UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-36231

ENETI INC.

(Translation of registrant's name into English)

L’Exotique, 99 Boulevard du Jardin Exotique, Monaco 98000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ⌧ Form 40-F □

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

On December 15, 2023, Eneti Inc. (the “Company”) entered into an agreement and plan of merger (the “Agreement and Plan of

Merger”) by and between the Company and Wind MI Limited, a company incorporated under the laws of the Republic of the Marshall Islands. The Agreement and Plan of Merger was entered into pursuant to the Business Combination Agreement, dated June 16,

2023, by and between the Company and Cadeler A/S.

Attached to this Report on Form 6-K as

Exhibit

99.1 is the Agreement and Plan of Merger.

Attached to this Report on Form 6-K as

Exhibit 99.2 is a copy of the notice, proxy statement and proxy card of the Company for the Company's Special Meeting of Shareholders

scheduled to be held on December 29, 2023, to approve the Agreement and Plan of Merger.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

ENETI INC.

(registrant)

|

|

Dated: December 15, 2023

|

|

| |

By:

|

/s/ Hugh Baker

|

| |

|

Hugh Baker

Chief Financial Officer

|

Exhibit 99.1

Execution Version

AGREEMENT AND PLAN OF MERGER

dated as of

December 15, 2023

between

ENETI INC.

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of December 15, 2023, is by and between Eneti Inc. (formerly named Scorpio Bulkers Inc.), a company incorporated under the laws of the Republic of the Marshall Islands (“Eneti”), and Wind MI Limited, a company incorporated under the laws of the Republic of the Marshall Islands (“Merger Sub”).

WHEREAS, as of the date hereof, there are 38,647,119 shares of the common stock of Eneti, par value $0.01

per share (the “Eneti Common Stock”) issued and outstanding and entitled to vote on this Agreement and the Merger contemplated hereby (and there are no

other shares in the capital stock of Eneti outstanding);

WHEREAS, as of the date hereof, there are 500 shares of the common stock of Merger Sub, of no par value

(the “Merger Sub Common Stock”) issued and outstanding and entitled to vote on this Agreement and the Merger contemplated hereby (and there are no other

shares in the capital stock of Merger Sub outstanding);

WHEREAS, the Board of Directors of Eneti and the sole Director of Merger Sub have approved and deemed it

advisable that the stockholders of Eneti and Merger Sub, respectively, approve and adopt this Agreement pursuant to which, among other things, Eneti will be merged with and into Merger Sub on the terms and subject to the conditions set forth in this

Agreement;

NOW, THEREFORE, the parties hereto hereby agree as follows:

ARTICLE 1

The Merger

Section 1.01. The

Merger. (a) At the Effective Time (as defined below), Eneti shall be merged (the “Merger”) with and into Merger Sub pursuant to the provisions of

the Business Corporations Act of the Republic of the Marshall Islands (“BCAMI”) and in accordance with the terms and conditions hereof, whereupon the

separate existence of Eneti shall cease in accordance with the BCAMI, and Merger Sub shall be the surviving corporation (the “Surviving Corporation”) in

accordance with the BCAMI.

(b) As soon as practicable but no later than three (3) business days after the satisfaction or, to the

extent permitted hereunder, waiver of all conditions to the Merger, Eneti and Merger Sub will file articles of merger with the Marshall Islands Registrar of Corporations and make all other filings or recordings required by the BCAMI in connection with

the Merger. The Merger shall become effective at such time (the “Effective Time”) as the articles of merger are duly

filed with the Marshall Islands Registrar of Corporations or at such later time as is specified in the articles of merger.

(c) From and after the Effective Time, the Surviving Corporation shall possess all the rights,

privileges, immunities, powers and purposes, and shall assume and be liable for all the liabilities, obligations, and penalties of each of Eneti and Merger Sub, all as provided under the BCAMI.

Section 1.02. Conversion

of Shares. At the Effective Time:

(a) Except as otherwise provided in Section 1.02(b), each share of Eneti Common Stock outstanding as of

immediately prior to the Effective Time shall be converted into the right to receive U.S. $11.36755 in cash, without interest and subject to reduction for any applicable withholding taxes (the “Merger Consideration”). As of the Effective Time, all such shares of Eneti Common Stock shall no longer be outstanding and shall automatically be canceled and shall cease to exist, and shall thereafter

represent only the right to receive the Merger Consideration to be paid in accordance with Section 1.03, without interest.

(b) Each share of Eneti Common Stock held by Eneti as treasury stock or held directly or indirectly by

Cadeler A/S as of immediately prior to the Effective Time shall be canceled, and no payment shall be made with respect thereto.

(c) Each share of Merger Sub Common Stock outstanding as of immediately prior to the Effective Time

shall be converted into and shall each become one share of the common stock of the Surviving Corporation with the same rights, powers and privileges as the shares so converted and such shares shall constitute the only outstanding shares of capital

stock of the Surviving Corporation.

Section 1.03.

Surrender and Payment. (a) Prior to the Effective Time, Merger Sub (or one of its affiliates) shall have appointed an exchange agent (the “Exchange

Agent”) for the purpose of exchanging for the Merger Consideration (i) all certificates representing shares of Eneti Common Stock (the “Certificates”)

and (ii) all uncertificated shares of Eneti Common Stock (the “Uncertificated Shares”) and shall have deposited with the Exchange Agent an amount in cash

sufficient to fund the Merger Consideration payable pursuant to Section 1.02(a) (the “Exchange Fund”). The Exchange Fund shall not be used for any other

purpose. Merger Sub (or one of its affiliates) shall pay all charges and expenses, including those of the Exchange Agent, in connection with the exchange of Eneti Common Stock for the Merger Consideration. Promptly after the Effective Time, Merger

Sub (or one of its affiliates) shall send, or shall cause the Exchange Agent to send, to each holder of shares of Eneti Common Stock as of immediately prior to the Effective Time a letter of transmittal and instructions (which shall specify that

delivery of the Merger Consideration shall be effected, and risk of loss and

title shall pass, only upon proper delivery of the Certificates or transfer of the Uncertificated Shares to the Exchange

Agent) for use in such exchange.

(b) The holder of any share of Eneti Common Stock that has been converted into the right to receive the

Merger Consideration shall be entitled to receive, upon (i) surrender to the Exchange Agent of a Certificate, together with a properly completed letter of transmittal, or (ii) receipt of an “agent’s message” by the Exchange Agent (or such other

evidence, if any, of transfer as the Exchange Agent may reasonably request) in the case of a book-entry transfer of Uncertificated Shares, the Merger Consideration in respect of each share of Eneti Common Stock represented by a Certificate or

Uncertificated Share, as applicable. Until so surrendered or transferred, as the case may be, each such Certificate or Uncertificated Share shall represent after the Effective Time for all purposes only the right to receive such Merger Consideration.

(c) If any portion of the Merger Consideration is to be paid to a person other than the person in whose

name the surrendered Certificate or the transferred Uncertificated Share is registered, it shall be a condition to such payment that (i) either such Certificate shall be properly endorsed or shall otherwise be in proper form for transfer or such

Uncertificated Share shall be properly transferred and (ii) the person requesting such payment shall pay to the Exchange Agent any transfer or other taxes required as a result of such payment to a person other than the registered holder of such

Certificate or Uncertificated Share or establish to the satisfaction of the Exchange Agent that such tax has been paid or is not payable.

(d) After the Effective Time, there shall be no further registration of transfers of shares of Eneti

Common Stock. If, after the Effective Time, Certificates or Uncertificated Shares are presented to the Surviving Corporation or the Exchange Agent, they shall be canceled and exchanged for the Merger Consideration provided for, and in accordance with

the procedures set forth, in this Article 1.

(e) Any portion of the Merger Consideration made available to the Exchange Agent pursuant to Section 1.03(a) that remains unclaimed by the holders of shares of Eneti Common Stock twelve months after the Effective Time shall be returned to the Surviving

Corporation, and any such holder who has not exchanged shares of Eneti Common Stock for the Merger Consideration in accordance with this Section 1.03 prior to that

time shall thereafter look only to the Surviving Corporation for payment of the Merger Consideration in respect of such shares, without any interest thereon. Notwithstanding the foregoing, the Surviving Corporation shall not be liable to any holder of

shares of Eneti Common Stock for any amounts paid to a public official pursuant to applicable abandoned property, escheat or similar laws.

Section 1.04. Withholding Rights. Notwithstanding any provision contained herein to the contrary, each of the Exchange Agent and the Surviving

Corporation, as the case may be, shall be entitled to deduct and withhold from the Merger Consideration otherwise payable to

any person pursuant to this Article 1 such amounts as it is required to deduct and withhold with respect to the making of such payment under any provision of any applicable tax law in any jurisdiction or a political subdivision thereof (whether

national, regional, foreign or otherwise). If the Exchange Agent or the Surviving Corporation, as the case may be, so withholds amounts, such amounts shall be treated for all purposes of this Agreement as having been paid to the holder of the shares

of Eneti Common Stock in respect of which the Exchange Agent or the Surviving Corporation, as the case may be, made such deduction and withholding.

Section 1.05.

Lost Certificates. If any Certificate shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the person claiming such Certificate to be lost, stolen or destroyed and, if required by the Surviving

Corporation, the posting by such person of a bond, in such reasonable amount as the Surviving Corporation may direct, as indemnity against any claim that may be made against it with respect to such Certificate, the Exchange Agent will issue, in

exchange for such lost, stolen or destroyed Certificate, the Merger Consideration to be paid in respect of the shares of Eneti Common Stock represented by such Certificate, as contemplated by this Article 1.

ARTICLE 2

The Surviving Corporation

Section 2.01. Certificate

of Incorporation. The articles of incorporation of Merger Sub in effect at the Effective Time shall be the articles of incorporation of the Surviving Corporation, until amended in accordance with applicable law.

Section 2.02. Bylaws.

The bylaws of Merger Sub in effect at the Effective Time shall be the bylaws of the Surviving Corporation until amended in accordance with applicable law.

Section 2.03. Directors

and Officers. From and after the Effective Time, until successors are duly elected or appointed and qualified in accordance with applicable law, the sole director and secretary of Merger Sub at the Effective Time shall be the sole director

and secretary of the Surviving Corporation.

ARTICLE 3

Covenants

Section 3.01. Best

Efforts. Subject to the terms and conditions of this Agreement, Eneti and Merger Sub will use their best efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable under

applicable laws and regulations to consummate the transactions contemplated by this Agreement.

Section 3.02. Stockholder

Meetings. In furtherance (and not in limitation) of the covenant set forth in Section 3.01, each of Eneti and Merger Sub shall cause a special meeting of

its respective stockholders to be duly called and held as soon as reasonably practicable after the date hereof for the purpose of voting on the approval and adoption of this Agreement and the Merger.

Section 3.03. Further

Assurances. At and after the Effective Time, any officer or director of the Surviving Corporation shall be authorized to execute and deliver, in the name and on behalf of Eneti or Merger Sub, any deeds, bills of sale, assignments or

assurances and to take and do, in the name and on behalf of Eneti or Merger Sub, any other actions and things to vest, perfect or confirm of record or otherwise in the Surviving Corporation any and all right, title and interest in, to and under any of

the rights, properties or assets of Eneti acquired or to be acquired by the Surviving Corporation as a result of, or in connection with, the Merger.

ARTICLE 4

Conditions to the Merger

Section 4.01. Conditions

to Obligations of Each Party. The obligations of the parties to consummate the Merger are subject to the satisfaction of each of the following conditions, any and all of which may be waived in whole or in part by Eneti or Merger Sub, as the

case may be, to the extent permitted by applicable law:

(a) this Agreement shall have been approved and adopted by the stockholders of each of Eneti and Merger

Sub in accordance with the BCAMI; and

(b) no governmental entity of competent jurisdiction shall have (i) enacted, issued or promulgated any

law that is in effect as of immediately prior to the Effective Time or (ii) issued or granted any order or injunction (whether temporary, preliminary or permanent) that is in effect as of immediately prior to the Effective Time, in each case which

restrains, enjoins or otherwise prohibits the consummation of the Merger.

ARTICLE 5

Miscellaneous

Section 5.01. Successors

and Assigns. The provisions of this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

Section 5.02. Governing

Law. This Agreement shall be construed in accordance with and governed by the laws of the Republic of the Marshall

Islands, without giving effect to principles of conflicts of law that would call for the application of the law of any other

jurisdiction.

Section 5.03. Counterparts;

Effectiveness. This Agreement may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. In the event that any signature is

delivered electronically, including, without limitation, by facsimile transmission, by electronic mail transmission including a “.pdf” or similar format data file attachment, or through the use of an electronic signature, such signature shall indicate

a valid execution of this Agreement by the party so executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile, “.pdf” or similar format file, or other electronically generated signature page were an

original thereof. This Agreement shall become effective when each party hereto shall have received the counterpart hereof signed by the other party hereto.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed.

| |

ENETI INC.

|

|

| |

By:

|

/s/ Cameron Mackey |

|

| |

|

Name:

|

Cameron Mackey

|

|

| |

|

Title:

|

Chief Operating Officer

|

|

| |

WIND MI LIMITED

|

|

| |

By:

|

/s/ Mario Robayo |

|

| |

|

Name:

|

Mario Robayo

|

|

| |

|

Title:

|

Director

|

|

[Signature Page to Agreement and Plan of Merger]

Exhibit 99.2

December 15, 2023

TO THE SHAREHOLDERS OF ENETI INC.

Enclosed is a notice of a special meeting (the “Meeting”) of the holders of common shares (the “Shareholders”) of Eneti Inc. (the

“Company”), which will be held at the office of Scorpio Commercial Management S.A.M., L’Exotique, 99 Boulevard du Jardin Exotique, Monaco 98000 on December 29, 2023 at 9:30 a.m. Central European Time, the Company’s proxy statement and certain

other related materials. These materials may be found at www.eneti-inc.com.

At the Meeting, Shareholders will consider and vote upon a proposal (the “Proposal”) to approve the Agreement and Plan of Merger

between the Company and Wind MI Limited (“Merger Sub”) , a wholly-owned subsidiary of Cadeler A/S, dated as of December 15, 2023 (the “Merger Agreement”) pursuant to which the Company will merge with and into Merger Sub, with Merger Sub being

the surviving entity in the merger (the “Merger”).

On June 16, 2023, the Company and Cadeler entered into the business combination agreement (the “Business Combination Agreement”)

to combine the businesses of the Company and Cadeler. On November 7, 2023, pursuant to the Business Combination Agreement, Cadeler launched a tender offer to exchange for each outstanding share of the Company’s common stock, par value $0.01

per share (the “Eneti Shares”), validly tendered and not validly withdrawn in the offer, American Depositary Shares (“ADS”), representing, in the aggregate, 3.409 shares of Cadeler, nominal value DKK 1 per share (“Cadeler Shares”) with each

ADS representing four (4) Cadeler Shares (the “Offer”). On December 14, 2023, the Offer expired, and 86.386% of Eneti Shares were tendered pursuant to the Offer. The Merger is being proposed pursuant to the Business Combination Agreement as

the second step of the business combination of the Company and Cadeler. The purpose of the Merger is for Cadeler to acquire all Eneti Shares that it did not acquire in the Offer. Cadeler has advised the Company that it intends to cause all of

the Eneti Shares acquired by Cadeler in the Offer (together representing 86.386% of the total number of outstanding Eneti Shares) to be represented at the Meeting and to vote in favor of the Proposal.

If the Agreement and Plan of Merger is approved and the Merger contemplated thereby is consummated, each Eneti Share outstanding

as of immediately prior to the Effective Time of the Merger (as defined in the Agreement and Plan of Merger), other than any such shares held at such time by Cadeler, will be converted into the right to receive U.S. $11.36755 in cash, without

interest and subject to reduction for any applicable withholding taxes (the “Merger Consideration”). As of the Effective Time, all such Eneti Shares shall no longer be outstanding and shall automatically be canceled and shall cease to exist,

and shall thereafter represent only the right to receive the Merger Consideration to be paid in accordance with the terms of the Agreement and Plan of Merger, without interest.

Provided that a quorum is present, adoption of the Proposal requires the affirmative vote of a majority of all outstanding Eneti

Shares entitled to attend and vote at the Meeting. To constitute a quorum, there must be present either in person or by proxy shareholders of record holding at least one-third of the shares issued and outstanding and entitled to vote at the

Meeting. If less than a quorum is present, a majority of those shares present either in person or by proxy will have the power to adjourn the Meeting until a quorum is present.

You are cordially invited to attend the Meeting in person. If you attend the Meeting, you may revoke your proxy and vote your

shares in person.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT

THE MEETING. ACCORDINGLY, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH DOES NOT REQUIRE POSTAGE IF MAILED IN THE UNITED STATES. YOU CAN ALSO VOTE BY INTERNET AND TELEPHONE BY FOLLOWING THE

INSTRUCTIONS ON YOUR PROXY CARD. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON. ALL SHAREHOLDERS MUST PRESENT A FORM OF PERSONAL PHOTO IDENTIFICATION IN ORDER TO BE ADMITTED TO THE MEETING. IN ADDITION, IF YOUR

SHARES ARE HELD IN THE NAME OF YOUR BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO ATTEND THE MEETING, YOU MUST BRING AN ACCOUNT STATEMENT OR LETTER FROM YOUR BROKER, BANK OR OTHER NOMINEE INDICATING THAT YOU WERE THE OWNER OF THE SHARES AS OF

THE CLOSE OF BUSINESS ON THE RECORD DATE, DECEMBER 15, 2023.

ANY SIGNED PROXY RETURNED AND NOT COMPLETED WILL BE VOTED IN FAVOR OF THE PROPOSAL PRESENTED IN THE PROXY

STATEMENT. THE VOTE OF EVERY SHAREHOLDER IS IMPORTANT AND YOUR COOPERATION WILL BE APPRECIATED.

| |

Very truly yours,

Emanuele Lauro

Chairman and Chief Executive Officer

|

|

Monaco

99 Boulevard du Jardin Exotique, Monaco MC 98000

Tel: +377 9798 5715

|

New York

150 East 58th Street - New York, NY 10155, USA

Tel: +1 646 432 1675

|

e-mail & website: info@eneti.com

www.eneti.com

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

December 15, 2023

NOTICE IS HEREBY given that a special meeting (the “Meeting”) of the holders of common shares (the “Shareholders”) of Eneti Inc.

(the “Company”) will be held on December 29, 2023 at 9:30 a.m. Central European Time, at the office of Scorpio Commercial Management S.A.M., L’Exotique, 99 Boulevard du Jardin Exotique, Monaco 98000 for the following purpose, which is more

completely set forth in the accompanying proxy statement:

To consider and vote upon a proposal (the “Proposal”) to approve the Agreement and Plan of Merger between the Company and Wind MI

Limited (“Merger Sub”) , a wholly-owned subsidiary of Cadeler A/S, dated as of December 15, 2023 (the “Merger Agreement”) pursuant to which the Company will merge with and into Merger Sub, with Merger Sub being the surviving entity in the

merger (the “Merger”).

The Board has fixed the close of business on December 15, 2023 as the record date for the determination of the Shareholders

entitled to receive this notice of Meeting and to vote at the Meeting or any adjournment thereof.

Shareholders of record holding at least one-third of the shares issued and outstanding and entitled to vote at the Meeting, who

attend the Meeting in person or by proxy, shall be a quorum for the purposes of the Meeting.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT

THE MEETING. ACCORDINGLY, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH DOES NOT REQUIRE POSTAGE IF MAILED IN THE UNITED STATES. YOU CAN ALSO VOTE BY INTERNET AND TELEPHONE BY FOLLOWING THE

INSTRUCTIONS ON YOUR PROXY CARD. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON. ALL SHAREHOLDERS MUST PRESENT A FORM OF PERSONAL PHOTO IDENTIFICATION IN ORDER TO BE ADMITTED TO THE MEETING. IN ADDITION, IF YOUR

SHARES ARE HELD IN THE NAME OF YOUR BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO ATTEND THE MEETING, YOU MUST BRING AN ACCOUNT STATEMENT OR LETTER FROM YOUR BROKER, BANK OR OTHER NOMINEE INDICATING THAT YOU WERE THE OWNER OF THE SHARES AT

THE CLOSE OF BUSINESS ON THE RECORD DATE, DECEMBER 15, 2023.

ANY SIGNED PROXY RETURNED AND NOT COMPLETED WILL BE VOTED IN FAVOR OF THE PROPOSAL PRESENTED IN THE PROXY

STATEMENT. THE VOTE OF EVERY SHAREHOLDER IS IMPORTANT AND YOUR COOPERATION WILL BE APPRECIATED.

This notice of Meeting, the proxy statement and certain other related materials may be found at www.eneti-inc.com.

|

December 15, 2023

Monaco

|

BY ORDER OF THE BOARD

Auste Vizbaraite

Secretary

|

ENETI INC.

L’EXOTIQUE, 99 BOULEVARD DU JARDIN EXOTIQUE, MONACO MC 98000

__________________________

PROXY STATEMENT FOR

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 29, 2023

__________________________

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the board of directors (the “Board”) of Eneti Inc., a Marshall Islands corporation

(the “Company”), for use at the special meeting (the “Meeting”) of holders of common shares of the Company (the “Shareholders”) to be held the office of Scorpio Commercial Management S.A.M., L’Exotique, 99 Boulevard du Jardin Exotique, Monaco

98000 on December 29, 2023 at 9:30 a.m. Central European Time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying notice of Meeting. This proxy statement and the accompanying form of proxy

are expected to be mailed to the Shareholders entitled to vote at the Meeting on or about December 15, 2023. These materials may be found at www.eneti-inc.com.

Voting Rights and Outstanding Shares

On December 15, 2023 (the “Record Date”), the Company had issued and outstanding 38,647,119 common shares, par value $0.01 per

share. Each Shareholder of record at the close of business on the Record Date is entitled to one vote for each of the Company’s common shares then held. One or more Shareholders of record (in person or by proxy) holding at least one-third of

the shares issued and outstanding and entitled to vote at the Meeting shall constitute a quorum for the purposes of the Meeting. The Company’s common shares represented by any proxy in the enclosed form will be voted in accordance with the

instructions given on the proxy if the proxy is properly executed and is received by the Company prior to the close of voting at the Meeting or any adjournment or postponement thereof. Any proxies returned signed without instructions will be

voted FOR the proposal set forth on the notice of Meeting.

The Company’s common shares are listed on the New York Stock Exchange under the symbol “NETI.”

Revocability of Proxies

A Shareholder may revoke its proxy at any time before it is exercised. A proxy may be revoked by filing with the Secretary of the

Company at the Company’s principal executive office L’Exotique, 99 Boulevard du Jardin Exotique, Monaco 98000, a written notice of revocation by a duly executed proxy bearing a later date (not later than the Meeting date), or by attending the

Meeting and voting in person.

PROPOSAL

APPROVAL OF MERGER AND MERGER AGREEMENT

The Board is submitting for approval at the Meeting the Agreement and Plan of Merger between the Company and Wind MI Limited

(“Merger Sub”), a wholly-owned subsidiary of Cadeler A/S, dated as of December 15, 2023 (the “Merger Agreement”) pursuant to which the Company will merge with and into Merger Sub, with Merger Sub being the surviving entity in the merger (the

“Merger”).

On June 16, 2023, the Company and Cadeler entered into the business combination agreement (the “Business Combination Agreement”)

to combine the businesses of the Company and Cadeler. On November 7, 2023, pursuant to the Business Combination Agreement, Cadeler launched a tender offer to exchange for each outstanding share of the Company’s common stock, par value $0.01

per share (the “Eneti Shares”), validly tendered and not validly withdrawn in the offer, American Depositary Shares (“ADS”), representing, in the aggregate, 3.409 shares of Cadeler, nominal value DKK 1 per share (“Cadeler Shares”) with each

ADS representing four (4) Cadeler Shares (the “Offer”). On December 14, 2023, the Offer expired, and 86.386% of Eneti Shares were tendered pursuant to the Offer. The Merger is being proposed pursuant to the Business Combination Agreement as

the second step of the business combination of the Company and Cadeler. The purpose of the Merger is for Cadeler to acquire all Eneti Shares that it did not acquire in the Offer. Cadeler has advised the Company that it intends to cause all of

the Eneti Shares acquired by Cadeler in the Offer (together representing 86.386% of the total number of outstanding Eneti Shares) to be represented at the Meeting and to vote in favor of the Proposal.

If the Agreement and Plan of Merger is approved and the Merger contemplated thereby is consummated, each Eneti Share outstanding

as of immediately prior to the Effective Time of the Merger (as defined in the Agreement and Plan of Merger), other than any such shares held at such time by Cadeler, will be converted into the right to receive U.S. $11.36755 in cash, without

interest and subject to reduction for any applicable withholding taxes (the “Merger Consideration”). As of the Effective Time, all such Eneti Shares shall no longer be outstanding and shall automatically be canceled and shall cease to exist,

and shall thereafter represent only the right to receive the Merger Consideration to be paid in accordance with the terms of the Agreement and Plan of Merger, without interest.

For a complete description of the Business Combination Agreement and the business combination between the Company and Cadeler,

please see the Company’s Solicitation/Recommendation statement on Schedule 14D-9, filed with the U.S. Securities and Exchange Commission on November 7, 2023, incorporated by reference herein.

Required Vote. Adoption of the Proposal requires the affirmative vote of the holders of a majority of all outstanding Eneti

Shares entitled to attend and vote at the Meeting.

Effect of Abstentions. Abstentions will have the effect of voting AGAINST the Proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF THE MERGER AND THE MERGER AGREEMENT, PURSUANT TO WHICH THE COMPANY

WILL MERGE WITH AND INTO MERGER SUB WITH MERGER SUB SURVIVING THE MERGER. UNLESS REVOKED AS PROVIDED ABOVE, SIGNED PROXIES RECEIVED BY MANAGEMENT WILL BE VOTED IN FAVOR OF THE PROPOSAL UNLESS A CONTRARY VOTE IS SPECIFIED.

SOLICITATION

The cost of preparing and soliciting proxies will be borne by the Company. Solicitation will be made primarily by mail, but

Shareholders may be solicited by telephone, e-mail, or personal contact.

ELECTRONIC DELIVERY

Shareholders can access documents related to the Meeting at: www.eneti-inc.com.

EFFECT OF ABSTENTIONS

An “abstention” occurs when a Shareholder sends in a proxy with explicit instructions to decline to vote regarding a particular

matter. Abstentions are counted as present for purposes of determining a quorum. However, abstentions will have the effect of voting AGAINST the Proposal.

OTHER MATTERS

No other matters are expected to be presented for action at the Meeting. Should any additional matter come before the Meeting, it

is intended that proxies in the accompanying form will be voted in accordance with the judgment of the person or persons named in the proxy.

|

December 15, 2023

Monaco

|

By Order of the Board

Auste Vizbaraite

Secretary

|

AGREEMENT AND PLAN OF MERGER

dated as of

December 15, 2023

between

ENETI INC.

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of

December 15, 2023, is by and between Eneti Inc. (formerly named Scorpio Bulkers Inc.), a company incorporated under the laws of the Republic of the Marshall Islands (“Eneti”), and Wind MI Limited, a

company incorporated under the laws of the Republic of the Marshall Islands (“Merger Sub”).

WHEREAS, as of the date hereof, there are 38,647,119 shares of the common stock of Eneti, par value $0.01 per

share (the “Eneti Common Stock”) issued and outstanding and entitled to vote on this Agreement and the Merger contemplated hereby (and there are no other shares in the capital stock of Eneti

outstanding);

WHEREAS, as of the date hereof, there are 500 shares of the common stock of Merger Sub, of no par value (the “Merger Sub Common Stock”) issued and outstanding and entitled to vote on this Agreement and the Merger contemplated hereby (and there are no other shares in the capital stock of Merger Sub outstanding);

WHEREAS, the Board of Directors of Eneti and the sole Director of Merger Sub have approved and deemed it

advisable that the stockholders of Eneti and Merger Sub, respectively, approve and adopt this Agreement pursuant to which, among other things, Eneti will be merged with and into Merger Sub on the terms and subject to the conditions set

forth in this Agreement;

NOW, THEREFORE, the parties hereto hereby agree as follows:

ARTICLE 1

The Merger

Section 1.01. The Merger. (a) At the Effective Time (as defined

below), Eneti shall be merged (the “Merger”) with and into Merger Sub pursuant to the provisions of the Business Corporations Act of the Republic of the Marshall Islands (“BCAMI”) and in accordance with the terms and conditions hereof, whereupon the separate existence of Eneti shall cease in accordance with the BCAMI, and Merger Sub shall be the surviving corporation (the “Surviving Corporation”) in accordance with the BCAMI.

(b) As soon as practicable but no later than three (3) business days after the satisfaction or, to the

extent permitted hereunder, waiver of all conditions to the Merger, Eneti and Merger Sub will file articles of merger with the Marshall Islands Registrar of Corporations and make all other filings or recordings required by the BCAMI in

connection with the Merger. The Merger shall become effective at such time (the “Effective Time”) as the articles of merger are duly

filed with the Marshall Islands Registrar of Corporations or at such later time as is specified in the articles of merger.

(c) From and after the Effective Time, the Surviving Corporation shall possess all the rights, privileges,

immunities, powers and purposes, and shall assume and be liable for all the liabilities, obligations, and penalties of each of Eneti and Merger Sub, all as provided under the BCAMI.

Section 1.02. Conversion of Shares. At the Effective Time:

(a) Except as otherwise provided in Section 1.02(b), each share of Eneti Common Stock outstanding as of

immediately prior to the Effective Time shall be converted into the right to receive U.S. $11.36755 in cash, without interest and subject to reduction for any applicable withholding taxes (the “Merger

Consideration”). As of the Effective Time, all such shares of Eneti Common Stock shall no longer be outstanding and shall automatically be canceled and shall cease to exist, and shall thereafter represent only the right to

receive the Merger Consideration to be paid in accordance with Section 1.03, without interest.

(b) Each share of Eneti Common Stock held by Eneti as treasury stock or held directly or indirectly by

Cadeler A/S as of immediately prior to the Effective Time shall be canceled, and no payment shall be made with respect thereto.

(c) Each share of Merger Sub Common Stock outstanding as of immediately prior to the Effective Time shall

be converted into and shall each become one share of the common stock of the Surviving Corporation with the same rights, powers and privileges as the shares so converted and such shares shall constitute the only outstanding shares of

capital stock of the Surviving Corporation.

Section 1.03. Surrender and Payment. (a) Prior to the Effective

Time, Merger Sub (or one of its affiliates) shall have appointed an exchange agent (the “Exchange Agent”) for the purpose of exchanging for the Merger Consideration (i) all certificates representing

shares of Eneti Common Stock (the “Certificates”) and (ii) all uncertificated shares of Eneti Common Stock (the “Uncertificated Shares”) and shall have

deposited with the Exchange Agent an amount in cash sufficient to fund the Merger Consideration payable pursuant to Section 1.02(a) (the “Exchange Fund”). The Exchange Fund shall not be used for

any other purpose. Merger Sub (or one of its affiliates) shall pay all charges and expenses, including those of the Exchange Agent, in connection with the exchange of Eneti Common Stock for the Merger Consideration. Promptly after the

Effective Time, Merger Sub (or one of its affiliates) shall send, or shall cause the Exchange Agent to send, to each holder of shares of Eneti Common Stock as of immediately prior to the Effective Time a letter of transmittal and

instructions (which shall specify that delivery of the Merger Consideration shall be effected, and risk of loss and

title shall pass, only upon proper delivery of the Certificates or transfer of the Uncertificated Shares to the Exchange Agent)

for use in such exchange.

(b) The holder of any share of Eneti Common Stock that has been converted into the right to receive the

Merger Consideration shall be entitled to receive, upon (i) surrender to the Exchange Agent of a Certificate, together with a properly completed letter of transmittal, or (ii) receipt of an “agent’s message” by the Exchange Agent (or such

other evidence, if any, of transfer as the Exchange Agent may reasonably request) in the case of a book-entry transfer of Uncertificated Shares, the Merger Consideration in respect of each share of Eneti Common Stock represented by a

Certificate or Uncertificated Share, as applicable. Until so surrendered or transferred, as the case may be, each such Certificate or Uncertificated Share shall represent after the Effective Time for all purposes only the right to

receive such Merger Consideration.

(c) If any portion of the Merger Consideration is to be paid to a person other than the person in whose

name the surrendered Certificate or the transferred Uncertificated Share is registered, it shall be a condition to such payment that (i) either such Certificate shall be properly endorsed or shall otherwise be in proper form for transfer

or such Uncertificated Share shall be properly transferred and (ii) the person requesting such payment shall pay to the Exchange Agent any transfer or other taxes required as a result of such payment to a person other than the registered

holder of such Certificate or Uncertificated Share or establish to the satisfaction of the Exchange Agent that such tax has been paid or is not payable.

(d) After the Effective Time, there shall be no further registration of transfers of shares of Eneti Common

Stock. If, after the Effective Time, Certificates or Uncertificated Shares are presented to the Surviving Corporation or the Exchange Agent, they shall be canceled and exchanged for the Merger Consideration provided for, and in

accordance with the procedures set forth, in this Article 1.

(e) Any portion of the Merger Consideration made available to the Exchange Agent pursuant to Section 1.03(a) that remains unclaimed by the holders of shares of Eneti Common Stock twelve months after the Effective Time shall be returned to the Surviving Corporation,

and any such holder who has not exchanged shares of Eneti Common Stock for the Merger Consideration in accordance with this Section 1.03 prior to that time shall

thereafter look only to the Surviving Corporation for payment of the Merger Consideration in respect of such shares, without any interest thereon. Notwithstanding the foregoing, the Surviving Corporation shall not be liable to any holder

of shares of Eneti Common Stock for any amounts paid to a public official pursuant to applicable abandoned property, escheat or similar laws.

Section 1.04. Withholding Rights. Notwithstanding any provision

contained herein to the contrary, each of the Exchange Agent and the Surviving

Corporation, as the case may be, shall be entitled to deduct and withhold from the Merger Consideration otherwise payable to any

person pursuant to this Article 1 such amounts as it is required to deduct and withhold with respect to the making of such payment under any provision of any applicable tax law in any jurisdiction or a political subdivision thereof

(whether national, regional, foreign or otherwise). If the Exchange Agent or the Surviving Corporation, as the case may be, so withholds amounts, such amounts shall be treated for all purposes of this Agreement as having been paid to the

holder of the shares of Eneti Common Stock in respect of which the Exchange Agent or the Surviving Corporation, as the case may be, made such deduction and withholding.

Section 1.05. Lost Certificates. If any Certificate shall have

been lost, stolen or destroyed, upon the making of an affidavit of that fact by the person claiming such Certificate to be lost, stolen or destroyed and, if required by the Surviving Corporation, the posting by such person of a bond, in

such reasonable amount as the Surviving Corporation may direct, as indemnity against any claim that may be made against it with respect to such Certificate, the Exchange Agent will issue, in exchange for such lost, stolen or destroyed

Certificate, the Merger Consideration to be paid in respect of the shares of Eneti Common Stock represented by such Certificate, as contemplated by this Article 1.

ARTICLE 2

The Surviving Corporation

Section 2.01. Certificate of Incorporation. The articles of

incorporation of Merger Sub in effect at the Effective Time shall be the articles of incorporation of the Surviving Corporation, until amended in accordance with applicable law.

Section 2.02. Bylaws. The bylaws of Merger Sub in effect at the

Effective Time shall be the bylaws of the Surviving Corporation until amended in accordance with applicable law.

Section 2.03. Directors and Officers. From and after the Effective

Time, until successors are duly elected or appointed and qualified in accordance with applicable law, the sole director and secretary of Merger Sub at the Effective Time shall be the sole director and secretary of the Surviving

Corporation.

ARTICLE 3

Covenants

Section 3.01. Best Efforts. Subject to the terms and conditions of

this Agreement, Eneti and Merger Sub will use their best efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable under applicable laws and regulations to consummate the

transactions contemplated by this Agreement.

Section 3.02. Stockholder Meetings. In furtherance (and not in

limitation) of the covenant set forth in Section 3.01, each of Eneti and Merger Sub shall cause a special meeting of its respective stockholders to be duly called and

held as soon as reasonably practicable after the date hereof for the purpose of voting on the approval and adoption of this Agreement and the Merger.

Section 3.03. Further Assurances. At and after the Effective Time,

any officer or director of the Surviving Corporation shall be authorized to execute and deliver, in the name and on behalf of Eneti or Merger Sub, any deeds, bills of sale, assignments or assurances and to take and do, in the name and on

behalf of Eneti or Merger Sub, any other actions and things to vest, perfect or confirm of record or otherwise in the Surviving Corporation any and all right, title and interest in, to and under any of the rights, properties or assets of

Eneti acquired or to be acquired by the Surviving Corporation as a result of, or in connection with, the Merger.

ARTICLE 4

Conditions to the Merger

Section 4.01. Conditions to Obligations of Each Party. The

obligations of the parties to consummate the Merger are subject to the satisfaction of each of the following conditions, any and all of which may be waived in whole or in part by Eneti or Merger Sub, as the case may be, to the extent

permitted by applicable law:

(a) this Agreement shall have been approved and adopted by the stockholders of each of Eneti and Merger Sub

in accordance with the BCAMI; and

(b) no governmental entity of competent jurisdiction shall have (i) enacted, issued or promulgated any law

that is in effect as of immediately prior to the Effective Time or (ii) issued or granted any order or injunction (whether temporary, preliminary or permanent) that is in effect as of immediately prior to the Effective Time, in each case

which restrains, enjoins or otherwise prohibits the consummation of the Merger.

ARTICLE 5

Miscellaneous

Section 5.01. Successors and Assigns. The provisions of this

Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

Section 5.02. Governing Law. This Agreement shall be construed in

accordance with and governed by the laws of the Republic of the Marshall

Islands, without giving effect to principles of conflicts of law that would call for the application of the law of any other

jurisdiction.

Section 5.03. Counterparts; Effectiveness. This Agreement may be

signed in any number of counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. In the event that any signature is delivered electronically, including,

without limitation, by facsimile transmission, by electronic mail transmission including a “.pdf” or similar format data file attachment, or through the use of an electronic signature, such signature shall indicate a valid execution of

this Agreement by the party so executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile, “.pdf” or similar format file, or other electronically generated signature page were an original

thereof. This Agreement shall become effective when each party hereto shall have received the counterpart hereof signed by the other party hereto.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed.

| |

ENETI INC.

|

|

| |

By:

|

|

|

| |

|

Name:

|

|

|

| |

|

Title:

|

|

|

| |

WIND MI LIMITED

|

|

| |

By:

|

|

|

| |

|

Name:

|

|

|

| |

|

Title:

|

|

|

[Signature Page to Agreement and Plan of Merger]

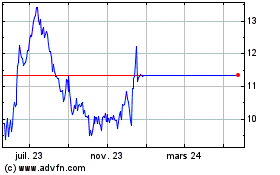

Eneti (NYSE:NETI)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Eneti (NYSE:NETI)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024