Raytheon Beats Q4 Earnings, Misses Revs - Analyst Blog

30 Janvier 2014 - 4:47PM

Zacks

Raytheon Company (RTN) reported fourth quarter

2013 adjusted earnings of $1.58 per share, beating the Zacks

Consensus Estimate of $1.35 by 17.0%. The better-than-expected

results were driven by strong program execution.

However, earnings dropped 2.5% from the year-ago adjusted profit

level of $1.62, mainly due to lower sales.

Full-year 2013 adjusted earnings were $6.38 per share, above the

Zacks Consensus Estimate of $5.85 by 9.1% and the year-ago figure

of $6.28 by 1.6%.

Operational Performance

The company’s top line at $5,870 million registered an 8.8% fall

year over year. The reported number also missed the Zacks Consensus

Estimate of $5,958 million by 1.5%.

New bookings in the fourth quarter were $7.5 billion and $22.1

billion in 2013. Total backlog at the end of 2013 was $33.7 billion

(down 6.9% year over year) and funded backlog was $23.0 billion

(down 4.3%).

Total operating expenses were $5,161 million, down 9.2% year over

year. Operating income during the quarter was $709 million, down

from the year-ago level of $755 million.

Quarterly Segment Performance

Integrated Defense Systems (IDS): Segment

revenue decreased 9% year over year to $1,569 million due to lower

sales from the tactical radar program and the completion of an

international Patriot program.

Segment operating income was also down 8% year over year to $241

million.

Intelligence, Information and Services

(IIS): Segment revenue was down 9% year over year to

$1,458 million due to lower volume on classified and training

programs. Operating income in the reported quarter was also down

11% to $121 million.

Missile Systems (MS): Segment revenue

decreased 8% year over year to $1,638 million. Weak net sales were

a function of lower sales on U.S. Army sensor programs.

Nonetheless, operating income spiked 2% year over year to $201

million on account of a change in contract mix.

Space and Airborne Systems (SAS): Revenue

in the quarter declined 11% year over year to $1,613 million. The

decline in revenue was due to lower sales volume on classified

programs. Operating income also dropped 11% year over year to $253

million due to lower volumes.

Financial Update

Raytheon ended 2013 with cash and cash equivalents of $3,296

million versus $3,188 million as of Dec 31, 2012. Long-term debt

was $4,734 million, up slightly from the debt level of $4,731

million as of Dec 31, 2012.

Raytheon’s capital expenditure was $115 million in the reported

quarter, down from the year-ago spending level of $135 million. For

2013, the company’s capital outlay stood at $280 million compared

with $339 million in 2012.

In the fourth quarter, Raytheon repurchased 4.7 million shares of

common stock for $400 million as per its share repurchase program.

In Nov 2013, Raytheon’s board of directors authorized the

repurchase of up to an additional $2.0 billion of the company's

outstanding common stock.

Guidance

For 2014, Raytheon expects sales in the range of $22.5–$23.0

billion. The company’s adjusted earnings per share are forecast in

the $5.76 to $5.91 range. The Zacks Consensus Estimate is pegged

higher at $6.31 for 2014.

The defense major expects operating cash flow from continuing

operations in the range of $2.3 billion to $2.5 billion for

full-year 2014.

At the Peers

Raytheon is one of the top five defense contractors to report

earnings this quarter.

The world’s largest stand-alone defense contractor,

Lockheed Martin Corp. (LMT), posted fourth quarter

2013 adjusted earnings from continuing operations of $2.38 per

share, comfortably surpassing the Zacks Consensus Estimate of $2.00

by 19.0%. Earnings in the reported quarter also surged almost 21.4%

from the year-ago adjusted profit level of $1.96 per share. The

upcast in earnings was mainly attributable to its strong

operational performance.

Northrop Grumman Corp. (NOC) reported fourth

quarter 2013 results before the opening bell today. Adjusted

earnings per share of $2.00 comfortably surpassed the Zacks

Consensus Estimate of $1.94 by 3.1%. The earnings beat was

attributable to a lower share count and strong operating

performance. However, the bottom line came in below the year-ago

figure of $2.06 by 2.9% mainly due to lower revenue generation.

Defense and aerospace operator General Dynamics

Corp.’s (GD) fourth-quarter 2013 operating earnings were

$1.76 per share, in line with the Zacks Consensus Estimate.

Earnings were ahead of the year-ago figure of $1.39.

Our Take

With rising demand from the Gulf countries as well as from the

Asia-Pacific region, we believe international sales will continue

to be the company’s key revenue driver. At home, despite the

sequestration, Raytheon appears to have clinched high-value

contracts also during the quarter.

The 2014 fiscal budget prioritized investments in Missile and Space

Systems, which are expected to bring in more contracts for

Raytheon. In addition, the company’s focus on technological

advancements, as exemplified by its GaN systems, will make defense

solutions affordable and effective.

Raytheon’s business consolidation efforts will also provide

successful cost-saving solutions, leading to expanding operating

margins in the long term.

Zacks Rank

Raytheon and Northrop Grumman currently hold a Zacks Rank #2 (Buy),

while Lockheed Martin sports a Zacks Rank #1 (Strong Buy).

GENL DYNAMICS (GD): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

RAYTHEON CO (RTN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

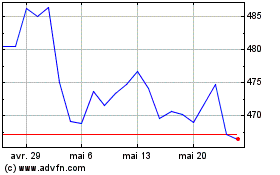

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

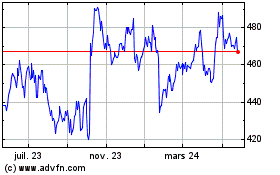

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024