Lockheed Rides Rise in Military Sales -- WSJ

24 Octobre 2018 - 9:02AM

Dow Jones News

By Doug Cameron

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 24, 2018).

Lockheed Martin Corp. eased concerns Tuesdays about the defense

industry's growth prospects, heading toward what many analysts

expect could mark a peak next year for U.S. military spending.

The world's largest defense contractor forecast revenue would

rise by up to 6% in 2019 from $53 billion this year as Lockheed

boosts production of missiles and F-35 combat jets. The company

also played down its exposure to arms sales to Saudi Arabia.

Concerns about growth and profit margins have weighed on defense

stocks this year, leaving a sector that had outperformed the

broader market for five years struggling to keep parity with the

main indexes.

Boeing Co, Northrop Grumman Corp. and Raytheon Co, are all due

to report earnings this week as well.

Lockheed has benefited from a two-year increase in military

spending that has added $75 billion for equipment and services to

the U.S. budget. Pentagon leaders have said they need to improve

military readiness and launch new programs in areas such as

hypersonic missiles and cybersecurity.

However, President Trump last week signaled potential

across-the-board spending cuts next year. After upcoming U.S.

midterm elections, a new Congress could reverse recent spending

increases.

Lockheed chief executive Marillyn Hewson, who met the president

at an industry roundtable last week, said on an investor call

Tuesday that his remarks didn't necessarily imply a cut in Pentagon

spending.

Ms. Hewson said Lockheed continued to work with the U.S.

government on an estimated $28 billion in potential long-term deals

with Saudi Arabia.

Mr. Trump has resisted calls to curb U.S. arms sales to Saudi

Arabia after Turkish officials alleged the kingdom killed

journalist Jamal Khashoggi in its Istanbul consulate on Oct. 2. Mr.

Trump said the planned deals are vital for American companies and

jobs. "I'd rather keep the million jobs, and find another

solution," he said at the industry roundtable.

Lockheed Chief Financial Officer Bruce Tanner said the company

didn't know when it might receive an order for Thaad missile

defense systems from Saudi Arabia that the U.S. government is

brokering. Lockheed had previously said it expected a contract that

analysts have estimated could be worth $10 billion this year.

Tanner said Lockheed expects to have around $500 million in sales

to the kingdom next year and $900 million in 2019.

Lockheed said it expects its closely watched operating cash-flow

to be stable around $7 billion in each of the next three years. The

company reported forecast-beating profits of $1.47 billion for the

quarter to Sept. 30 compared with $963 million a year earlier, with

per-share earnings rising to $5.14 from $3.32. Its order backlog

rose to $109 billion.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 24, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

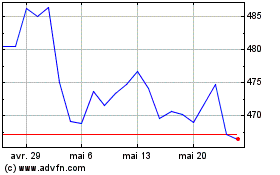

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

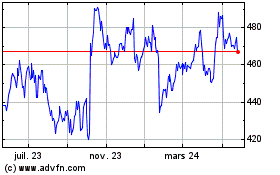

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024