- Net income of $1.3 million, or $0.02 per share, reported for

the quarter, which included charges and credits totaling $3.9

million ($3.1 million, after-tax, or $0.05 per share)

- Adjusted net income of $4.4 million, or $0.07 per share,

excluding charges and credits (a non-GAAP measure(1))

- Consolidated revenues of $186.4 million increased 11%

sequentially, driven primarily by the timing of conversion of

orders from backlog along with modest U.S. oil-focused completion

market share gains

- Adjusted EBITDA (a non-GAAP measure(1)) of $21.3 million

increased 38% sequentially

- Received cash proceeds of $10.3 million in connection with the

sale of a previously idled facility

- Purchased $11.5 million principal amount of our 4.75%

convertible senior notes at a discount and $2.4 million of our

common stock

Oil States International, Inc. (NYSE: OIS):

Three Months Ended

% Change

(Unaudited, In Thousands, Except Per Share

Amounts)

June 30, 2024

March 31, 2024

June 30, 2023

Sequential

Year-over-Year

Consolidated results:

Revenues

$

186,383

$

167,262

$

183,529

11%

2%

Operating income (loss)(3)

$

2,045

$

(11,177

)

$

3,269

n.m.

(37)%

Net income (loss)

$

1,301

$

(13,374

)

$

558

n.m.

133%

Adjusted net income (loss), excluding

charges and credits(1)

$

4,391

$

(1,873

)

$

558

n.m.

n.m.

Adjusted EBITDA(1)

$

21,306

$

15,455

$

19,016

38%

12%

Revenues by segment(2):

Offshore Manufactured Products

$

101,556

$

86,857

$

78,647

17%

29%

Well Site Services

46,421

47,292

64,536

(2)%

(28)%

Downhole Technologies

38,406

33,113

40,346

16%

(5 )%

Revenues by destination:

Offshore and international

$

118,625

$

100,180

$

89,817

18%

32%

U.S. land

67,758

67,082

93,712

1%

(28 )%

Operating income (loss) by

segment(2)(3):

Offshore Manufactured Products

$

14,357

$

10,603

$

8,838

35%

62 %

Well Site Services

(535

)

(419

)

4,732

(28)%

n.m.

Downhole Technologies

(1,141

)

(12,079

)

(121

)

91%

n.m.

Adjusted Segment EBITDA(1)(2):

Offshore Manufactured Products

$

20,131

$

15,800

$

12,994

27%

55%

Well Site Services

8,548

6,593

11,425

30%

(25)%

Downhole Technologies

3,114

2,191

4,626

42%

(33)%

___________________

(1)

These are non-GAAP measures. See

“Reconciliations of GAAP to Non-GAAP Financial Information” tables

below for reconciliations to their most comparable GAAP measures as

well as further clarification and explanation.

(2)

In first quarter 2024, certain

short-cycle, consumable product operations historically reported

within the Offshore Manufactured Products segment were integrated

into the Downhole Technologies segment. Historical segment

financial data, backlog and other information were conformed with

the revised segment presentation.

(3)

Operating income (loss) for the three

months ended June 30, 2024 included facility consolidation and

other charges totaling $4.4 million. Operating income (loss) for

the three months ended March 31, 2024 included goodwill impairment,

facility consolidation and other charges totaling $12.5 million.

See “Segment Data” below for additional information.

Oil States International, Inc. reported net income of $1.3

million, or $0.02 per share, and Adjusted EBITDA of $21.3 million

for the second quarter of 2024 on revenues of $186.4 million.

Reported second quarter 2024 net income included charges and

credits of $3.9 million ($3.1 million after-tax, or $0.05 per

share). These results compare to revenues of $167.3 million, a net

loss of $13.4 million, or $0.21 per share, and Adjusted EBITDA of

$15.5 million reported in the first quarter of 2024, which included

a non-cash goodwill impairment charge of $10.0 million ($9.5

million after-tax, or $0.15 per share) and facility consolidation

and other charges of $2.5 million ($2.0 million after-tax, or $0.03

per share).

Oil States’ President and Chief Executive Officer, Cindy B.

Taylor, stated:

“Our second quarter consolidated revenues and Adjusted EBITDA

increased 11% and 38% sequentially – driven by higher

project-related activity within our Offshore Manufactured Products

segment. Our U.S. land revenues in the current quarter reflect our

decision to exit a number of underperforming operations within our

Well Site Services segment in addition to a 3% sequential-quarter

decline in the average rig count.

In the second quarter, our Offshore Manufactured Products

segment revenues increased 17% sequentially totaling $102 million,

while Adjusted Segment EBITDA rose 27% to $20 million. Bookings

totaled $101 million during the quarter compared to $66 million

booked in the first quarter of 2024, yielding backlog of $300

million as of June 30 and a quarterly book-to-bill ratio of

1.0x.

“Revenues reported by our Well Site Services segment decreased

2% on a sequential quarter basis, given the impact of lower

activity and the segment’s exit of four underperforming locations

in the United States over the past six months. Adjusted Segment

EBITDA increased 30% from the first quarter of 2024 – reflective of

higher customer activity in the Gulf of Mexico and the Permian

Basin along with various cost reduction initiatives.

“Our Downhole Technologies segment revenues and Adjusted Segment

EBITDA increased 16% and 42%, respectively, from the first quarter

of 2024, driven primarily by increased completion product and

international perforating sales.

“We continue to focus on improving operations and allocating

capital to efficiently and safely provide our customers with

advanced technologies and services, while enhancing returns,

reducing debt and returning cash to our stockholders. Strong cash

flows from operations totaling $10 million allowed for convertible

debt and share repurchases in the quarter.”

Business Segment Results

In first quarter 2024, certain short-cycle, consumable product

operations historically reported within the Offshore Manufactured

Products segment (legacy frac plugs and elastomer products) were

integrated into our Downhole Technologies segment to better align

with the underlying activity demand drivers and current segment

management structure, as well as provide for additional operational

synergies. Historical segment financial data (GAAP and non-GAAP),

backlog and other information were conformed with the revised

segment presentation.

(See Segment Data and Adjusted Segment EBITDA tables below)

Offshore Manufactured Products

Offshore Manufactured Products reported revenues of $101.6

million, operating income of $14.4 million and Adjusted Segment

EBITDA of $20.1 million in the second quarter of 2024, compared to

revenues of $86.9 million, operating income of $10.6 million and

Adjusted Segment EBITDA of $15.8 million reported in the first

quarter of 2024. The segment recorded charges of $1.5 million in

both the second and first quarters of 2024, associated with the

ongoing consolidation of certain manufacturing and service

locations. Adjusted Segment EBITDA margin was 20% in the second

quarter of 2024 compared to 18% in the first quarter of 2024.

Backlog totaled $300 million as of June 30, 2024. Second quarter

bookings totaled $101 million, compared to bookings of $66 million

in the first quarter – yielding a quarterly book-to-bill ratio of

1.0x (year-to-date ratio of 0.9x).

Well Site Services

Well Site Services reported revenues of $46.4 million, an

operating loss of $0.5 million and Adjusted Segment EBITDA of $8.5

million in the second quarter of 2024, compared to revenues of

$47.3 million, an operating loss of $0.4 million and Adjusted

Segment EBITDA of $6.6 million reported in the first quarter of

2024. The segment recognized $1.9 million and $0.7 million in costs

associated with the consolidation and exit of underperforming

locations during the second and first quarters of 2024.

Additionally, during the second and first quarters of 2024, the

segment recorded costs of $1.0 million and $0.4 million,

respectively, associated with the defense of certain patents

related to its proprietary technologies. Adjusted Segment EBITDA

margin was 18% in the second quarter of 2024, compared to 14% in

the first quarter of 2024.

Downhole Technologies

Downhole Technologies reported revenues of $38.4 million, an

operating loss of $1.1 million and Adjusted Segment EBITDA of $3.1

million in the second quarter of 2024, compared to revenues of

$33.1 million, an operating loss of $12.1 million and Adjusted

Segment EBITDA of $2.2 million in the first quarter of 2024.

Reported results in the first quarter of 2024 included a non-cash

goodwill impairment charge of $10.0 million, recorded in connection

with the segment realignment discussed above.

Corporate

Corporate operating expenses in the second quarter of 2024

totaled $10.6 million.

Interest Expense, Net

Net interest expense totaled $2.1 million in the second quarter

of 2024, which included $0.3 million of non-cash amortization of

deferred debt issuance costs.

Income Taxes

During the second quarter of 2024, the Company recognized tax

benefit of $0.7 million on pre-tax income of $0.6 million, which

included favorable changes in valuation allowances recorded against

deferred tax assets and certain non-deductible expenses. The

Company recognized tax expense of $24 thousand on a pre-tax loss of

$13.4 million in the first quarter of 2024, which included a $7.7

million non-deductible goodwill impairment charge as well as other

non-deductible expenses.

Cash Flows

During the second quarter of 2024, cash flows provided by

operations totaled $10.2 million and capital expenditures totaled

$5.8 million. The Company sold an idle facility and certain other

equipment for proceeds totaling $10.5 million in the quarter.

The Company purchased $11.5 million principal amount of its

4.75% convertible senior notes at 94% of par and $2.4 million (543

thousand shares) of its common stock in the second quarter. A total

of $15.8 million remains available under the Company’s share

repurchase authorization, which extends through February 2025.

Financial Condition

Cash on-hand totaled $25.2 million at June 30, 2024. No

borrowings were outstanding under the Company’s asset-based

revolving credit facility at June 30, 2024.

Conference Call

Information

The call is scheduled for July 29, 2024 at 9:00 a.m. Central

Daylight Time, is being webcast and can be accessed from the

Company’s website at www.ir.oilstatesintl.com. Participants may

also join the conference call by dialing 1 (888) 210-3346 in the

United States or by dialing +1 (646) 960-0253 internationally and

using the passcode 7534957. A replay of the conference call will be

available approximately two hours after the completion of the call

and can be accessed from the Company’s website at

www.ir.oilstatesintl.com.

About Oil States

Oil States International, Inc. is a global provider of

manufactured products and services to customers in the energy,

industrial and military sectors. The Company’s manufactured

products include highly engineered capital equipment and consumable

products. Oil States is headquartered in Houston, Texas with

manufacturing and service facilities strategically located across

the globe. Oil States is publicly traded on the New York Stock

Exchange under the symbol “OIS”.

For more information on the Company, please visit Oil States

International’s website at www.oilstatesintl.com.

Cautionary Language Concerning Forward

Looking Statements

The foregoing contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Forward-looking

statements are those that do not state historical facts and are,

therefore, inherently subject to risks and uncertainties. The

forward-looking statements included herein are based on current

expectations and entail various risks and uncertainties that could

cause actual results to differ materially from those

forward-looking statements. Such risks and uncertainties include,

among others, the level of supply and demand for oil and natural

gas, fluctuations in the current and future prices of oil and

natural gas, the level of exploration, drilling and completion

activity, general global economic conditions, the cyclical nature

of the oil and natural gas industry, geopolitical conflicts and

tensions, the financial health of our customers, the actions of the

Organization of Petroleum Exporting Countries (“OPEC”) and other

producing nations with respect to crude oil production levels and

pricing, the impact of environmental matters, including executive

actions and regulatory efforts to adopt environmental or climate

change regulations that may result in increased operating costs or

reduced oil and natural gas production or demand globally,

consolidation of our customers, our ability to access and the cost

of capital in the bank and capital markets, our ability to develop

new competitive technologies and products, and other factors

discussed in the “Business” and “Risk Factors” sections of the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023, and the subsequently filed Quarterly Report on Form 10-Q

and Periodic Reports on Form 8-K. Readers are cautioned not to

place undue reliance on forward-looking statements, which speak

only as of the date hereof, and, except as required by law, the

Company undertakes no obligation to update those statements or to

publicly announce the results of any revisions to any of those

statements to reflect future events or developments.

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In Thousands, Except Per Share

Amounts)

(Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Revenues:

Products

$

108,579

$

94,329

$

92,630

$

202,908

$

192,470

Services

77,804

72,933

90,899

150,737

187,258

186,383

167,262

183,529

353,645

379,728

Costs and expenses:

Product costs

82,503

75,137

72,659

157,640

151,336

Service costs

59,530

56,814

69,371

116,344

141,429

Cost of revenues (exclusive of

depreciation and amortization expense presented below)

142,033

131,951

142,030

273,984

292,765

Selling, general and administrative

expense

26,373

22,496

23,528

48,869

47,544

Depreciation and amortization expense

14,698

14,195

15,537

28,893

30,793

Impairment of goodwill

—

10,000

—

10,000

—

Other operating (income) expense, net

1,234

(203

)

(835

)

1,031

(518

)

184,338

178,439

180,260

362,777

370,584

Operating income (loss)

2,045

(11,177

)

3,269

(9,132

)

9,144

Interest expense, net

(2,061

)

(2,101

)

(2,059

)

(4,162

)

(4,450

)

Other income (expense), net

652

(72

)

210

580

486

Income (loss) before income taxes

636

(13,350

)

1,420

(12,714

)

5,180

Income tax benefit (provision)

665

(24

)

(862

)

641

(2,464

)

Net income (loss)

$

1,301

$

(13,374

)

$

558

$

(12,073

)

$

2,716

Net income (loss) per share:

Basic

$

0.02

$

(0.21

)

$

0.01

$

(0.19

)

$

0.04

Diluted

0.02

(0.21

)

0.01

(0.19

)

0.04

Weighted average number of common shares

outstanding:

Basic

62,483

62,503

62,803

62,493

62,814

Diluted

62,704

62,503

63,174

62,493

63,161

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In Thousands)

June 30, 2024

December 31, 2023

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

25,188

$

47,111

Accounts receivable, net

203,694

203,211

Inventories, net

217,347

202,027

Prepaid expenses and other current

assets

22,587

35,648

Total current assets

468,816

487,997

Property, plant, and equipment, net

270,878

280,389

Operating lease assets, net

22,825

21,970

Goodwill, net

69,789

79,867

Other intangible assets, net

144,505

153,010

Other noncurrent assets

24,365

23,253

Total assets

$

1,001,178

$

1,046,486

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Current portion of long-term debt

$

616

$

627

Accounts payable

62,322

67,546

Accrued liabilities

38,493

44,227

Current operating lease liabilities

6,711

6,880

Income taxes payable

1,184

1,233

Deferred revenue

34,404

36,757

Total current liabilities

143,730

157,270

Long-term debt

124,339

135,502

Long-term operating lease liabilities

18,864

18,346

Deferred income taxes

5,657

7,717

Other noncurrent liabilities

18,199

18,106

Total liabilities

310,789

336,941

Stockholders’ equity:

Common stock

786

772

Additional paid-in capital

1,133,282

1,129,240

Retained earnings

272,845

284,918

Accumulated other comprehensive loss

(76,162

)

(69,984

)

Treasury stock

(640,362

)

(635,401

)

Total stockholders’ equity

690,389

709,545

Total liabilities and stockholders’

equity

$

1,001,178

$

1,046,486

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In Thousands)

(Unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

(12,073

)

$

2,716

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities:

Depreciation and amortization expense

28,893

30,793

Impairment of goodwill

10,000

—

Stock-based compensation expense

4,056

3,361

Amortization of deferred financing

costs

841

892

Deferred income tax provision

(benefit)

(2,299

)

997

Gains on disposals of assets

(1,355

)

(561

)

Gains on extinguishment of 4.75%

convertible senior notes

(515

)

—

Other, net

(379

)

(267

)

Changes in operating assets and

liabilities:

Accounts receivable

(2,335

)

39,042

Inventories

(16,436

)

(21,197

)

Accounts payable and accrued

liabilities

(9,504

)

(25,924

)

Deferred revenue

(2,353

)

8,237

Other operating assets and liabilities,

net

2,341

653

Net cash flows provided by (used in)

operating activities

(1,118

)

38,742

Cash flows from investing activities:

Capital expenditures

(15,881

)

(17,338

)

Proceeds from disposition of property and

equipment

12,751

690

Other, net

(68

)

(66

)

Net cash flows used in investing

activities

(3,198

)

(16,714

)

Cash flows from financing activities:

Revolving credit facility borrowings

22,619

35,592

Revolving credit facility repayments

(22,619

)

(35,592

)

Purchases of 4.75% convertible senior

notes

(10,846

)

—

Repayment of 1.50% convertible senior

notes

—

(17,315

)

Other debt and finance lease

repayments

(318

)

(226

)

Payment of financing costs

(1,111

)

(95

)

Purchases of treasury stock

(2,374

)

(3,001

)

Shares added to treasury stock as a result

of net share settlements

due to vesting of stock awards

(2,587

)

(1,948

)

Net cash flows used in financing

activities

(17,236

)

(22,585

)

Effect of exchange rate changes on cash

and cash equivalents

(371

)

959

Net change in cash and cash

equivalents

(21,923

)

402

Cash and cash equivalents, beginning of

period

47,111

42,018

Cash and cash equivalents, end of

period

$

25,188

$

42,420

Cash paid (received) for:

Interest

$

3,899

$

4,060

Income taxes, net

1,346

(1,475

)

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

SEGMENT DATA

(In Thousands)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

2024

March 31, 2024

June 30,

2023

June 30,

2024

June 30,

2023

Revenues(1):

Offshore Manufactured Products

Project-driven:

Products

$

59,752

$

53,137

$

45,455

$

112,889

$

94,072

Services

31,024

25,233

24,846

56,257

49,476

90,776

78,370

70,301

169,146

143,548

Military and other products

10,780

8,487

8,346

19,267

15,604

Total Offshore Manufactured Products

101,556

86,857

78,647

188,413

159,152

Well Site Services

46,421

47,292

64,536

93,713

131,594

Downhole Technologies

38,406

33,113

40,346

71,519

88,982

Total revenues

$

186,383

$

167,262

$

183,529

$

353,645

$

379,728

Operating income (loss)(1):

Offshore Manufactured Products(2)

$

14,357

$

10,603

$

8,838

$

24,960

$

16,536

Well Site Services(3)

(535

)

(419

)

4,732

(954

)

11,698

Downhole Technologies(4)

(1,141

)

(12,079

)

(121

)

(13,220

)

1,752

Corporate

(10,636

)

(9,282

)

(10,180

)

(19,918

)

(20,842

)

Total operating income

$

2,045

$

(11,177

)

$

3,269

$

(9,132

)

$

9,144

________________

(1)

In the first quarter 2024, certain

short-cycle, consumable product operations historically reported

within the Offshore Manufactured Products segment were integrated

into the Downhole Technologies segment. Historical segment

financial results were conformed with the revised segment

presentation.

(2)

Operating income for both the three months

ended June 30, 2024 and March 31, 2024 included facility

consolidation charges of $1.5 million, associated with the Offshore

Manufactured Products segment’s ongoing consolidation and

relocation of certain manufacturing and service locations.

(3)

Operating loss for the three months ended

June 30, 2024 and March 31, 2024 included $1.9 million and $0.7

million, respectively, in costs associated with consolidation and

exit of certain underperforming locations. Additionally, during the

three months ended June 30, 2024 and March 31, 2024 the segment

incurred $1.0 million and $0.4 million, respectively, of costs

associated with the defense of certain Well Site Services segment

patents related to proprietary technologies.

(4)

Operating loss for the three months ended

March 31, 2024 included a non-cash goodwill impairment charge of

$10.0 million, recognized in connection with the segment

realignment.

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO

NON-GAAP FINANCIAL INFORMATION

ADJUSTED EBITDA (A)

(In Thousands)

(Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Net income (loss)

$

1,301

$

(13,374

)

$

558

$

(12,073

)

$

2,716

Interest expense, net

2,061

2,101

2,059

4,162

4,450

Income tax provision (benefit)

(665

)

24

862

(641

)

2,464

Depreciation and amortization expense

14,698

14,195

15,537

28,893

30,793

Impairment of goodwill

—

10,000

—

10,000

—

Facility consolidation and other

charges

4,426

2,509

—

6,935

—

Gains on extinguishment of 4.75%

convertible senior notes

(515

)

—

—

(515

)

—

Adjusted EBITDA

$

21,306

$

15,455

$

19,016

$

36,761

$

40,423

________________

(A)

The term Adjusted EBITDA consists of net

income (loss) plus net interest expense, taxes, depreciation and

amortization expense, impairment of goodwill, and facility

consolidation and other charges, less gains on extinguishment of

4.75% convertible senior notes (“2026 Notes”). Adjusted EBITDA is

not a measure of financial performance under generally accepted

accounting principles (“GAAP”) and should not be considered in

isolation from or as a substitute for net income (loss) or cash

flow measures prepared in accordance with GAAP or as a measure of

profitability or liquidity. Additionally, Adjusted EBITDA may not

be comparable to other similarly titled measures of other

companies. The Company has included Adjusted EBITDA as a

supplemental disclosure because its management believes that

Adjusted EBITDA provides useful information regarding its ability

to service debt and to fund capital expenditures and provides

investors a helpful measure for comparing its operating performance

with the performance of other companies that have different

financing and capital structures or tax rates. The Company uses

Adjusted EBITDA to compare and to monitor the performance of the

Company and its business segments to other comparable public

companies and as a benchmark for the award of incentive

compensation under its annual incentive compensation plan. The

table above sets forth reconciliations of Adjusted EBITDA to net

income (loss), which is the most directly comparable measure of

financial performance calculated under GAAP.

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO

NON-GAAP FINANCIAL INFORMATION

ADJUSTED SEGMENT EBITDA

(B)

(In Thousands)

(Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Offshore Manufactured Products:

Operating income

$

14,357

$

10,603

$

8,838

$

24,960

$

16,536

Other income (expense), net

(20

)

41

81

21

246

Depreciation and amortization expense

4,247

3,693

4,075

7,940

8,150

Facility consolidation and other

charges

1,547

1,463

—

3,010

—

Adjusted Segment EBITDA

$

20,131

$

15,800

$

12,994

$

35,931

$

24,932

Well Site Services:

Operating income (loss)

$

(535

)

$

(419

)

$

4,732

$

(954

)

$

11,698

Other income (expense), net

157

(113

)

129

44

240

Depreciation and amortization expense

6,047

6,079

6,564

12,126

12,710

Facility consolidation and other

charges

2,879

1,046

—

3,925

—

Adjusted Segment EBITDA

$

8,548

$

6,593

$

11,425

$

15,141

$

24,648

Downhole Technologies:

Operating income (loss)

$

(1,141

)

$

(12,079

)

$

(121

)

$

(13,220

)

$

1,752

Depreciation and amortization expense

4,255

4,270

4,747

8,525

9,615

Impairment of goodwill

—

10,000

—

10,000

—

Adjusted Segment EBITDA

$

3,114

$

2,191

$

4,626

$

5,305

$

11,367

Corporate:

Operating loss

$

(10,636

)

$

(9,282

)

$

(10,180

)

$

(19,918

)

$

(20,842

)

Other income, net

515

—

—

515

—

Depreciation and amortization expense

149

153

151

302

318

Gains on extinguishment of 4.75%

convertible senior notes

(515

)

—

—

(515

)

—

Adjusted Segment EBITDA

$

(10,487

)

$

(9,129

)

$

(10,029

)

$

(19,616

)

$

(20,524

)

________________

(B)

The term Adjusted Segment EBITDA consists

of operating income (loss) plus other income (expense),

depreciation and amortization expense, impairment of goodwill, and

facility consolidation and other charges, less gains on

extinguishment of 2026 Notes. Adjusted Segment EBITDA is not a

measure of financial performance under GAAP and should not be

considered in isolation from or as a substitute for operating

income (loss) or cash flow measures prepared in accordance with

GAAP or as a measure of profitability or liquidity. Additionally,

Adjusted Segment EBITDA may not be comparable to other similarly

titled measures of other companies. The Company has included

Adjusted Segment EBITDA as supplemental disclosure because its

management believes that Adjusted Segment EBITDA provides useful

information regarding its ability to service debt and to fund

capital expenditures and provides investors a helpful measure for

comparing its operating performance with the performance of other

companies that have different financing and capital structures or

tax rates. The Company uses Adjusted Segment EBITDA to compare and

to monitor the performance of its business segments to other

comparable public companies and as a benchmark for the award of

incentive compensation under its annual incentive compensation

plan. The table above sets forth reconciliations of Adjusted

Segment EBITDA to operating income (loss), which is the most

directly comparable measure of financial performance calculated

under GAAP.

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO

NON-GAAP FINANCIAL INFORMATION

ADJUSTED NET INCOME (LOSS),

EXCLUDING CHARGES AND CREDITS (C) AND

ADJUSTED NET INCOME (LOSS) PER

SHARE, EXCLUDING CHARGES AND CREDITS (D)

(In Thousands, Except Per Share

Amounts)

(Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Net income (loss)

$

1,301

$

(13,374

)

$

558

$

(12,073

)

$

2,716

Impairment of goodwill

—

10,000

—

10,000

—

Facility consolidation and other

charges

4,426

2,509

—

6,935

—

Gains on extinguishment of 4.75%

convertible senior notes

(515

)

—

—

(515

)

—

Total adjustments, before taxes

3,911

12,509

—

16,420

—

Tax benefit

(821

)

(1,008

)

—

(1,829

)

—

Total adjustments, net of taxes

3,090

11,501

—

14,591

—

Adjusted net income (loss), excluding

charges and credits

$

4,391

$

(1,873

)

$

558

$

2,518

$

2,716

Adjusted weighted average number of

diluted common shares outstanding (E)

62,704

62,503

63,174

62,708

63,161

Adjusted diluted net income (loss) per

share, excluding charges and credits (E)

$

0.07

$

(0.03

)

$

0.01

$

0.04

$

0.04

________________

(C)

Adjusted net income (loss), excluding

charges and credits consists of net income (loss) plus impairment

of goodwill and facility consolidation and other charges, less

gains on extinguishment of the 2026 Notes. Adjusted net income

(loss), excluding charges and credits is not a measure of financial

performance under GAAP and should not be considered in isolation

from or as a substitute for net income (loss) as prepared in

accordance with GAAP. The Company has included adjusted net income

(loss), excluding charges and credits as a supplemental disclosure

because its management believes that adjusted net income (loss),

excluding charges and credits provides investors a helpful measure

for comparing its operating performance with previous and

subsequent periods.

(D)

Adjusted net income (loss) per share,

excluding charges and credits is calculated as adjusted net income

(loss), excluding charges and credits divided by the weighted

average number of common shares outstanding. Adjusted net income

(loss) per share, excluding charges and credits is not a measure of

financial performance under GAAP and should not be considered in

isolation from or as a substitute for net income (loss) per share

as prepared in accordance with GAAP. The Company has included

adjusted net income (loss) per share, excluding charges and credits

as a supplemental disclosure because its management believes that

adjusted net income (loss) per share, excluding charges and credits

provides investors a helpful measure for comparing its operating

performance with previous and subsequent periods.

(E)

The calculation of diluted adjusted

earnings per share for the six months ended June 30, 2024 included

215 thousand shares issuable pursuant to outstanding performance

share units.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240729495423/en/

Lloyd A. Hajdik Oil States International, Inc. Executive Vice

President, Chief Financial Officer and Treasurer (713) 652-0582

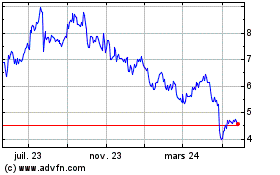

Oil States (NYSE:OIS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

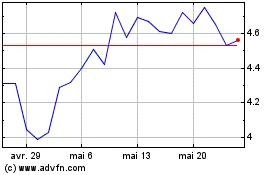

Oil States (NYSE:OIS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024