Form N-CSR - Certified Shareholder Report

27 Décembre 2024 - 7:52PM

Edgar (US Regulatory)

|

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

|

|

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

|

|

|

|

|

|

MANAGEMENT INVESTMENT COMPANIES

|

|

|

|

|

|

|

Investment Company Act file number:

|

(811–05740)

|

|

|

|

|

|

|

Exact name of registrant as specified in charter:

|

Putnam Managed Municipal Income Trust

|

|

|

|

|

|

|

Address of principal executive offices:

|

100 Federal Street, Boston, Massachusetts 02110

|

|

|

|

|

|

|

Name and address of agent for service:

|

Stephen Tate, Vice President

|

|

|

|

|

|

|

|

Boston, Massachusetts 02110

|

|

|

|

|

|

|

Copy to:

|

Bryan Chegwidden, Esq.

|

|

|

|

|

|

|

|

1211 Avenue of the Americas

|

|

|

|

|

|

|

|

Boston, Massachusetts 02199

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

(617) 292-1000

|

|

|

|

|

|

|

Date of fiscal year end:

|

October 31, 2024

|

|

|

|

|

|

|

Date of reporting period:

|

Novenmber 1, 2023 – October 31, 2024

|

|

|

|

|

|

Item 1. Report to Stockholders:

|

|

|

|

|

|

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

|

Putnam

Managed Municipal

Income Trust

Annual report

10 | 31 | 24

The fund has adopted a managed distribution policy (the “Distribution Policy”) with the goal of providing shareholders with a consistent, although not guaranteed, monthly distribution. In accordance with the Distribution Policy, the fund currently expects to make monthly distributions to common shareholders at a distribution rate per share of $0.0238. Distributions may include ordinary and/or tax-exempt income, net capital gains, and/or a return of capital of your investment in the fund. You should not draw any conclusions about the fund’s investment performance from the amount of this distribution or from the terms of the Distribution Policy. The Distribution Policy provides that the Board of Trustees may amend or terminate the Distribution Policy at any time without prior notice to fund shareholders.

Message from the Trustees

December 18, 2024

Dear Fellow Shareholder:

We are pleased to provide the annual report of Putnam Managed Municipal Income Trust for the twelve-month reporting period ended October 31, 2024. Please read on for Fund performance information during the Fund’s reporting period.

We extend our sincere thanks to Kenneth R. Leibler, who retired from the Board on June 30, 2024, after serving as a Trustee since 2006 and Chair of the Board since 2018. At the same time, Barbara M. Baumann, a Trustee since 2010 and Vice Chair from 2022 to 2024, was appointed Chair of the Board. Effective May 17, 2024, Gregory G. McGreevey joined the Board as an independent Trustee, having previously served as Senior Managing Director, Investments, at Invesco Ltd. until 2023.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. For more information on your Fund, visit www.franklintempleton.com. Here you can gain immediate access to market and investment information, including:

|

|

|

• Fund prices and performance, |

|

• Market insights and commentaries from our portfolio managers, and |

|

• A host of educational resources. |

We look forward to helping you meet your financial goals.

Data are historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and net asset value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart are at NAV. See below and pages 7–8 for additional performance information, including fund returns at market price. Index results should be compared with fund performance at NAV. Fund results reflect the use of leverage, while index results are unleveraged.

Important data provider notices and terms available at www.franklintempletondatasources.com

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 10/31/24. See above and pages 7–8 for additional fund performance information. Index descriptions can be found on page 15.

All Bloomberg indices are provided by Bloomberg Index Services Limited.

|

| 2 Managed Municipal Income Trust |

Paul, how did municipal bonds perform during the 12-month period ended October 31, 2024?

Municipal (muni) bonds fared well over the 12 months under review, with the Bloomberg Municipal Bond Index returning 9.70%. Several factors contributed to muni bond performance, including declining interest rates, cooling inflation, and resilient economic growth.

The muni sector recorded particularly strong performance in the last two months of 2023, which witnessed increased optimism in connection with a shift in the U.S. Federal Reserve’s (Fed’s) rhetoric and investors bringing forward their expectations of monetary policy easing. Despite these expectations, the Fed kept the fed funds rate at a target range of 5.25%–5.50% into year-end, with accompanying statements indicating that it needed to assess the full effects of the tightening that had been delivered. The Fed remained cautious throughout the first half of 2024, as it waited for further confirmation of a sustained disinflationary process. September finally brought relief, with the Fed delivering its initial — and outsized — interest-rate cut that took the fed funds rate to a target range of 4.75%–5.00%.

|

| Managed Municipal Income Trust 3 |

Allocations are shown as a percentage of the fund’s net assets (common and preferred shares) as of 10/31/24. Cash and Equivalents, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Holdings and allocations may vary over time.

Inflation moved lower during the year, despite some bumps in the road in early 2024 when progress seemed to stall. The headline consumer price index (CPI) fell to 2.4% year-over-year (y/y) in September, down from the prior September’s 3.7% y/y reading. Core CPI, which excludes the volatile food and energy sectors, moved from 4.1% y/y in September 2023 to 3.3% y/y 12 months later. At the same time, even though there were several recession scares, economic growth remained robust. There were signs of a normalizing labor market and a modest shift in consumer expenditures from discretionary to essential spending, but gross domestic product (GDP) continued to grow at a healthy pace. The most recent data release, an advance estimate of 2024’s third-quarter GDP, showed an annualized increase of 2.8% for the three-month period ended October 31, 2024. This followed a 3.0% expansion recorded during the second quarter of 2024.

How did the fund perform during the reporting period?

For the 12 months ended October 31, 2024, the fund, at net asset value, recorded a gain of 23.58%, significantly outperforming its benchmark, the Bloomberg Municipal Bond Index. The fund also fared better than the median return of its Lipper peer group, High Yield Municipal Debt Funds [closed-end].

What was your strategy during the reporting period?

We closely monitored our credit positioning throughout the period. We remained

|

| 4 Managed Municipal Income Trust |

somewhat cautious on lower-rated cohorts and maintained a majority of our exposure in the lower tiers of the investment-grade universe and the highest-rated portions of the high-yield segment.

Given the shape of the muni bond yield curve, we favored bonds with longer-term maturities. In terms of sector allocations, the fund was invested in a wide range of sectors, including charter schools, retirement community, private higher education, housing-backed and land infrastructure bonds.

We continue to find opportunities across the muni bond market, and look for value in rating, sector, and coupon dislocations.

What were the fund’s distributions during the reporting period?

The fund’s distributions are fixed at a targeted rate. The targeted rate is not expected to vary with each distribution but may change from time to time. During the last fiscal year, the fund made monthly distributions totaling $0.2856 per share, which were characterized as $0.213629 per share of net investment income and $0.071971 per share of return of capital. Of the fund’s return of capital, the entire amount was the result of the fund’s targeted distribution policy. This policy has no impact on the fund’s investment strategy and may reduce the fund’s net asset value. The fund’s manager believes the policy helps maintain the fund’s competitiveness and may benefit the fund’s market price and premium/discount to the fund’s net asset value. [Please see the Distributions to shareholders note on page 53 for more information about fund distributions.]

How did the fund use derivatives during the period?

We used U.S. Treasury futures to manage the fund’s term structure and duration positioning.

As we approach 2025, what is your outlook?

We are constructive on tax-exempt muni bonds. Our view is informed by what we view as robust credit fundamentals, attractive valuations, and a supportive technical backdrop. Retail investor demand has been significant over the past several months and, going forward, we expect that the historically elevated yields on offerings should continue to draw flows into the sector. We believe muni bond yields remain elevated versus historical levels, indicating compelling value, and these bonds can be particularly appealing on a tax-adjusted basis as they remain higher than yields available on many other alternatives, in our view.

Fundamentals in the muni market remain stable and should be supportive of the asset class over the medium to long term, in our view. However, we believe the credit environment is normalizing as certain tailwinds that have been contributing to credit strength over recent years are waning somewhat. As the economy cools and inflation eases, tax revenue growth across state and local governments is projected to moderate or decline. While we believe healthy financial positions and large reserves mean that muni issuers will likely be able to easily deal with any potential challenges, we are still watching this space. We are not overly worried about a spike in defaults, but the possibility of more challenging macroeconomic conditions will mean that our rigorous bottom-up muni bond research and historically strong security selection will be particularly important in finding those credits that have the potential to outperform across market cycles.

In the U.S., Fed Chair Jerome Powell made it clear that, despite the central bank’s decision for an initial outsized rate cut, the economy has remained resilient, and further moves are unlikely to be as large. We agree with his assessment. Most economic data released during October pointed to an economy that

|

| Managed Municipal Income Trust 5 |

is not in need of aggressive monetary easing, in our view. The most recent summary of economic projections (the so-called “dot plot”) indicates that Federal Open Market Committee members expect a longer-run neutral rate of 2.9%. However, given the continued strength exhibited by the U.S. economy, we think that this easing cycle could be shallower than what is expected by the Fed and many other market participants. In fact, our economists envision a terminal fed funds target range of 3.75%–4.00%. While this is higher than what the Fed is penciling in, we would like to note that its estimate of the neutral rate has been inching up over the past year and might rise further still. Consequently, we expect that volatility in fixed income markets is likely going forward, as there is potential for disappointment if the Fed does not take interest rates as low as anticipated. It is our view that these instances can potentially provide an attractive entry point into the tax-exempt muni bond market. We believe there are opportunities to find value within the muni bond sector across the credit spectrum.

Thank you, Paul, for your time and insights today.

The foregoing information reflects our views, which are subject to change. They are not meant as investment advice. Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

|

| 6 Managed Municipal Income Trust |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended October 31, 2024, the end of its most recent fiscal year. In accordance with regulatory requirements for closed-end funds, we also include performance information as of the most recent calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares.

Annualized fund performance

Total return and comparative index results for periods ended 10/31/24

|

|

|

|

|

|

| |

Life of fund |

|

|

|

|

| |

(since 2/24/89) |

10 years |

5 years |

3 years |

1 year |

| Net asset value |

5.77% |

3.49% |

1.27% |

–1.23% |

23.58% |

| Market price |

5.44 |

3.98 |

0.26 |

–3.85 |

27.95 |

| Bloomberg Municipal |

|

|

|

|

|

| Bond Index |

5.15 |

2.30 |

1.05 |

–0.30 |

9.70 |

Performance assumes reinvestment of distributions and does not account for taxes.

Performance includes the deduction of management fees and administrative expenses.

Index results should be compared with fund performance at net asset value. Fund results reflect the use of leverage, while index results are unleveraged.

Important data provider notices and terms available at www.franklintempletondatasources.com

Past performance does not indicate future results.

|

| Managed Municipal Income Trust 7 |

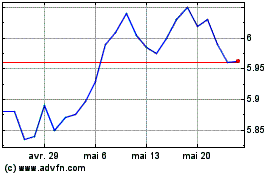

Fund price and distribution information For the 12-month period ended 10/31/24

|

|

|

| Distributions |

|

| Number |

12 |

| Income1 |

$0.213629 |

| Capital gains2 |

— |

| Return of capital* |

0.071971 |

| Total |

$0.285600 |

| |

Series A |

Series C |

| Distributions — preferred shares |

(240 shares) |

(1,507 shares) |

| Income1 |

$5,849.82 |

$2,969.41 |

| Capital gains2 |

— |

— |

| Total |

$5,849.82 |

$2,969.41 |

| Share value |

NAV |

Market price |

| 10/31/23 |

$5.75 |

$5.14 |

| 10/31/24 |

6.81 |

6.28 |

| Current distribution rate (end of period) |

NAV |

Market price |

| Current distribution rate3 |

4.19% |

4.55% |

| Taxable equivalent4 |

7.08 |

7.69 |

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

1 For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes.

2 Capital gains, if any, are taxable for federal and, in most cases, state purposes.

3 Most recent distribution, including any return of capital and excluding capital gains, annualized and divided by NAV or market price at period-end.

4 Assumes maximum 40.80% federal tax rate for 2024. Results for investors subject to lower tax rates would not be as advantageous.

* See page 59.

Annualized fund performance as of most recent calendar quarter

Total return for periods ended 9/30/24

|

|

|

|

|

|

| |

Life of fund |

|

|

|

|

| |

(since 2/24/89) |

10 years |

5 years |

3 years |

1 year |

| Net asset value |

5.86% |

3.88% |

1.79% |

–0.62% |

21.98% |

| Market price |

5.55 |

4.50 |

1.35 |

–3.04 |

24.71 |

See the discussion following the fund performance table on page 7 for information about the calculation of fund performance.

|

| 8 Managed Municipal Income Trust |

Information about the fund’s goal, investment strategies, principal risks, and fundamental investment policies

Goal

The goal of the fund is to seek a high level of current income exempt from federal income tax.

The fund’s main investment strategies and related risks

This section contains detail regarding the fund’s main investment strategies and the related risks you face as a fund shareholder. It is important to keep in mind that risk and reward generally go hand in hand; the higher the potential reward, the greater the risk.

The fund intends to achieve its goal by investing in a diversified portfolio of tax-exempt municipal securities which Putnam Management believes does not involve undue risk to income or principal. Up to 60% of the fund’s assets may consist of high-yield tax-exempt municipal securities that are below investment grade and involve special risk considerations. The fund also uses leverage, primarily by issuing preferred shares in an effort to enhance the returns for the common shareholders. The fund’s shares trade on a stock exchange at market prices, which may be lower than the fund’s net asset value.

• Tax-exempt investments. These investments are issued by or for states, territories or possessions of the United States or by their political subdivisions, agencies, authorities or other government entities, and the income from these investments is exempt from federal income tax. These investments are issued to raise money for public purposes, such as loans for the construction of housing, schools or hospitals, or to provide temporary financing in anticipation of the receipt of taxes and other revenue. They also include private activity obligations of public authorities to finance privately owned or operated facilities. Changes in law or adverse determinations by the Internal Revenue Service could make the income from some of these obligations taxable.

Interest income from private activity bonds may be subject to federal AMT for individuals. Corporate shareholders will be required to include all exempt interest dividends in determining their federal AMT. For more information, including possible state, local and other taxes, contact your tax advisor.

• General obligations. These are backed by the issuer’s authority to levy taxes and are considered an obligation of the issuer. They are payable from the issuer’s general unrestricted revenues, although payment may depend upon government appropriation or aid from other governments. These investments may be vulnerable to legal limits on a government’s power to raise revenue or increase taxes, as well as economic or other developments that can reduce revenues.

• Revenue obligations. These are payable from revenue earned by a particular project or other revenue source. They include private activity bonds such as industrial development bonds, which are paid only from the revenues of the private owners or operators of the facilities. Investors can look only to the revenue generated by the project or the private company operating the project rather than the credit of the state or local government authority issuing the bonds. Revenue obligations are typically subject to greater credit risk than general obligations because of the relatively limited source of revenue.

• Tender option bonds. The fund may leverage its assets through the use of proceeds received through tender option bond transactions. In a tender option bond transaction, the fund transfers a fixed-rate municipal bond to a special purpose entity trust (TOB trust) sponsored by a broker. The TOB trust funds the purchase of the fixed rate bonds by issuing short-term floating-rate bonds to third parties and allowing the fund to retain the residual interest in the TOB trust’s assets and cash flows, which are in the form of inverse floating rate bonds. The inverse floating rate bonds held by the fund give the fund the right to (1) cause the holders of the floating rate bonds to tender their notes at par, and (2) to have the fixed-rate bond held by the TOB trust transferred to the fund, causing the TOB trust to be liquidated. The fund will look through to the underlying municipal bond held by a TOB trust for purposes of the fund’s 80% policy.

• Interest rate risk. The values of bonds and other debt instruments usually rise and fall in response to changes in interest rates. Interest rates can change in response to the supply and demand for credit, government and/or central bank monetary policy and action, inflation rates, and other factors. Declining interest rates generally result in an increase in the value of existing debt instruments, and rising interest rates generally result in a decrease in the value of existing debt instruments. Changes in a debt instrument’s value usually will not affect the amount of interest income paid to the fund, but will affect the value of the fund’s shares.

|

| Managed Municipal Income Trust 9 |

Interest rate risk is generally greater for investments with longer maturities.

Some investments give the issuer the option to call or redeem an investment before its maturity date. If an issuer calls or redeems an investment during a time of declining interest rates, we might have to reinvest the proceeds in an investment offering a lower yield, and, therefore, the fund might not benefit from any increase in value as a result of declining interest rates.

• Credit risk. Investors normally expect to be compensated in proportion to the risk they are assuming. Thus, debt of issuers with poor credit prospects usually offers higher yields than debt of issuers with more secure credit. Higher-rated investments generally have lower credit risk.

We invest in a combination of higher-rated and lower-rated investments. The fund’s lower-rated investments consist of higher-yielding, higher-risk debt securities that are rated below BBB or its equivalent at the time of purchase by a nationally recognized securities rating agency rating the investment, or are unrated investments that we think are of comparable quality. We may invest up to 60% of the fund’s total assets in debt investments rated, at the time of purchase, BB and below or its equivalent by each agency rating such investments, including investments in the lowest rating category of the rating agency, and in unrated investments that we think are of comparable quality. We will not necessarily sell an investment if its rating is reduced after we buy it.

Investments rated below BBB or its equivalent are below-investment-grade (sometimes referred to as “junk bonds”) can be more sensitive to changes in markets, credit conditions, and interest rates and may be considered speculative. This rating reflects a greater possibility that the issuers may be unable to make timely payments of interest and principal and thus default. If default occurs, or is perceived as likely to occur, the value of the investment will usually be more volatile and is likely to fall. The value of a debt instrument may also be affected by changes in, or perceptions of, the financial condition of the issuer, borrower, counterparty, or other entity, or underlying collateral or assets, or changes in, or perceptions of, specific or general market, economic, industry, political, regulatory, geopolitical, environmental, public health, and other conditions. A default or expected default could also make it difficult for us to sell the investment at a price approximating the value we had previously placed on it. Tax-exempt debt, particularly lower-rated tax-exempt debt, usually has a more limited market than taxable debt, which may at times make it difficult for us to buy or sell certain debt instruments or to establish their fair value. Credit risk is generally greater for investments that are required to make interest payments only at maturity rather than at intervals during the life of the investment.

Credit ratings are based largely on the issuer’s historical financial condition and a rating agency’s investment analysis at the time of rating. The rating assigned to any particular investment does not necessarily reflect the issuer’s current financial condition, and does not reflect an assessment of the investment’s volatility or liquidity. Although we consider credit ratings in making investment decisions, we perform our own investment analysis and do not rely only on ratings assigned by the rating agencies. The amount of information about the financial condition of issuers of tax-exempt debt may not be as extensive as that which is made available by companies whose stock or debt is publicly traded. Our success in achieving the fund’s investment objective may depend more on our own credit analysis when we buy lower-quality bonds than when we buy higher quality bonds.

We may have to participate in legal proceedings or take possession of and manage assets that secure the issuer’s obligations. Our ability to enforce rights in bankruptcy proceedings may be more limited than would be the case for taxable debt. This could increase the fund’s operating expenses and decrease its net asset value. Any income that arises from ownership or operation of assets would be taxable.

Although investment-grade investments generally have lower credit risk, they may share some of the risks of lower-rated investments.

Bond investments may be more susceptible to downgrades or defaults during economic downturns or other periods of economic stress, which in turn could affect the market values and marketability of many or all bond obligations of issuers in a state, U.S. territory, or possession. For example, the novel coronavirus (COVID-19) pandemic has significantly stressed the financial resources of many tax-exempt debt issuers. This may make it less likely that issuers can meet their financial obligations when due and may adversely impact the value of their bonds, which could negatively impact the performance of the fund. In light of the uncertainty surrounding the magnitude, duration, reach, costs and effects of the COVID-19 pandemic, as well as actions that have been or could be taken by governmental authorities or other third parties, it is difficult to predict the level of financial stress and duration of such stress issuers may experience.

|

| 10 Managed Municipal Income Trust |

We may buy investments that are insured as to the payment of principal and interest in the event the issuer defaults. Any reduction in the insurer’s ability to pay claims may adversely affect the value of insured investments and, consequently, the value of the fund’s shares.

• Focus of investments. We may make significant investments in a particular segment of the tax-exempt debt market, such as tobacco settlement bonds or revenue bonds for health care facilities, housing or airports. We may also make significant investments in the debt of issuers located in the same state. These investments may cause the value of the fund’s shares to fluctuate more than the values of shares of funds that invest in a greater variety of investments. Certain events may adversely affect all investments within a particular market segment. Examples include legislation or court decisions, concerns about pending legislation or court decisions, and lower demand for the services or products provided by a particular market segment. Investing in issuers located in the same state may make the fund more vulnerable to that state’s economy and to factors affecting its tax-exempt issuers, such as their ability to collect revenues to meet payment obligations.

At times, the fund and other accounts that Putnam Management and its affiliates manage may own all or most of the debt of a particular issuer. This concentration of ownership may make it more difficult to sell, or to determine the fair value of, these investments.

• Derivatives. We may engage in a variety of transactions involving derivatives, such as municipal rate locks, tender option bond transactions, futures and swap contracts, although they do not represent a primary focus of the fund. Derivatives are financial instruments whose value depends upon, or is derived from, the value of something else, such as one or more underlying investments, pools of investments or indexes. We may make use of “short” derivative positions, the values of which typically move in the opposite direction from the price of the underlying investment, pool of investments, or index. We may use derivatives both for hedging and non-hedging purposes, such as to modify the behavior of an investment so that it responds differently than it would otherwise respond to changes in a particular interest rate or to modify the fund’s duration. Derivatives may increase or decrease an investment’s exposure to long- or short-term interest rates or cause the value of an investment to move in the opposite direction from prevailing short-term or long-term interest rates. For example, we may use interest rate swaps to hedge or gain exposure to interest rate risk, or to hedge or gain exposure to inflation. We may also use derivatives to adjust the fund’s positioning on the yield curve (a line that plots interest rates of bonds having equal credit quality but differing maturity dates) or to take tactical positions along the yield curve. However, we may also choose not to use derivatives, based on our evaluation of market conditions or the availability of suitable derivatives. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

Derivatives involve special risks and may result in losses. The successful use of derivatives depends on our ability to manage these sophisticated instruments. Some derivatives are “leveraged,” which means they provide the fund with investment exposure greater than the value of the fund’s investment in the derivatives. As a result, these derivatives may magnify or otherwise increase investment losses to the fund. The risk of loss from certain short derivative positions is theoretically unlimited. The value of derivatives may move in unexpected ways due to unanticipated market movements, the use of leverage, imperfect correlation between the derivative instrument and the reference asset, or other factors, especially in unusual market conditions, and volatility in the value of derivatives could adversely impact the fund’s returns, obligations and exposures.

Other risks arise from the potential inability to terminate or sell derivative positions. Derivatives may be subject to liquidity risk due to the fund’s obligation to make payments of margin, collateral, or settlement payments to counterparties. A liquid secondary market may not always exist for the fund’s derivative positions. In fact, certain over-the-counter instruments (investments not traded on an exchange) may not be liquid. Over-the-counter instruments also involve the risk that the other party to the derivative transaction may not be willing or able to meet its obligations with respect to the derivative transaction. The risk of a party failing to meet its obligations may increase if the fund has significant exposure to that counterparty. Derivative transactions may also be subject to operational risk, including due to documentation and settlement issues, system failures, inadequate controls and human error, and legal risk due to insufficient documentation, insufficient capacity or authority of a counterparty, or issues with respect to the legality or enforceability of the derivative contract.

|

| Managed Municipal Income Trust 11 |

• Preferred share leverage risk. Leverage from the issuance of preferred shares creates risks, including the likelihood of greater volatility of net asset value and market price of, and distributions from, the fund’s common shares and the risk that fluctuations in dividend rates on preferred shares may affect the return to common shareholders. If the income from the investments purchased with proceeds received from leverage is not sufficient to cover the cost of leverage, the amount of income available for distribution to common shareholders will be less than if leverage had not been used. While the fund has preferred shares outstanding, an increase in short-term interest rates could result in an increased cost of leverage, which could adversely affect the fund’s income available for distribution to common shareholders. In connection with its preferred shares, the fund is required to maintain specified asset coverage mandated by applicable federal securities laws and by the fund’s Amended and Restated Bylaws. The fund may be required to dispose of portfolio investments on unfavorable terms if market fluctuations or other factors cause the required asset coverage to be less than the prescribed amount. There can be no assurance that a leveraging strategy will be successful.

• Liquidity and illiquid investments. We may invest the fund’s assets in illiquid investments, which may be considered speculative and which may be difficult to sell. The sale of many of these investments is prohibited or limited by law or contract. Some investments may be difficult to value for purposes of determining the fund’s net asset value. Certain other investments may not have an active trading market due to adverse market, economic, industry, political, regulatory, geopolitical, environmental, public health, and other conditions, including investors trying to sell large quantities of a particular investment or type of investment, or lack of market makers or other buyers for a particular investment or type of investment. We may not be able to sell the fund’s illiquid investments when we consider it desirable to do so, or we may be able to sell them only at less than their value.

• Market risk. The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political or financial market conditions, investor sentiment and market perceptions (including perceptions about monetary policy, interest rates, inflation or the risk of default); government actions (including protectionist measures, intervention in the financial markets or other regulation, and changes in fiscal, monetary or tax policies); geopolitical events or changes (including natural disasters, terrorism and war); outbreaks of infectious illnesses or other widespread public health issues (including epidemics and pandemics); and factors related to a specific issuer, geography, industry or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. These risks may be exacerbated during economic downturns or other periods of economic stress.

The COVID-19 pandemic and efforts to contain its spread have resulted in, among other effects, significant market volatility, exchange trading suspensions and closures, declines in global financial markets, higher default rates, significant changes in fiscal and monetary policies, and economic downturns and recessions. The effects of the COVID-19 pandemic have negatively affected, and may continue to negatively affect, the global economy, the economies of the United States and other individual countries, the financial performance of individual issuers, sectors, industries, asset classes, and markets, and the value, volatility, and liquidity of particular securities and other assets. The effects of the COVID-19 pandemic also are likely to exacerbate other risks that apply to the fund, including the risks disclosed in this prospectus, which could negatively impact the fund’s performance and lead to losses on your investment in the fund. The duration of the COVID-19 pandemic and its effects cannot be determined with certainty.

• Management and operational risk. The fund is actively managed and its performance will reflect, in part, our ability to make investment decisions that seek to achieve the fund’s investment objective. There is no guarantee that the investment techniques, analyses, or judgments that we apply in making investment decisions for the fund will produce the intended outcome or that the investments we select for the fund will perform as well as other securities that were not selected for the fund. As a result, the fund may underperform its benchmark or other funds with a similar investment goal and may realize losses. In addition, we, or the fund’s other service providers, may experience disruptions or operating errors that could negatively impact the fund. Although service providers may have operational risk management policies and procedures and take appropriate precautions to avoid and mitigate risks that could lead to disruptions and operating errors, it may not be possible to identify all of the operational risks that may affect the fund or to develop processes and controls to completely eliminate or mitigate their occurrence or effects.

|

| 12 Managed Municipal Income Trust |

• Other investments. In addition to the main investment strategies described above, the fund may also make other types of investments, which may produce taxable income and be subject to other risks. The fund may also invest in cash or cash equivalents, including money market instruments or short-term instruments such as commercial paper, bank obligations (e.g., certificates of deposit and bankers’ acceptances), repurchase agreements, and U.S. Treasury bills or other government obligations. The fund may also from time to time invest all or a portion of its cash balances in money market and/or short-term bond funds advised by Putnam Management or its affiliates. The percentage of the fund invested in cash and cash equivalents and such money market and short-term bond funds is expected to vary over time and will depend on various factors, including market conditions, and our assessment of the cash level that is appropriate to allow the fund to pursue investment opportunities as they arise. Large cash positions may dampen performance and may prevent the fund from achieving its goal.

• Temporary defensive strategies. In response to adverse market, economic, political or other conditions, we may take temporary defensive positions, such as investing some or all of the fund’s assets in cash and cash equivalents, that differ from the fund’s usual investment strategies. However, we may choose not to use these temporary defensive strategies for a variety of reasons, even in very volatile market conditions. If we do employ these strategies, the fund may miss out on investment opportunities and may not achieve its goal. Additionally, while temporary defensive strategies are mainly designed to limit losses, they may not work as intended.

• Changes in policies. The Trustees may change the fund’s goal, investment strategies and other policies without shareholder approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement was specifically disclosed in the fund’s prospectus, statement of additional information or shareholder report and is otherwise still in effect.

The fund’s fundamental investment policies

The fund has adopted the following investment restrictions which may not be changed without the affirmative vote of a “majority of the outstanding voting securities” of the fund (which is defined in the Investment Company Act of 1940, as amended, (the “1940 Act”) to mean the affirmative vote of the lesser of (1) more than 50% of the outstanding common shares and outstanding preferred shares of the fund, each voting as a separate class, or (2) 67% or more of the outstanding common shares and of the outstanding preferred shares, each voting as a separate class, present at a meeting if more than 50% of the outstanding shares of each class are represented at the meeting in person or by proxy).

Under normal market conditions, the fund invests at least 80% of its assets in tax-exempt municipal securities.

Additionally, the fund may not:

1. Issue senior securities, as defined in the 1940 Act, other than shares of beneficial interest with preference rights, except to the extent such issuance might be involved with respect to borrowings described under restriction [regarding borrowing] below or with respect to transactions involving futures contracts or the writing of options within the limits described in the prospectus.

2. Borrow money, except that the fund may borrow amounts not exceeding 15% of the value (taken at the lower of cost or current value) of its total assets (not including the amount borrowed) at the time the borrowing is made for temporary purposes (including repurchasing its shares while effecting an orderly liquidation of portfolio securities) or for emergency purposes.

3. Underwrite securities issued by other persons except to the extent that, in connection with the disposition of its portfolio investments, it may be deemed to be an underwriter under the federal securities laws.

4. Purchase or sell real estate, although it may purchase securities of issuers which deal in real estate, securities which are secured by interests in real estate, and securities which represent interests in real estate, and it may acquire and dispose of real estate or interests in real estate acquired through the exercise of its rights as a holder of debt obligations secured by real estate or interests therein.

5. Purchase or sell commodities or commodity contracts, except that the fund may purchase and sell financial futures contracts and options and may enter into foreign exchange contracts and other financial transactions not involving physical commodities.

6. Make loans, except by purchase of debt obligations in which the fund may invest consistent with its investment policies (including without limitation debt obligations issued by other Putnam funds), by entering into repurchase agreements or by lending its portfolio securities.

|

| Managed Municipal Income Trust 13 |

7. With respect to 75% of its total assets, invest in the securities of any issuer if, immediately after such investment, more than 5% of the total assets of the fund (taken at current value) would be invested in the securities of such issuer; provided that this limitation does not apply to obligations issued or guaranteed as to interest or principal by the U.S. Government or its agencies or instrumentalities.

8. With respect to 75% of its total assets, acquire more than 10% of the outstanding voting securities of any issuer.

9. Purchase securities (other than securities of the U.S. Government, its agencies or instrumentalities or tax-exempt securities, except tax-exempt securities backed only by the assets and revenues of non-governmental issuers) if, as a result of such purchase, more than 25% of the fund’s total assets would be invested in any one industry.

|

| 14 Managed Municipal Income Trust |

Comparative index definitions

Bloomberg Municipal Bond Index is an unmanaged index of long-term, fixed-rate, investment-grade tax-exempt bonds.

Bloomberg U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed income securities.

ICE BofA (Intercontinental Exchange Bank of America) U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500® Index is an unmanaged index of common stock performance.

Lipper, an LSEG company, is a third-party industry-ranking entity that ranks funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category medians reflect performance trends for funds within a category.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Important data provider notices and terms available at www.franklintempletondatasources.com.

|

| Managed Municipal Income Trust 15 |

Other information for shareholders

Important notice regarding share repurchase program

In September 2024, the Trustees of your fund approved the renewal of a share repurchase program that had been in effect since 2005. This renewal allows your fund to repurchase, in the 365 days beginning October 1, 2024, up to 10% of the fund’s common shares outstanding as of September 30, 2024.

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single notice of internet availability, or a single printed copy, of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

The Investment Manager is committed to managing our funds in the best interests of our shareholders. The Putnam Investments’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2024, are available at franklintempleton.com/regulatory-fund-documents and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain The Putnam Investments’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the fund’s Form N-PORT on the SEC’s website at www.sec.gov.

Update regarding portfolio managers

Effective September 30, 2024, Benjamin Barber, CFA, James Conn, CFA, Francisco Rivera and Daniel Workman, CFA, joined Paul M. Drury and Garrett L. Hamilton as Portfolio Managers of the fund. Additional information regarding the new Portfolio Managers is below:

|

|

|

|

| Portfolio Manager |

Joined fund |

Employer |

Employer |

| Benjamin Barber, CFA |

2024 |

Franklin Advisers |

Portfolio Manager |

|

2020 – Present |

|

| |

|

Goldman Sachs Asset Management |

Portfolio Manager |

|

1999 – 2020 |

|

| James Conn, CFA |

2024 |

Franklin Advisers |

Portfolio Manager |

|

1996 – Present |

|

| Francisco Rivera |

2024 |

Franklin Advisers |

Portfolio Manager |

|

1994 – Present |

|

| Daniel Workman, CFA |

2024 |

Franklin Advisers |

Portfolio Manager |

|

2003 – Present |

|

|

| 16 Managed Municipal Income Trust |

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

|

| Managed Municipal Income Trust 17 |

Summary of Putnam closed-end funds’ amended and restated dividend reinvestment plans

Putnam Managed Municipal Income Trust, Putnam Master Intermediate Income Trust, Putnam Municipal Opportunities Trust and Putnam Premier Income Trust (each, a “Fund” and collectively, the “Funds”) each offer a dividend reinvestment plan (each, a “Plan” and collectively, the “Plans”). If you participate in a Plan, all income dividends and capital gain distributions are automatically reinvested in Fund shares by the Fund’s agent, Putnam Investor Services, Inc. (the “Agent”). If you are not participating in a Plan, every month you will receive all dividends and other distributions in cash, paid by check and mailed directly to you or your intermediary.

Upon a purchase (or, where applicable, upon registration of transfer on the shareholder records of a Fund) of shares of a Fund by a registered shareholder, each such shareholder will be deemed to have elected to participate in that Fund’s Plan. Each such shareholder will have all distributions by a Fund automatically reinvested in additional shares, unless such shareholder elects to terminate participation in a Plan by instructing the Agent to pay future distributions in cash. Shareholders who were not participants in a Plan as of January 31, 2010, will continue to receive distributions in cash but may enroll in a Plan at any time by contacting the Agent.

If you participate in a Fund’s Plan, the Agent will automatically reinvest subsequent distributions, and the Agent will send you a confirmation in the mail telling you how many additional shares were issued to your account.

To change your enrollment status or to request additional information about the Plans, you may contact the Agent either in writing, at P.O. Box 8383, Boston, MA 02266-8383, or by telephone at 1-800-225-1581 during normal East Coast business hours.

How you acquire additional shares through a Plan If the market price per share for your Fund’s shares (plus estimated brokerage commissions) is greater than or equal to their net asset value per share on the payment date for a distribution, you will be issued shares of the Fund at a value equal to the higher of the net asset value per share on that date or 95% of the market price per share on that date.

If the market price per share for your Fund’s shares (plus estimated brokerage commissions) is less than their net asset value per share on the payment date for a distribution, the Agent will buy Fund shares for participating accounts in the open market. The Agent will aggregate open-market purchases on behalf of all participants, and the average price (including brokerage commissions) of all shares purchased by the Agent will be the price per share allocable to each participant. The Agent will generally complete these open-market purchases within five business days following the payment date. If, before the Agent has completed open-market purchases, the market price per share (plus estimated brokerage commissions) rises to exceed the net asset value per share on the payment date, then the purchase price may exceed the net asset value per share, potentially resulting in the acquisition of fewer shares than if the distribution had been paid in newly issued shares.

How to withdraw from a Plan Participants may withdraw from a Fund’s Plan at any time by notifying the Agent, either in writing or by telephone. Such withdrawal will be effective immediately if notice is received by the Agent with sufficient time prior to any distribution record date; otherwise, such withdrawal will be effective with respect to any subsequent distribution following notice of withdrawal. There is no penalty for withdrawing from or not participating in a Plan.

Plan administration The Agent will credit all shares acquired for a participant under a Plan to the account in which the participant’s common shares are held. Each participant will

|

| 18 Managed Municipal Income Trust |

be sent reasonably promptly a confirmation by the Agent of each acquisition made for his or her account.

About brokerage fees Each participant pays a proportionate share of any brokerage commissions incurred if the Agent purchases additional shares on the open market, in accordance with the Plans. There are no brokerage charges applied to shares issued directly by the Funds under the Plans.

About taxes and Plan amendments Reinvesting dividend and capital gain distributions in shares of the Funds does not relieve you of tax obligations, which are the same as if you had received cash distributions. The Agent supplies tax information to you and to the IRS annually. Each Fund reserves the right to amend or terminate its Plan upon 30 days’ written notice. However, the Agent may assign its rights, and delegate its duties, to a successor agent with the prior consent of a Fund and without prior notice to Plan participants.

If your shares are held in a broker or nominee name If your shares are held in the name of a broker or nominee offering a dividend reinvestment service, consult your broker or nominee to ensure that an appropriate election is made on your behalf. If the broker or nominee holding your shares does not provide a reinvestment service, you may need to register your shares in your own name in order to participate in a Plan.

In the case of record shareholders such as banks, brokers or nominees that hold shares for others who are the beneficial owners of such shares, the Agent will administer the Plan on the basis of the number of shares certified by the record shareholder as representing the total amount registered in such shareholder’s name and held for the account of beneficial owners who are to participate in the Plan.

|

| Managed Municipal Income Trust 19 |

Trustee approval of management and sub-advisory contracts

At its meeting on September 27, 2024, the Board of Trustees of your fund, including all of the Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Putnam mutual funds, closed-end funds and exchange-traded funds (collectively, the “funds”) (the “Independent Trustees”), approved a new Sub-Advisory Agreement (the “New FTIML Sub-Advisory Agreement”) between Franklin Advisers, Inc. (“Franklin Advisers”) and its affiliate, Franklin Templeton Investment Management Limited (“FTIML”). Franklin Advisers and FTIML are each direct or indirect, wholly-owned subsidiaries of Franklin Resources, Inc. (“Franklin Templeton”). (Because FTIML is an affiliate of Franklin Advisers and Franklin Advisers remains fully responsible for all services provided by FTIML, the Trustees did not attempt to evaluate FTIML as a separate entity.)

The Board of Trustees, with the assistance of its Contract Committee (which consists solely of Independent Trustees) and its independent legal counsel (as that term is defined in Rule 0–1(a)(6) (i) under the 1940 Act), requested and evaluated all information it deemed reasonably necessary under the circumstances in connection with its review of the New FTIML Sub-Advisory Agreement. At its September 2024 meeting, the Contract Committee met with representatives of Franklin Templeton, and separately in executive session, to consider the information provided. At the September Trustees’ meetings, the Contract Committee also met in executive session with the other Independent Trustees to discuss its observations and recommendations. Throughout this process, the Contract Committee was assisted by the members of the Board of Trustees’ independent staff and by independent legal counsel for the Independent Trustees.

Considerations in connection with the Trustees’ approval of the New FTIML Sub-Advisory Agreement

The Trustees considered the proposed New FTIML Sub-Advisory Agreement in connection with the planned November 1, 2024 merger (the “Merger”) of Putnam Investments Limited (“PIL”), an affiliate of Franklin Advisers and a sub-adviser to your fund prior to the Merger, with and into FTIML. In connection with the Merger, PIL investment professionals would become employees of FTIML, and, upon consummation of the Merger, PIL would cease to exist as a separate legal entity.

The Trustees noted that Franklin Templeton viewed the Merger as a further step in the integration of the legacy Putnam and Franklin Templeton organizations, offering potential operational efficiencies and enhanced investment resources for the funds. The Trustees also considered, among other factors, that:

• The Merger and the New FTIML Sub-Advisory Agreement would not result in any reduction or material change in the nature or the level of the sub-advisory services provided to the funds;

• The PIL portfolio managers who are responsible for the day-to-day management of the applicable funds would be the same immediately prior to, and immediately after, the Merger, and these investment personnel would have access to the same research and other resources to support their respective investment advisory functions and operate under the same conditions both immediately before and after the Merger;

• Despite a change in the sub-advisory fee structure for certain funds, the New FTIML Sub-Advisory Agreement would not result in an increase in the advisory fee rates payable by each fund, as Franklin Advisers would be responsible for overseeing the investment advisory services provided to the applicable funds by FTIML under the New FTIML Sub-Advisory Agreement and would compensate FTIML for such services out of the fees it receives under each fund’s Management Contract with Franklin Advisers; and

• The terms of the New FTIML Sub-Advisory Agreement were substantially similar to those under the New PIL Sub-Management Contract (defined below)1 between Franklin Advisers and PIL.

The Trustees also considered that, prior to the Merger, counsel to Franklin Advisers and FTIML had provided a legal opinion that the Merger and the appointment of FTIML as sub-adviser to the funds would not result in an “assignment” under the 1940 Act of the New PIL Sub-Management

1 The New PIL Sub-Management Contract was operative until the effective date of the Merger, November 1, 2024, and was replaced by the New FTIML Sub-Advisory Agreement effective as of that date.

|

| 20 Managed Municipal Income Trust |

Contract and that the New FTIML Sub-Advisory Agreement did not require shareholder approval.

The Trustees also took into account that they had most recently approved the fund’s New PIL Sub-Management Contract in June 2024. Because, other than the parties to the contract, the revised sub-advisory fee structure for certain funds, and certain other non-substantive changes to contractual terms, the New FTIML Sub-Advisory Agreement was substantially similar to the New PIL Sub-Management Contract, the Trustees relied to a considerable extent on their previous approval of the New PIL Sub-Management Contract, which is described below.

Board of Trustees’ Conclusions

After considering the factors described above and those described below under the heading “Considerations and conclusions in connection with the Trustees’ June 2024 approvals,” as well as other factors, the Board of Trustees, including all of the Independent Trustees, concluded that the fees payable under the New FTIML Sub-Advisory Agreement represented reasonable compensation in light of the nature and quality of the services that would be provided to the funds, and determined to approve the New FTIML Sub-Advisory Agreement for your fund. These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor.

Considerations and conclusions in connection with the Trustees’ June 2024 approvals

At its meeting on June 28, 2024, the Board of Trustees of your fund, including all of the Independent Trustees, approved a New Management Contract (defined below) between your fund and Franklin Advisers, a New PIL Sub-Management Contract (defined below) for your fund between Franklin Advisers and its affiliate, PIL, and a new subadvisory agreement (the “New Putnam Management Subadvisory Agreement”) for your fund between Franklin Advisers and Putnam Investment Management, LLC (“Putnam Management”) (collectively, the “New Advisory Contracts”). Franklin Advisers, Putnam Management, and PIL are each direct or indirect, wholly-owned subsidiaries of Franklin Templeton.

The Trustees considered the proposed New Advisory Contracts in connection with an internal reorganization (the “Reorganization”) whereby the fixed income and Investment Solutions investment operations of Putnam Management, your fund’s investment adviser prior to the Reorganization, were combined with those of Franklin Advisers. As part of the Reorganization, Franklin Advisers assumed the role of investment adviser for your fund and the other Putnam fixed income and Investment Solutions mutual funds, exchange-traded funds and closed-end funds (collectively, the “FI/IS Funds”), which was accomplished through a transfer by Putnam Management of all of its rights and obligations under the previous management contracts between Putnam Management and the FI/IS Funds (the “Previous Management Contracts”) and the previous sub-management contract between Putnam Management and its affiliate, PIL, with respect to the FI/IS Funds (the “Previous Sub-Management Contract,” and, together with the Previous Management Contracts, the “Previous Contracts”) to Franklin Advisers (the “Contract Transfers”) by means of assignment and assumption agreements (the Previous Management Contracts and the Previous Sub-Management Contract, as modified by the terms of the related assignment and assumption agreements, are hereinafter referred to as the “New Management Contracts” and the “New PIL Sub-Management Contract,” respectively). (Because PIL is an affiliate of Franklin Advisers and Franklin Advisers remains fully responsible for all services provided by PIL, the Trustees did not attempt to evaluate PIL as a separate entity.)

In addition to the New Management Contracts and New PIL Sub-Management Contract, the Board of Trustees of your fund considered and approved the New Putnam Management Subadvisory Agreement pursuant to which Franklin Advisers retained Putnam Management as sub-adviser for each FI/IS Fund so that, following the Reorganization, Putnam Management’s equity team, which was not part of the Reorganization, could continue to provide certain services that it had historically provided to the FI/IS Funds, including, as applicable, the management of the equity portion of a FI/IS Fund’s portfolio, including equity trade execution services, the provision of derivatives and other investment trading facilities for a transitional period, and the provision of proxy voting services for a transitional period (the “Services”).

In connection with the review process, the Independent Trustees’ independent legal counsel (as that term is defined in Rule 0–1(a)(6) (i) under the 1940 Act) met with representatives of Putnam Management and Franklin Templeton to discuss the contract review materials that

|

| Managed Municipal Income Trust 21 |

would be furnished to the Contract Committee. The Board of Trustees, with the assistance of its Contract Committee (which consists solely of Independent Trustees) and its independent legal counsel, requested and evaluated all information it deemed reasonably necessary under the circumstances in connection with its review of the New Management Contracts. Over the course of several months ending in June 2024, the Contract Committee met on a number of occasions with representatives of Putnam Management and Franklin Templeton, and separately in executive session, to consider the information provided. Throughout this process, the Contract Committee was assisted by the members of the Board of Trustees’ independent staff and by independent legal counsel for the Independent Trustees.

At the Board of Trustees’ June 2024 meeting, the Contract Committee met in executive session to discuss and consider its recommendations with respect to the approval of the New Advisory Contracts. At that meeting, the Contract Committee also met in executive session with the other Independent Trustees to discuss its observations and recommendations.

The Trustees noted that Franklin Templeton viewed the Reorganization as a further step in the integration of the legacy Putnam Management and Franklin Advisers fixed income and Investment Solutions organizations, offering potential operational efficiencies and enhanced investment resources for the FI/IS Funds. The Trustees also considered, among other factors, that:

• The Contract Transfers would not result in a change in the senior management at Franklin Templeton, so that the same management will be in place before and after the Contract Transfers, which contemplate no reduction in the nature and level of the advisory and administrative services provided to the FI/IS Funds;

• The portfolio managers who are responsible for the day-to-day management of the FI/IS Funds would be the same immediately prior to, and immediately after, the Contract Transfers, and these investment personnel would have access to the same research and other resources to support their respective investment management functions both before and immediately after the Contract Transfers; and

• The Contract Transfers would not result in an increase in the advisory fee rates payable by each FI/IS Fund and that, other than an acknowledgment by Franklin Advisers and Putnam Management that for purposes of the New Management Contracts, each applicable FI/IS Fund will continue to be “an open-end fund sponsored by Putnam Management,” for purposes of calculating the advisory fee rates, and updating the parties to the agreements, the terms of the New Management Contracts and New PIL Sub-Management Contract were substantially identical to those under the Previous Contracts (including with respect to the term of the New Management Contracts and New PIL Sub-Management Contract, which run through June 30, 2025, unless the contracts are sooner terminated or continued pursuant to their terms).

With respect to the New Putnam Management Subadvisory Agreement, the Trustees considered that, under the agreement, Putnam Management would provide any necessary Services to the applicable FI/IS Fund under generally the same terms and conditions related to the FI/IS Fund as such Services were previously provided by Putnam Management under the FI/IS Fund’s Previous Management Contract. The Trustees also considered that Franklin Advisers would be responsible for overseeing the Services provided to the FI/IS Funds by Putnam Management under the New Putnam Management Subadvisory Agreement and would compensate Putnam Management for such services out of the fees it receives under the New Management Contracts. The Trustees further noted Franklin Advisers’ and Putnam Management’s representations that Putnam Management’s appointment as sub-adviser to the FI/IS Funds would not result in any material change in the nature or level of investment advisory services provided to the FI/IS Funds.

The Trustees also considered that, prior to the Reorganization, counsel to Franklin Advisers and Putnam Management had provided a legal opinion that the Contract Transfers would not result in an “assignment” under the 1940 Act of the Previous Contracts or a material amendment of those contracts, and, therefore, the New Management Contracts and New PIL Sub-Management Contract did not require shareholder approval. In addition, the Trustees considered that counsel to Franklin Advisers and Putnam Management had provided a legal opinion that shareholder approval of the New Putnam Management Subadvisory Agreement was not required under the 1940 Act.

|

| 22 Managed Municipal Income Trust |

General conclusions

In addition to the above considerations, the Independent Trustees’ approvals were based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund and the fees paid by competitive funds; and

• That the fee schedule in effect for your fund represented an appropriate sharing between fund shareholders and Franklin Advisers of any economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. The considerations and conclusions discussed herein were also informed by the fact that there would be continuity in the management of the FI/IS Funds, including your fund, immediately following the Reorganization (i.e., the same portfolio managers that managed the fund prior to the Reorganization would be in place immediately following the Reorganization). The Trustees also considered that the FI/IS Funds had no operating history with Franklin Templeton or its affiliates prior to 2024.

Management fee schedules and total expenses

Under its Previous Management Contract and under its New Management Contract, your fund has the benefit of breakpoints in its management fee schedule that provide shareholders with reduced fee rates as the fund’s assets under management increase. The Trustees considered that breakpoints in a fund’s management fee schedule were one way in which economies of scale in managing a fund can be shared with the fund’s shareholders. The Trustees noted, however, that since closed-end funds typically do not change materially in size through the sale or redemption of shares, these are not likely to have a meaningful impact. The Trustees reviewed the total expenses of each Putnam fund, recognizing that in most cases management fees represented the major, but not the sole, determinant of total costs to fund shareholders.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Broadridge Financial Solutions, Inc. (“Broadridge”). This comparative information included your fund’s percentile ranking for effective management fees and total expenses, which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the first quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the first quintile in total expenses as of December 31, 2023. The first quintile represents the least expensive funds and the fifth quintile the most expensive funds. The fee and expense data reported by Broadridge as of December 31, 2023 reflected the most recent fiscal year-end data available in Broadridge’s database at that time.

In connection with their review of fund management fees and total expenses, the Trustees also reviewed the costs of the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included year-over-year data with respect to revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and investor services provided to the funds, as applicable. In this regard, the Trustees also reviewed an analysis of the revenues, expenses and profitability of Putnam Management and its affiliates, allocated on a fund-by-fund basis, with respect to (as applicable) the funds’ management and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability in 2023 for each of the applicable agreements separately and for the agreements taken together on a combined basis. The Trustees also reviewed the revenues, expenses and profitability of Franklin Templeton’s global investment management business and its U.S. registered investment company business, which includes the financial results of Franklin Advisers. Because the FI/IS Funds had no operating history with Franklin Templeton or its affiliates, the Trustees did not review fund-by-fund profitability information for Franklin Templeton. The Trustees concluded that, at current asset levels, the fee schedules in place for each of the funds, including the fee schedule for your fund, represented reasonable compensation for the services to be provided by Franklin Advisers (which are substantially identical to those

|

| Managed Municipal Income Trust 23 |

historically provided by Putnam Management) and represented an appropriate sharing between fund shareholders and Franklin Advisers of any economies of scale as may exist in the management of the funds at that time.

The information examined by the Trustees in connection with their review of the New Advisory Contracts included information regarding services provided and fees charged by Putnam Management and its affiliates to other clients, including collective investment trusts offered in the defined contribution retirement plan market, sub-advised mutual funds, private funds sponsored by affiliates of Putnam Management, model-only separately managed accounts and Putnam Management’s manager-traded separately managed account programs. This information included, in cases where a product’s investment strategy corresponds with a FI/IS Fund’s strategy, comparisons of those fees with fees charged to the funds, as well as an assessment of the differences in the services provided to these clients as compared to the services provided to the funds. The Trustees also considered information regarding services provided and fees charged by Franklin Advisers and its other Franklin Templeton affiliates to other clients, including U.S. registered mutual funds, funds organized outside of the United States (i.e., offshore funds), separate accounts (including separately managed accounts), collective investment trusts and sub-advised funds, which included, where applicable, the specific fees charged to strategies that are comparable to those of the FI/IS Funds. The Trustees observed that the differences in fee rates between these clients and the funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect, among other things, historical competitive forces operating in separate marketplaces. The Trustees considered the fact that in many cases fee rates across different asset classes are higher on average for 1940 Act-registered funds than for other clients, and the Trustees also considered the differences between the services that Putnam Management historically provided and that Franklin Advisers will provide to the FI/IS Funds as investment adviser and those that they provide to their other clients. The Trustees did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance