Overview

The aerospace and defense industry found its largest base in the

U.S. with a fittingly impressive military budget. The U.S.'s global

leadership position requires it to maintain the capacity to respond

to the ever-changing national security environment.

Sequestration and spending cuts were expected to adversely affect

the performances of the defense behemoths that explicitly provide

products and services to the U.S. Department of Defense. In

reality, the defense players are doing well despite the fear of

Damocles' sword hanging over defense budgets and big-ticket

programs.

Budget Issues - the Sequester

In Apr 2013, the Obama administration proposed a defense budget of

$526.6 billion for FY14, down $0.9 billion from the FY13 annualized

continuing resolution level of $527.5 billion.

Again in May, an amendment to the FY2014 President’s budget was

issued that included $80.7 billion (excluding prior-year

cancellations) for Overseas Contingency Operations (OCO), which is

essentially government-speak for foreign wars and war on terror

operations.

On Dec 10, 2013, the House and Senate negotiators have reached a

two-year budget agreement, mitigating about half the sequester cuts

expected to gouge the defense budget in fiscal year 2014. Upon

successful approval from both the House and Senate, any near-term

government shutdown will be averted.

The budget sequester that went into effect at the start of Mar 2013

and that has a direct bearing on the U.S. government's defense

spending is a function of the country's fiscal and economic

challenges. These cuts will not spare any of the defense majors

from

Lockheed Martin Corp. (LMT) to

Huntington Ingalls Industries Inc. (HII).

Offsetting the Sequestration Effect

Sequestration will cut some $1 trillion from the defense budget

over the next decade, according to The Washington Free Beacon. Yet,

the aerospace and defense industry is holding up well this year

thanks to technological innovations, big contracts, acquisitions

and growing commercial demand.

Since the domestic aerospace and defense sector is facing budget

cuts and a constrained spending environment, the industry is

looking for growth from international orders. Additionally, a

number of new emerging markets as well as developed nations such as

India, Japan, the United Arab Emirates, Saudi Arabia and Brazil are

boosting defense spending and generating business for the U.S.

aerospace and defense companies.

Moreover, these defense behemoths have diversified their businesses

to counter the effect of the sequester. Also, the complex military

programs being awarded to these companies much before the

across-the-board spending cuts came into force have somewhat

diluted the sequester impact.

Zacks Industry Rank

The Zacks Industry Rank relies on the same estimate revisions

methodology that drives the Zacks Rank for stocks. The way to look

at the complete list of 258+ industries is that the outlook for

industries with Zacks Industry Rank of #88 and lower is 'Positive,'

between #89 and #176 is 'Neutral' and #177 and higher is

'Negative.' Zacks Industry Rank for the Aerospace industry is at

#170 out of 258 industries, which puts it in the Neutral zone.

Earnings Review and Outlook

The third-quarter earnings season has been a testament to the

bullish trend in the defense sphere, defying sequestration and

budget cut woes. The earnings results of all the defense companies

in our universe, except two surpassed the Zacks Consensus

Estimate.

The highest positive surprise of 37 cents came from Huntington

Ingalls while the lowest surprise of 2 cents was clocked by

L-3 Communications Holdings Inc. (LLL). On the

contrary,

Textron Inc. (TXT) and

Rockwell

Collins Inc. (COL) missed the Zacks Consensus Estimate by

25.53% and 2.29%, respectively.

As of Nov 22, 2013, the aerospace sector’s top and bottom line beat

ratio was 62.5% and 75%, respectively as compared to 42.1% and

65.4%, respectively, for the S&P 500.

For a detailed look at the earnings outlook for this sector and

others, please read our weekly Earnings Trends reports.

The Gainers

Huntington Ingalls Industries

From Mar 1, 2013 to date, there have been a number of share price

gainers with Huntington Ingalls Industries witnessing the highest

increase of around 93.0%, beginning Mar 1, 2013.

This company carrying a Zacks Rank #2 (Buy) ended the quarter with

a 46.25% positive surprise driven by solid program execution at

Ingalls Shipbuilding and Newport News Shipbuilding while it posted

a 25.63% positive surprise over the last four quarters on

average.

Alliant Techsystems

Alliant Techsystems Inc. (ATK) with a Zacks Rank #1

(Strong Buy) delivered a positive earnings surprise of 16.53% this

quarter and 13.39% over the last four quarters. Lower interest

expense and solid performance by the Sporting business led to the

upswing in earnings. The company witnessed a share price

appreciation of around 92.4%.

The company uses its cash in the best possible manner. Recently,

the company acquired Caliber Company, the parent company of Savage

Sports Corporation. The acquisition gives the company an

opportunity to bolster its leadership position in sporting and

security ammunition and accessories into the long guns market. The

acquired entity contributed $57 million to revenues in the reported

quarter. Apart from the company’s cash deployment strategy, a

continuous in-flow of contracts makes it a Strong Buy.

Raytheon Company

Driven by operational improvements and capital deployment actions,

the earnings surprise this quarter for

Raytheon

Company (RTN) was a positive 13.53%. Surprise over the

last four quarters was a positive 21.16%. Beginning Mar 1, 2013,

the company’s share price has risen approximately 51.8%. Raytheon

also sports a Zacks Rank #1 (Strong Buy).

Though the fourth quarter 2013 and full year 2013 estimates in the

table above depict a year-over-year decline, Raytheon looks good

with a continuous in-flow of contracts, introduction of new

products, completion of flight test series, consolidation and

earnings beat to boot.

The 2014 fiscal defense budget prioritized investments in Missile

and Space Systems, which is expected to bring in more contracts for

Raytheon. In addition, the company’s focus on technological

advancements, as exemplified by its GaN systems, will make defense

solutions affordable and effective.

Raytheon is more focused on overseas sales to counter domestic

budget pressure. Best known for its missile defense systems, such

as the Patriot, Raytheon‘s international business is now expected

to garner close to 30% of total revenues this year. Earlier this

month, Raytheon received the green light from Pentagon for the sale

of some 15,000 anti-tank missiles to Saudi Arabia under two

separate deals with a combined value of $1.1 billion.

As of Sep 30, 2013, the company had a funded backlog of $22.1

billion that would convert into revenues in the near term. In

addition, the strong cash position, consistent dividend payment and

repurchase of shares make the stock look attractive. Indeed, the

company’s strong cash position of $2.9 billion has been helping it

to acquire other firms. In June this year, the company acquired

Visual Analytics Inc. that will help the company in meeting the

data analytics, data visualization and information sharing needs of

its customers.

Lockheed Martin

Lockheed Martin, the foremost defense prime, experienced its share

price rise 56.1% since Mar 1, 2013. The positive surprise was

13.72% in this quarter and 14.00% in the last four quarters.

Lockheed Martin with a Zacks Rank #2 (Buy) has a strong liquidity

position and utilizes the cash in the best possible manner via

dividends and share repurchases. The company has lifted its full

year 2013 earnings guidance on its third quarter earnings

conference call, backed by the quarter’s strong performance.

A key catalyst is the F-35 program, which is expected to account

for approximately 16% of 2013 revenue. The growing international

mix is also expected to increase to about 15% in 2014. Despite the

uncertainty plaguing the industry, the company has been able to

generate $15 billion in orders during the third quarter.

The Boeing Company

The Boeing Co. (BA) carries a Zacks Rank #2 (Buy). We note

that it has surpassed the Zacks Consensus Estimate by 16.88% in the

past quarter driven by solid operating performance fueled by higher

aircraft deliveries. Over the last four quarters, the company

experienced an 11.96% positive surprise on an average.

Despite various technical issues at its Commercial Airplane

Division, Boeing is seeing strong growth driven by rising demand

for air travel from the emerging markets and replacement (of older

aircraft) demand from the developed markets. Moreover, a recovery

from the financial crisis and consolidation within the industry has

enabled airliners to place big orders for new airplanes with

aircraft manufacturers like Boeing, Airbus, Bombardier and

Embraer.

Boeing’s share price soared 79.8% from Mar 1, 2013. Backlog and

deliveries are also robust. Total Defense, Space & Security

backlog was $70 billion as of Sep 30, 2013.

That said, we note that Boeing has mostly secured low-priced

contracts lately with the occasional high-value order attributable

to the ongoing sequestration in the U.S.

Good to Hold

Northrop Grumman

From Mar 1, 2013 to date, Northrop Grumman Corp.’s

(NOC) share price has boosted 65.3%. It has delivered a positive

earnings surprise of 8.84% this quarter driven by a lower share

count and strong operating performance. The earnings beat over the

last four quarters comes to 14.99%.

A steady flow of contracts which also include international orders,

a funded backlog of $23.4 billion, introduction of new products,

and the tendency of returning wealth to its shareholders drive this

Zacks Rank #3 (Buy) stock.

Losers

Textron Inc.

Although its share price increased 26.30% beginning Mar 1, 2013,

this Zacks Ranked #4 (Sell) stock ended the quarter with a negative

earnings surprise of 25.53% and an average negative surprise of

9.23% over the last four quarters.

Furthermore, Textron also lowered its 2013 earnings per share

guidance reflecting lower margins at Bell for manufacturing

inefficiencies along with labor disruptions, and lower aircraft

deliveries at Cessna.

Embraer SA

Although Embraer SA (ERJ) has been able to show a

positive earnings surprise of 6.38% this quarter, it experienced a

26.19% negative surprise over the last four quarters on an average.

The company’s share price gained 11.8% beginning Mar 1, 2013.

The company has a Zacks Rank #4 (Sell) and investors are

recommended to stay away from the stock for the time being.

Pros and Cons

In spite of the budget austerities and sequestration, defense

majors are riding high on foreign orders. These have to some extent

compensated for lower defense spending at home.

Undeterred by defense budget cuts, the big defense operators are

expanding their operations through acquisitions. Moreover, they are

busy restructuring their businesses. Also, they are keeping

themselves abreast in the technological front with new products

countering fresh competition.

The broad growth and development of the aerospace and defense

industry is tied to the defense budgets of different nations around

the globe, besides the U.S. The U.S. defense department has reduced

the defense budget significantly. These cutbacks will impact the

big contractors, as the lion's share of their revenues comes from

domestic defense spending.

Moreover, with the majority of revenue coming from government

contracts, the industry could be adversely affected by the

cancellation and delay of major government contracts. Again, with

more and more acquisitions being made by the defense players, there

is always the risk of completion, integration and financing of

these deals.

Our Take

The aerospace & defense industry has been a keystone of the

U.S. economy for decades and has provided well paying jobs for a

variety of skill levels. The U.S. aerospace industry continues to

contribute significantly to the country's economy and provides

capabilities vital for national security.

However, on the flip side, the industry's position is now

challenged by global competition, changes in technology, national

and worldwide economic conditions, and global policies affecting

defense, civilian and commercial aviation.

Moreover, any delay in the execution of orders would lead to an

imbalance between the cost and revenue structure. This would not

only hurt profitability but also lead to delays and even

cancellations of orders and/or programs.

On the whole, budget austerities still remain an overhang both in

the civil and military sectors. The companies that have little

diversification outside the U.S. are highly susceptible to spending

cuts from sequestration. On the other hand, those with an

international order book would find it less difficult to outwit

sequestration.

Admittedly, the sector enjoyed a solid earnings season,

technological progress, acquisition benefits and cost-cutting

efforts from individual companies. But these positives are held in

balance by defense budget austerities. This keeps us Neutral on the

sector for the time being. has been able to show a positive

earnings surprise of 6.38% this quarter, it experienced a 26.19%

negative surprise over the last four quarters on an average. The

company’s share price gained 11.8% beginning Mar 1, 2013.

The company has a Zacks Rank #4 (Sell) and investors are

recommended to stay away from the stock for the time being.

ALLIANT TECHSYS (ATK): Free Stock Analysis Report

BOEING CO (BA): Free Stock Analysis Report

ROCKWELL COLLIN (COL): Free Stock Analysis Report

EMBRAER AIR-ADR (ERJ): Free Stock Analysis Report

HUNTINGTON INGL (HII): Free Stock Analysis Report

L-3 COMM HLDGS (LLL): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

RAYTHEON CO (RTN): Free Stock Analysis Report

TEXTRON INC (TXT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

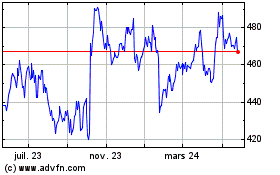

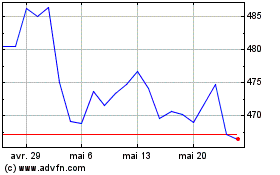

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024