Prudential Financial to Reinsure $7B Japanese Whole Life Block with Prismic Life

22 Janvier 2025 - 10:30PM

Business Wire

Second transaction expands Prismic’s AUM to estimated $17

billion

Prudential Financial, Inc. (NYSE: PRU) announced today an

agreement to reinsure a portion of its recently originated Japanese

whole life policies with a subsidiary of Prismic Life (Prismic), a

Bermuda-based life and annuity reinsurance company sponsored by

Prudential and Warburg Pincus and supported by a group of global

investors.

Under the terms of the agreement, Prismic will reinsure

approximately $7 billion of reserves backing USD-denominated

Japanese whole life insurance policies which were recently

originated by Prudential’s Japanese affiliates. Prudential’s

obligations to these policyholders will remain unchanged following

the reinsurance arrangement, and Prudential will continue to

administer the contracts.

“We are excited to enter a second Prismic transaction alongside

our co-investors which adds further scale to this unique

reinsurance platform,” said Charles F. Lowrey, chairman and CEO of

Prudential Financial. “We look forward to deepening our strategic

partnership with Prismic to help grow our business and expand

access to investing, insurance, and retirement security around the

world.”

The transaction is expected to bring Prismic’s assets under

management to $17 billion. PGIM Multi-Asset Solutions and Warburg

Pincus will continue to provide asset management services to

Prismic across public and private markets, including public fixed

income, private credit, private real estate, and private

equity.

“Prismic is proud to provide a reinsurance solution for

Prudential’s Japanese whole life insurance policies,” said Nandini

Mongia, group executive chair and CEO of Prismic. “This transaction

further strengthens Prismic’s platform by diversifying its earnings

and risk profile, building on the inaugural transaction with

Prudential in September 2023.”

As part of the transaction, Prudential intends to make an equity

investment in Prismic of approximately $100 million, alongside a

group of global investors who will invest additional consideration

of approximately $400 million.

The consummation of the transaction, which was entered into in

December 2024 and ratified by Prismic investors in January 2025, is

subject to receipt of regulatory approvals and the satisfaction of

other customary closing conditions.

Prismic Life was advised by PGIM Multi-Asset Solutions LLC, Agam

Capital Management LLC, Willkie Farr & Gallagher LLP, and

Appleby (Bermuda) Limited. Debevoise & Plimpton LLP served as

legal counsel to Prudential Financial.

About Prudential Financial

Prudential Financial, Inc. (NYSE: PRU), a global financial

services leader and premier active global investment manager with

approximately $1.6 trillion in assets under management as of

September 30, 2024, has operations in the United States, Asia,

Europe, and Latin America. Prudential’s diverse and talented

employees help make lives better and create financial opportunity

for more people by expanding access to investing, insurance, and

retirement security. Prudential’s iconic Rock symbol has stood for

strength, stability, expertise, and innovation for nearly 150

years. For more information, please visit news.prudential.com.

About Prismic Life

Prismic Life is a global reinsurance platform that benefits from

Prudential Financial, Inc.’s sponsorship and PGIM and Warburg

Pincus’ market-leading asset management franchises to deliver value

for its clients. Prismic Life’s expertise and operational

scalability allows it to provide risk and balance sheet management

solutions to clients and the opportunity for investors to

participate in reinsurance as an investment. For more information

about Prismic Life, please visit prismiclife.com.

Prudential Forward-Looking Statements

Certain of the statements included in this release, such as

those regarding the planned reinsurance transaction with Prismic

Life and the expected completion and the impacts thereof, including

the impact to Prismic’s assets under management, PGIM’s provision

of asset management services and the anticipated investments in

Prismic by Prudential and other investors, constitute

forward-looking statements within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. Words such as “expects,”

“believes,” “anticipates,” “includes,” “plans,” “assumes,”

“estimates,” “projects,” “intends,” “should,” “will,” “shall” or

variations of such words are generally part of forward-looking

statements. Prudential’s forward-looking statements are made based

on management’s current expectations and beliefs concerning future

developments and their potential effects upon Prudential Financial,

Inc. and its subsidiaries. There can be no assurance that future

developments affecting Prudential Financial, Inc. and its

subsidiaries will be those anticipated by management. These

forward-looking statements are not a guarantee of future

performance and involve risks and uncertainties, and there are

certain important factors that could cause actual results to

differ, possibly materially, from expectations or estimates

reflected in such forward-looking statements. Certain important

factors that could cause actual results to differ, possibly

materially, from expectations or estimates reflected in such

forward-looking statements can be found in the “Risk Factors” and

“Forward-Looking Statements” sections included in Prudential’s

Annual Report on Form 10-K. Prudential does not undertake to update

any particular forward-looking statement included in this

document.

The securities subject to the equity investment referred to in

this press release have not been registered under the Securities

Act of 1933, as amended (the “Securities Act”), and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the

Securities Act and applicable state laws. This press release is for

informational purposes only and is not an offer to sell or purchase

nor the solicitation of an offer to sell or purchase securities and

shall not constitute an offer, solicitation or sale in any state or

jurisdiction in which, or to any person to whom such an offer,

solicitation or sale would be unlawful.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122152566/en/

Prudential Media Contact: YeaJin Kim,

yeajin.kim@prudential.com Prismic Media Contact: Christian

Ercole christian.ercole@prismiclife.com

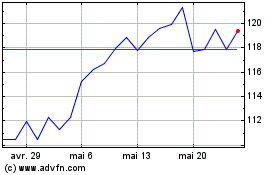

Prudential Financial (NYSE:PRU)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Prudential Financial (NYSE:PRU)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025