0001370946false00013709462025-02-242025-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

Form 8-K

______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 24, 2025

______________________________________

Owens Corning

(Exact name of registrant as specified in its charter)

______________________________________ | | | | | | | | | | | | | | |

| DE | | 1-33100 | | 43-2109021 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

One Owens Corning Parkway Toledo, OH 43659

(Address of principal executive offices) (Zip Code)

419-248-8000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

______________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | OC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| ☐ | Emerging growth company |

| |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On February 24, 2025, Owens Corning (the "Company") issued a press release announcing its financial results for the fourth quarter of 2024 and the fiscal year ended December 31, 2024.

Exhibit 99.1 contains certain financial measures that are considered "non-GAAP financial measures" as defined in the federal securities laws and contains an explanation and, as applicable, a reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States.

The information in Item 2.02 of this Current Report is being furnished pursuant to General Instructions B.2 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in Item 2.02 of this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| Owens Corning |

| | |

| February 24, 2025 | By: | /s/ Todd W. Fister |

| | Todd W. Fister |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Owens Corning Delivers Full-Year Net Sales of $11.0 Billion;

Generates Earnings of $647 Million and Adjusted EBIT of $2.0 Billion

TOLEDO, Ohio – February 24, 2025 - Owens Corning (NYSE: OC), a residential and commercial building products leader, today reported fourth-quarter and full-year 2024 results.

•Reported Net Sales of $11.0 Billion, a 13% Increase from Prior Year, with Newly Acquired Doors Business Contributing $1.4 Billion in Revenue

•Generated Net Earnings Margin of 6%, Adjusted EBIT Margin of 19%, and Adjusted EBITDA Margin of 25%

•Delivered Diluted EPS of $7.37 and Adjusted Diluted EPS of $15.91

•Produced Operating Cash Flow of $1.9 Billion and Free Cash Flow of $1.2 Billion

•Returned $638 Million, or 51%, of Free Cash Flow to Shareholders through Dividends and Share Repurchases

“2024 was a transformative year for Owens Corning as we successfully executed three major strategic moves to reshape and focus the company on building products in North America and Europe, while consistently delivering higher, more resilient earnings and cash flow,” said Chair and Chief Executive Officer Brian Chambers. “Through our unique enterprise capabilities, market-leading positions, and consistent execution, we have delivered on the three-year commitments set at our last Investor Day in 2021. As a new Owens Corning, we look forward to sharing more about our strategy and financial goals for the future at our next Investor Day in May.”

Enterprise Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions, except per share amounts) | Fourth-Quarter | Full-Year | |

| 2024 | 2023 | Change | 2024 | 2023 | Change | |

| Net Sales | $2,840 | $2,304 | $536 | 23% | $10,975 | $9,677 | $1,298 | 13% | |

Net (Loss) Earnings Attributable to OC(1) | (258) | 131 | (389) | (297)% | 647 | 1,196 | (549) | (46)% | |

| As a Percent of Net Sales | (9)% | 6% | N/A | N/A | 6% | 12% | N/A | N/A | |

| Adjusted EBIT | 430 | 392 | 38 | 10% | 2,038 | 1,805 | 233 | 13% | |

| As a Percent of Net Sales | 15% | 17% | N/A | N/A | 19% | 19% | N/A | N/A | |

| Adjusted EBITDA | 629 | 518 | 111 | 21% | 2,702 | 2,313 | 389 | 17% | |

| As a Percent of Net Sales | 22% | 22% | N/A | N/A | 25% | 24% | N/A | N/A | |

| Diluted EPS | (2.97) | 1.46 | (4.43) | (303)% | 7.37 | 13.14 | (5.77) | (44)% | |

| Adjusted Diluted EPS | 3.22 | 3.21 | 0.01 | —% | 15.91 | 14.42 | 1.49 | 10% | |

| Operating Cash Flow | 676 | 698 | (22) | (3)% | 1,892 | 1,719 | 173 | 10% | |

| Free Cash Flow | 479 | 562 | (83) | (15)% | 1,245 | 1,193 | 52 | 4% | |

(1) Fourth-quarter and full-year 2024 include impact from strategic moves made in the year. Refer to Table 2 for additional detail.

Enterprise Strategy Highlights

•Owens Corning maintained a high level of safety performance in 2024 with a recordable incident rate (RIR) of 0.48. This excludes the Doors segment, which will be integrated into company safety reporting in 2025.

•Over the last year, Owens Corning executed three major, transformative initiatives to reshape the company into a focused leader in building products for North America and Europe. These initiatives include the acquisition of Masonite International Corporation, conducting a strategic review of the company’s global glass reinforcements business, and entering into an agreement to sell the company’s building materials business in China and Korea.

•On February 14, Owens Corning announced the company entered into a definitive agreement for the sale of its glass reinforcements business, concluding the review of strategic alternatives for the business announced in 2024. This transaction strengthens Owens Corning as a market leader in building products. The sale is expected to close in 2025. Proceeds from the sale will fund organic growth initiatives and cash returns to shareholders.

•The glass reinforcements business is part of the company’s Composites segment, which includes other businesses that Owens Corning will retain. As a result of the definitive agreement to sell glass reinforcements, the company’s vertically integrated glass nonwovens business and its structural lumber business will operate within the Roofing segment. Owens Corning’s two glass melting plants in the U.S. that provide glass fibers to make nonwovens products will operate and be integrated within its Insulation segment.

•On February 11, Owens Corning announced an investment to expand the manufacturing capacity of its high-performing laminate shingle portfolio, including its premium Duration® series shingles. This organic growth investment will add a new laminate shingle facility to be built in the southeastern United States. The plant will produce approximately six million squares of capacity per year to support strong demand for Owens Corning shingles and is expected to come online in 2027.

Cash Returned to Shareholders

•During 2024, the company returned $638 million to shareholders through cash dividends and share repurchases. The company paid cash dividends of $208 million and repurchased 2.6 million shares of common stock for $430 million. At the end of the year, 6.4 million shares were available for repurchase under the current authorization.

•In December 2024, Owens Corning announced its Board of Directors declared quarterly cash dividends of $0.69 per common share, a 15% increase compared with the associated prior quarterly dividends. The company has more than doubled its quarterly dividend over the last three years.

“Our outstanding results in 2024 demonstrate the earnings power of Owens Corning. Through our best-in-class execution, we grew revenue, expanded margins, and maintained a strong balance sheet while making strategic investments to strengthen our market-leading positions. We generated $1.2 billion of free cash flow during the year, with over 50% returned to shareholders through share repurchases and dividends,” said Executive Vice President and Chief Financial Officer Todd Fister. “Going forward, we will continue to be disciplined operators and capital allocators, using our healthy balance sheet to invest in our existing businesses and return significant cash to shareholders.”

Other Notable Highlights

•Owens Corning has been named to the Wall Street Journal’s list of top 250 Best-Managed Companies. The list ranks companies based on principles of corporate effectiveness including customer satisfaction, employee engagement and development, innovation, social responsibility, and financial strength. Owens Corning placed fourth in customer satisfaction among those recognized.

•For the 15th consecutive year, Owens Corning earned a place on the Dow Jones Sustainability World Index. The index is an elite listing of the world’s largest companies based on long-term economic, environmental, and social criteria.

•Owens Corning will host an Investor Day at its world headquarters in Toledo, Ohio, on Wednesday, May 14. The company will also provide a live webcast. More details will be given in the coming months.

2024 Performance

Full-Year

•In 2024, Owens Corning delivered double-digit net sales growth versus prior year. The company generated adjusted EBIT margin of 19% and adjusted EBITDA margin of 25%. Strong commercial and operational execution fueled enterprise margin expansion over prior year, as each of the businesses delivered strong performance relative to market conditions. Free cash flow of $1.2 billion increased over $50 million compared to 2023, through strong earnings and disciplined capital allocation.

| | | | | | | | | | | | | | | | | | | | | |

| Segment Results ($ in millions) | Net Sales | EBIT Margin | EBITDA Margin | |

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |

| Roofing | $4,052 | $4,030 | 32% | 29% | 34% | 31% | |

| Insulation | 3,692 | 3,668 | 18% | 17% | 24% | 23% | |

| Doors | 1,448 | — | 7% | N/A | 16% | N/A | |

| Composites | 2,118 | 2,286 | 10% | 11% | 19% | 18% | |

Fourth-Quarter

•In the fourth quarter, the company delivered sales of $2.8 billion, growth of 23% versus prior year. Margin expansion in each of the legacy businesses resulted in adjusted EBIT margin of 15% and adjusted EBITDA margin of 22%. Fourth quarter marks the 18th consecutive quarter of the company delivering mid-teens or better EBIT margins and 20% or better adjusted EBITDA margins.

| | | | | | | | | | | | | | | | | | | | | |

| Segment Results ($ in millions) | Net Sales | EBIT Margin | EBITDA Margin | |

Q4 2024 | Q4 2023 | Q4 2024 | Q4 2023 | Q4 2024 | Q4 2023 | |

| Roofing | $912 | $928 | 31% | 31% | 32% | 32% | |

| Insulation | 926 | 931 | 17% | 16% | 23% | 22% | |

| Doors | 564 | — | 5% | N/A | 15% | N/A | |

| Composites | 515 | 514 | 9% | 5% | 18% | 13% | |

First-Quarter and Full-Year 2025 Outlook

•The key economic factors that impact the company’s business are residential repair activity, residential remodeling activity, U.S. housing starts, and commercial construction activity.

•Owens Corning expects near-term demand for nondiscretionary repair activity to remain stable as the year begins while residential new construction and remodeling is expected to remain soft. Commercial construction activity in North America is expected to start the year slower than prior year. The result of incremental tariffs which have not yet been implemented may also have a near-term impact. In Europe, the company expects market conditions to remain weak in the near-term in residential and commercial markets, similar to the second half 2024.

•As Owens Corning invests in capacity to grow core products and markets, the company anticipates a short-term step up in capital expenditures due to investments in previously announced projects. Owens Corning remains committed to its capital allocation strategy, generating strong free cash flow, and returning at least 50% to shareholders over time.

•For the first-quarter 2025, the company expects to continue delivering strong results, reflecting structural changes to the company and its cost structure, even in a mixed market environment. It expects revenue from continuing operations to grow mid-20 percent, compared to prior year’s revenue of $2.0 billion adjusted for glass reinforcements being moved to discontinued operations. The enterprise is expected to generate EBITDA margin from continuing operations of low-20 percent.

Current 2025 financial outlook is presented below.

| | | | | |

| General Corporate Expenses | $240 million to $260 million(1) |

| Interest Expense | $250 million to $260million |

| Effective Tax Rate on Adjusted Earnings | 24% to 26% |

| |

| Capital Additions | Approximately $800 million(2) |

| Depreciation and Amortization | Approximately $650 million(3) |

(1)Includes current estimates for expenses related to the glass reinforcements business that will not be included in discontinued operations.

(2)Includes capital additions for the glass reinforcements business.

(3)Excludes depreciation and amortization for glass reinforcements due to discontinued operations reporting beginning in Q1 2025.

Fourth-Quarter 2024 Conference Call and Presentation

Monday, February 24, 2025

9 a.m. Eastern Time

All Callers

•Live dial-in telephone number: U.S. 1.833.470.1428; Canada 1.833.950.0062; and other international locations +1.404.975.4839.

•Entry number: 307871 (Please dial in 10-15 minutes before conference call start time)

•Live webcast: https://events.q4inc.com/attendee/716642151

Telephone and Webcast Replay

•Telephone replay will be available one hour after the end of the call through March 3, 2025. In the U.S., call 1.866.813.9403. In Canada, call 1.226.828.7578. In other international locations, call +1.929.458.6194.

•Conference replay number: 682923

•Webcast replay will be available for one year using the above link.

About Owens Corning

Owens Corning is a residential and commercial building products leader committed to building a sustainable future through material innovation. Our products provide durable, sustainable, energy-efficient solutions that leverage our unique capabilities and market-leading positions to help our customers win and grow. We are global in scope, human in scale with more than 25,000 employees in 31 countries dedicated to generating value for our customers and shareholders and making a difference in the communities where we work and live. Founded in 1938 and based in Toledo, Ohio, USA, Owens Corning posted 2024 sales of $11.0 billion. For more information, visit www.owenscorning.com.

Use of Non-GAAP Measures

Owens Corning uses non-GAAP measures in its earnings press release that are intended to supplement investors' understanding of the company's financial information. These non-GAAP measures include EBIT, adjusted EBIT, EBITDA, adjusted EBITDA, adjusted earnings, adjusted diluted earnings per share attributable to Owens Corning common stockholders ("adjusted EPS"), adjusted pre-tax earnings, free cash flow, free cash flow conversion and net debt-to-adjusted EBITDA. When used to report historical financial information, reconciliations of these non-GAAP measures to the corresponding GAAP measures are included in the financial tables of this press release. Specifically, see Table 2 for EBIT, adjusted EBIT, EBITDA, and adjusted EBITDA, Table 3 for adjusted earnings and adjusted EPS, and Table 8 for free cash flow and free cash flow conversion (annually).

For purposes of internal review of Owens Corning's year-over-year operational performance, management excludes from net earnings attributable to Owens Corning certain items it believes are not representative of ongoing operations. The non-GAAP financial measures resulting from these adjustments (including adjusted EBIT, adjusted EBITDA, adjusted earnings, adjusted EPS, and adjusted pre-tax earnings) are used internally by Owens Corning for various purposes, including reporting results of operations to the Board of Directors, analysis of performance, and related employee compensation measures. Management believes that these adjustments result in a measure that provides a useful representation of its operational performance; however, the adjusted measures should not be considered in isolation or as a substitute for net earnings attributable to Owens Corning as prepared in accordance with GAAP.

Free cash flow is a non-GAAP liquidity measure used by investors, financial analysts and management to help evaluate the company's ability to generate cash to pursue opportunities that enhance shareholder value. The company defines free cash flow as net cash flow provided by operating activities, less cash paid for property, plant and equipment. Free cash flow is not a measure of residual cash flow available for discretionary expenditures due to the company's mandatory debt service

requirements. Free cash flow conversion is a non-GAAP liquidity measure used to measure the company’s efficiency in turning profits into free cash flow from its core operations. The company defines free cash flow conversion as free cash flow divided by adjusted earnings. Free cash flow and free cash flow conversion is used internally by the company for various purposes, including reporting results of operations to the Board of Directors of the company and analysis of performance.

Management believes that these measures provide a useful representation of our operational performance and liquidity; however, the measures should not be considered in isolation or as a substitute for net cash flow provided by operating activities or net earnings attributable to Owens Corning as prepared in accordance with GAAP.

When the company provides forward-looking expectations for non-GAAP measures, the most comparable GAAP measures and a reconciliation between the non-GAAP expectations and the corresponding GAAP measures are generally not available without unreasonable effort due to the variability, complexity and limited visibility of the adjusting items that would be excluded from the non-GAAP measures in future periods. The variability in timing and amount of adjusting items could have significant and unpredictable effect on our future GAAP results.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are subject to risks, uncertainties and other factors and actual results may differ materially from those results projected in the statements. These risks, uncertainties and other factors include, without limitation: levels of residential and commercial or industrial construction activity; demand for our products; industry and economic conditions including, but not limited to, supply chain disruptions, recessionary conditions, inflationary pressures, and interest rate and financial markets volatility; changes to tariff, trade or investment policies or laws; availability and cost of energy and raw materials; competitive and pricing factors; relationships with key customers and customer concentration in certain areas; our ability to achieve expected synergies, cost reductions and/or productivity improvements; issues related to acquisitions, divestitures and joint ventures or expansions; our ability to complete the announced divestiture of our glass reinforcements business on the expected terms and within the anticipated time period, or at all, which is dependent on the parties' ability to satisfy certain closing conditions; climate change, weather conditions and storm activity; legislation and related regulations or interpretations, in the United States or elsewhere; domestic and international economic and political conditions, policies or other governmental actions, as well as war and civil disturbance; uninsured losses or major manufacturing disruptions, including those from natural disasters, catastrophes, pandemics, theft or sabotage; environmental, product-related or other legal and regulatory liabilities, proceedings or actions; research and development activities and intellectual property protection; issues involving implementation and protection of information technology systems; foreign exchange and commodity price fluctuations; our level of indebtedness; our liquidity and the availability and cost of credit; the level of fixed costs required to run our business; levels of goodwill or other indefinite-lived intangible assets; price volatility in certain wind energy markets in the U.S.; loss of key employees and labor disputes or shortages; defined benefit plan funding obligations; and factors detailed from time to time in the company’s Securities and Exchange Commission filings. The information in this news release speaks as of February 24, 2025, and is subject to change. The company does not undertake any duty to update or revise forward-looking statements except as required by federal securities laws. Any distribution of this news release after that date is not intended and should not be construed as updating or confirming such information.

| | | | | | | | | | | |

| Media Inquiries: | | | Investor Inquiries: |

| Megan James | | | Amber Wohlfarth |

| 419.348.0768 | | | 419.248.5639 |

Owens Corning Company News / Owens Corning Investor Relations News

Table 1

Owens Corning and Subsidiaries

Consolidated Statements of Earnings

(unaudited)

(in millions, except per share amounts)

| | | | | | | | | | | | | | |

| Three Months Ended December 31, | Twelve Months Ended December 31, |

| 2024 | 2023 | 2024 | 2023 |

| NET SALES | $ | 2,840 | | $ | 2,304 | | $ | 10,975 | | $ | 9,677 | |

| COST OF SALES | 2,041 | | 1,689 | | 7,721 | | 6,994 | |

| Gross margin | 799 | | 615 | | 3,254 | | 2,683 | |

| OPERATING EXPENSES | | | | |

| Marketing and administrative expenses | 304 | | 219 | | 1,044 | | 831 | |

| Science and technology expenses | 43 | | 38 | | 144 | | 123 | |

| | | | |

| Loss on sale of business | 91 | | — | | 91 | | — | |

| Impairment due to strategic review | 483 | | — | | 483 | | — | |

| | | | |

| Gain on sale of site | — | | — | | — | | (189) | |

| Other expense, net | 120 | | 29 | | 365 | | 106 | |

| Total operating expenses | 1,041 | | 286 | | 2,127 | | 871 | |

| OPERATING (LOSS) INCOME | (242) | | 329 | | 1,127 | | 1,812 | |

| Non-operating expense (income) | — | | 146 | | (1) | | 145 | |

| (LOSS) EARNINGS BEFORE INTEREST AND TAXES | (242) | | 183 | | 1,128 | | 1,667 | |

| Interest expense, net | 61 | | 14 | | 212 | | 76 | |

| | | | |

| (LOSS) EARNINGS BEFORE TAXES | (303) | | 169 | | 916 | | 1,591 | |

| Income tax (benefit) expense | (43) | | 40 | | 275 | | 401 | |

| Equity in net earnings of affiliates | 2 | | 1 | | 6 | | 3 | |

| NET (LOSS) EARNINGS | (258) | | 130 | | 647 | | 1,193 | |

| Net loss attributable to non-redeemable and redeemable noncontrolling interests | — | | (1) | | — | | (3) | |

| NET (LOSS) EARNINGS ATTRIBUTABLE TO OWENS CORNING | $ | (258) | | $ | 131 | | $ | 647 | | $ | 1,196 | |

| EARNINGS PER COMMON SHARE ATTRIBUTABLE TO OWENS CORNING COMMON STOCKHOLDERS | | | | |

| Basic | $ | (3.00) | | $ | 1.48 | | $ | 7.45 | | $ | 13.27 | |

| Diluted | $ | (2.97) | | $ | 1.46 | | $ | 7.37 | | $ | 13.14 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Table 2

Owens Corning and Subsidiaries

EBIT Reconciliation Schedules

(unaudited)

Adjusting (expense) income items to EBIT are shown in the table below (in millions): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Twelve Months Ended |

| March 31, | June 30, | September 30, | December 31, | December 31, |

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 |

| Restructuring costs | $ | (14) | | $ | (18) | | $ | (47) | | $ | (47) | | $ | (1) | | $ | (41) | | $ | (24) | | $ | (63) | | $ | (86) | | $ | (169) | |

| Gains on sale of certain precious metals | — | | 2 | | — | | — | | 19 | | — | | — | | — | | 19 | | 2 | |

| Strategic review-related charges | (2) | | — | | (15) | | — | | (16) | | — | | (13) | | — | | (46) | | — | |

| Impairment of venture investments | — | | — | | — | | — | | (13) | | — | | (2) | | — | | (15) | | — | |

| Loss on sale of business | — | | — | | — | | — | | — | | — | | (91) | | — | | (91) | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| Recognition of acquisition inventory fair value step-up | — | | — | | (12) | | — | | (6) | | — | | — | | — | | (18) | | — | |

| Pension settlement losses | — | | — | | — | | — | | — | | — | | — | | (145) | | — | | (145) | |

| Acquisition-related transaction costs | (18) | | — | | (29) | | — | | (2) | | — | | — | | — | | (49) | | — | |

| Acquisition-related integration costs | — | | — | | (21) | | — | | (53) | | — | | (9) | | — | | (83) | | — | |

| Gain on sale of Santa Clara, California site | — | | 189 | | — | | — | | — | | — | | — | | — | | — | | 189 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Paroc marine recall | (1) | | — | | (6) | | — | | (1) | | (14) | | (50) | | (1) | | (58) | | (15) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Impairment due to strategic review | — | | — | | — | | — | | — | | — | | (483) | | — | | (483) | | — | |

| Total adjusting items | $ | (35) | | $ | 173 | | $ | (130) | | $ | (47) | | $ | (73) | | $ | (55) | | $ | (672) | | $ | (209) | | $ | (910) | | $ | (138) | |

The reconciliation from net earnings attributable to Owens Corning to EBIT and Adjusted EBIT, and the reconciliation from EBIT to EBITDA and adjusted EBITDA are shown in the table below (in millions): | | | | | | | | | | | | | | |

| Three Months Ended December 31, | Twelve Months Ended December 31, |

| 2024 | 2023 | 2024 | 2023 |

| NET (LOSS) EARNINGS ATTRIBUTABLE TO OWENS CORNING | $ | (258) | | $ | 131 | | $ | 647 | | $ | 1,196 | |

| Net loss attributable to non-redeemable and redeemable noncontrolling interests | — | | (1) | | — | | (3) | |

| NET (LOSS) EARNINGS | (258) | | 130 | | 647 | | 1,193 | |

| Equity in net earnings of affiliates | 2 | | 1 | | 6 | | 3 | |

| Income tax expense | (43) | | 40 | | 275 | | 401 | |

| (LOSS) EARNINGS BEFORE TAXES | (303) | | 169 | | 916 | | 1,591 | |

| Interest expense, net | 61 | | 14 | | 212 | | 76 | |

| | | | |

| (LOSS) EARNINGS BEFORE INTEREST AND TAXES | (242) | | 183 | | 1,128 | | 1,667 | |

| Less: Adjusting items from above | (672) | | (209) | | (910) | | (138) | |

| ADJUSTED EBIT | $ | 430 | | $ | 392 | | $ | 2,038 | | $ | 1,805 | |

| Net sales | $ | 2,840 | | $ | 2,304 | | $ | 10,975 | | $ | 9,677 | |

| ADJUSTED EBIT as a % of Net sales | 15 | % | 17 | % | 19 | % | 19 | % |

| | | | |

| (LOSS) EARNINGS BEFORE INTEREST AND TAXES | $ | (242) | | $ | 183 | | $ | 1,128 | | $ | 1,667 | |

| Depreciation and amortization | 194 | | 163 | | 677 | | 609 | |

| (LOSS) EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION | (48) | | 346 | | 1,805 | | 2,276 | |

| Less: Adjusting items from above | (672) | | (209) | | (910) | | (138) | |

| Accelerated depreciation and amortization included in restructuring | 5 | | (37) | | (13) | | (101) | |

| ADJUSTED EBITDA | $ | 629 | | $ | 518 | | $ | 2,702 | | $ | 2,313 | |

| Net sales | $ | 2,840 | | $ | 2,304 | | $ | 10,975 | | $ | 9,677 | |

| ADJUSTED EBITDA as a % of Net sales | 22 | % | 22 | % | 25 | % | 24 | % |

Table 3

Owens Corning and Subsidiaries

EPS Reconciliation Schedules

(unaudited)

(in millions, except per share data)

A reconciliation from net earnings attributable to Owens Corning to adjusted earnings and a reconciliation from diluted earnings per share to adjusted diluted earnings per share are shown in the tables below: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Twelve Months Ended |

| | March 31, | June 30, | September 30, | December 31, | December 31, |

| | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 |

RECONCILIATION TO ADJUSTED EARNINGS |

| NET EARNINGS (LOSS) ATTRIBUTABLE TO OWENS CORNING | $ | 299 | | $ | 383 | | $ | 285 | | $ | 345 | | $ | 321 | | $ | 337 | | $ | (258) | | $ | 131 | | $ | 647 | | $ | 1,196 | |

Adjustment to remove adjusting items (a) | 35 | | (173) | | 146 | | 47 | | 73 | | 55 | | 672 | | 209 | | 926 | | 138 |

Adjustment to remove tax (benefit)/expense on adjusting items (b) | (7) | | 46 | | (24) | | (11) | | (10) | | (11) | | (106) | | (46) | | (147) | | (22) |

Adjustment to remove significant tax benefit (c) | — | | — | | — | | — | | — | | — | | (29) | | — | | (29) | | — | |

Adjustment to tax expense/(benefit) to reflect pro forma tax rate (d) | (8) | | 1 | | 2 | | 7 | | 5 | | (1) | | 1 | | (7) | | — | | — | |

ADJUSTED EARNINGS | $ | 319 | | $ | 257 | | $ | 409 | | $ | 388 | | $ | 389 | | $ | 380 | | $ | 280 | | $ | 287 | | $ | 1,397 | | $ | 1,312 | |

| | | | | | | | | | |

| | | | | | | | | | |

RECONCILIATION TO ADJUSTED DILUTED EARNINGS PER SHARE ATTRIBUTABLE TO OWENS CORNING COMMON STOCKHOLDERS |

DILUTED EARNINGS PER COMMON SHARE ATTRIBUTABLE TO OWENS CORNING COMMON STOCKHOLDERS | $ | 3.40 | | $ | 4.17 | | $ | 3.24 | | $ | 3.78 | | $ | 3.65 | | $ | 3.71 | | $ | (2.97) | | $ | 1.46 | | $ | 7.37 | | $ | 13.14 | |

Adjustment to remove adjusting items (a) | 0.40 | | (1.88) | | 1.66 | | 0.51 | | 0.83 | | 0.61 | | 7.72 | | 2.34 | | 10.55 | | 1.52 | |

Adjustment to remove tax (benefit)/expense on adjusting items (b) | (0.08) | | 0.50 | | (0.27) | | (0.12) | | (0.11) | | (0.12) | | (1.22) | | (0.51) | | (1.67) | | (0.24) | |

Adjustment to remove significant tax benefit (c) | — | | — | | — | | — | | — | | — | | (0.33) | | — | | (0.34) | | — | |

Adjustment to tax (benefit)/expense to reflect pro forma tax rate (d) | (0.09) | | 0.01 | | 0.02 | | 0.08 | | 0.06 | | (0.02) | | 0.02 | | (0.08) | | — | | — | |

ADJUSTED DILUTED EARNINGS PER SHARE ATTRIBUTABLE TO OWENS CORNING COMMON STOCKHOLDERS | $ | 3.63 | | $ | 2.80 | | $ | 4.65 | | $ | 4.25 | | $ | 4.43 | | $ | 4.18 | | $ | 3.22 | | $ | 3.21 | | $ | 15.91 | | $ | 14.42 | |

| | | | | | | | | | |

| | | | | | | | | | |

RECONCILIATION TO DILUTED SHARES OUTSTANDING |

Weighted average shares outstanding used for basic earnings per share | 87.3 | | 91.3 | | 87.2 | | 90.5 | | 87.0 | | 90.0 | | 86.0 | | 88.5 | | 86.9 | | 90.1 | |

Non-vested restricted shares and performance shares | 0.6 | | 0.6 | | 0.8 | | 0.8 | | 0.9 | | 0.9 | | 1 | | 1 | | 0.9 | | 0.9 | |

| | | | | | | | | | |

Diluted shares outstanding | 87.9 | | 91.9 | | 88.0 | | 91.3 | | 87.9 | | 90.9 | | 87.0 | | 89.5 | | 87.8 | | 91.0 | |

| | | | | |

| (a) | Please refer to Table 2 "EBIT Reconciliation Schedules" for additional information on adjusting items. Adjusting items shown here also include financing fees of $16 million relative to the term loan amortized to interest expense, net for the twelve months ended December 31, 2024. |

| (b) | The tax impact of adjusting items is based on our expected tax accounting treatment and rate for the jurisdiction of each adjusting item. |

| (c) | Significant tax benefit in 2024 include adjustments related to the expiration of the statute of limitations for the 2020 tax year. There were no significant tax items in 2023. |

| (d) | To compute adjusted earnings, we apply a full year pro forma effective tax rate to each quarter presented. For 2024, we have used an effective tax rate of 24%, which was our 2024 effective tax rate excluding the adjusting items referenced in (a), (b) and (c). For comparability, in 2023, we have used an effective tax rate of 24%, which was our 2023 effective tax rate excluding the adjusting items referenced in (a), (b) and (c). |

Table 4

Owens Corning and Subsidiaries

Consolidated Balance Sheets

(unaudited)

(in millions, except per share data) | | | | | | | | |

| December 31, | December 31, |

| ASSETS | 2024 | 2023 |

| CURRENT ASSETS | | |

| Cash and cash equivalents | $ | 361 | | $ | 1,615 | |

| Receivables, less allowance of $4 at December 31, 2024 and $11 at December 31, 2023 | 1,244 | | 987 | |

| Inventories | 1,587 | | 1,198 | |

| | |

| Other current assets | 186 | | 117 | |

| Total current assets | 3,378 | | 3,917 | |

| Property, plant and equipment, net | 4,164 | | 3,841 | |

| Operating lease right-of-use assets | 414 | | 222 | |

| Goodwill | 2,843 | | 1,392 | |

| Intangible assets, net | 2,688 | | 1,528 | |

| Deferred income taxes | 54 | | 24 | |

| Other non-current assets | 534 | | 313 | |

| TOTAL ASSETS | $ | 14,075 | | $ | 11,237 | |

| LIABILITIES AND EQUITY | | |

| CURRENT LIABILITIES | | |

| Accounts payable | $ | 1,430 | | $ | 1,216 | |

| Current operating lease liabilities | 87 | | 62 | |

| Long-term debt – current portion | 38 | | 431 | |

| Other current liabilities | 742 | | 615 | |

| Total current liabilities | 2,297 | | 2,324 | |

| Long-term debt, net of current portion | 5,116 | | 2,615 | |

| Pension plan liability | 49 | | 69 | |

| Other employee benefits liability | 102 | | 112 | |

| Non-current operating lease liabilities | 375 | | 165 | |

| Deferred income taxes | 719 | | 427 | |

| Other liabilities | 297 | | 315 | |

| Total liabilities | 8,955 | | 6,027 | |

| Redeemable noncontrolling interest | — | | 25 | |

| OWENS CORNING STOCKHOLDERS’ EQUITY | | |

| Preferred stock, par value $0.01 per share (a) | — | | — | |

| Common stock, par value $0.01 per share (b) | 1 | | 1 | |

| Additional paid in capital | 4,228 | | 4,166 | |

| Accumulated earnings | 5,224 | | 4,794 | |

| Accumulated other comprehensive deficit | (691) | | (503) | |

| Cost of common stock in treasury (c) | (3,685) | | (3,292) | |

| Total Owens Corning stockholders’ equity | 5,077 | | 5,166 | |

| Noncontrolling interests | 43 | | 19 | |

| Total equity | 5,120 | | 5,185 | |

| TOTAL LIABILITIES AND EQUITY | $ | 14,075 | | $ | 11,237 | |

(a)10 shares authorized; none issued or outstanding at December 31, 2024 and December 31, 2023

(b)400 shares authorized; 135.5 issued and 85.4 outstanding at December 31, 2024; 135.5 issued and 87.2 outstanding at December 31, 2023

(c)50.1 shares at December 31, 2024 and 48.3 shares at December 31, 2023

Table 5

Owens Corning and Subsidiaries

Consolidated Statements of Cash Flows

(unaudited)

(in millions) | | | | | | | | | | | |

| | Twelve Months Ended

December 31, | | | |

| | 2024 | 2023 | | | |

| NET CASH FLOW PROVIDED BY OPERATING ACTIVITIES | | | | | |

| Net earnings | $ | 647 | | $ | 1,193 | | | | |

| Adjustments to reconcile net earnings to cash provided by operating activities | | | | | |

| Depreciation and amortization | 677 | | 609 | | | | |

| Loss on sale of business | 91 | | — | | | | |

| | | | | |

| Impairment due to strategic review | 483 | | — | | | | |

| Deferred income taxes | (92) | | 26 | | | | |

| Pension annuity settlement charge | — | | 145 | | | | |

| | | | | |

| Stock-based compensation expense | 93 | | 51 | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Gains on sale certain precious metals | (19) | | (2) | | | | |

| | | | | |

| Gain on sale of site | — | | (189) | | | | |

| | | | | |

| Other adjustments to reconcile net earnings to cash provided by operating activities | (15) | | (44) | | | | |

| Change in operating assets and liabilities: | | | | | |

| Changes in receivables, net | 6 | | (26) | | | | |

| Changes in inventories | (43) | | 148 | | | | |

| Changes in accounts payable and accrued liabilities | 13 | | (158) | | | | |

| Changes in other operating assets and liabilities | 71 | | 3 | | | | |

| | | | | |

| Pension fund contribution | (7) | | (18) | | | | |

| Payments for other employee benefits liabilities | (10) | | (11) | | | | |

| | | | | |

| Other | (3) | | (8) | | | | |

| Net cash flow provided by operating activities | 1,892 | | 1,719 | | | | |

| NET CASH FLOW USED FOR INVESTING ACTIVITIES | | | | | |

| Cash paid for property, plant and equipment | (647) | | (526) | | | | |

| | | | | |

| Proceeds from the sale of assets or affiliates | 115 | | 194 | | | | |

| Investment in subsidiaries and affiliates, net of cash acquired | (2,857) | | (6) | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Other | (4) | | (18) | | | | |

| Net cash flow used for investing activities | (3,393) | | (356) | | | | |

| NET CASH FLOW PROVIDED BY (USED FOR) FINANCING ACTIVITIES | | | | | |

| Proceeds from senior revolving credit and receivables securitization facilities | 720 | | — | | | | |

| Payments on senior revolving credit and receivables securitization facilities | (720) | | — | | | | |

| Proceeds from term loan borrowing | 2,784 | | — | | | | |

| Payments on term loan borrowing | (2,800) | | — | | | | |

| Proceeds from long-term debt | 1,968 | | — | | | | |

| Payments on long-term debt | (873) | | — | | | | |

| | | | | |

| Dividends paid | (208) | | (188) | | | | |

| | | | | |

| Purchases of treasury stock | (491) | | (657) | | | | |

| Finance lease payments | (41) | | (33) | | | | |

| Other | (5) | | 1 | | | | |

| Net cash flow provided by (used for) financing activities | 334 | | (877) | | | | |

| Effect of exchange rate changes on cash | (87) | | 30 | | | | |

| Net (decrease) increase in cash, cash equivalents, and restricted cash | (1,254) | | 516 | | | | |

| Cash, cash equivalents and restricted cash at beginning of period | 1,623 | | 1,107 | | | | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | $ | 369 | | $ | 1,623 | | | | |

| | | | | |

| | | | | |

| | | | | |

Table 6

Owens Corning and Subsidiaries

Segment Information

(unaudited)

Roofing

The table below provides a summary of net sales, EBIT and depreciation and amortization expense for the Roofing segment (in millions): | | | | | | | | | | | | | | |

| Three Months Ended December 31, | Twelve Months Ended December 31, |

| 2024 | 2023 | 2024 | 2023 |

| Net sales | $ | 912 | | $ | 928 | | $ | 4,052 | | $ | 4,030 | |

| % change from prior year | -2 | % | 16 | % | 1 | % | 10 | % |

| EBIT | $ | 280 | | $ | 284 | | $ | 1,298 | | $ | 1,174 | |

| EBIT as a % of net sales | 31 | % | 31 | % | 32 | % | 29 | % |

| Depreciation and amortization expense | $ | 16 | | $ | 16 | | $ | 62 | | $ | 64 | |

| EBITDA | $ | 296 | | $ | 300 | | $ | 1,360 | | $ | 1,238 | |

| EBITDA as a % of net sales | 32 | % | 32 | % | 34 | % | 31 | % |

| | | | |

Insulation

The table below provides a summary of net sales, EBIT and depreciation and amortization expense for the Insulation segment (in millions): | | | | | | | | | | | | | | |

| Three Months Ended December 31, | Twelve Months Ended December 31, |

| 2024 | 2023 | 2024 | 2023 |

| Net sales | $ | 926 | | $ | 931 | | $ | 3,692 | | $ | 3,668 | |

| % change from prior year | -1 | % | -3 | % | 1 | % | -1 | % |

| EBIT | $ | 155 | | $ | 150 | | $ | 682 | | $ | 619 | |

| EBIT as a % of net sales | 17 | % | 16 | % | 18 | % | 17 | % |

| Depreciation and amortization expense | $ | 56 | | $ | 51 | | $ | 210 | | $ | 210 | |

| EBITDA | $ | 211 | | $ | 201 | | $ | 892 | | $ | 829 | |

| EBITDA as a % of net sales | 23 | % | 22 | % | 24 | % | 23 | % |

| | | | |

| | | | |

Doors

The table below provides a summary of net sales, EBIT and depreciation and amortization expense for the Doors segment (in millions): | | | | | | | | | | | | | | |

| Three Months Ended December 31, | Twelve Months Ended December 31, |

| 2024 | 2023 | 2024 | 2023 |

| Net sales | $ | 564 | | $ | — | | $ | 1,448 | | $ | — | |

| % change from prior year | N/A | N/A | N/A | N/A |

| EBIT | $ | 29 | | $ | — | | $ | 99 | | $ | — | |

| EBIT as a % of net sales | 5 | % | N/A | 7 | % | N/A |

| Depreciation and amortization expense | $ | 53 | | $ | — | | $ | 133 | | $ | — | |

| EBITDA | $ | 82 | | $ | — | | $ | 232 | | $ | — | |

| EBITDA as a % of net sales | 15 | % | N/A | 16 | % | N/A |

Composites

The table below provides a summary of net sales, EBIT and depreciation and amortization expense for the Composites segment (in millions): | | | | | | | | | | | | | | |

| Three Months Ended December 31, | Twelve Months Ended December 31, |

| 2024 | 2023 | 2024 | 2023 |

| Net sales | $ | 515 | | $ | 514 | | $ | 2,118 | | $ | 2,286 | |

| % change from prior year | — | % | -13 | % | -7 | % | -14 | % |

| EBIT | $ | 47 | | $ | 26 | | $ | 215 | | $ | 242 | |

| EBIT as a % of net sales | 9 | % | 5 | % | 10 | % | 11 | % |

| Depreciation and amortization expense | $ | 47 | | $ | 42 | | $ | 182 | | $ | 172 | |

| EBITDA | $ | 94 | | $ | 68 | | $ | 397 | | $ | 414 | |

| EBITDA as a % of net sales | 18 | % | 13 | % | 19 | % | 18 | % |

| | | | |

| | | | |

Table 7

Owens Corning and Subsidiaries

Corporate, Other and Eliminations

(unaudited)

Corporate, Other and Eliminations

The table below provides a summary of EBIT and depreciation and amortization expense for the Corporate, Other and Eliminations category (in millions): | | | | | | | | | | | | | | |

| Three Months Ended December 31, | Twelve Months Ended December 31, |

| 2024 | 2023 | 2024 | 2023 |

| Restructuring costs | $ | (24) | | $ | (63) | | $ | (86) | | $ | (169) | |

| Acquisition-related integration costs | (9) | | — | | (83) | | — | |

| Gains on sale of certain precious metals | — | | — | | 19 | | 2 | |

| Strategic review-related charges | (13) | | — | | (46) | | — | |

| | | | |

| Loss on sale of business | (91) | | — | | (91) | | — | |

| Recognition of acquisition inventory fair value step-up | — | | — | | (18) | | — | |

| | | | |

| Pension settlement losses | — | | (145) | | — | | (145) | |

| Impairment due to strategic review | (483) | | — | | (483) | | — | |

| Acquisition-related transaction costs | — | | — | | (49) | | — | |

| Gain on sale of Santa Clara, California site | — | | — | | — | | 189 | |

| | | | |

| | | | |

| Paroc marine recall | (50) | | (1) | | (58) | | (15) | |

| | | | |

| | | | |

| Impairment of venture investments | (2) | | — | | (15) | | — | |

| General corporate expense and other | (81) | | (68) | | (256) | | (230) | |

| EBIT - Total Corporate, other and eliminations | $ | (753) | | $ | (277) | | $ | (1,166) | | $ | (368) | |

| Depreciation and amortization | $ | 22 | | $ | 54 | | $ | 90 | | $ | 163 | |

Table 8

Owens Corning and Subsidiaries

Free Cash Flow Reconciliation Schedule

(unaudited)

The reconciliation from net cash flow provided by operating activities to free cash flow, the calculation of operating cash flow conversion, the calculation of free cash flow conversion of adjusted earnings (“free cash flow conversion”) and the reconciliation of operating cash flow conversion to free cash flow conversion are shown in the table below (in millions): | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | Twelve Months Ended December 31, |

| | 2024 | 2023 | 2024 | 2023 |

| NET CASH FLOW PROVIDED BY OPERATING ACTIVITIES | $ | 676 | | $ | 698 | | $ | 1,892 | | $ | 1,719 | |

| Less: Cash paid for property, plant and equipment | (197) | | (136) | | (647) | | (526) | |

| | | | |

| FREE CASH FLOW | $ | 479 | | $ | 562 | | $ | 1,245 | | $ | 1,193 | |

| | | | |

| NET (LOSS) EARNINGS ATTRIBUTABLE TO OWENS CORNING | $ | (258) | | $ | 131 | | $ | 647 | | $ | 1,196 | |

| ADJUSTED EARNINGS (a) | $ | 280 | | $ | 287 | | $ | 1,397 | | $ | 1,312 | |

| OPERATING CASH FLOW CONVERSION (b) | n/a | n/a | 292 | % | 144 | % |

| FREE CASH FLOW CONVERSION (c) | n/a | n/a | 89 | % | 91 | % |

| | | | | |

| (a) | Please refer to Table 3 "EPS Reconciliation Schedules" for the reconciliation from net earnings attributable to Owens Corning to adjusted earnings. |

| (b) | Operating cash flow conversion is defined as Net cash flow provided by operating activities divided by Net income attributable to Owens Corning. |

| (c) | Free cash flow conversion is defined as Free cash flow divided by Adjusted earnings. We compute free cash flow conversion on an annual basis only due to the seasonality of our businesses. |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

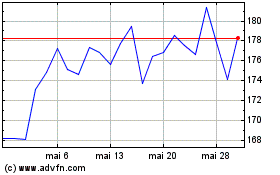

Owens Corning (NYSE:OC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Owens Corning (NYSE:OC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025