of the Share Exchange Offer on December 15, 2023, the Cadeler ADSs commenced trading on New York Stock Exchange on a “when-issued”

basis subject to the official notice of issuance of the Cadeler ADSs following completion of the Share Exchange Offer. The Cadeler ADSs

are expected to commence trading on regular-way settlement basis on or about December 20, 2023

Submission of the EU/EEA Listing Prospectus

for approval

Cadeler has today submitted the EU/EEA Listing

Prospectus to the Danish FSA for approval. The EU/EEA Listing Prospectus relates to the new Cadeler shares underlying the Cadeler ADSs

to be issued in connection with the completion and settlement of the Share Exchange Offer. The new Cadeler shares are to be admitted to

trading and listed on the Oslo Stock Exchange.

Following the Danish FSA's approval of the EU/EEA

Listing Prospectus, Cadeler has requested the Danish FSA to issue a certificate to passport the EU/EEA Listing Prospectus to Norway by

notifying the Norwegian Financial Supervisory Authority. Once the EU/EEA Listing Prospectus has been passported, the new Cadeler shares

will be admitted to trading and listed on the Oslo Stock Exchange.

Indicative Timetable

The following table sets out the expected dates

and times of the outstanding key events relating to the settlement of the Share Exchange Offer and the admission of the Cadeler ADSs and

the new Cadeler shares to the New York Stock Exchange and the Oslo Stock Exchange, as applicable. This is an indicative timetable and

is subject to change.

|

Event |

Calendar date |

| Expected date for approval of the EU/EEA Listing Prospectus for the new Cadeler Shares |

On or about December 18, 2023 |

| Expected settlement date |

On or about December 19, 2023 |

| Admission to trading of the new Cadeler shares on the Oslo Stock Exchange |

On or about December 20, 2023 |

| Commencement of trading of Cadeler ADSs on the New York Stock Exchange on a regular-way settlement basis |

On or about December 20, 2023 |

For further information, please contact:

Point of contact for investors:

Mikkel Gleerup, CEO

+45 3246 3102

mikkel.gleerup@cadeler.com

Point of contact for media:

Karen Roiy, Head of Marketing & Communication

+45 6020 8706

karen.roiy@cadeler.com

About Cadeler A/S:

Cadeler A/S is a key supplier within the offshore

wind industry for installation services and marine and engineering operations with a strong focus on safety and the environment. Cadeler’s

experience as provider of high-quality offshore wind support services, combined with innovative vessel designs, positions the company

to deliver premium services to the industry. Cadeler facilitates the global energy transition towards a future built on renewable energy.

Cadeler is listed on the Oslo Stock Exchange (OSE: CADLR) and the New York Stock Exchange (NYSE: CDLR).

Visit www.cadeler.com

for more information.

Important Notice

This communication does not constitute a prospectus

as defined by Regulation (EU) 2017/1129 of 14 June 2017 (the “EU/EEA Prospectus Regulation”) and no public takeover offer

is made pursuant to the Directive 2004/25/EC of 21 April 2004 on takeover bids in connection with the exchange offer referred to above.

This communication does not contain all the information that should be considered concerning the Share Exchange Offer and is not intended

to form the basis of any investment decision or any other decision in respect of the proposed transaction.

Forward-Looking Statements

Matters discussed in this announcement may constitute

forward-looking statements. Forward-looking statements are statements that are not historical facts and may be identified by words such

as “believe”, “expect”, “anticipate”, "strategy", “intend”, “estimate”,

“will”, ”potentially”, “estimate”, “may”, “continue”, ”should”,

“plan” and similar expressions. The absence of these words, however, does not mean that the statements are not forward-looking.

The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions.

Although the Company believe that these assumptions were reasonable when made, these are inherently subject to significant known and unknown

risks, uncertainties, contingencies and other important factors which are difficult or impossible to predict, and are beyond the Company’s

control. Actual events may differ significantly from any anticipated development due to a number of factors, including without limitation,

changes in public sector investment levels, changes in the general domestic and international economic, political and market conditions

including in the markets in which the Company operates, the Company's ability to attract, retain and motivate qualified personnel, changes

in the Company's ability to engage in commercially acceptable acquisitions and strategic investments, factors affecting the backlog or

contract profitability, actions by regulatory authorities, customers and other third parties, the ability to implement business plans,

forecasts, and other expectations (including with respect to synergies related to the business combination with Eneti Inc.), risks related

to the ability to project future cash utilization and reserves needed for contingent future liabilities and business operations, changes

in laws and regulation affecting the Company or the industry in which it operates and the potential impact of legal proceedings and actions.

The factors identified are not set out in any particular order. New risks and uncertainties may emerge from time to time, and it is not

possible to predict all risks and uncertainties. Such risks, uncertainties, contingencies and other important factors could cause actual

events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The Company

does not make any guarantee that the assumptions underlying the forward-looking statements in this announcement are free from errors nor

does it accept any responsibility for the future accuracy of the opinions expressed in this announcement or any obligation to update or

revise the statements in this announcement to reflect subsequent events. Past performance should not be relied upon, and is not, a guarantee

of future performance. You should not place undue reliance on the forward-looking statements in this announcement. The information, opinions

and forward-looking statements contained in this announcement speak only as at its date and are subject to change without notice. The

Company does not undertake any obligation to review, update, confirm, or to release publicly any revisions to any forward-looking statements

to reflect events that occur or circumstances that arise in relation to the content of this announcement.

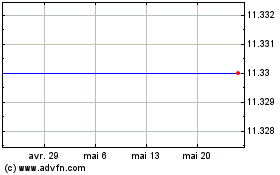

Eneti (NYSE:NETI) Graphique Historique de l'Action De Avr 2024 à Mai 2024

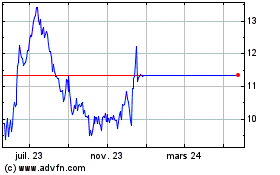

Eneti (NYSE:NETI) Graphique Historique de l'Action De Mai 2023 à Mai 2024

Les dernières valeurs consultées apparaîtront dans cette boîte, vous permettant de choisir facilement les titres vus auparavant.

|