Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 Juillet 2023 - 6:01PM

Edgar (US Regulatory)

Nuveen

New

York

Municipal

Value

Fund

Portfolio

of

Investments

May

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

LONG-TERM

INVESTMENTS

-

98.1% (100.0%

of

Total

Investments)

X

165,745,800

MUNICIPAL

BONDS

-

98.1% (100.0%

of

Total

Investments)

X

165,745,800

Consumer

Staples

-

3.3%

(3.4%

of

Total

Investments)

$

1,100

Erie

County

Tobacco

Asset

Securitization

Corporation,

New

York,

Tobacco

Settlement

Asset-Backed

Bonds,

Series

2005A,

5.000%,

6/01/38

7/23

at

100.00

BBB

$

1,030,436

New

York

Counties

Tobacco

Trust

VI,

New

York,

Tobacco

Settlement

Pass-Through

Bonds,

Series

Series

2016A-1:

530

5.625%,

6/01/35

No

Opt.

Call

A-

543,446

3,440

5.750%,

6/01/43

No

Opt.

Call

BBB-

3,561,122

500

TSASC

Inc.,

New

York,

Tobacco

Settlement

Asset-Backed

Bonds,

Fiscal

2017

Series

B,

5.000%,

6/01/25

No

Opt.

Call

B-

492,010

Total

Consumer

Staples

5,627,014

Education

and

Civic

Organizations

-

16.9%

(17.2%

of

Total

Investments)

700

Buffalo

and

Erie

County

Industrial

Land

Development

Corporation,

New

York,

Revenue

Bonds,

Enterprise

Charter

School

Project,

Series

2011A,

7.500%,

12/01/40

7/23

at

100.00

CCC

622,685

1,250

Build

New

York

City

Resource

Corporation,

New

York,

Revenue

Bonds,

City

University

of

New

York

-

Queens

College,

Q

Student

Residences,

LLC

Project,

Refunding

Series

2014A,

5.000%,

6/01/43

6/24

at

100.00

Aa2

1,255,550

Build

New

York

City

Resource

Corporation,

New

York,

Revenue

Bonds,

Classical

Charter

Schools

Series

2023A:

100

4.500%,

6/15/43

6/31

at

100.00

BBB-

94,438

140

4.750%,

6/15/58

6/31

at

100.00

BBB-

128,439

1,015

Build

New

York

City

Resource

Corporation,

New

York,

Revenue

Bonds,

KIPP

New

York

City

Public

School

Facilities,

Canal

West

Project,

Series

2022,

5.250%,

7/01/62

7/32

at

100.00

BBB-

1,025,992

Build

New

York

City

Resource

Corporation,

New

York,

Revenue

Bonds,

South

Bronx

Charter

School

for

International

Cultures

and

the

Arts

Project,

Series

2013A:

265

5.000%,

4/15/33,

144A

7/23

at

100.00

BB+

260,731

385

5.000%,

4/15/43,

144A

7/23

at

100.00

BB+

360,556

230

Build

NYC

Resource

Corporation,

New

York,

Revenue

Bonds,

Family

Life

Academy

Charter

School,

Series

2020C-1,

5.000%,

6/01/40,

144A

12/30

at

100.00

N/R

187,452

515

Dormitory

Authority

of

the

State

of

New

York,

General

Revenue

Bonds,

Saint

Johns

University,

Series

2013A,

5.000%,

7/01/44

7/23

at

100.00

A-

515,587

1,080

Dormitory

Authority

of

the

State

of

New

York,

General

Revenue

Bonds,

Yeshiva

University,

Series

2022A,

5.000%,

7/15/50

7/32

at

100.00

BBB-

1,072,602

1,000

Dormitory

Authority

of

the

State

of

New

York,

Housing

Revenue

Bonds,

Fashion

Institute

of

Technology,

Series

2007,

5.250%,

7/01/34

-

FGIC

Insured

No

Opt.

Call

Baa2

1,049,540

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

Icahn

School

of

Medicine

at

Mount

Sinai,

Refunding

Series

2015A:

1,330

5.000%,

7/01/40

7/25

at

100.00

A-

1,349,498

2,180

5.000%,

7/01/45

7/25

at

100.00

A-

2,203,980

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

New

School

University,

Series

2015A:

1,820

5.000%,

7/01/45

7/25

at

100.00

A3

1,837,508

385

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

New

School

University,

Series

2022A,

4.000%,

7/01/47

7/32

at

100.00

A3

344,914

825

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

New

York

University,

Series

2015A,

5.000%,

7/01/45

7/25

at

100.00

Aa2

838,307

2,385

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

New

York

University,

Series

2016A,

5.000%,

7/01/39

7/26

at

100.00

Aa2

2,474,867

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

New

York

University,

Series

2018A:

1,000

5.000%,

7/01/40

7/28

at

100.00

Aa2

1,067,110

175

5.000%,

7/01/48

7/28

at

100.00

Aa2

185,105

Nuveen

New

York

Municipal

Value

Fund

(continued)

Portfolio

of

Investments

May

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Education

and

Civic

Organizations

(continued)

$

2,000

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

New

York

University,

Series

2019A,

5.000%,

7/01/42

7/29

at

100.00

Aa2

$

2,149,420

2,625

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

Rockefeller

University,

Green

Series

2019B,

5.000%,

7/01/50

7/29

at

100.00

Aa1

2,793,578

670

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

Rockefeller

University,

Series

2022A,

4.000%,

7/01/42

7/32

at

100.00

Aa1

647,428

845

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

Vaughn

College

of

Aeronautics

&

Technology,

Series

2016A,

5.500%,

12/01/36,

144A

12/26

at

100.00

BB-

828,455

725

Glen

Cove

Local

Economic

Assistance

Corporation,

New

York,

Revenue

Bonds,

Garvies

Point

Public

Improvement

Project,

Capital

Appreciation

Series

2016C,

5.625%,

1/01/55

1/34

at

100.00

N/R

628,118

Hempstead

Town

Local

Development

Corporation,

New

York,

Revenue

Bonds,

Adelphi

University

Project,

Series

2013:

100

5.000%,

9/01/38

9/23

at

100.00

A-

100,197

300

5.000%,

9/01/43

9/23

at

100.00

A-

300,426

Monroe

County

Industrial

Development

Corporation,

New

York,

Revenue

Bonds,

St.

John

Fisher

College,

Series

2011:

1,000

6.000%,

6/01/30

7/23

at

100.00

A-

1,002,150

1,000

6.000%,

6/01/34

7/23

at

100.00

A-

1,002,080

50

New

Rochelle

Corporation,

New

York,

Local

Development

Revenue

Bonds,

Iona

College

Project,

Series

2015A,

5.000%,

7/01/40

7/25

at

100.00

BBB

50,584

405

New

York

City

Industrial

Development

Agency,

New

York,

PILOT

Payment

in

Lieu

of

Taxes

Revenue

Bonds,

Queens

Baseball

Stadium

Project,

Refunding

Series

2021A,

3.000%,

1/01/37

-

AGM

Insured

1/31

at

100.00

AA

347,336

3,000

New

York

City

Industrial

Development

Agency,

New

York,

PILOT

Payment

in

Lieu

of

Taxes

Revenue

Bonds,

Yankee

Stadium

Project,

Series

2009A,

0.000%,

3/01/40

-

AGC

Insured

No

Opt.

Call

AA

1,383,750

500

New

York

City

Industrial

Development

Agency,

New

York,

PILOT

Payment

in

Lieu

of

Taxes

Revenue

Bonds,

Yankee

Stadium

Project,

Series

2020A,

4.000%,

3/01/45

-

AGM

Insured

9/30

at

100.00

AA

470,185

Total

Education

and

Civic

Organizations

28,578,568

Financials

-

0.7%

(0.7%

of

Total

Investments)

1,000

Liberty

Development

Corporation,

New

York,

Goldman

Sachs

Headquarters

Revenue

Bonds

Series

2007,

5.500%,

10/01/37

No

Opt.

Call

A2

1,128,970

Total

Financials

1,128,970

Health

Care

-

11.3%

(11.5%

of

Total

Investments)

Dormitory

Authority

of

the

State

of

New

York,

General

Revenue

Bonds,

Northwell

Health

Obligated

Group,

Series

2022A:

1,430

4.000%,

5/01/45

5/32

at

100.00

A-

1,350,349

2,700

4.250%,

5/01/52

5/32

at

100.00

A-

2,486,430

1,000

5.000%,

5/01/52

5/32

at

100.00

A-

1,047,860

2,100

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

Montefiore

Obligated

Group,

Series

2018A,

5.000%,

8/01/34

8/28

at

100.00

BBB-

2,078,454

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

NYU

Langone

Hospitals

Obligated

Group,

Series

2020A:

2,000

4.000%,

7/01/50

7/30

at

100.00

A+

1,833,760

1,040

4.000%,

7/01/53

7/30

at

100.00

A+

939,026

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

Orange

Regional

Medical

Center

Obligated

Group,

Series

2017:

225

5.000%,

12/01/24,

144A

No

Opt.

Call

BBB-

224,996

800

5.000%,

12/01/31,

144A

6/27

at

100.00

BBB-

805,608

800

5.000%,

12/01/36,

144A

6/27

at

100.00

BBB-

789,720

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Health

Care

(continued)

Dutchess

County

Local

Development

Corporation,

New

York,

Revenue

Bonds,

Health

Quest

Systems,

Inc.

Project,

Series

2016B:

$

1,460

4.000%,

7/01/41

7/26

at

100.00

BBB+

$

1,273,412

2,000

5.000%,

7/01/46

7/26

at

100.00

BBB+

1,906,620

290

Livingston

County

Industrial

Development

Agency,

New

York,

Civic

Facility

Revenue

Bonds,

Nicholas

H.

Noyes

Hospital,

Series

2005,

6.000%,

7/01/30

7/23

at

100.00

N/R

290,487

480

Monroe

County

Industrial

Development

Corporation,

New

York,

Revenue

Bonds,

Rochester

General

Hospital

Project,

Series

2017,

5.000%,

12/01/46

12/26

at

100.00

BBB+

475,776

1,005

Monroe

County

Industrial

Development

Corporation,

New

York,

Revenue

Bonds,

Rochester

Regional

Health

Project,

Series

2020A,

4.000%,

12/01/46

12/30

at

100.00

BBB+

854,833

2,875

Westchester

County

Local

Development

Corporation,

New

York,

Revenue

Bonds,

Westchester

Medical

Center

Obligated

Group

Project,

Refunding

Series

2016,

5.000%,

11/01/46

11/25

at

100.00

BBB-

2,765,750

Total

Health

Care

19,123,081

Industrials

-

2.3%

(2.3%

of

Total

Investments)

3,930

New

York

Liberty

Development

Corporation,

New

York,

Liberty

Revenue

Bonds,

3

World

Trade

Center

Project,

Class

1

Series

2014,

5.000%,

11/15/44,

144A

11/24

at

100.00

N/R

3,858,867

10

New

York

Liberty

Development

Corporation,

New

York,

Liberty

Revenue

Bonds,

7

World

Trade

Center

Project,

Refunding

Green

Series

2022A-

CL2,

3.500%,

9/15/52

3/30

at

100.00

A2

7,541

Total

Industrials

3,866,408

Long-Term

Care

-

0.3%

(0.3%

of

Total

Investments)

270

Dormitory

Authority

of

the

State

of

New

York,

Non-State

Supported

Debt,

Ozanam

Hall

of

Queens

Nursing

Home

Revenue

Bonds,

Series

2006,

5.000%,

11/01/31

7/23

at

100.00

A1

271,966

100

Monroe

County

Industrial

Development

Corporation,

New

York,

Revenue

Bonds,

Saint

Ann's

Community

Project,

Series

2019,

5.000%,

1/01/40

1/26

at

103.00

N/R

82,605

90

Yonkers

Industrial

Development

Agency,

New

York,

Civic

Facilities

Revenue

Bonds,

Special

Needs

Facilities

Pooled

Program

Bonds,

Series

2008-C1,

5.800%,

7/01/23,

144A

6/23

at

100.00

N/R

89,718

Total

Long-Term

Care

444,289

Materials

-

0.3%

(0.3%

of

Total

Investments)

530

Build

New

York

City

Resource

Corporation,

New

York,

Solid

Waste

Disposal

Revenue

Bonds,

Pratt

Paper

NY,

Inc.

Project,

Series

2014,

5.000%,

1/01/35,

(AMT),

144A

1/25

at

100.00

N/R

536,238

Total

Materials

536,238

Tax

Obligation/General

-

7.3%

(7.4%

of

Total

Investments)

1,000

Nassau

County,

New

York,

General

Obligation

Bonds,

General

Improvement

Bonds

Series

2019B,

5.000%,

4/01/44

-

AGM

Insured

4/30

at

100.00

AA

1,080,590

5,000

Nassau

County,

New

York,

General

Obligation

Bonds,

General

Improvement

Series

2022A,

4.125%,

4/01/47

-

AGM

Insured

4/32

at

100.00

AA

4,918,750

1,000

Nassau

County,

New

York,

General

Obligation

Bonds,

General

Improvment

Series

2016C,

5.000%,

4/01/35

4/26

at

100.00

AA-

1,040,370

1,000

New

York

City,

New

York,

General

Obligation

Bonds,

Fiscal

2014

Series

A-1,

5.000%,

8/01/26

8/23

at

100.00

AA

1,002,250

1,000

New

York

City,

New

York,

General

Obligation

Bonds,

Fiscal

2018

Series

E-1,

5.000%,

3/01/40

3/28

at

100.00

AA

1,062,130

835

New

York

City,

New

York,

General

Obligation

Bonds,

Fiscal

2020

SeriesD-1,

4.000%,

3/01/50

3/30

at

100.00

AA

803,496

1,900

New

York

City,

New

York,

General

Obligation

Bonds,

Fiscal

2021

Series

F-1,

5.000%,

3/01/50

3/31

at

100.00

AA

2,027,167

409

Puerto

Rico,

General

Obligation

Bonds,

Restructured

Series

2022A-1,

4.000%,

7/01/41

7/31

at

103.00

N/R

342,574

Total

Tax

Obligation/General

12,277,327

Nuveen

New

York

Municipal

Value

Fund

(continued)

Portfolio

of

Investments

May

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Tax

Obligation/Limited

-

17.6%

(18.0%

of

Total

Investments)

$

1,000

Dormitory

Authority

of

the

State

of

New

York,

State

Personal

Income

Tax

Revenue

Bonds,

General

Purpose,

Bidding

Group

1

Through

5,

Series

2020A,

4.000%,

3/15/44

9/30

at

100.00

Aa1

$

983,970

2,140

Dormitory

Authority

of

the

State

of

New

York,

State

Sales

Tax

Revenue

Bonds,

Series

2015B.

Group

A,B&C,

5.000%,

3/15/32

9/25

at

100.00

AA+

2,227,077

3,000

Dormitory

Authority

of

the

State

of

New

York,

State

Sales

Tax

Revenue

Bonds,

Series

2017A

Group

C,

5.000%,

3/15/41

3/27

at

100.00

AA+

3,153,900

2,500

Government

of

Guam,

Business

Privilege

Tax

Bonds,

Refunding

Series

2015D,

5.000%,

11/15/28

11/25

at

100.00

BB

2,540,825

540

Hudson

Yards

Infrastructure

Corporation,

New

York,

Revenue

Bonds,

Second

Indenture

Fiscal

2017

Series

A,

5.000%,

2/15/39

2/27

at

100.00

Aa2

565,461

1,000

New

York

City

Transitional

Finance

Authority,

New

York,

Building

Aid

Revenue

Bonds,

Fiscal

2019

Subseries

S-1,

5.000%,

7/15/43

7/28

at

100.00

AA

1,061,500

2,465

New

York

City

Transitional

Finance

Authority,

New

York,

Building

Aid

Revenue

Bonds,

Fiscal

2020

Subseries

S-1B,

4.000%,

7/15/43

7/29

at

100.00

AA

2,427,926

3,000

New

York

City

Transitional

Finance

Authority,

New

York,

Building

Aid

Revenue

Bonds,

Fiscal

Series

2015S-2,

5.000%,

7/15/40

7/25

at

100.00

AA

3,082,710

445

New

York

City

Transitional

Finance

Authority,

New

York,

Building

Aid

Revenue

Bonds,

Fiscal

Series

2016S-1,

5.000%,

7/15/34

1/26

at

100.00

AA

464,963

1,525

New

York

City

Transitional

Finance

Authority,

New

York,

Future

Tax

Secured

Bonds,

Subordinate

Fiscal

2014

Series

D-1,

5.000%,

2/01/35

2/24

at

100.00

AAA

1,538,222

1,125

New

York

City

Transitional

Finance

Authority,

New

York,

Future

Tax

Secured

Bonds,

Subordinate

Fiscal

2017

Series

E-1,

5.000%,

2/01/39

2/27

at

100.00

AAA

1,190,194

1,685

New

York

State

Thruway

Authority,

State

Personal

Income

Tax

Revenue

Bonds,

Bidding

Group

1

Series

2022A,

5.000%,

3/15/45

9/32

at

100.00

AA+

1,832,454

90

New

York

State

Thruway

Authority,

State

Personal

Income

Tax

Revenue

Bonds,

Climate

Certified

Green

Series

2022C,

5.000%,

3/15/53

9/32

at

100.00

AA+

96,854

1,000

New

York

State

Urban

Development

Corporation,

State

Personal

Income

Tax

Revenue

Bonds,

General

Purpose

Group

1,

Series

2019A,

4.000%,

3/15/48

9/28

at

100.00

Aa1

970,710

2,000

New

York

State

Urban

Development

Corporation,

State

Personal

Income

Tax

Revenue

Bonds,

General

Purpose,

Series

2020C,

4.000%,

3/15/49

9/30

at

100.00

Aa1

1,934,300

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Restructured

2018A-1:

6,509

0.000%,

7/01/51

7/28

at

30.01

N/R

1,296,267

3,218

5.000%,

7/01/58

7/28

at

100.00

N/R

3,082,651

17

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Taxable

Restructured

Cofina

Project

Series

2019A-2,

4.536%,

7/01/53

7/28

at

100.00

N/R

15,216

1,030

Triborough

Bridge

and

Tunnel

Authority,

New

York,

Payroll

Mobility

Tax

Bonds,

Senior

Lien

Series

2022

A,

4.000%,

5/15/51

5/32

at

100.00

AA+

976,420

355

Triborough

Bridge

and

Tunnel

Authority,

New

York,

Payroll

Mobility

Tax

Senior

Lien

Bonds,

Series

2022C,

4.125%,

5/15/52

5/32

at

100.00

AA+

341,570

Total

Tax

Obligation/Limited

29,783,190

Transportation

-

21.6%

(22.0%

of

Total

Investments)

1,500

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Green

Climate

Bond

Certified

Series

2019A-1,

5.000%,

11/15/48,

(Mandatory

Put

11/15/24)

No

Opt.

Call

A3

1,513,605

970

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Green

Climate

Bond

Certified

Series

2020C-1,

5.000%,

11/15/50

5/30

at

100.00

A3

990,525

1,315

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Refunding

Series

2015F,

5.000%,

11/15/32

11/25

at

100.00

A3

1,344,969

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Series

2013E:

1,235

5.000%,

11/15/38

11/23

at

100.00

A3

1,208,942

1,800

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Series

2014D-1,

5.000%,

11/15/39

11/24

at

100.00

A3

1,806,066

New

York

City

Industrial

Development

Agency,

New

York,

Civic

Facility

Revenue

Bonds,

Bronx

Parking

Development

Company,

LLC

Project,

Series

2007:

2,000

5.750%,

10/01/37

(4)

7/23

at

100.00

N/R

1,600,000

1,500

2.350%,

10/01/46

(4)

7/23

at

100.00

N/R

1,200,000

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Transportation

(continued)

New

York

Transportation

Development

Corporation,

New

York,

Facility

Revenue

Bonds,

Thruway

Service

Areas

Project,

Series

2021:

$

290

4.000%,

10/31/46,

(AMT)

10/31

at

100.00

BBB-

$

249,719

2,390

4.000%,

4/30/53,

(AMT)

10/31

at

100.00

BBB-

1,979,518

3,815

New

York

Transportation

Development

Corporation,

New

York,

Special

Facilities

Bonds,

LaGuardia

Airport

Terminal

B

Redevelopment

Project,

Series

2016A,

5.250%,

1/01/50,

(AMT)

7/24

at

100.00

Baa2

3,800,579

New

York

Transportation

Development

Corporation,

New

York,

Special

Facility

Revenue

Bonds,

American

Airlines,

Inc.

John

F

Kennedy

International

Airport

Project,

Refunding

Series

2016:

655

5.000%,

8/01/26,

(AMT)

6/23

at

100.00

B

655,805

2,625

5.000%,

8/01/31,

(AMT)

6/23

at

100.00

B

2,628,544

105

New

York

Transportation

Development

Corporation,

New

York,

Special

Facility

Revenue

Bonds,

American

Airlines,

Inc.

John

F

Kennedy

International

Airport

Project,

Series

2020,

5.375%,

8/01/36,

(AMT)

8/30

at

100.00

B

106,016

290

New

York

Transportation

Development

Corporation,

New

York,

Special

Facility

Revenue

Bonds,

Terminal

4

John

F

Kennedy

International

Airport

Project,

Series

2020A,

5.000%,

12/01/37,

(AMT)

12/30

at

100.00

Baa1

301,072

340

New

York

Transportation

Development

Corporation,

New

York,

Special

Facility

Revenue

Bonds,

Terminal

4

John

F

Kennedy

International

Airport

Project,

Series

2020C,

5.000%,

12/01/35

12/30

at

100.00

Baa1

369,182

1,785

New

York

Transportation

Development

Corporation,

New

York,

Special

Facility

Revenue

Bonds,

Terminal

4

John

F

Kennedy

International

Airport

Project,

Series

2022,

5.000%,

12/01/35,

(AMT)

12/32

at

100.00

Baa1

1,898,847

New

York

Transportation

Development

Corporation,

Special

Facility

Revenue

Bonds,

Delta

Air

Lines,

Inc.

-

LaGuardia

Airport

Terminals

C&D

Redevelopment

Project,

Series

2018:

2,000

5.000%,

1/01/27,

(AMT)

No

Opt.

Call

Baa3

2,057,020

400

5.000%,

1/01/28,

(AMT)

No

Opt.

Call

Baa3

413,776

850

5.000%,

1/01/31,

(AMT)

1/28

at

100.00

Baa3

877,600

400

New

York

Transportation

Development

Corporation,

Special

Facility

Revenue

Bonds,

Delta

Air

Lines,

Inc.

-

LaGuardia

Airport

Terminals

C&D

Redevelopment

Project,

Series

2020,

5.000%,

10/01/40,

(AMT)

10/30

at

100.00

Baa3

405,284

3,000

Port

Authority

of

New

York

and

New

Jersey,

Consolidated

Revenue

Bonds,

One

Hundred

Eighty-Ninth

Series

2015,

5.000%,

5/01/40

5/25

at

100.00

AA-

3,071,520

1,575

Port

Authority

of

New

York

and

New

Jersey,

Consolidated

Revenue

Bonds,

One

Hundred

Seventy

Ninth

Series

2013,

5.000%,

12/01/43

12/23

at

100.00

AA-

1,583,206

1,930

Port

Authority

of

New

York

and

New

Jersey,

Consolidated

Revenue

Bonds,

Two

Hundred

Eleventh

Series

2018,

4.000%,

9/01/43

9/28

at

100.00

AA-

1,908,693

800

Port

Authority

of

New

York

and

New

Jersey,

Consolidated

Revenue

Bonds,

Two

Hundred

Fifth

Series

2017,

5.000%,

11/15/42

11/27

at

100.00

AA-

849,080

1,000

Port

Authority

of

New

York

and

New

Jersey,

Consolidated

Revenue

Bonds,

Two

Hundred

Twentieth

Series

2019,

4.000%,

11/01/59,

(AMT)

11/29

at

100.00

AA-

906,150

525

Triborough

Bridge

and

Tunnel

Authority,

New

York,

General

Purpose

Revenue

Bonds,

MTA

Bridges

&

Tunnels,

Series

2017A,

5.000%,

11/15/47

5/27

at

100.00

AA-

546,961

2,000

Triborough

Bridge

and

Tunnel

Authority,

New

York,

General

Revenue

Bonds,

Refunding

Series

2018C,

5.000%,

11/15/37

11/28

at

100.00

AA-

2,164,860

Total

Transportation

36,437,539

U.S.

Guaranteed

-

1.0%

(1.1%

of

Total

Investments)

(5)

Dormitory

Authority

of

the

State

of

New

York,

Lease

Revenue

Bonds,

State

University

Dormitory

Facilities,

Series

2015A:

235

5.000%,

7/01/31,

(Pre-refunded

7/01/25)

7/25

at

100.00

Aa3

243,679

265

5.000%,

7/01/33,

(Pre-refunded

7/01/25)

7/25

at

100.00

Aa3

274,786

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

New

School

University,

Series

2015A:

135

5.000%,

7/01/45,

(Pre-refunded

7/01/25)

7/25

at

100.00

N/R

139,848

Nuveen

New

York

Municipal

Value

Fund

(continued)

Portfolio

of

Investments

May

31,

2023

(Unaudited)

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

U.S.

Guaranteed

(5)

(continued)

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Series

2013E:

$

1,100

5.000%,

11/15/31,

(Pre-refunded

11/15/23)

11/23

at

100.00

A3

$

1,108,030

Total

U.S.

Guaranteed

1,766,343

Utilities

-

15.5%

(15.8%

of

Total

Investments)

300

Buffalo

Municipal

Water

Finance

Authority,

New

York,

Water

System

Revenue

Bonds,

Refunding

Series

2015A,

5.000%,

7/01/29

7/25

at

100.00

A+

309,426

420

Long

Island

Power

Authority,

New

York,

Electric

System

General

Revenue

Bonds,

Series

2014A,

5.000%,

9/01/44

9/24

at

100.00

A

422,793

580

Long

Island

Power

Authority,

New

York,

Electric

System

General

Revenue

Bonds,

Series

2016B,

5.000%,

9/01/46

9/26

at

100.00

A

599,871

3,000

New

York

City

Municipal

Water

Finance

Authority,

New

York,

Water

and

Sewer

System

Second

General

Resolution

Revenue

Bonds,

Fiscal

2017

Adjustable

Rate

Series

BB-1,

5.000%,

6/15/46

6/27

at

100.00

AA+

3,161,670

2,200

New

York

City

Municipal

Water

Finance

Authority,

New

York,

Water

and

Sewer

System

Second

General

Resolution

Revenue

Bonds,

Fiscal

2020

Series

EE,

4.000%,

6/15/42

6/30

at

100.00

AA+

2,200,022

1,145

New

York

City

Municipal

Water

Finance

Authority,

New

York,

Water

and

Sewer

System

Second

General

Resolution

Revenue

Bonds,

Fiscal

2023

Series

AA-1,

5.250%,

6/15/52

12/32

at

100.00

AA+

1,273,263

2,500

New

York

State

Environmental

Facilities

Corporation,

State

Clean

Water

and

Drinking

Water

Revolving

Funds

Revenue

Bonds,

New

York

City

Municipal

Water

Finance

Authority

Projects,

Second

Resolution

Subordinated

SRF

Series

2015A,

5.000%,

6/15/40

6/25

at

100.00

AAA

2,556,375

4,300

New

York

State

Environmental

Facilities

Corporation,

State

Clean

Water

and

Drinking

Water

Revolving

Funds

Revenue

Bonds,

New

York

City

Municipal

Water

Finance

Authority

Projects-Second

Resolution

Bonds,

Subordinated

SRF

Series

2017E,

5.000%,

6/15/47

6/27

at

100.00

AAA

4,524,460

New

York

State

Environmental

Facilities

Corporation,

State

Clean

Water

and

Drinking

Water

Revolving

Funds

Revenue

Bonds,

New

York

City

Municipal

Water

Finance

Authority

Projects-Second

Resolution

Bonds,

Subordinated

SRF

Series

2018B:

500

5.000%,

6/15/43

6/28

at

100.00

AAA

536,965

1,000

5.000%,

6/15/48

6/28

at

100.00

AAA

1,066,280

1,895

New

York

State

Environmental

Facilities

Corporation,

State

Clean

Water

and

Drinking

Water

Revolving

Funds

Revenue

Bonds,

New

York

City

Municipal

Water

Finance

Authority

Projects-Second

Resolution

Bonds,

Subordinated

SRF

Series

2022A,

5.000%,

6/15/51

6/32

at

100.00

AAA

2,070,193

2,000

New

York

State

Environmental

Facilities

Corporation,

State

Revolving

Funds

Revenue

Bonds,

Green

Series

2022B,

5.250%,

9/15/52

9/32

at

100.00

AAA

2,237,280

500

Niagara

Area

Development

Corporation,

New

York,

Solid

Waste

Disposal

Facility

Revenue

Refunding

Bonds,

Covanta

Energy

Project,

Series

2018A,

4.750%,

11/01/42,

(AMT),

144A

7/23

at

100.00

B1

434,555

775

Puerto

Rico

Aqueduct

and

Sewerage

Authority,

Revenue

Bonds,

Refunding

Senior

Lien

Series

2020A,

5.000%,

7/01/47,

144A

7/30

at

100.00

N/R

746,604

Utility

Debt

Securitization

Authority,

New

York,

Restructuring

Bonds,

Series

2013TE:

2,000

5.000%,

12/15/34

12/23

at

100.00

AAA

2,017,400

2,005

5.000%,

12/15/41

12/23

at

100.00

AAA

2,019,676

Total

Utilities

26,176,833

Total

Long-Term

Investments

(cost

$165,632,432)

165,745,800

Other

Assets

&

Liabilities,

Net

-

1.9%

3,158,367

Net

Assets

Applicable

to

Common

Shares

-

100%

$

168,904,167

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

165,745,800

$

–

$

165,745,800

Total

$

–

$

165,745,800

$

–

$

165,745,800

(1)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(2)

Optional

Call

Provisions:

Dates

(month

and

year)

and

prices

of

the

earliest

optional

call

or

redemption.

There

may

be

other

call

provisions

at

varying

prices

at

later

dates.

Certain

mortgage-backed

securities

may

be

subject

to

periodic

principal

paydowns.

(3)

For

financial

reporting

purposes,

the

ratings

disclosed

are

the

highest

of

Standard

&

Poor’s

Group

(“Standard

&

Poor’s”),

Moody’s

Investors

Service,

Inc.

(“Moody’s”)

or

Fitch,

Inc.

(“Fitch”)

rating.

This

treatment

of

split-rated

securities

may

differ

from

that

used

for

other

purposes,

such

as

for

Fund

investment

policies.

Ratings

below

BBB

by

Standard

&

Poor’s,

Baa

by

Moody’s

or

BBB

by

Fitch

are

considered

to

be

below

investment

grade.

Holdings

designated

N/R

are

not

rated

by

any

of

these

national

rating

agencies.

(4)

Defaulted

security.

A

security

whose

issuer

has

failed

to

fully

pay

principal

and/or

interest

when

due,

or

is

under

the

protection

of

bankruptcy.

(5)

Backed

by

an

escrow

or

trust

containing

sufficient

U.S.

Government

or

U.S.

Government

agency

securities,

which

ensure

the

timely

payment

of

principal

and

interest.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

AMT

Alternative

Minimum

Tax

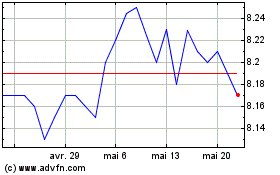

Nuveen New York Municipa... (NYSE:NNY)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Nuveen New York Municipa... (NYSE:NNY)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024